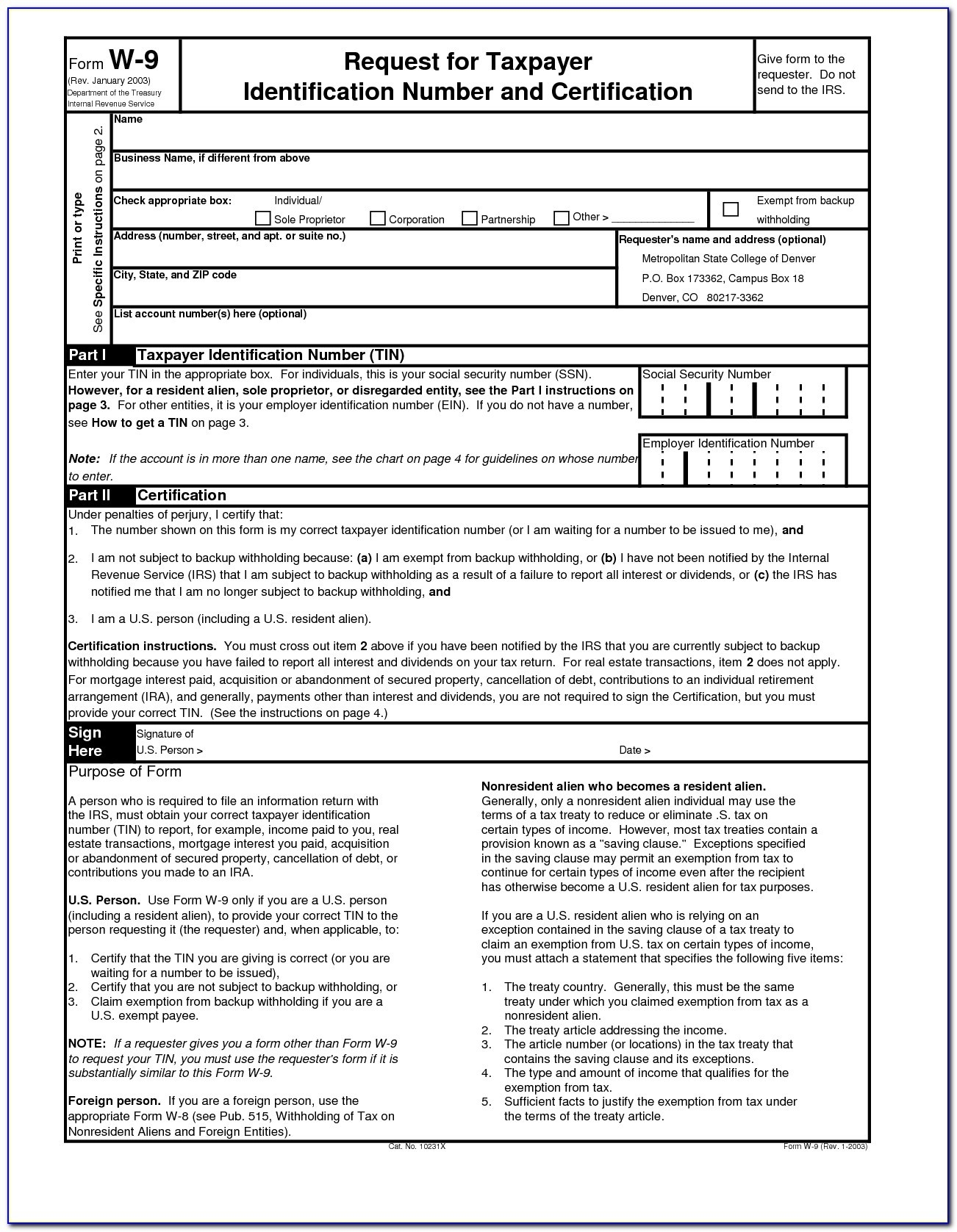

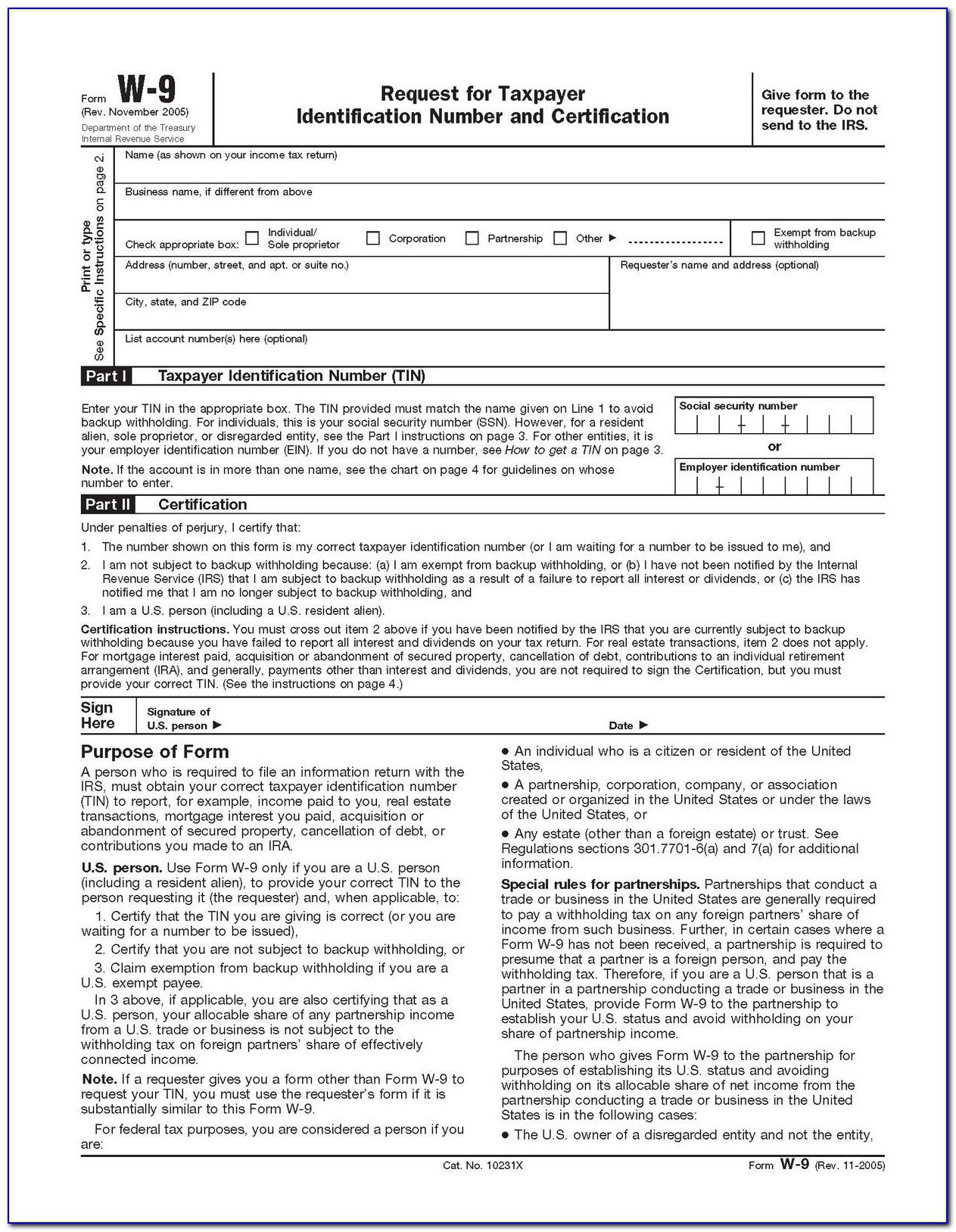

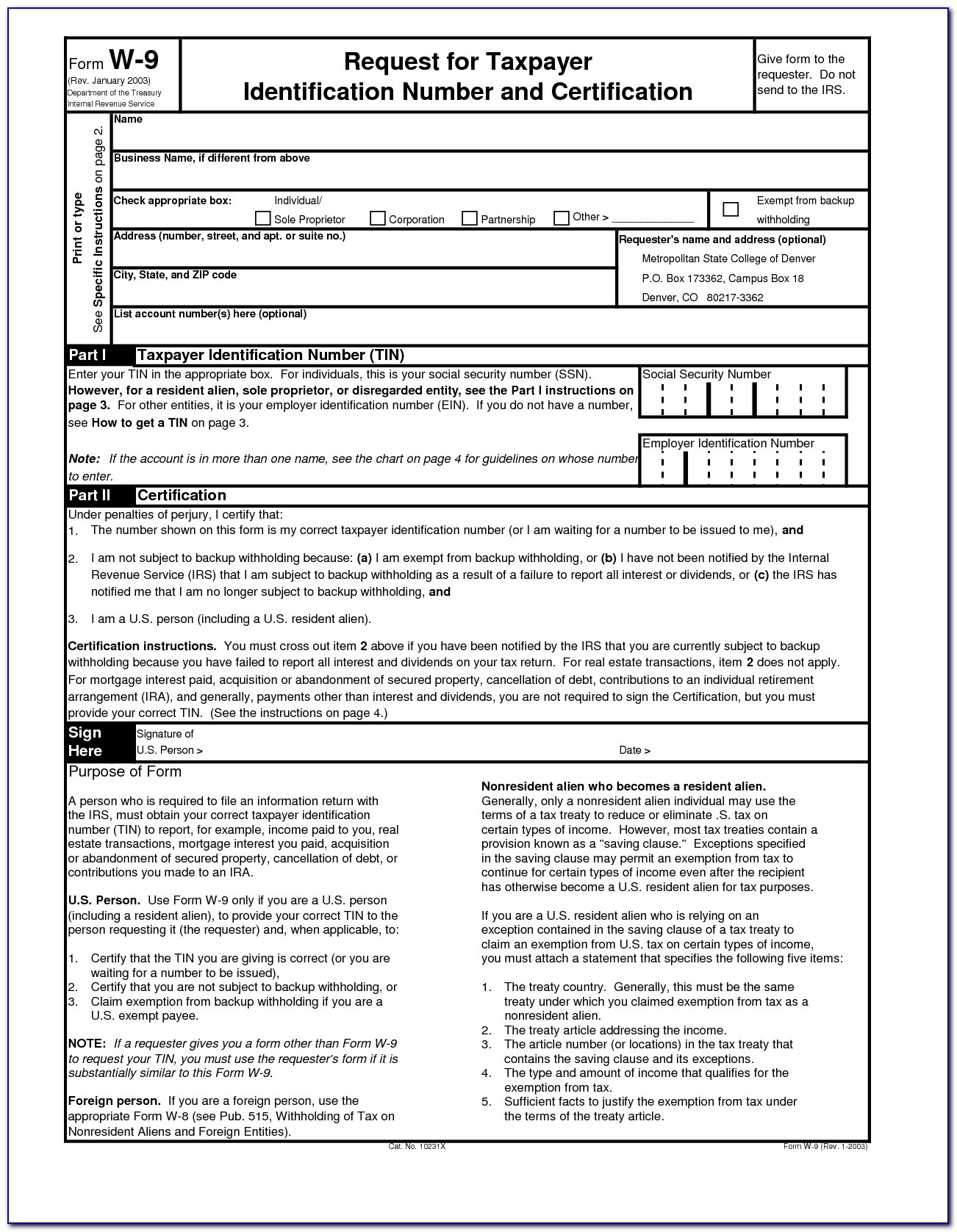

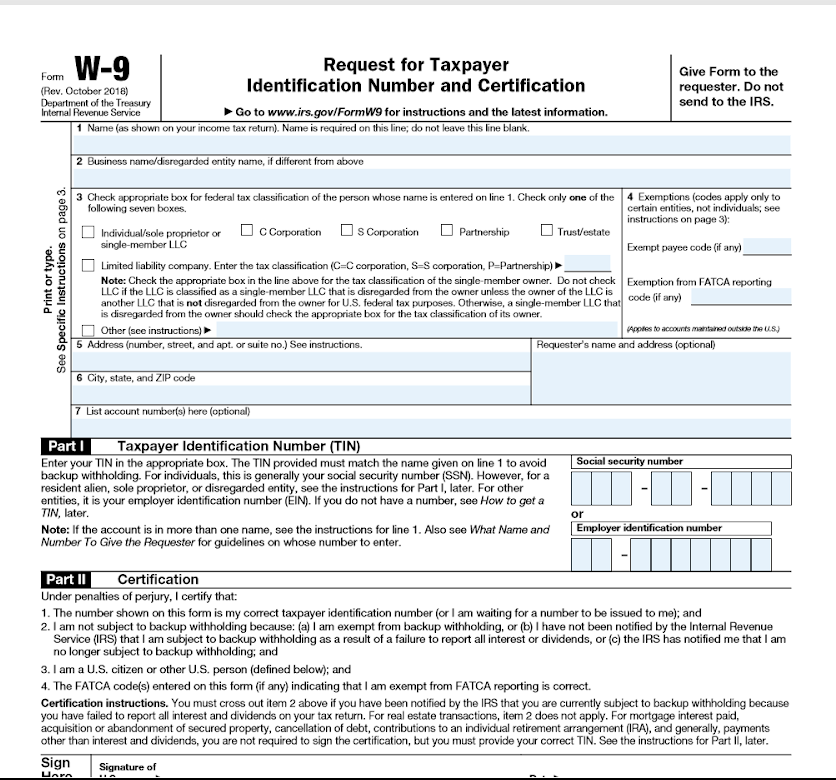

Printable W9 2023

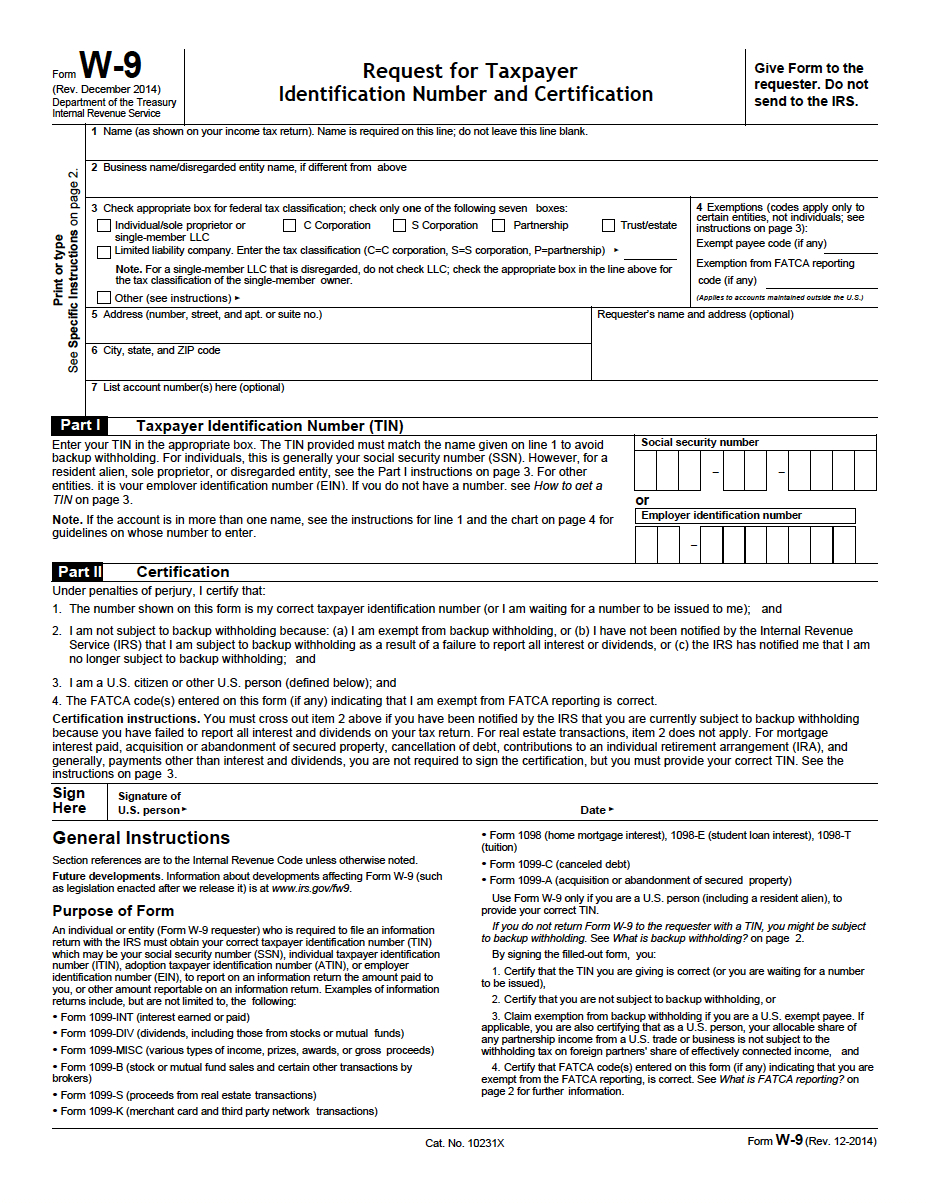

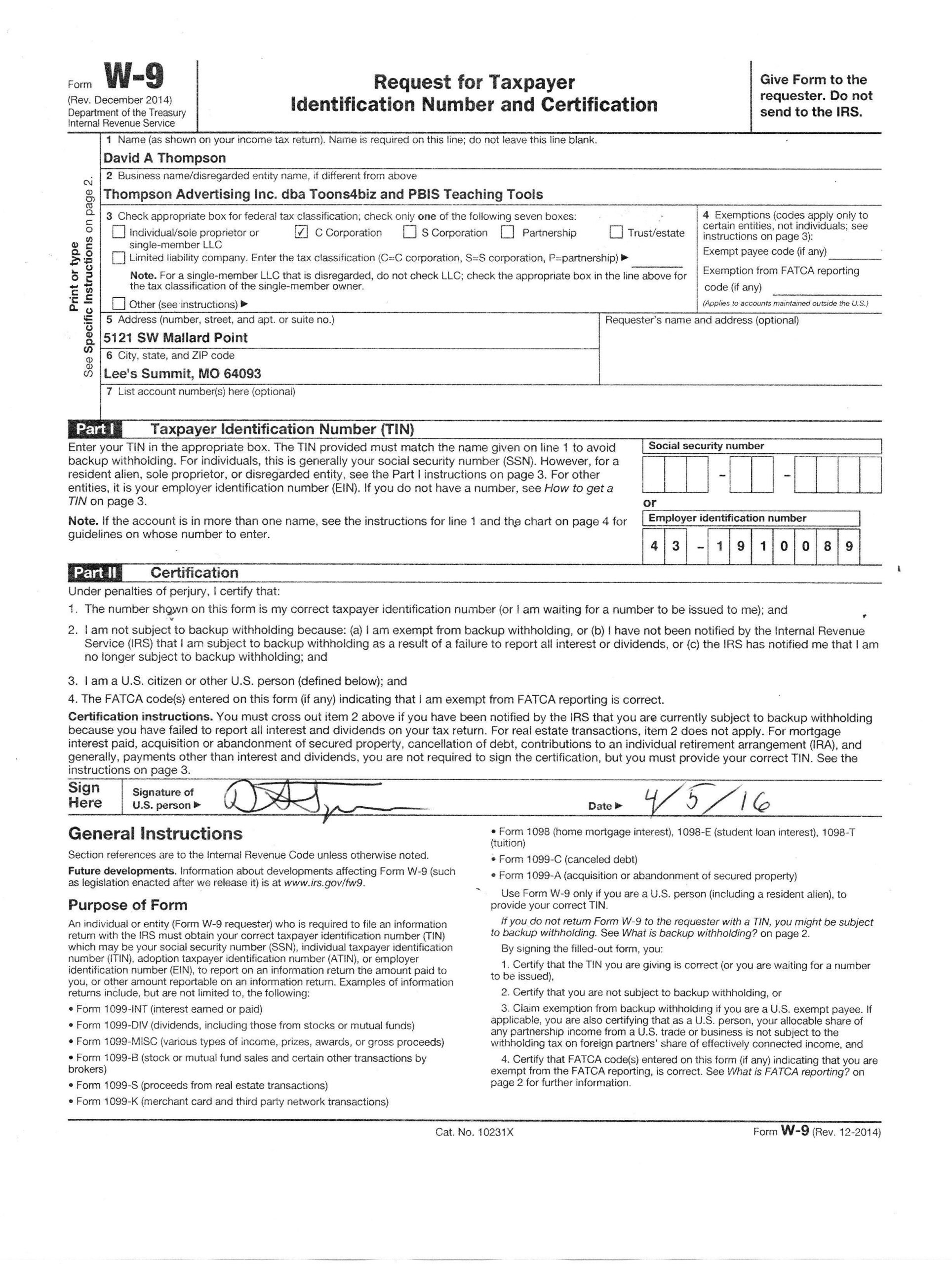

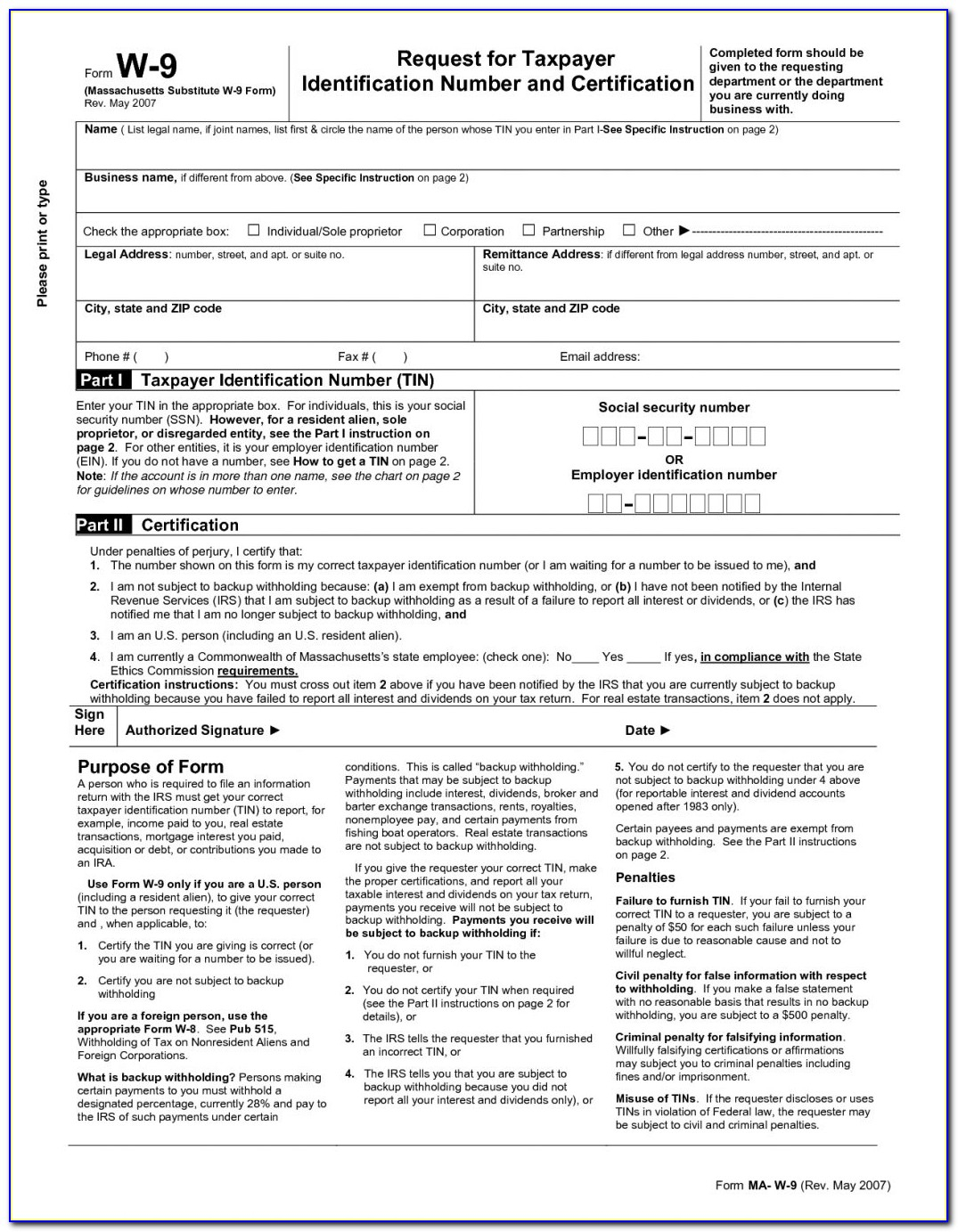

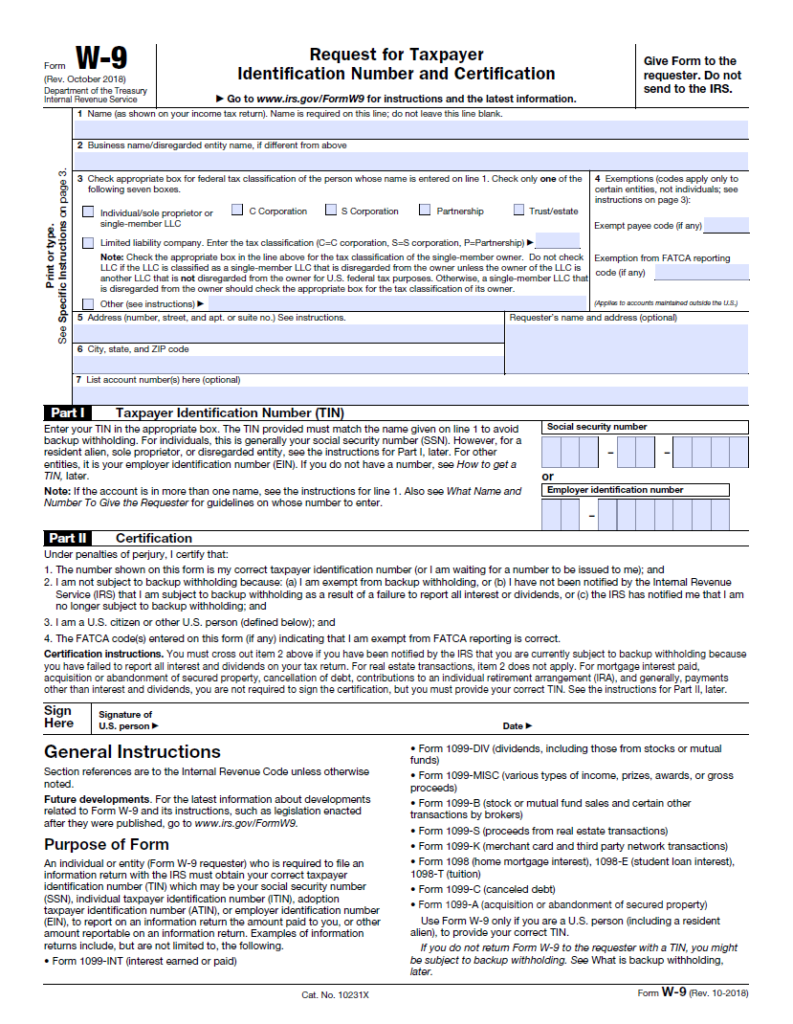

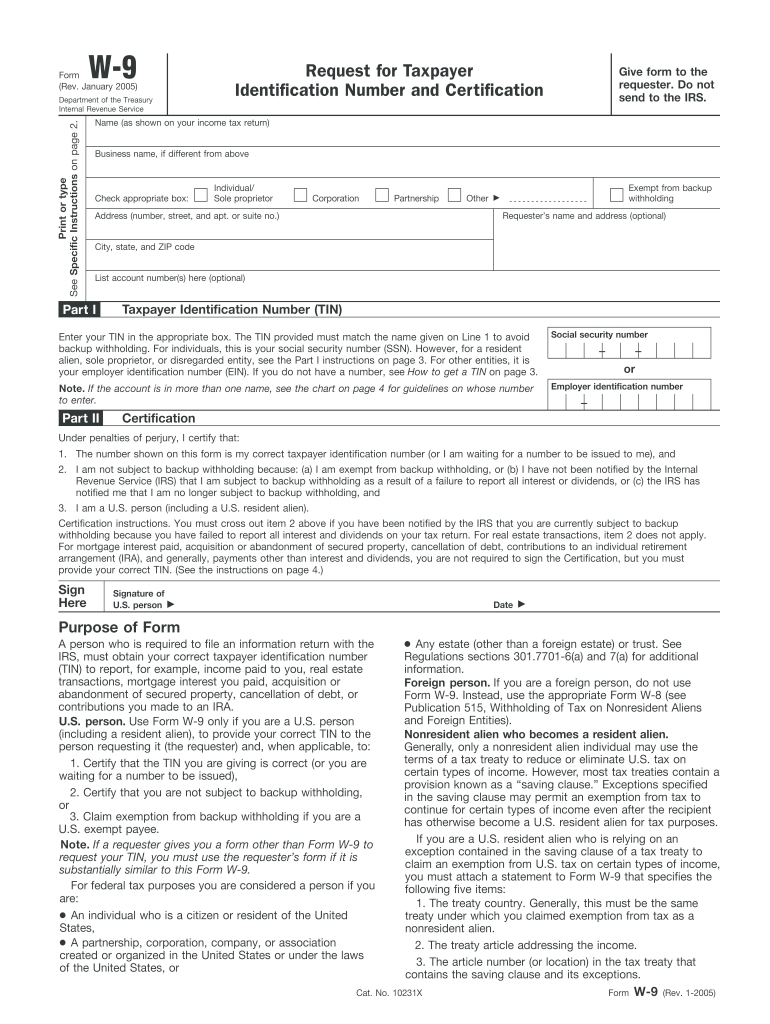

Printable W9 2023 - Business name/disregarded entity name, if different from above. You need to fill out this form if you. W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. Click on a column heading to sort the list by the contents of that column. Web updated june 12, 2023. See specific instructions on page 3. Web print or type. We've got answers to all your questions! Who has to fill it out? Do not leave this line blank.

Web the latest versions of irs forms, instructions, and publications. 2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered on line 1. This important tax document is vital for accurate reporting of income and taxes. Who has to fill it out? Web w9 form 2023. Do not leave this line blank. W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. Check appropriate box for federal tax classification of the person whose name is entered on line 1. Do not leave this line blank. This form summarizes all the payments that you have received.

Click on a column heading to sort the list by the contents of that column. W9 form 2023 are for freelancers, independent contractors, and consultants. Web w9 form 2023. Acquisition or abandonment of secured property. Check appropriate box for federal tax classification of the person whose name is entered on line 1. Business name/disregarded entity name, if different from above. This important tax document is vital for accurate reporting of income and taxes. W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. Check only one of the 2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered on line 1.

Blank Tn 2020 W9 Calendar Template Printable

Who has to fill it out? Name is required on this line; Web updated june 12, 2023. Web print or type. View more information about using irs forms, instructions, publications and other item files.

Printable W9 Form W9Form With Regard To Printable W9 Form Free

1 name (as shown on your income tax return). W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. Who has to fill it out? This form summarizes all the payments that you have received. Click on a column heading to sort the list by the contents of.

Blank W9 2018 2019 Free W9Form To Print Free Printable W9 Free

We've got answers to all your questions! 2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered on line 1. Who has to fill it out? W9 form 2023 are for freelancers, independent contractors, and consultants. Name is required on this line;

Free Printable W9 Form From Irs

Web print or type. Acquisition or abandonment of secured property. W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. We've got answers to all your questions! Do not leave this line blank.

Blank W9 2018 2019 Free W9Form To Print W9 Form Printable 2017

Do not leave this line blank. Who has to fill it out? View more information about using irs forms, instructions, publications and other item files. Check out the relevant requirements for contractors & employers. Web updated june 12, 2023.

2020 W9 Forms To Print Example Calendar Printable in W9 Form

1 name (as shown on your income tax return). Do not leave this line blank. W9s are most commonly used for independent contractors but are also in real estate transactions, by banks, and even in legal settlements. W9 form 2023 are for freelancers, independent contractors, and consultants. This important tax document is vital for accurate reporting of income and taxes.

W 9 Form Pdf Printable Example Calendar Printable

Who has to fill it out? Name is required on this line; This important tax document is vital for accurate reporting of income and taxes. Web the latest versions of irs forms, instructions, and publications. Check appropriate box for federal tax classification of the person whose name is entered on line 1.

Printable Blank W9 Form Example Calendar Printable

2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered on line 1. Check appropriate box for federal tax classification of the person whose name is entered on line 1. Who has to fill it out? 1 name (as shown on your income tax return). Check.

W 9 Forms Printable

Do not leave this line blank. 1 name (as shown on your income tax return). Who has to fill it out? 2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered on line 1. W9 form 2023 are for freelancers, independent contractors, and consultants.

See Specific Instructions On Page 3.

Do not leave this line blank. Click on a column heading to sort the list by the contents of that column. Name (as shown on your income tax return). Check only one of the

Name Is Required On This Line;

This form summarizes all the payments that you have received. Web updated june 12, 2023. W9 form 2023 are for freelancers, independent contractors, and consultants. 1 name (as shown on your income tax return).

Web W9 Form 2023.

2 business name/disregarded entity name, if different from above 3 check appropriate box for federal tax classification of the person whose name is entered on line 1. Contributions you made to an ira. This important tax document is vital for accurate reporting of income and taxes. Name is required on this line;

Web Print Or Type.

Check appropriate box for federal tax classification of the person whose name is entered on line 1. View more information about using irs forms, instructions, publications and other item files. Who has to fill it out? We've got answers to all your questions!