Va Form 760 Instructions

Va Form 760 Instructions - Web search for va forms by keyword, form name, or form number. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. 07/21 your first name m.i. Type text, add images, blackout confidential details, add comments, highlights and more. Web virginia form 760 instructions what's new virginia's fixed date conformity with the internal revenue code: File by may 1, 2023 —. Quickly access top tasks for frequently downloaded va forms. Web virginia form 760 *va0760122888* resident income tax return. Edit your va tax form 760 online. Select the orange button to.

4 6rfldo 6hfxulw\ dqg htxlydohqw 7lhu 5dlourdg 5hwluhphqw ehqh¿wv li wd[deoh rq. File by may 1, 2023 —. Edit your va tax form 760 online. If the amount on line 9 is less than the amount shown below for your filing. If your tax is underpaid as of any installment due date, you. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Be sure to provide date of birth above. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. 07/21 your first name m.i. Web form 760ip is a virginia individual income tax form.

Web find forms & instructions by category. Web virginia resident form 760 *va0760120888* individual income tax return. Web virginia form 760 *va0760122888* resident income tax return. Web virginia form 760 instructions what's new virginia's fixed date conformity with the internal revenue code: Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. Web follow these steps to download and open a va.gov pdf form in adobe acrobat reader instead. 4 6rfldo 6hfxulw\ dqg htxlydohqw 7lhu 5dlourdg 5hwluhphqw ehqh¿wv li wd[deoh rq. Web form 760ip is a virginia individual income tax form. Be sure to provide date of birth above. See line 9 and instructions.

VA 760 Instructions 2017 Fill out Tax Template Online US Legal Forms

Web follow these steps to download and open a va.gov pdf form in adobe acrobat reader instead. Web virginia resident form 760 *va0760120888* individual income tax return. Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. Web filing a separate virginia form 760, enter the vagi on line.

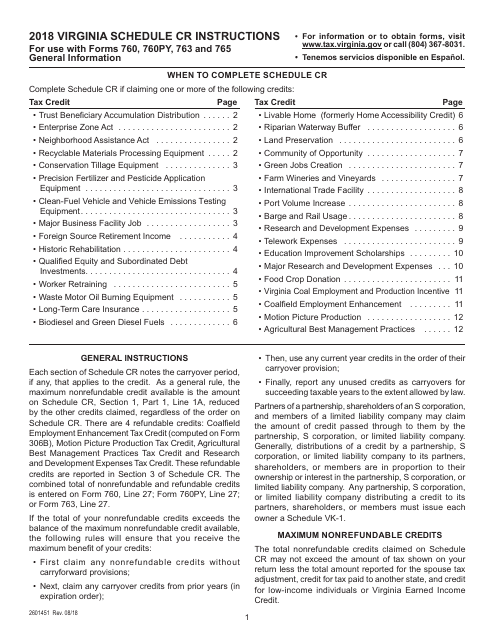

Download Instructions for Form 760, 760PY, 763, 765 Schedule CR Credit

You’ll need to have the latest version of adobe acrobat reader. Web find forms & instructions by category. If your tax is underpaid as of any installment due date, you. File by may 1, 2023 —. Web follow these steps to download and open a va.gov pdf form in adobe acrobat reader instead.

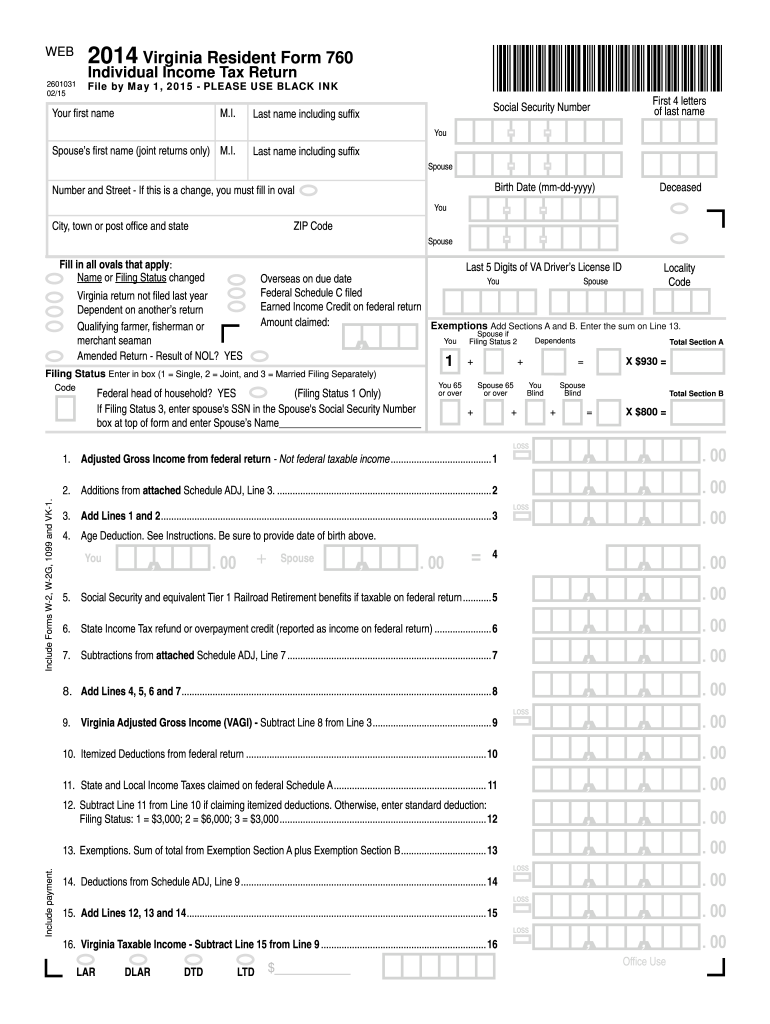

760 virginia tax form 2014 Fill out & sign online DocHub

Web search for va forms by keyword, form name, or form number. Edit your va tax form 760 online. If the amount on line 9 is less than the amount shown below for your filing. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. Quickly access top tasks for frequently.

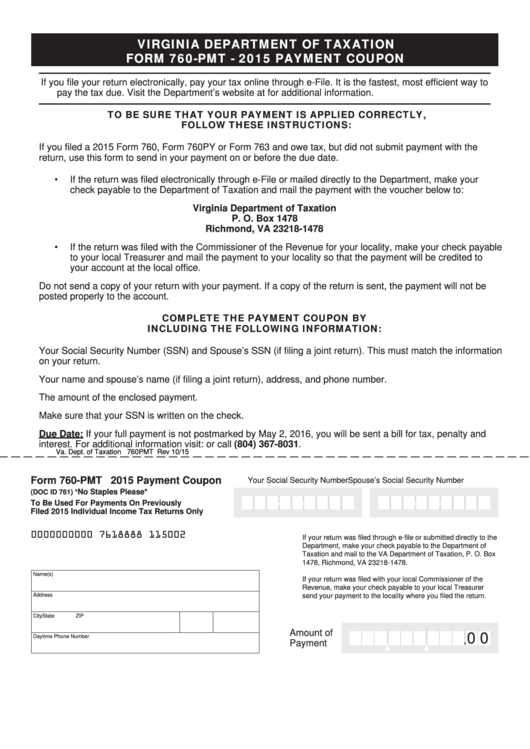

Fillable Form 760Pmt Virginia Payment Coupon 2015 printable pdf

You’ll need to have the latest version of adobe acrobat reader. Web form 760ip is a virginia individual income tax form. Web virginia form 760 *va0760122888* resident income tax return. File by may 1, 2023 —. Sign it in a few clicks.

2018 virginia resident form 760 Fill out & sign online DocHub

Web make use of the tips about how to fill out the va 760 instructions: Type text, add images, blackout confidential details, add comments, highlights and more. Web filing a separate virginia form 760, enter the vagi on line 9, form 760, from your spouse's return. 4 6rfldo 6hfxulw\ dqg htxlydohqw 7lhu 5dlourdg 5hwluhphqw ehqh¿wv li wd[deoh rq. You’ll need.

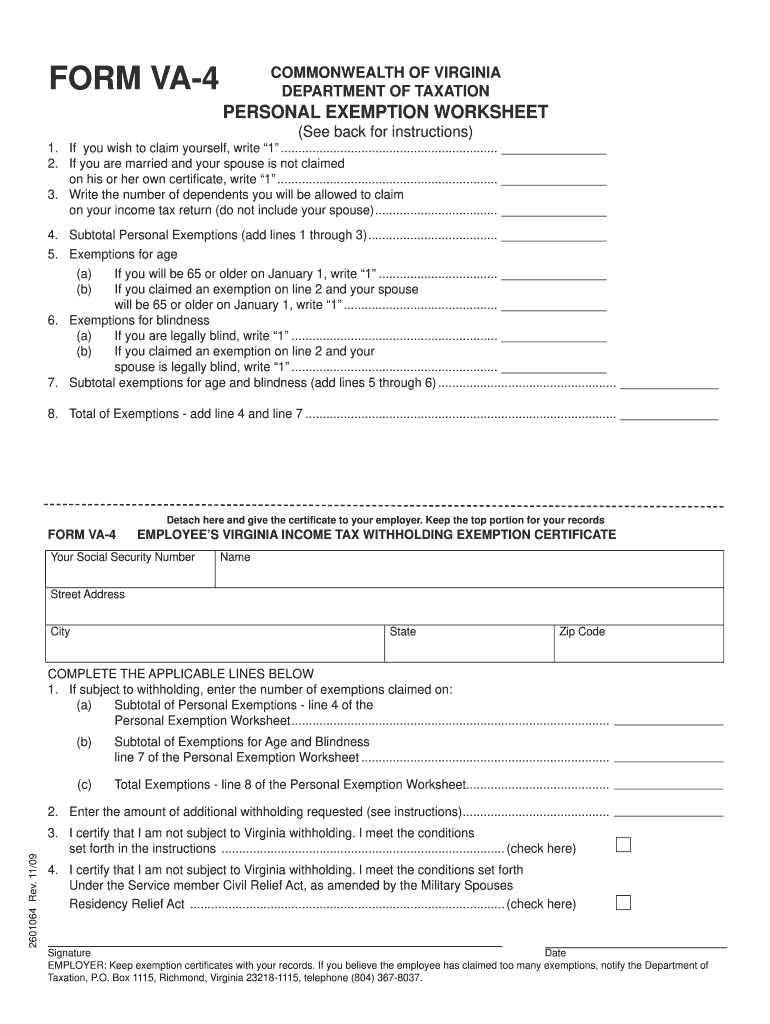

Va 4 State Tax Form Fillable Fill Out and Sign Printable PDF Template

File by may 1, 2023 —. If your tax is underpaid as of any installment due date, you. Web virginia form 760 instructions what's new virginia's fixed date conformity with the internal revenue code: 4 6rfldo 6hfxulw\ dqg htxlydohqw 7lhu 5dlourdg 5hwluhphqw ehqh¿wv li wd[deoh rq. Quickly access top tasks for frequently downloaded va forms.

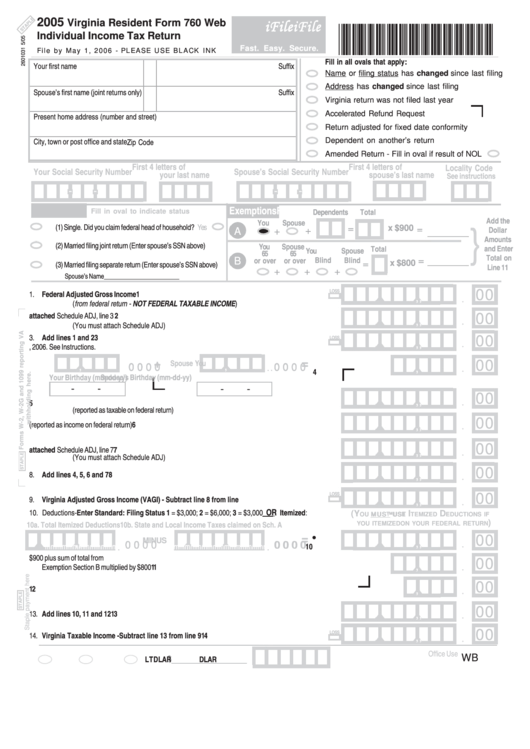

Virginia Resident Form 760 Web Individual Tax Return 2005

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web virginia form 760 *va0760122888* resident income tax return. Web complete form.

Spouse Tax Adjustment Worksheet

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Edit your va tax form 760 online. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. Sign it in a few.

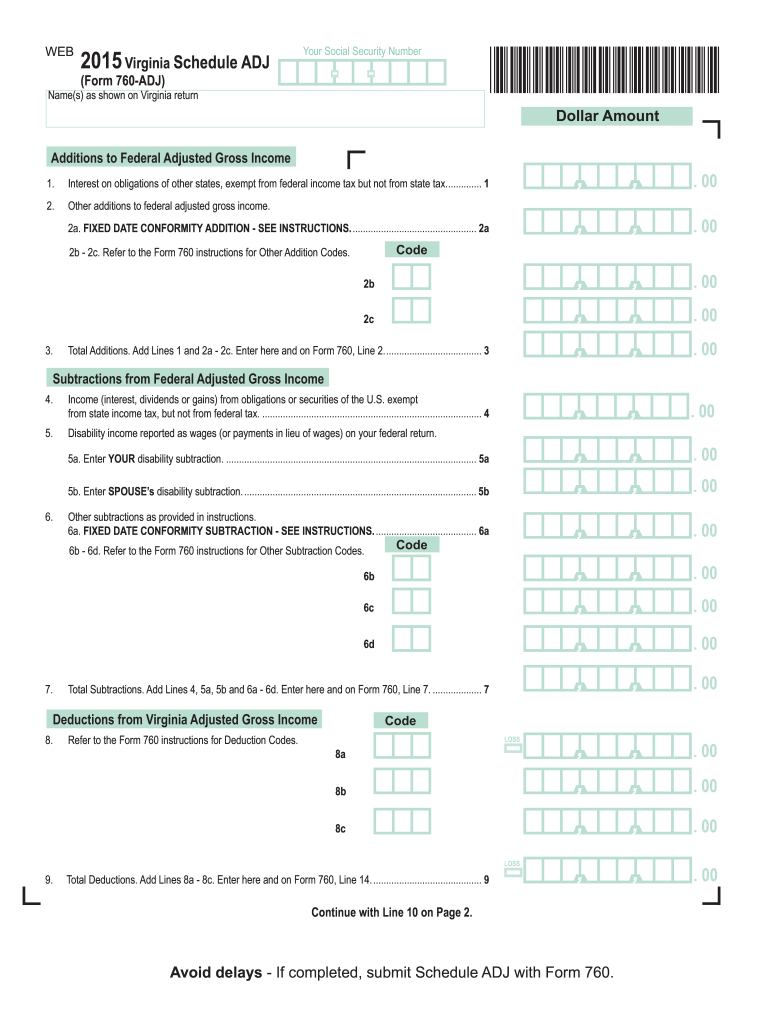

2015 Form VA 760ADJ Fill Online, Printable, Fillable, Blank pdfFiller

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Type text, add images, blackout confidential details, add comments, highlights and more. Be sure to provide date of birth above. Edit your va tax form 760 online. Web find forms & instructions by category.

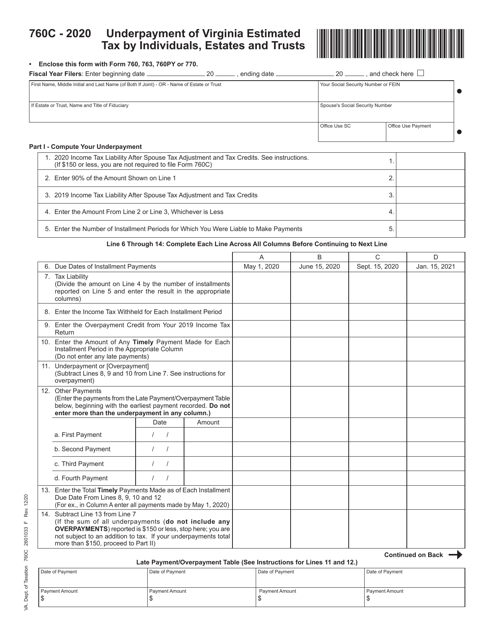

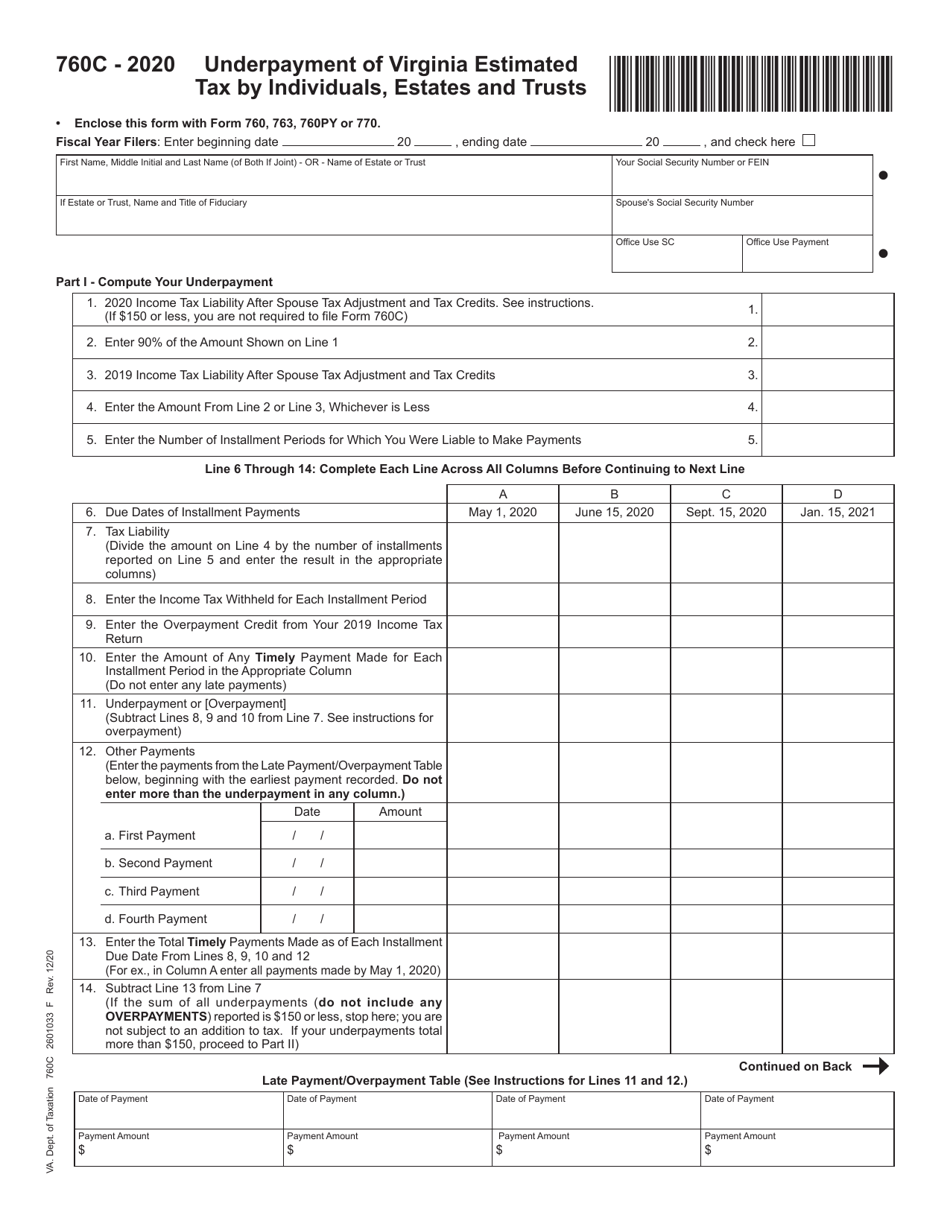

Form 760C Download Fillable PDF or Fill Online Underpayment of Virginia

You’ll need to have the latest version of adobe acrobat reader. If the amount on line 9 is less than the amount shown below for your filing. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. Web virginia form 760.

Web 2021 Virginia Form 760 *Va0760121888* Resident Income Tax Return 2601031 File By May 1, 2022 — Use Black Ink Rev.

Select the orange button to. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. Web find forms & instructions by category. Web virginia form 760 *va0760122888* resident income tax return.

See Line 9 And Instructions.

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Quickly access top tasks for frequently downloaded va forms. Web make use of the tips about how to fill out the va 760 instructions:

Web Virginia Resident Form 760 *Va0760120888* Individual Income Tax Return.

Web form 760ip is a virginia individual income tax form. 4 6rfldo 6hfxulw\ dqg htxlydohqw 7lhu 5dlourdg 5hwluhphqw ehqh¿wv li wd[deoh rq. Corporation and pass through entity tax. You’ll need to have the latest version of adobe acrobat reader.

Sign It In A Few Clicks.

Be sure to provide date of birth above. Web virginia form 760 instructions what's new virginia's fixed date conformity with the internal revenue code: Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). 07/21 your first name m.i.