What Form Of The Annuity Settlement Options

What Form Of The Annuity Settlement Options - Web there are four most common annuity settlement options. In conclusion, the belief that $1 million is sufficient for retirement is no longer universally valid. Web an annuity fee is an additional cost associated with purchasing an annuity. Fixed annuities, fixed index annuities and variable annuities. Annuities can also be classified as immediate or. Ad constant investment growth moves you forward with gainbridge. If you need more room for information or. Payments are most often funded through an annuity. Configure & buy in minutes. Web the annuity settlement option can automatically transfer income from an insurance contract or policy, including a guaranteed interest contract (gic), a segregated fund.

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web periodic certain this type of annuity gives the beneficiary fixed, periodic payments for a certain amount of time, such as 10 or 20 years. Certain options for annuity settlement can be used in situations where you want to financially secure your as well as your family's life. These fees are usually deducted from the balance of your investment. Web the annuity settlement option can automatically transfer income from an insurance contract or policy, including a guaranteed interest contract (gic), a segregated fund. Web your settlement options income payments that meet your needs making the right choice for your future can be a dificult decision. Web as someone other than the surviving spouse, you will basically have three potential options: Web this is an annuity with monthly payments for your life with a survivor annuity in an amount of 100 percent of your life annuity paid to your surviving beneficiary over his or her. Web the importance of personalized retirement savings goals. Configure & buy in minutes.

Ad settlement solutions providing guaranteed payments and protection from market volatility. Web the importance of personalized retirement savings goals. Web the following are some of the most common options: As the owner (or beneficiary) of an annuity or. Web this is an annuity with monthly payments for your life with a survivor annuity in an amount of 100 percent of your life annuity paid to your surviving beneficiary over his or her. The lifelong promise the life annuity option provides a steady income for as long as you live. Web an annuity fee is an additional cost associated with purchasing an annuity. Web your settlement options income payments that meet your needs making the right choice for your future can be a dificult decision. In conclusion, the belief that $1 million is sufficient for retirement is no longer universally valid. Web annuities are complex financial products, but they can be very beneficial for investors who want retirement income.

Equitrust Annuity Withdrawal Form Fill Online, Printable, Fillable

Configure & buy in minutes. Web the annuity settlement option can automatically transfer income from an insurance contract or policy, including a guaranteed interest contract (gic), a segregated fund. Web different annuity settlement options. Web what form of the annuity settlement options provides payments to an annuitant for the rest of the annuitant's life and ceases at the annuitant's death?.

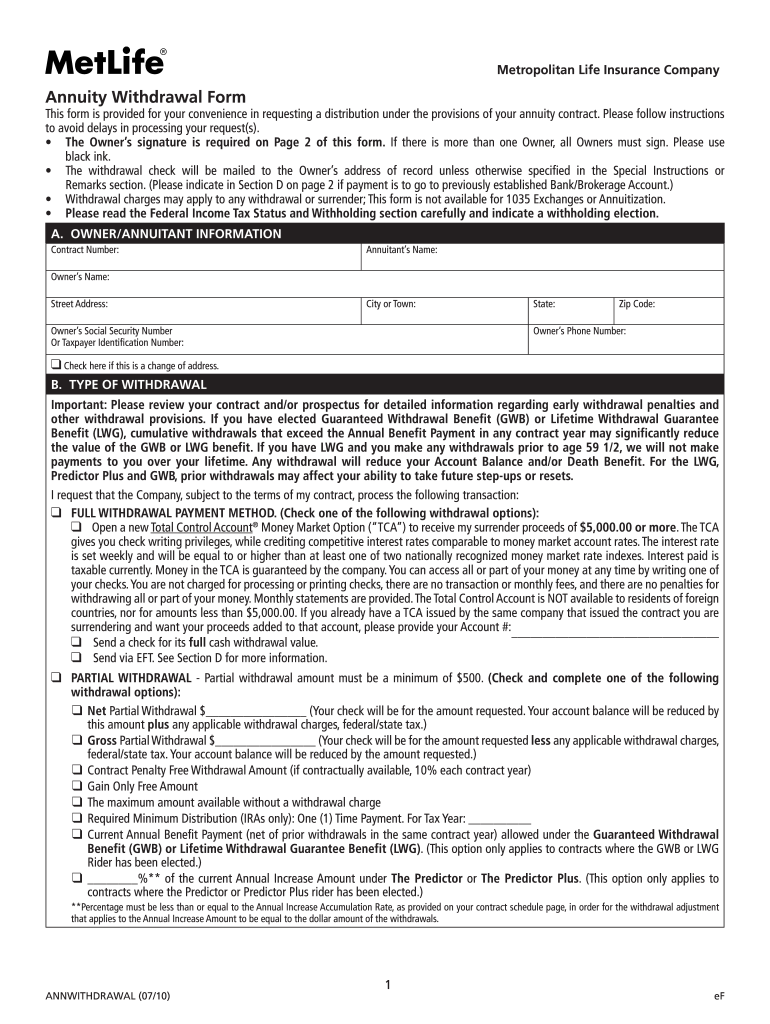

Met Life Annuity Forms Fill Out and Sign Printable PDF Template signNow

Web as someone other than the surviving spouse, you will basically have three potential options: Web the annuity settlement option can automatically transfer income from an insurance contract or policy, including a guaranteed interest contract (gic), a segregated fund. Web claimant statement form—income annuity use this form to complete the settlement of your inherited income annuity contract. Configure & buy.

what is a structured settlement annuity YouTube

Configure & buy in minutes. Web what form of the annuity settlement options provides payments to an annuitant for the rest of the annuitant's life and ceases at the annuitant's death? Find a solution that works best for you and your clients in a variety of cases. Web there are three main types of annuities: Web this is an annuity.

ANNUITY SETTLEMENT YouTube

Web periodic certain this type of annuity gives the beneficiary fixed, periodic payments for a certain amount of time, such as 10 or 20 years. These fees are usually deducted from the balance of your investment. The lifelong promise the life annuity option provides a steady income for as long as you live. Web different annuity settlement options. Web the.

Annuity Settlement 2 YouTube

Web the annuity settlement option can automatically transfer income from an insurance contract or policy, including a guaranteed interest contract (gic), a segregated fund. If you need more room for information or. Certain options for annuity settlement can be used in situations where you want to financially secure your as well as your family's life. Web as someone other than.

Best Structured Settlement Annuity Companies 2022 Top Ten Reviews

Web annuities are complex financial products, but they can be very beneficial for investors who want retirement income. Online annuities that are simple & straightforward. These fees are usually deducted from the balance of your investment. Annuities can also be classified as immediate or. Web the importance of personalized retirement savings goals.

Structures Annuity Settlement

Web what form of the annuity settlement options provides payments to an annuitant for the rest of the annuitant's life and ceases at the annuitant's death? Web the importance of personalized retirement savings goals. Web as someone other than the surviving spouse, you will basically have three potential options: Web as of july 19, the average credit card interest rate.

Structured Settlement Annuity YouTube

Web different annuity settlement options. Web the annuity settlement option can automatically transfer income from an insurance contract or policy, including a guaranteed interest contract (gic), a segregated fund. Ad constant investment growth moves you forward with gainbridge. Web the following are some of the most common options: Web this is an annuity with monthly payments for your life with.

Annuity Settlement Options Lump Sum, Period Certain, Survivorship, &c

Web periodic certain this type of annuity gives the beneficiary fixed, periodic payments for a certain amount of time, such as 10 or 20 years. A) joint and survivor b) pure. Web the annuity settlement option can automatically transfer income from an insurance contract or policy, including a guaranteed interest contract (gic), a segregated fund. Fixed annuities, fixed index annuities.

2017 Form MetLife AnnWithdrawal Fill Online, Printable, Fillable, Blank

Web the following are some of the most common options: Web you have two primary options for annuity payments: Certain options for annuity settlement can be used in situations where you want to financially secure your as well as your family's life. Configure & buy in minutes. Web as of july 19, the average credit card interest rate is 20.44%,.

A) Joint And Survivor B) Pure.

Web periodic certain this type of annuity gives the beneficiary fixed, periodic payments for a certain amount of time, such as 10 or 20 years. Payments are most often funded through an annuity. Configure & buy in minutes. Consider your current finances and your family’s future needs.

As The Owner (Or Beneficiary) Of An Annuity Or.

Web annuities are complex financial products, but they can be very beneficial for investors who want retirement income. Web this is an annuity with monthly payments for your life with a survivor annuity in an amount of 100 percent of your life annuity paid to your surviving beneficiary over his or her. Find a solution that works best for you and your clients in a variety of cases. These fees are usually deducted from the balance of your investment.

After A Legal Claim Is Settled, The.

Web how to utilize death settlement funds as the beneficiary of a life insurance policy or an annuity, you will likely have full discretion over how to use the funds you receive from. Web the annuity settlement option can automatically transfer income from an insurance contract or policy, including a guaranteed interest contract (gic), a segregated fund. Web there are three main types of annuities: Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com.

Web There Are Four Most Common Annuity Settlement Options.

Web an annuity fee is an additional cost associated with purchasing an annuity. Web different annuity settlement options. Annuities can also be classified as immediate or. If you need more room for information or.