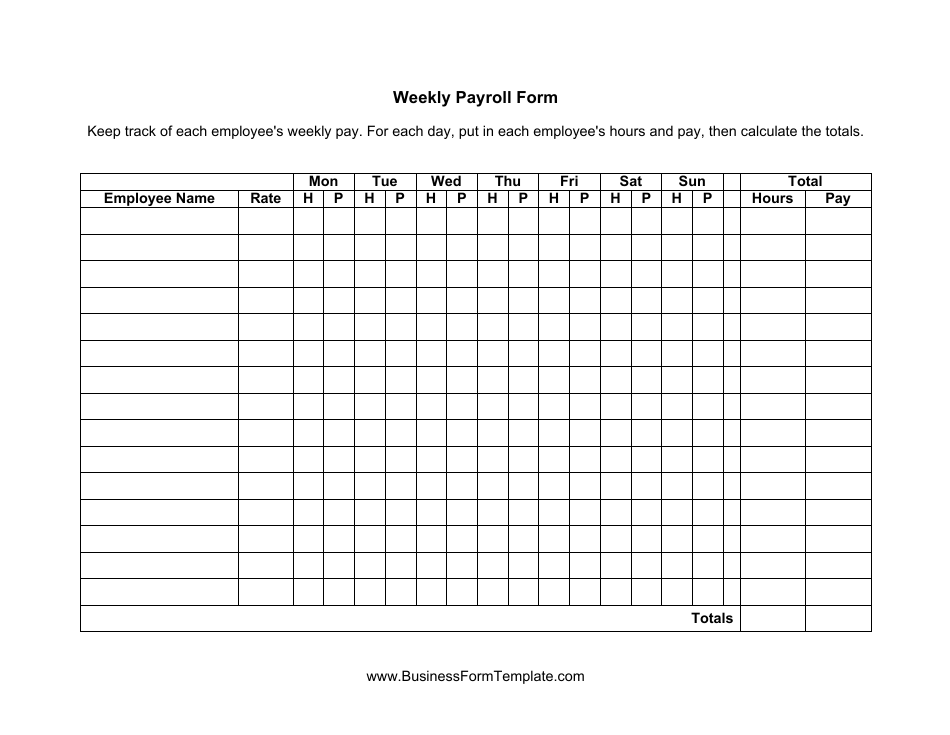

Weekly Payroll Form

Weekly Payroll Form - If you're familiar with adobe® acrobat®. End date, payment for employee. Includes spaces for up to 40 employees' names, id numbers, hourly rates, overtime rates, hours and pto. Ne albuquerque nm 87110 mailing address: Web weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions. With jotform’s free pay stub template, you can. Easy to run payroll, get set up & running in minutes! A pay stub is used by employers to notify an employee of their pay amount and provide documentation for it. Web file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs for each quarter by the last day of the. Web weekly payroll for contractor's optional use.

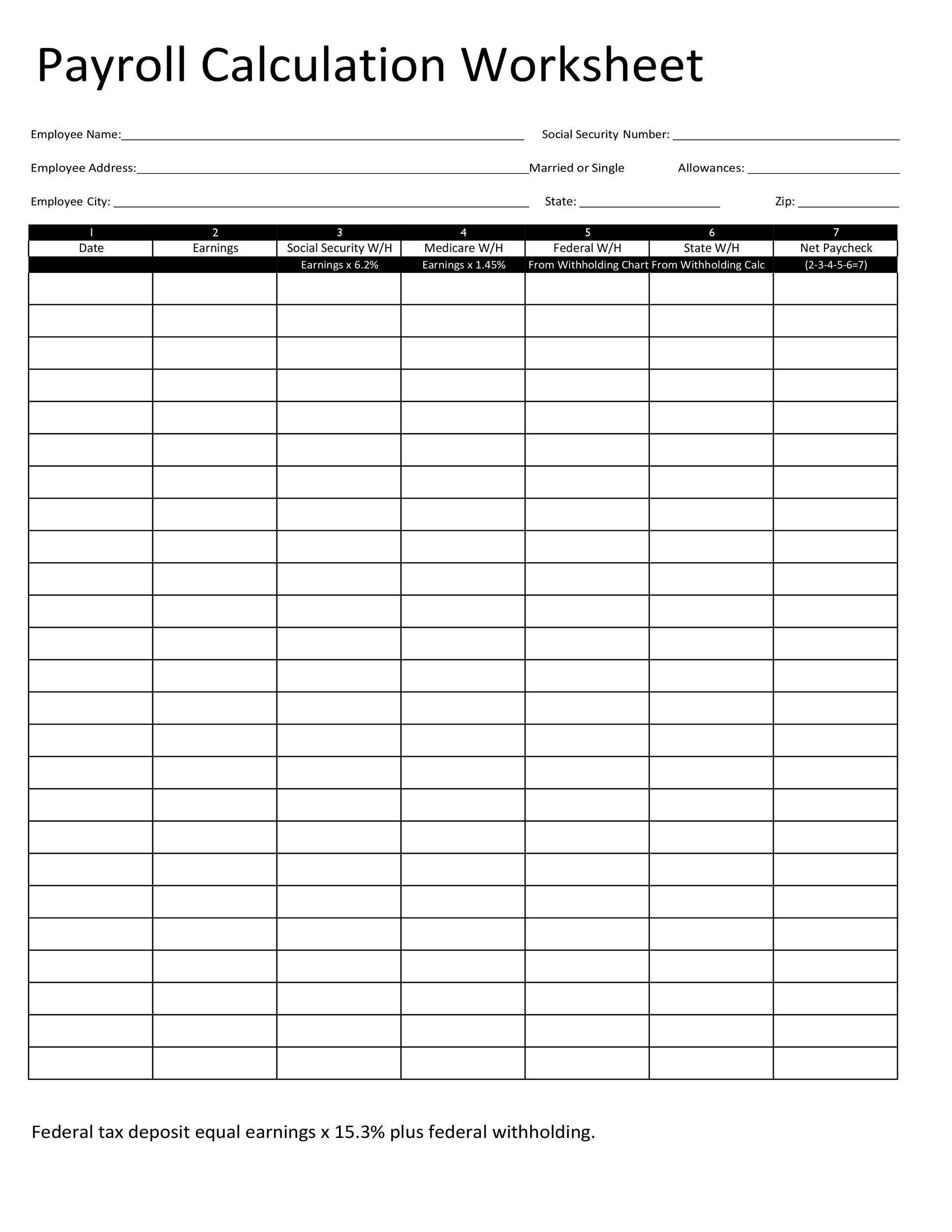

Ad best overall payroll software service in 2023 by nerdwallet.com. Web in 2023, there are 26 pay dates under the biweekly schedule. Includes spaces for up to 40 employees' names, id numbers, hourly rates, overtime rates, hours and pto. § 5.5(a)(3) • weekly payroll information may be submitted in any form desired • optional form wh. Wage bracket method tables for manual. Web file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs for each quarter by the last day of the. Web weekly payroll for contractor's optional use. Percentage method tables for automated payroll systems and withholding on periodic payments of pensions and annuities. If the adjusted wage amount (line 1h) is. Web get a weekly payroll here.

Web weekly payroll for contractor's optional use. The amount of income tax your employer withholds from your. If you're familiar with adobe® acrobat®. As stated on the payroll records notification. § 5.5(a)(3) • weekly payroll information may be submitted in any form desired • optional form wh. For employees, withholding is the amount of federal income tax withheld from your paycheck. A pay stub is used by employers to notify an employee of their pay amount and provide documentation for it. Most dependable payroll solution for small businesses in 2023 by techradar editors. Wage bracket method tables for manual. The amount from form 8974, line 12, or, if applicable, line 17, is reported on.

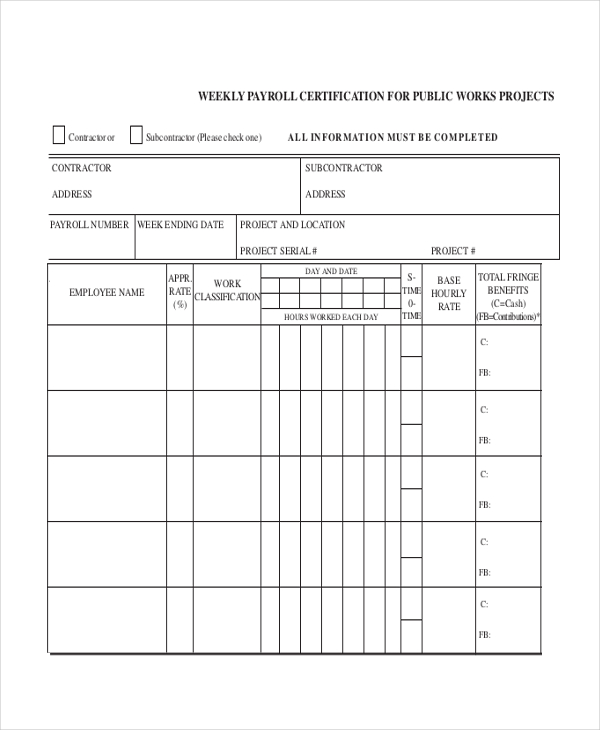

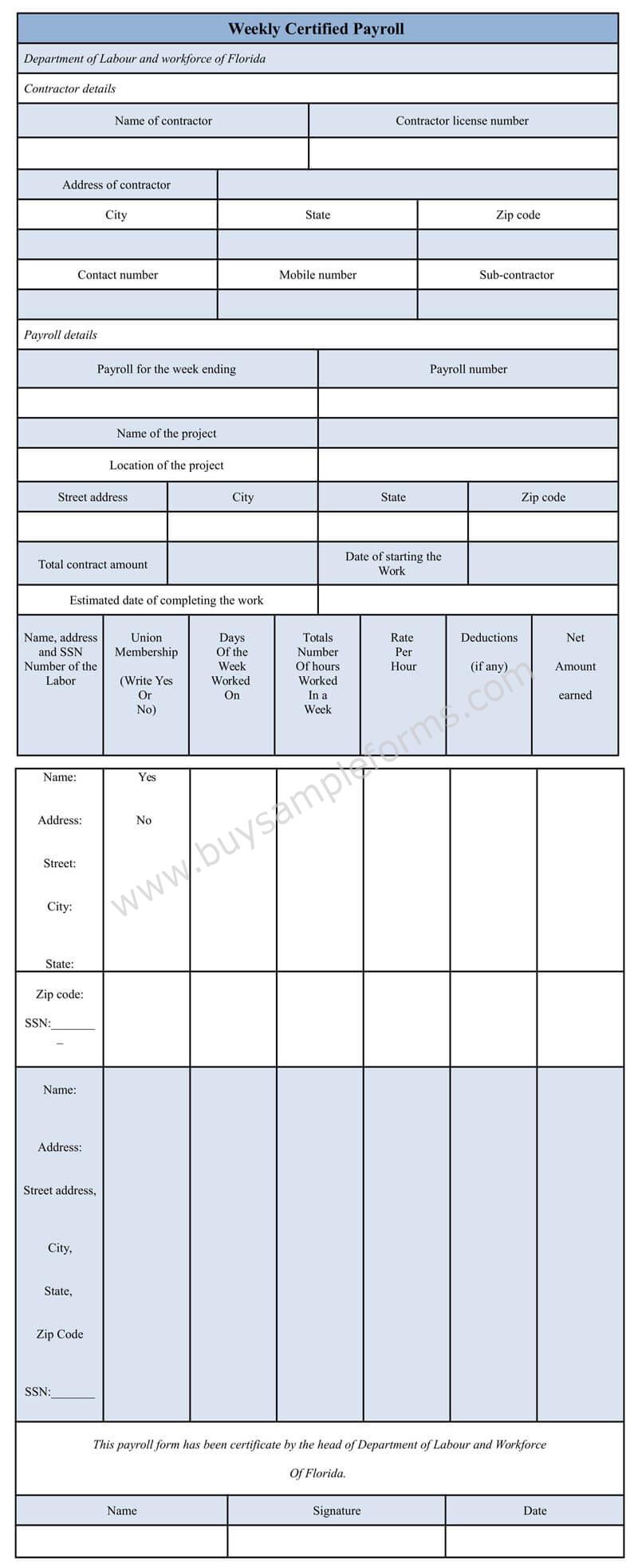

FREE 9+ Sample Certified Payroll Forms in PDF Excel Word

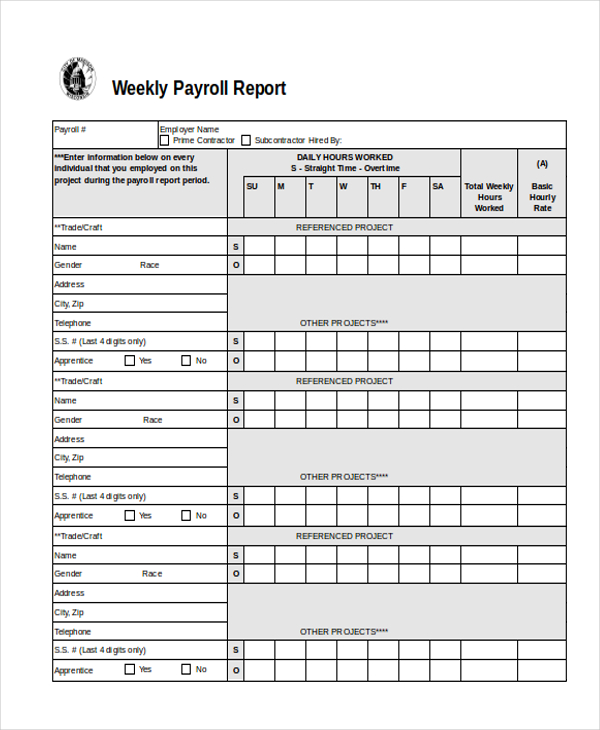

If the adjusted wage amount (line 1h) is. Wage bracket method tables for manual. Includes spaces for up to 40 employees' names, id numbers, hourly rates, overtime rates, hours and pto. Web • weekly payrolls must include specific information as required by 29 c.f.r. With jotform’s free pay stub template, you can.

FREE 21+ Sample Payroll Forms in MS Word PDF Excel

§ 5.5(a)(3) • weekly payroll information may be submitted in any form desired • optional form wh. As stated on the payroll records notification. Includes spaces for up to 40 employees' names, id numbers, hourly rates, overtime rates, hours and pto. A pay stub is used by employers to notify an employee of their pay amount and provide documentation for.

FREE 14+ Employee Payroll Samples & Templates in PDF MS Word Excel

The amount of income tax your employer withholds from your. Web weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions. Web file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs.

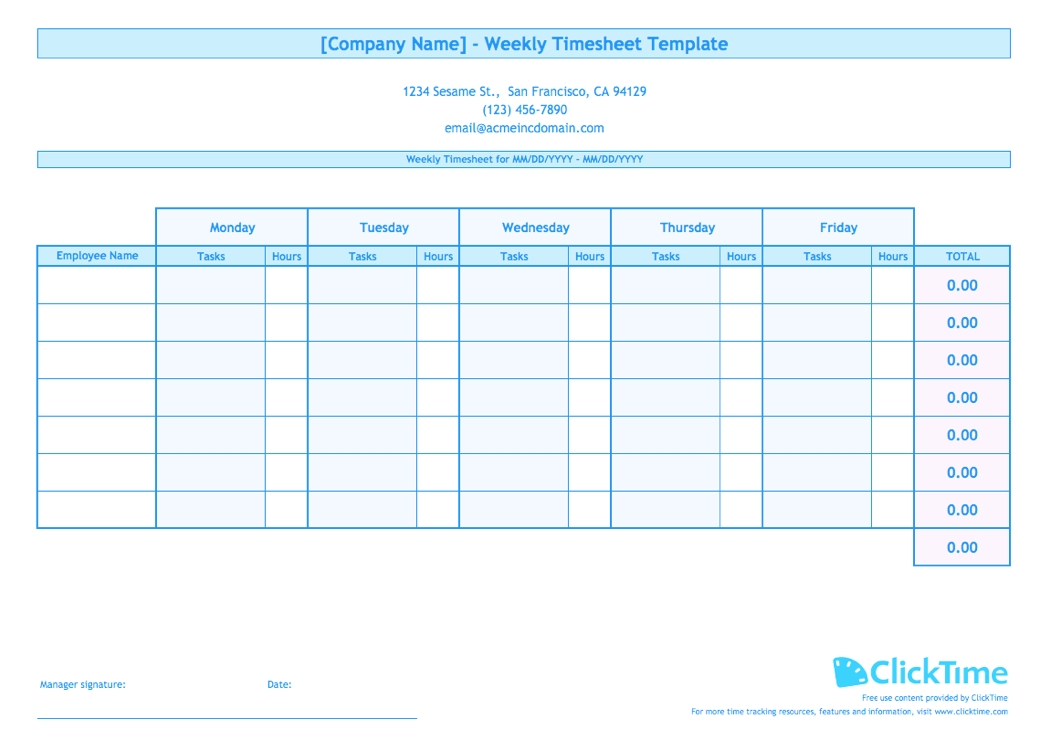

Weekly Payroll Sheet Example Templates at

Web in 2023, there are 26 pay dates under the biweekly schedule. Web you can count on these templates to help you figure out where the money's going and how much everyone gets, week after week and month after month. If the adjusted wage amount (line 1h) is. Ad payroll so easy, you can set it up & run it.

Weekly Payroll Spreadsheet Template Download Printable PDF Templateroller

Web file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs for each quarter by the last day of the. Percentage method tables for automated payroll systems and withholding on periodic payments of pensions and annuities. Easy to run payroll, get set up & running in minutes! As stated on the.

Download Weekly Certified Payroll Form in Word Format Sample Forms

Ne albuquerque nm 87110 mailing address: Web get a weekly payroll here. Web file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs for each quarter by the last day of the. Web form 8974 is used to determine the amount of the credit that can be used in the current.

New York Weekly Payroll Form Payroll template, Payroll, Legal forms

The amount of income tax your employer withholds from your. § 5.5(a)(3) • weekly payroll information may be submitted in any form desired • optional form wh. Ne albuquerque nm 87110 mailing address: For employees, withholding is the amount of federal income tax withheld from your paycheck. End date, payment for employee.

Sample Of Weekly Payroll Format

Web • weekly payrolls must include specific information as required by 29 c.f.r. If you're familiar with adobe® acrobat®. Includes spaces for up to 40 employees' names, id numbers, hourly rates, overtime rates, hours and pto. Web when you pay an employee for a period of less than 1 week, and the employee signs a statement under penalties of perjury.

Weekly Payroll Template Collection

Ad best overall payroll software service in 2023 by nerdwallet.com. Web you can count on these templates to help you figure out where the money's going and how much everyone gets, week after week and month after month. End date, payment for employee. For employees, withholding is the amount of federal income tax withheld from your paycheck. Easy to run.

20+ Payroll Templates Free Sample, Example Format

Wage bracket method tables for manual. Web get a weekly payroll here. The amount of income tax your employer withholds from your. End date, payment for employee. Web weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions.

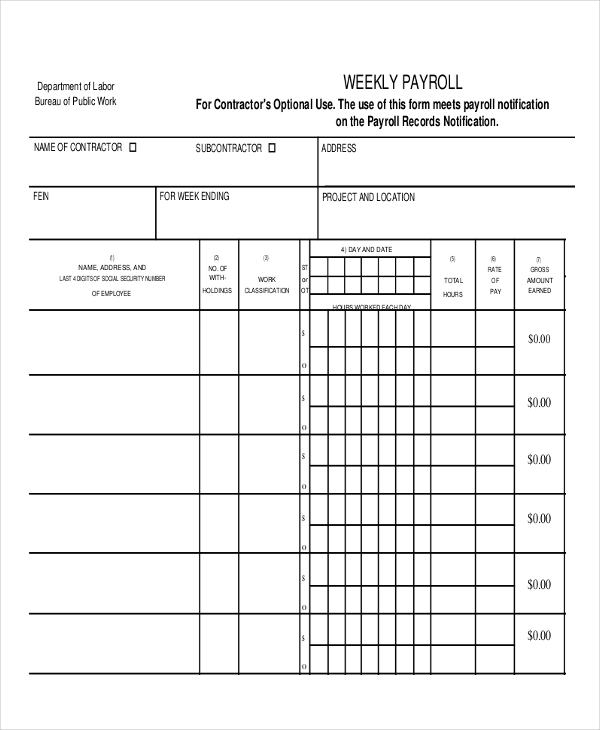

Web Weekly Payroll For Contractor's Optional Use.

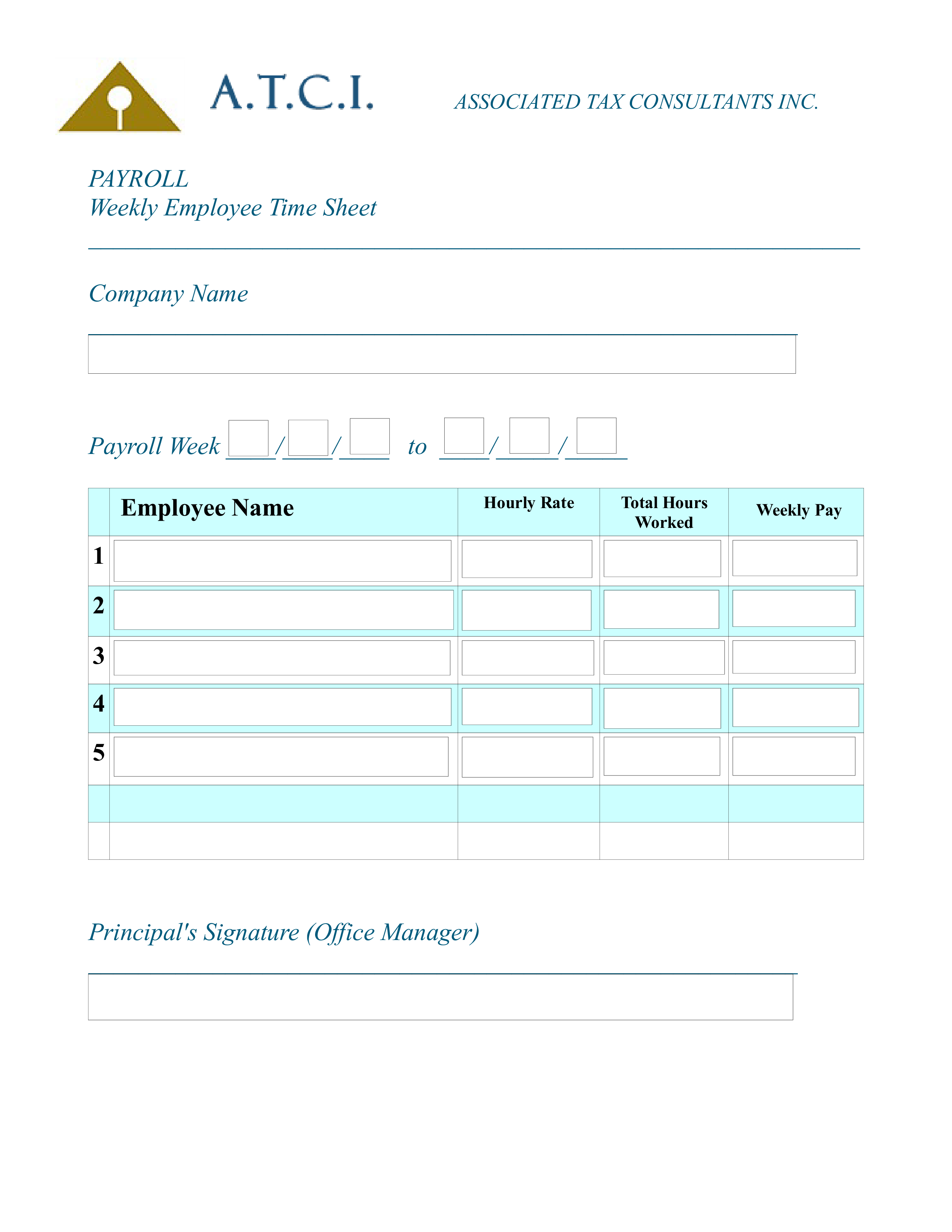

The use of this form meets payroll notification requirements; With jotform’s free pay stub template, you can. The amount from form 8974, line 12, or, if applicable, line 17, is reported on. Easy to run payroll, get set up & running in minutes!

Wage Bracket Method Tables For Manual.

Includes spaces for up to 40 employees' names, id numbers, hourly rates, overtime rates, hours and pto. Ne albuquerque nm 87110 mailing address: Web file form 941, employer’s quarterly federal tax return, if you paid wages subject to employment taxes with the irs for each quarter by the last day of the. Web you can count on these templates to help you figure out where the money's going and how much everyone gets, week after week and month after month.

The Amount Of Income Tax Your Employer Withholds From Your.

End date, payment for employee. Web form 8974 is used to determine the amount of the credit that can be used in the current quarter. Ad payroll so easy, you can set it up & run it yourself. Web in 2023, there are 26 pay dates under the biweekly schedule.

A Pay Stub Is Used By Employers To Notify An Employee Of Their Pay Amount And Provide Documentation For It.

If you're familiar with adobe® acrobat®. For employees, withholding is the amount of federal income tax withheld from your paycheck. Ad best overall payroll software service in 2023 by nerdwallet.com. If the adjusted wage amount (line 1h) is.