Taxslayer Form 8949

Taxslayer Form 8949 - Web file form 8949 with the schedule d for the return you are filing. The information recorded on form 8949 reconciles the amounts. Web if you have a loss from a wash sale, you cannot deduct it on your return. Web where is form 8949? Web to enter a wash sale on form 8949 in taxslayer proweb, from the federal section of the tax return (form 1040) select: The sale or exchange of a capital asset not reported. Web supported federal forms. The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. See below for a list of all of the. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest.

Web file form 8949 with the schedule d for the return you are filing. Forms 8949 and schedule d will be. See below for a list of all of the. Form 8949 is used to report the following information: Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Web up to $40 cash back form 8949, sales and other dispositions of capital assets records the details of your capital asset sales or exchanges. Web where is form 8949? The sale or exchange of a capital asset not reported. Web supported federal forms. Capital gains and losses occur when a taxpayer sells a capital.

Capital gains and losses occur when a taxpayer sells a capital. Form 8949 is used to report the following information: The information is generally reported on a form 8949 and/or a schedule d as a capital gain or loss. Web to enter a wash sale on form 8949 in taxslayer pro, from the main menu of the tax return (form 1040), select: Web file form 8949 with the schedule d for the return you are filing. Web use form 8949 to report sales and exchanges of capital assets. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Additionally, a gain on a wash sale is taxable. The sale or exchange of a capital asset not reported. Web if you have a loss from a wash sale, you cannot deduct it on your return.

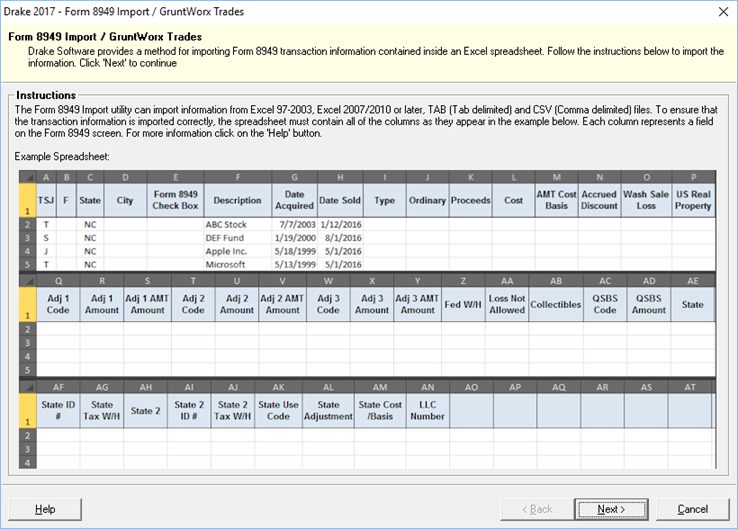

Form 8949 Import/GruntWorx Trades

The sale or exchange of a capital asset not reported. Part i of the 8949. Web file form 8949 with the schedule d for the return you are filing. See below for a list of all of the. Web use form 8949 to report sales and exchanges of capital assets.

Form 8949 Sales and Other Dispositions of Capital Assets (2014) Free

Web form 8949 is used to list all capital gain and loss transactions. The information recorded on form 8949 reconciles the amounts. Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Web where is form 8949? Web form 8949 department of the treasury internal revenue service sales and other.

2019 Form IRS 8949 Instructions Fill Online, Printable, Fillable, Blank

Web use form 8949 to report sales and exchanges of capital assets. Forms 8949 and schedule d will be. Form 8949 can likewise be utilized to address. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Form 8949 (sales and other dispositions of capital.

How to File a Tax Extension with TaxSlayer The Official Blog of TaxSlayer

Web file form 8949 with the schedule d for the return you are filing. Web if you have a loss from a wash sale, you cannot deduct it on your return. See below for a list of all of the. The information recorded on form 8949 reconciles the amounts. The sale or exchange of a capital asset not reported.

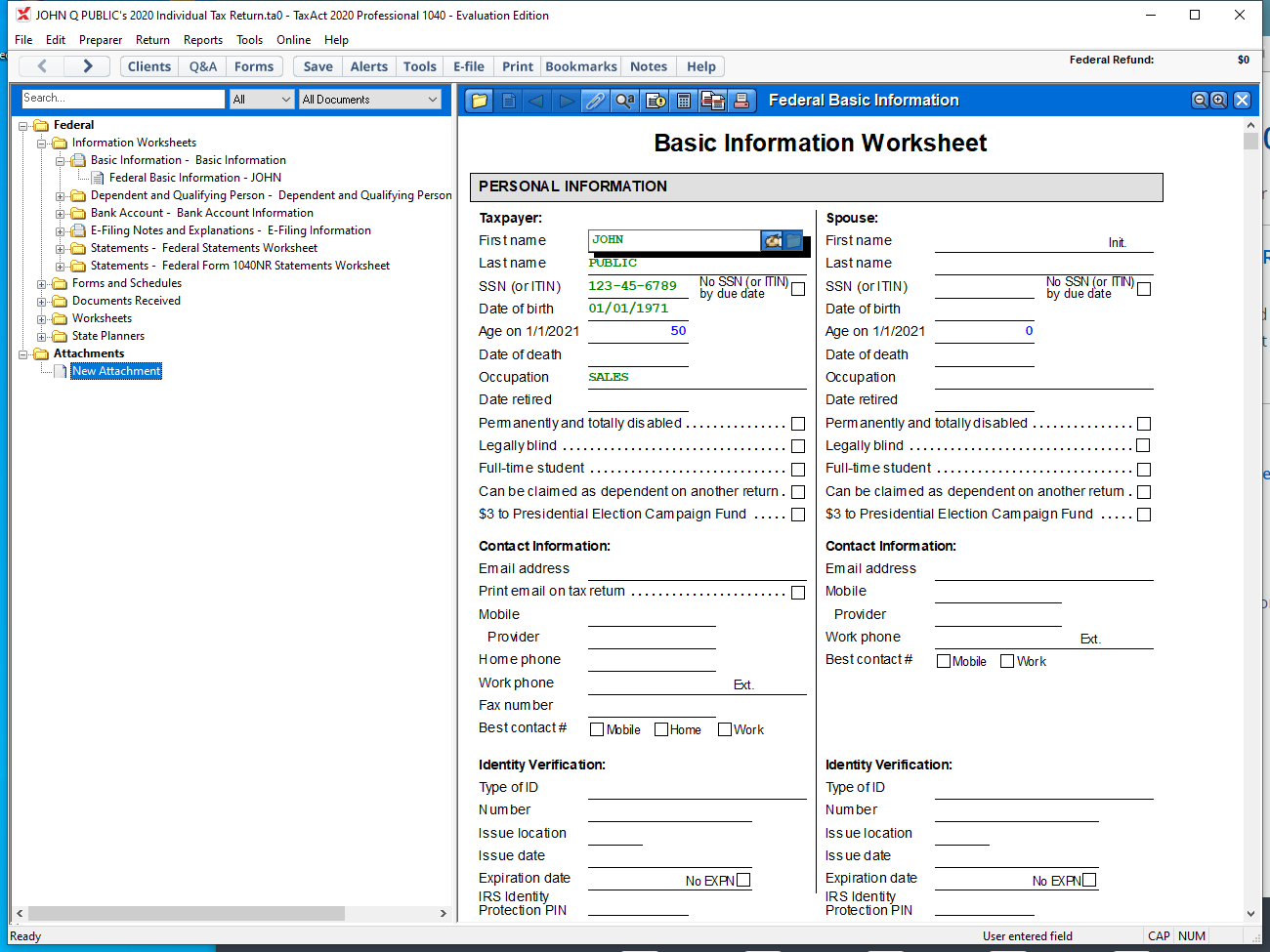

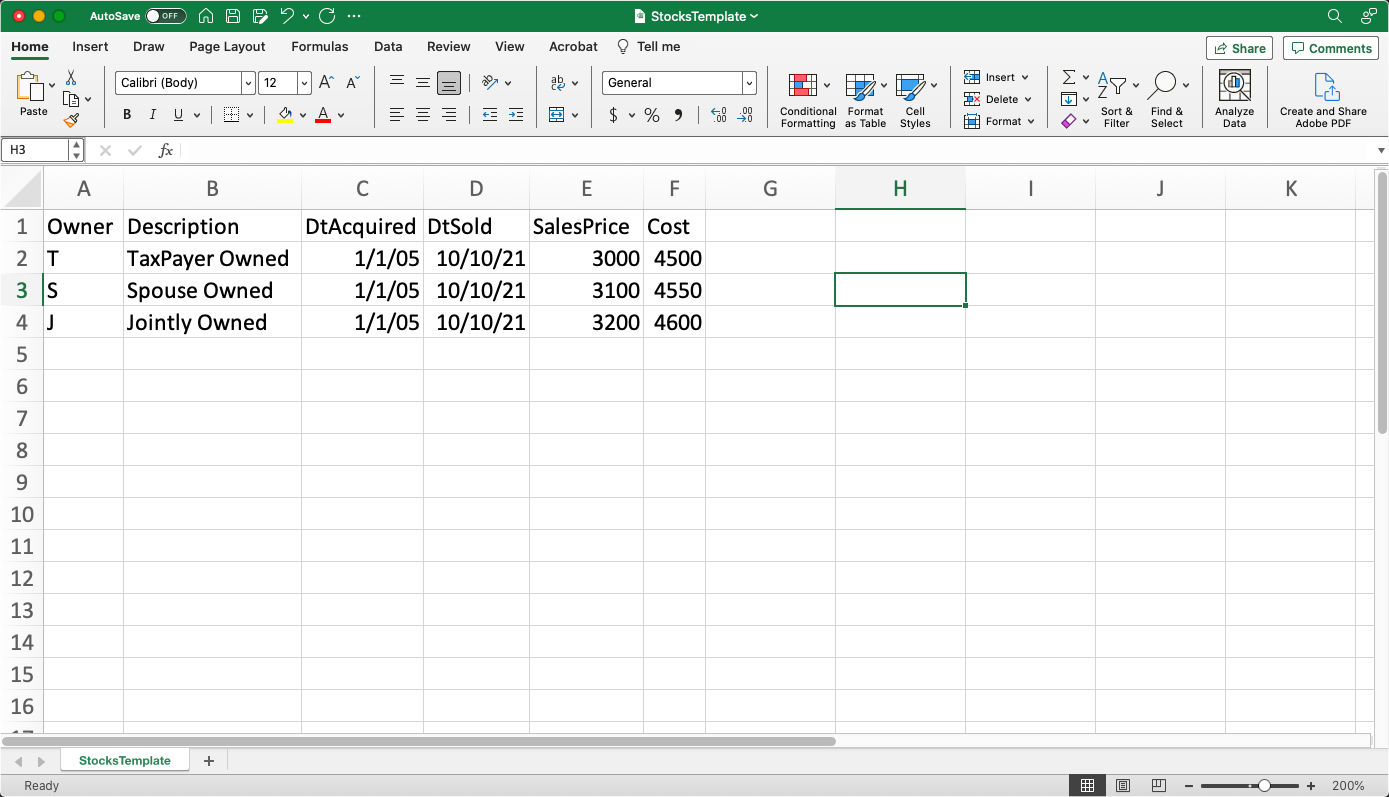

Form 8949 Reporting for Users of Tax Act Professional Tax Software

Capital gains and losses occur when a taxpayer sells a capital. Web up to $40 cash back form 8949, sales and other dispositions of capital assets records the details of your capital asset sales or exchanges. The sale or exchange of a capital asset not reported. Users of form8949.com who use taxslayer for tax. Additionally, a gain on a wash.

Form 8949 and Sch. D diagrams How are capital gains taxed when I sell

Web file form 8949 with the schedule d for the return you are filing. Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. The sale or exchange of a capital asset not reported. Part i of the 8949. Web form 8949 is used to list all capital gain and.

TaxSlayer Form 1099B Import

The sale or exchange of a capital asset not reported. Forms 8949 and schedule d will be. Web use form 8949 to report sales and exchanges of capital assets. Capital gains and losses occur when a taxpayer sells a capital. Part i of the 8949.

Schedule D, Form 8949, GruntWorx Trades Import (1099B, 8949, ScheduleD)

Web where is form 8949? Additionally, a gain on a wash sale is taxable. Web file form 8949 with the schedule d for the return you are filing. Web supported federal forms. Web to enter a wash sale on form 8949 in taxslayer pro, from the main menu of the tax return (form 1040), select:

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Web to enter a wash sale on form 8949 in taxslayer pro, from the main menu of the tax return (form 1040), select: Web if you have a loss from a wash sale, you cannot deduct it on your return. Form 8949 is used to report the following information: Web up to $40 cash back form 8949, sales and other.

Mailing In Your IRS Form 8949 After eFiling Your Return

Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Form 8949 can likewise be utilized to address. Users of form8949.com who use taxslayer for tax. You can generate form 8949, from the gainskeeper tax center tab by clicking the schedule d link at the.

You Can Generate Form 8949, From The Gainskeeper Tax Center Tab By Clicking The Schedule D Link At The Top Of The Page.

Web use form 8949 to report sales and exchanges of capital assets. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the latest. Web form 8949 is used to list all capital gain and loss transactions. Web supported federal forms.

Form 8949 (Sales And Other Dispositions Of Capital Assets) Records The Details Of Your Capital Asset (Investment) Sales Or Exchanges.

Web to enter a wash sale on form 8949 in taxslayer pro, from the main menu of the tax return (form 1040), select: Web where is form 8949? Forms 8949 and schedule d will be. Capital gains and losses occur when a taxpayer sells a capital.

The Sale Or Exchange Of A Capital Asset Not Reported.

The information recorded on form 8949 reconciles the amounts. Form 8949 is used to report the following information: Additionally, a gain on a wash sale is taxable. Form 8949 can likewise be utilized to address.

Web If You Have A Loss From A Wash Sale, You Cannot Deduct It On Your Return.

Web to enter a wash sale on form 8949 in taxslayer proweb, from the federal section of the tax return (form 1040) select: See below for a list of all of the. Web file form 8949 with the schedule d for the return you are filing. Part i of the 8949.