Oregon State Tax Return Form

Oregon State Tax Return Form - If amending for an nol, tax year the nol was generated: Select a heading to view its forms, then u se the search. What if i cannot pay my taxes? You can also check refund status through oregon’s. Cookies are required to use this site. Web popular forms & instructions; Individual tax return form 1040 instructions; Web 2022 forms and publications. What happens after i file? Oregon state income tax forms for current and previous tax years.

Taxformfinder has an additional 50 oregon income tax forms that you may need, plus all federal income. Web ireg filing your tax return filing your tax return filing your tax return ( 731.840 retaliatory or corporate excise tax in lieu of certain taxes and assessments; Download and save the form to your computer, then open it in adobe reader to complete and print. The irs and dor will begin. If amending for an nol, tax year the nol was generated: Web your browser appears to have cookies disabled. Cookies are required to use this site. Amount applied from your prior year’s tax refund. Web 2022 forms and publications. Web file now with turbotax related oregon individual income tax forms:

Amount applied from your prior year’s tax refund. Sign into your efile.com account and check acceptance by the irs. Select a heading to view its forms, then u se the search. What happens after i file? Oregon state income tax forms for current and previous tax years. Web if this in reference to the 2017 state refund (received in 2018) and whether it is taxable on your 2018 tax year return, total of all your payments and withholding. Web 2022 forms and publications. Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue. Web popular forms & instructions; Web current forms and publications.

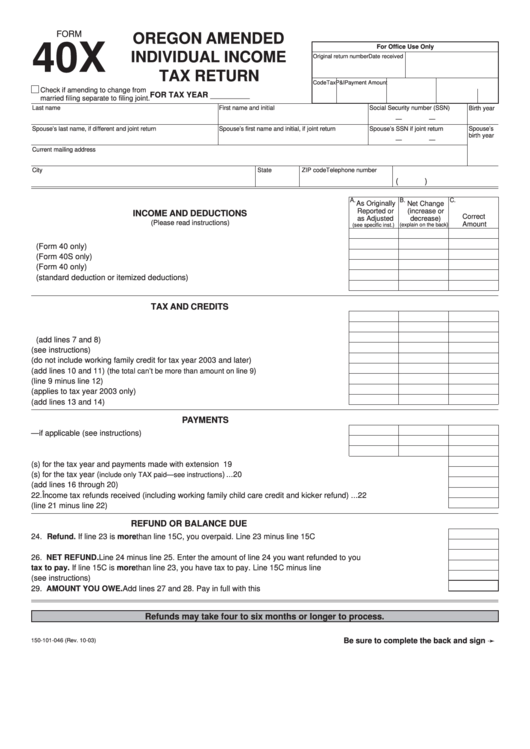

Form 40x Oregon Amended Individual Tax Return printable pdf

Select a heading to view its forms, then u se the search. Oregon state income tax forms for current and previous tax years. What happens after i file? These 2021 forms and more are available: The irs and dor will begin.

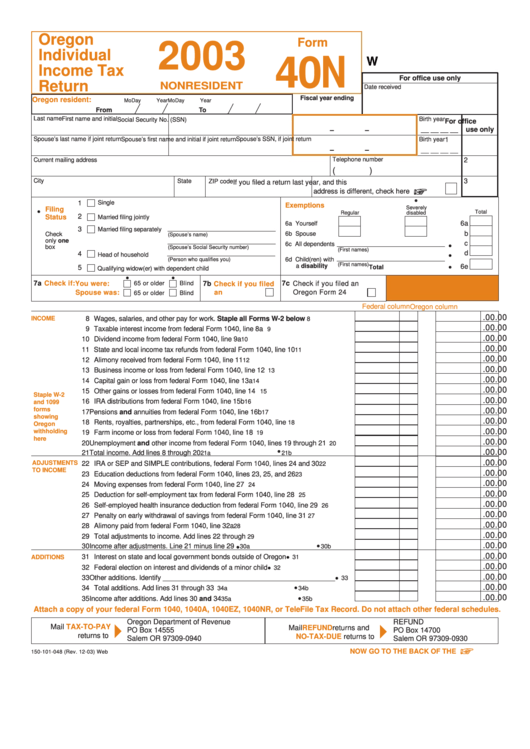

Fillable Form 40n Oregon Individual Tax Return Nonresident

Be sure to verify that the form you are downloading is for the correct year. Amount applied from your prior year’s tax refund. Taxformfinder provides printable pdf copies. Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue. Individual tax return form 1040 instructions;

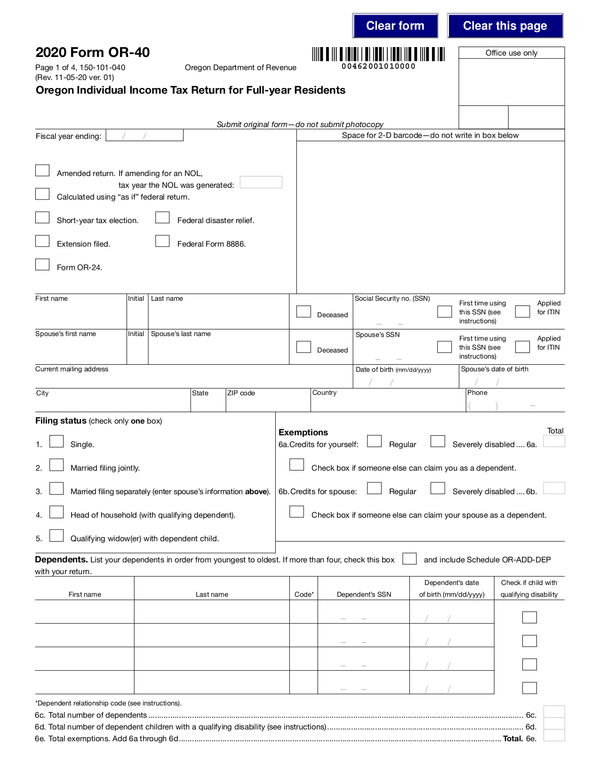

Fill Free fillable forms for the state of Oregon

Select a heading to view its forms, then u se the search. What happens if i am audited? These 2021 forms and more are available: Web if this in reference to the 2017 state refund (received in 2018) and whether it is taxable on your 2018 tax year return, total of all your payments and withholding. Download and save the.

Tax Successes in Oregon 20/20 Tax Resolution

These 2021 forms and more are available: Be sure to verify that the form you are downloading is for the correct year. Web 2022 forms and publications. Download and save the form to your computer, then open it in adobe reader to complete and print. Form 40, form 40s, form 40n, or form 40p refund amount click “next” to view.

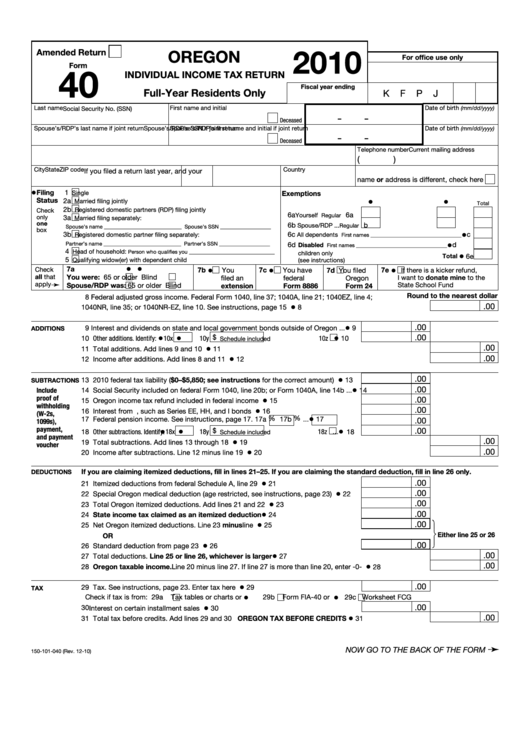

Fillable Form 40 Oregon Individual Tax Return (FullYear

The irs and dor will begin. Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue. Cookies are required to use this site. We don't recommend using your. Blank fields do not qualify.

Oregon state and local taxes rank 16th highest in U.S. as share of

Amount applied from your prior year’s tax refund. Cookies are required to use this site. The irs and dor will begin. Web oregon has a state income tax that ranges between 5% and 9.9% , which is administered by the oregon department of revenue. Blank fields do not qualify.

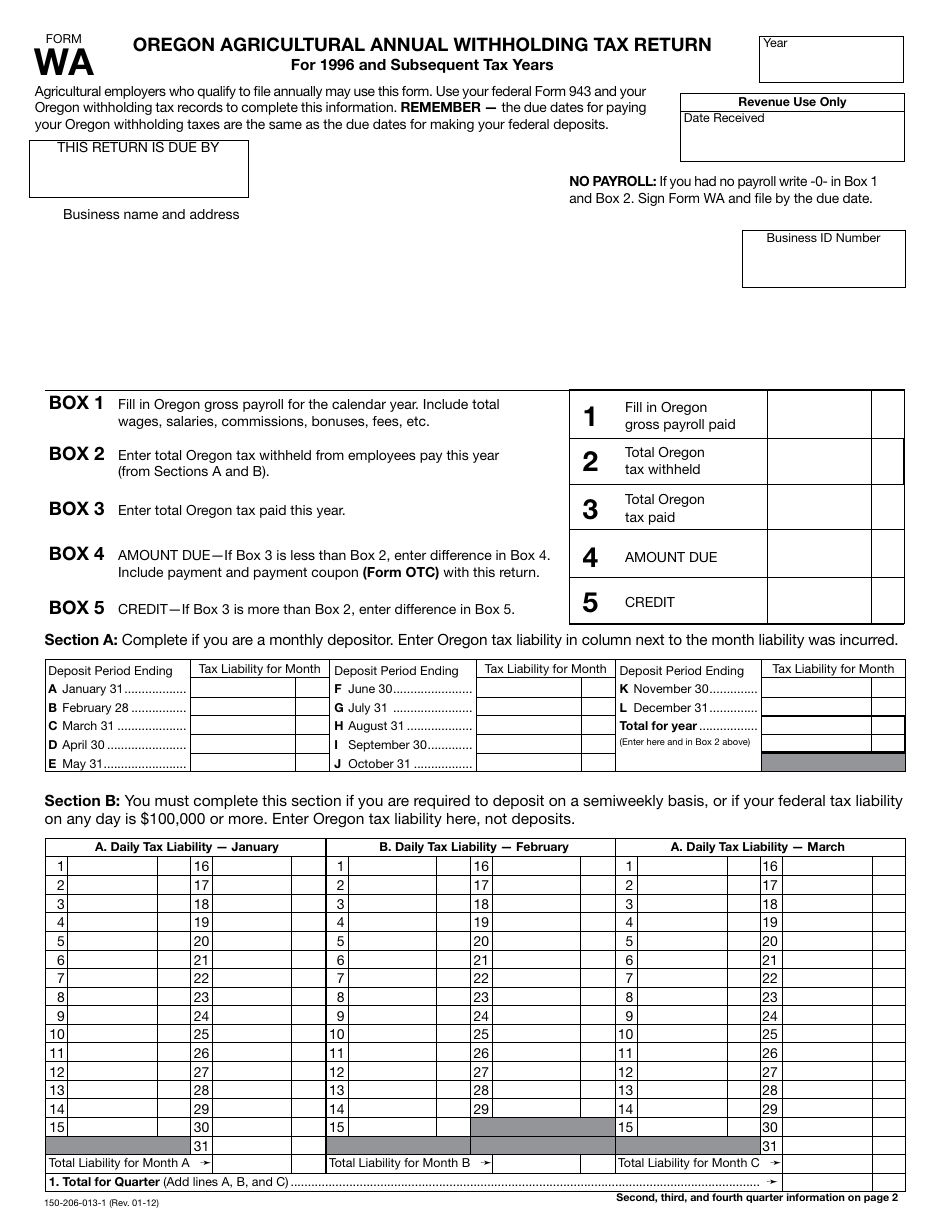

Form WA Download Printable PDF or Fill Online Oregon Agricultural

Amount applied from your prior year’s tax refund. You can also check refund status through oregon’s. Select a heading to view its forms, then u se the search. Web popular forms & instructions; What happens after i file?

1040ez Oregon State Tax Forms Universal Network

Sign into your efile.com account and check acceptance by the irs. What if i cannot pay my taxes? Blank fields do not qualify. We don't recommend using your. What happens if i am audited?

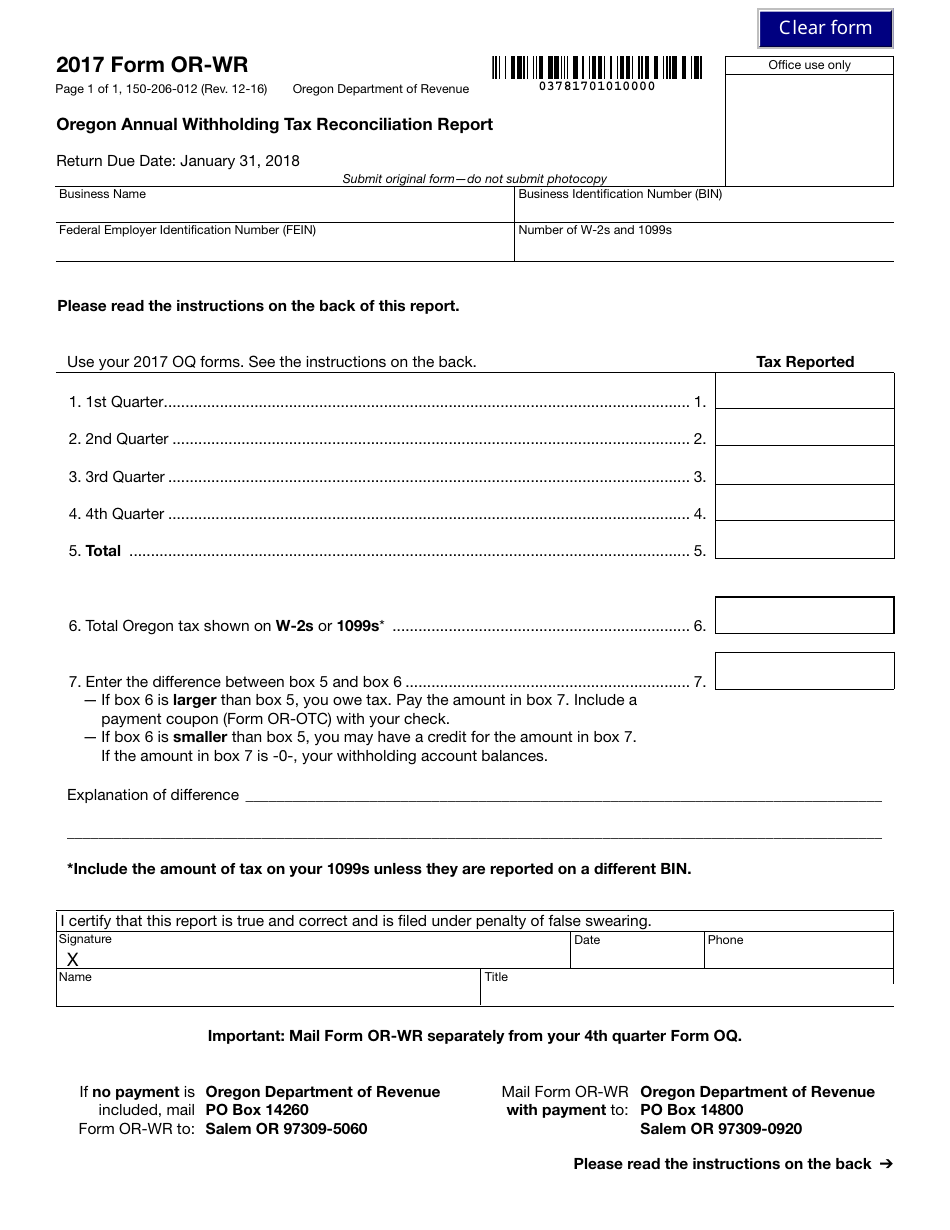

Oregon Annual Withholding Tax Reconciliation Report 2019 20202022

What happens if i am audited? What if i cannot pay my taxes? Web 2022 forms and publications. Web your browser appears to have cookies disabled. Taxformfinder has an additional 50 oregon income tax forms that you may need, plus all federal income.

Select A Heading To View Its Forms, Then U Se The Search.

If amending for an nol, tax year the nol was generated: Amount applied from your prior year’s tax refund. Do not return the form with blank fields; Web popular forms & instructions;

Web Your Browser Appears To Have Cookies Disabled.

Check your irs tax refund status. Web ireg filing your tax return filing your tax return filing your tax return ( 731.840 retaliatory or corporate excise tax in lieu of certain taxes and assessments; What if i cannot pay my taxes? Be sure to verify that the form you are downloading is for the correct year.

We Don't Recommend Using Your.

View all of the current year's forms and publications by popularity or program area. Individual tax return form 1040 instructions; What happens after i file? Download and save the form to your computer, then open it in adobe reader to complete and print.

Web Oregon Has A State Income Tax That Ranges Between 5% And 9.9% , Which Is Administered By The Oregon Department Of Revenue.

Web if this in reference to the 2017 state refund (received in 2018) and whether it is taxable on your 2018 tax year return, total of all your payments and withholding. Web where is my refund? Blank fields do not qualify. The irs and dor will begin.