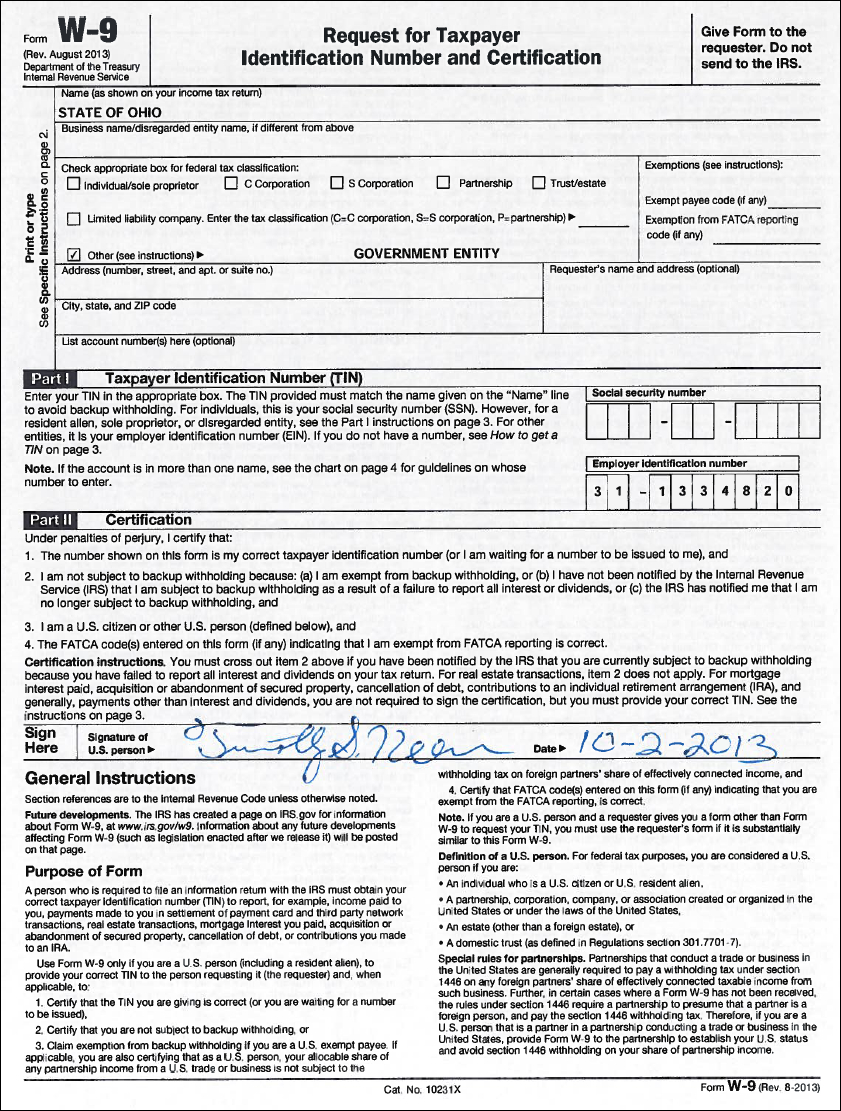

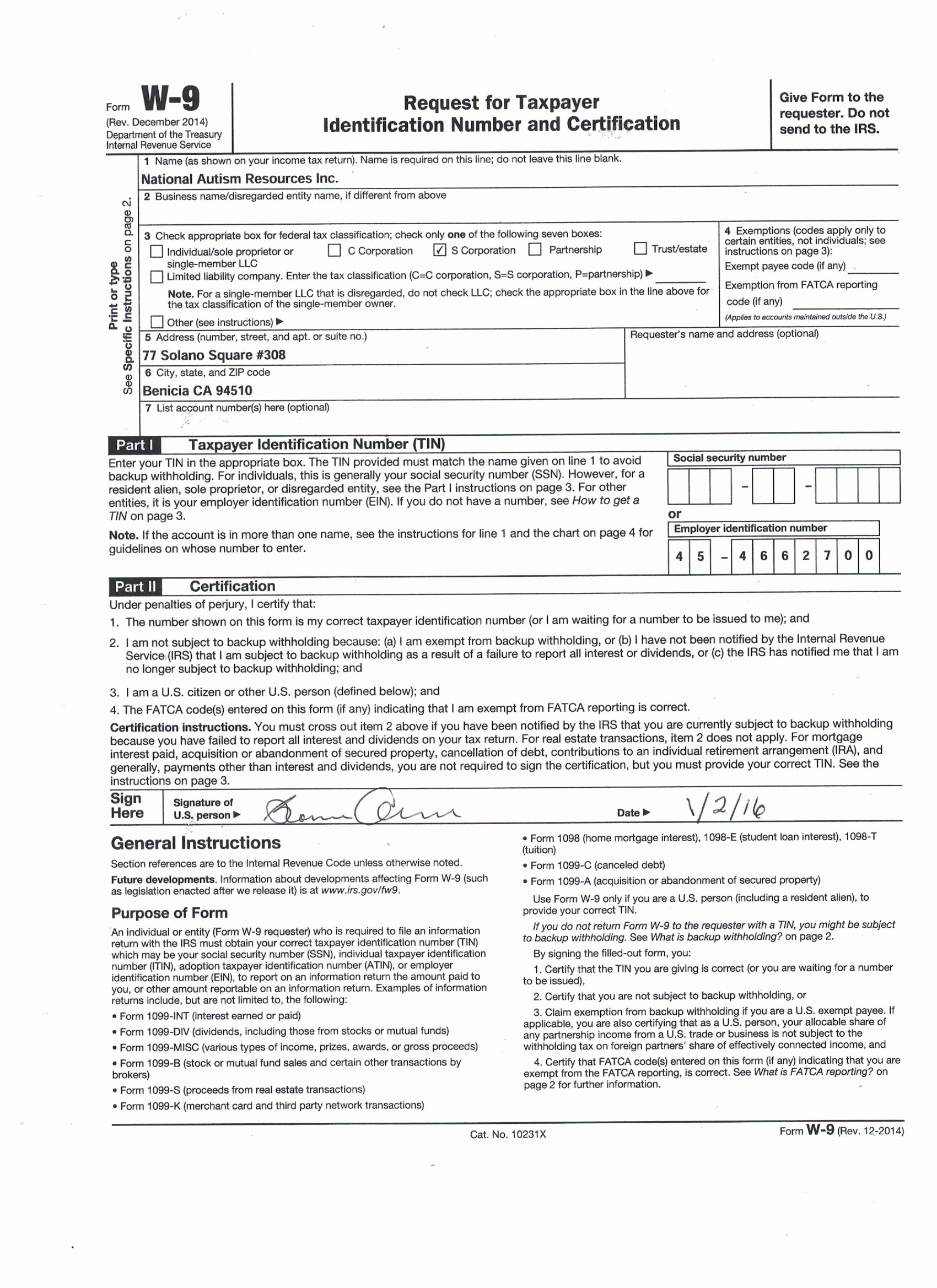

W-9 Form 2014

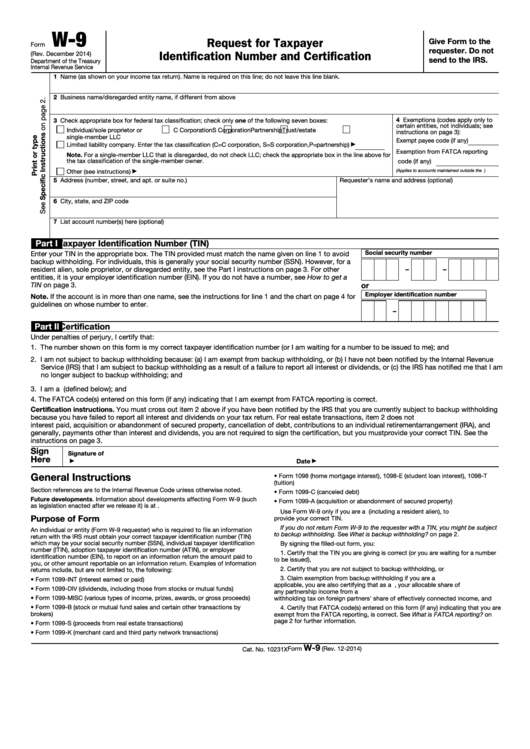

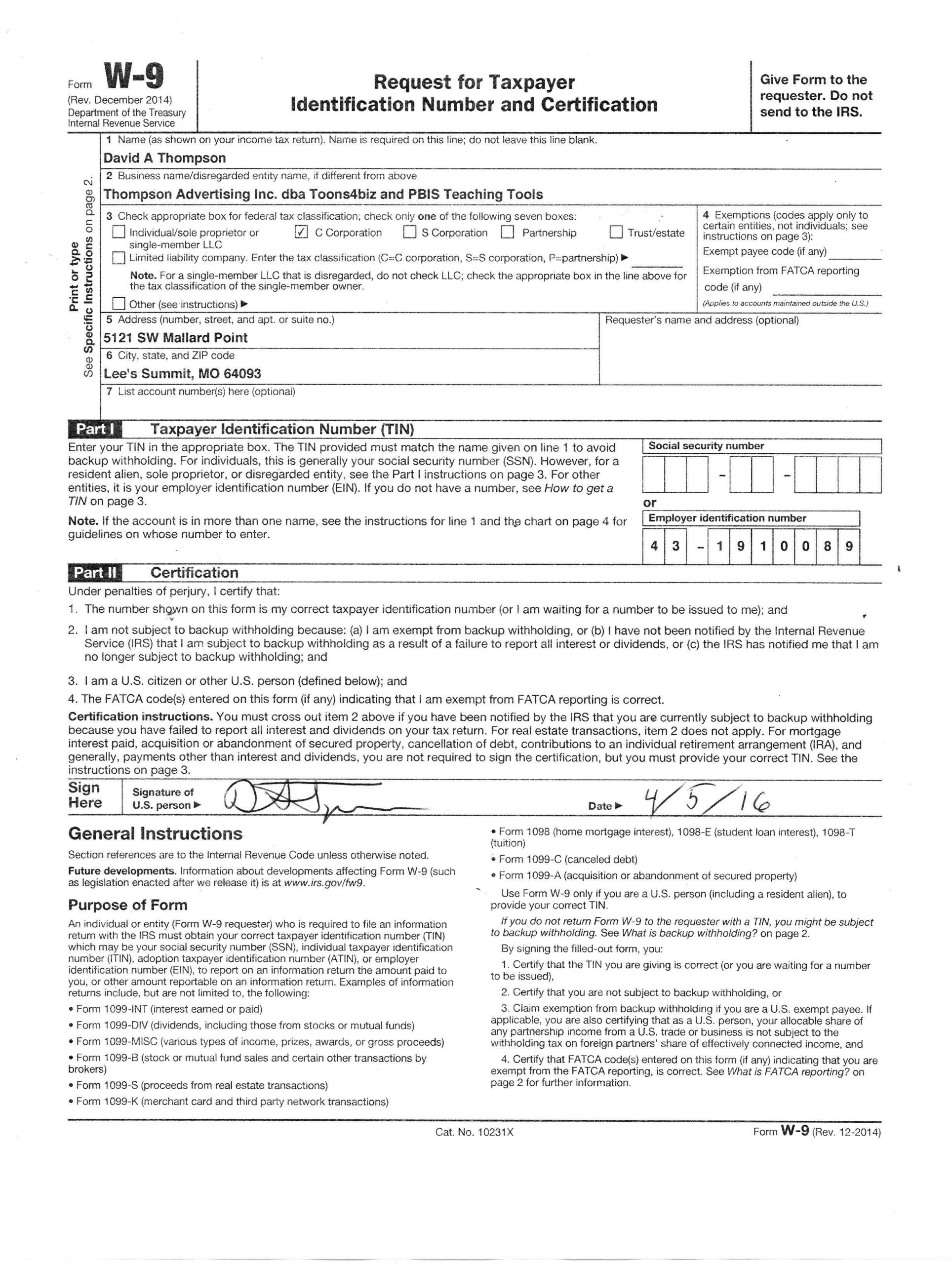

W-9 Form 2014 - What is backup withholding, later. Generally, enter the name shown on your tax return. The form helps businesses obtain important information from payees to prepare information returns for the irs. Do not leave this line blank. Name is required on this line; Do not leave this line blank. No need to install software, just go to dochub, and sign up instantly and for free. Request for taxpayer identification number and certification : Name (as shown on your income tax return). December 2014) department of the treasury identification number and certification internal revenue service give form to the requester.

4 exemptions (codes apply only to certain entities, not individuals; Name (as shown on your income tax return). October 2018) request for taxpayer identification number and certification section references are to the internal revenue code unless partnership's effectively connected income. One of the most common situations is when someone works as an independent contractor for a business. Generally, only a nonresident alien individual may use the terms of a tax you are subject. Business name/disregarded entity name, if different from above · reduce your tax liability or · compensate you for any loss. Enter the tax classification (c=c corporation, s=s corporation, p=partnership) For individuals, the tin is generally a social security number (ssn). This can be a social security number or the employer identification number (ein) for a business.

Business name/disregarded entity name, if different from above check appropriate box for federal tax By signing it you attest that: Generally, enter the name shown on your tax return. Web that has elected to be treated as a u.s. This includes their name, address, employer identification number (ein), and other vital information. Do not leave this line blank. See what is fatca reporting on page 2 for further information. Enter the tax classification (c=c corporation, s=s corporation, p=partnership) Do not send to the irs. Do not leave this line blank.

Printable Blank W 9 Forms Pdf Example Calendar Printable

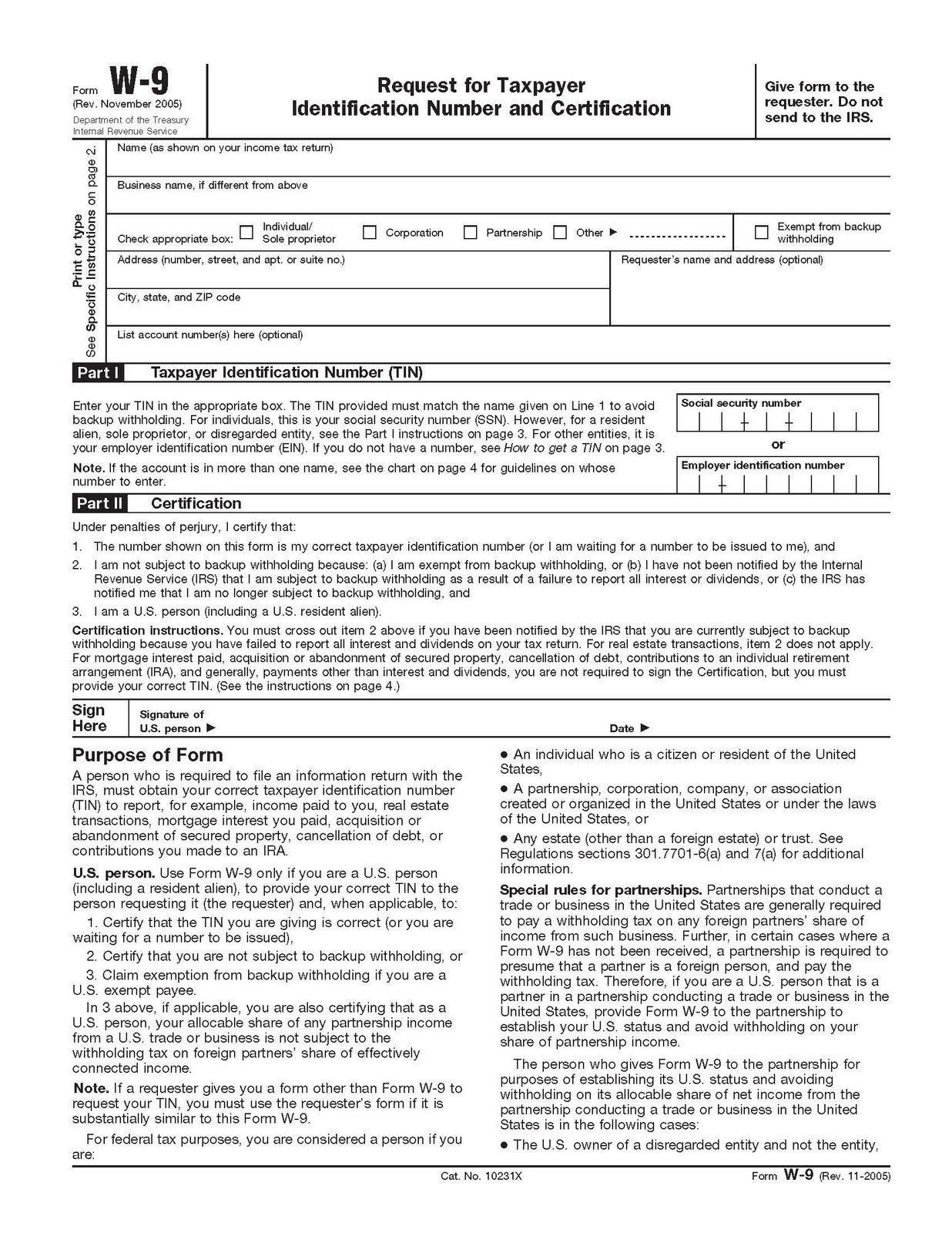

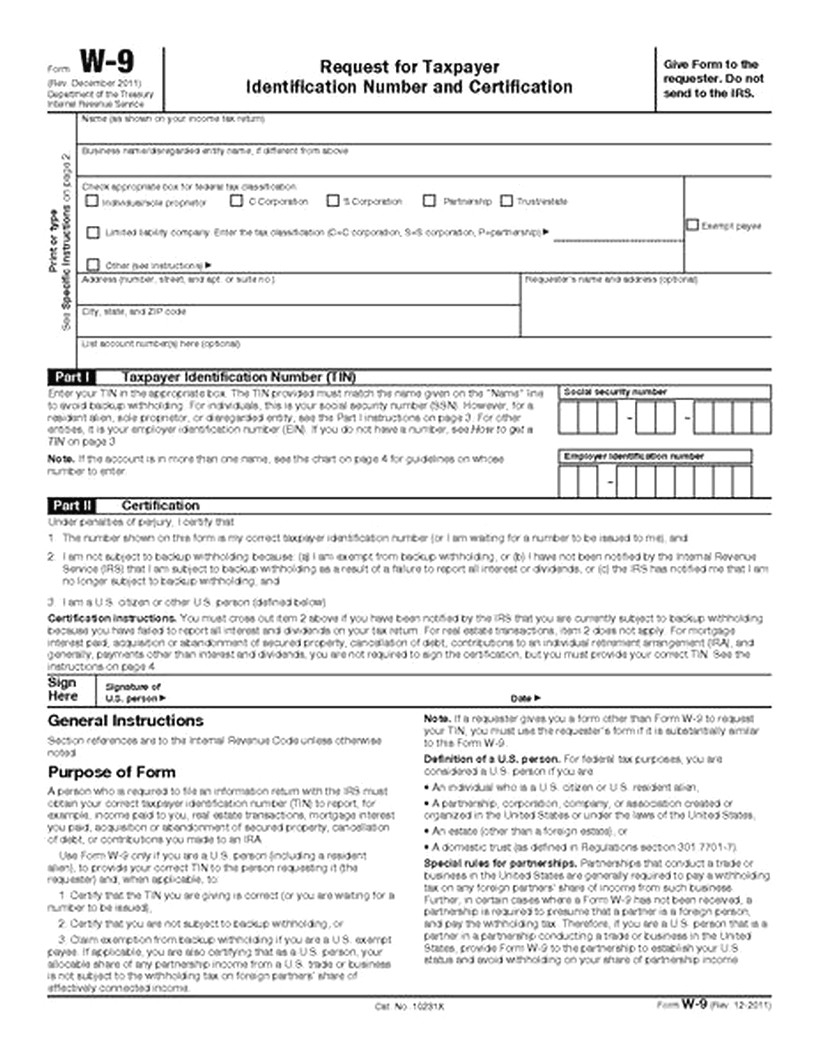

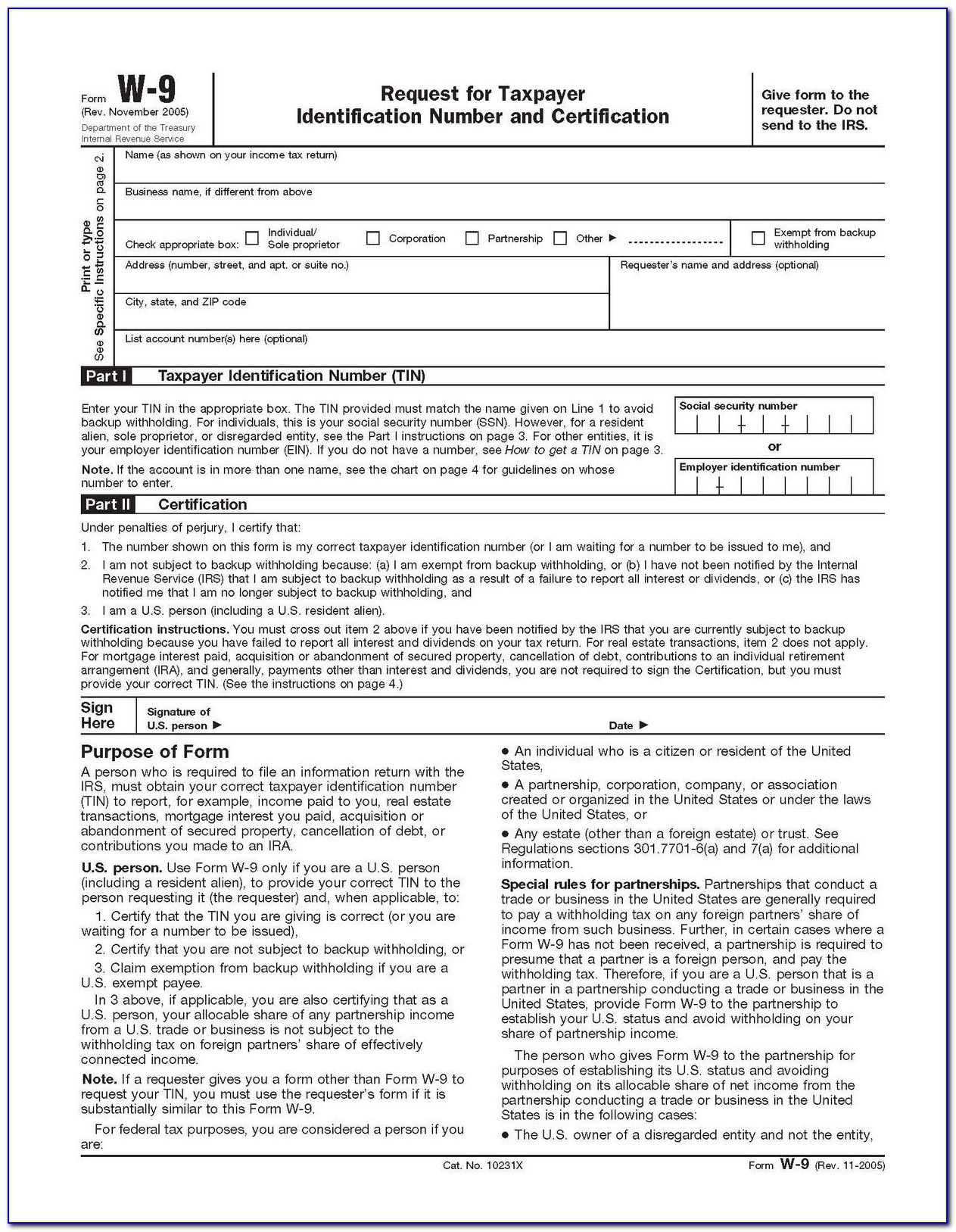

Request for taxpayer identification number and certification : January 2011) department of request for taxpayer identification the treasury internal revenue service number and certification name (as shown on your income tax return) give form to the requester. Do not leave this line blank. December 2014) department of the treasury identification number and certification internal revenue service give form to the.

How To Fill Out And Sign Your W9 Form Online intended for W 9 Form To

The form helps businesses obtain important information from payees to prepare information returns for the irs. Easily fill out pdf blank, edit, and sign them. See instructions on page 3): Business name/disregarded entity name, if different from above 4 exemptions (codes apply only to certain entities, not individuals;

How to Submit Your W 9 Forms Pdf Free Job Application Form

Web edit, sign, and share form w 9 2014 online. Do not send to the irs. This information is used when filing taxes or preparing payroll documents. Person (including a resident alien), to provide your correct tin. By signing it you attest that:

Blank W9 Tax Form W9 Form Printable, Fillable 2021 throughout W 9

Generally, only a nonresident alien individual may use the terms of a tax you are subject. · reduce your tax liability or · compensate you for any loss. January 2011) department of request for taxpayer identification the treasury internal revenue service number and certification name (as shown on your income tax return) give form to the requester. Web corporation partnership.

Blank W 9 Form 2021 Calendar Template Printable

Do not send to the irs. Web that has elected to be treated as a u.s. Generally, only a nonresident alien individual may use the terms of a tax you are subject. Easily fill out pdf blank, edit, and sign them. Request for taxpayer identification number and certification :

Free W 9 Form Printable Calendar Printables Free Blank

Enter the tax classification (c=c corporation, s=s corporation, p=partnership) Request for taxpayer identification number and certification : This form can be used to request the correct name and taxpayer identification number, or tin, of the payee. Generally, only a nonresident alien individual may use the terms of a tax you are subject. Do not send to the irs.

Printable Blank W 9 Forms Pdf Example Calendar Printable

Do not leave this line blank. Exempt payee code (if any) limited liability company. One of the most common situations is when someone works as an independent contractor for a business. For individuals, the tin is generally a social security number (ssn). See what is fatca reporting on page 2 for further information.

W9 Form Printable 2017 Free Free Printable

Request for taxpayer identification number and certification : Person (including a resident alien), to provide your correct tin. See what is fatca reporting on page 2 for further information. Do not send to the irs. Save or instantly send your ready documents.

Fillable Form W9 Request For Taxpayer Identification Number And

Save or instantly send your ready documents. Name is required on this line; See what is fatca reporting on page 2 for further information. Request for taxpayer identification number and certification : · reduce your tax liability or · compensate you for any loss.

Free W9 Forms 2021 Printable Pdf Calendar Printables Free Blank

Easily fill out pdf blank, edit, and sign them. Business name/disregarded entity name, if different from above Do not send to the irs. December 2014 department of the treasury internal revenue service request for taxpayer identification number and certification give form to the requester. October 2018) request for taxpayer identification number and certification section references are to the internal revenue.

For Individuals, The Tin Is Generally A Social Security Number (Ssn).

See instructions on page 3): Nonresident alien who becomes a resident alien. Request for taxpayer identification number and certification Name is required on this line;

Web Edit, Sign, And Share Form W 9 2014 Online.

Enter the tax classification (c=c corporation, s=s corporation, p=partnership) Name (as shown on your income tax return). This includes their name, address, employer identification number (ein), and other vital information. Request for taxpayer identification number and certification :

By Signing It You Attest That:

It’s important to provide accurate information on the form in order to ensure. Do not send to the irs. Generally, only a nonresident alien individual may use the terms of a tax you are subject. · reduce your tax liability or · compensate you for any loss.

Do Not Send To The Irs.

January 2011) department of request for taxpayer identification the treasury internal revenue service number and certification name (as shown on your income tax return) give form to the requester. This form can be used to request the correct name and taxpayer identification number, or tin, of the payee. The form helps businesses obtain important information from payees to prepare information returns for the irs. Do not send to the irs.