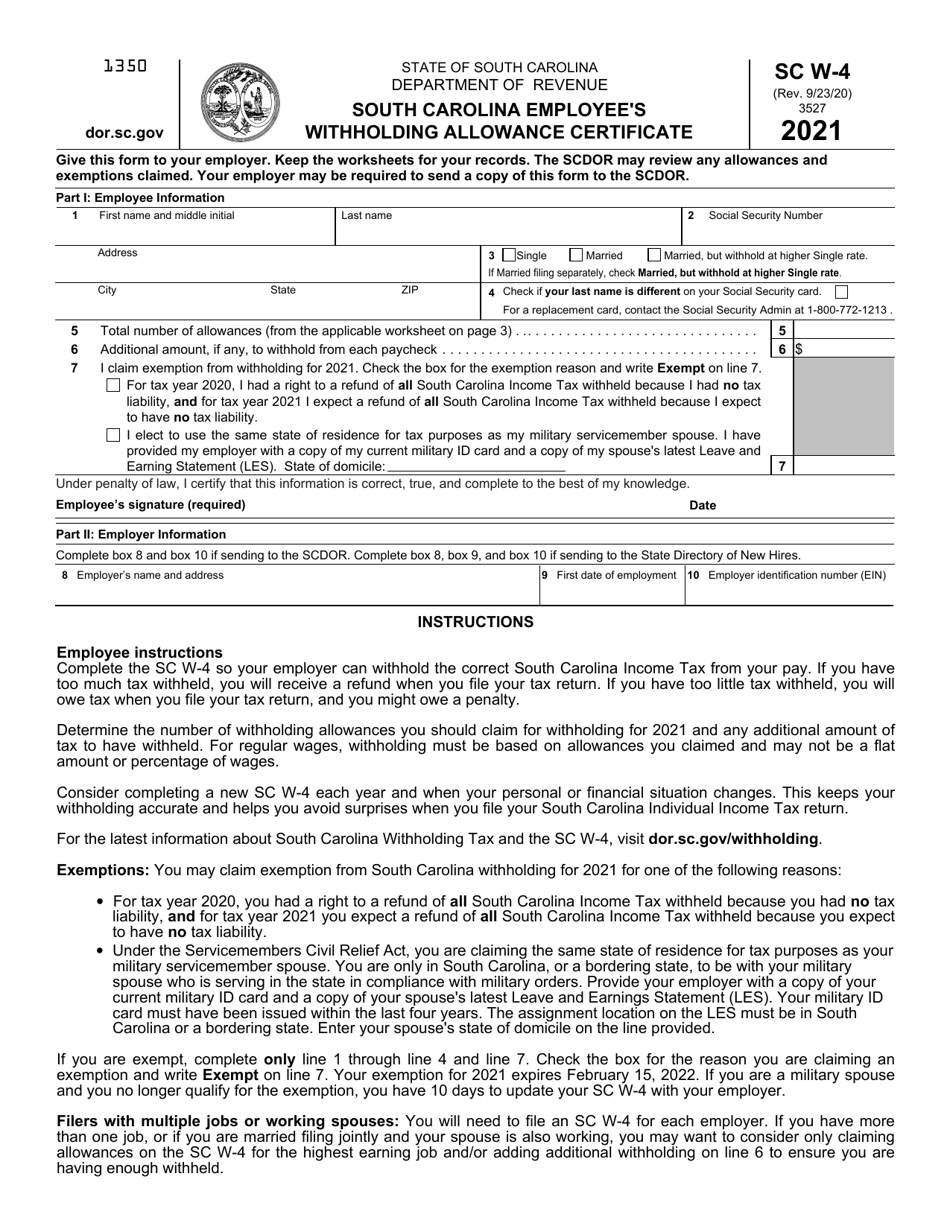

South Carolina Withholding Form 2023

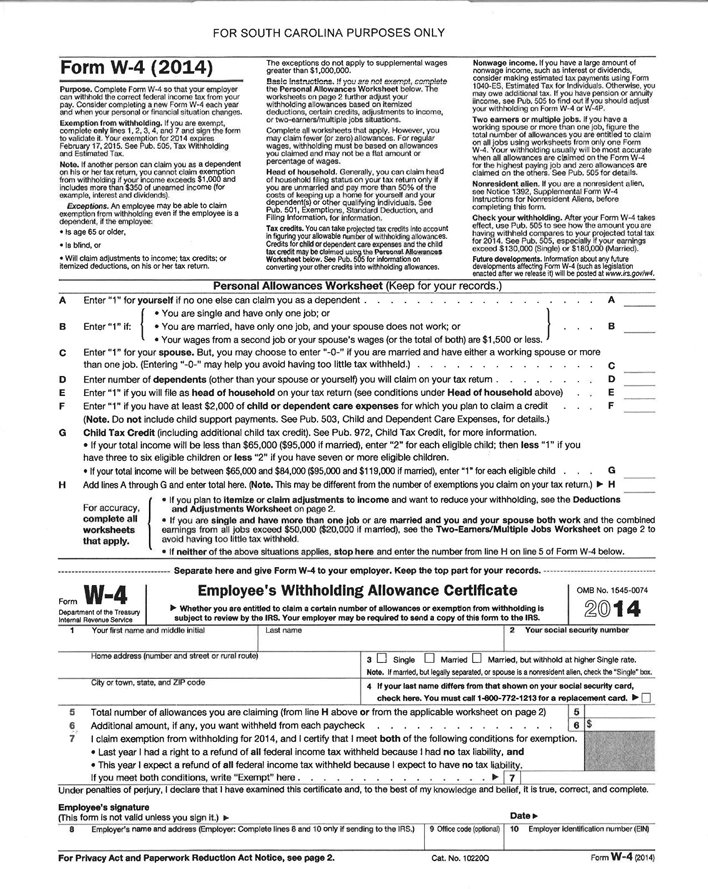

South Carolina Withholding Form 2023 - Sign up for email reminder s 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld. 14 by the state revenue department. Web state of south carolina department of revenue wh1603 (rev. Web want more information about withholding taxes? You can print other south carolina tax forms here. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. South carolina’s 2023 withholding methods were released nov. Fica wage and tax adjustment request waiver

You can print other south carolina tax forms here. Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld. Web state of south carolina department of revenue wh1603 (rev. 11/1/22) 3478 employers must calculate taxable income for each employee. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table Visit dor.sc.gov/withholding what’s new for withholding tax? I.compute annualized salary multiply weekly salary by 52 weeks to calculate the. Form namesc withholding tax information guide: Then, compute the amount of tax to be withheld using the subtraction method or the addition method.

Web state of south carolina department of revenue wh1603 (rev. Sign up for email reminder s Form namesc withholding tax information guide: Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld. South carolina’s 2023 withholding methods were released nov. Fica wage and tax adjustment request waiver Manage your tax accounts online for free! Web want more information about withholding taxes? You can print other south carolina tax forms here. The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%.

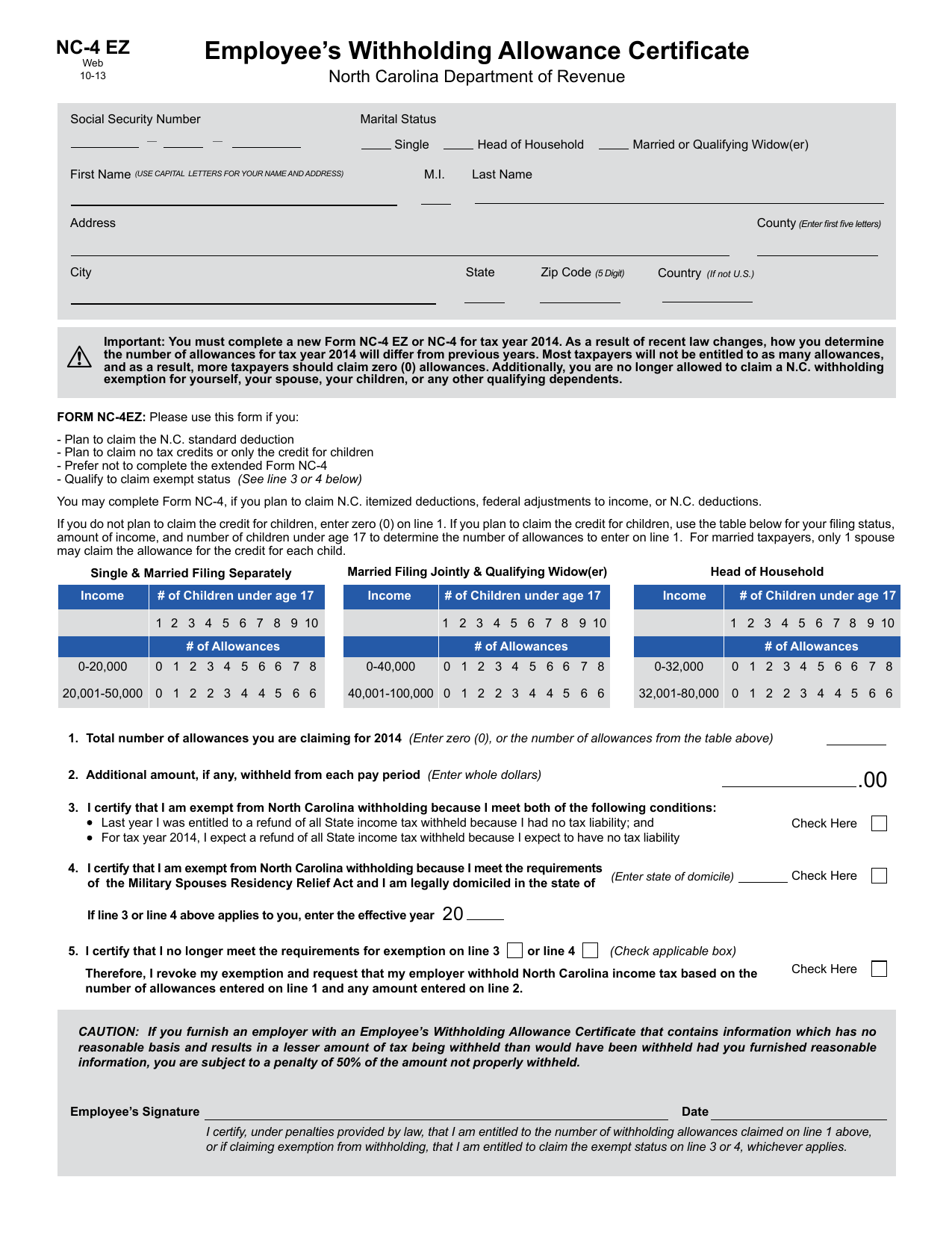

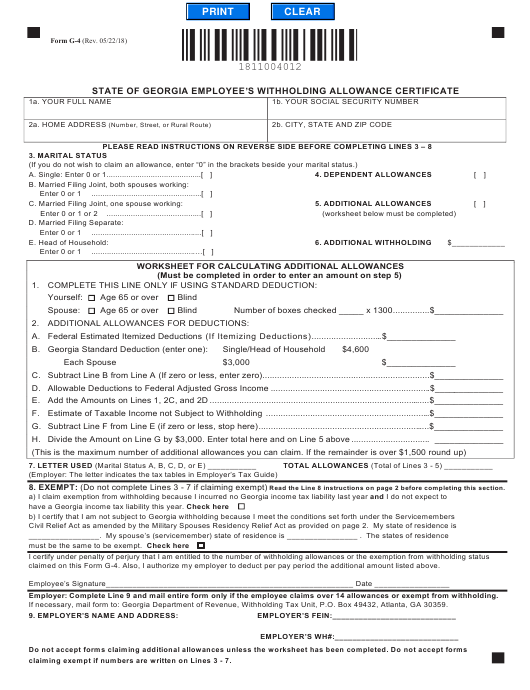

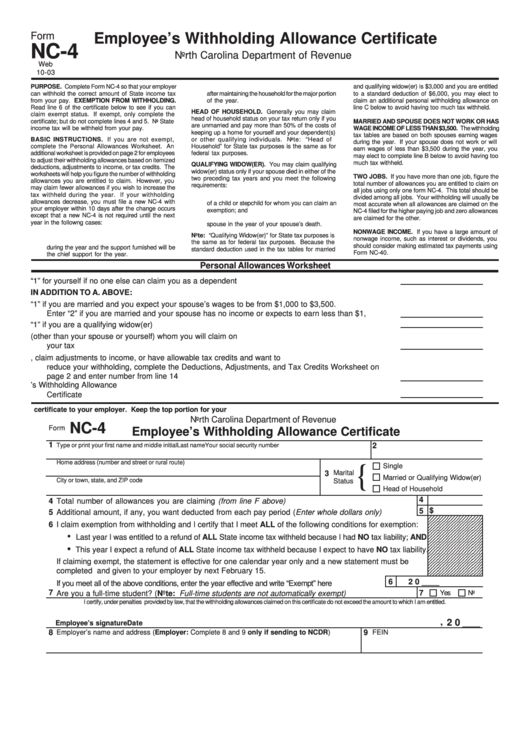

Employee’s Withholding Allowance Certificate NC4 EZ

Manage your tax accounts online for free! The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%. Web state of south carolina department of revenue wh1603 (rev. 11/1/22) 3478 employers must calculate taxable income for each employee. Fica wage.

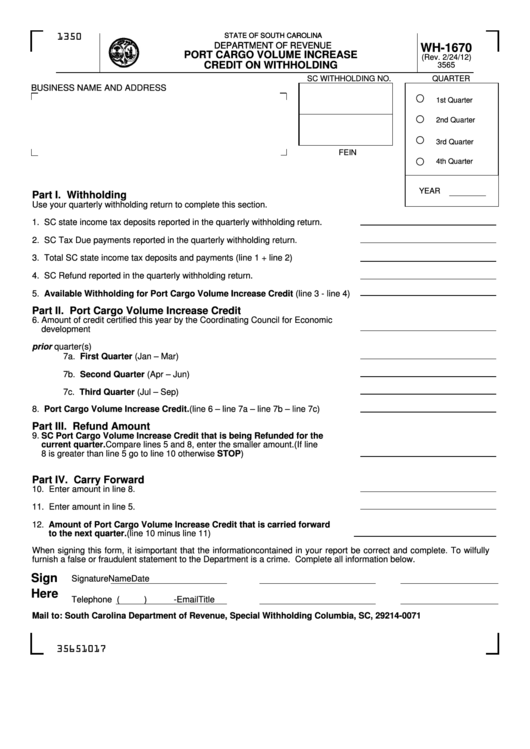

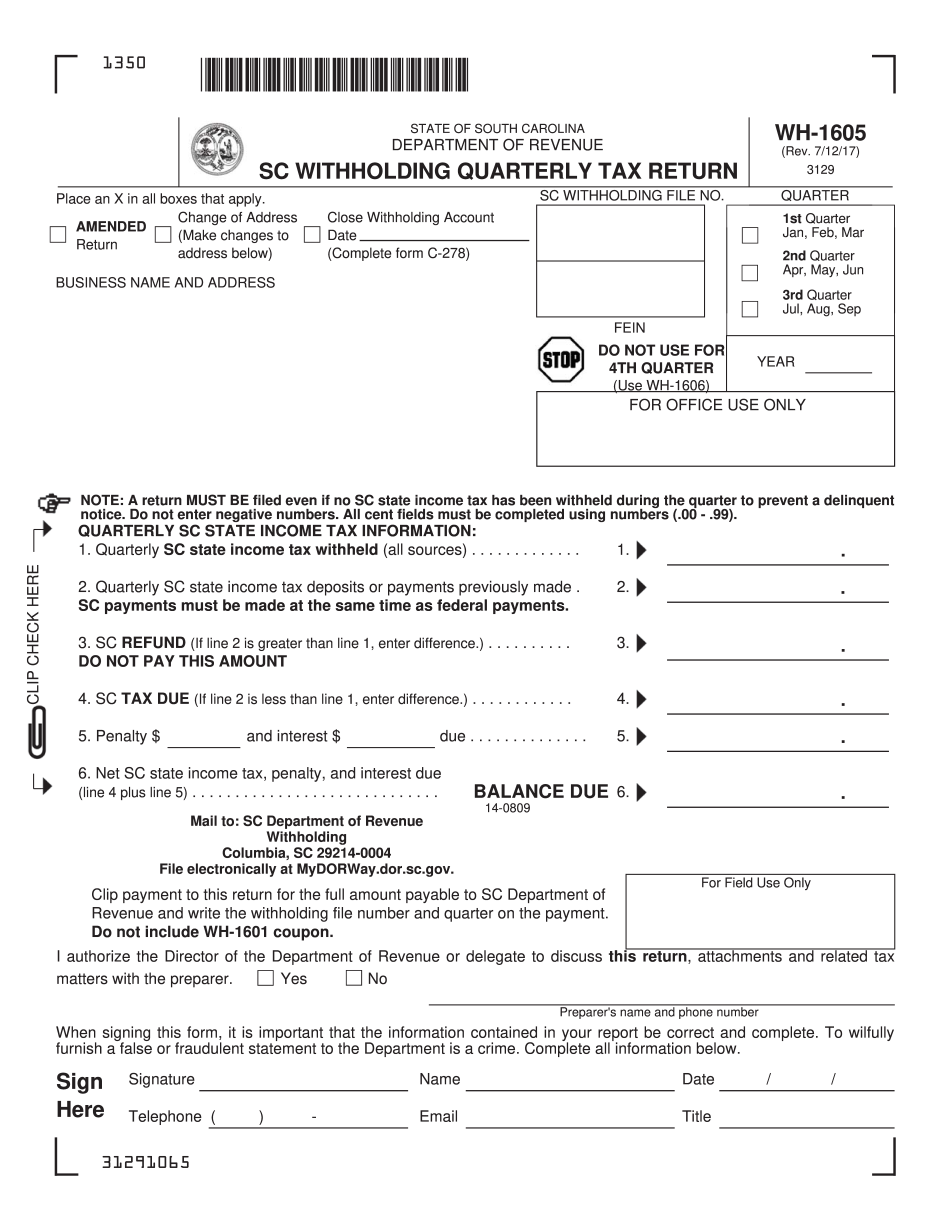

Form Wh1670 Port Cargo Volume Increase Credit On Withholding South

South carolina’s 2023 withholding methods were released nov. Then, compute the amount of tax to be withheld using the subtraction method or the addition method. Web state of south carolina department of revenue wh1603 (rev. Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld. I.compute annualized.

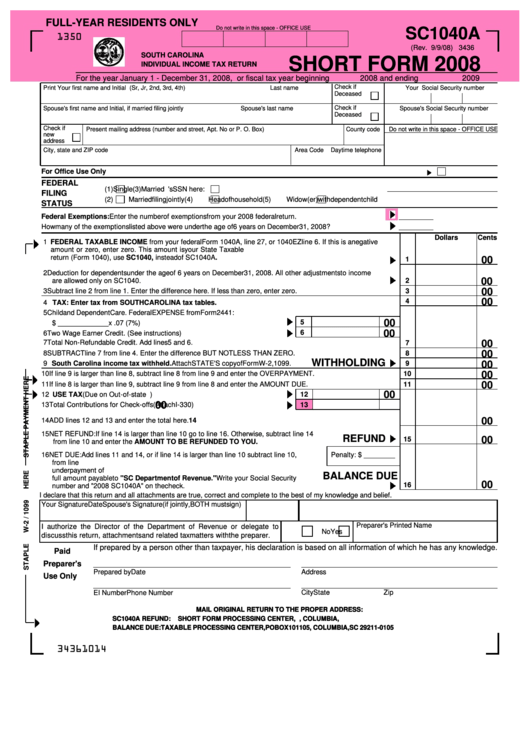

South Carolina Tax Withholding Form

Manage your tax accounts online for free! Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Sign up for email reminder s You can.

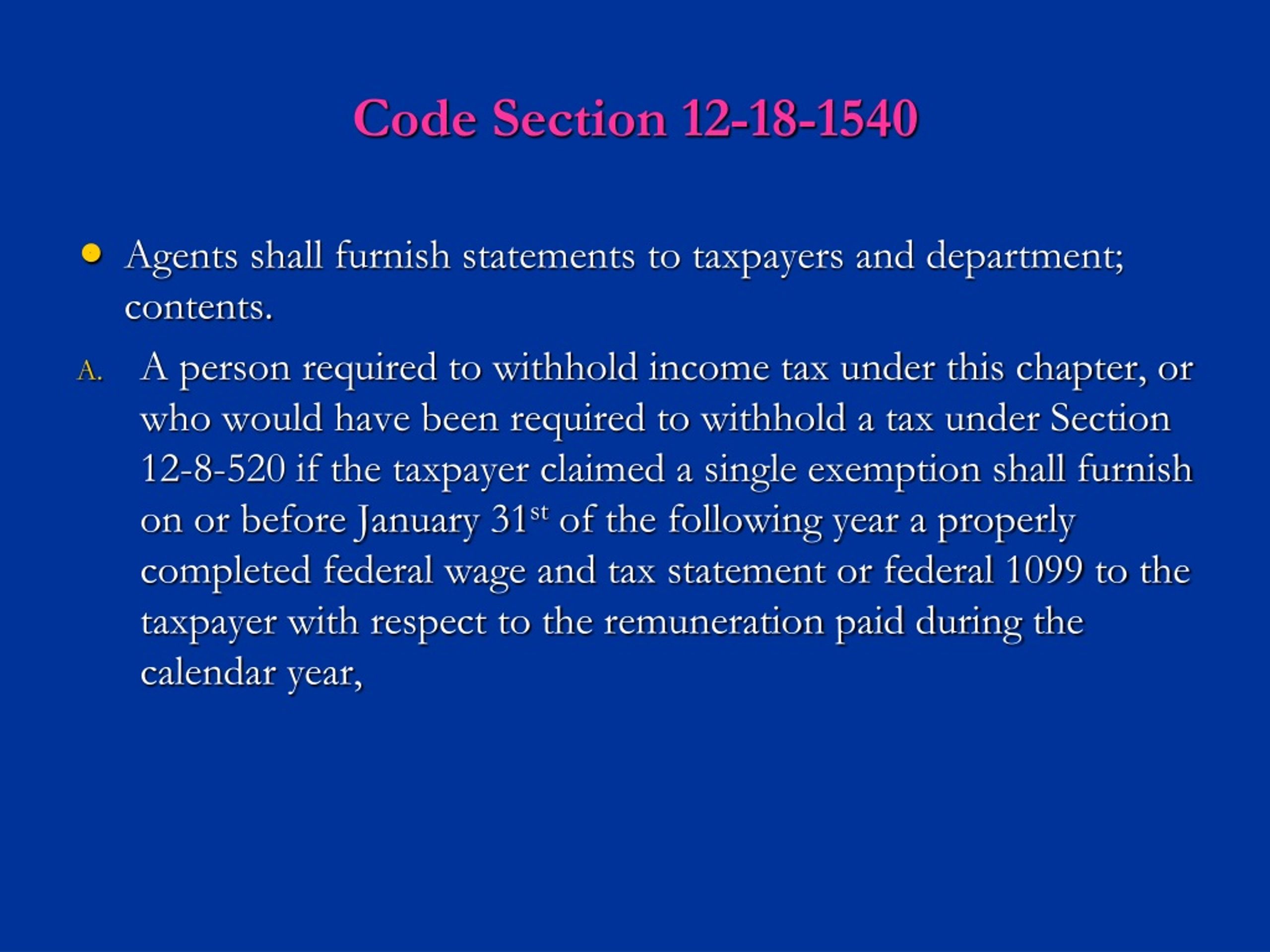

PPT South Carolina Withholding and Forms W2 PowerPoint Presentation

I.compute annualized salary multiply weekly salary by 52 weeks to calculate the. South carolina’s 2023 withholding methods were released nov. Form namesc withholding tax information guide: Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023.

Form SC W4 Download Fillable PDF or Fill Online South Carolina

10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table Web state of south carolina department of revenue wh1603 (rev. Form namesc withholding tax information guide: Visit dor.sc.gov/withholding what’s new for withholding tax? You can print other south carolina tax forms here.

South Carolina Form WH1605 Printable SC Withholding Quarterly Tax Return

11/1/22) 3478 employers must calculate taxable income for each employee. 14 by the state revenue department. Form namesc withholding tax information guide: Then, compute the amount of tax to be withheld using the subtraction method or the addition method. Visit dor.sc.gov/withholding what’s new for withholding tax?

State Employee Withholding Form 2023

I.compute annualized salary multiply weekly salary by 52 weeks to calculate the. 11/1/22) 3478 employers must calculate taxable income for each employee. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. You can print other south carolina tax forms here. Fica wage and tax adjustment request waiver

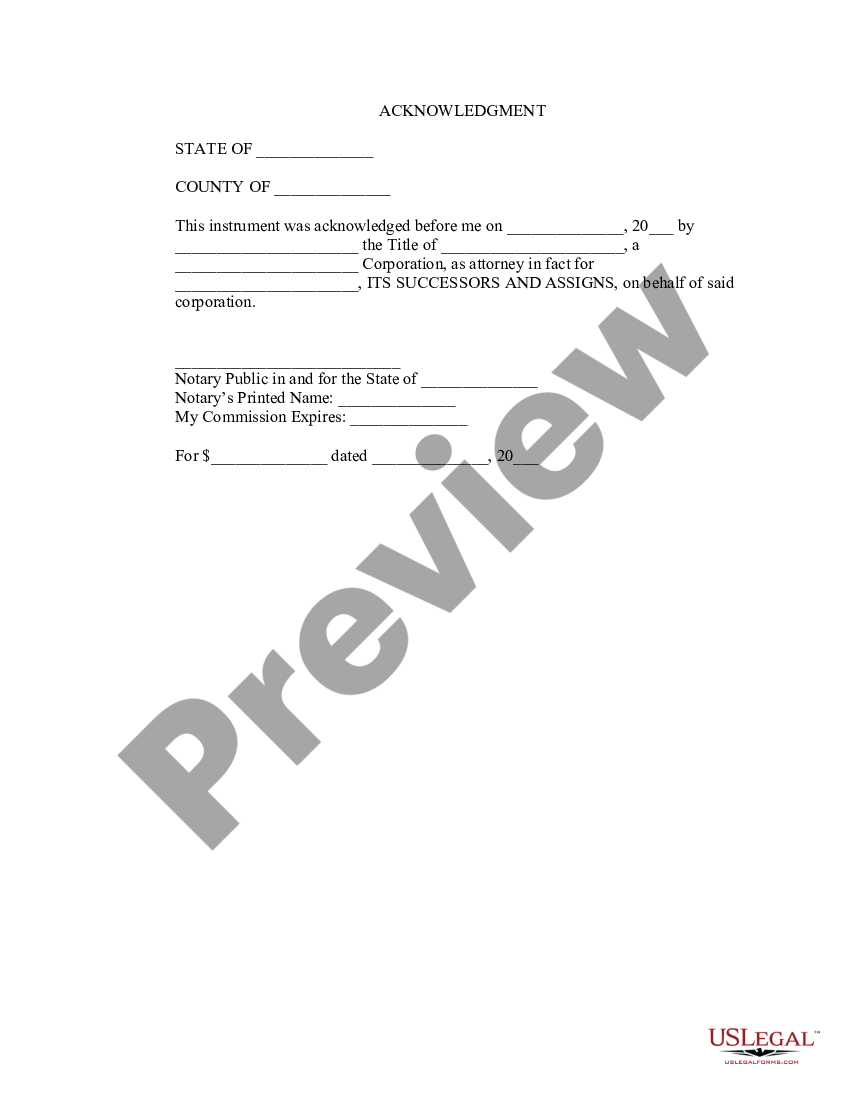

South Carolina Assignment Withholding US Legal Forms

14 by the state revenue department. Manage your tax accounts online for free! For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. 11/1/22) 3478 employers must calculate taxable income for each employee. You can print other south carolina tax forms here.

South Carolina State Tax Withholding Form

Visit dor.sc.gov/withholding what’s new for withholding tax? I.compute annualized salary multiply weekly salary by 52 weeks to calculate the. Web want more information about withholding taxes? You can print other south carolina tax forms here. The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with.

State Tax Withholding Forms Template Free Download Speedy Template

Visit dor.sc.gov/withholding what’s new for withholding tax? Fica wage and tax adjustment request waiver Web want more information about withholding taxes? Sign up for email reminder s 11/1/22) 3478 employers must calculate taxable income for each employee.

14 By The State Revenue Department.

South carolina’s 2023 withholding methods were released nov. You can print other south carolina tax forms here. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Visit dor.sc.gov/withholding what’s new for withholding tax?

Manage Your Tax Accounts Online For Free!

Web state of south carolina department of revenue wh1603 (rev. Form namesc withholding tax information guide: 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld.

Web Want More Information About Withholding Taxes?

Fica wage and tax adjustment request waiver Then, compute the amount of tax to be withheld using the subtraction method or the addition method. 11/1/22) 3478 employers must calculate taxable income for each employee. The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%.

I.compute Annualized Salary Multiply Weekly Salary By 52 Weeks To Calculate The.

Sign up for email reminder s