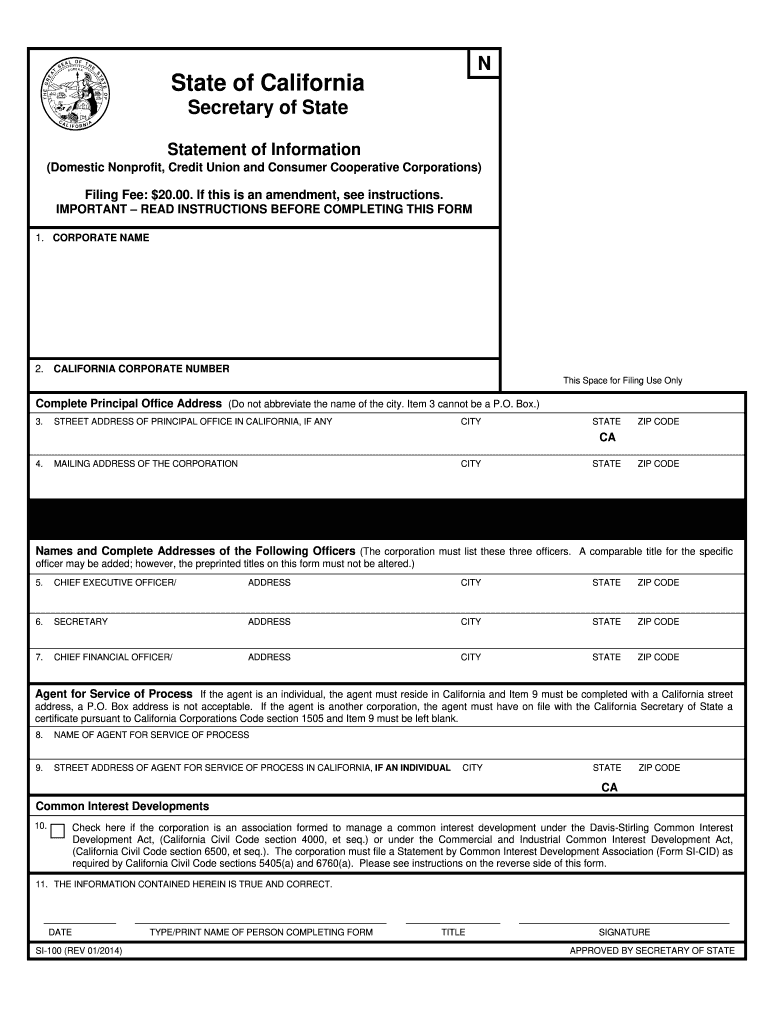

Si-100 California Form

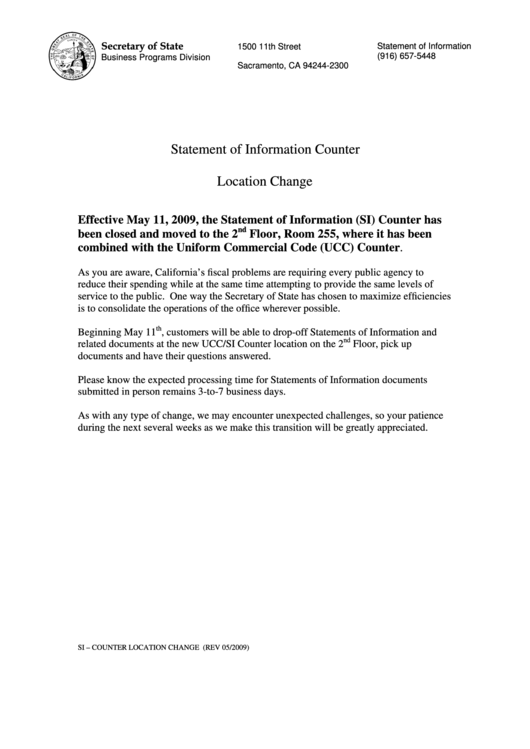

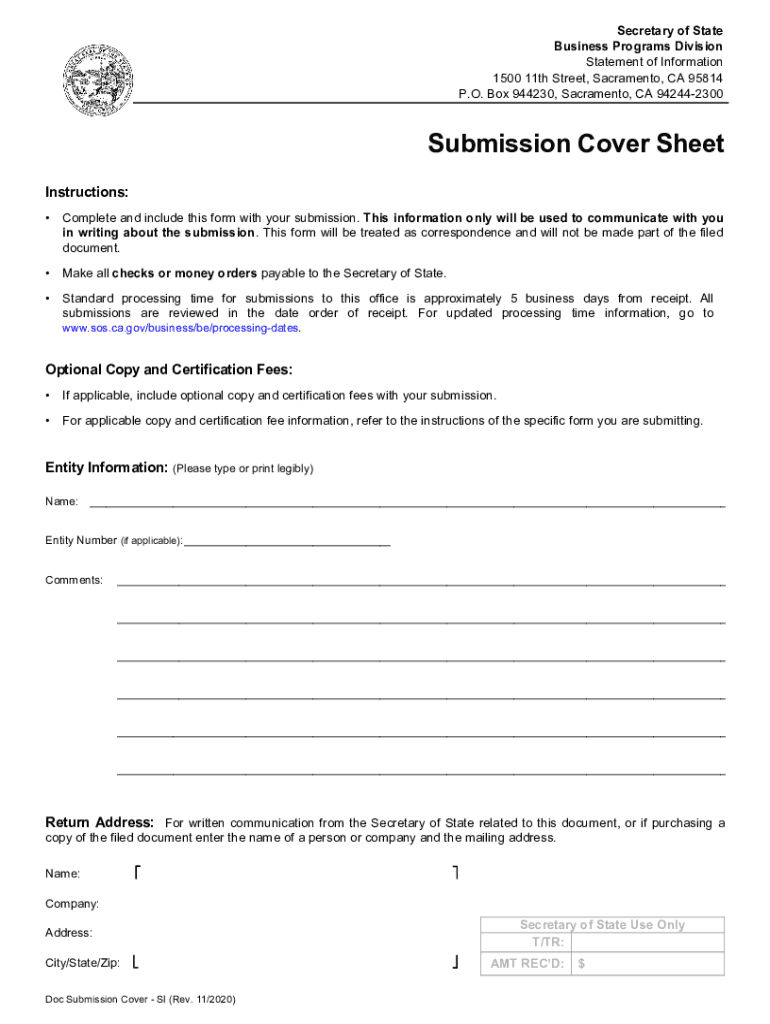

Si-100 California Form - For faster service, file online at. Filing • credit unions and cooperative corporations: Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Use fill to complete blank online. Web 1500 11th street, sacramento, ca 95814 p.o. Web form 100 is california’s tax return for corporations, banks, financial corporations, real estate mortgage investment conduits (remics), regulated investment companies (rics),. Due within 90 days of initial registration and every. Political organizations (exempt under r&tc section 23701r) with taxable income in. File the short version of form 3500a, submission of exemption. Instructions for completing the statement of (california) form.

Political organizations (exempt under r&tc section 23701r) with taxable income in. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Web 1500 11th street, sacramento, ca 95814 p.o. For faster service, file online at. The form can be only. Web what is a form si 100? Web form 100, california corporation franchise or income tax return, must be filed by: If the corporate name is not correct, please attach a statement. Weber, ph.d., california secretary of state 1500 11th street sacramento, california 95814 office: File the short version of form 3500a, submission of exemption.

Please do not alter the preprinted name. File the short version of form 3500a, submission of exemption. Weber, ph.d., california secretary of state 1500 11th street sacramento, california 95814 office: Web 1500 11th street, sacramento, ca 95814 p.o. Instructions for completing the statement of (california) form. Form si 100 is a document that contains the requirements of filing for an individual income tax, and has to be submitted by all citizens. The form can be only. Web form 100 is california’s tax return for corporations, banks, financial corporations, real estate mortgage investment conduits (remics), regulated investment companies (rics),. Use fill to complete blank online. Political organizations (exempt under r&tc section 23701r) with taxable income in.

Fillable Si100 Statement Of Information (Domestic Nonprofit, Credit

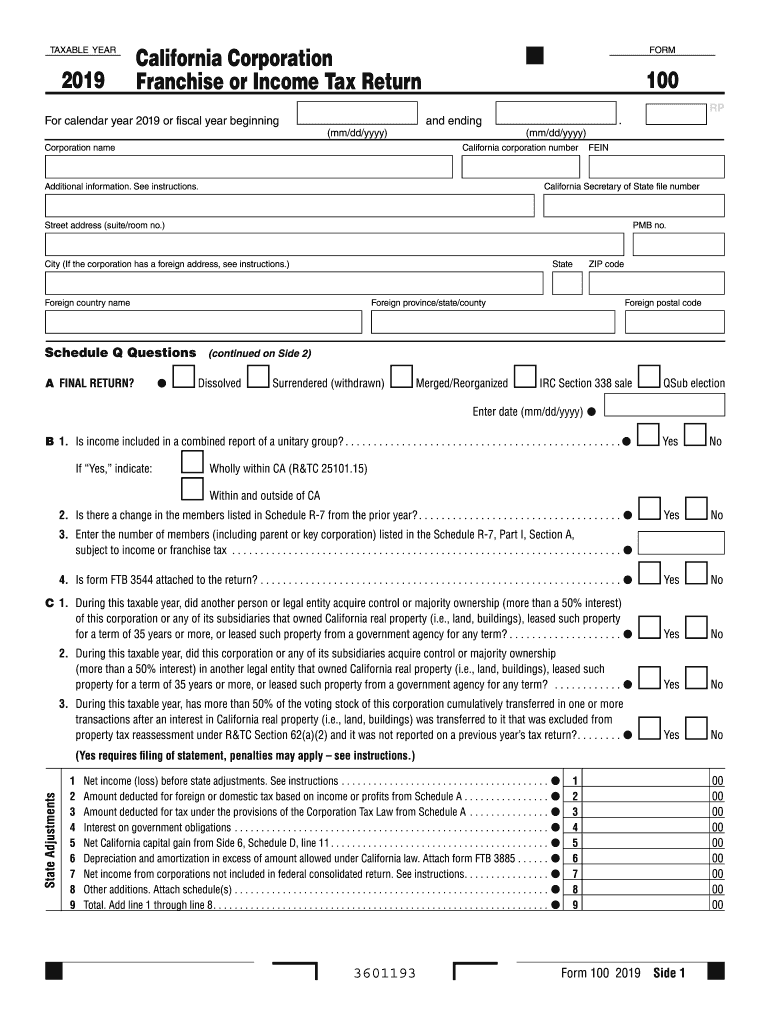

Weber, ph.d., california secretary of state 1500 11th street sacramento, california 95814 office: Web form 100 is california’s tax return for corporations, banks, financial corporations, real estate mortgage investment conduits (remics), regulated investment companies (rics),. If the corporate name is not correct, please attach a statement. Due within 90 days of initial registration and every. For faster service, file online.

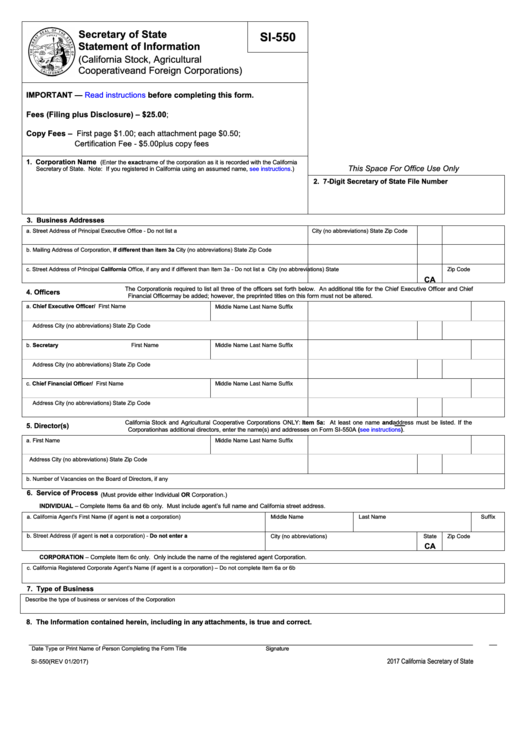

CA SI550 2017 Fill and Sign Printable Template Online US Legal Forms

Instructions for completing the statement of (california) form. File the short version of form 3500a, submission of exemption. Filing • credit unions and cooperative corporations: Use fill to complete blank online. Please do not alter the preprinted name.

Fillable Form Si550 Statement Of Information printable pdf download

Web what is a form si 100? Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Web form 100, california corporation franchise or income tax return, must be filed by: Form si 100 is a document that contains the requirements of filing for an individual income tax, and has to.

Fillable form 100 2015 Fill out & sign online DocHub

If the corporate name is not correct, please attach a statement. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Filing • credit unions and cooperative corporations: The form can be only. Use fill to complete blank online.

CA SI100 20202022 Fill and Sign Printable Template Online

Instructions for completing the statement of (california) form. For faster service, file online at. If the corporate name is not correct, please attach a statement. Filing • credit unions and cooperative corporations: Web form 100, california corporation franchise or income tax return, must be filed by:

Administration SKY Memorial Foundation

Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Form si 100 is a document that contains the requirements of filing for an individual income tax, and has to be submitted by all citizens. Weber, ph.d., california secretary of state 1500 11th street sacramento, california 95814 office: If the corporate.

2014 Form CA SI100 Fill Online, Printable, Fillable, Blank pdfFiller

Instructions for completing the statement of (california) form. Due within 90 days of initial registration and every. Web form 100 is california’s tax return for corporations, banks, financial corporations, real estate mortgage investment conduits (remics), regulated investment companies (rics),. Political organizations (exempt under r&tc section 23701r) with taxable income in. Please do not alter the preprinted name.

CA FL100 S 2016 Complete Legal Document Online US Legal Forms

Web form 100, california corporation franchise or income tax return, must be filed by: File the short version of form 3500a, submission of exemption. Form si 100 is a document that contains the requirements of filing for an individual income tax, and has to be submitted by all citizens. Due within 90 days of initial registration and every. Web form.

Si 100 Form Fill Out and Sign Printable PDF Template signNow

Use fill to complete blank online. Web what is a form si 100? Instructions for completing the statement of (california) form. Web form 100, california corporation franchise or income tax return, must be filed by: For faster service, file online at.

100 California WILSHIRE CAPITAL PARTNERS

For faster service, file online at. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer. Political organizations (exempt under r&tc section 23701r) with taxable income in. Form si 100 is a document that contains the requirements of filing for an individual income tax, and has to be submitted by all.

Form Si 100 Is A Document That Contains The Requirements Of Filing For An Individual Income Tax, And Has To Be Submitted By All Citizens.

File the short version of form 3500a, submission of exemption. Please do not alter the preprinted name. Political organizations (exempt under r&tc section 23701r) with taxable income in. Web what is a form si 100?

Web Form 100 Is California’s Tax Return For Corporations, Banks, Financial Corporations, Real Estate Mortgage Investment Conduits (Remics), Regulated Investment Companies (Rics),.

Use fill to complete blank online. For faster service, file online at. The form can be only. Web form 100, california corporation franchise or income tax return, must be filed by:

Instructions For Completing The Statement Of (California) Form.

Filing • credit unions and cooperative corporations: If the corporate name is not correct, please attach a statement. Due within 90 days of initial registration and every. Three military veterans testified in congress' highly anticipated hearing on ufos wednesday, including a former air force intelligence officer.

Weber, Ph.d., California Secretary Of State 1500 11Th Street Sacramento, California 95814 Office:

Web 1500 11th street, sacramento, ca 95814 p.o.