Schedule J Tax Form

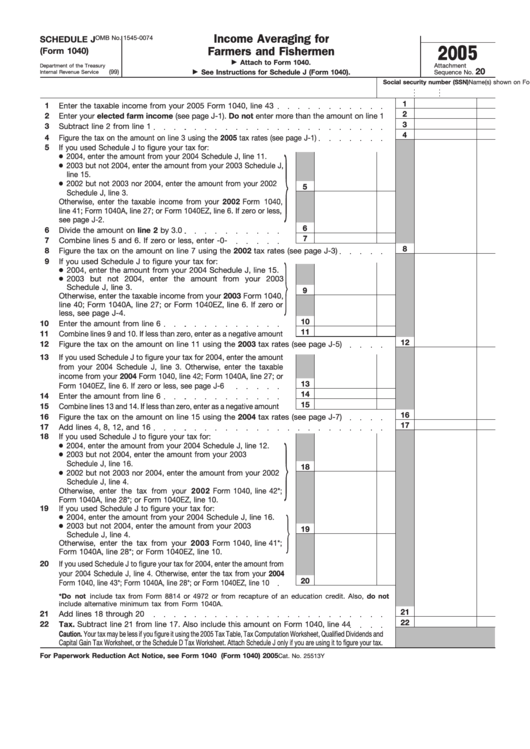

Schedule J Tax Form - Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. Table of contents when income averaging is beneficial farming businesses that qualify for income averaging fishing businesses and income averaging click to expand when income averaging is beneficial Web form 1040 schedule j allows farmers and fishermen to average an income against lower incomes from the previous three tax years. Farmers and fishermen may elect to do this when it will lower their. Go to www.irs.gov/schedulej for instructions and the latest information. There is a fee for each return requested. Name(s) shown on return omb no. J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. Your social security number note: Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing.

Farmers and fishermen may elect to do this when it will lower their. Web prior year tax returns you may need copies of your original or amended income tax returns for 2019, 2020, and 2021 to figure your tax on schedule j. Compute tax using the tax rate of 5% (.05). Table of contents when income averaging is beneficial farming businesses that qualify for income averaging fishing businesses and income averaging click to expand when income averaging is beneficial Web schedule j beneficiaries estate of: J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or business of farming or fishing. Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing. Your social security number note: Web form 1040 schedule j allows farmers and fishermen to average an income against lower incomes from the previous three tax years.

Your social security number note: This is tax before credits. J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing. Web schedule j beneficiaries estate of: Include the alternative tax on schedule j, part i, line 9e. Table of contents when income averaging is beneficial farming businesses that qualify for income averaging fishing businesses and income averaging click to expand when income averaging is beneficial Web prior year tax returns you may need copies of your original or amended income tax returns for 2019, 2020, and 2021 to figure your tax on schedule j. There is a fee for each return requested. Farmers and fishermen may elect to do this when it will lower their.

Form 8615 Tax for Certain Children Who Have Unearned (2015

Go to www.irs.gov/schedulej for instructions and the latest information. Your social security number note: See form 4506 for the fee amount. Farmers and fishermen may elect to do this when it will lower their. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees,.

Form 1118 (Schedule J) Adjustments to Separate Limitation

Farmers and fishermen may elect to do this when it will lower their. There is a fee for each return requested. Web schedule j is the internal revenue service form used when you want to average your fishing or farming income. See form 4506 for the fee amount. Go to www.irs.gov/schedulej for instructions and the latest information.

Fillable Schedule J (Form 1040) Averaging For Farmers And

This is tax before credits. J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. There is a fee for each return requested. See form 4506 for the fee amount. Table of contents when income averaging is beneficial farming businesses that qualify for income averaging fishing businesses and income averaging click to expand when income.

Solved Form 1120 (2018) Schedule J Tax Computation and

Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing. This is tax before credits. Web use form 8902, alternative.

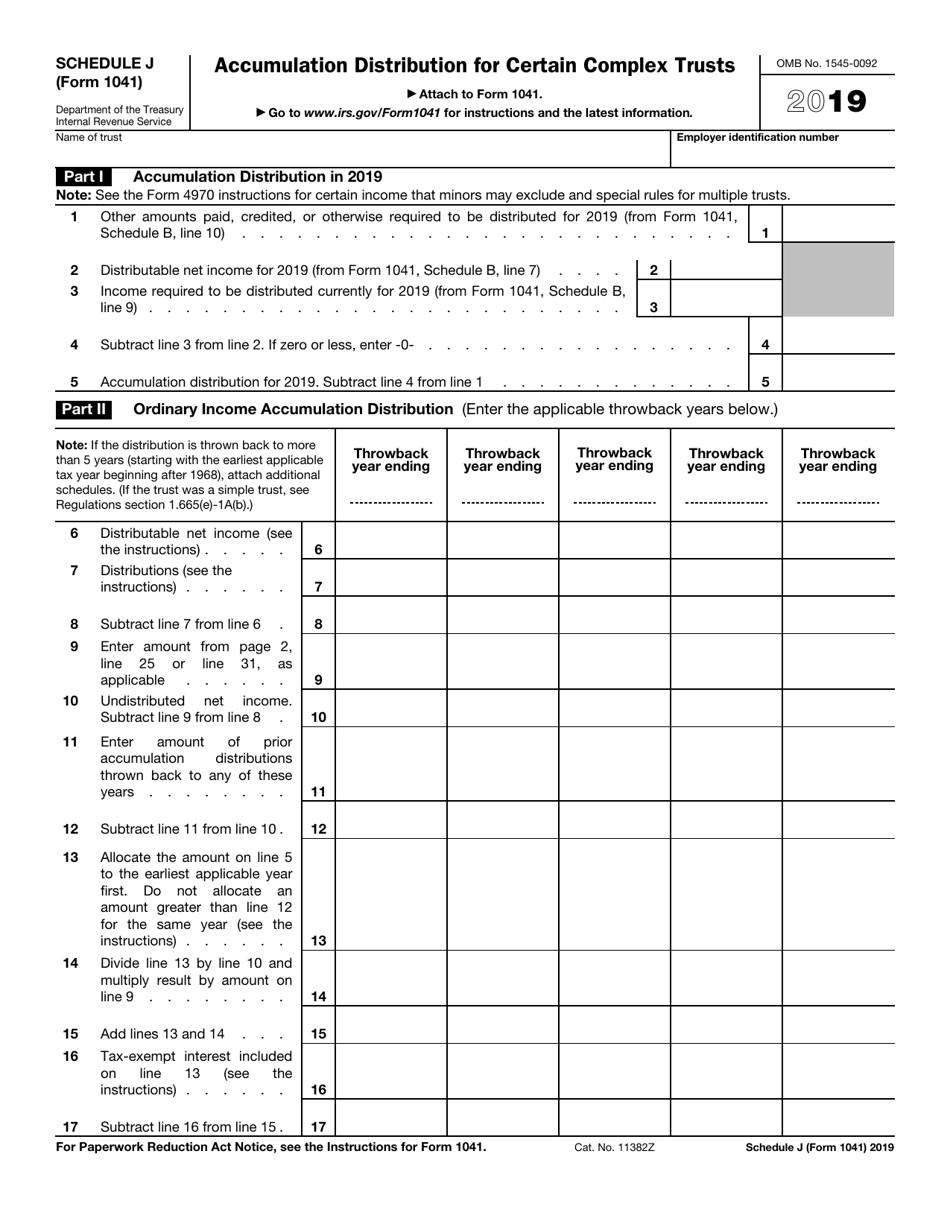

IRS Form 1041 Schedule J Download Fillable PDF or Fill Online

Web schedule j farm i k a 2022 k entucky f arm i ncome a veraging enclose with form 740 see federal instructions for schedule j. Your social security number note: Web schedule j is the internal revenue service form used when you want to average your fishing or farming income. Web use form 8902, alternative tax on qualifying shipping.

Form 1118 (Schedule J) Adjustments to Separate Limitation

Compute tax using the tax rate of 5% (.05). Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. There is a fee for each return requested. Web schedule j beneficiaries estate of: Web prior year tax returns you may need copies of your original or.

Form 1040 (Schedule J) Averaging Form for Farmers and

See form 4506 for the fee amount. Web use form 8902, alternative tax on qualifying shipping activities, to figure the tax. J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming.

Form 1041 (Schedule J) Accumulation Distribution for Certain Complex

Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain.

What Is Schedule J Averaging for Farmers and Fishermen

Web schedule j farm i k a 2022 k entucky f arm i ncome a veraging enclose with form 740 see federal instructions for schedule j. Web schedule j is the internal revenue service form used when you want to average your fishing or farming income. Web schedule j (form 990) is used by an organization that files form 990.

Form 1041 (Schedule J) Accumulation Distribution for Certain Complex

Farmers and fishermen may elect to do this when it will lower their. Web schedule j is the internal revenue service form used when you want to average your fishing or farming income. Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and.

Web Use Form 8902, Alternative Tax On Qualifying Shipping Activities, To Figure The Tax.

Compute tax using the tax rate of 5% (.05). Web schedule j is the internal revenue service form used when you want to average your fishing or farming income. Web schedule j farm i k a 2022 k entucky f arm i ncome a veraging enclose with form 740 see federal instructions for schedule j. Table of contents when income averaging is beneficial farming businesses that qualify for income averaging fishing businesses and income averaging click to expand when income averaging is beneficial

See Form 4506 For The Fee Amount.

J 2022 commonwealth of kentucky department of revenue enter name(s) as shown on tax return. Farmers and fishermen may elect to do this when it will lower their. Web form 1040 schedule j allows farmers and fishermen to average an income against lower incomes from the previous three tax years. Web prior year tax returns you may need copies of your original or amended income tax returns for 2019, 2020, and 2021 to figure your tax on schedule j.

There Is A Fee For Each Return Requested.

This is tax before credits. Web information about schedule j (form 1040), income averaging for farmers and fishermen, including recent updates, related forms and instructions on how to file. Your social security number note: Go to www.irs.gov/schedulej for instructions and the latest information.

Web Schedule J Beneficiaries Estate Of:

Web schedule j (form 990) is used by an organization that files form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization. Include the alternative tax on schedule j, part i, line 9e. Name(s) shown on return omb no. Use schedule j to figure your income tax by averaging all or part of your taxable income from your trade or business of farming or fishing.