Sole Proprietor Form

Sole Proprietor Form - Web a sole proprietor is an individual who owns an unincorporated business that is not registered as a corporation or limited liability company. Web a sole proprietorship is an unincorporated business with one owner. Web what is an llc? Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Use our simple online incorporation process & turn your great idea into a great business. Create a free legal form in minutes. With this business structure, the individual and business are legally the same. Web a sole proprietorship is easy to set up and is the least costly of the four entities. Web a sole proprietorship is the default choice for anyone who runs a business but hasn’t set up another formal business structure like an llc. An llc is a legally separate business entity that’s created under state law.

Create a free legal form in minutes. Web 9 rows find the definition of a sole proprietorship and the required forms. Coming up with a business name can be exciting―it is a representation of you and the. Web what tax forms to use as a sole proprietorship? This is the simplest and most common form used when starting a new business. Ad our simple online application can be completed in as little as 10 minutes. An llc combines elements of a sole proprietorship, partnership, and. Web a sole proprietorship is easy to set up and is the least costly of the four entities. Use our simple online incorporation process & turn your great idea into a great business. With this business structure, the individual and business are legally the same.

Web a sole proprietor is an individual who owns an unincorporated business that is not registered as a corporation or limited liability company. Web generally, businesses are created and operated in one of the following forms: Use our simple online incorporation process & turn your great idea into a great business. Pick your name if you want to use a name for your business that is not your personal name, you need to register for a “ doing business as ” (dba) name. With this business structure, the individual and business are legally the same. Ad our simple online application can be completed in as little as 10 minutes. Ad whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Web what tax forms to use as a sole proprietorship? An llc is a legally separate business entity that’s created under state law. Web 9 rows find the definition of a sole proprietorship and the required forms.

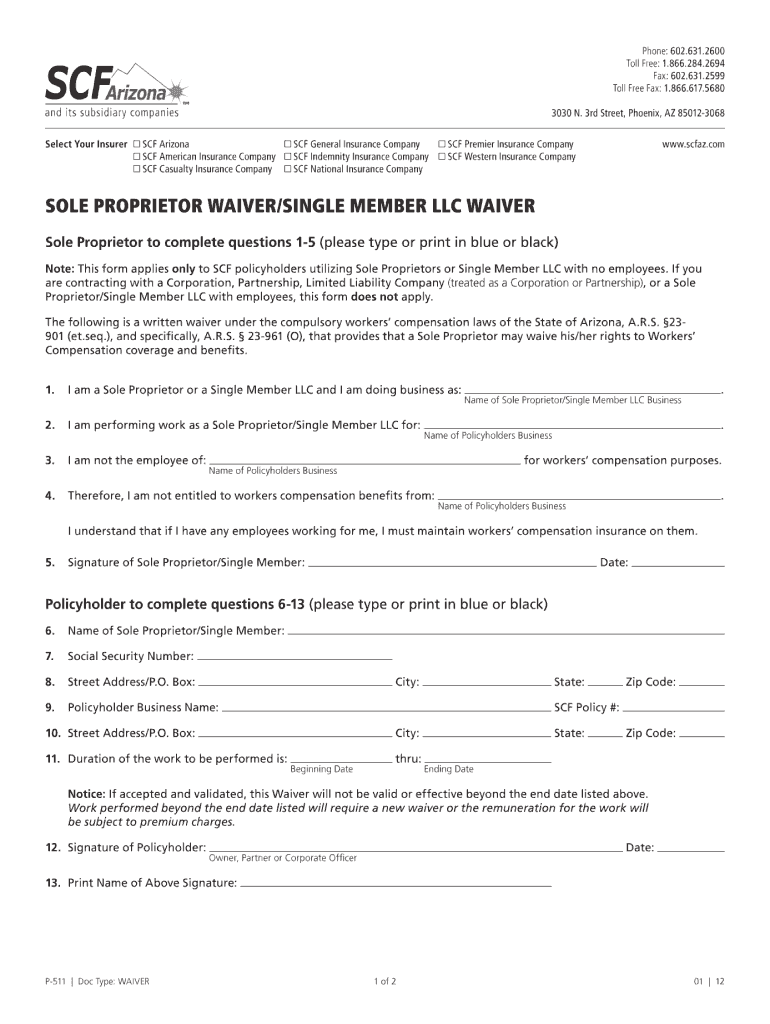

Arizona Sole Proprietor Waiver Fill Out and Sign Printable PDF

The most common and the simplest form of business is the sole. As soon as you embark on a solo side gig, freelance job, or a new business venture, you’re. Web what is an llc? Hence, use 1040 as the sole proprietorship income tax form. Web 10 steps to start your business plan your business market research and competitive analysis.

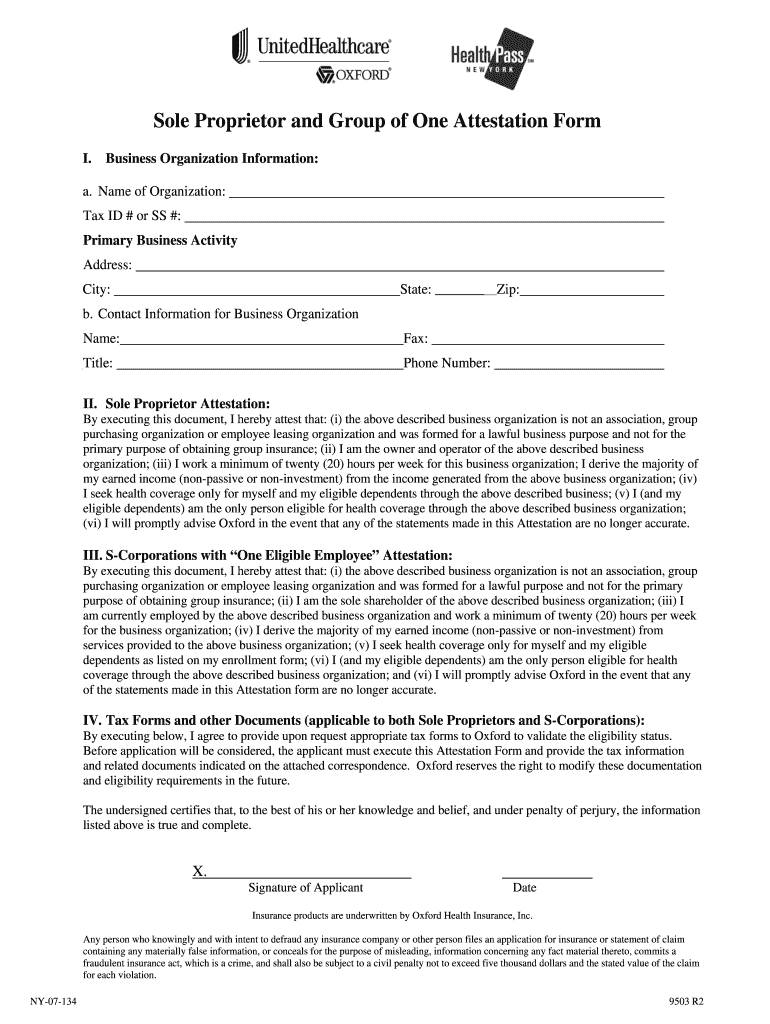

Proprietor Attestation Fill Online, Printable, Fillable, Blank

We will save you time and money by avoiding costly errors. All a sole proprietor business owner needs for a startup is: Create a free legal form in minutes. Web a sole proprietorship is easy to set up and is the least costly of the four entities. This is the simplest and most common form used when starting a new.

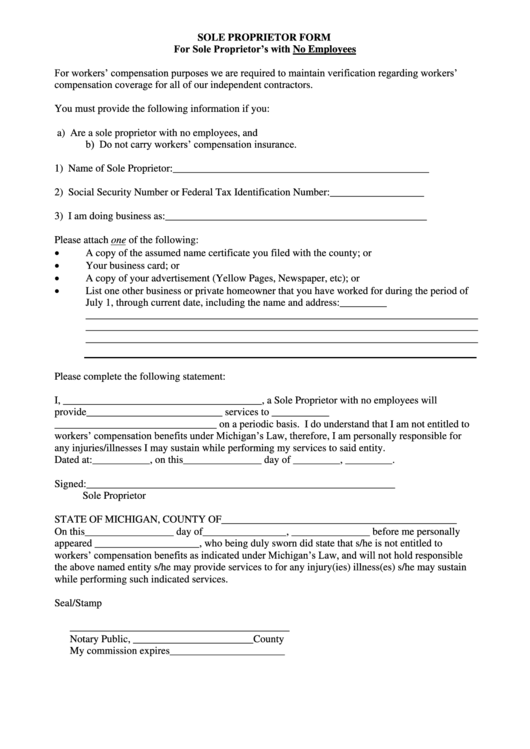

Sole Proprietor Form printable pdf download

All a sole proprietor business owner needs for a startup is: This is the simplest and most common form used when starting a new business. Web 9 rows find the definition of a sole proprietorship and the required forms. Web a sole proprietorship is easy to set up and is the least costly of the four entities. Sole proprietorships are.

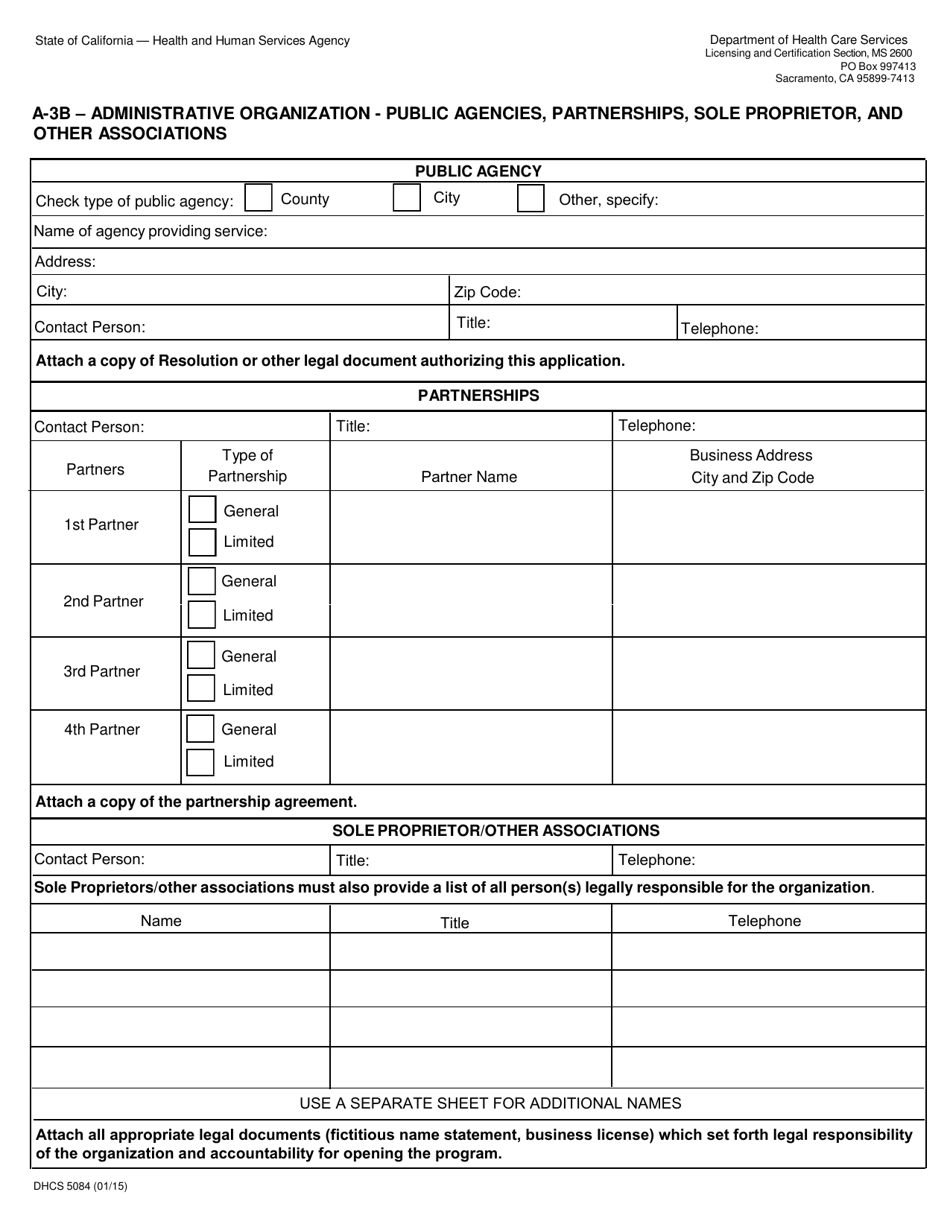

Form DHCS5084 Download Fillable PDF or Fill Online A3b

As soon as you embark on a solo side gig, freelance job, or a new business venture, you’re. This is the simplest and most common form used when starting a new business. Enter the net profit or loss from schedule c on schedule 1 (form 1040). Web what is an llc? Web information about schedule c (form 1040), profit or.

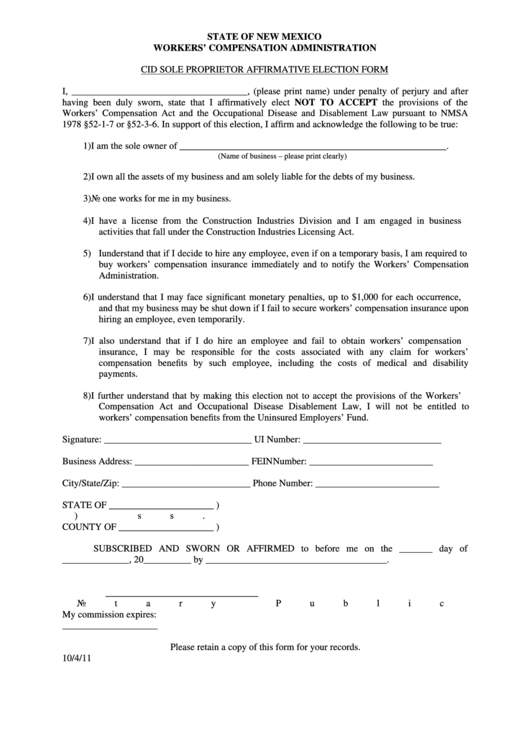

Cid Sole Proprietor Affirmative Election Form New Mexico Workers

All a sole proprietor business owner needs for a startup is: Create a free legal form in minutes. Web a sole proprietorship is an unincorporated business with one owner. As soon as you embark on a solo side gig, freelance job, or a new business venture, you’re. Use our simple online incorporation process & turn your great idea into a.

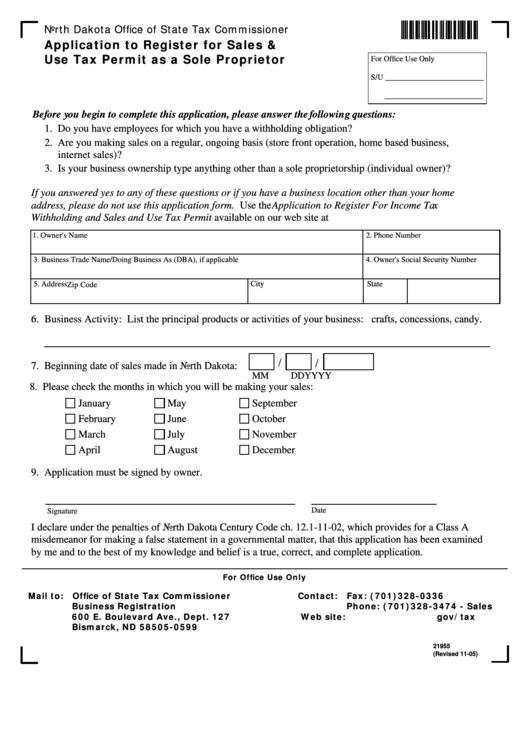

Fillable 21955 Application To Register For Sales & Use Tax Permit As

This is the simplest and most common form used when starting a new business. A business name and address. Web what tax forms to use as a sole proprietorship? An llc combines elements of a sole proprietorship, partnership, and. Web a sole proprietorship is easy to set up and is the least costly of the four entities.

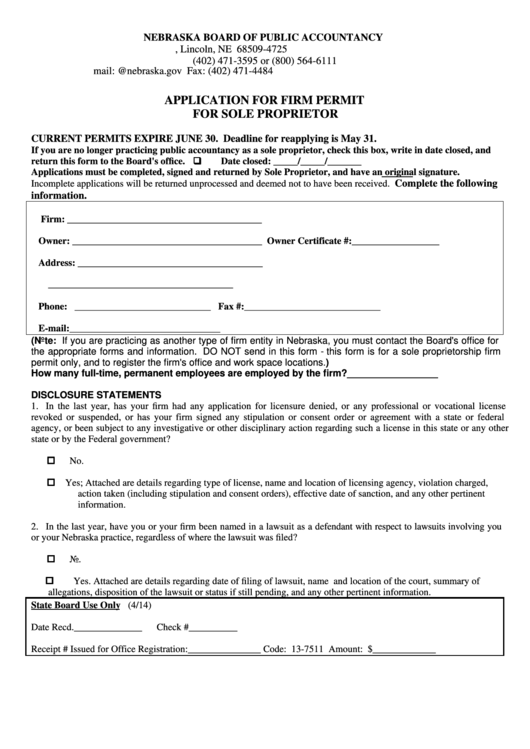

Application For Firm Permit For Sole Proprietor Form Nebraska Board

Enter the net profit or loss from schedule c on schedule 1 (form 1040). A business name and address. As soon as you embark on a solo side gig, freelance job, or a new business venture, you’re. This is the simplest and most common form used when starting a new business. Web what is an llc?

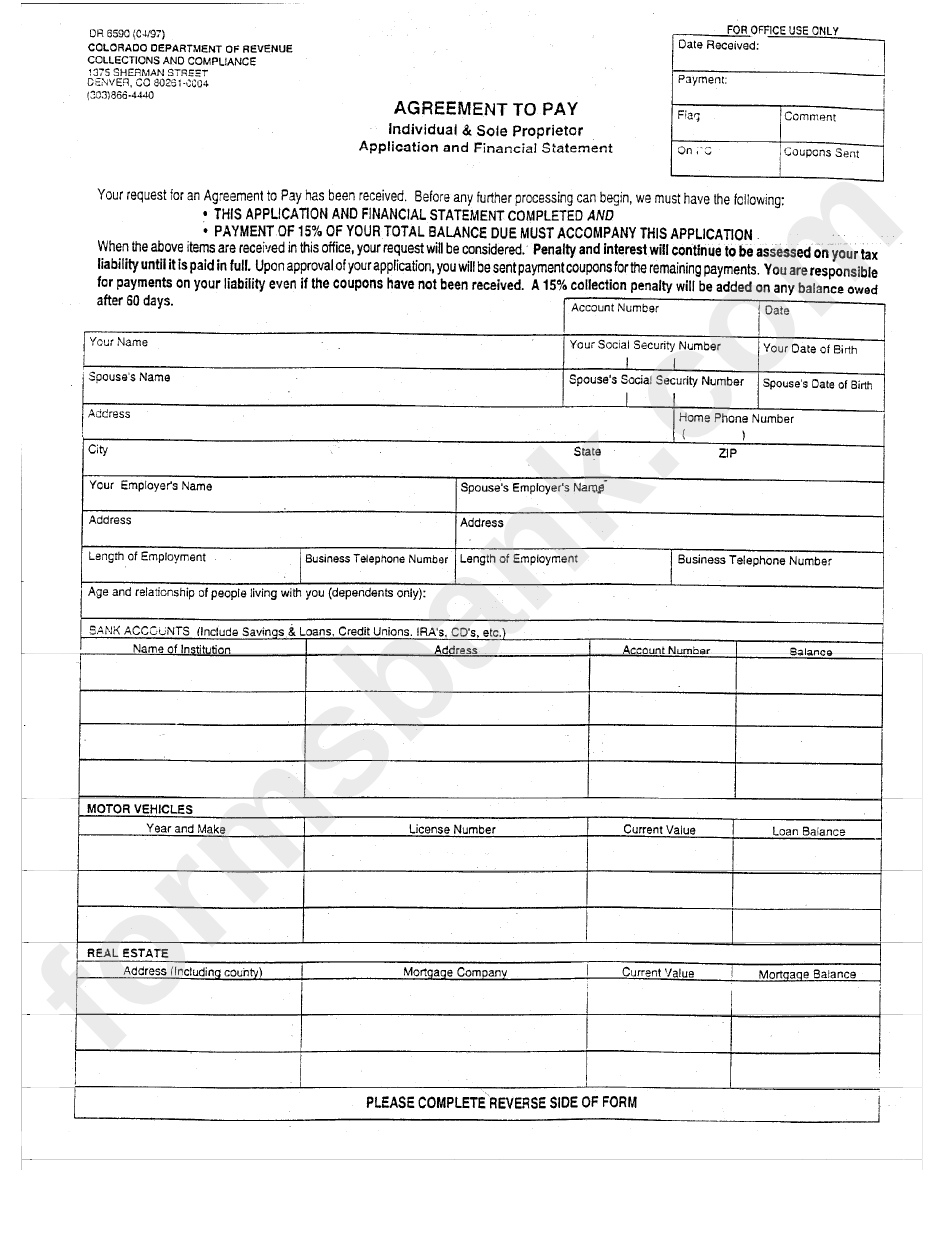

Form Dr 6590 Agreement To Pay Individual & Sole Proprietor

A business name and address. All a sole proprietor business owner needs for a startup is: Create a free legal form in minutes. Ad our simple online application can be completed in as little as 10 minutes. Coming up with a business name can be exciting―it is a representation of you and the.

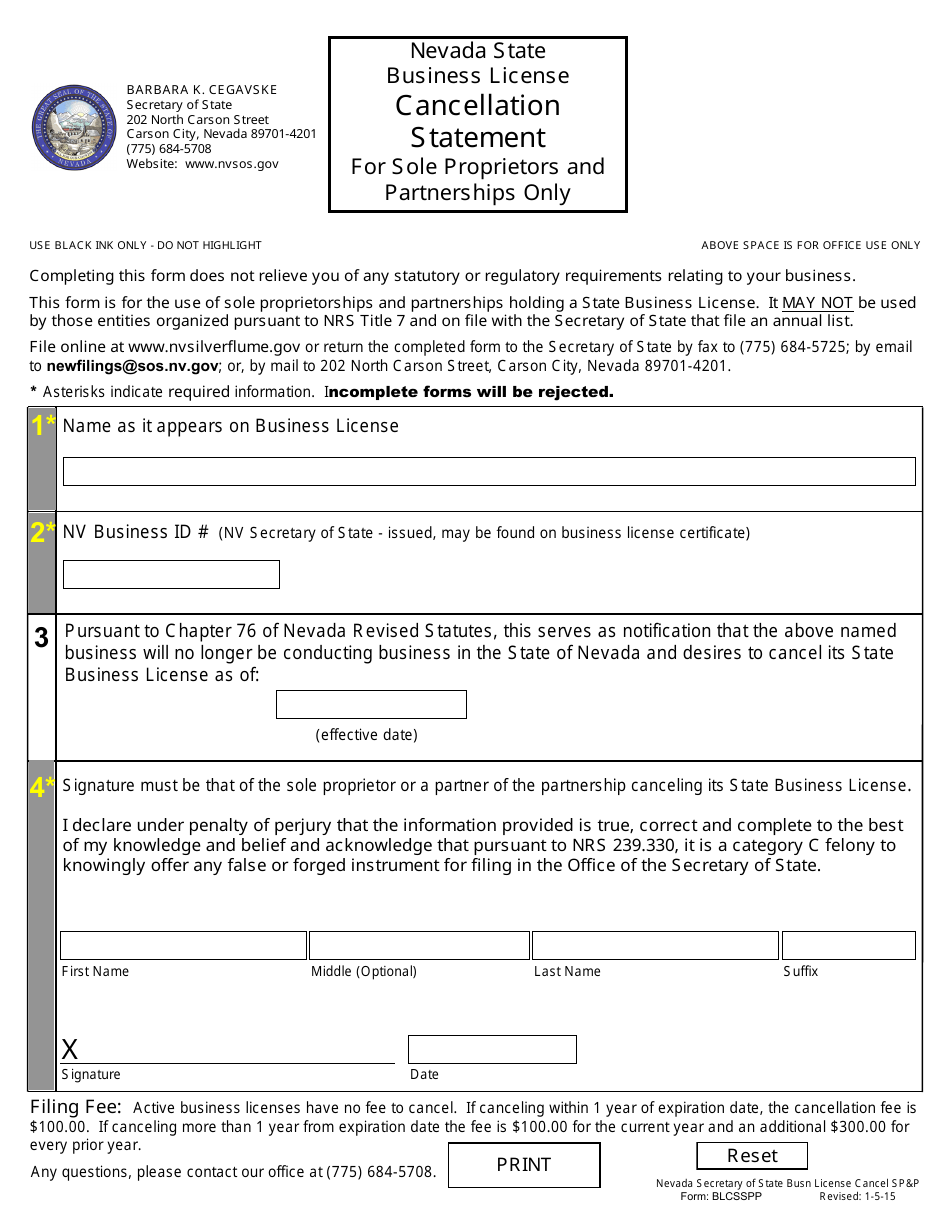

Form BLCSSPP Download Fillable PDF or Fill Online Sole Proprietor or

An llc combines elements of a sole proprietorship, partnership, and. The main form is schedule c, on irs form 1040. Web generally, businesses are created and operated in one of the following forms: Ad whether you have plans to crowdfund or go public, we'll help jumpstart your corporation. Web a sole proprietorship is an unincorporated business with one owner.

Sole Proprietorship Meaning,Features,Needs,Advantages,Disadvantages

Web a sole proprietorship is an unincorporated business with one owner. An llc combines elements of a sole proprietorship, partnership, and. An llc is a legally separate business entity that’s created under state law. Ad 1) get access to 500+ legal templates 2) print & download, 100% free until 2/15 Web a sole proprietorship is the default choice for anyone.

Web Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession Practiced As A Sole Proprietor;.

Web generally, businesses are created and operated in one of the following forms: A business name and address. An llc combines elements of a sole proprietorship, partnership, and. Web 7 steps to start a sole proprietorship step 1.

It Is The Simplest Form Of.

Web a sole proprietorship is easy to set up and is the least costly of the four entities. Web key highlights sole proprietorships are the simplest form of business structure and are easy and cheap to start due to few government rules. Ad developed by legal professionals. With this business structure, the individual and business are legally the same.

Web What Tax Forms To Use As A Sole Proprietorship?

Web in sole proprietorships, the owner files business taxes through personal tax returns. We will save you time and money by avoiding costly errors. An llc is a legally separate business entity that’s created under state law. Web a sole proprietorship is the easiest form of business to start.

Web A Sole Proprietor Is An Individual Who Owns An Unincorporated Business That Is Not Registered As A Corporation Or Limited Liability Company.

Pick your name if you want to use a name for your business that is not your personal name, you need to register for a “ doing business as ” (dba) name. Web what is an llc? The main form is schedule c, on irs form 1040. Decide on a business name.