Transfer On Death Deed Form California 2022

Transfer On Death Deed Form California 2022 - This law created a requirement that the execution of a tod must be witnessed by two. What does the tod deed do? Web transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: Web this revocation form only affects a transfer on death deed that you made. The tod deed method allows for the transfer of real property upon ones death without. You should carefully read all of the. 11.170 transfer on death (tod) beneficiary (vc §§4150.7, 5910.5, 9852.7,. Web california transfer on death affidavit information. This bill would revise and recast those provisions, and instead make them operative until january 1, 2032. Ad ca revocable tod deed & more fillable forms, register and subscribe now!

This law created a requirement that the execution of a tod must be witnessed by two. Web tod deeds executed before january 1, 2022, will remain valid until the transferor’s death. Using an affidavit of death to claim real estate from a california transfer on death deed. Web existing law makes these provisions inoperative on january 1, 2022. Web this has changed the way a homeowner can create or revoke a transfer on death deed, starting in 2022. Web 11.015 basic transfer requirements; Recorded concurrently “in connection with” transfer subject to dtt recorded concurrently “in connection with” a transfer of. Customizable form to update property ownership after death of owner. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Try it for free now!

Try it for free now! Web california transfer on death affidavit information. This law created a requirement that the execution of a tod must be witnessed by two. Web transfer is exempt from fee per gc § 27388.1(a)(2): However, with the uncertainty of the status of this law, there is. Using an affidavit of death to claim real estate from a california transfer on death deed. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Ad ca revocable tod deed & more fillable forms, register and subscribe now! 11.170 transfer on death (tod) beneficiary (vc §§4150.7, 5910.5, 9852.7,. Web you must send a “notice of revocable transfer on death deed” to all legal heirs.

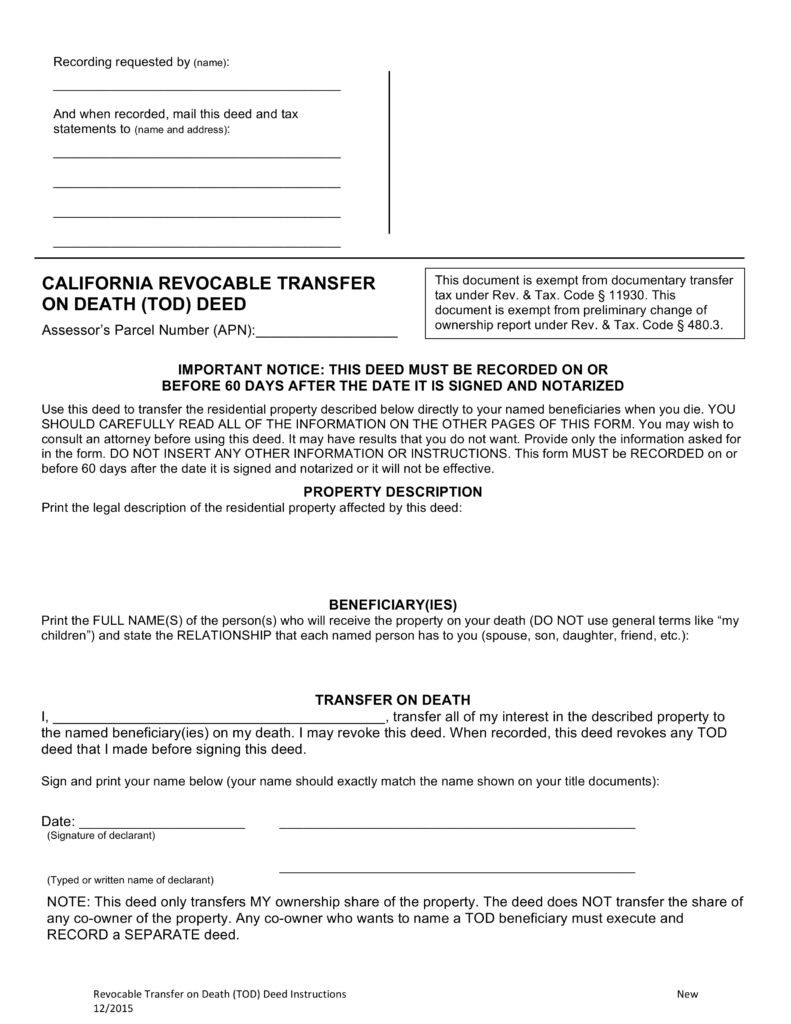

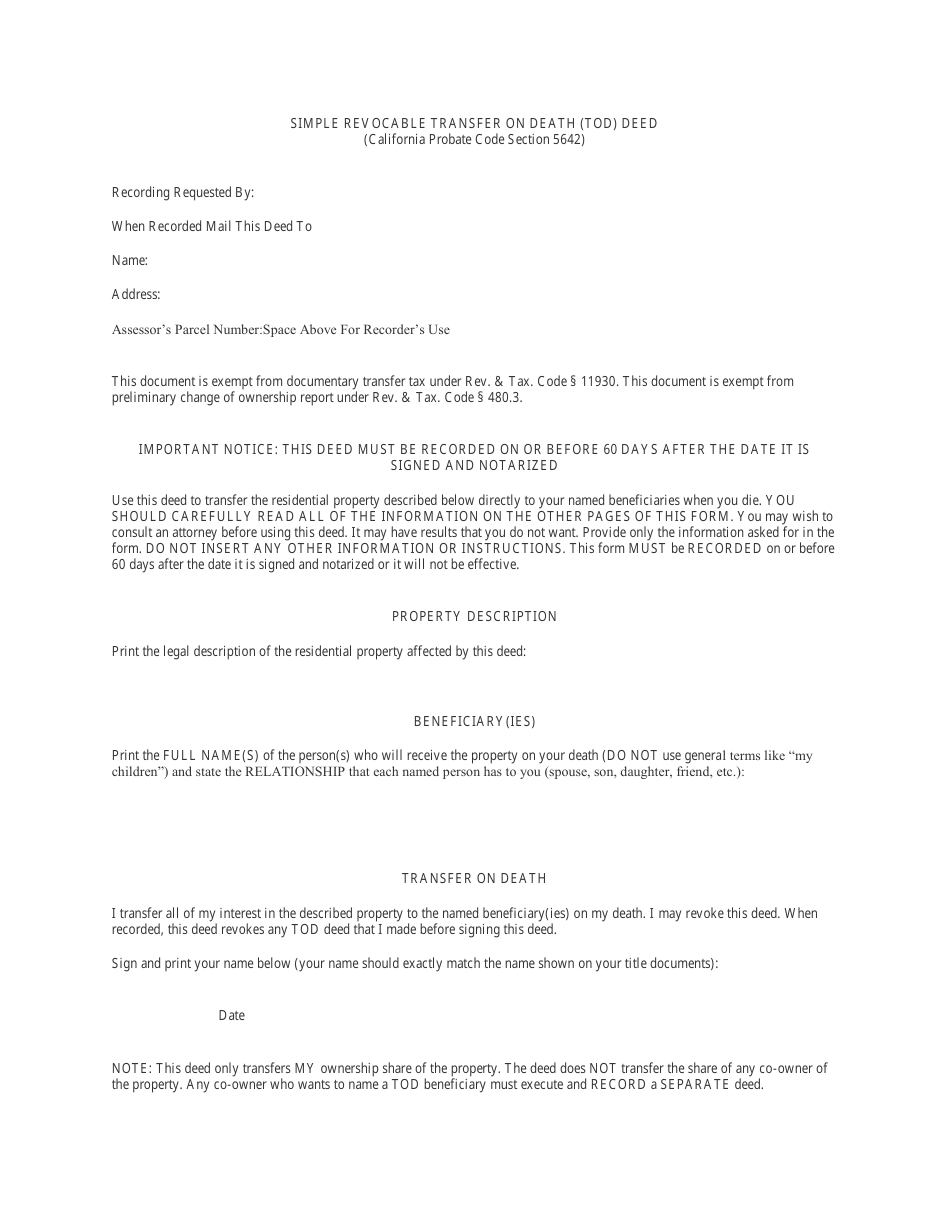

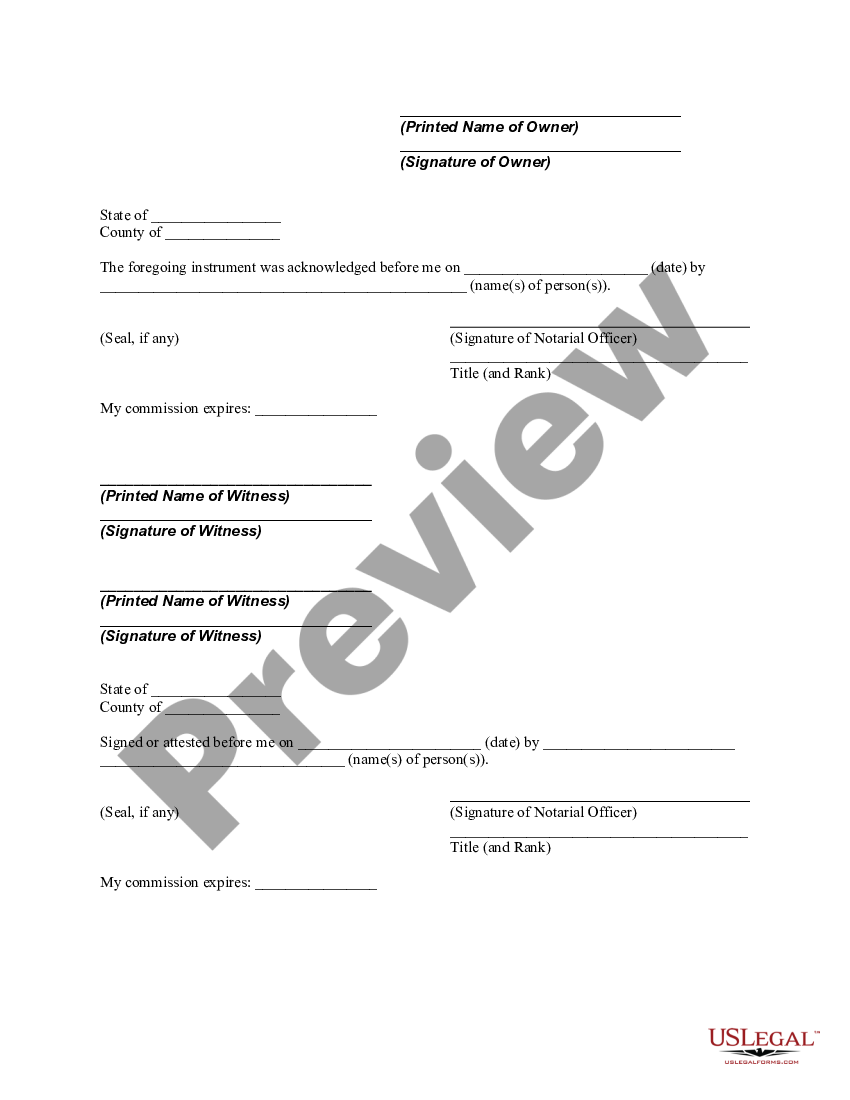

CA Simple Revocable TOD Deed Complete Legal Document Online US

Web tod deeds executed before january 1, 2022, will remain valid until the transferor’s death. Web yes, your transfer on death deed will remain valid as long as it is executed before january 1, 2022. This bill would revise and recast those provisions, and instead make them operative until january 1, 2032. What does the tod deed do? 11.020 california.

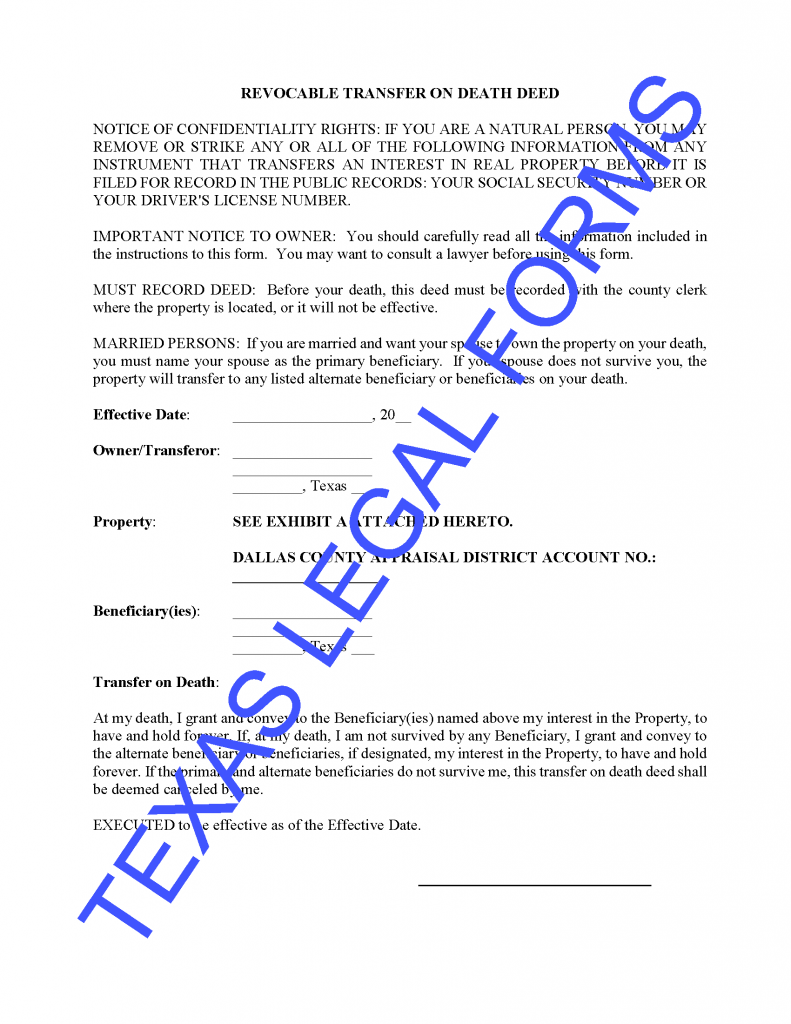

Revocable Transfer on Death Deed Texas Legal Forms by David Goodhart

Web existing law makes these provisions inoperative on january 1, 2022. Easily customize your transfer on death deed. You should carefully read all of the. 11.170 transfer on death (tod) beneficiary (vc §§4150.7, 5910.5, 9852.7,. Upload, modify or create forms.

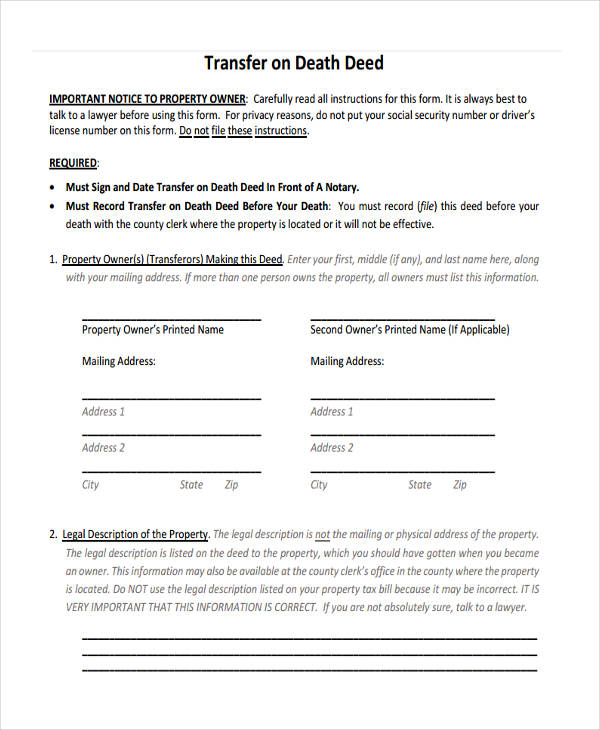

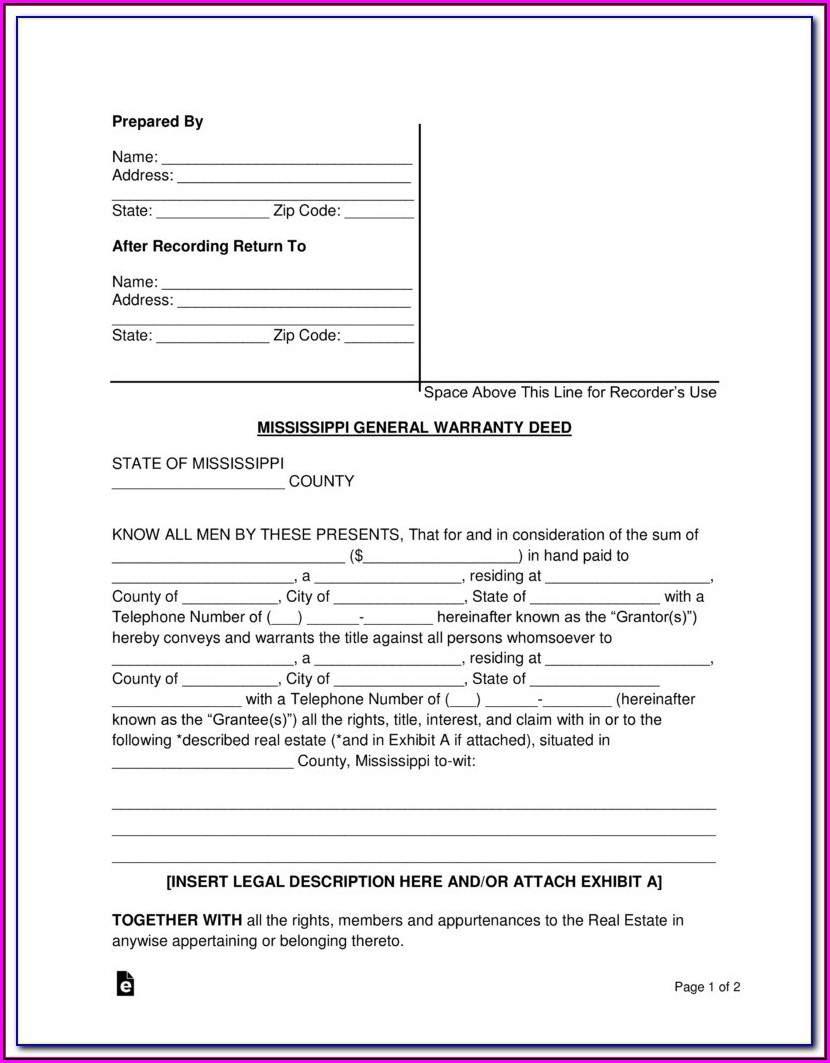

FREE 22+ Sample Deed Forms in PDF

Recorded concurrently “in connection with” transfer subject to dtt recorded concurrently “in connection with” a transfer of. Web yes, your transfer on death deed will remain valid as long as it is executed before january 1, 2022. Web transfer is exempt from fee per gc § 27388.1(a)(2): Web tod deeds executed before january 1, 2022, will remain valid until the.

Free Printable Beneficiary Deed Free Printable

Try it for free now! Sacramento county public law library subject: Web common questions about the use of this form. Web you must send a “notice of revocable transfer on death deed” to all legal heirs. Web yes, your transfer on death deed will remain valid as long as it is executed before january 1, 2022.

California Simple Revocable Transfer on Death Deed Form Download

Web this has changed the way a homeowner can create or revoke a transfer on death deed, starting in 2022. Web our california tod deed form reflects the current version of the law. Using an affidavit of death to claim real estate from a california transfer on death deed. Web tod deeds executed before january 1, 2022, will remain valid.

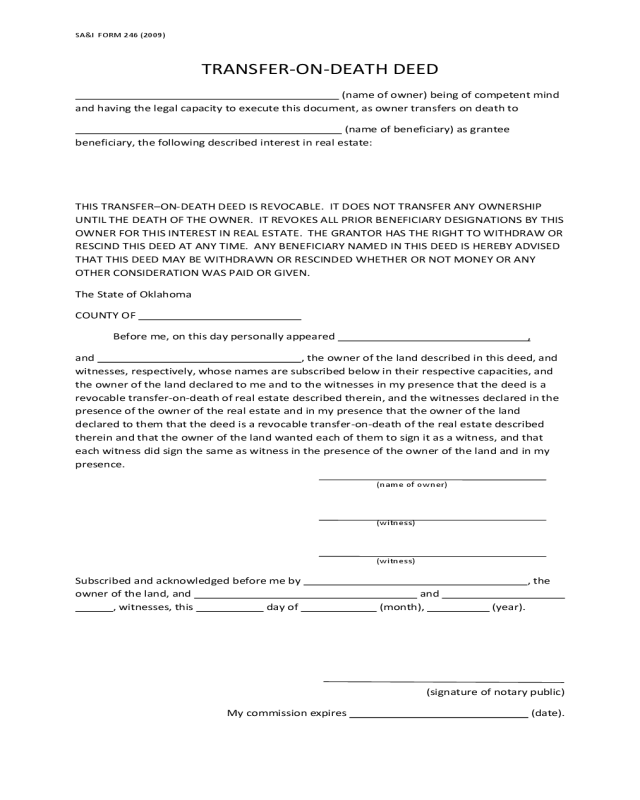

Oklahoma Transfer on Death Deed Transfer On Death Deed Oklahoma Form

If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. The tod deed method allows for the transfer of real property upon ones death without. Web you must send a “notice of revocable transfer on death deed” to all legal heirs. This bill would revise and recast those.

Transfer on Death Form 2 Free Templates in PDF, Word, Excel Download

Customizable form to update property ownership after death of owner. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Web use this deed to transfer the residential property described below directly to your named beneficiaries when you die. Web 11.015 basic transfer requirements; Web you must send.

2022 Transfer on Death Form Fillable, Printable PDF & Forms Handypdf

However, with the uncertainty of the status of this law, there is. Sacramento county public law library subject: Web existing law makes these provisions inoperative on january 1, 2022. Web transfer on death deed i/we, (owner/owners), hereby convey to (grantee beneficiary), effective on my/our death the following described real property: This bill would revise and recast those provisions, and instead.

transfer death deed Doc Template pdfFiller

Easily customize your transfer on death deed. Web our california tod deed form reflects the current version of the law. This bill would revise and recast those provisions, and instead make them operative until january 1, 2032. Upload, modify or create forms. Customizable form to update property ownership after death of owner.

Free Oregon Transfer On Death Deed Form Form Resume Examples

Easily customize your transfer on death deed. What does the tod deed do? Ad answer simple questions to make a transfer on death deed on any device in minutes. This bill would revise and recast those provisions, and instead make them operative until january 1, 2032. Web yes, your transfer on death deed will remain valid as long as it.

Web This Revocation Form Only Affects A Transfer On Death Deed That You Made.

Upload, modify or create forms. Web existing law makes these provisions inoperative on january 1, 2022. Web yes, your transfer on death deed will remain valid as long as it is executed before january 1, 2022. Web transfer is exempt from fee per gc § 27388.1(a)(2):

This Law Created A Requirement That The Execution Of A Tod Must Be Witnessed By Two.

Web in response, a new law was passed that goes into effect on january 1, 2022. Web for a complete list, see california probate code section 13050. If a california tod is executed before jan. Web this has changed the way a homeowner can create or revoke a transfer on death deed, starting in 2022.

Web Common Questions About The Use Of This Form.

11.020 california welfare and institutions code sales; Ad answer simple questions to make a transfer on death deed on any device in minutes. When you die, the identified property will transfer to your named beneficiary. What does the tod deed do?

Web Our California Tod Deed Form Reflects The Current Version Of The Law.

If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Web you must send a “notice of revocable transfer on death deed” to all legal heirs. Web 11.015 basic transfer requirements; You must include a copy of the recorded transfer on death deed and of the death certificate.