Schedule H Form

Schedule H Form - Web schedule h, household employment taxes, is a form that household employers use to report household employment taxes to the irs. For instructions and the latest information. Go to www.irs.gov/form990 for instructions and the latest information. You pay at least one household employee cash. You must file an irs schedule h if one or more of the following is true: Web schedule h (form 990) department of the treasury internal revenue service hospitals complete if the organization answered “yes” on form 990, part iv, question 20a. Official bankruptcy forms are approved by the judicial conference and must be used under bankruptcy rule 9009. A schedule h breaks down household employee payment and tax information. Web for paperwork reduction act notice, see the instructions for form 5500. Department of the treasury internal revenue service.

Schedule h (form 5500) 2021 v. For instructions and the latest information. You pay at least one household employee cash. Web for paperwork reduction act notice, see the instructions for form 5500. December 2021) current earnings and profits. Go to www.irs.gov/form990 for instructions and the latest information. You must file an irs schedule h if one or more of the following is true: (a) beginning of year (b) end of year (1) If, besides your household employee, you have other employees for whom you report employment taxes on form 941, form 944, or form 943 and on form 940, you can include your taxes for your household employee on those forms. Web you can file schedule h (form 1040) by itself.

Web schedule h, household employment taxes, is a form that household employers use to report household employment taxes to the irs. Schedule h (form 5500) 2021 v. If, besides your household employee, you have other employees for whom you report employment taxes on form 941, form 944, or form 943 and on form 940, you can include your taxes for your household employee on those forms. Schedule h (form 1040) for figuring your household employment taxes. Schedule h (form 5500) 2021 page ; Web here is a list of forms that household employers need to complete. Web schedule h is used by household employers to report household employment taxes. For instructions and the latest information. Official bankruptcy forms are approved by the judicial conference and must be used under bankruptcy rule 9009. Department of the treasury internal revenue service.

Schedule H

A schedule h breaks down household employee payment and tax information. Schedule h (form 5500) 2021 v. See the schedule h (form 1040) instructions for details. Web for paperwork reduction act notice, see the instructions for form 5500. You pay at least one household employee cash.

Form 5500 Instructions 5 Steps to Filing Correctly

Web for paperwork reduction act notice, see the instructions for form 5500. Schedule h (form 1040) for figuring your household employment taxes. Schedule h (form 5500) 2021 page ; Go to www.irs.gov/form990 for instructions and the latest information. Web when schedule h must be filed.

Form 990 (Schedule H) Hospitals (2014) Free Download

Official bankruptcy forms are approved by the judicial conference and must be used under bankruptcy rule 9009. Schedule h (form 5500) 2021 v. Schedule h (form 1040) for figuring your household employment taxes. Web for paperwork reduction act notice, see the instructions for form 5500. Go to www.irs.gov/form990 for instructions and the latest information.

Form 990 (Schedule H) Hospitals (2014) Free Download

Web when schedule h must be filed. If, besides your household employee, you have other employees for whom you report employment taxes on form 941, form 944, or form 943 and on form 940, you can include your taxes for your household employee on those forms. For instructions and the latest information. Schedule h (form 5500) 2021 page ; For.

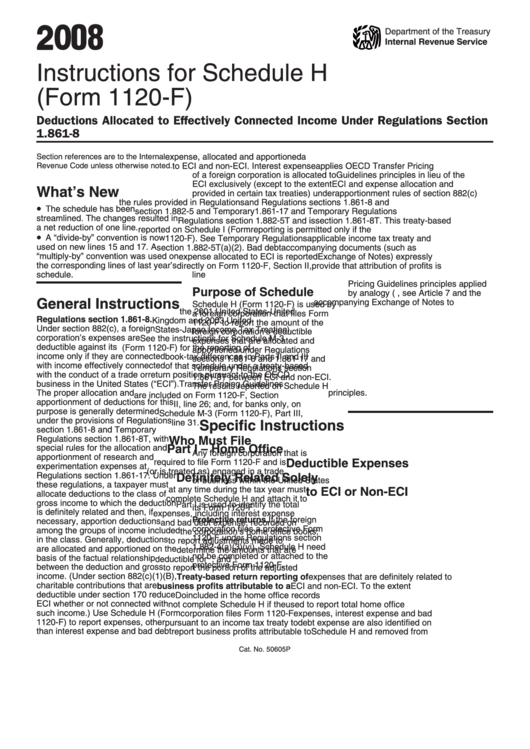

Instructions For Schedule H (Form 1120F) 2008 printable pdf download

Go to www.irs.gov/form990 for instructions and the latest information. If, besides your household employee, you have other employees for whom you report employment taxes on form 941, form 944, or form 943 and on form 940, you can include your taxes for your household employee on those forms. Your codebtors (individuals) download form (pdf, 90.4 kb) form number: For instructions.

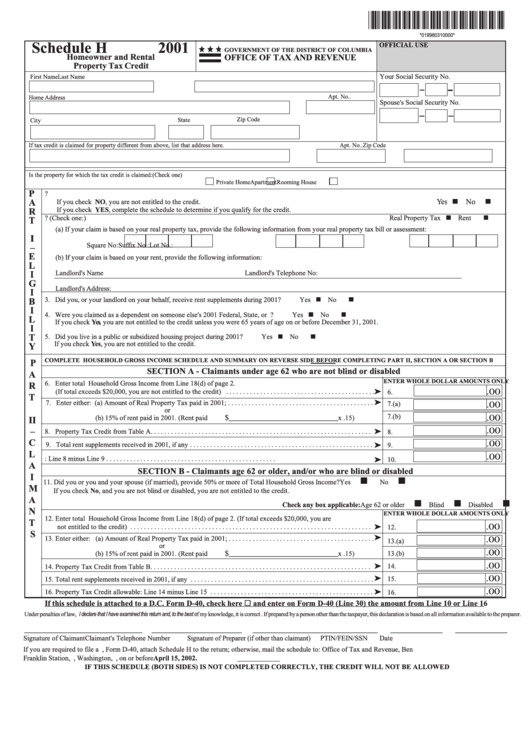

Schedule H Form Homeowner And Rental Property Tax Credit 2001

Department of the treasury internal revenue service. You pay at least one household employee cash. See the schedule h (form 1040) instructions for details. Use schedule h (form 1040) to report household employment taxes if you paid cash wages to a household employee and the wages were subject to social security, medicare, or futa taxes, or if you withheld federal.

DoL 5500 Schedule H 2012 Fill and Sign Printable Template Online

Schedule h (form 5500) 2021 page ; This is an official bankruptcy form. December 2021) current earnings and profits. Official bankruptcy forms are approved by the judicial conference and must be used under bankruptcy rule 9009. Web for paperwork reduction act notice, see the instructions for form 5500.

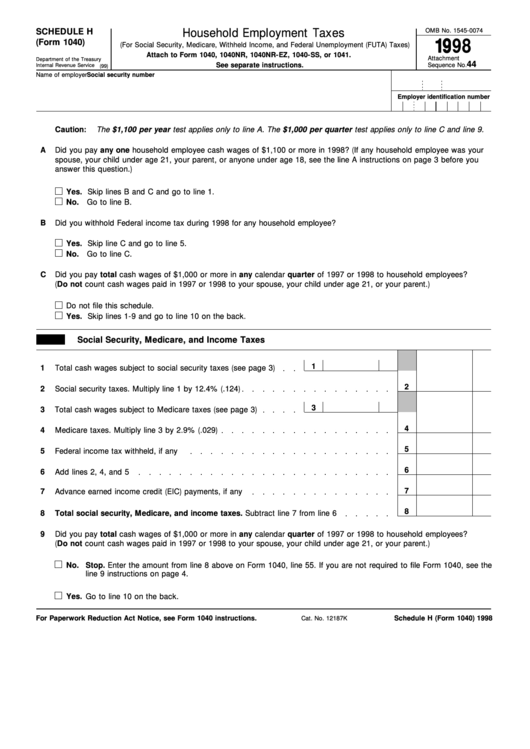

Fillable Schedule H (Form 1040) Household Employment Taxes 1998

Web schedule h (form 5471) (rev. You must file an irs schedule h if one or more of the following is true: Your codebtors (individuals) download form (pdf, 90.4 kb) form number: (a) beginning of year (b) end of year (1) Schedule h (form 1040) for figuring your household employment taxes.

Fillable Schedule H (Form 1120) Section 280h Limitations For A

See the schedule h (form 1040) instructions for details. Web schedule h is used by household employers to report household employment taxes. For instructions and the latest information. Web schedule h (form 5471) (rev. Web schedule h, household employment taxes, is a form that household employers use to report household employment taxes to the irs.

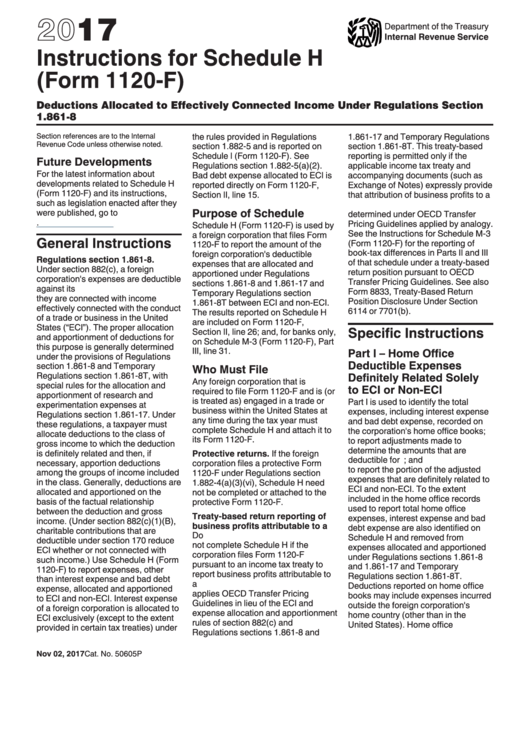

Instructions For Schedule H (Form 1120F) 2017 printable pdf download

Schedule h (form 1040) for figuring your household employment taxes. For instructions and the latest information. Use schedule h (form 1040) to report household employment taxes if you paid cash wages to a household employee and the wages were subject to social security, medicare, or futa taxes, or if you withheld federal income tax. Go to www.irs.gov/form990 for instructions and.

This Is An Official Bankruptcy Form.

A schedule h breaks down household employee payment and tax information. Schedule h (form 1040) for figuring your household employment taxes. Use schedule h (form 1040) to report household employment taxes if you paid cash wages to a household employee and the wages were subject to social security, medicare, or futa taxes, or if you withheld federal income tax. (a) beginning of year (b) end of year (1)

Go To Www.irs.gov/Form990 For Instructions And The Latest Information.

Schedule h (form 5500) 2021 v. Department of the treasury internal revenue service. Web when schedule h must be filed. December 2021) current earnings and profits.

You Pay At Least One Household Employee Cash.

For instructions and the latest information. Web schedule h (form 5471) (rev. For instructions and the latest information. Web here is a list of forms that household employers need to complete.

Official Bankruptcy Forms Are Approved By The Judicial Conference And Must Be Used Under Bankruptcy Rule 9009.

Your codebtors (individuals) download form (pdf, 90.4 kb) form number: Web you can file schedule h (form 1040) by itself. You must file an irs schedule h if one or more of the following is true: Web schedule h, household employment taxes, is a form that household employers use to report household employment taxes to the irs.