Tax Form 3903

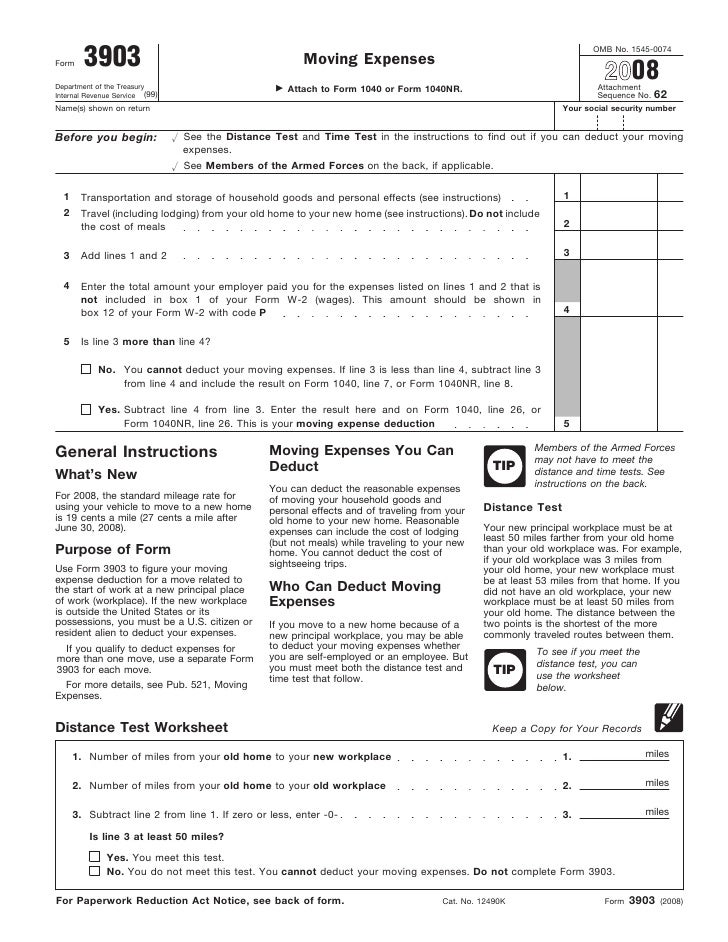

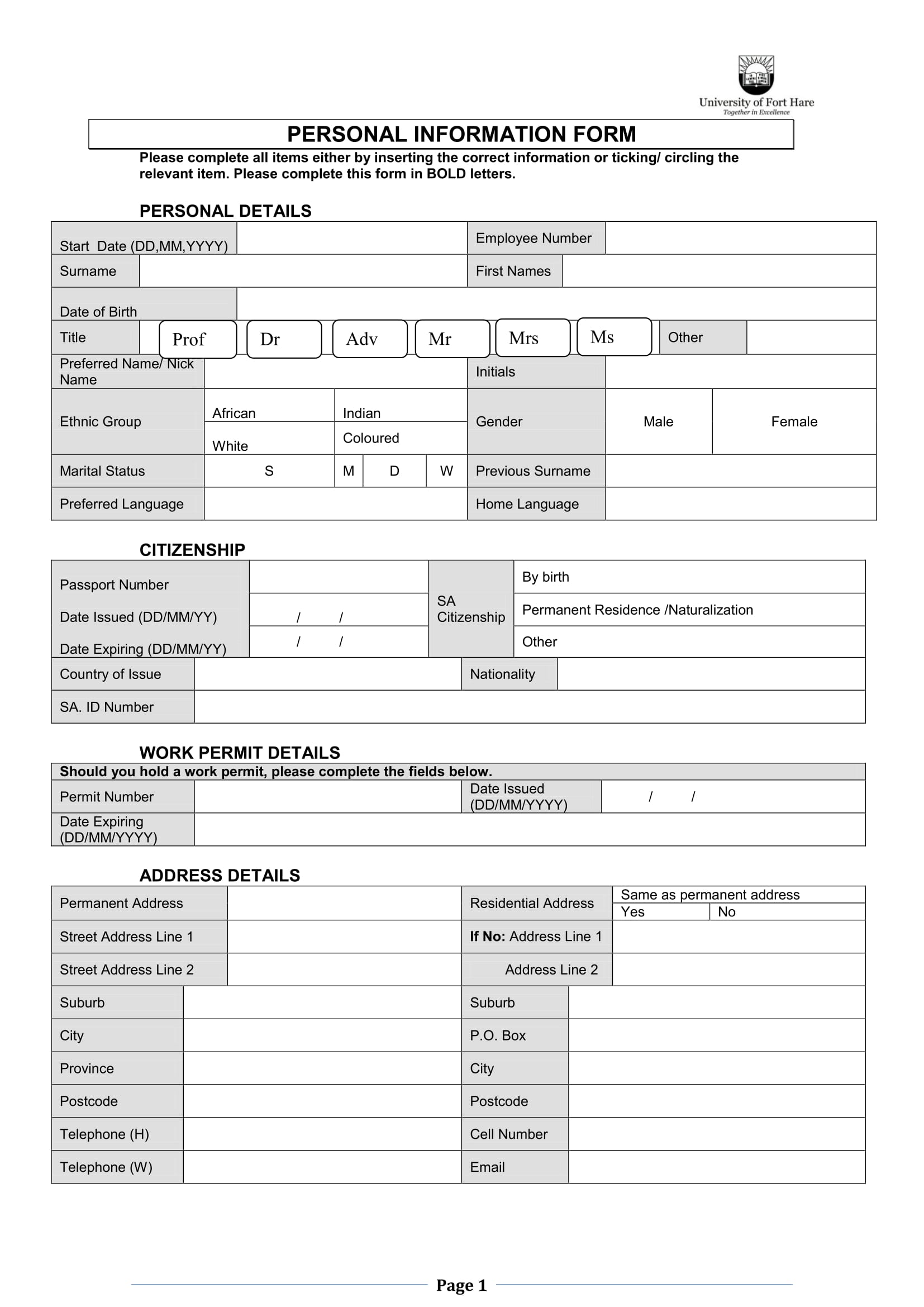

Tax Form 3903 - If the new workplace is outside the united states or its possessions, you must be a u.s. Web filers of form 2555. Residents of fawn creek township tend to be conservative. Web view full report card. If the new workplace is outside the united states or its possessions, you must be a u.s. Below 100 means cheaper than the us average. Check the personal tax reliefs that you may be eligible for this year (a personal.tax savings for married couples and families. Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). Web form 3903 is a tax form produced by the internal revenue service (irs) that people use to write off moving expenses associated with new employment. Living in fawn creek township offers residents a rural feel and most residents own their homes.

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Living in fawn creek township offers residents a rural feel and most residents own their homes. In order to keep your same standard of living your salary can vary greatly. If the new workplace is outside the united states or its possessions, you must be a u.s. The us average is 4.6%. Tax reliefs and rebates at a glance for married.personal tax rebate. If you file form 2555, foreign earned income, to exclude any of your income or housing costs, report the full amount of your deductible moving expenses on form 3903 and on schedule 1 (form 1040), line 14. Meeting the time and distance tests. Citizen or resident alien to deduct your expenses. About our cost of living index did you know?

Web view full report card. Web besides filing your federal income tax return form (such as a 1040, 1040a or 1040ez), you’ll also need to file form 3903 for moving expenses. In order to keep your same standard of living your salary can vary greatly. Select whether the form 3903 applies to the taxpayer, spouse, or joint. Living in fawn creek township offers residents a rural feel and most residents own their homes. 170 name(s) shown on return your social security number Citizen or resident alien to deduct your expenses. You can deduct moving expenses only if you are a member of the armed forces and meet certain other requirements. You must satisfy two primary criteria to qualify for counting these expenses as tax deductions: Web 100 = us average.

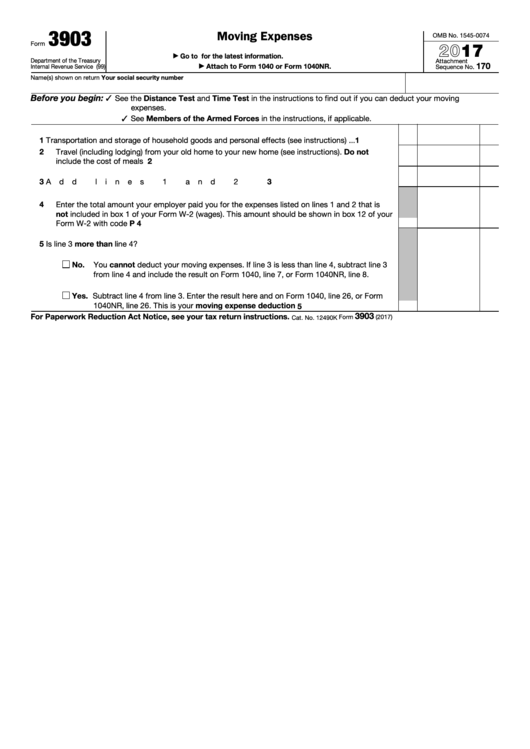

Form 3903 Instructions 2017

You can deduct moving expenses only if you are a member of the armed forces on active duty and, due to a military order, you, your spouse, or your dependents move because of a permanent change of station. Meeting the time and distance tests. Web a move from your last post of duty to your home or to a nearer.

Fillable Form 3903 Moving Expenses 2017 printable pdf download

You must satisfy two primary criteria to qualify for counting these expenses as tax deductions: You can deduct moving expenses only if you are a member of the armed forces and meet certain other requirements. Check the personal tax reliefs that you may be eligible for this year (a personal.tax savings for married couples and families. We will update this.

Form 3903 Moving Expenses (2015) Free Download

Web moving expenses before you begin: Tax reliefs and rebates at a glance for married.personal tax rebate. Transportation and storage of household goods and personal effects complete line 1 using your actual expenses. Web form 3903 is a tax form created by the internal revenue service (irs) for tax deductions related to moving expenses due to a new job. Citizen.

IRS Form 3903 Are Moving Expenses Tax Deductible? TurboTax Tax Tips

Citizen or resident alien to deduct your expenses. The move must occur within 1 year of ending your active duty or within the period allowed under the joint travel regulations. You can't deduct expenses that are reimbursed or paid for directly by the government. Web besides filing your federal income tax return form (such as a 1040, 1040a or 1040ez),.

Form 3903 Moving Expenses Definition

You can deduct moving expenses only if you are a member of the armed forces and meet certain other requirements. Above 100 means more expensive. Transportation and storage of household goods and personal effects complete line 1 using your actual expenses. Web view full report card. If the new workplace is outside the united states or its possessions, you must.

Form 3903 Moving Expenses (2015) Free Download

You can deduct moving expenses only if you are a member of the armed forces on active duty and, due to a military order, you, your spouse, or your dependents move because of a permanent change of station. The move must occur within 1 year of ending your active duty or within the period allowed under the joint travel regulations..

Are Moving Expenses Tax Deductible? (2023 Guidelines) Home Bay

Tax reliefs and rebates at a glance for married.personal tax rebate. Web we last updated federal form 3903 in december 2022 from the federal internal revenue service. Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). Fawn creek township is in montgomery.

Form 3903 Instructions 2018

Web 100 = us average. Web you can deduct your unreimbursed moving expenses for you, your spouse, and your dependents. Web form 3903 is a tax form created by the internal revenue service (irs) for tax deductions related to moving expenses due to a new job. The move must occur within 1 year of ending your active duty or within.

Form 3903Moving Expenses

The us average is 7.3%. For paperwork reduction act notice, see your tax return instructions. If the new workplace is outside the united states or its possessions, you must be a u.s. Citizen or resident alien to deduct your expenses. This form is for income earned in tax year 2022, with tax returns due in april 2023.

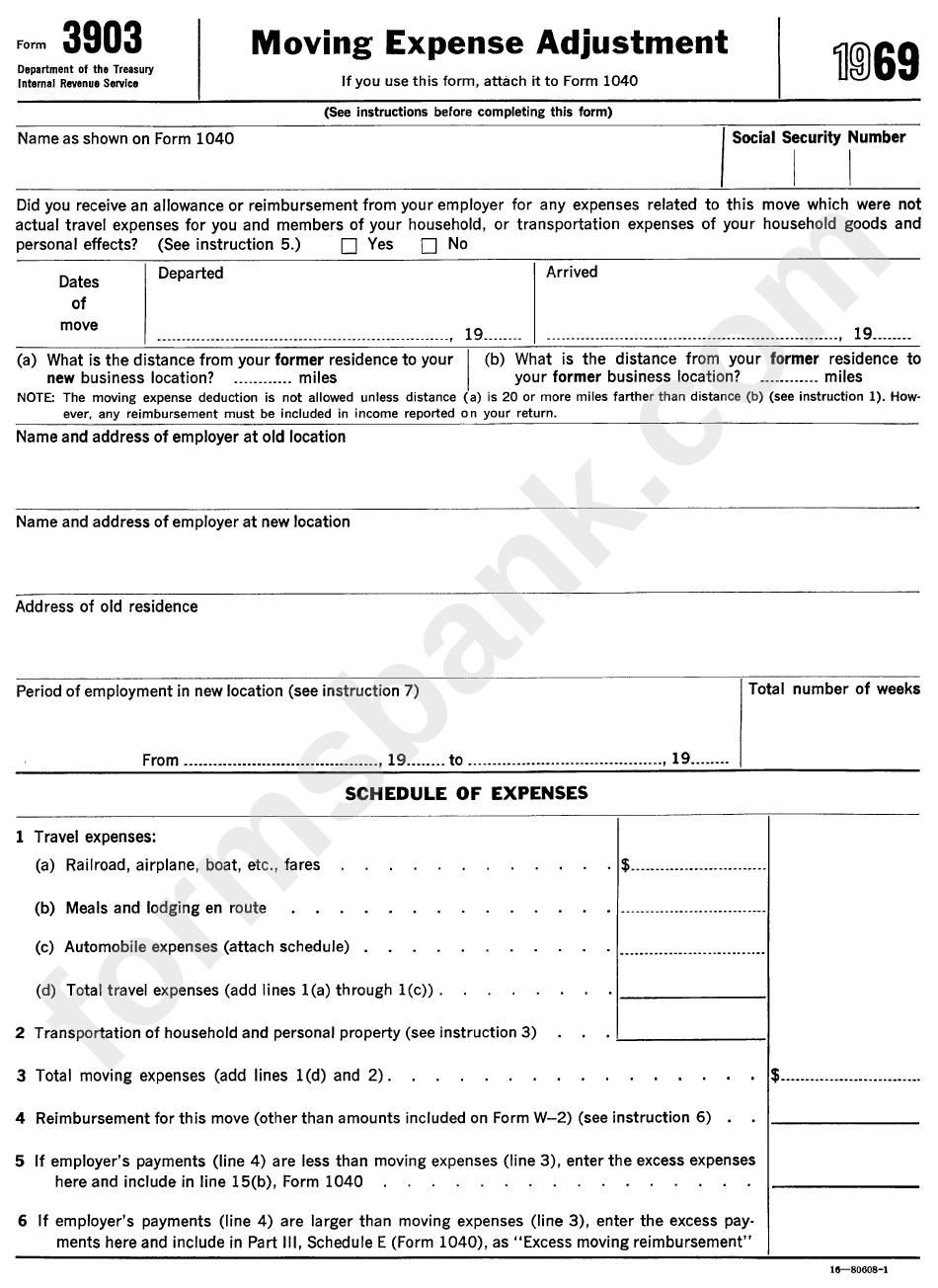

Form 3903 Moving Expense Adjustment (1969) printable pdf download

The move must occur within 1 year of ending your active duty or within the period allowed under the joint travel regulations. 170 name(s) shown on return your social security number We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Fawn creek township is.

Below 100 Means Cheaper Than The Us Average.

This entry is mandatory for the federal deduction for tax year 2018 and newer. Web filers of form 2555. Since tax year 2018, you can only deduct moving. Web form 3903 is a tax form created by the internal revenue service (irs) for tax deductions related to moving expenses due to a new job.

This Is Why We Are Now Offering A Premium Salary & Cost.

Use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). The move must occur within 1 year of ending your active duty or within the period allowed under the joint travel regulations. Citizen or resident alien to deduct your expenses. Select whether the form 3903 applies to the taxpayer, spouse, or joint.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Federal Government.

You must satisfy two primary criteria to qualify for counting these expenses as tax deductions: If you qualify to deduct expenses for more than one move, use a separate form 3903 for each move. You can deduct moving expenses only if you are a member of the armed forces on active duty and, due to a military order, you, your spouse, or your dependents move because of a permanent change of station. You can deduct moving expenses only if you are a member of the armed forces and meet certain other requirements.

Transportation And Storage Of Household Goods And Personal Effects Complete Line 1 Using Your Actual Expenses.

Web to generate form 3903: If the new workplace is outside the united states or its possessions, you must be a u.s. See the instructions to find out if you qualify. Residents of fawn creek township tend to be conservative.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at1.44.35PM-b546319cf5d044c49b8599a543cf26ac.png)