Realtor Tax Form

Realtor Tax Form - Web 1 day agoaugust 14. See pricing and listing details of kansas city real estate for sale. Web many realtors® contact the national association looking for real estate forms. 3,236 sqft 3,236 square feet; (1) give the date and business purpose of each trip; Forms are state specific because real estate laws vary significantly from state to state. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web brokered by better homes and gardens real estate kansas city homes. Web the colorado division of property taxation.

If checked, transferor is a foreign person. Web view 2163 homes for sale in kansas city, mo at a median listing home price of $265,000. But a real estate agent’s taxes are different than those. Due date for issue of tds. Web document business miles in a record book as follows: Web brokered by better homes and gardens real estate kansas city homes. Forms are state specific because real estate laws vary significantly from state to state. An additional surtax may be charged by charter counties in florida. Web this section provides you with direct links to many commonly used financial resources for small businesses. Web updated for tax year 2022 • march 21, 2023 04:30 pm overview if you pay taxes on your personal property and real estate that you own, you payments may be.

Web 1 day agoaugust 14. Web this section provides you with direct links to many commonly used financial resources for small businesses. Web brokered by better homes and gardens real estate kansas city homes. Web tax exemption application page 5 of 5 tax exemption instructions 1. Web many realtors® contact the national association looking for real estate forms. (2) note the place to which you traveled; If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you. Web the colorado division of property taxation. If checked, transferor is a foreign person. Web updated for tax year 2022 • march 21, 2023 04:30 pm overview if you pay taxes on your personal property and real estate that you own, you payments may be.

Realtor Tax Deductions And Tips You Must Know Tax deductions

Which include the price, sales history, property. 1313 sherman st., room 419 denver, co 80203. If checked, transferor is a foreign person. Web many realtors® contact the national association looking for real estate forms. Web brokered by better homes and gardens real estate kansas city homes.

Why Every Realtor Needs a Tax Strategy Winning Agent

(2) note the place to which you traveled; Web updated for tax year 2022 • march 21, 2023 04:30 pm overview if you pay taxes on your personal property and real estate that you own, you payments may be. Web brokered by better homes and gardens real estate kansas city homes. Forms are state specific because real estate laws vary.

A realtor has taxdeductions like every other smallbusiness to help

Tips on rental real estate income, deductions and. Forms are state specific because real estate laws vary significantly from state to state. An additional surtax may be charged by charter counties in florida. Web brokered by better homes and gardens real estate kansas city homes. Web as of july 19, the average credit card interest rate is 20.44%, down slightly.

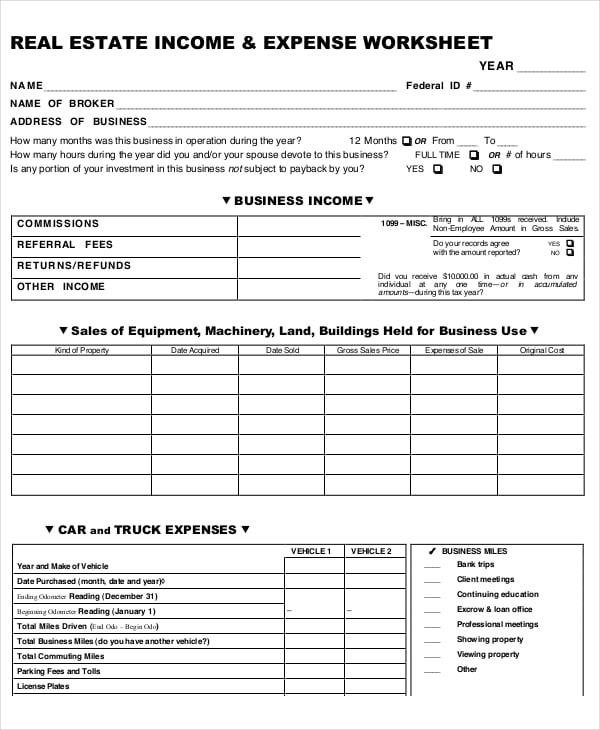

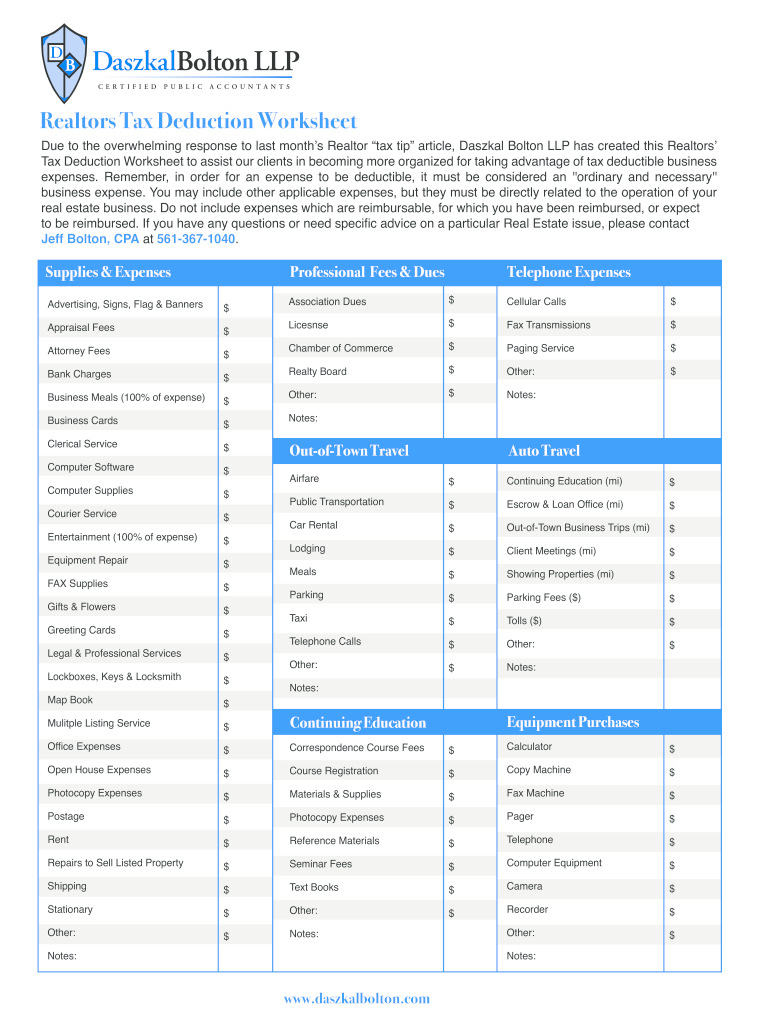

Tax Deduction Worksheet Realtors Form Fill Out and Sign Printable PDF

(2) note the place to which you traveled; Web individual personal property address change form; Web 1 day agoaugust 14. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web what deductions can i take as an owner of rental property?

Exclusively for the Executive Realtor Tax Deduction Cheat Sheet

See pricing and listing details of kansas city real estate for sale. Web 1 day agoaugust 14. Web the current transfer tax rate is $0.70 for every $100.00 of consideration (i.e., 0.70%). Each application for tax exemption must be filled out completely with all accompanying facts. (2) note the place to which you traveled;

Pin on Realtor Tips

An additional surtax may be charged by charter counties in florida. Web tax exemption application page 5 of 5 tax exemption instructions 1. Web 1 day agoaugust 14. Web the missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid. Web.

Realtor Tax Deductions And Tips You Must Know These tips will help you

1313 sherman st., room 419 denver, co 80203. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Forms are state specific because real estate laws vary significantly from state to state. If you receive rental income from the rental of a dwelling unit, there.

24+ Expense Sheet Sample

Web view 2163 homes for sale in kansas city, mo at a median listing home price of $265,000. Web brokered by better homes and gardens real estate kansas city homes. If checked, transferor is a foreign person. Which include the price, sales history, property. See pricing and listing details of kansas city real estate for sale.

What Expenses Can I Deduct As A Real Estate Agent TATUST

Web view 2163 homes for sale in kansas city, mo at a median listing home price of $265,000. Web the colorado division of property taxation. Web many realtors® contact the national association looking for real estate forms. (1) give the date and business purpose of each trip; 1313 sherman st., room 419 denver, co 80203.

Real Estate Agent Tax Deductions Worksheet 2021 Form Fill Out and

Web view 2163 homes for sale in kansas city, mo at a median listing home price of $265,000. Forms are state specific because real estate laws vary significantly from state to state. Web the colorado division of property taxation. Web document business miles in a record book as follows: (3) record the number of.

Web 1 Day Agoaugust 14.

Web tax exemption application page 5 of 5 tax exemption instructions 1. See pricing and listing details of kansas city real estate for sale. Web this section provides you with direct links to many commonly used financial resources for small businesses. Due date for issue of tds.

Web Many Realtors® Contact The National Association Looking For Real Estate Forms.

Web individual personal property address change form; Tips on rental real estate income, deductions and. Web the current transfer tax rate is $0.70 for every $100.00 of consideration (i.e., 0.70%). 1313 sherman st., room 419 denver, co 80203.

Which Include The Price, Sales History, Property.

An additional surtax may be charged by charter counties in florida. If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you. Web the colorado division of property taxation. Web document business miles in a record book as follows:

(1) Give The Date And Business Purpose Of Each Trip;

Web brokered by better homes and gardens real estate kansas city homes. 3,236 sqft 3,236 square feet; (3) record the number of. Forms are state specific because real estate laws vary significantly from state to state.