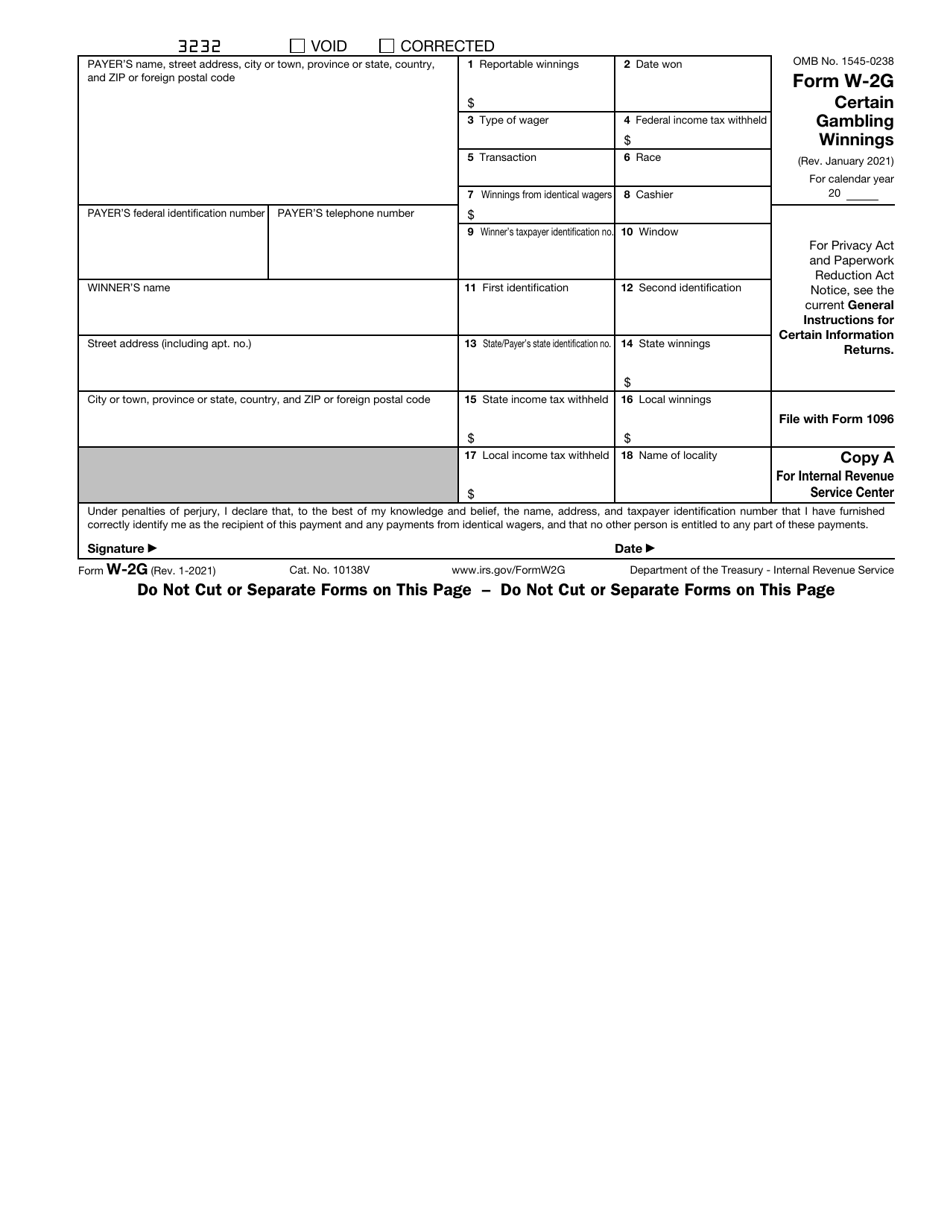

W-2G Form 2022

W-2G Form 2022 - Web instructions to winner box 1. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. $1,200 or more in gambling winnings from bingo or slot machines; This information is being furnished to the internal revenue. Web updated for tax year 2022 • december 4, 2022 06:03 pm overview whether you play the ponies or pull slots, your gambling winnings are subject to federal. Open or continue your return in turbotax, if you aren't already in it; Complete, edit or print tax forms instantly. $600 or more on other. Ad complete irs tax forms online or print government tax documents.

$1,200 or more on slots or bingo. $1,200 or more in gambling winnings from bingo or slot machines; Web file now with turbotax related federal corporate income tax forms: Complete, edit or print tax forms instantly. Web instructions to winner box 1. Taxformfinder has an additional 774 federal income tax forms that you may need, plus all federal income. You must file a copy and attach it to your federal income tax return. $1,500 or more on keno. Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly.

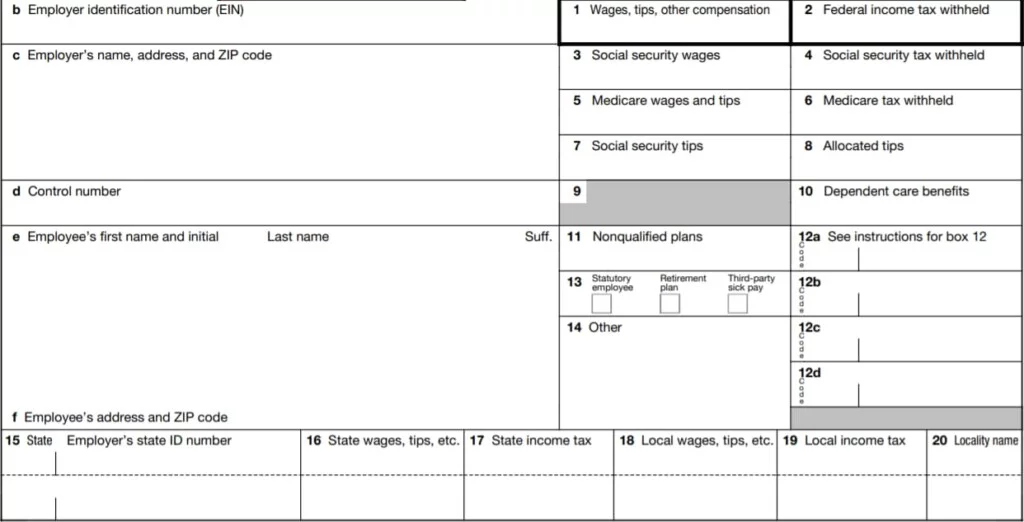

Web updated for tax year 2022 • december 4, 2022 06:03 pm overview whether you play the ponies or pull slots, your gambling winnings are subject to federal. $1,200 or more on slots or bingo. Copy b—to be filed with employee’s federal tax return. File this form to report gambling winnings and any federal income tax withheld on those winnings. Ad complete irs tax forms online or print government tax documents. You can download or print current or. $1,200 or more in gambling winnings from bingo or slot machines; You must file a copy and attach it to your federal income tax return. Web file now with turbotax related federal corporate income tax forms: $1,500 or more on keno.

940 Form 2021 IRS Forms TaxUni

Taxformfinder has an additional 774 federal income tax forms that you may need, plus all federal income. If you choose to file by paper, the deadline is. Web instructions to winner box 1. Web updated for tax year 2022 • december 4, 2022 06:03 pm overview whether you play the ponies or pull slots, your gambling winnings are subject to.

W2G Form 2022

If you choose to file by paper, the deadline is. Ad complete irs tax forms online or print government tax documents. You can download or print current or. Open or continue your return in turbotax, if you aren't already in it; $1,200 or more on slots or bingo.

Kode Undangan Hago 2022 Form W 2g IMAGESEE

Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Web instructions to winner box 1. Copy b—to be filed with employee’s federal tax return. If you choose to file by paper, the deadline is.

Kode Undangan Hago 2022 Form W 2g IMAGESEE

Web instructions to winner box 1. $1,500 or more on keno. File this form to report gambling winnings and any federal income tax withheld on those winnings. Open or continue your return in turbotax, if you aren't already in it; Complete, edit or print tax forms instantly.

IRS Form W2G Download Fillable PDF or Fill Online Certain Gambling

$1,500 or more on keno. $5,000 or more in poker. Complete, edit or print tax forms instantly. Web instructions to winner box 1. If you choose to file by paper, the deadline is.

Form Fillable Electronic Irs Forms Printable Forms Free Online

This information is being furnished to the internal revenue. $1,200 or more in gambling winnings from bingo or slot machines; If you choose to file by paper, the deadline is. Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents.

w2g idms form Fill out & sign online DocHub

This information is being furnished to the internal revenue. Complete, edit or print tax forms instantly. $1,500 or more on keno. Ad complete irs tax forms online or print government tax documents. $1,200 or more in gambling winnings from bingo or slot machines;

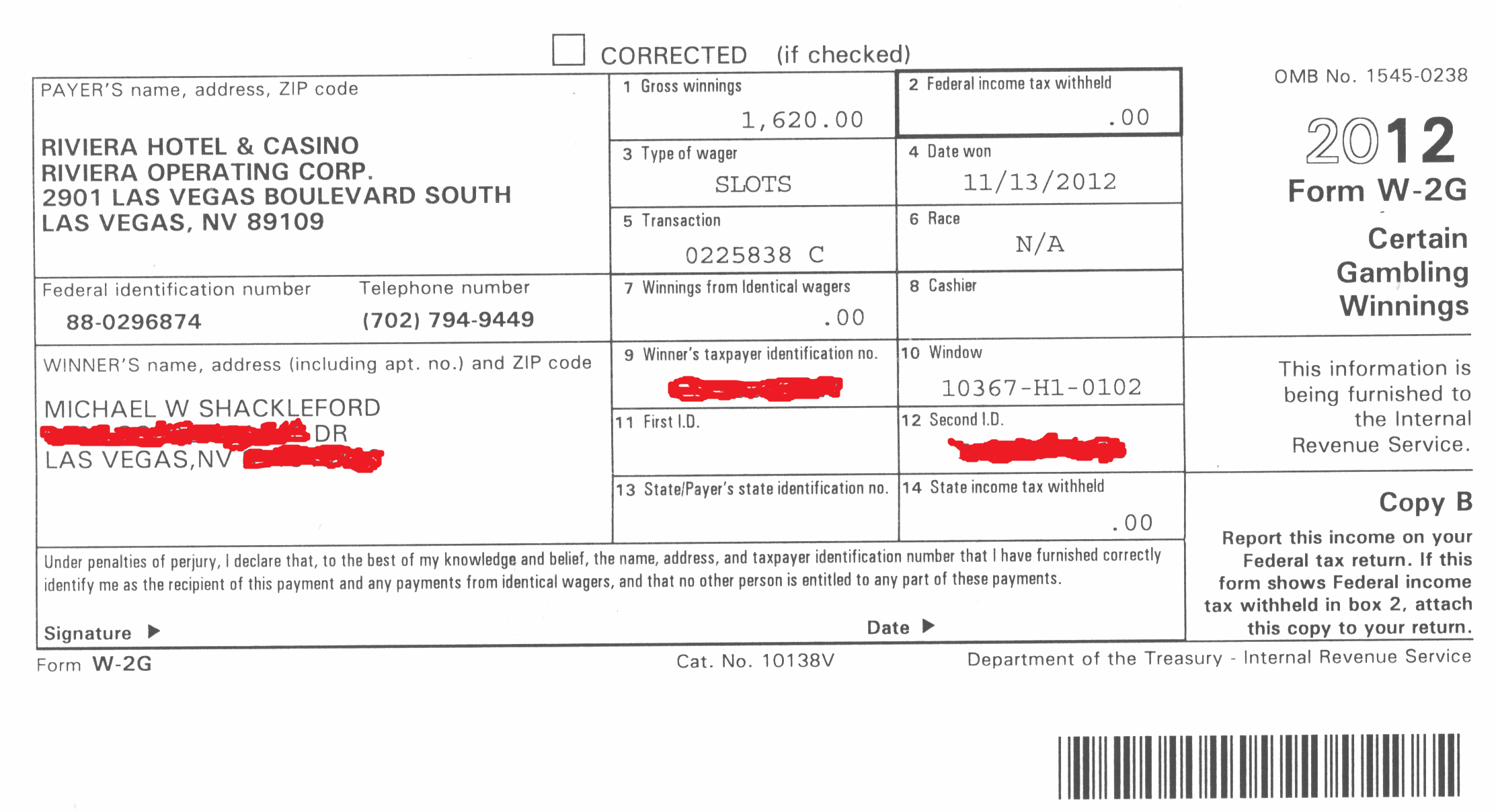

Taxable Return from Video Poker

Web updated for tax year 2022 • december 4, 2022 06:03 pm overview whether you play the ponies or pull slots, your gambling winnings are subject to federal. $5,000 or more in poker. You must file a copy and attach it to your federal income tax return. Copy b—to be filed with employee’s federal tax return. Web instructions to winner.

W 2 Form 2012 Printable Printable Word Searches

Web file now with turbotax related federal corporate income tax forms: Web instructions to winner box 1. $1,200 or more in gambling winnings from bingo or slot machines; Complete, edit or print tax forms instantly. Copy b—to be filed with employee’s federal tax return.

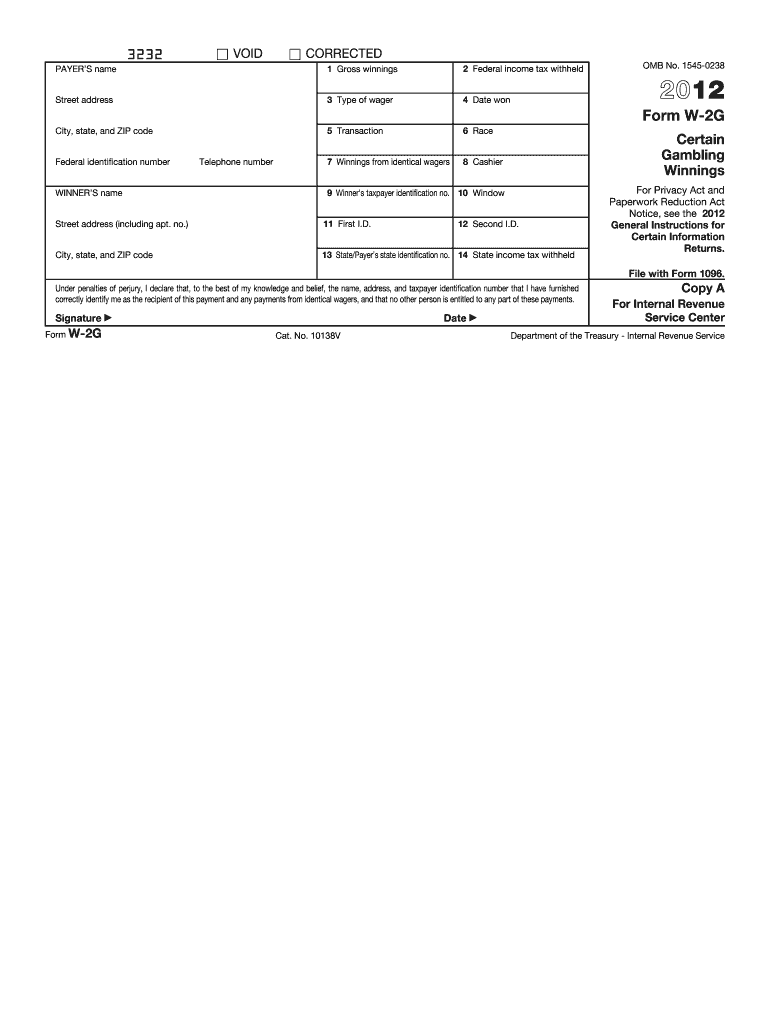

irs form w2g 2020 Fill Online, Printable, Fillable Blank

File this form to report gambling winnings and any federal income tax withheld on those winnings. $600 or more on other. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Taxformfinder has an additional 774 federal income tax forms that you may need, plus all federal income.

Open Or Continue Your Return In Turbotax, If You Aren't Already In It;

$5,000 or more in poker. Taxformfinder has an additional 774 federal income tax forms that you may need, plus all federal income. Ad complete irs tax forms online or print government tax documents. $600 or more on other.

$1,500 Or More On Keno.

This information is being furnished to the internal revenue. Web instructions to winner box 1. You can download or print current or. You must file a copy and attach it to your federal income tax return.

Complete, Edit Or Print Tax Forms Instantly.

Copy b—to be filed with employee’s federal tax return. Complete, edit or print tax forms instantly. Web updated for tax year 2022 • december 4, 2022 06:03 pm overview whether you play the ponies or pull slots, your gambling winnings are subject to federal. $1,200 or more on slots or bingo.

$1,200 Or More In Gambling Winnings From Bingo Or Slot Machines;

If you choose to file by paper, the deadline is. Web file now with turbotax related federal corporate income tax forms: Complete, edit or print tax forms instantly. File this form to report gambling winnings and any federal income tax withheld on those winnings.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.03.26AM-e376b945aa4e4b7381f63b10e4de9cc2.png)