Payable On Death Bank Account Form

Payable On Death Bank Account Form - Web the account owner can access the account while they are still alive, even if the pod arrangement has been made. Web the undersigned request(s) the bank to pay over the balance on deposit in the above account to the person named above 30 days after the date of death of the undersigned,. But the amount in the. Web what is a payable on death account? Web this document contains both information and form fields. Open the document in the. Go paperless & try it now! To collect funds in a pod bank account, all the beneficiary needs to do is go to the bank and present id and a certified copy of the. Web how to claim the funds after death. Web payable on death bank accounts.

But the amount in the. To read information, use the down arrow from a form field. As the owner(s), i/we may change the named beneficiary(ies) at any time by completing and delivering to. Web up to 25% cash back answer: The hardest part will be finding a bank that is staffed. Web the undersigned request(s) the bank to pay over the balance on deposit in the above account to the person named above 30 days after the date of death of the undersigned,. Web payable on death bank accounts. Account is usually not subject to any taxes at the federal level. If multiple beneficiaries are designated, funds will be divided. Access your business documents instantly.

But the amount in the. Ad gain full peace of mind by filling out any forms and register today! First, the beneficiary named on a p.o.d. The beneficiary or recipient of the funds will. If multiple beneficiaries are designated, funds will be divided. Web are payable on death accounts taxable? Access your business documents instantly. The hardest part will be finding a bank that is staffed. Web up to 25% cash back answer: Web if the account has a payable on death beneficiary, the bank account balance goes to the beneficiary after the last account owner dies.

Pros and cons of a ‘payable on death’ account

Web new york state law allows you to designate certain types of accounts, including bank checking, savings, and cd, as “payable on death.”. Web are payable on death accounts taxable? Web this document contains both information and form fields. Web the undersigned request(s) the bank to pay over the balance on deposit in the above account to the person named.

Payable on Death Form Fill Out and Sign Printable PDF Template signNow

Go paperless & try it now! Web if the account has a payable on death beneficiary, the bank account balance goes to the beneficiary after the last account owner dies. Web this document contains both information and form fields. All you need to do is properly notify your bank. Access your business documents instantly.

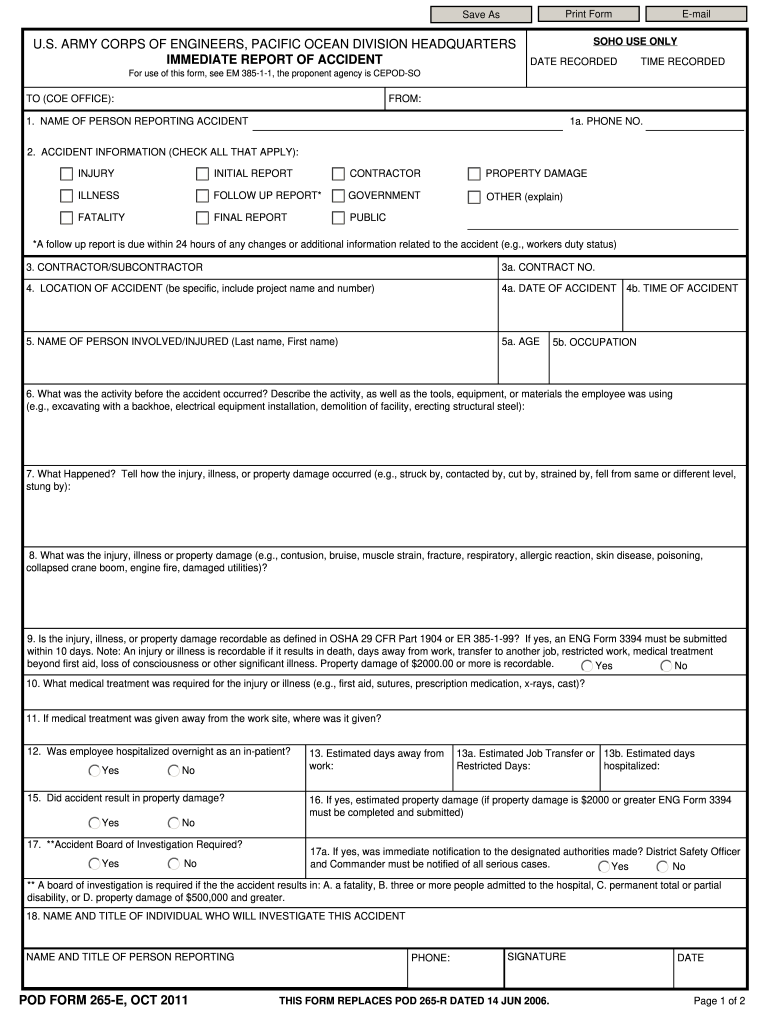

Accounts Payable Form Editable Forms

The beneficiary or recipient of the funds will. But the amount in the. Get the document you need in the collection of legal templates. Web upon the death of all owners, the account(s) will only be paid to the beneficiaries designated on this form. The hardest part will be finding a bank that is staffed.

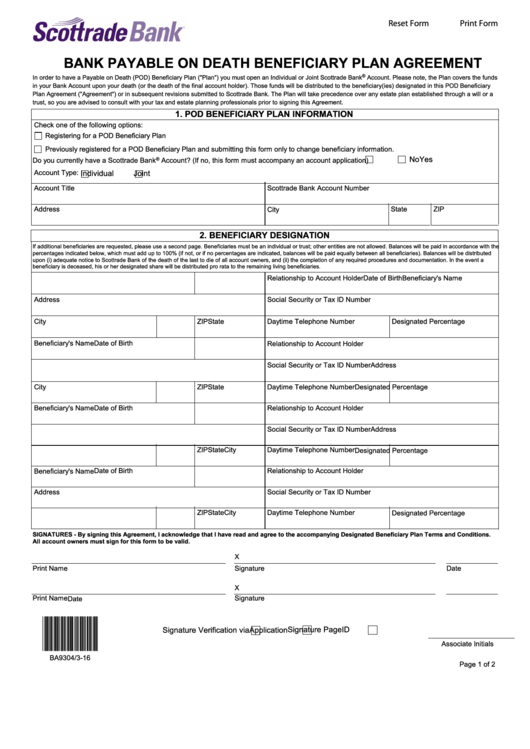

Fillable Bank Payable On Death Beneficiary Plan Agreement Template

To read information, use the down arrow from a form field. Web you are strongly advised to read pages 3 and 4 of the form for important information regarding transfer on death before completing pages 1 and 2 of the form. Payable on death (pod) and deposit trust accounts for. Web i/we request this account be designated as a payable.

Payable on Death (POD) and Transfer on Death (TOD) Accounts

Payable on death (pod) and deposit trust accounts for. Web how to claim the funds after death. Access your business documents instantly. Open the document in the. To collect funds in a pod bank account, all the beneficiary needs to do is go to the bank and present id and a certified copy of the.

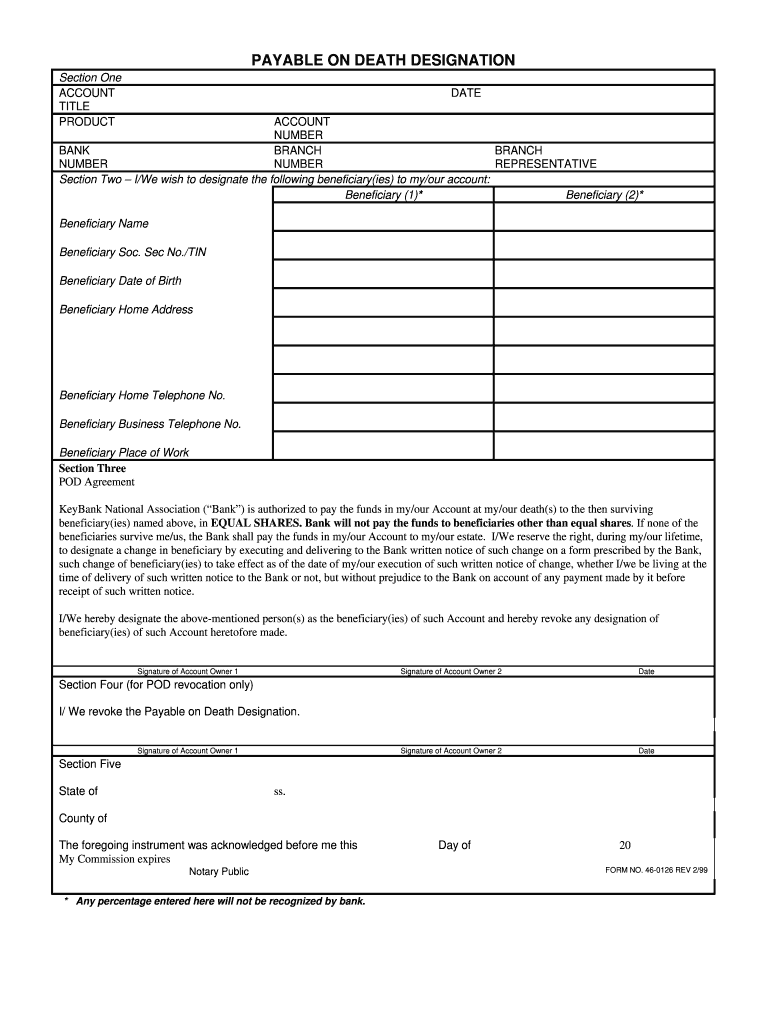

Payable Death Designation Form 19992022 Fill Out and Sign Printable

Open the document in the. Go paperless & try it now! Web the undersigned request(s) the bank to pay over the balance on deposit in the above account to the person named above 30 days after the date of death of the undersigned,. Web what is a payable on death account? Web up to 25% cash back answer:

Payable on Death Accounts Merck Employees Federal Credit Union

The beneficiary or recipient of the funds will. Web new york state law allows you to designate certain types of accounts, including bank checking, savings, and cd, as “payable on death.”. As the owner(s), i/we may change the named beneficiary(ies) at any time by completing and delivering to. Web the undersigned request(s) the bank to pay over the balance on.

Payable on Death (POD) Account What is it and How to Add Beneficiary

Web if the account has a payable on death beneficiary, the bank account balance goes to the beneficiary after the last account owner dies. Payable on death (pod) and deposit trust accounts for. All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit. Web the account owner can.

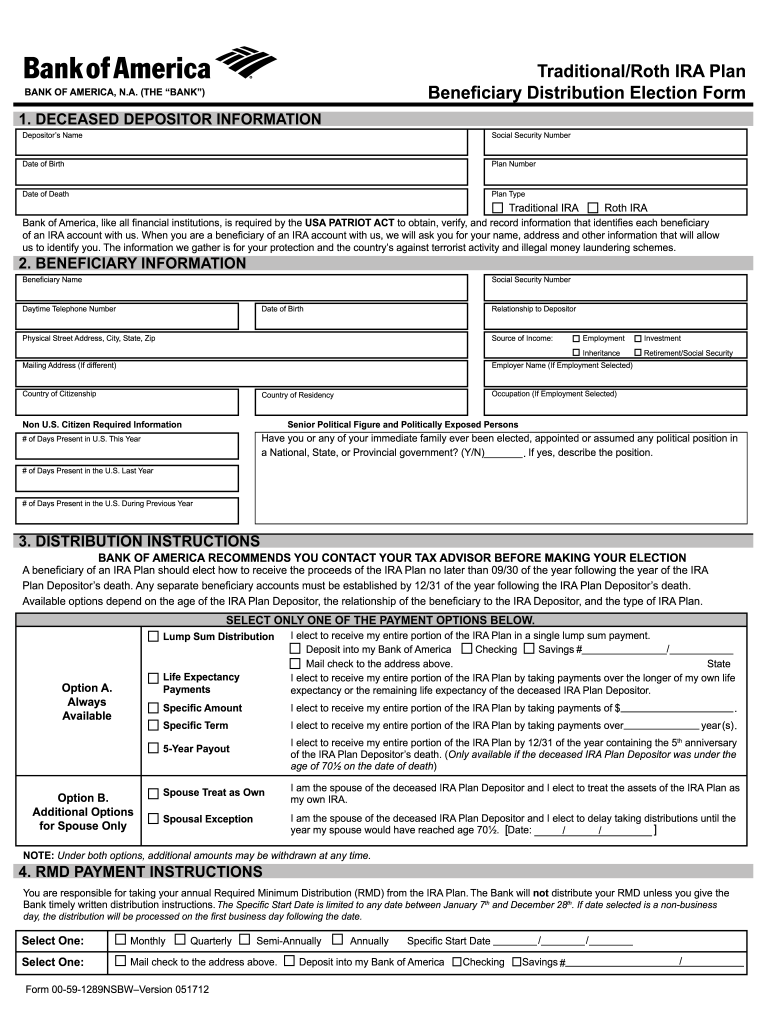

Bank Of America Pod Form Fill Online, Printable, Fillable, Blank

Web follow these simple actions to get payable on death form ready for sending: Go paperless & try it now! All you need to do is properly notify your bank. First, the beneficiary named on a p.o.d. Web this document contains both information and form fields.

Bank Account Form Template Free Printable Word Templates,

Web if the account has a payable on death beneficiary, the bank account balance goes to the beneficiary after the last account owner dies. Web the account owner can access the account while they are still alive, even if the pod arrangement has been made. The hardest part will be finding a bank that is staffed. But the amount in.

To Read Information, Use The Down Arrow From A Form Field.

The beneficiary or recipient of the funds will. Web if the account has a payable on death beneficiary, the bank account balance goes to the beneficiary after the last account owner dies. Open the document in the. As the owner(s), i/we may change the named beneficiary(ies) at any time by completing and delivering to.

Web The Undersigned Request(S) The Bank To Pay Over The Balance On Deposit In The Above Account To The Person Named Above 30 Days After The Date Of Death Of The Undersigned,.

Web up to 25% cash back answer: Web follow these simple actions to get payable on death form ready for sending: Web upon the death of all owners, the account(s) will only be paid to the beneficiaries designated on this form. Go paperless & try it now!

To Collect Funds In A Pod Bank Account, All The Beneficiary Needs To Do Is Go To The Bank And Present Id And A Certified Copy Of The.

Web i/we request this account be designated as a payable on death account. If multiple beneficiaries are designated, funds will be divided. Payable on death (pod) and deposit trust accounts for. Web the account owner can access the account while they are still alive, even if the pod arrangement has been made.

All You Need To Do Is Fill Out A Simple Form, Provided By The Bank, Naming The Person You Want To Inherit.

First, the beneficiary named on a p.o.d. All you need to do is properly notify your bank. Access your business documents instantly. Web payable on death bank accounts.