Printable Itemized Deductions Worksheet

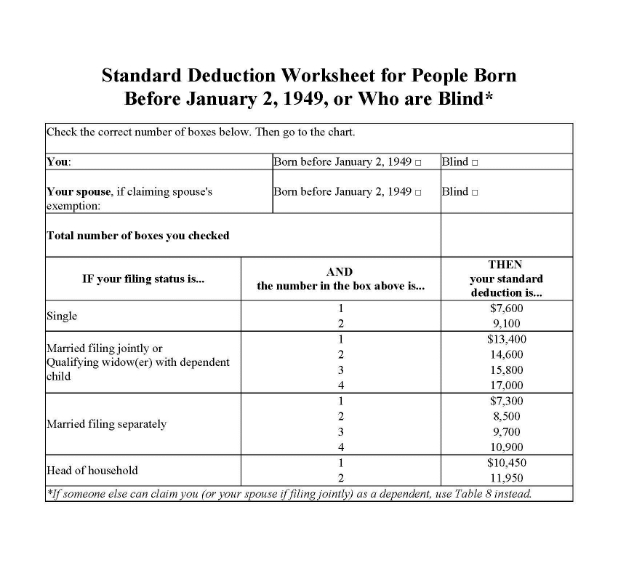

Printable Itemized Deductions Worksheet - Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web most jurisdictions have a tax assessor website that you can view and print the tax receipts (search for “tax assessor. Web complete printable itemized deductions worksheet online with us legal forms. Web part ii adjustments to federal itemized deductions medical and dental expenses see instructions. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Fill out the blank areas; Your total 2022 medical/dental expenses (not reimbursed or paid by others) are: Web this worksheet allows you to itemize your tax deductions for a given year. Save or instantly send your ready documents.

Your agi in 2022 (line 11 of 2022 form 1040) is: Tax deductions for calendar year 2 0 ___ ___ hired$___________help. Web most jurisdictions have a tax assessor website that you can view and print the tax receipts (search for “tax assessor. Web find the list of itemized deductions worksheet you require. Save or instantly send your ready documents. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Involved parties names, places of. Easily fill out pdf blank, edit, and sign them. Web part ii adjustments to federal itemized deductions medical and dental expenses see instructions. We do not need your details.

Save or instantly send your ready documents. Sign it in a few clicks draw. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. See line 29 , later. Web limit on itemized deductions. Just enter your totals for each expense line even if it doesn’t seem like you will have. Your agi in 2022 (line 11 of 2022 form 1040) is: Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web find the list of itemized deductions worksheet you require.

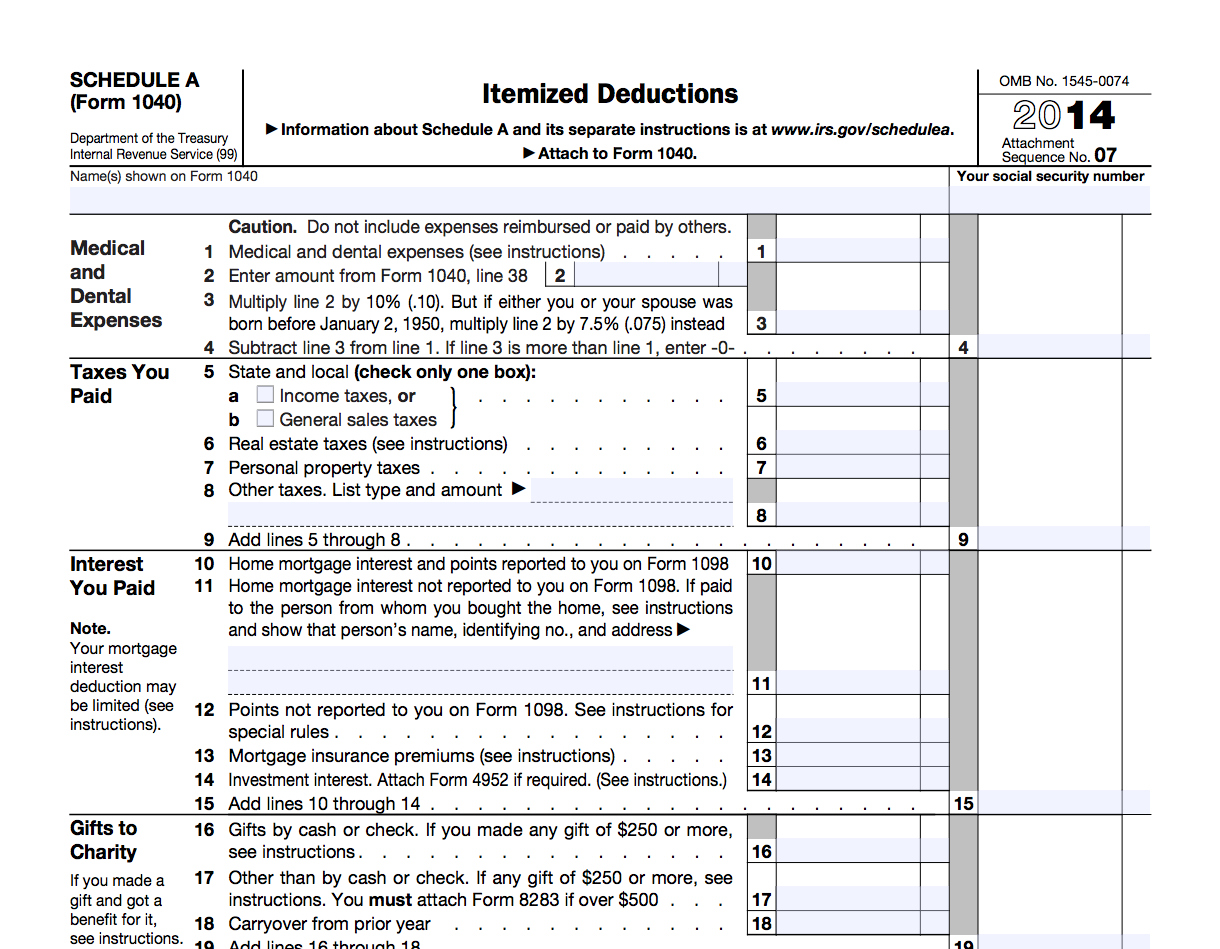

Irs Itemized Deductions Worksheet —

Your total 2022 medical/dental expenses (not reimbursed or paid by others) are: Save or instantly send your ready. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web most jurisdictions have a tax assessor website that you can view and print the tax receipts.

Itemized Deductions Worksheet 2016

Just enter your totals for each expense line even if it doesn’t seem like you will have. Web complete printable itemized deductions worksheet online with us legal forms. The help topics listed below and on the next page are listed in. Easily fill out pdf blank, edit, and sign them. Web download our free 2022 small business tax deductions worksheet,.

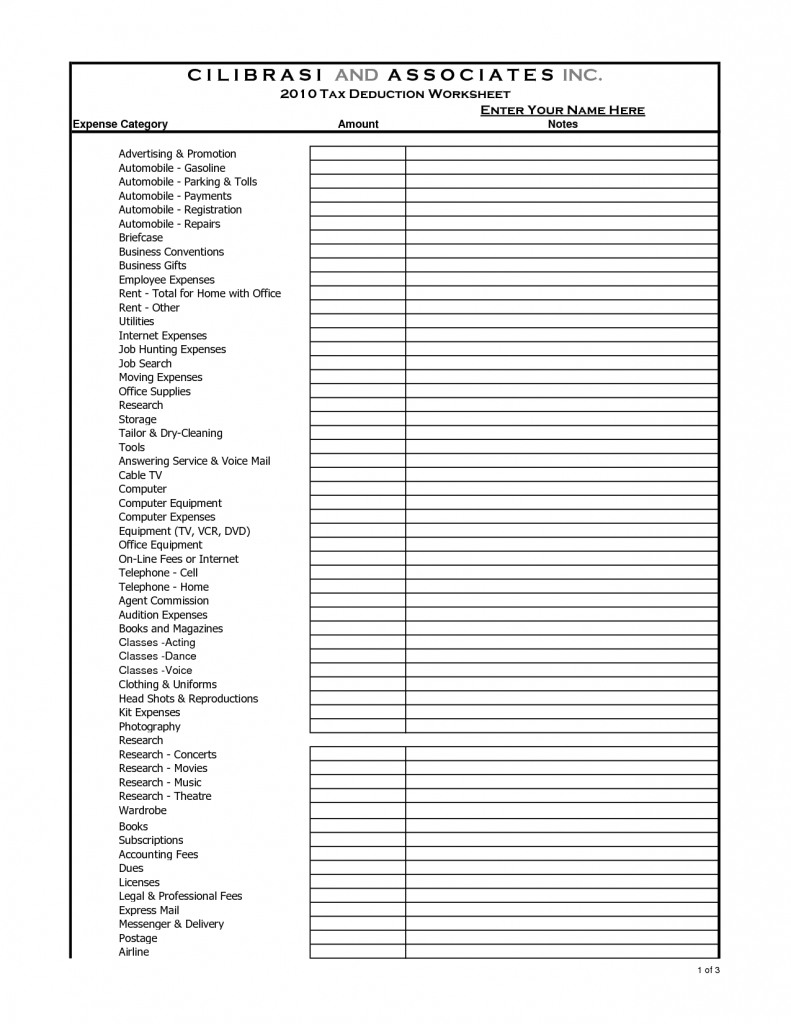

16 Best Images of Schedule C Deductions Worksheet Itemized Deduction

Web most jurisdictions have a tax assessor website that you can view and print the tax receipts (search for “tax assessor. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Just enter your totals for each expense line even if it doesn’t seem like you will have. Save or instantly send your ready. Sign it in.

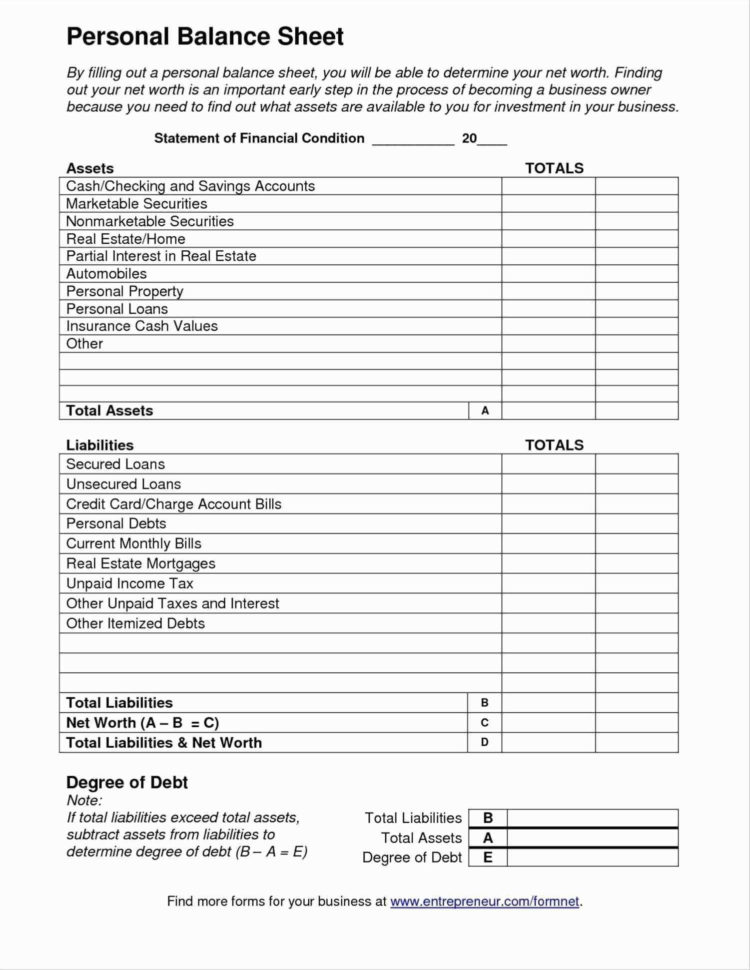

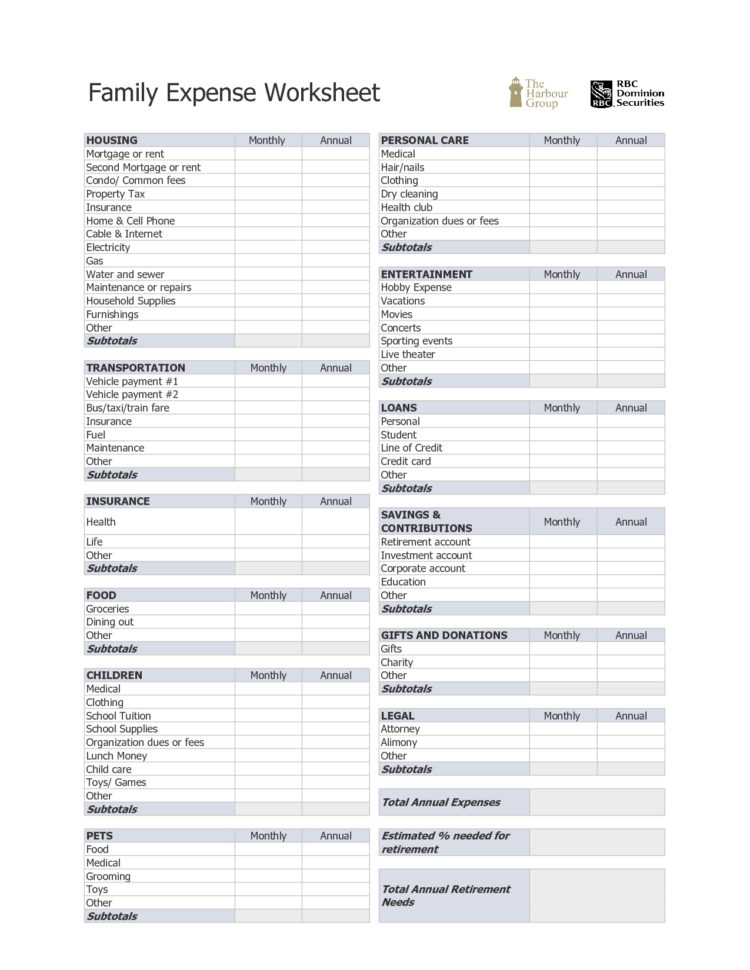

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

Involved parties names, places of. See line 29 , later. Your total 2022 medical/dental expenses (not reimbursed or paid by others) are: Easily fill out pdf blank, edit, and sign them. Future developments for the latest information about developments.

Itemized Deductions Checklist Fill and Sign Printable Template Online

Web find the list of itemized deductions worksheet you require. Check the box if you did not itemize for federal but will itemize for. Web download or print the 2022 federal (itemized deductions) (2022) and other income tax forms from the federal internal revenue service. The help topics listed below and on the next page are listed in. Web complete.

Tax Deduction Worksheet For Self Employed Worksheet Resume Examples

Web complete printable itemized deductions worksheet online with us legal forms. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Fill out the blank areas; The help topics listed below and on the next page are listed in. Easily fill out pdf blank, edit,.

5 Popular Itemized Deductions 2021 Tax Forms 1040 Printable

Web part ii adjustments to federal itemized deductions medical and dental expenses see instructions. Save or instantly send your ready documents. Check the box if you did not itemize for federal but will itemize for. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married):.

California Itemized Deductions Worksheet

The help topics listed below and on the next page are listed in. Web part ii adjustments to federal itemized deductions medical and dental expenses see instructions. Save or instantly send your ready documents. Sign it in a few clicks draw. Easily fill out pdf blank, edit, and sign them.

Itemized Deductions Spreadsheet intended for List Of Itemized

Web most jurisdictions have a tax assessor website that you can view and print the tax receipts (search for “tax assessor. Web find the list of itemized deductions worksheet you require. Open it up using the online editor and start altering. See line 29 , later. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you.

14 Best Images of IRS Itemized Deductions Worksheet Tax Itemized

Save or instantly send your ready documents. Web find the list of itemized deductions worksheet you require. Future developments for the latest information about developments. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Web limit on itemized deductions.

Web Most Jurisdictions Have A Tax Assessor Website That You Can View And Print The Tax Receipts (Search For “Tax Assessor.

Easily fill out pdf blank, edit, and sign them. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Open it up using the online editor and start altering. Future developments for the latest information about developments.

Web This Worksheet Allows You To Itemize Your Tax Deductions For A Given Year.

Fill out the blank areas; See line 29 , later. Web limit on itemized deductions. Save or instantly send your ready documents.

Web Department Of The Treasury Internal Revenue Service 2022 Instructions For Schedule Aitemized Deductions Use Schedule A (Form 1040) To Figure Your Itemized.

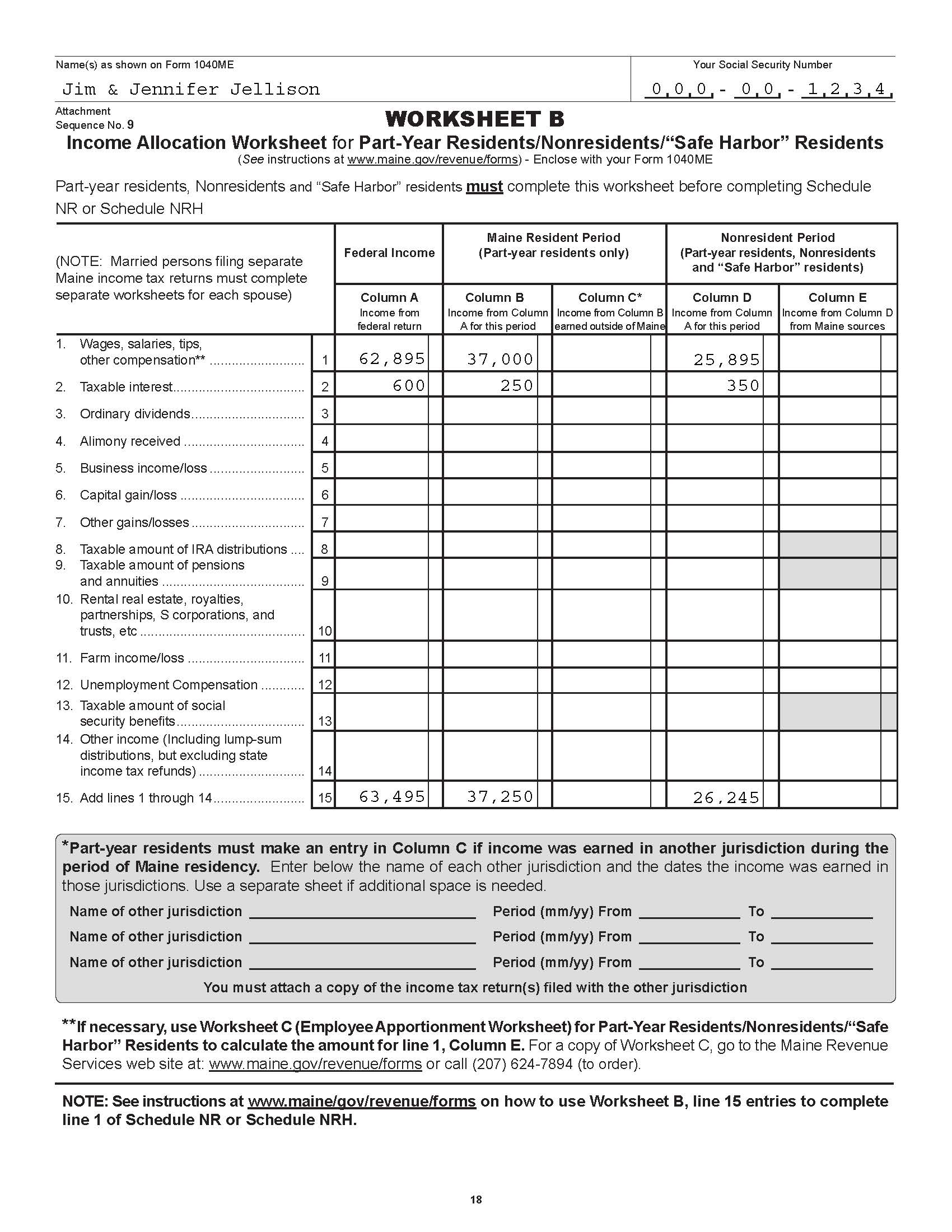

Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Your agi in 2022 (line 11 of 2022 form 1040) is: The help topics listed below and on the next page are listed in. Web part ii adjustments to federal itemized deductions medical and dental expenses see instructions.

Web Find The List Of Itemized Deductions Worksheet You Require.

Tax deductions for calendar year 2 0 ___ ___ hired$___________help. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Check the box if you did not itemize for federal but will itemize for. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments, highlights and more.