Schedule B Form 941 For 2021

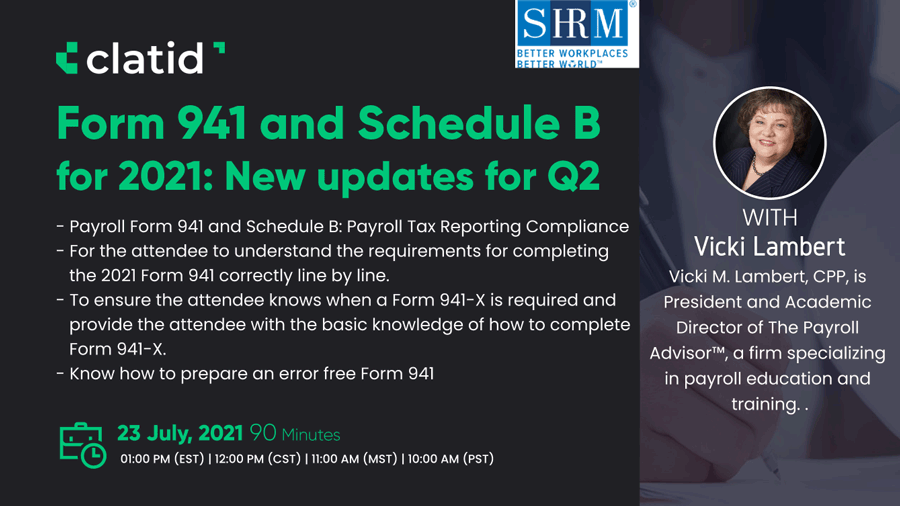

Schedule B Form 941 For 2021 - The irs demands that the form 941 and the schedule b match to the penny…every single time…without. See deposit penalties in section 11 of pub. Web form 941 schedule b is available for 2021. Web this webinar covers the irs form 941 and its accompanying form schedule b for 2nd quarter of 2021. For 2021.step by step instructions for the irs form 941 schedule b.e. Web the schedule b is also a crucial form for many employers. Employers engaged in a trade or business who pay compensation form 9465. 5 hours ago changes & updates to form 941 schedule b for 2021 irs form 941 is used to report employee. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. You are a semiweekly depositor if you:

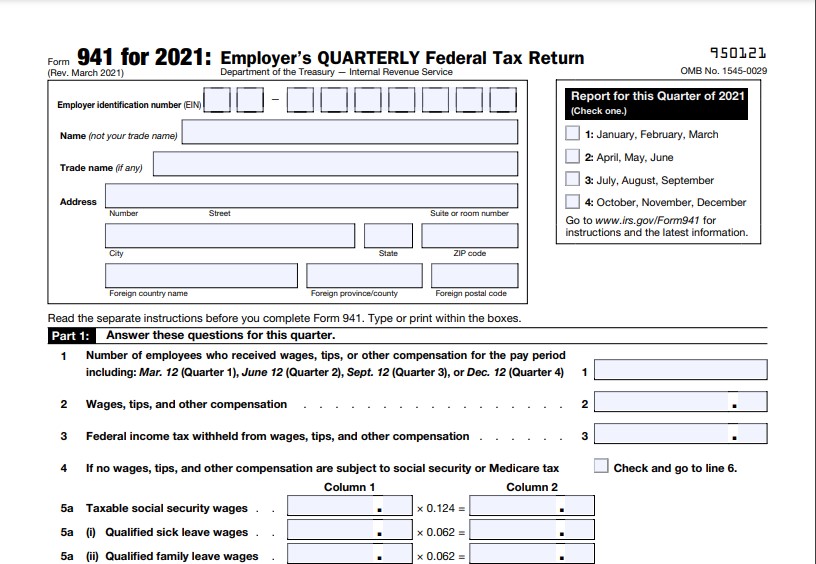

Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Taxbandits also supports prior year filings of form 941 for 2022,. 15 or section 8 of pub. See deposit penalties in section 11 of pub. Web employer's quarterly federal tax return for 2021. I'll provide information on how it will be included when filing your 941 forms. It discusses what is new for the latest version form in. It takes only a few minutes to complete form 941 schedule b online. This information is collected on schedule b.

For employers who withhold taxes from employee's paychecks or who must pay the employer's. You are a semiweekly depositor if you: Web irs form 941 schedule b for 2021 941 schedule b tax. Qualified small business payroll tax credit for increasing research activities. It discusses what is new for the latest version form in. 5 hours ago changes & updates to form 941 schedule b for 2021 irs form 941 is used to report employee. I'll provide information on how it will be included when filing your 941 forms. Web schedule b is filed with form 941. See deposit penalties in section 11 of pub. Employers engaged in a trade or business who pay compensation form 9465.

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

For 2021.step by step instructions for the irs form 941 schedule b.e. Form 941 is an information form in the payroll form series which deals with. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. The irs demands that the form 941 and the schedule b match to the penny…every single time…without. Web changes &.

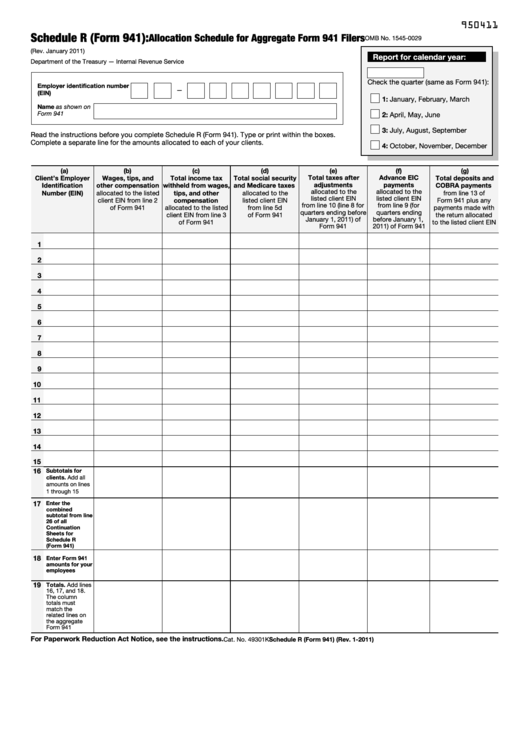

Fillable Schedule R (Form 941) Allocation Schedule For Aggregate Form

This form must be completed by a semiweekly schedule depositor who. For 2021.step by step instructions for the irs form 941 schedule b.e. 5 hours ago changes & updates to form 941 schedule b for 2021 irs form 941 is used to report employee. Double check all the fillable fields to ensure complete accuracy. Employers engaged in a trade or.

941 schedule b 2021 Fill Online, Printable, Fillable Blank form941

Web report error it appears you don't have a pdf plugin for this browser. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Employers engaged in a trade or business who pay compensation form 9465. Double check all the fillable fields to ensure complete accuracy. Web a schedule b form 941 is used by the internal.

Form 941 Printable & Fillable Per Diem Rates 2021

See deposit penalties in section 11 of pub. Web features form 941 schedule b the irs requires additional information regarding the tax liabilities for a semiweekly depositors. For employers who withhold taxes from employee's paychecks or who must pay the employer's. Double check all the fillable fields to ensure complete accuracy. It discusses what is new for the latest version.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

8 hours ago irs form 941 schedule b. Web everything you need to know about form 941 schedule b. Reported more than $50,000 of employment taxes in the. Form 941 is an information form in the payroll form series which deals with. Therefore, the due date of schedule b is the same as the due date for the applicable form.

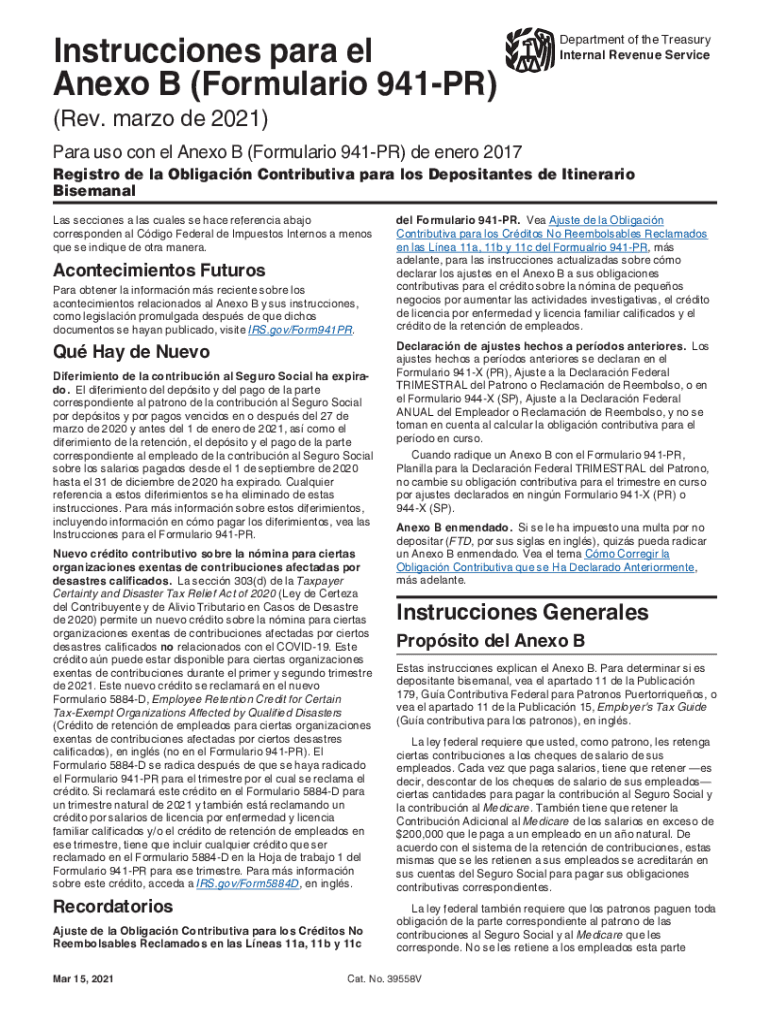

IRS Instructions 941PR Schedule B 20212022 Fill and Sign

Taxbandits also supports prior year filings of form 941 for 2022,. Taxbandits supports form 941 schedule r for peos, cpeos,. Employers engaged in a trade or business who pay compensation form 9465. Web i see the hassle you've been through with your schedule b filing. Web jazlyn williams reporter/editor a revised form 941 and instructions reflecting changes made by the.

Payroll Form 941 and Schedule B Payroll Tax Reporting Compliance

Web this webinar covers the irs form 941 and its accompanying form schedule b for 2nd quarter of 2021. Ad download or email irs 941 & more fillable forms, register and subscribe now! Double check all the fillable fields to ensure complete accuracy. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web changes & updates.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

This form must be completed by a semiweekly schedule depositor who. Taxbandits supports form 941 schedule r for peos, cpeos,. I'll provide information on how it will be included when filing your 941 forms. This information is collected on schedule b. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form.

Instructions for Schedule R Form 941 Rev June Instructions for Schedule

Reported more than $50,000 of employment taxes in the. Web the schedule b is also a crucial form for many employers. Web form 941 schedule b is available for 2021. Web features form 941 schedule b the irs requires additional information regarding the tax liabilities for a semiweekly depositors. Employers engaged in a trade or business who pay compensation form.

How to Print Form 941 ezAccounting Payroll

For employers who withhold taxes from employee's paychecks or who must pay the employer's. Web form 941 schedule b is available for 2021. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. 15 or section 8 of pub. The filing of schedule b.

Reported More Than $50,000 Of Employment Taxes In The.

The filing of schedule b. Apply a check mark to point the choice where expected. 5 hours ago changes & updates to form 941 schedule b for 2021 irs form 941 is used to report employee. 8 hours ago irs form 941 schedule b.

Web Employer's Quarterly Federal Tax Return For 2021.

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. This form must be completed by a semiweekly schedule depositor who. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web irs form 941 schedule b for 2021 941 schedule b tax.

See Deposit Penalties In Section 11 Of Pub.

In some situations, schedule b may be filed. For employers who withhold taxes from employee's paychecks or who must pay the employer's. Web this webinar covers the irs form 941 and its accompanying form schedule b for 2nd quarter of 2021. You are a semiweekly depositor if you:

Double Check All The Fillable Fields To Ensure Complete Accuracy.

Qualified small business payroll tax credit for increasing research activities. Web jazlyn williams reporter/editor a revised form 941 and instructions reflecting changes made by the arpa were issued for use in the 2nd through 4th. Ad download or email irs 941 & more fillable forms, register and subscribe now! Therefore, the due date of schedule b is the same as the due date for the applicable form 941.