Ssa Withholding Form

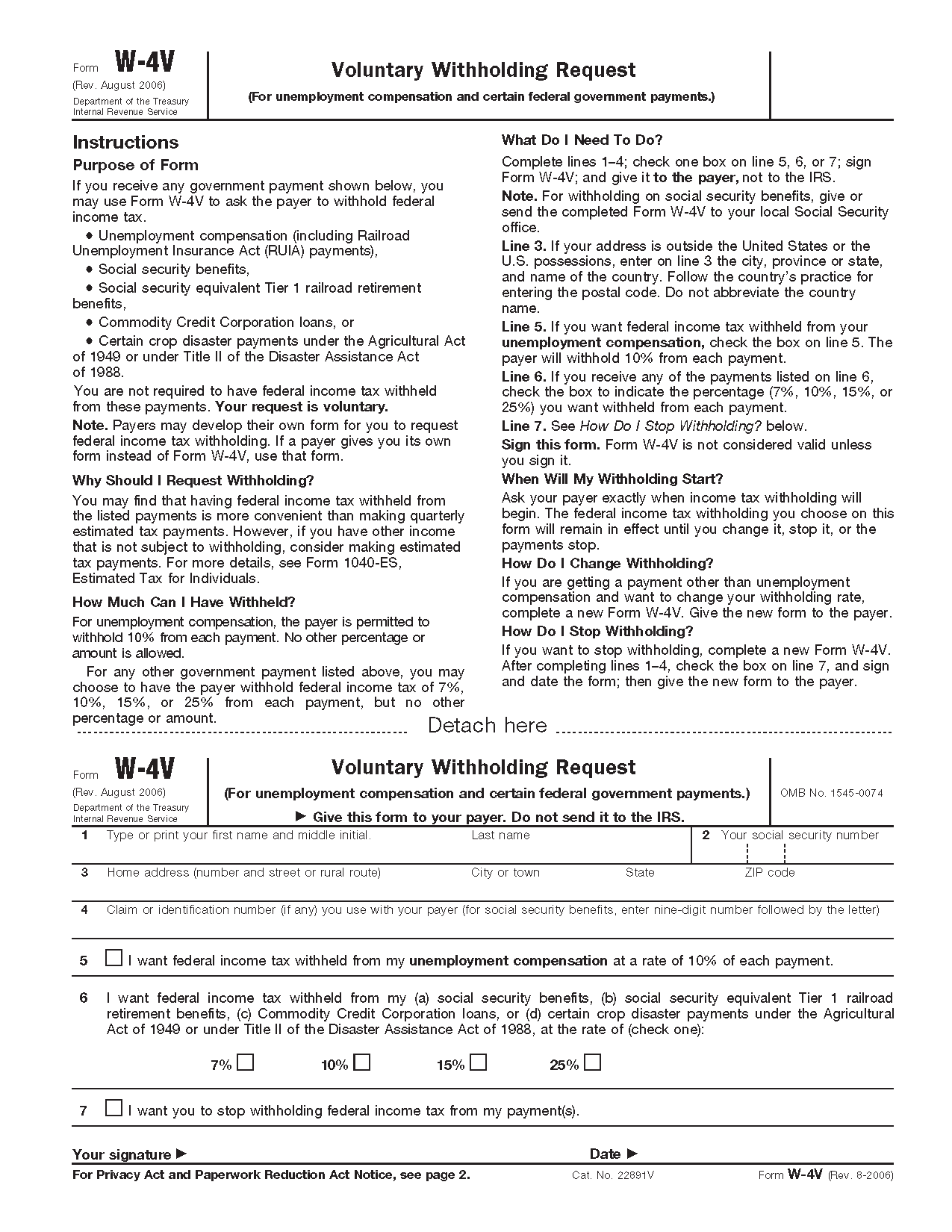

Ssa Withholding Form - In some areas, you may request a replacement social security card online. Authorization to disclose information to the social security administration. Web if you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. Sign in to your account if you didn't get a tax form in the mail that shows your social security income from last year, download a pdf. Web application for a social security card. Use this form to ask payers to withhold federal income tax from certain government payments. Efile your federal tax return now If your address is outside the united states or the u.s. Web request to withhold taxes. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.

Efile your federal tax return now Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Use this form to ask payers to withhold federal income tax from certain government payments. Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Please answer the following questions as completely as you can. If your address is outside the united states or the u.s. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year. You can print other federal tax forms here. In some areas, you may request a replacement social security card online. Possessions, enter on line 3 the city, province or state, and name of the country.

If you do have to pay taxes on your social security benefits, you can make quarterly estimated tax payments to the irs or choose to have federal taxes withheld from your benefits. See withholding income tax from your social security benefits for more information. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year. You can print other federal tax forms here. Sign in to your account if you didn't get a tax form in the mail that shows your social security income from last year, download a pdf. Authorization to disclose information to the social security administration. Possessions, enter on line 3 the city, province or state, and name of the country. Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Follow the country’s practice for entering the postal code. Web complete this form if you are requesting that we adjust the current rate of withholding to recover your overpayment because you are unable to meet your necessary living expenses.

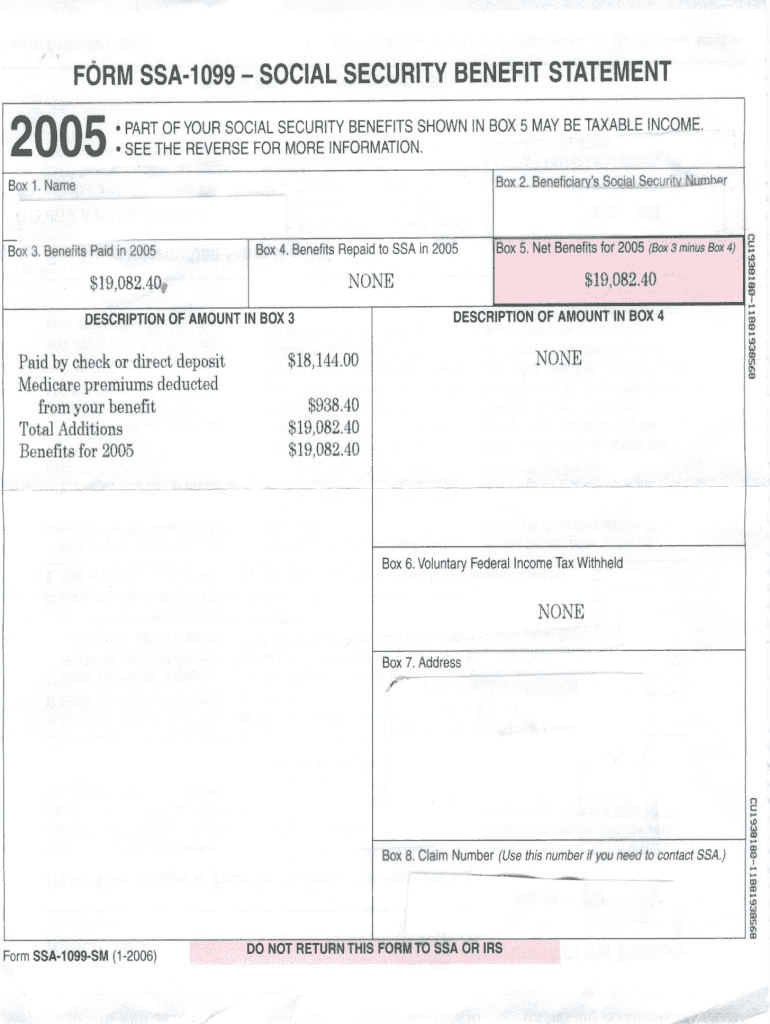

Printable Form Ssa 1099 Printable Form 2022

Web request to withhold taxes. Please answer the following questions as completely as you can. In some areas, you may request a replacement social security card online. Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Sign in to your account if you didn't get a.

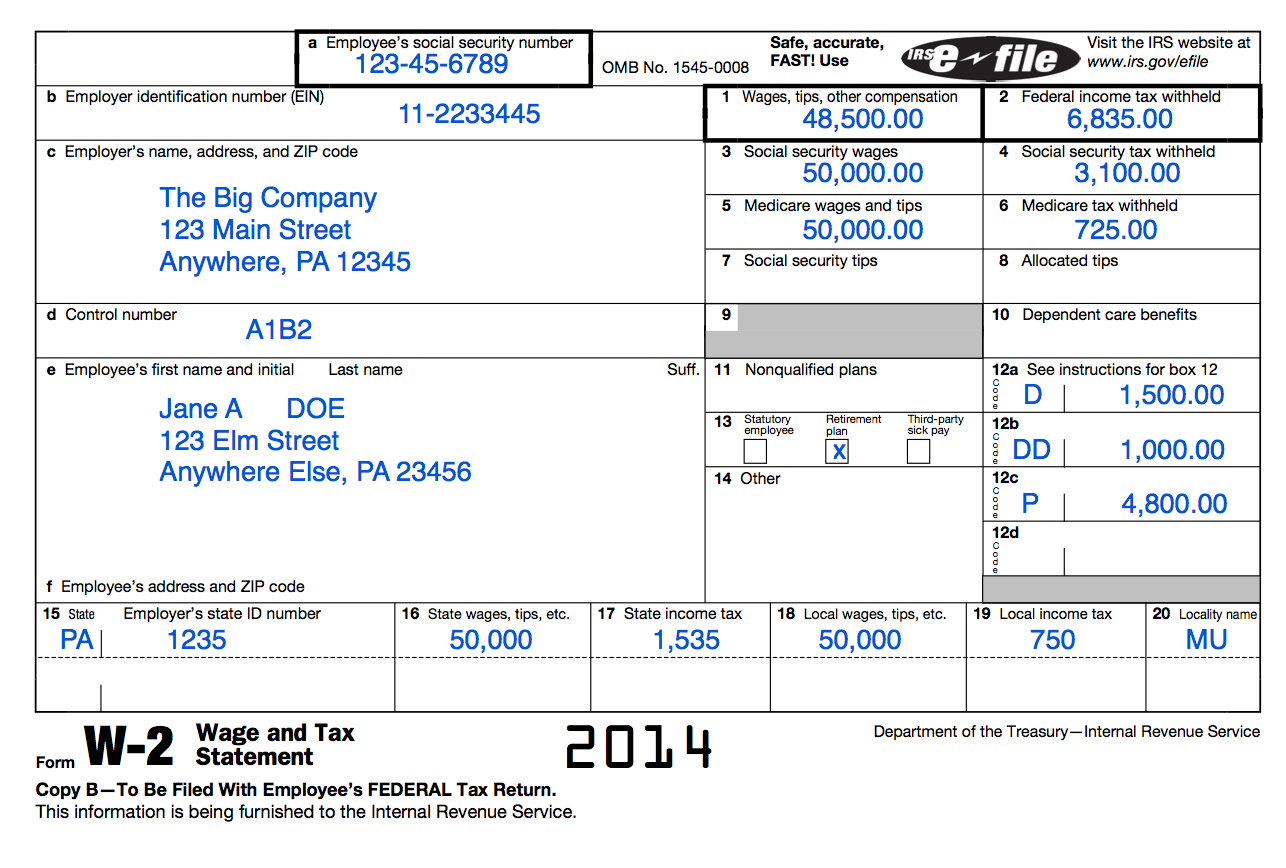

Irs Form W4V Printable where do i mail my w 4v form for social

Web if you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return..

Ssa Voluntary Tax Withholding Form

If your address is outside the united states or the u.s. Sign in to your account if you didn't get a tax form in the mail that shows your social security income from last year, download a pdf. Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax.

Printable Form Ssa 1099 Printable Form 2022

Sign in to your account if you didn't get a tax form in the mail that shows your social security income from last year, download a pdf. Web request to withhold taxes. Web complete this form if you are requesting that we adjust the current rate of withholding to recover your overpayment because you are unable to meet your necessary.

Ssa 3288 Fillable / 17 Printable ssa 3288 Forms and Templates

Web request to withhold taxes. You can print other federal tax forms here. Use this form to ask payers to withhold federal income tax from certain government payments. Web application for a social security card. Authorization to disclose information to the social security administration.

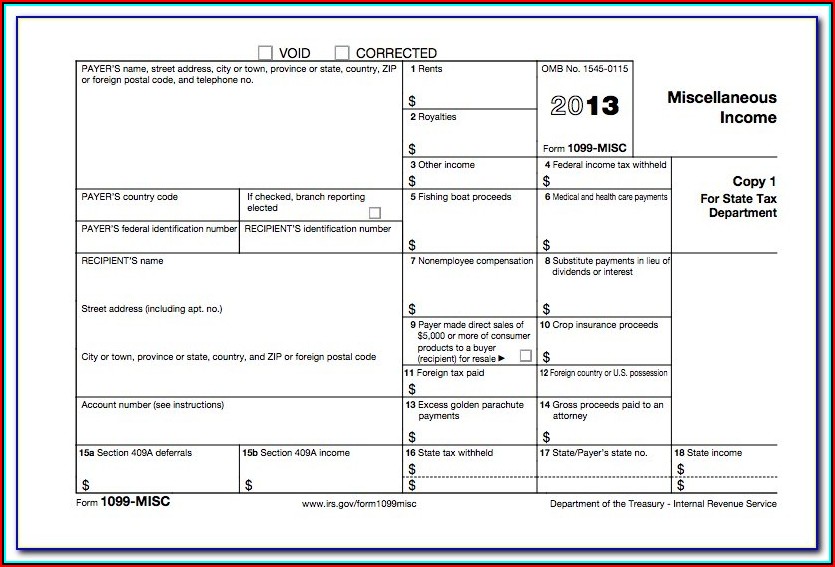

Example Of Non Ssa 1099 Form / Publication 915 (2020), Social Security

Use this form to ask payers to withhold federal income tax from certain government payments. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year. If you do have to pay taxes on your social security benefits, you can make quarterly.

Ssa Voluntary Tax Withholding Form

Web request to withhold taxes. Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. See withholding income tax from your social security benefits for more information. Authorization to disclose information to the social security administration. Follow the country’s practice for entering the postal code.

Social Security Medicare Form Cms 1763 Form Resume Examples jl10DJW012

Web application for a social security card. If you do have to pay taxes on your social security benefits, you can make quarterly estimated tax payments to the irs or choose to have federal taxes withheld from your benefits. Web complete this form if you are requesting that we adjust the current rate of withholding to recover your overpayment because.

SSA POMS RM 01103.034 Form W4, "Employee's Withholding Allowance

You can print other federal tax forms here. You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year. In some areas, you may request a replacement social security card online. Efile your federal tax return now Web application for a social.

W 4V Form SSA Printable 2022 W4 Form

Web request to withhold taxes. Web if you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. We will use your answers to decide if we can reduce the amount you must pay us back each month. Possessions, enter on line 3 the city, province or state,.

Sign In To Your Account If You Didn't Get A Tax Form In The Mail That Shows Your Social Security Income From Last Year, Download A Pdf.

In some areas, you may request a replacement social security card online. See withholding income tax from your social security benefits for more information. Authorization to disclose information to the social security administration. If your address is outside the united states or the u.s.

If You Do Have To Pay Taxes On Your Social Security Benefits, You Can Make Quarterly Estimated Tax Payments To The Irs Or Choose To Have Federal Taxes Withheld From Your Benefits.

Possessions, enter on line 3 the city, province or state, and name of the country. Web application for a social security card. Efile your federal tax return now You will pay federal income taxes on your benefits if your combined income (50% of your benefit amount plus any other earned income) exceeds $25,000/year filing individually or $32,000/year.

We Will Use Your Answers To Decide If We Can Reduce The Amount You Must Pay Us Back Each Month.

Follow the country’s practice for entering the postal code. Submit a request to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Use this form to ask payers to withhold federal income tax from certain government payments. Please answer the following questions as completely as you can.

Web Request To Withhold Taxes.

Web breadcrumb home manage benefits get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. You can print other federal tax forms here. Web complete this form if you are requesting that we adjust the current rate of withholding to recover your overpayment because you are unable to meet your necessary living expenses. Web if you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes.