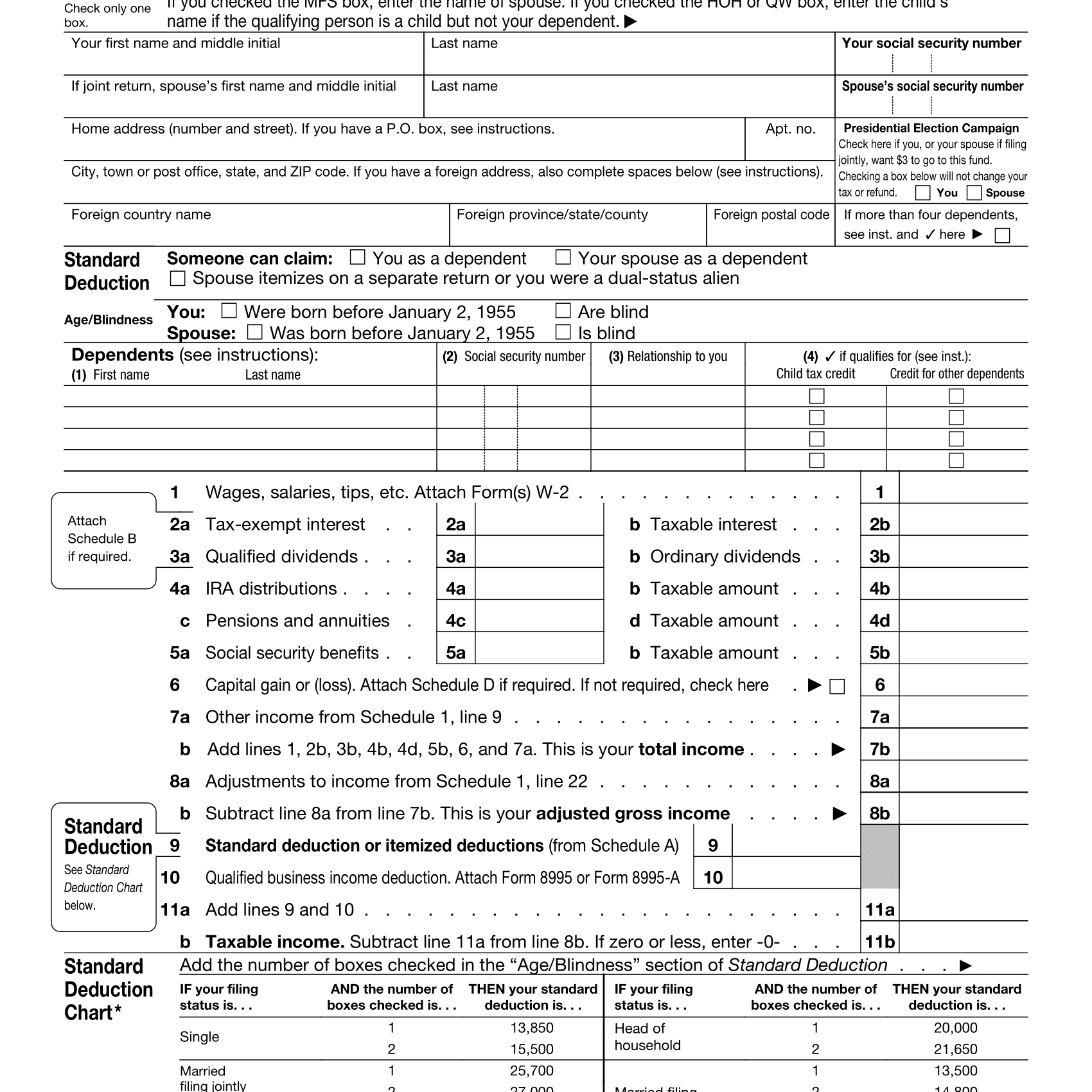

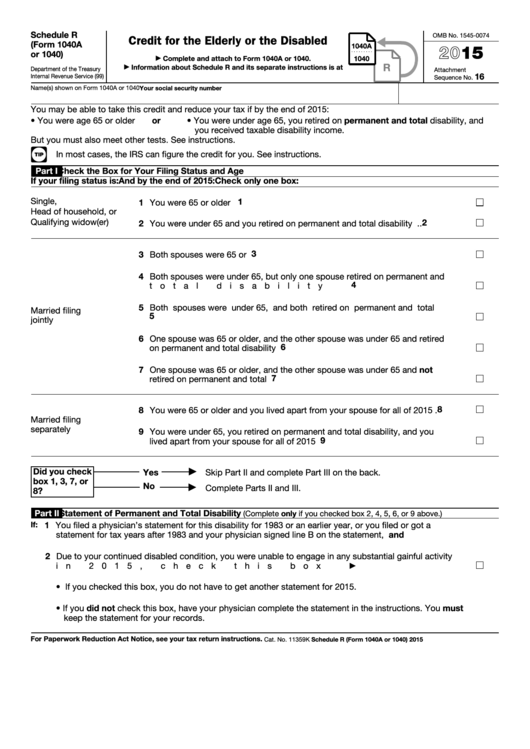

Schedule R Tax Form

Schedule R Tax Form - Agents approved by the irs under code sec. Tax form 1040 schedule r is a necessary form for filers of over 65 years of age or those with a disability. Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. January, february, march name as shown on form 941 2: Web popular forms & instructions; Web 1040 (schedule r) is a federal individual income tax form. Use fillable and printable blanks in pdf and word. Web information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and instructions on how to file. Web internal revenue service center. Tax credit for elderly or disabled guide to schedule r:

Enter on line 17 the total income from the trade or business after any adjustment for federal and state differences. Select the other information tab. Sign, send or download forms easily. Web schedule r of form 941. Web annually provide a schedule that includes the address of all owned residential rental units within the city. For more information, see schedule ca (540). For the latest information about developments related to schedule r (form 1040) and its instructions, such as legislation enacted after they were published, go to irs.gov/scheduler. Reached age 65 before the last day of the tax year, or was under age 65 at the end of the tax year and meet all three of these requirements: Schedule r attached to the combined tax return for all residential rental units for tax years beginning on or after january 1, 2018. Web r attach this schedule behind the california tax return and prior to the supporting schedules.

March 2023) allocation schedule for aggregate form 941 filers department of the treasury — internal revenue service omb no. *rental units regulated at or below 60% ami are exempt. View program fees by tax year. For more information, see schedule ca (540). The credit is primarily based upon your age, disability, and filing status. You can not file schedule r with the shortest irs form 1040ez. You may be able to take this credit and reduce your tax if by the end of 2022: Tax form 1040 schedule r is a necessary form for filers of over 65 years of age or those with a disability. Reached age 65 before the last day of the tax year, or was under age 65 at the end of the tax year and meet all three of these requirements: Use this address if you are not enclosing a payment use this address if you are enclosing a payment;

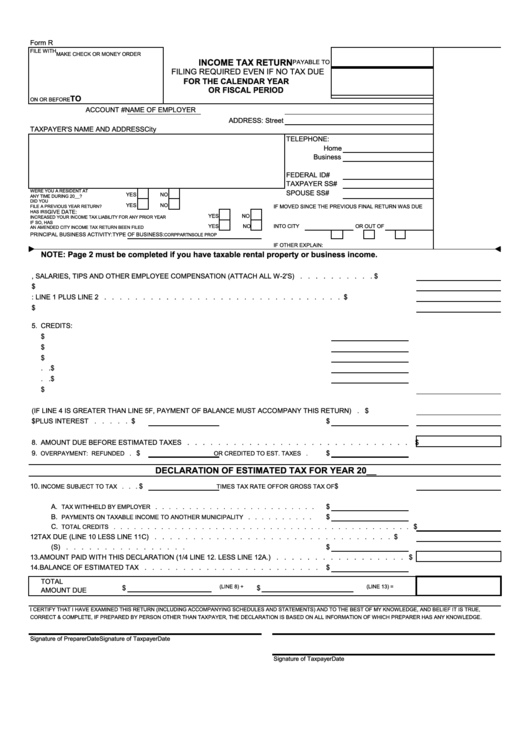

Form R Tax Return printable pdf download

Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. January, february, march name as shown on form 941 2: You may be able to take this credit and reduce your tax if by the end of 2022: Web r attach this schedule behind the california tax return and prior to.

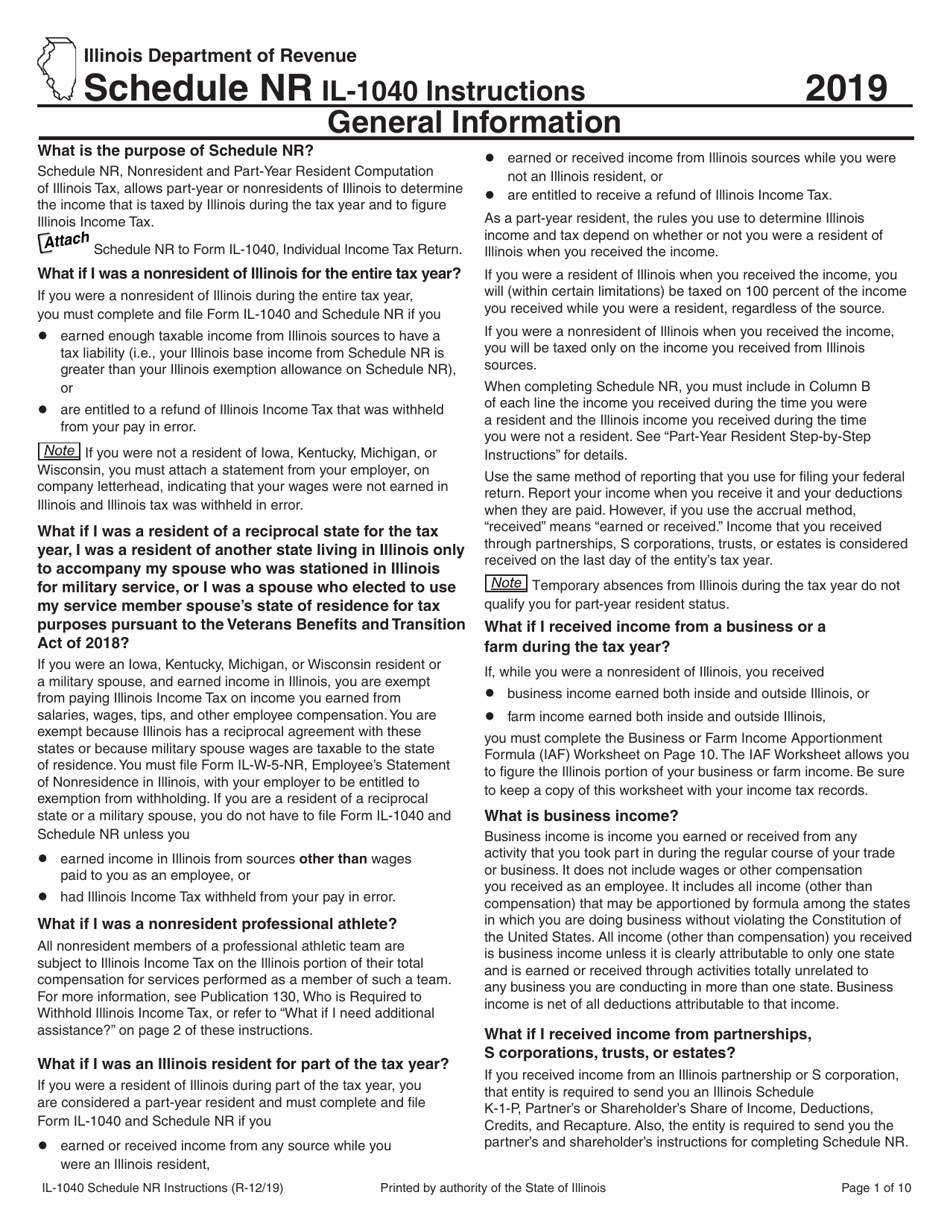

Download Instructions for Form IL1040 Schedule NR Nonresident and Part

Use schedule r (form 1040) to figure the credit for the elderly or the disabled. For the latest information about developments related to schedule r (form 1040) and its instructions, such as legislation enacted after they were published, go to irs.gov/scheduler. Copies of forms 1040, 1040a, and 1040ez are generally available for 7 years from filing before they are. Individual.

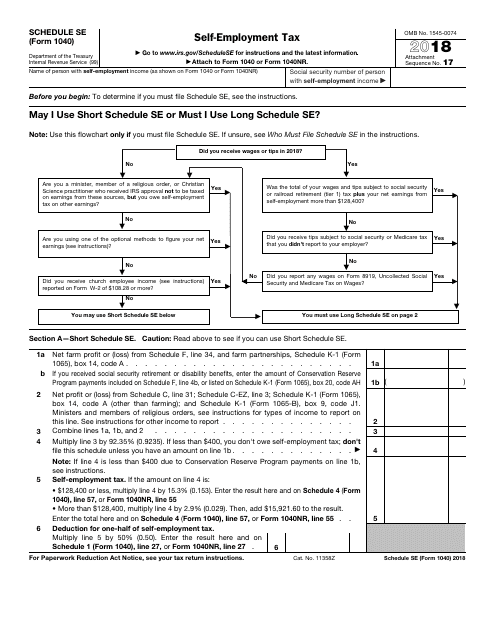

IRS Form 1040 Schedule SE Download Fillable PDF or Fill Online Self

Web popular forms & instructions; ( for a copy of form, instruction, or publication) address to mail form to irs: Reached age 65 before the last day of the tax year, or was under age 65 at the end of the tax year and meet all three of these requirements: Select the other information tab. Some common tax credits apply.

2022 Form 1040nr Ez Example Calendar Template 2022

Web 1040 (schedule r) is a federal individual income tax form. You can not file schedule r with the shortest irs form 1040ez. Web schedule r (form 1040) can help you figure the credit for the elderly or the disabled. Web turbotax / tax calculators & tips / tax tips guides & videos / disability / guide to schedule r:.

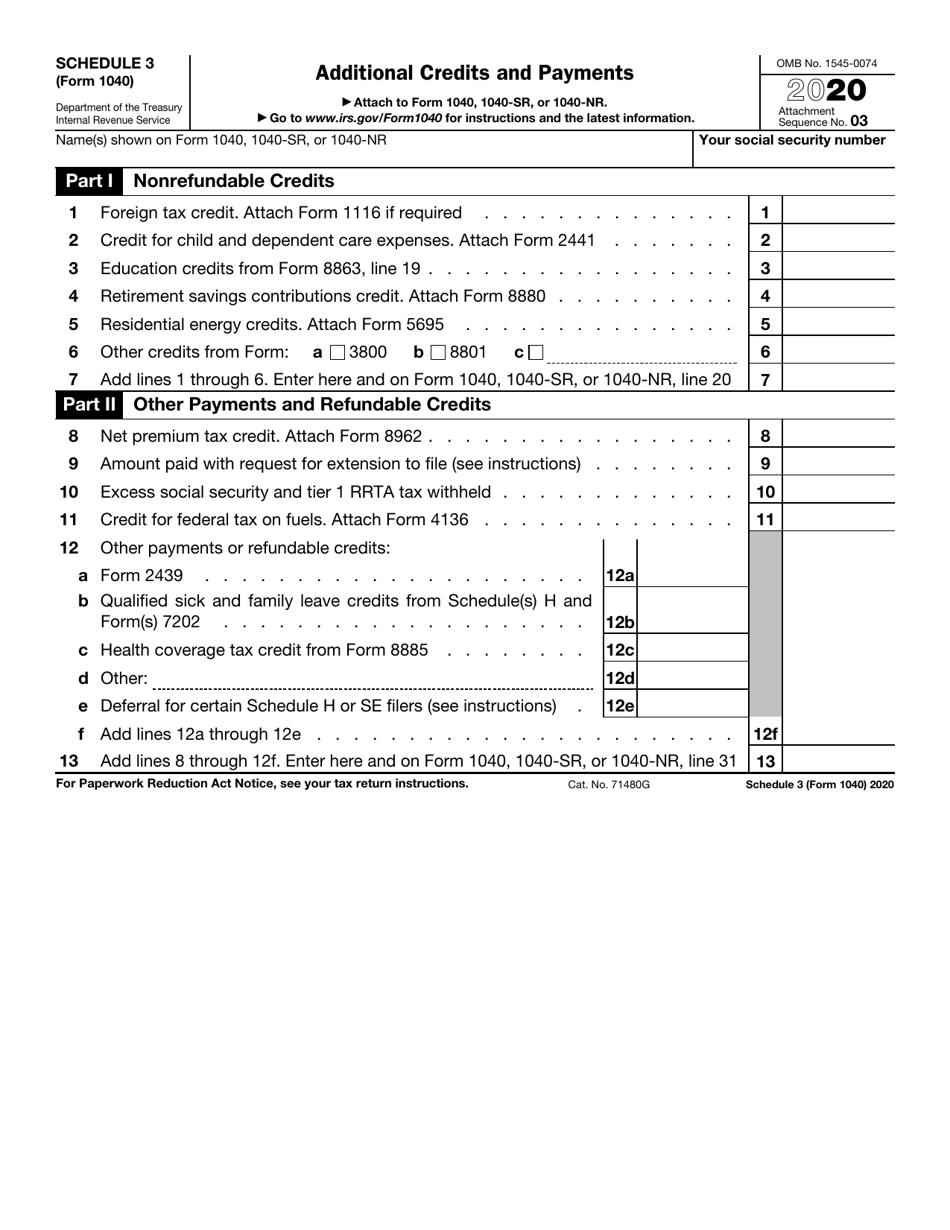

IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

( for a copy of form, instruction, or publication) address to mail form to irs: Web r attach this schedule behind the california tax return and prior to the supporting schedules. Web internal revenue service center. Web what is form 1040 schedule r? Web select irs schedule r (1040 form) credit for the elderly or the disabled for a needed.

2021 Standard Deduction For Over 65 Standard Deduction 2021

Web 1040 (schedule r) is a federal individual income tax form. Web internal revenue service center. • you were age 65 or older. Go to www.irs.gov/scheduler for instructions and the latest information. Page two of irs form 1040a and form 1040 both request that you attach schedule r to claim a credit for the elderly or the disabled.

Tax Season Is a Time to Keep Cool A Writer's Guide to Missing 1099

Web schedule r (form 1040) can help you figure the credit for the elderly or the disabled. Section 3504 agents who elect to file an aggregate form 940 on behalf of home health care service recipients and all cpeos must attach a schedule r (form 940) to their aggregate form 940. Form 1040, 1120, 941, etc. • you were age.

Fillable Schedule R Form 1040a Or 1040 Credit For The 1040 Form Printable

Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Use schedule r (form 1040) to figure the credit for the elderly or the disabled. Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Follow these steps to check schedule r, part i, boxes.

2020 Form IRS 990 Schedule R Fill Online, Printable, Fillable, Blank

Use this address if you are not enclosing a payment use this address if you are enclosing a payment; Follow these steps to check schedule r, part i, boxes 2, 4, 5, 6, or 9: • you were age 65 or older. Knowing what schedule r is will help you. Web turbotax / tax calculators & tips / tax tips.

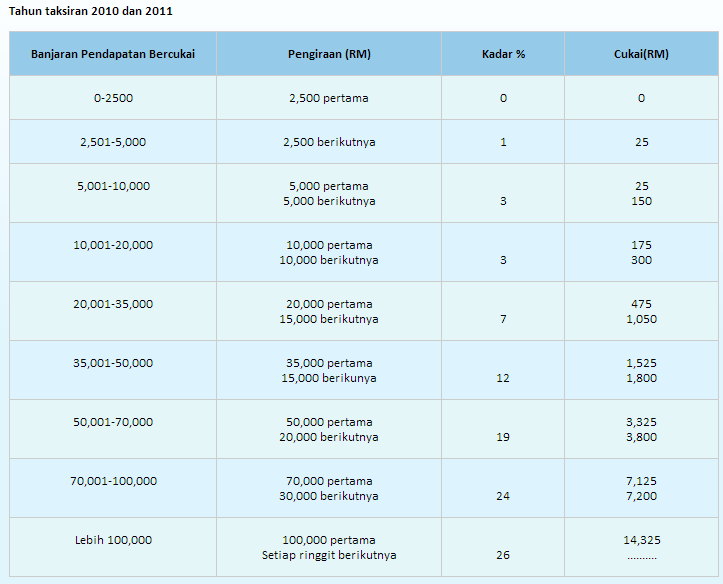

Invest Made Easy for Malaysian Only Private Retirement Scheme (PRS

Web information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and instructions on how to file. Knowing what schedule r is will help you. Select the other information tab. Web taxes what is tax form 1040 schedule r? Agents approved by the irs under code sec.

Web Schedule R (Form 1040) Can Help You Figure The Credit For The Elderly Or The Disabled.

For more information, see schedule ca (540). Follow these steps to check schedule r, part i, boxes 2, 4, 5, 6, or 9: Page two of irs form 1040a and form 1040 both request that you attach schedule r to claim a credit for the elderly or the disabled. Web annually provide a schedule that includes the address of all owned residential rental units within the city.

Web Schedule R Of Form 941.

Use schedule r (form 1040) to figure the credit for the elderly or the disabled. Web select irs schedule r (1040 form) credit for the elderly or the disabled for a needed year and complete it online. Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Web internal revenue service center.

Individual Tax Return Form 1040 Instructions;

Web schedule r (form 941): The credit is primarily based upon your age, disability, and filing status. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Sign, send or download forms easily.

Use Fillable And Printable Blanks In Pdf And Word.

Web popular forms & instructions; *rental units regulated at or below 60% ami are exempt. Web what is form 1040 schedule r? Schedule r (1040 form) irs schedule r (1040 form) credit for the elderly or the disabled.