Schedule L Tax Form

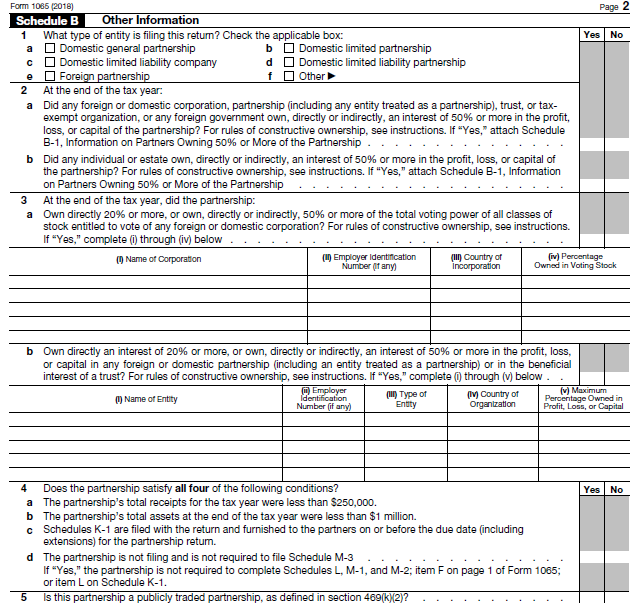

Schedule L Tax Form - Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Return of partnership income where the partnership reports to the irs their balance. ( for a copy of form, instruction, or publication) address to mail form to irs: Web get federal tax forms. Web popular forms & instructions; Answer there should be no amounts entered. Individual tax return form 1040 instructions; Select deductions from the left menu, then itemized deductions (sch a). Return of partnership income where the partnership reports to the irs their balance sheet as. Go to the input return tab.

Web popular forms & instructions; Individual tax return form 1040 instructions; Answer there should be no amounts entered. Web a form published by the irs allowing certain taxpayers to calculate the standard deduction for which they are eligible. Income tax return for an s corporation where the corporation reports to the irs their balance. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years. One uses schedule l if one suffered a loss from a federally. Web 1120 department of the treasury internal revenue service u.s. Web schedule l (form 1118) (december 2021) department of the treasury internal revenue service name of corporation for calendar year 20 foreign tax redeterminations , or. Return of partnership income where the partnership reports to the irs their balance.

Web popular forms & instructions; One uses schedule l if one suffered a loss from a federally. Select deductions from the left menu, then itemized deductions (sch a). Web of the tax from line 7 that is attributable to the first $49,500 of the purchase price of each new motor vehicle and enter it here (see instructions). Income tax return for an s corporation where the corporation reports to the irs their balance. Web get federal tax forms. Answer there should be no amounts entered. Get the current filing year’s forms, instructions, and publications for free from the irs. Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the. Return of partnership income where the partnership reports to the irs their balance.

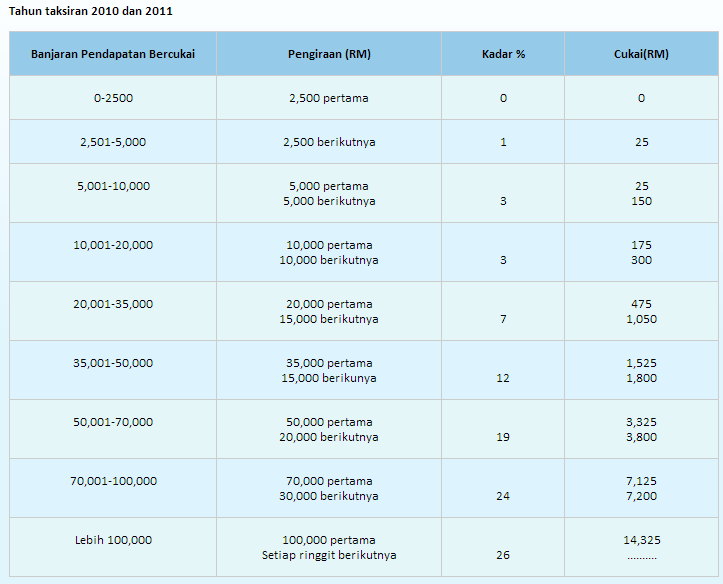

Invest Made Easy for Malaysian Only Private Retirement Scheme (PRS

Go to the input return tab. Web 1120 department of the treasury internal revenue service u.s. ( for a copy of form, instruction, or publication) address to mail form to irs: Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years. Answer there should be no.

1120 tax table

Get the current filing year’s forms, instructions, and publications for free from the irs. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years. Web get federal tax forms. Answer there should be no amounts entered. Web a form published by the irs allowing certain taxpayers.

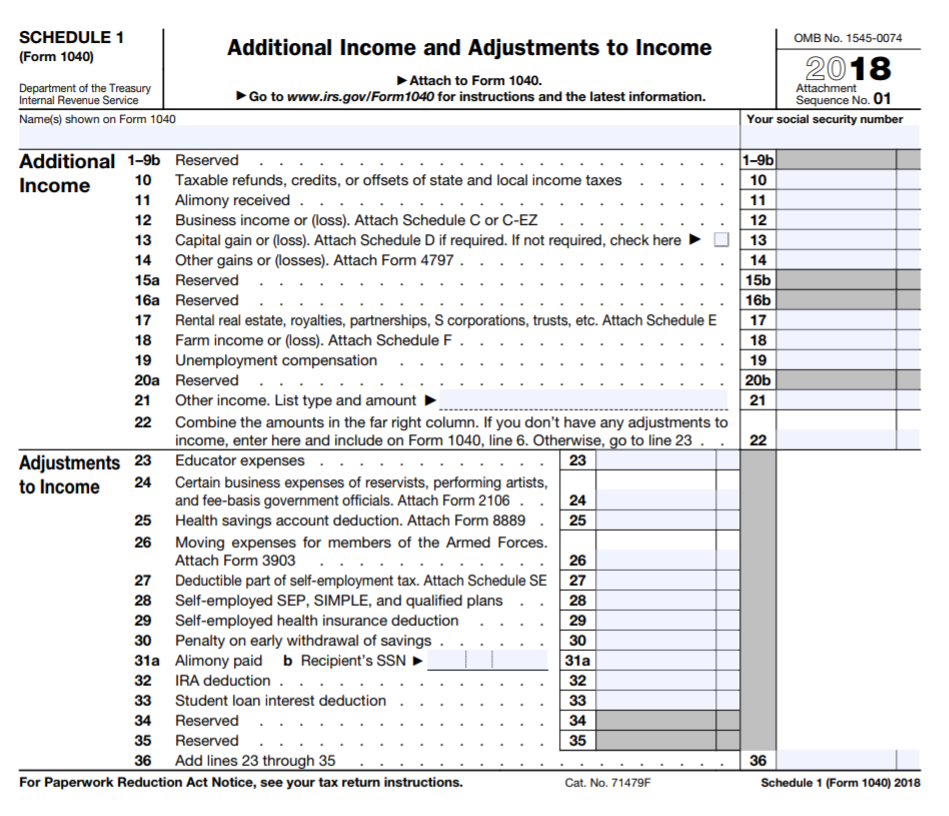

Understanding the New Tax Forms for Filing 2018 Taxes OTAcademy

Web of the tax from line 7 that is attributable to the first $49,500 of the purchase price of each new motor vehicle and enter it here (see instructions). Web to force the schedule a to print. Web schedule l (form 1118) (december 2021) department of the treasury internal revenue service name of corporation for calendar year 20 foreign tax.

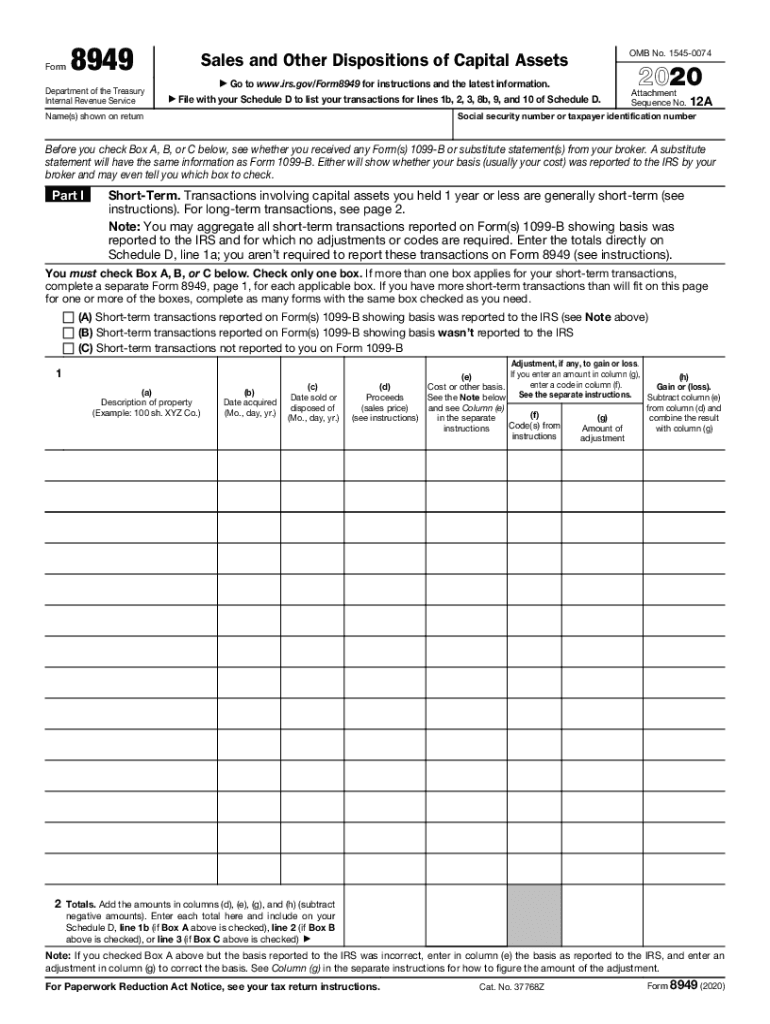

IRS 8949 20202021 Fill out Tax Template Online US Legal Forms

Web a form published by the irs allowing certain taxpayers to calculate the standard deduction for which they are eligible. Income tax return for an s corporation where the corporation reports to the irs their balance. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years..

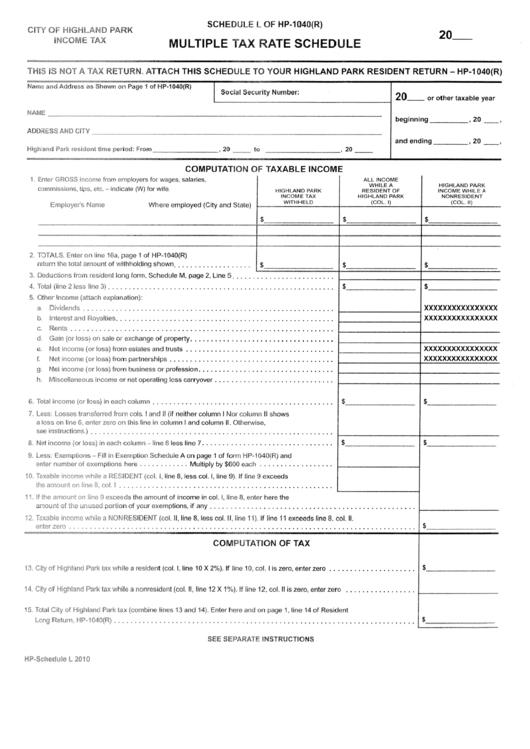

Schedule L Of Form Hp1040(R) Multiple Tax Rate Schedule 2010

Web popular forms & instructions; Web get federal tax forms. Select deductions from the left menu, then itemized deductions (sch a). Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. ( for a copy of form, instruction, or publication) address to mail form to irs:

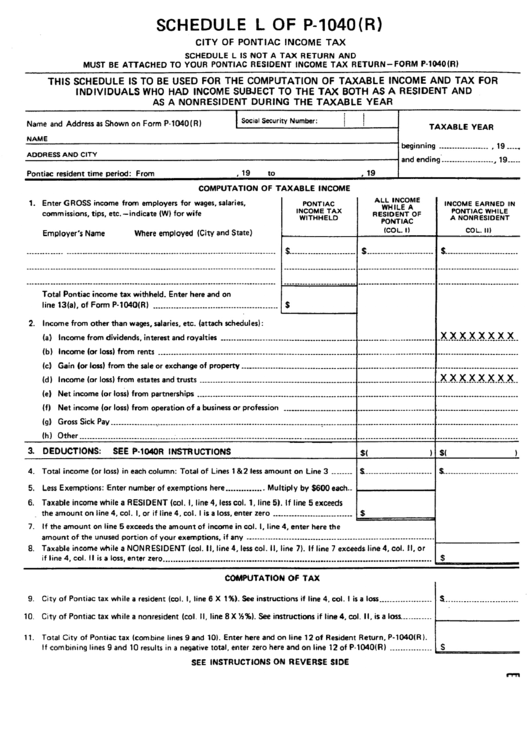

Schedule L Of Form P1040 (R) Computation Of Tax City Of Pontiac

Answer there should be no amounts entered. Return of partnership income where the partnership reports to the irs their balance sheet as. Web popular forms & instructions; Web get federal tax forms. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to.

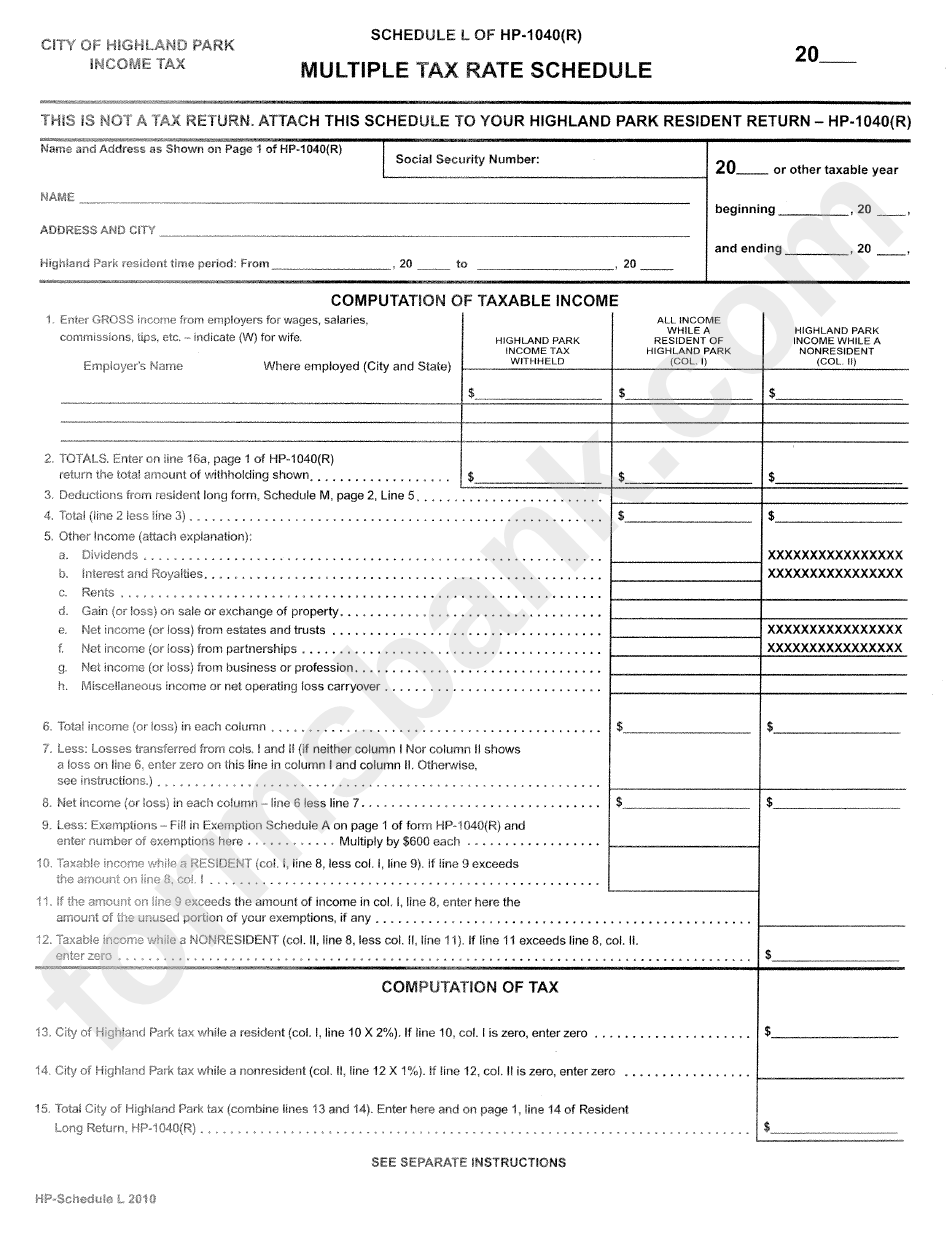

Schedule L Of Form Hp1040(R) Multiple Tax Rate Schedule 2010

Web popular forms & instructions; Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the. Web 1120 department of the treasury internal revenue service u.s. Web a form published by the irs allowing certain taxpayers to calculate the standard deduction.

Schedule L (Balance Sheets per Books) for Form 1120S [Video] in 2021

Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years. Individual tax return form 1040 instructions; Web popular forms & instructions; Web schedule l balance sheet is out.

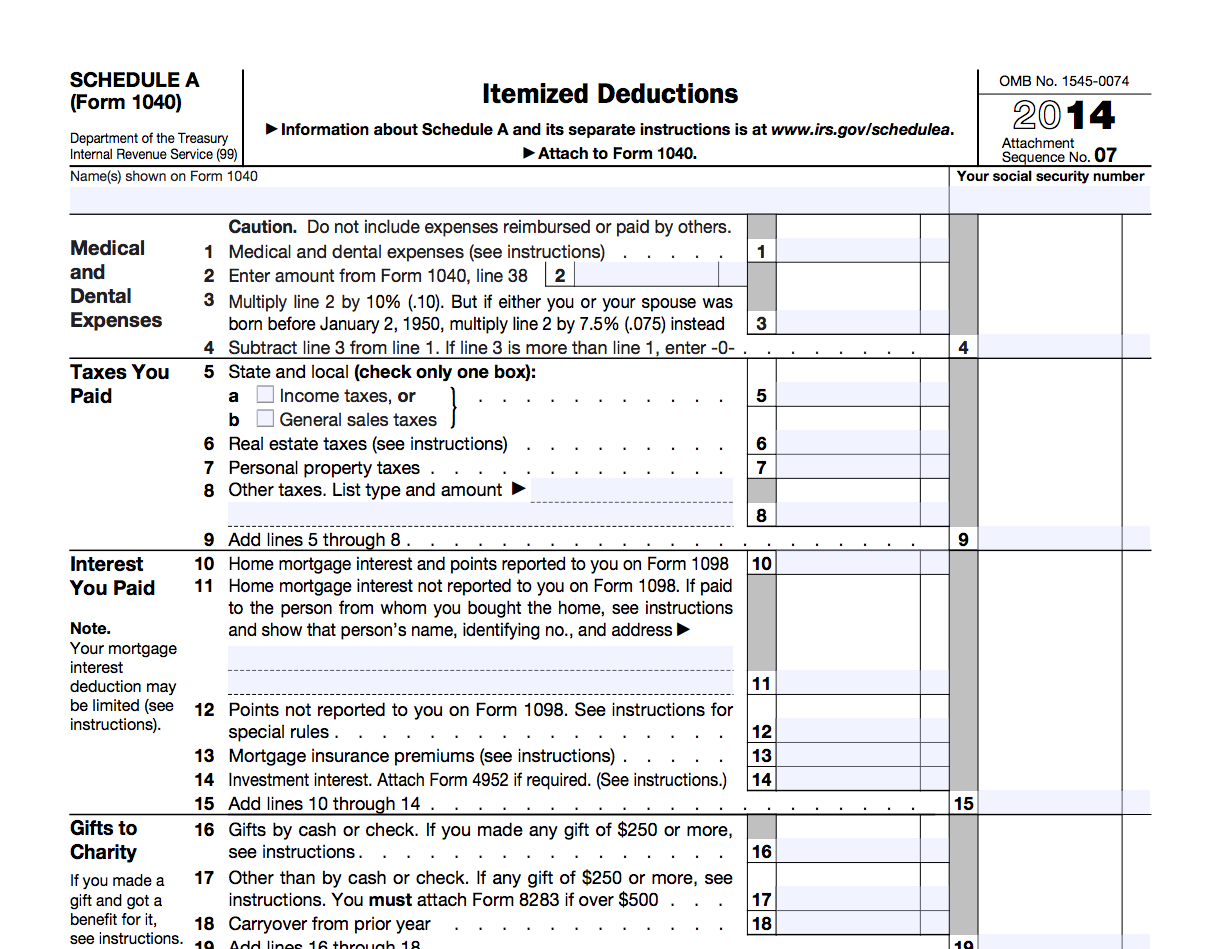

Itemized Tax Deductions McKinley & Hutchings CPA PLLC

Go to the input return tab. Return of partnership income where the partnership reports to the irs their balance sheet as. Web popular forms & instructions; Return of partnership income where the partnership reports to the irs their balance. Individual tax return form 1040 instructions;

Schedule L Form 7 Seven Doubts You Should Clarify About Schedule L Form

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Select deductions from the left menu, then itemized deductions (sch a). Go to the input return tab. Web schedule l (form 1118).

Schedule L (Form 1118) Is Used To Identify Foreign Tax Redeterminations That Occur In The Current Tax Year In Each Separate Category, The Years.

Return of partnership income department of the treasury internal revenue service go to www.irs.gov/form1065 for instructions and the latest information. Income tax return for an s corporation where the corporation reports to the irs their balance. Web a form published by the irs allowing certain taxpayers to calculate the standard deduction for which they are eligible. Web get federal tax forms.

Web To Force The Schedule A To Print.

Return of partnership income where the partnership reports to the irs their balance. Individual tax return form 1040 instructions; Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the.

Get The Current Filing Year’s Forms, Instructions, And Publications For Free From The Irs.

Web of the tax from line 7 that is attributable to the first $49,500 of the purchase price of each new motor vehicle and enter it here (see instructions). Web popular forms & instructions; Return of partnership income where the partnership reports to the irs their balance sheet as. Select deductions from the left menu, then itemized deductions (sch a).

Go To The Input Return Tab.

Web schedule l (form 1118) (december 2021) department of the treasury internal revenue service name of corporation for calendar year 20 foreign tax redeterminations , or. Web 1120 department of the treasury internal revenue service u.s. ( for a copy of form, instruction, or publication) address to mail form to irs: One uses schedule l if one suffered a loss from a federally.

![Schedule L (Balance Sheets per Books) for Form 1120S [Video] in 2021](https://i.pinimg.com/736x/42/4e/b6/424eb628114e7e5047130f8cced0e5f4.jpg)