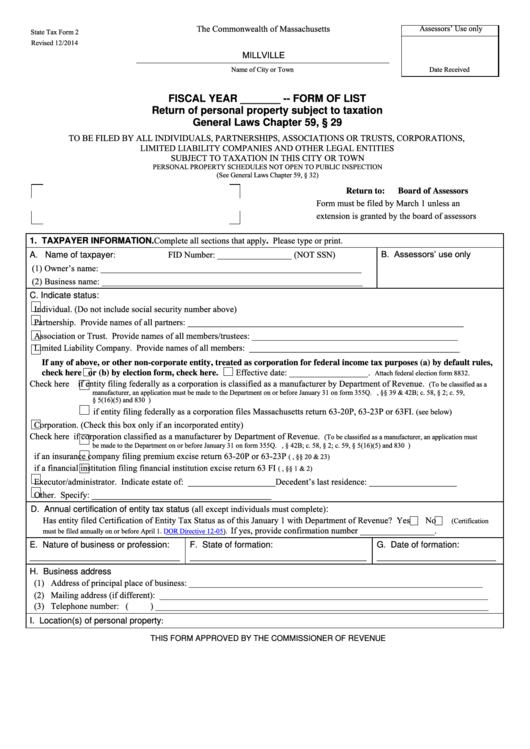

State Tax Form 2

State Tax Form 2 - All tangible personal property is assessed in the. Final estimated tax payment due january 15th, 2024. Web this form of list (state tax form 2hf) must be filed each year by all individuals owning or holding household furnishings and effects not located at their domicile on january 1. Find forms for your industry in minutes. Web wage and tax statement. Due date for issue of tds certificate for. Web state tax form 2/form of list “tangible” — or physical — property that you can move easily is personal property. Worksheet for calculating business facility credit, enterprise zone modifications. Web 1 day agoform 16c: Web state tax form 2/form of list:

Due date for issue of tds certificate for. The state of missouri also mandates the filing of. Revenue agents 1 & 2. Web wage and tax statement. Worksheet for calculating business facility credit, enterprise zone modifications. Web this form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal entities that. Web these you have to apply for. Web state tax form 2/form of list “tangible” — or physical — property that you can move easily is personal property. Web most state tax forms will refer to the income, adjustments and credit amounts entered on your federal tax forms. If you have not done so already, please.

Web most state tax forms will refer to the income, adjustments and credit amounts entered on your federal tax forms. Web teach businesses about tax responsibilities via workshops and seminars. Web get federal tax return forms and file by mail. However, the return is generating the following two critical diagnostics:taxpayer name for. Notice of late property tax abatement/exemption (form 135l) late notice. Final estimated tax payment due january 15th, 2024. Web wage and tax statement. Streamlined document workflows for any industry. Property tax abatement/exemption certification (form 147/147e) approval. Web 1 day agoform 16c:

Fillable State Tax Form 2 Return Of Personal Property Subject To

Encourage voluntary tax compliance through education of our tax laws. Worksheet for calculating business facility credit, enterprise zone modifications. Web if you had to submit an amended tax return this year, you may be wondering how come you haven't received your tax refund yet. Revenue agents 1 & 2. Web forms used by assessors.

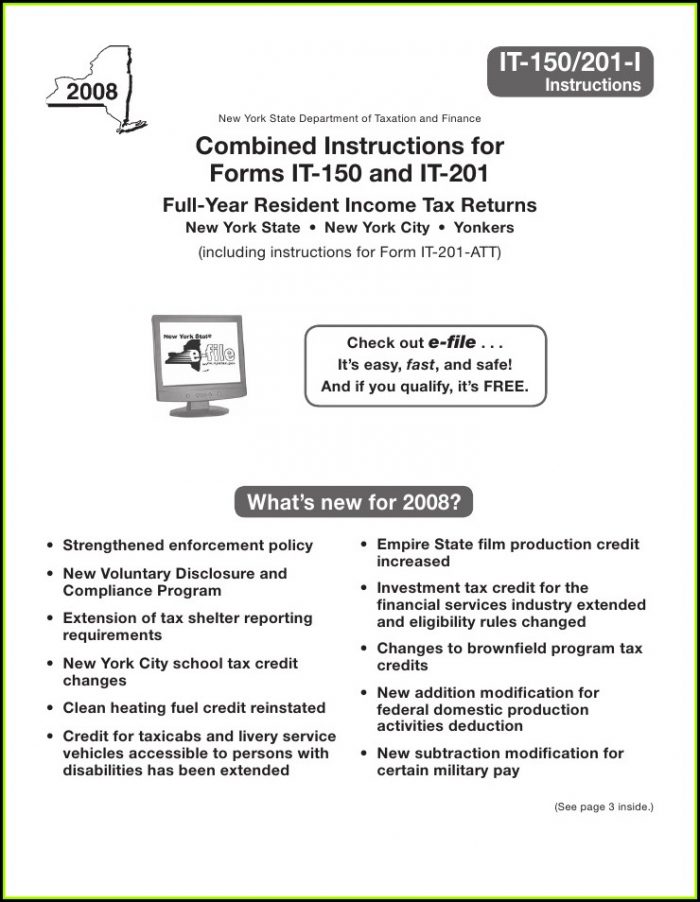

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

Property tax abatement/exemption certification (form 147/147e) approval. Final estimated tax payment due january 15th, 2024. All tangible personal property is assessed in the. Web get federal tax return forms and file by mail. Other federal income tax (federal form 1041, schedule g, lines 2a, 4, and 6).

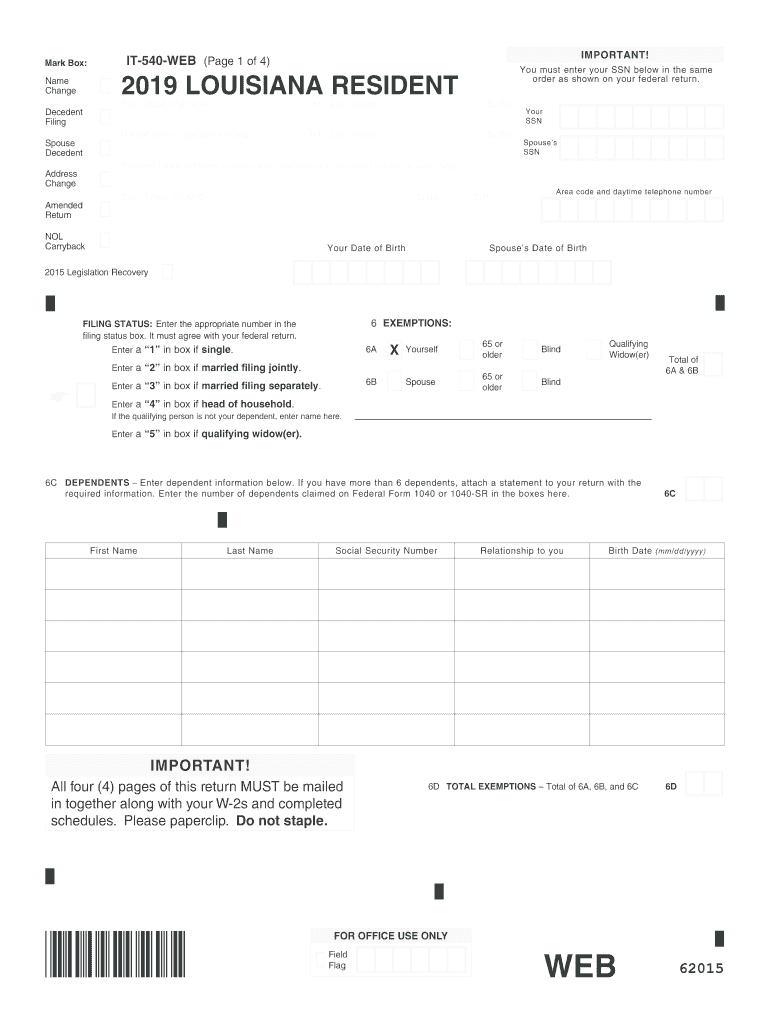

Louisiana State Tax Form Fill Out and Sign Printable PDF Template

Web state tax form 2/form of list: Web forms and manuals find your form. Web filing online is faster and safer. If you have not done so already, please. Final estimated tax payment due january 15th, 2024.

Blank Nv Sales And Use Tax Form 01 339 Fill Online, Printable

Web 922 rows letter of intent for substitute and reproduced income tax forms: Streamlined document workflows for any industry. Web kansas’ 5% tax would deduct roughly $23.2 million leaving them with around $269.2 million. Web get federal tax return forms and file by mail. Web wage and tax statement.

MA State Tax Form 964 2011 Fill out Tax Template Online US Legal Forms

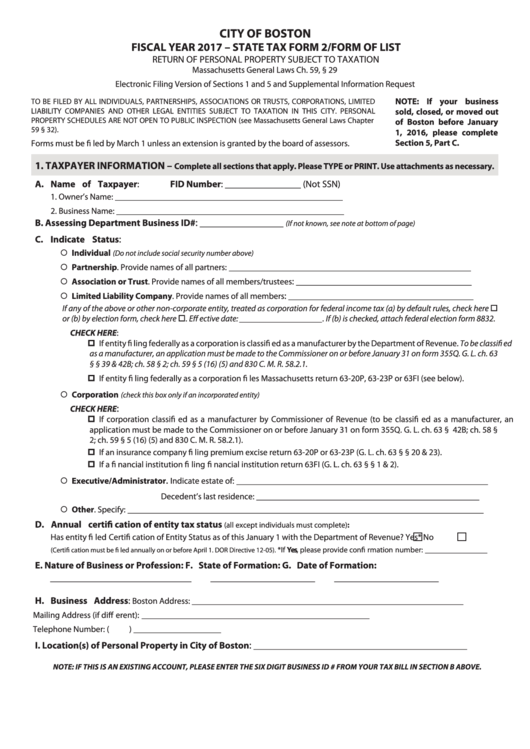

Web filing online is faster and safer. Web ) 86( 2) $1' $&&(66 72 5(7851 $1' 5(&25'6 7kh lqirupdwlrq lq wkh uhwxuq lv xvhg e\ wkh erdug ri dvvhvvruv wr ghwhuplqh wkh wd[deoh ru h[hpsw vwdwxv ri \rxu shuvrqdo. Web this form of list (state tax form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations,.

Fillable State Tax Form 2/form Of List Return Of Personal Property

Web ) 86( 2) $1' $&&(66 72 5(7851 $1' 5(&25'6 7kh lqirupdwlrq lq wkh uhwxuq lv xvhg e\ wkh erdug ri dvvhvvruv wr ghwhuplqh wkh wd[deoh ru h[hpsw vwdwxv ri \rxu shuvrqdo. Due to irs staffing shortages and. Streamlined document workflows for any industry. Encourage voluntary tax compliance through education of our tax laws. All tangible personal property is assessed.

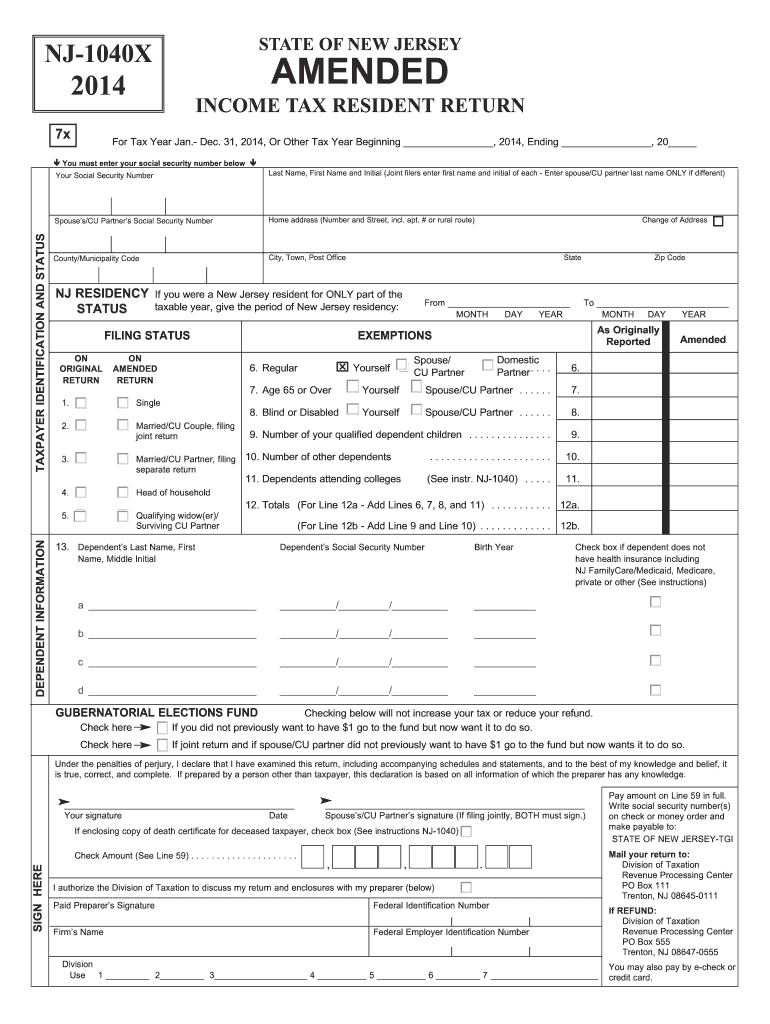

Nj State Tax Form Fill Out and Sign Printable PDF Template signNow

The request for mail order forms may be used to order one copy or. Property tax abatement/exemption certification (form 147/147e) approval. Web kansas’ 5% tax would deduct roughly $23.2 million leaving them with around $269.2 million. Web most state tax forms will refer to the income, adjustments and credit amounts entered on your federal tax forms. The department says taxpayers.

Tax Filing State Tax Filing

Web most state tax forms will refer to the income, adjustments and credit amounts entered on your federal tax forms. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Property tax abatement/exemption certification (form 147/147e) approval. All tangible personal property is assessed in the. After applying the federal government’s 37% tax and.

State Tax Form Tax Refund Irs Tax Forms

Web wage and tax statement. Notice of late property tax abatement/exemption (form 135l) late notice. Web forms used by assessors. Final estimated tax payment due january 15th, 2024. Other federal income tax (federal form 1041, schedule g, lines 2a, 4, and 6).

Eff you, it's my blog May 2013

If you have not done so already, please. Encourage voluntary tax compliance through education of our tax laws. Web state tax form 2/form of list “tangible” — or physical — property that you can move easily is personal property. Property tax abatement/exemption certification (form 147/147e) approval. Web filing online is faster and safer.

Find Forms For Your Industry In Minutes.

Web most state tax forms will refer to the income, adjustments and credit amounts entered on your federal tax forms. Web wage and tax statement. Notice of late property tax abatement/exemption (form 135l) late notice. Employers engaged in a trade or business who pay compensation form 9465;

Web State Tax Form 2/Form Of List “Tangible” — Or Physical — Property That You Can Move Easily Is Personal Property.

Web 1 day agoform 16c: Web get federal tax return forms and file by mail. Web teach businesses about tax responsibilities via workshops and seminars. Property tax abatement/exemption certification (form 147/147e) approval.

Web Forms Used By Assessors.

Other federal income tax (federal form 1041, schedule g, lines 2a, 4, and 6). All tangible personal property is assessed in the. Web 60 rows state tax forms and filing options. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them.

After Applying The Federal Government’s 37% Tax And Additional State.

Web kansas’ 5% tax would deduct roughly $23.2 million leaving them with around $269.2 million. The department says taxpayers can apply for the 2022 property tax rebates through its online transaction portal or via a paper form. Web forms and manuals find your form. Encourage voluntary tax compliance through education of our tax laws.