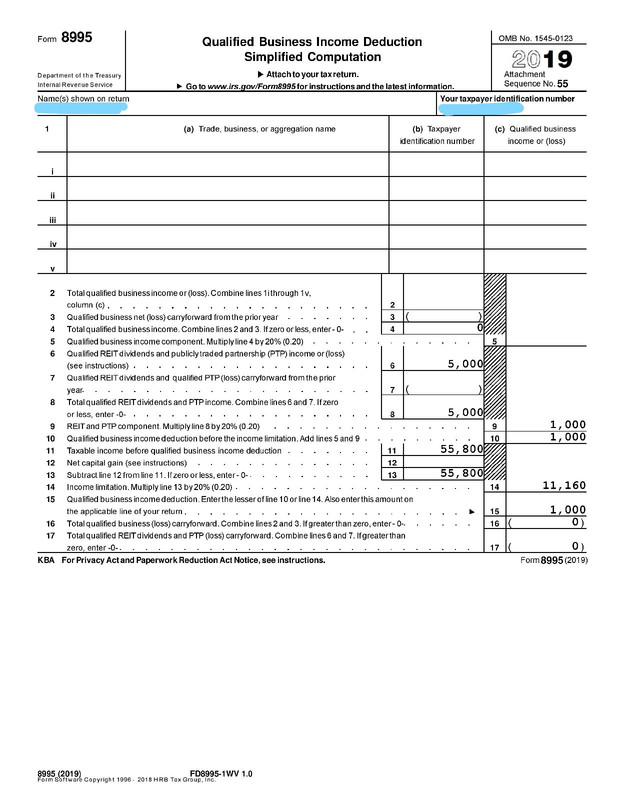

Tax Form 8995

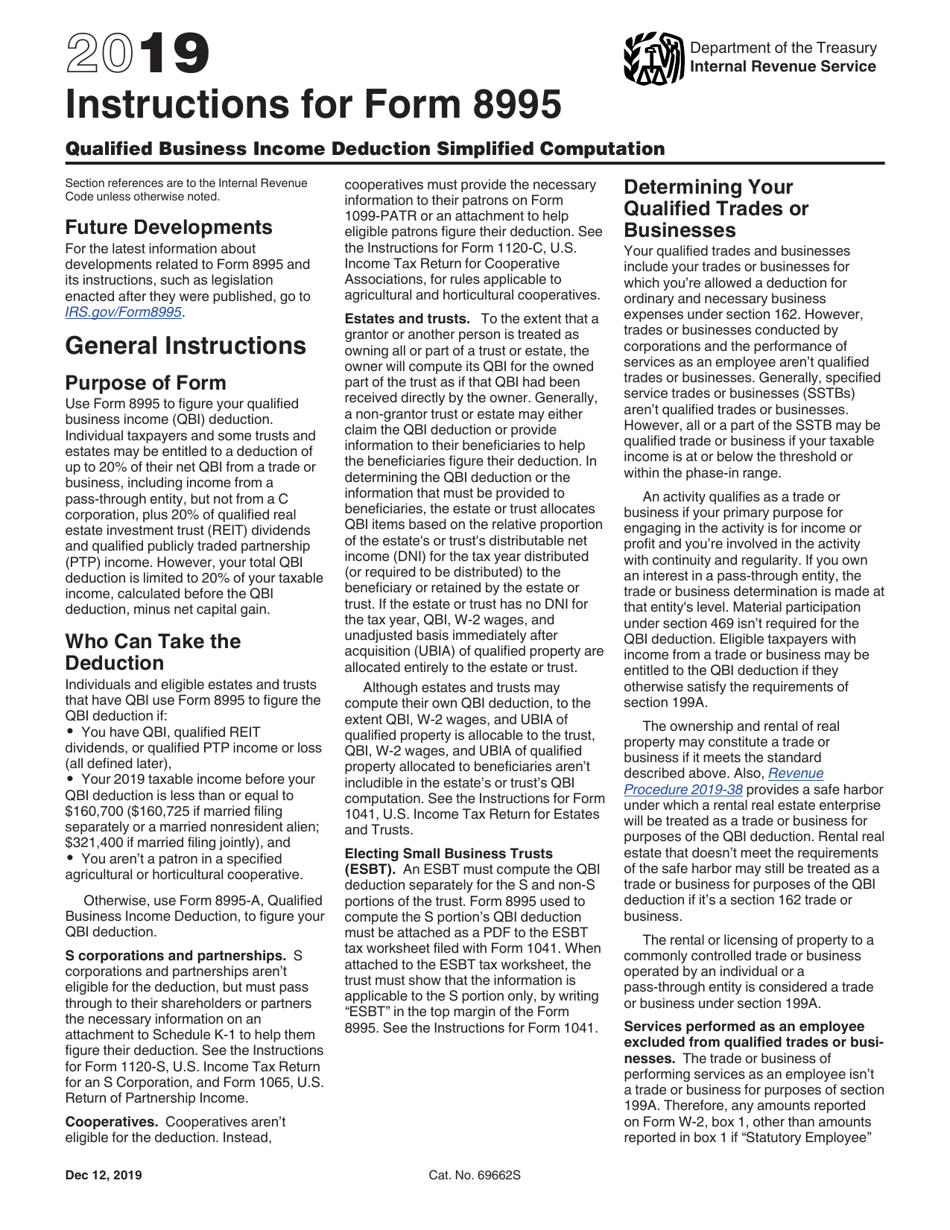

Tax Form 8995 - Web income tax forms 8995 federal — qualified business income deduction simplified computation download this form print this form it appears you don't have a pdf. Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines. Official irs income tax forms are printable and can be downloaded for free. As with most tax issues, the. Determining your qualified business income your qbi includes items of income, gain, deduction, and loss. The net capital gain, the taxable income as that term is used in irc § 199a) of the partnership or s corporation itself are used in preparing the. Form 8995 is a simplified version for taxpayers whose. Get the current year income tax forms today! Web for example, the income figures (e.g. Our website is dedicated to providing.

Get the current year income tax forms today! The computation of the federal qualified business income. Determining your qualified business income your qbi includes items of income, gain, deduction, and loss. Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines. The net capital gain, the taxable income as that term is used in irc § 199a) of the partnership or s corporation itself are used in preparing the. Web find the 2022 federal tax forms you need. Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Web what is form 8995? Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web for example, the income figures (e.g.

Official irs income tax forms are printable and can be downloaded for free. Web what is form 8995? Web for example, the income figures (e.g. Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. Determining your qualified business income your qbi includes items of income, gain, deduction, and loss. Deduction as if the affected business entity was. Web we are sending you letter 12c because we need more information to process your individual income tax return. The computation of the federal qualified business income. Get the current year income tax forms today! The net capital gain, the taxable income as that term is used in irc § 199a) of the partnership or s corporation itself are used in preparing the.

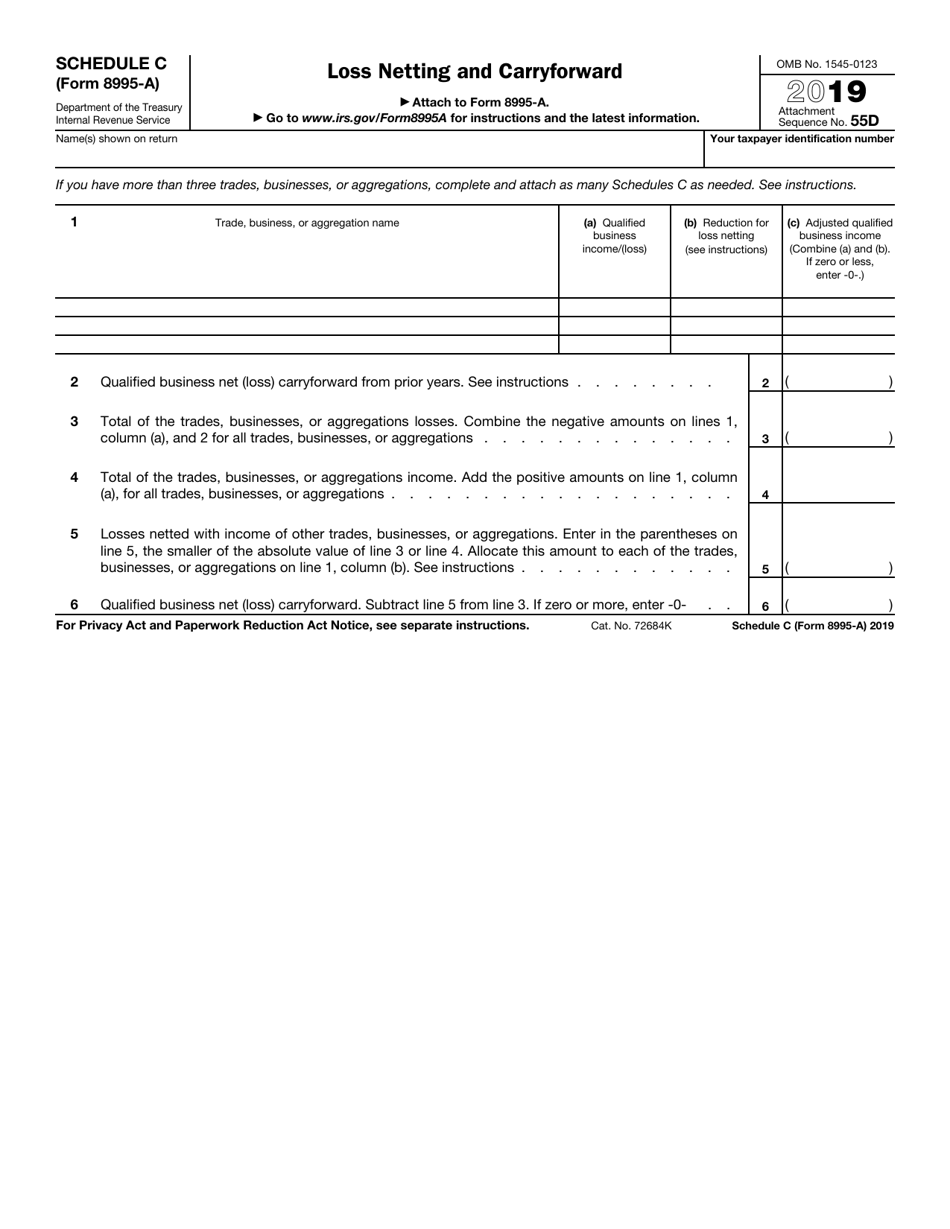

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

Get the current year income tax forms today! Web for example, the income figures (e.g. Our website is dedicated to providing. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi).

Total Stock Market Index Section 199A dividends this year Page 4

Web what is form 8995? Determining your qualified business income your qbi includes items of income, gain, deduction, and loss. Our website is dedicated to providing. Form 8995 is a simplified version for taxpayers whose. Web income tax forms 8995 federal — qualified business income deduction simplified computation download this form print this form it appears you don't have a.

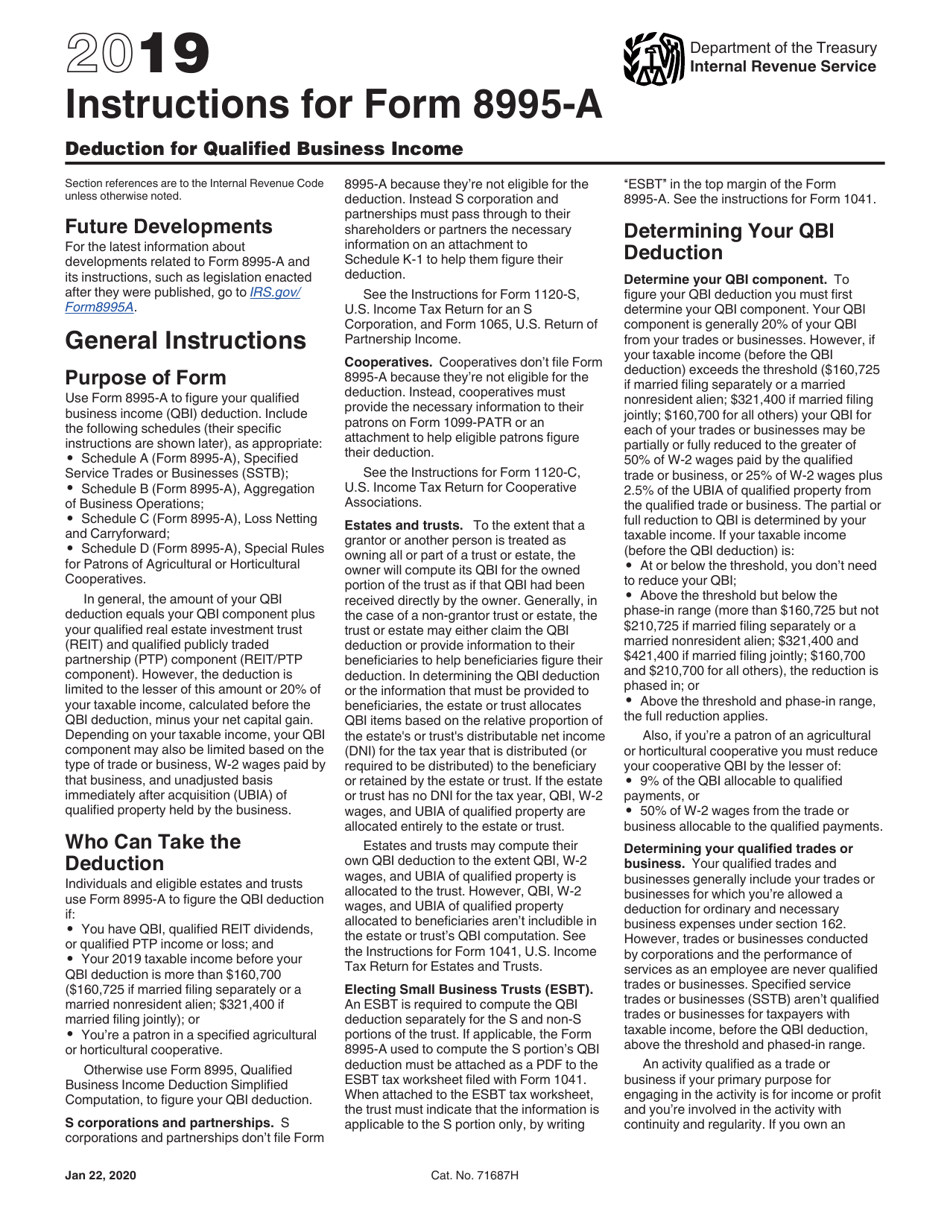

Download Instructions for IRS Form 8995A Deduction for Qualified

Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web we are sending you letter 12c because we need more information to process your individual income tax.

Download Instructions for IRS Form 8995 Qualified Business

Determining your qualified business income your qbi includes items of income, gain, deduction, and loss. Web what is form 8995? Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Form 8995 is a simplified version for taxpayers whose. Web the federal form 8995, also known as the qualified.

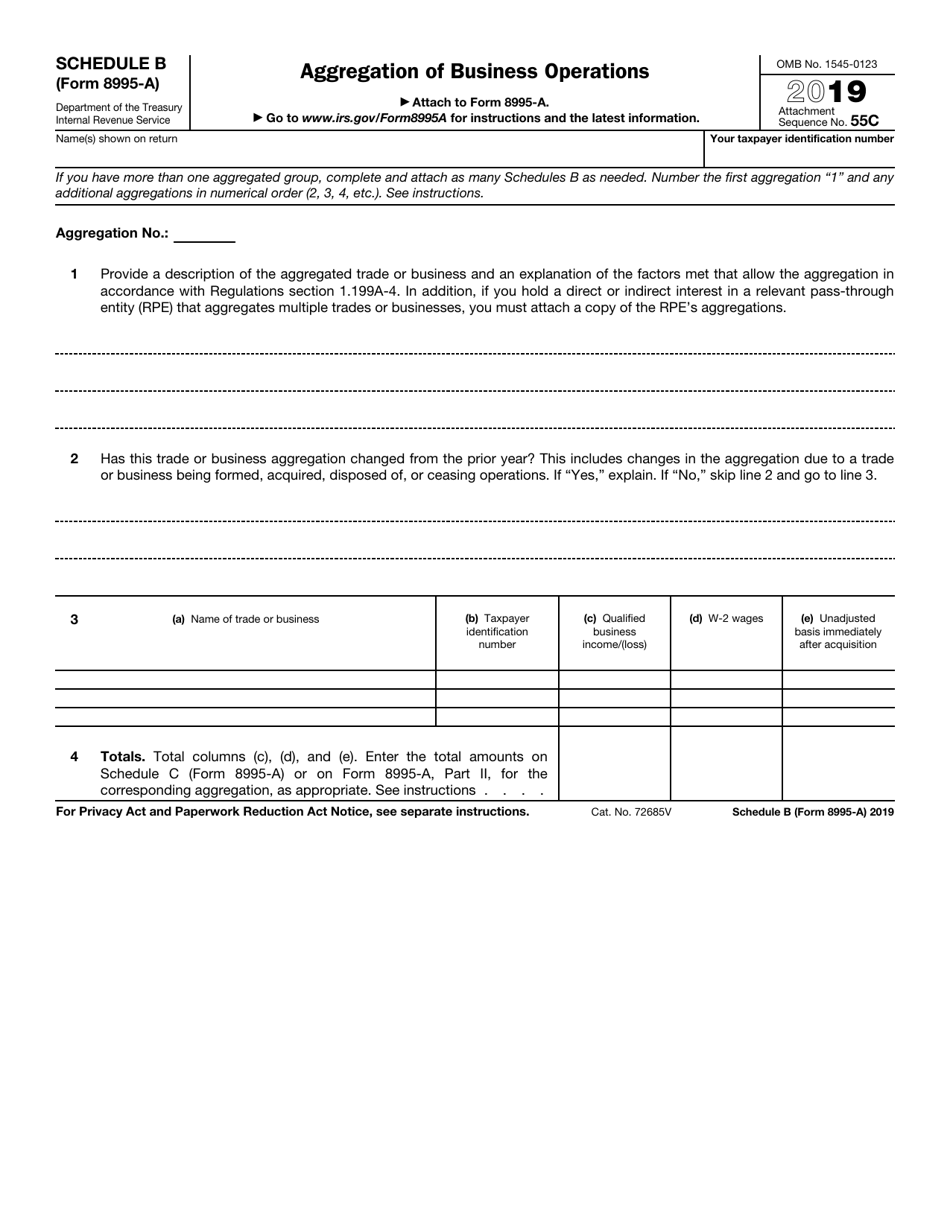

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Determining your qualified business income your qbi includes items of income, gain, deduction, and loss. Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web income tax forms 8995 federal.

8995 Fill out & sign online DocHub

Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Our website is dedicated to providing. Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines. Web find the 2022 federal tax forms you need. Web income tax forms 8995.

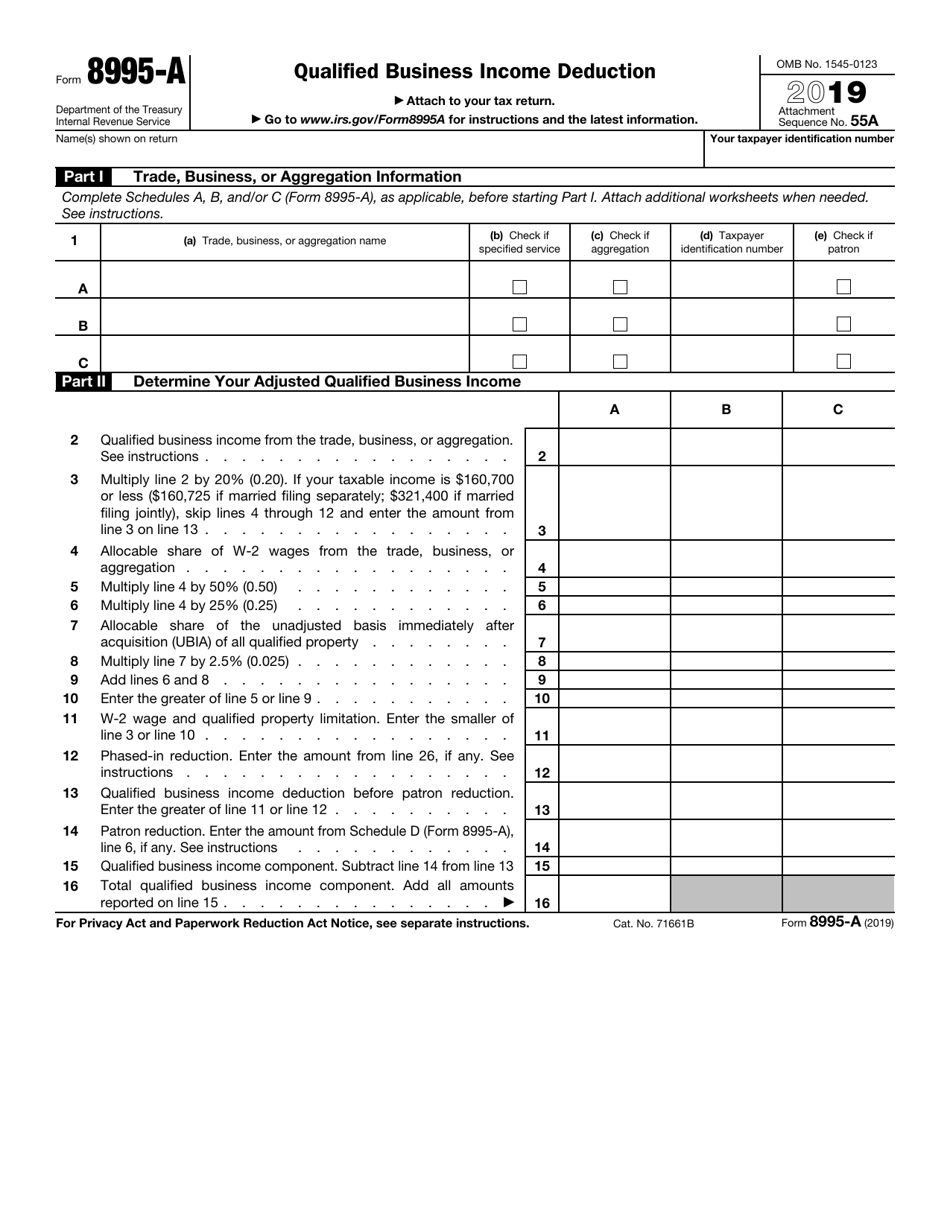

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Form 8995 is a simplified version for taxpayers whose. Web find the 2022 federal tax forms you need. Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web income tax.

Do Your 2021 Tax Return Right with IRS VITA Certified EXPERTS for

Web form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to your tax return. Web for example, the income figures (e.g. The computation of the federal qualified business income. Our website is dedicated to providing. Web we are sending you letter 12c because we need more information to process your individual income tax.

Complete Janice's Form 8995 for 2019. Qualified Business

Get the current year income tax forms today! Web we are sending you letter 12c because we need more information to process your individual income tax return. Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. Web form 8995 department of the treasury internal.

The One Tax Form You Need To Claim The QBI Deduction Beene Garter, A

Web find the 2022 federal tax forms you need. Web we are sending you letter 12c because we need more information to process your individual income tax return. Web for example, the income figures (e.g. Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to. The computation.

The Computation Of The Federal Qualified Business Income.

Web for example, the income figures (e.g. Web 8995 qualified business income deduction form 8995 department of the treasury internal revenue service qualified business income deduction simplified computation attach to. The net capital gain, the taxable income as that term is used in irc § 199a) of the partnership or s corporation itself are used in preparing the. Web the 8995 form is a crucial document used for reporting qualified business income deduction (qbid) as per the irs guidelines.

Determining Your Qualified Business Income Your Qbi Includes Items Of Income, Gain, Deduction, And Loss.

Web income tax forms 8995 federal — qualified business income deduction simplified computation download this form print this form it appears you don't have a pdf. Web what is form 8995? Deduction as if the affected business entity was. Get the current year income tax forms today!

Web Form 8995 Is A Newly Created Tax Form Used To Calculate The Qualified Business Income Deduction (Qbid).

Official irs income tax forms are printable and can be downloaded for free. Web we are sending you letter 12c because we need more information to process your individual income tax return. As with most tax issues, the. Form 8995 is a simplified version for taxpayers whose.

Web Form 8995 Department Of The Treasury Internal Revenue Service Qualified Business Income Deduction Simplified Computation Attach To Your Tax Return.

Web the federal form 8995, also known as the qualified business income deduction simplified computation, must be filed by us taxpayers eligible for the qbid. Web form 8995 qualified business income deduction simplified computation is used to figure your qualified business income (qbi) deduction. Our website is dedicated to providing. Web find the 2022 federal tax forms you need.