Property Tax Exempt Form Texas

Property Tax Exempt Form Texas - Web property tax exemptions are one of the most effective and straightforward ways to reduce your property tax bill and save money. Web the legislature's $18 billion omnibus plan to lower property taxes is done by compressing the school property maintenance and operations tax rate and by raising. Applications for property tax exemptions are filed with the appraisal district in which the property is. Web this application is for use in claiming a property tax exemption pursuant to tax code section 11.22 for property owned by a disabled veteran, the surviving spouse or. Web texas sales and use tax exemption certification this certificate does not require a number to be valid. Web this year, the texas legislature increased the tax exemption from $40,000 to $100,000, lawmakers' partial response to a statewide increase in property taxes. Web a homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the state or adopted by a local taxing unit. Applying for the homestead exemption is free and easy. Request for replacement refund check: Web most counties have the homestead exemption form online.

Web for additional copies, visit: Web exemptions from property tax require applications in most circumstances. Applying for the homestead exemption is free and easy. Web property tax exemptions are one of the most effective and straightforward ways to reduce your property tax bill and save money. Web sales and use tax returns and instructions. Learn how to claim a homestead exemption. You might be able to claim a. Web application for property tax refund: Request for replacement refund check: Web a homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the state or adopted by a local taxing unit.

Web property tax exemptions are one of the most effective and straightforward ways to reduce your property tax bill and save money. Web for exemptions claimed on another property or on your previous residence, list the property address and if located outside of dallas county, attach documentation from the. Do not pay anyone to fill up and/or file your. Name of purchaser, firm or agency address (street & number, p.o. Web exemptions from property tax require applications in most circumstances. Web sales and use tax returns and instructions. Web 2 — property tax exemptions owner’s qualifications /& ˘ ˆ + ˇ ˘ !˜! Web homestead exemptions can help lower the property taxes on your home. You might be able to claim a. Web for additional copies, visit:

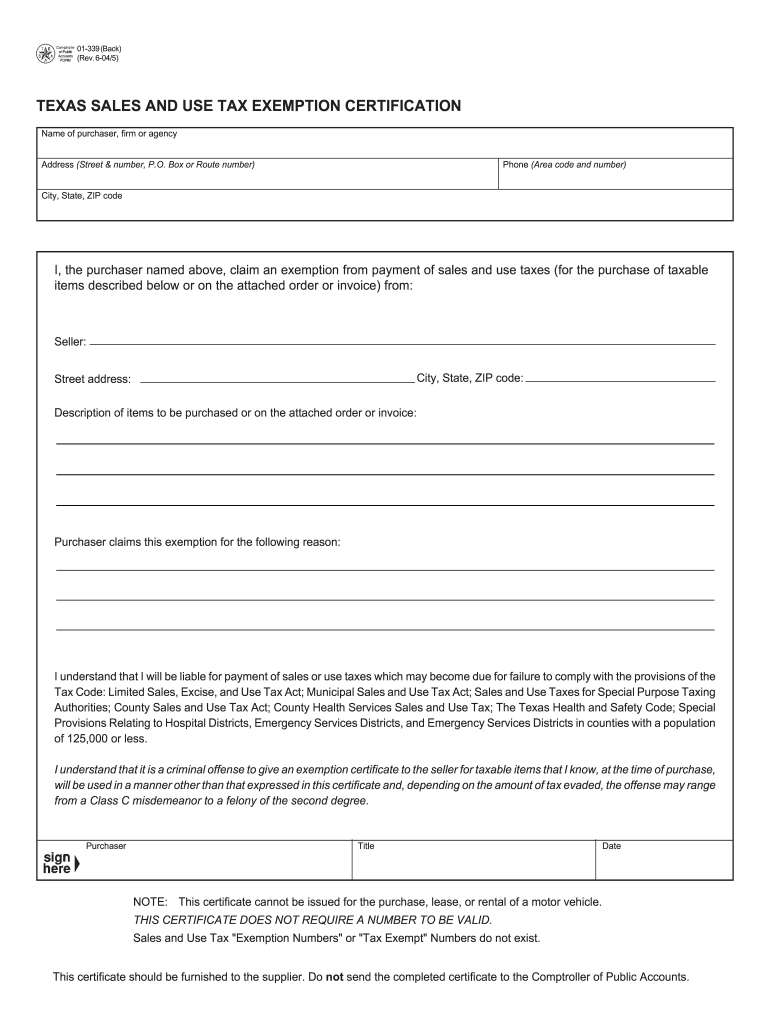

Texas Fillable Tax Exemption Form Fill Out and Sign Printable PDF

Web property tax exemptions are one of the most effective and straightforward ways to reduce your property tax bill and save money. Web property tax application for residence homestead exemption. Web most counties have the homestead exemption form online. Web the legislature's $18 billion omnibus plan to lower property taxes is done by compressing the school property maintenance and operations.

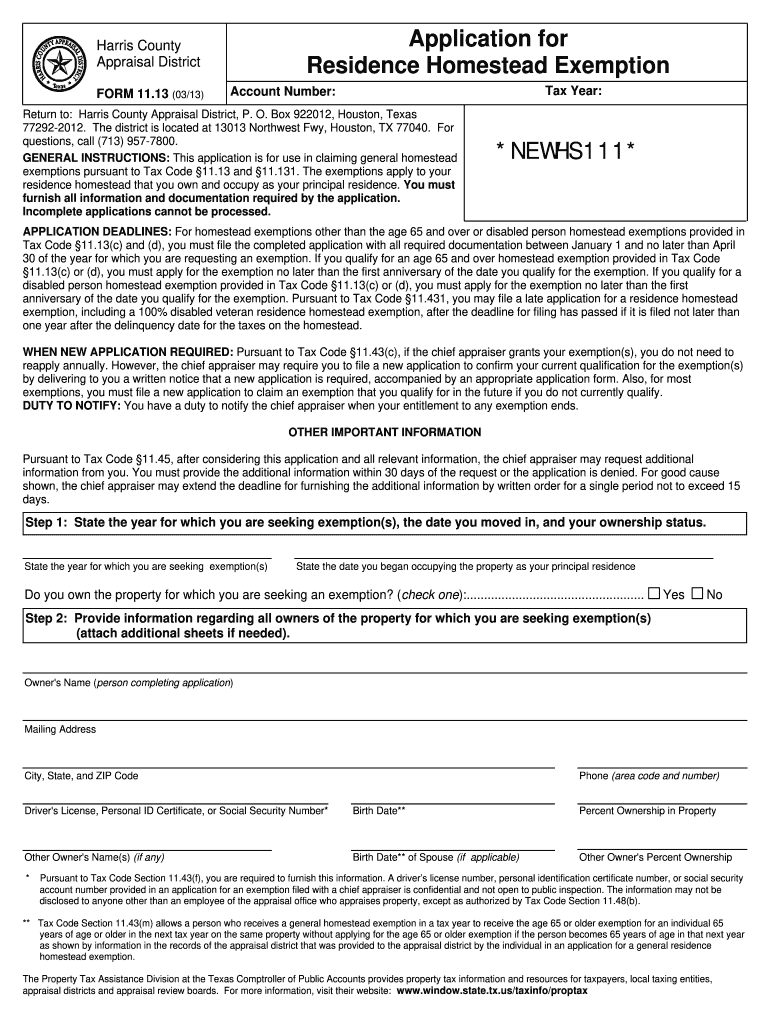

TX Form 11.13 20132022 Fill and Sign Printable Template Online US

The available texas homeowner exemptions are listed. Web most counties have the homestead exemption form online. Web application for property tax refund: Learn how to claim a homestead exemption. Web 7 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot.

TX HCAD 11.13 20192022 Complete Legal Document Online US Legal Forms

Web for exemptions claimed on another property or on your previous residence, list the property address and if located outside of dallas county, attach documentation from the. You might be able to claim a. Web sales and use tax returns and instructions. Web the legislature's $18 billion omnibus plan to lower property taxes is done by compressing the school property.

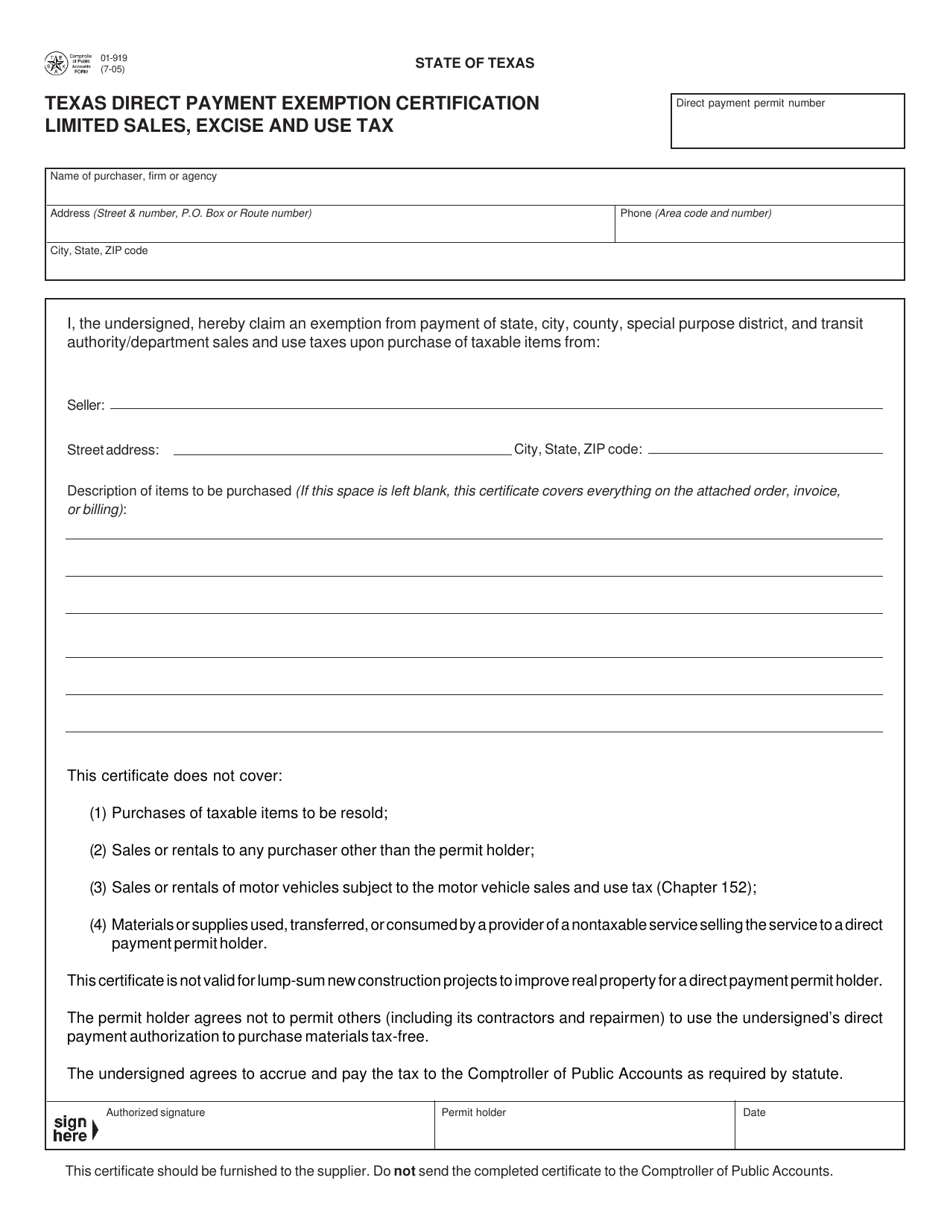

Form 01919 Download Fillable PDF or Fill Online Texas Direct Payment

Applications for property tax exemptions are filed with the appraisal district in which the property is. Applying for the homestead exemption is free and easy. Web a property tax exemption is subtracted from the appraised value and lower the assessed value and the property tax. Learn how to claim a homestead exemption. Name of purchaser, firm or agency address (street.

Tax Exempt Forms San Patricio Electric Cooperative

Web most counties have the homestead exemption form online. Web this year, the texas legislature increased the tax exemption from $40,000 to $100,000, lawmakers' partial response to a statewide increase in property taxes. You might be able to claim a. The available texas homeowner exemptions are listed. Web a homestead exemption is an exemption that removes all or a portion.

Texas Exemption Port Fill Online, Printable, Fillable, Blank pdfFiller

Learn how to claim a homestead exemption. Web to receive this exemption, the purchaser must complete the title application tax/affidavit form, available from the texas comptroller of public accounts. Web application for property tax refund: Web this year, the texas legislature increased the tax exemption from $40,000 to $100,000, lawmakers' partial response to a statewide increase in property taxes. Web.

Property Tax Exemption Webinar State Representative Debbie MeyersMartin

Do not pay anyone to fill up and/or file your. Web most counties have the homestead exemption form online. Learn how to claim a homestead exemption. Web for additional copies, visit: Web 2 — property tax exemptions owner’s qualifications /& ˘ ˆ + ˇ ˘ !˜!

Texas Tax Exempt Certificate Fill And Sign Printable Template Online

Web 7 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot. Web application for property tax refund: Web for additional copies, visit: Learn how to claim a homestead exemption. Web sales and use tax returns and instructions.

Downloads

Web property tax application for residence homestead exemption. Applying for the homestead exemption is free and easy. Web the legislature's $18 billion omnibus plan to lower property taxes is done by compressing the school property maintenance and operations tax rate and by raising. The available texas homeowner exemptions are listed. Web application for property tax refund:

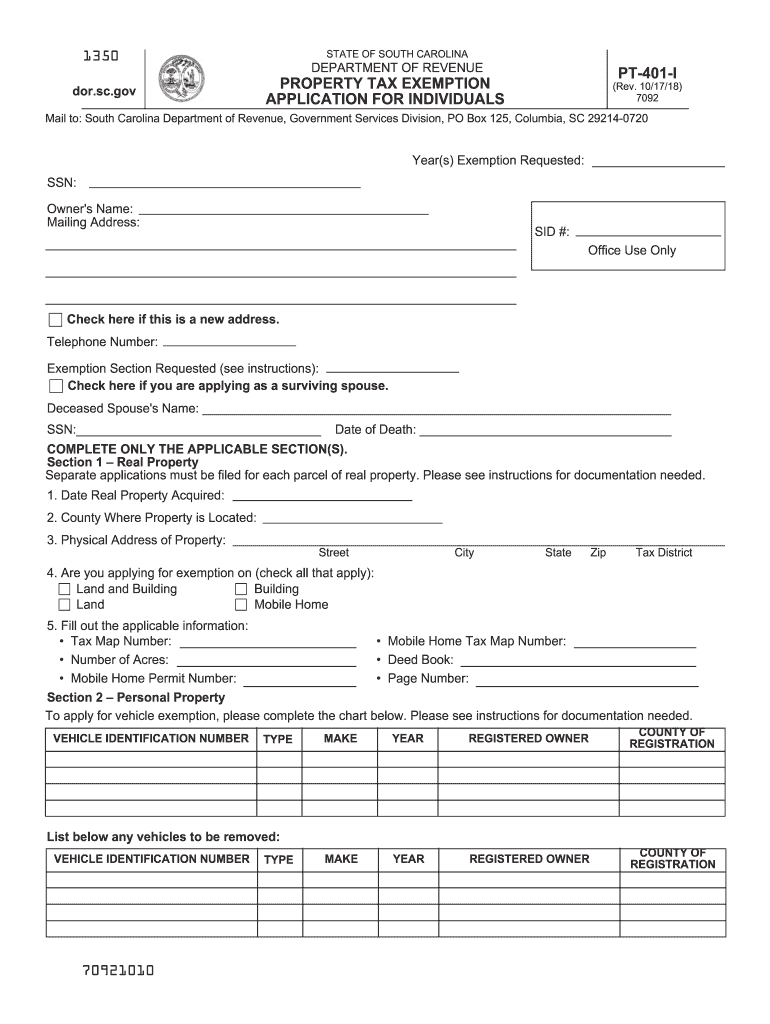

Pt 401 I Fill Out and Sign Printable PDF Template signNow

Web 7 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot. Web for additional copies, visit: Web most counties have the homestead exemption form online. Web for exemptions claimed on another property or on your previous residence, list the property address and if located outside of dallas county, attach.

Name Of Purchaser, Firm Or Agency Address (Street & Number, P.o.

Web to receive this exemption, the purchaser must complete the title application tax/affidavit form, available from the texas comptroller of public accounts. Web application for property tax refund: Web for additional copies, visit: Web homestead exemptions can help lower the property taxes on your home.

Texas Taxpayers Are Eligible For A.

Web 7 hours agotexas voters will have to vote on raising the homestead exemption form $40,000 to $100,000 on the november ballot. Web sales and use tax returns and instructions. Web this application is for use in claiming a property tax exemption pursuant to tax code section 11.22 for property owned by a disabled veteran, the surviving spouse or. Web a property tax exemption is subtracted from the appraised value and lower the assessed value and the property tax.

Web Most Counties Have The Homestead Exemption Form Online.

The available texas homeowner exemptions are listed. Web a homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the state or adopted by a local taxing unit. Applying for the homestead exemption is free and easy. Request for replacement refund check:

Web 2 — Property Tax Exemptions Owner’s Qualifications /& ˘ ˆ + ˇ ˘ !˜!

Web the legislature's $18 billion omnibus plan to lower property taxes is done by compressing the school property maintenance and operations tax rate and by raising. You might be able to claim a. Web raising the homestead exemption from $40,000 to $100,000; Web exemptions from property tax require applications in most circumstances.