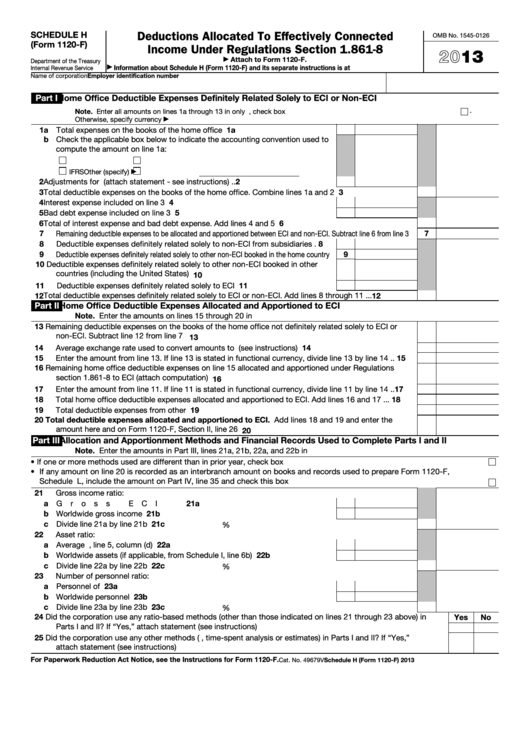

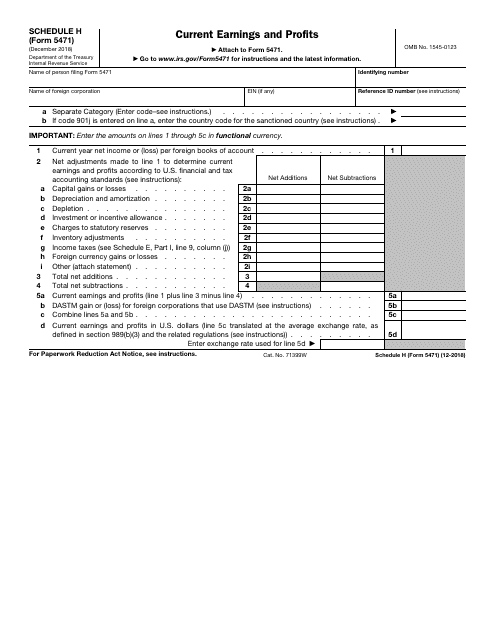

Schedule H Form 5471

Schedule H Form 5471 - As a result of this change: Name of person filing form 5471. Name of person filing form 5471. Who must complete schedule h. Current earnings and profits created date: Schedule h is no longer completed separately for each applicable category of income. Web changes to separate schedule h (form 5471). New line 5c(iii)(d) was added so that a taxpayer can enter requested information for four sanctioned countries with respect to the section 901(j) category. Web changes to separate schedule h (form 5471). Anyone preparing a form 5471 knows that the.

Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Reference id number of foreign corporation. The purpose of this new line is to. A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. This article is designed to supplement the irs instructions to the form 5471. Current earnings and profits created date: Web schedule h (form 5471) (rev. Web changes to separate schedule h (form 5471). Name of person filing form 5471.

Name of person filing form 5471 identifying number name of foreign corporationein (if any). Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). This article is designed to supplement the irs instructions to the form 5471. December 2021) current earnings and profits department of the treasury internal revenue service attach to form 5471. Current earnings and profits created date: Web changes to separate schedule h (form 5471). Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. Schedule h (form 5471) (rev. • lines a and b at the top of the schedule (pertaining to identifying the category of income for which the schedule was being Schedule h is no longer completed separately for each applicable category of income.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Who must complete schedule h. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). This article is designed to supplement the irs instructions to the form 5471. Schedule h (form 5471) (december 2018) author: Recently, schedule h was revised.

Fillable Schedule H (Form 1120F) Deductions Allocated To Effectively

Name of person filing form 5471. Who must complete schedule h. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Name of person filing form 5471. Web form 5471, officially called the information return of u.s.

IRS Form 5471 Schedule H Download Fillable PDF or Fill Online Current

Reference id number of foreign corporation. The purpose of this new line is to. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. • lines a and b at the top of the schedule (pertaining to identifying the category of income for which the schedule was being Schedule h.

Guide to Form 5471 Schedule E and Schedule H SF Tax Counsel

Schedule h (form 5471) (december 2018) author: Reference id number of foreign corporation. Recently, schedule h was revised. Anyone preparing a form 5471 knows that the. December 2021) current earnings and profits department of the treasury internal revenue service attach to form 5471.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Reference id number of foreign corporation. Schedule h is now completed once, for all categories of income. Web changes to separate schedule h (form 5471). Anyone preparing a form 5471 knows that the. A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for.

Form 5471, Pages 24 YouTube

Recently, schedule h was revised. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Web changes to separate schedule h (form 5471). Name of person filing form 5471. Line 2g has been modified to update the references to schedule e, due to changes made.

IRS Form 5471 Schedule H SF Tax Counsel

Reference id number of foreign corporation. Web schedule h (form 5471) (rev. A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for. Name of person filing form 5471 identifying number name of foreign corporationein (if any). As a result of this change:

The IRS Makes Significant Changes to Schedule H of Form 5471 SF Tax

Schedule h (form 5471) (december 2018) author: Name of person filing form 5471. Recently, schedule h was revised. Web changes to separate schedule h (form 5471). New line 5c(iii)(d) was added so that a taxpayer can enter requested information for four sanctioned countries with respect to the section 901(j) category.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

• lines a and b at the top of the schedule (pertaining to identifying the category of income for which the schedule was being Schedule h (form 5471) (december 2018) author: Web form 5471, officially called the information return of u.s. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes.

IRS Form 5471 Schedule E and Schedule H SF Tax Counsel

Web form 5471, officially called the information return of u.s. Schedule h is no longer completed separately for each applicable category of income. Web changes to separate schedule h (form 5471). Name of person filing form 5471. Schedule h (form 5471) (rev.

Anyone Preparing A Form 5471 Knows That The.

Name of person filing form 5471. As a result of this change: December 2021) current earnings and profits department of the treasury internal revenue service attach to form 5471. Recently, schedule h was revised.

Web Changes To Separate Schedule H (Form 5471).

Schedule h is no longer completed separately for each applicable category of income. Web form 5471, officially called the information return of u.s. Schedule h is now completed once, for all categories of income. • lines a and b at the top of the schedule (pertaining to identifying the category of income for which the schedule was being

Schedule H (Form 5471) (December 2018) Author:

Web changes to separate schedule h (form 5471). Schedule h (form 5471) (rev. Web schedule h is completed with a form 5471 to disclose the current earnings & profits (e&p) of the cfc. This article is designed to supplement the irs instructions to the form 5471.

Name Of Person Filing Form 5471 Identifying Number Name Of Foreign Corporationein (If Any).

Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”). Name of person filing form 5471. A foreign corporation's e&p is completed in a similar fashion to an e&p calculation for. Reference id number of foreign corporation.