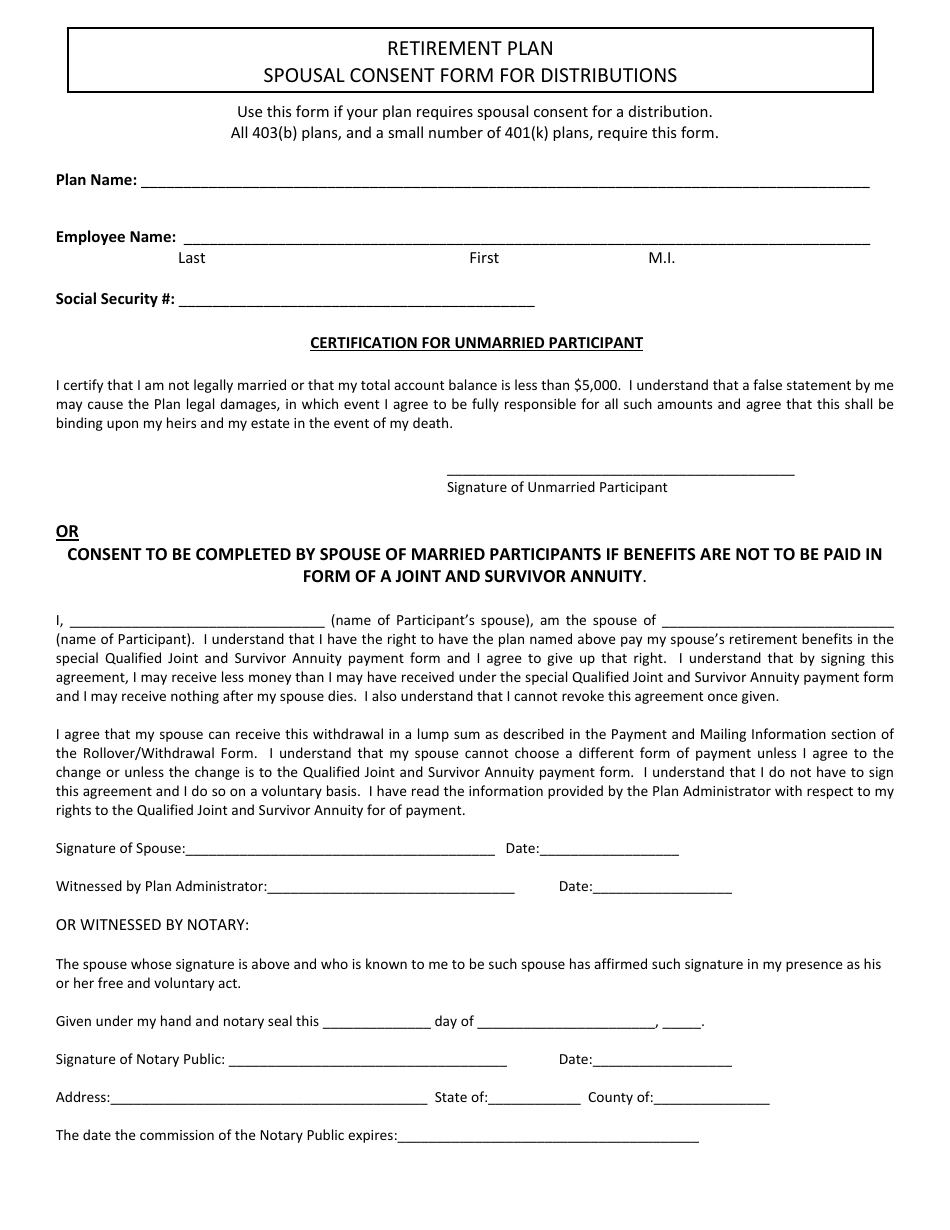

Spousal Consent Form 401K

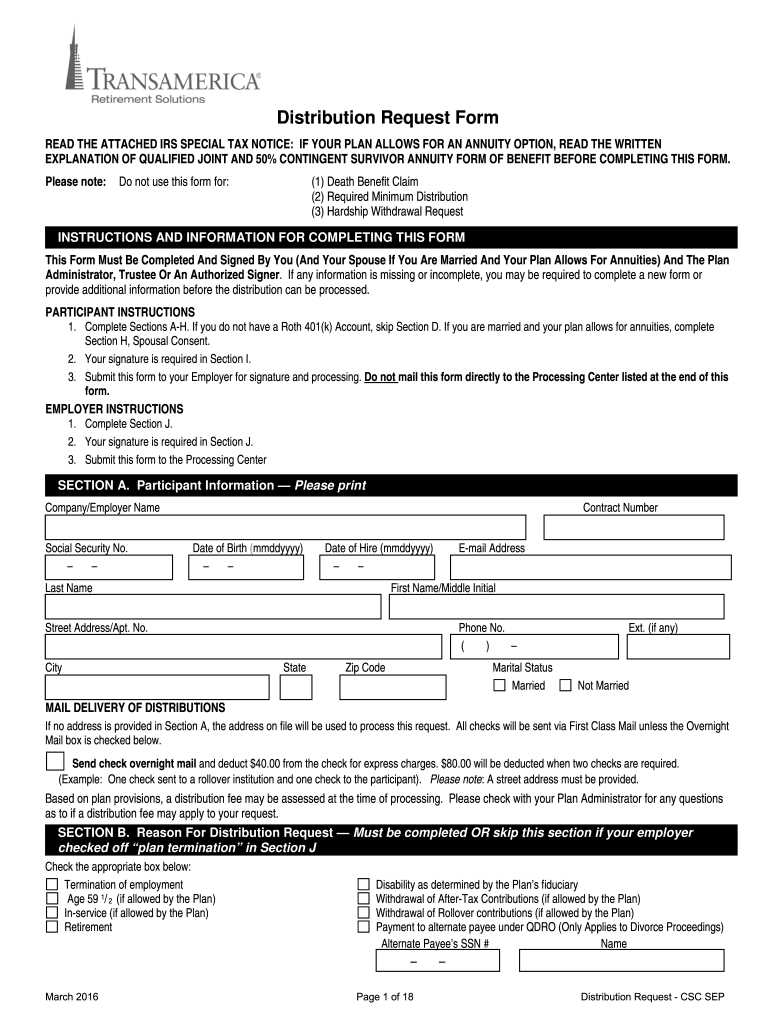

Spousal Consent Form 401K - Web generally, if your account balance exceeds $5,000, the plan administrator must obtain your consent before making a distribution. Web change beneficiaries for 401 (k) and other retirement plans view your retirement savings account balance or change your contributions check your insurance claim status or. Ad everything you need on the road to retirement can be done online. Depending on the type of benefit distribution. • agree to the designation of the beneficiary(ies) on. You may not need to fill out all of the forms. Others don’t require spousal consent for distributions or loans. Easily fill out pdf blank, edit, and sign them. Web generally, consent is required if the participant’s account balance exceeds $5,000. Easily fill out pdf blank, edit, and sign them.

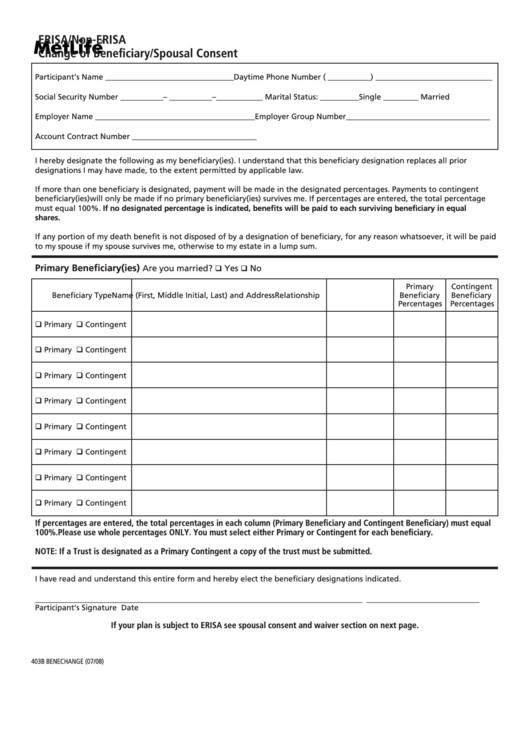

Spouse’s consent notarized signature required if spouse is not the only primary beneficiary. Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401 (k) plan offers one or. Web spousal consent form phoenix: Web generally, consent is required if the participant’s account balance exceeds $5,000. Automatic enrollment & low monthly fees—to get more people saving for retirement. Web 1 day agohouse and senate democrats quietly reintroduced bills on thursday to require spousal consent for 401(k) distributions. Web all the forms you need to transfer to fers. You may not need to fill out all of the forms. Depending on the type of benefit distribution provided under the 401(k) plan, the plan. Save or instantly send your ready documents.

Some 401(k) plans may require an employee to get spousal consent before getting approved for a 401(k) loan. Web complete spousal consent form online with us legal forms. Most forms can be completed online, or you can download. Ad everything you need on the road to retirement can be done online. Depending on the type of benefit distribution. Automatic enrollment & low monthly fees—to get more people saving for retirement. Save or instantly send your ready documents. H.r.5060 and s.2627 would “amend the. Others don’t require spousal consent for distributions or loans. • agree to the designation of the beneficiary(ies) on.

401k Enrollment Form Fill Online, Printable, Fillable, Blank pdfFiller

Web change beneficiaries for 401 (k) and other retirement plans view your retirement savings account balance or change your contributions check your insurance claim status or. You may not need to fill out all of the forms. Others don’t require spousal consent for distributions or loans. Some 401(k) plans may require an employee to get spousal consent before getting approved.

Spousal Consent Form Sample Fill Online Printable Fillable Blank Gambaran

Web all the forms you need to transfer to fers. Easily fill out pdf blank, edit, and sign them. Automatic enrollment & low monthly fees—to get more people saving for retirement. Web complete spousal consent form online with us legal forms. In general, a notarized spousal consent form may be required in.

Metlife Change Of Beneficiary/spousal Consent Form printable pdf download

Web all the forms you need to transfer to fers. Automatic enrollment & low monthly fees—to get more people saving for retirement. Automatic enrollment & low monthly fees—to get more people saving for retirement. Depending on the type of benefit distribution provided under the 401(k) plan, the plan. Ad everything you need on the road to retirement can be done.

Transamerica 401K Withdrawal Fill Out and Sign Printable PDF Template

Web 1 day agohouse and senate democrats quietly reintroduced bills on thursday to require spousal consent for 401(k) distributions. Most forms can be completed online, or you can download. You may not need to fill out all of the forms. Depending on the type of benefit distribution. Web some 401(k) plans require spousal consent whenever a participant takes a distribution.

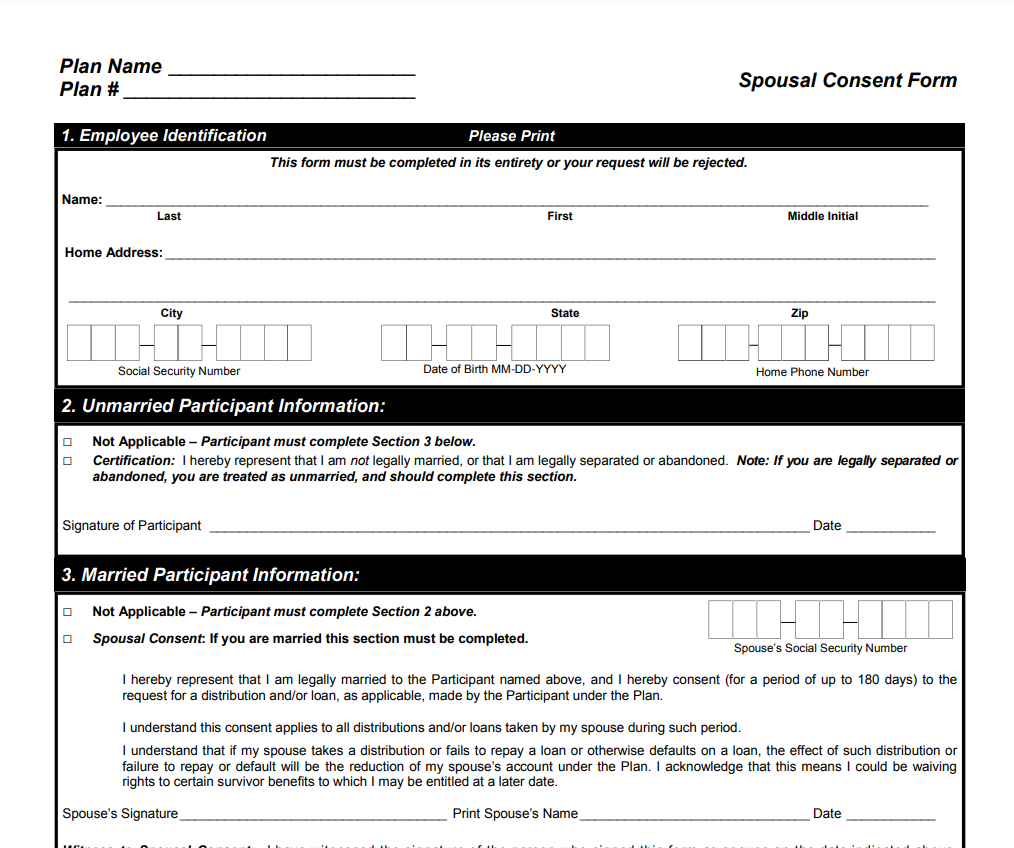

Spouse Consent Form 2023

• agree to the designation of the beneficiary(ies) on. You may not need to fill out all of the forms. Automatic enrollment & low monthly fees—to get more people saving for retirement. Ad everything you need on the road to retirement can be done online. Web what is spousal consent in 401(k) loans?

Spousal Consent Form Miami Free Download

If you are married, your plan requires you to designate that your spouse receives at least 50% of your vested account balance unless your spouse consents to. Others don’t require spousal consent for distributions or loans. Web spousal consent form phoenix: Web generally, consent is required if the participant’s account balance exceeds $5,000. Web generally, if your account balance exceeds.

(DOC) REQUIREMENT OF SPOUSAL CONSENT AND THE DISPOSITIONS Ogada Meso

Most forms can be completed online, or you can download. Web up to $40 cash back the answer to this question can vary depending on the specific jurisdiction and laws. Automatic enrollment & low monthly fees—to get more people saving for retirement. H.r.5060 and s.2627 would “amend the. Web spousal consent form phoenix:

Is spousal consent required for 401k loan?

If you are married, your plan requires you to designate that your spouse receives at least 50% of your vested account balance unless your spouse consents to. Web generally, consent is required if the participant’s account balance exceeds $5,000. Web generally, if your account balance exceeds $5,000, the plan administrator must obtain your consent before making a distribution. Automatic enrollment.

ads/responsive.txt Fidelity 401k Spousal Consent form Beautiful

Web 1 day agohouse and senate democrats quietly reintroduced bills on thursday to require spousal consent for 401(k) distributions. Some 401(k) plans may require an employee to get spousal consent before getting approved for a 401(k) loan. • agree to the designation of the beneficiary(ies) on. Web all the forms you need to transfer to fers. Web up to $40.

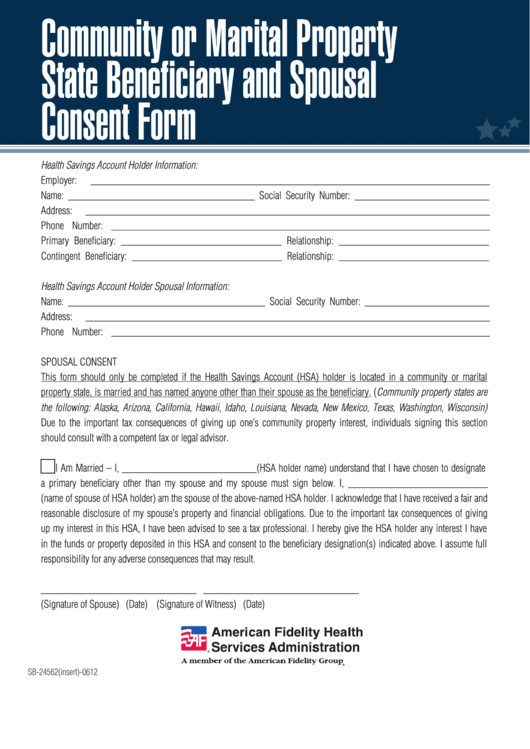

Community Or Marital Property State Beneficiary And Spousal Consent

You may not need to fill out all of the forms. Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401 (k) plan offers one or. Spouse’s consent notarized signature required if spouse is not the only primary beneficiary. Others don’t require spousal consent for distributions or loans. Web 1.

Web Generally, If Your Account Balance Exceeds $5,000, The Plan Administrator Must Obtain Your Consent Before Making A Distribution.

Web 1 day agohouse and senate democrats quietly reintroduced bills on thursday to require spousal consent for 401(k) distributions. Web complete spousal consent form online with us legal forms. Ad everything you need on the road to retirement can be done online. Some 401(k) plans may require an employee to get spousal consent before getting approved for a 401(k) loan.

Web Up To $40 Cash Back The Answer To This Question Can Vary Depending On The Specific Jurisdiction And Laws.

Easily fill out pdf blank, edit, and sign them. Spouse’s consent notarized signature required if spouse is not the only primary beneficiary. Depending on the type of benefit distribution provided under the 401(k) plan, the plan. Depending on the type of benefit distribution.

Save Or Instantly Send Your Ready Documents.

Web all the forms you need to transfer to fers. Automatic enrollment & low monthly fees—to get more people saving for retirement. The following forms are all related to the election of fers coverage. Others don’t require spousal consent for distributions or loans.

Web Generally, Consent Is Required If The Participant’s Account Balance Exceeds $5,000.

If you are married, your plan requires you to designate that your spouse receives at least 50% of your vested account balance unless your spouse consents to. Easily fill out pdf blank, edit, and sign them. • agree to the designation of the beneficiary(ies) on. Spousal consent is required if a married participant designates a nonspouse primary beneficiary and may be necessary if a 401 (k) plan offers one or.