Tax Cap Form Clark County

Tax Cap Form Clark County - It will only change if you make any changes to the ownership on your parcel (i.e. Meade county to the west and comanche. Only one property may be selected in the state of nevada as a primary residence. Web once your property becomes your primary residence, your 3% tax cap is set for all billing years going forward. _____ print name _____ telephone number: _____ this section to be completed for residential properties only: If you do not receive your tax bill by august 1st each year, please use the automated telephone system to request a copy. The treasurer's office mails out real property tax bills only one time each fiscal year. Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a correction form, the treasurer’s office will send you a revised bill once the updated tax cap information has been processed,” a county spokesman wrote. The county is bordered on the south by the state of oklahoma;

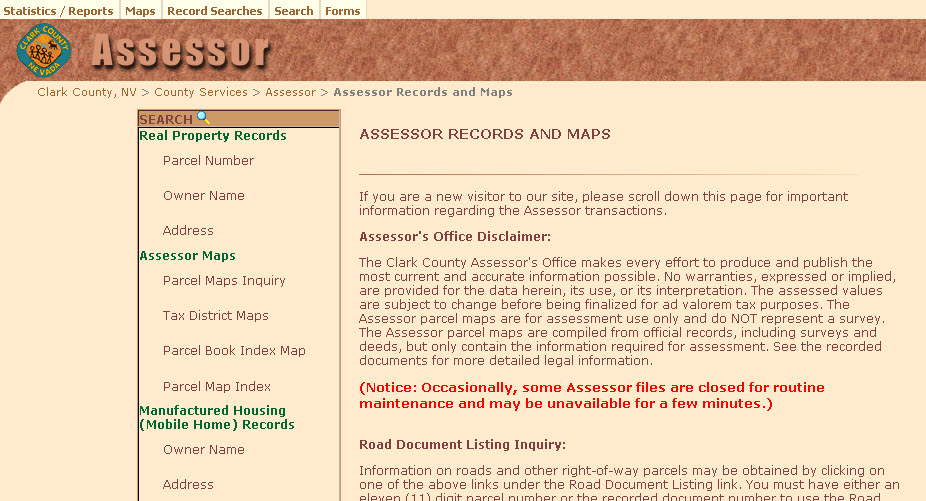

Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement showing what has been sent to their mortgage company for payment. Meade county to the west and comanche. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. The most commonly used forms are organized by subject below. Web clark county assessor’s office. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. Real property tax payment options; Web 11k views 7 months ago. Clarke was a sixth kansas cavalry captain. Property owners have been lined up outside the county assessor's.

Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. Web 11k views 7 months ago. Ford county to the north; Clark county is located in the southwest portion of kansas. Real property tax payment options; [email protected] 500 s grand central pkwy las vegas, nevada 89155 Web real property tax information. _____ this section to be completed for residential properties only: Clarke was a sixth kansas cavalry captain. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county.

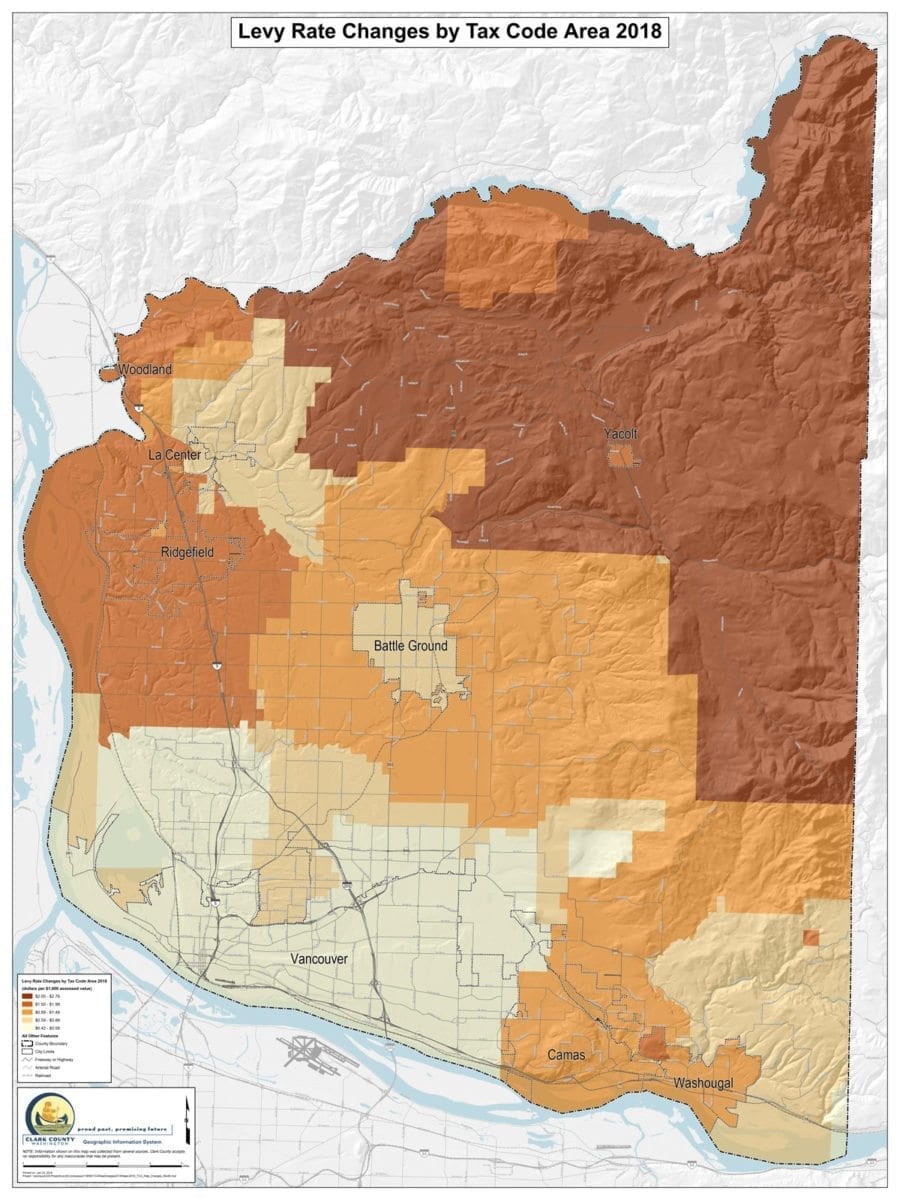

Property taxes increase countywide

Clarke was a sixth kansas cavalry captain. Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. _____ print name _____ telephone number: Web clark county assessor’s office. Web “if you receive a tax bill with the incorrect property tax cap percentage and you have submitted a.

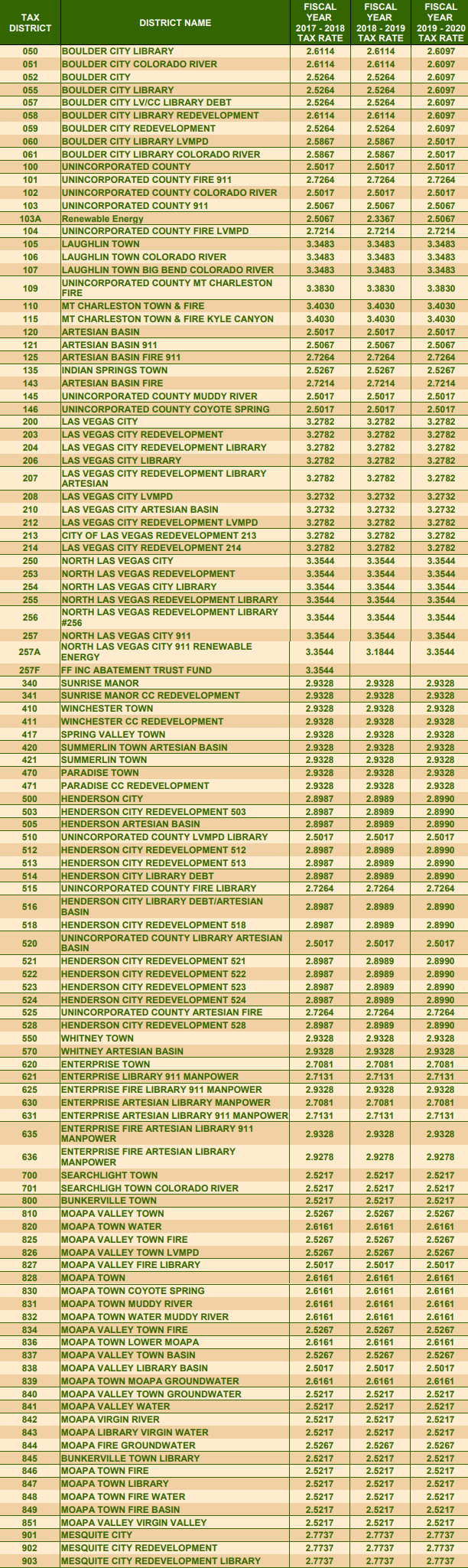

Clark County Tax Rates for 2019/2020

Only one property may be selected in the state of nevada as a primary residence. The most commonly used forms are organized by subject below. Property owners have been lined up outside the county assessor's. Web once your property becomes your primary residence, your 3% tax cap is set for all billing years going forward. [email protected] 500 s grand.

Clark County Tax Cap Form Clark County Assessors Office EveDonusFilm

People still have until next year to apply for the 3 percent tax cap. Ford county to the north; This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. Web las vegas (klas) — clark county residents rushed to the assessor’s office wednesday to meet a june 30 deadline to cap the property tax.

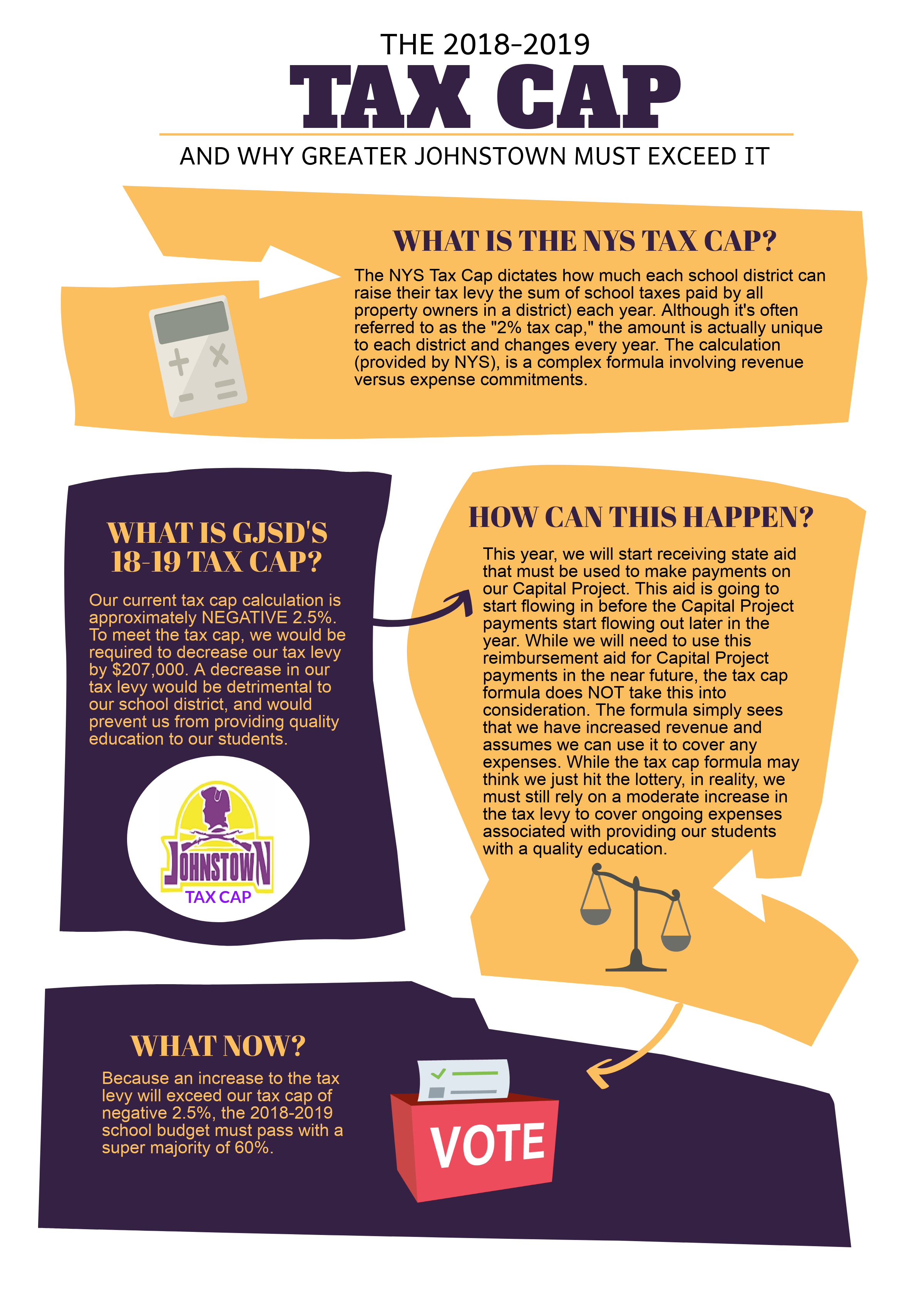

The 201819 Tax Cap Greater Johnstown School District, Johnstown, NY

The county is bordered on the south by the state of oklahoma; Web las vegas (ktnv) — the deadline to file your property tax cap form for this fiscal year in clark county was today. Only one property may be selected in the state of nevada as a primary residence. It will only change if you make any changes to.

Clark County Nevada Property Tax Senior Discount

_____ manufactured home account number: Ford county to the north; Web a clark county assessor addresses the property tax cap situation. The treasurer's office mails out real property tax bills only one time each fiscal year. [email protected] 500 s grand central pkwy las vegas, nevada 89155

Fictitious Business Name Statement Sample In Washington State Fill

Web the recorder's office provides the following blank forms search for file name: Web 11k views 7 months ago. Real property tax auction information; Meade county to the west and comanche. [email protected] 500 s grand central pkwy las vegas, nevada 89155

Clark County Alarm Permit Fill Online, Printable, Fillable, Blank

Only one property may be selected in the state of nevada as a primary residence. Web currently, properties qualifying as the owner's primary residence will receive a 3% tax cap, all other properties are subject to the “other” tax cap, also known as the “commercial property tax rate”, which can be up to 8% but this year is set at.

Clark County Assessor’s Office to mail out property tax cap notices

Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. Your statement will give you information. This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11. Web 11k views 7 months ago. Web las vegas (klas) — clark county residents rushed to.

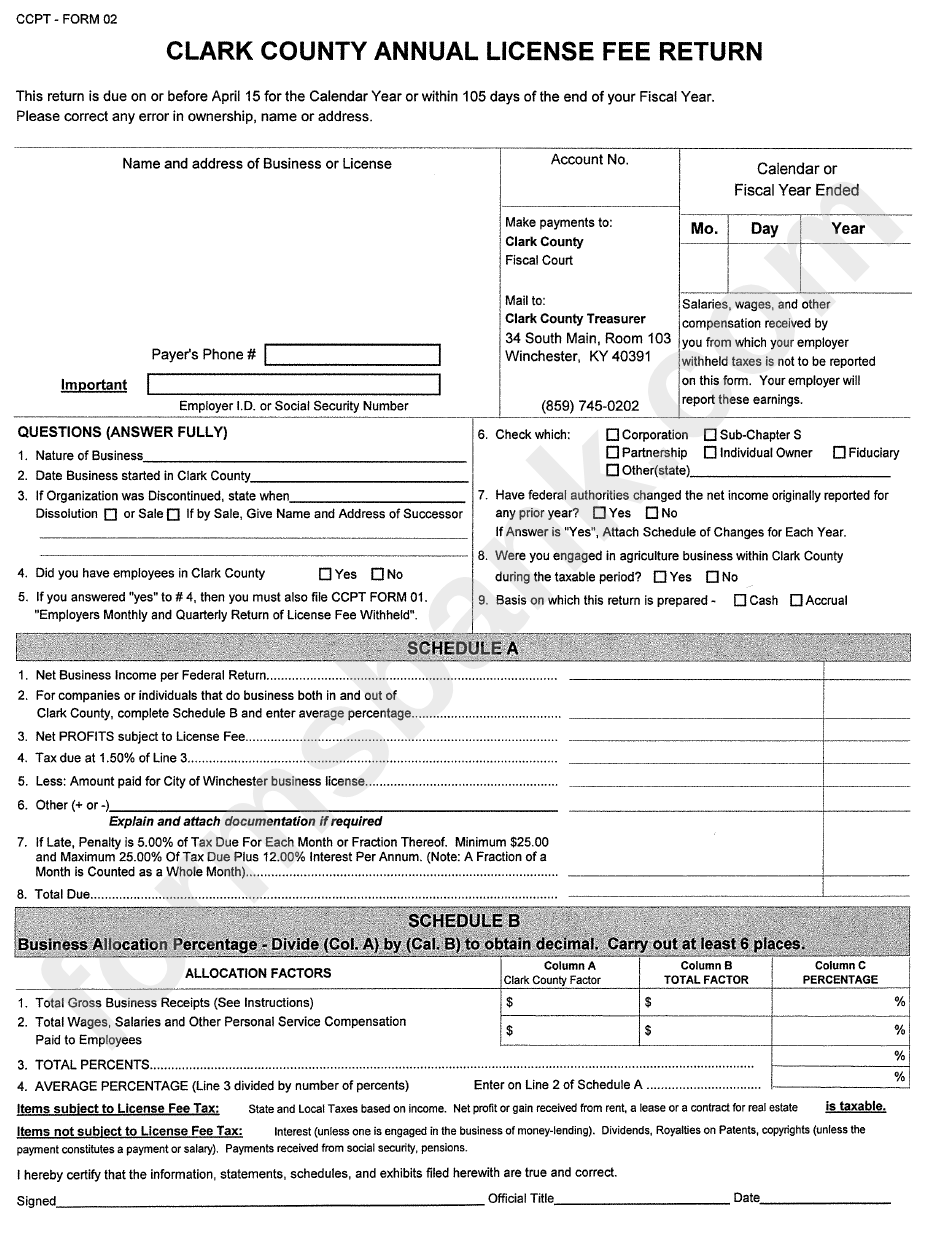

Ccpt Form 02 Annual License Fee Return Clark Country printable pdf

If you do not receive your tax bill by august 1st each year, please use the automated telephone system to request a copy. Web it was a part of ford county previously. Web a clark county assessor addresses the property tax cap situation. Ford county to the north; Web las vegas (ktnv) — the deadline to file your property tax.

Coalition in Support of the Tax Cap Launches Digital Campaign

_____ print name _____ telephone number: Web “to fix the upcoming tax cap to fix that is 8% for the next fiscal year or starting july 1, you have until june 30th of 2023 to correct that,” said clark county assessor briana johnson. Web 11k views 7 months ago. Web real property tax information; [email protected] 500 s grand central.

Forms 7 Documents Real Property Transfer Tax (Rptt) 7 Documents Recording Documents 2 Documents Ordering Official Document Copies 1 Document Fee Schedule 1 Document Request For Confidentiality Forms And Information 3 Documents

_____ this section to be completed for residential properties only: Web real property tax information. In order to download the forms in the pdf format, you will need to have adobe reader. Web it was a part of ford county previously.

Watch This Video Explaining Property Tax.

Web commonly requested forms the assessor's office makes a number of forms available to property owners and taxpayers to manage their property. Web clark county assessor’s office. Remove or add someone to title). Only one property may be selected in the state of nevada as a primary residence.

Each Of These Documents Show The Property Tax Cap Percentage For Their Address/Addresses.

[email protected] 500 s grand central pkwy las vegas, nevada 89155 Web residents will receive either a tax bill if they do not pay their property taxes through a mortgage company or a tax statement showing what has been sent to their mortgage company for payment. _____ print name _____ telephone number: This site is best viewed using chrome, firefox, edge, internet explorer version 10 or version 11.

Property Owners Have Been Lined Up Outside The County Assessor's.

If you do not receive your tax bill by august 1st each year, please use the automated telephone system to request a copy. Web the assessor's office mails out tax cap abatement notices to residential property owners who purchased property or had a change in ownership after july 1 in clark county. Web new clark county homeowners must fill out tax cap notices being mailed to prevent increase in property taxes story by alexis fernandez • 3h ago new homeowners in clark county may be. The treasurer's office mails out real property tax bills only one time each fiscal year.