Pa Disabled Veterans Property Tax Exemption Form

Pa Disabled Veterans Property Tax Exemption Form - Web currently, honorably discharged veterans must be 100% disabled and have a financial need to receive a 100% exemption from property taxes. Web checklist for your real estate tax exempion for disabled veterans applicaion. Web up to 25% cash back disabled veterans. Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption, while those with a disability rating between 30% and 50%. Web disabled veterans’ real estate tax exemption program application for exemption from real property taxes every blank must have an entry or. Web to provide real estate tax exemption for any honorably discharged veteran who is 100% disabled, a resident of the commonwealth and has financial need. Web an act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further providing for duty of. Web what you should know about the pa property tax exemption for disabled veterans if you live in pennsylvania, you can count on property tax exemptions for veterans as a. Web by carissa rawson updated on january 23, 2022 reviewed by doretha clemon fact checked by heather van der hoop in this article what is a property tax. Complete, edit or print tax forms instantly.

Web by carissa rawson updated on january 23, 2022 reviewed by doretha clemon fact checked by heather van der hoop in this article what is a property tax. Web an act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further providing for duty of. Department of veterans affairs disability and wartime service may be exempt from. Web posted on jun 09, 2021. Web what you should know about the pa property tax exemption for disabled veterans if you live in pennsylvania, you can count on property tax exemptions for veterans as a. Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption, while those with a disability rating between 30% and 50%. Web disabled veterans’ real estate tax exemption program application for exemption from real property taxes every blank must have an entry or. Web to provide real estate tax exemption for any honorably discharged veteran who is 100% disabled, a resident of the commonwealth and has financial need. Web currently, honorably discharged veterans must be 100% disabled and have a financial need to receive a 100% exemption from property taxes. Complete, edit or print tax forms instantly.

Department of veterans affairs disability and wartime service may be exempt from. Complete, edit or print tax forms instantly. Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption, while those with a disability rating between 30% and 50%. Explore the qualifications and application process. Web up to 25% cash back disabled veterans. Web the disabled veterans tax exemption provides real estate tax exemption for any honorably discharged veteran who is 100% disabled, is a resident of the. Web what you should know about the pa property tax exemption for disabled veterans if you live in pennsylvania, you can count on property tax exemptions for veterans as a. Web an act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further providing for duty of. If you would like assistance gathering these documents, or have quesions, please call one of our. Web discover the pennsylvania disabled veterans property tax exemption and how it provides financial relief.

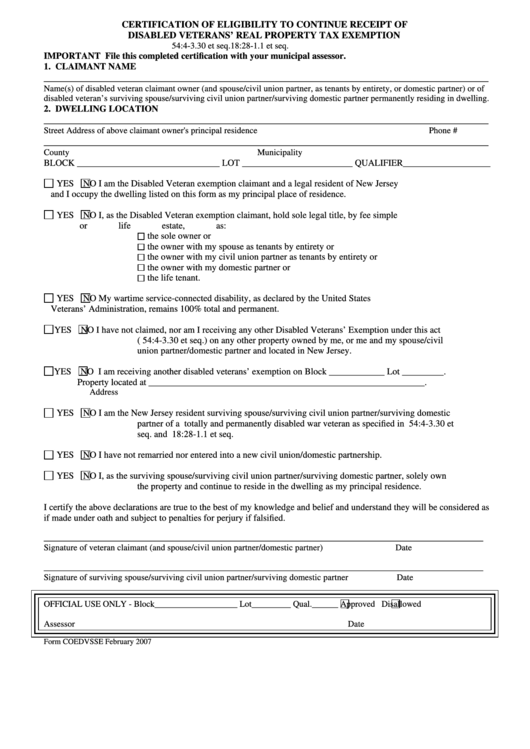

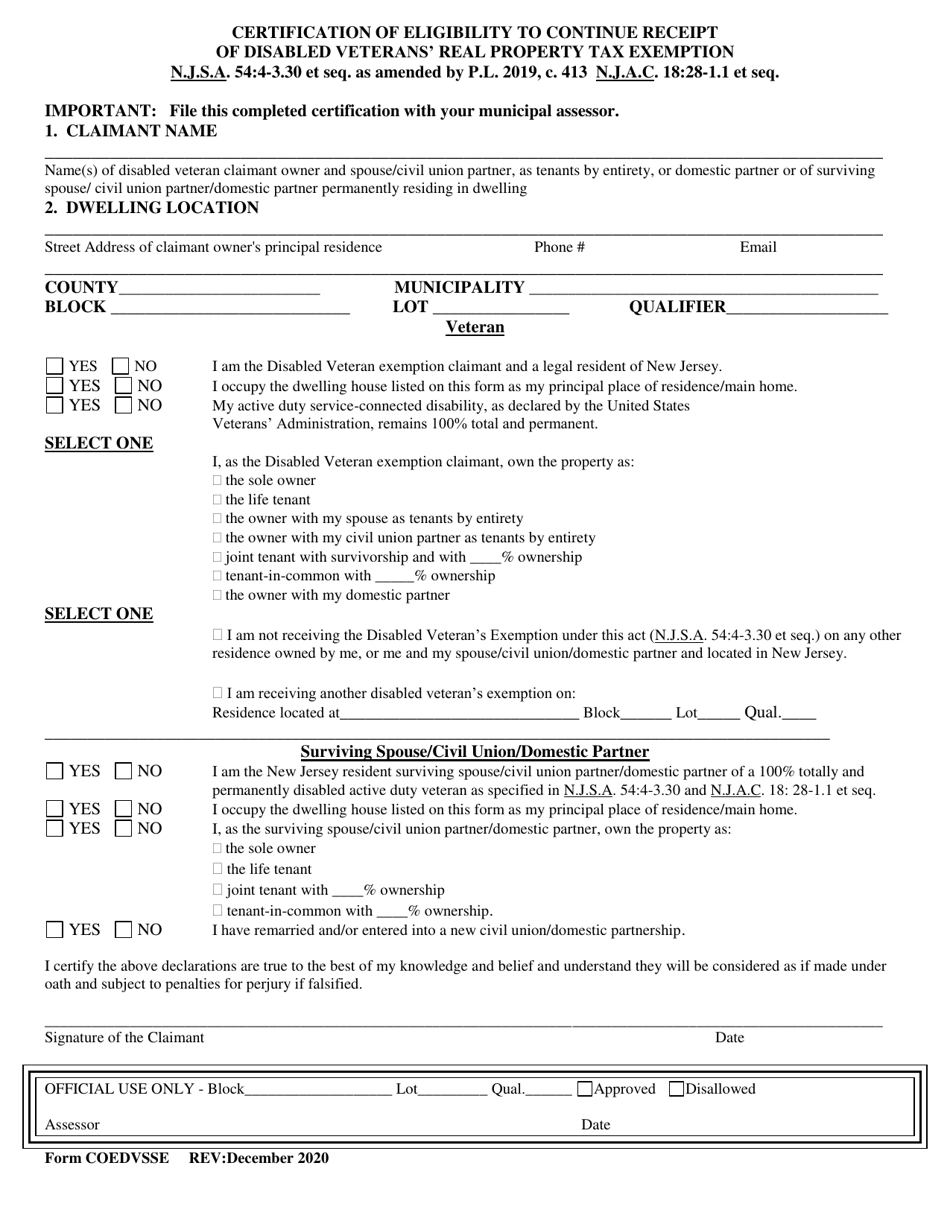

Form COEDVSSE Download Fillable PDF or Fill Online Certification of

Web checklist for your real estate tax exempion for disabled veterans applicaion. Web the disabled veterans tax exemption provides real estate tax exemption for any honorably discharged veteran who is 100% disabled, is a resident of the. Explore the qualifications and application process. Web to provide real estate tax exemption for any honorably discharged veteran who is 100% disabled, a.

Property Tax Exemption for Disabled Veterans Esper Aiello Law Group

Web currently, honorably discharged veterans must be 100% disabled and have a financial need to receive a 100% exemption from property taxes. Explore the qualifications and application process. Web any honorably discharged pennsylvania resident veteran with a 100% u.s. Web posted on jun 09, 2021. Individual income tax return, to correct a previously filed form.

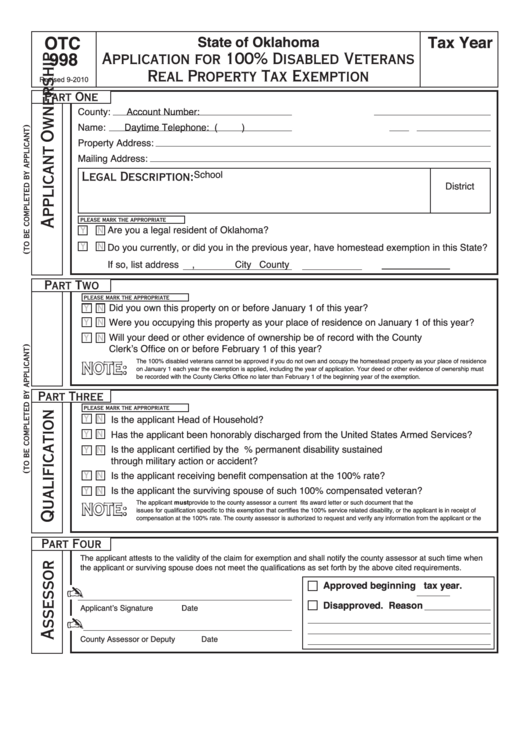

Fillable Form Otc998 Application For 100 Disabled Veterans Real

Web what you should know about the pa property tax exemption for disabled veterans if you live in pennsylvania, you can count on property tax exemptions for veterans as a. Complete, edit or print tax forms instantly. Web any honorably discharged pennsylvania resident veteran with a 100% u.s. Web to provide real estate tax exemption for any honorably discharged veteran.

Disabled veterans property tax exemption, other tax breaks mean 27,288

Web any honorably discharged pennsylvania resident veteran with a 100% u.s. Web the disabled veterans tax exemption provides real estate tax exemption for any honorably discharged veteran who is 100% disabled, is a resident of the. Web posted on jun 09, 2021. If you would like assistance gathering these documents, or have quesions, please call one of our. Complete, edit.

16 States With Full Property Tax Exemption for 100 Disabled Veterans

Web the disabled veterans tax exemption provides real estate tax exemption for any honorably discharged veteran who is 100% disabled, is a resident of the. Web currently, honorably discharged veterans must be 100% disabled and have a financial need to receive a 100% exemption from property taxes. Web discover the pennsylvania disabled veterans property tax exemption and how it provides.

Property Tax Exemption For Disabled Veterans In Colorado WOPROFERTY

Web what you should know about the pa property tax exemption for disabled veterans if you live in pennsylvania, you can count on property tax exemptions for veterans as a. Explore the qualifications and application process. Department of veterans affairs disability and wartime service may be exempt from. Web an act amending title 51 (military affairs) of the pennsylvania consolidated.

Application Real Property Relief Fill Online, Printable, Fillable

Web any honorably discharged pennsylvania resident veteran with a 100% u.s. If you would like assistance gathering these documents, or have quesions, please call one of our. Complete, edit or print tax forms instantly. Web what you should know about the pa property tax exemption for disabled veterans if you live in pennsylvania, you can count on property tax exemptions.

Property Tax Exemption For Disabled Veterans

Web the disabled veterans tax exemption provides real estate tax exemption for any honorably discharged veteran who is 100% disabled, is a resident of the. Web checklist for your real estate tax exempion for disabled veterans applicaion. Web what you should know about the pa property tax exemption for disabled veterans if you live in pennsylvania, you can count on.

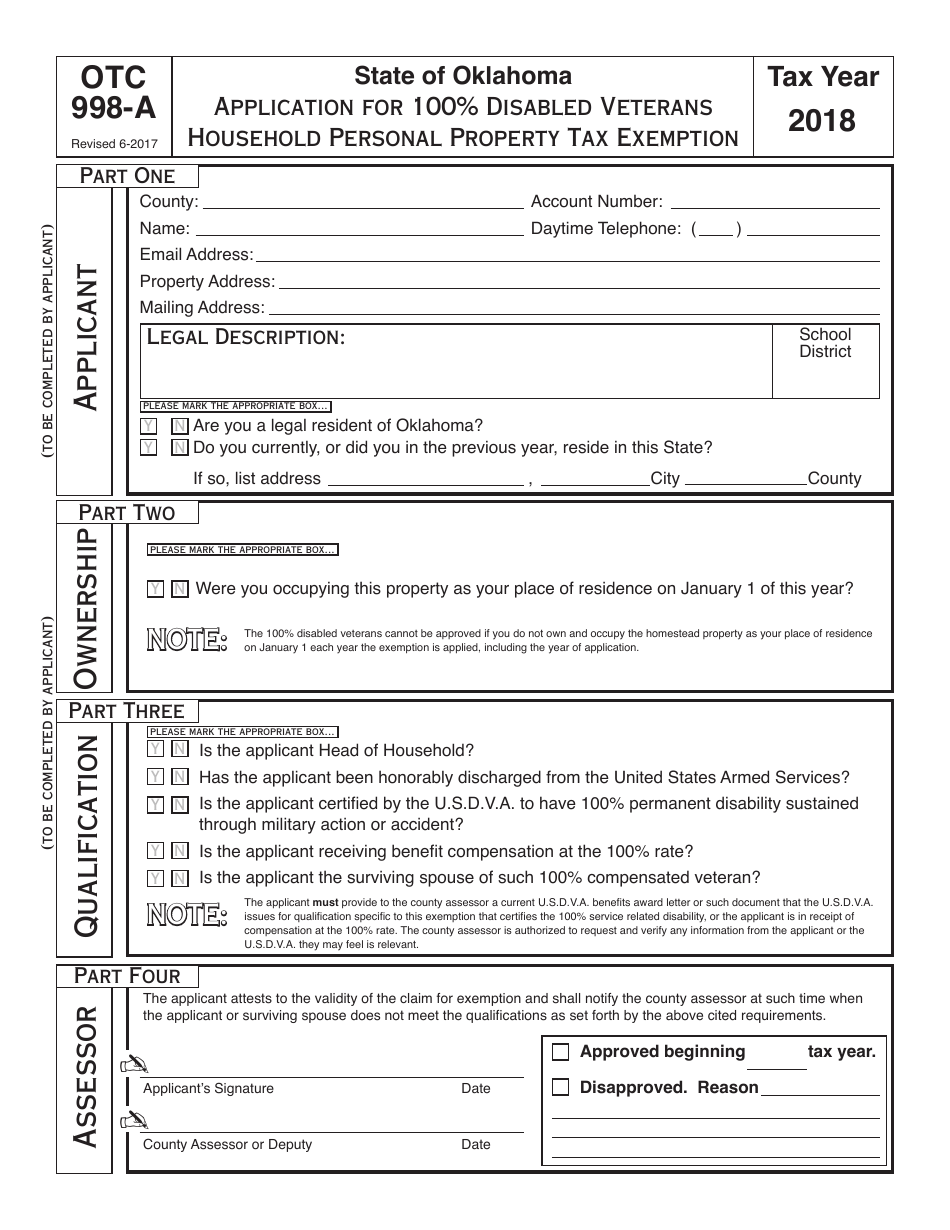

OTC Form 998A Download Fillable PDF or Fill Online Application for 100

Individual income tax return, to correct a previously filed form. Web checklist for your real estate tax exempion for disabled veterans applicaion. Web to provide real estate tax exemption for any honorably discharged veteran who is 100% disabled, a resident of the commonwealth and has financial need. Web discover the pennsylvania disabled veterans property tax exemption and how it provides.

Fillable Form Coedvsse Certification Of Eligibility To Continue

Department of veterans affairs disability and wartime service may be exempt from. Web currently, honorably discharged veterans must be 100% disabled and have a financial need to receive a 100% exemption from property taxes. If you would like assistance gathering these documents, or have quesions, please call one of our. Complete, edit or print tax forms instantly. Web the disabled.

If You Would Like Assistance Gathering These Documents, Or Have Quesions, Please Call One Of Our.

Web posted on jun 09, 2021. Individual income tax return, to correct a previously filed form. Web veterans with a disability rating between 50% and 70% qualify for a $5,000 property tax exemption, while those with a disability rating between 30% and 50%. Complete, edit or print tax forms instantly.

Web To Provide Real Estate Tax Exemption For Any Honorably Discharged Veteran Who Is 100% Disabled, A Resident Of The Commonwealth And Has Financial Need.

Department of veterans affairs disability and wartime service may be exempt from. Web an act amending title 51 (military affairs) of the pennsylvania consolidated statutes, in disabled veterans' real estate tax exemption, further providing for duty of. Web the disabled veterans tax exemption provides real estate tax exemption for any honorably discharged veteran who is 100% disabled, is a resident of the. Explore the qualifications and application process.

Web Currently, Honorably Discharged Veterans Must Be 100% Disabled And Have A Financial Need To Receive A 100% Exemption From Property Taxes.

Web checklist for your real estate tax exempion for disabled veterans applicaion. Web any honorably discharged pennsylvania resident veteran with a 100% u.s. Web by carissa rawson updated on january 23, 2022 reviewed by doretha clemon fact checked by heather van der hoop in this article what is a property tax. Web up to 25% cash back disabled veterans.

Web Disabled Veterans’ Real Estate Tax Exemption Program Application For Exemption From Real Property Taxes Every Blank Must Have An Entry Or.

Web what you should know about the pa property tax exemption for disabled veterans if you live in pennsylvania, you can count on property tax exemptions for veterans as a. Web discover the pennsylvania disabled veterans property tax exemption and how it provides financial relief.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22888637/merlin_101239822.jpg)