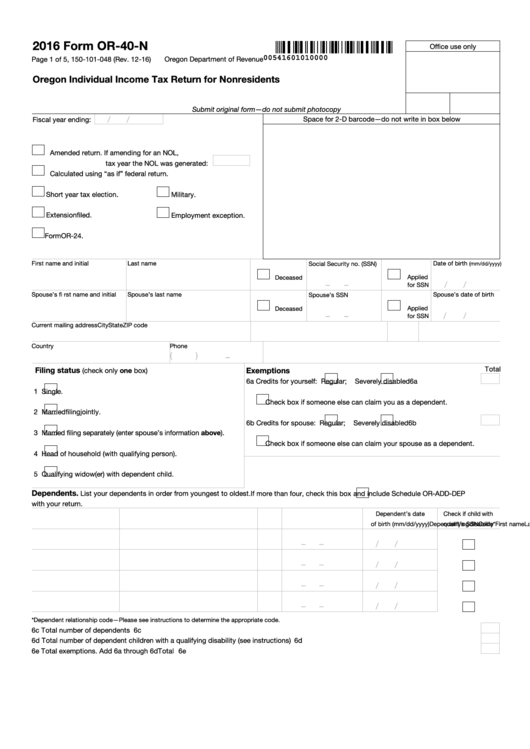

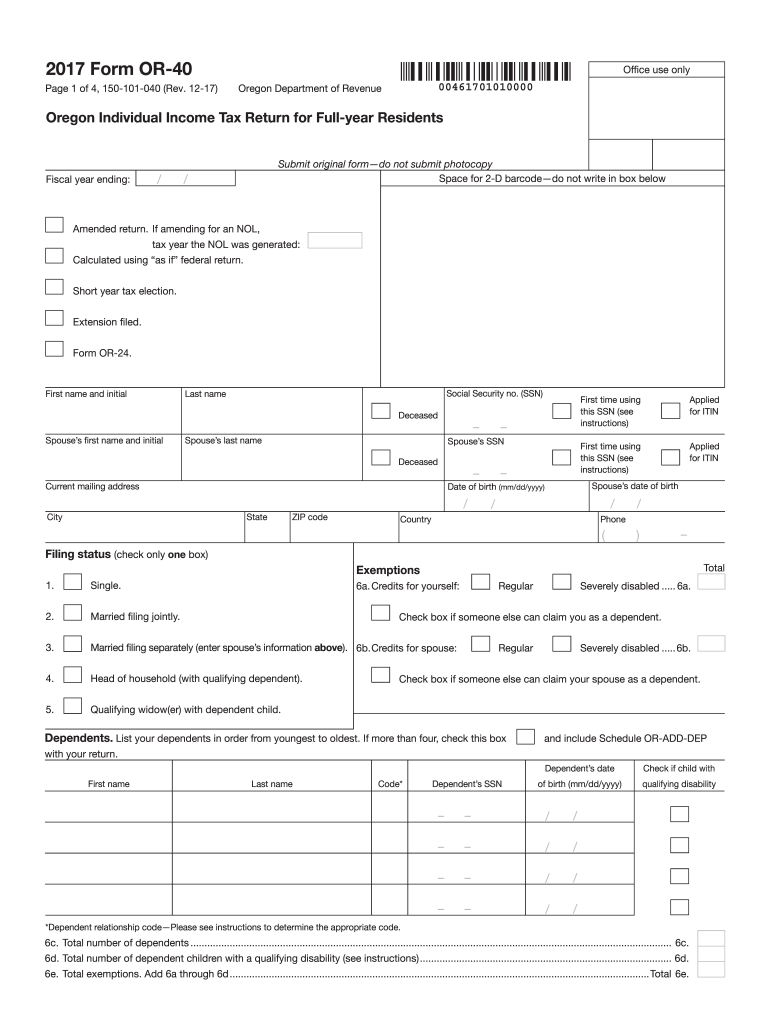

Oregon Form 40 N Instructions

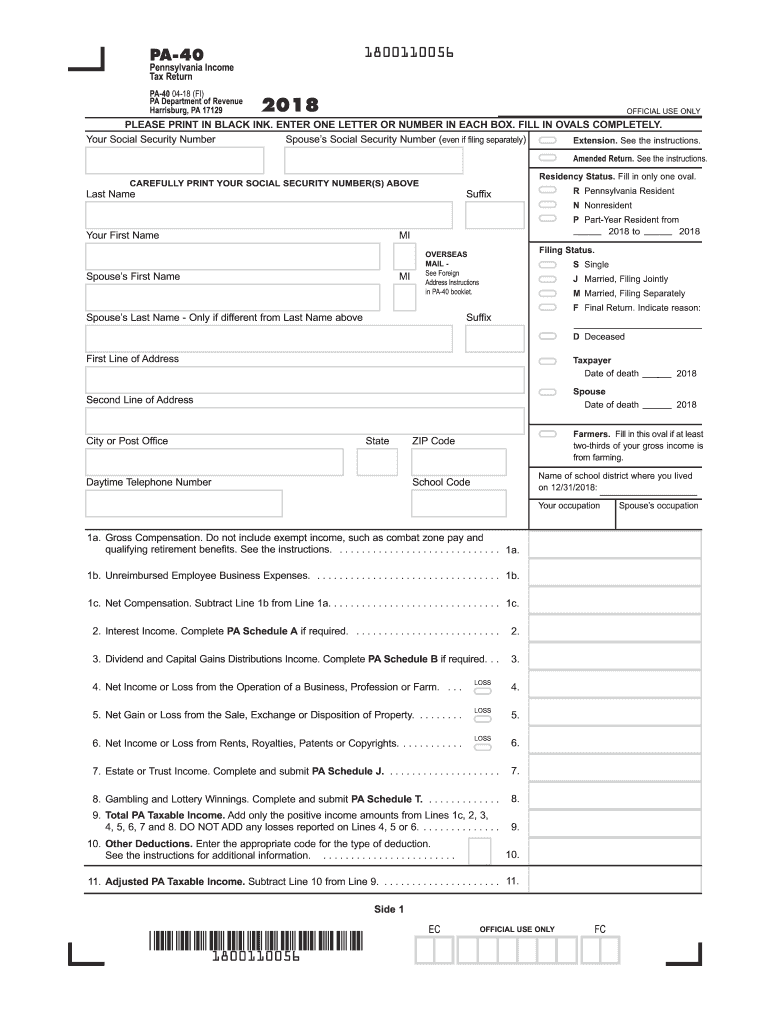

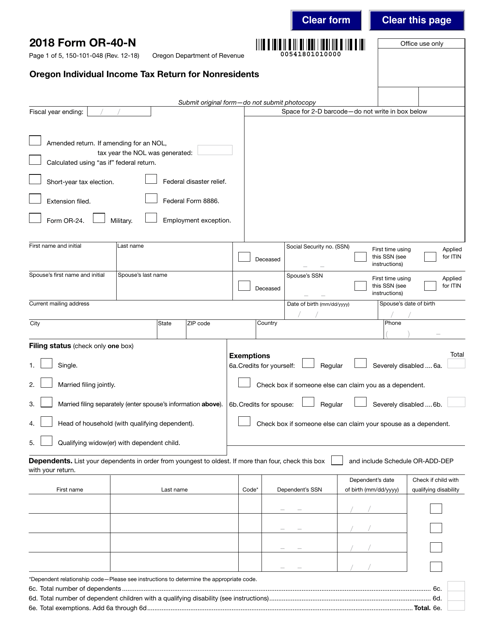

Oregon Form 40 N Instructions - Use blue or black ink. If you choose to file a joint return for oregon, use form 40n. We last updated the nonresident individual income tax return in january 2023, so. Don’t submit photocopies or use. You may need more information. Web • these instructions are not a complete statement of laws and oregon department of revenue rules. Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax. Web 65 or older 17d. Blind standard deductions single married filing jointly married filing separately qualifying surviving spouse head of household $2,420 $4,840 $2,420 or. Web follow the simple instructions below:

To electronically sign a federal. Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax. You may need more information. Don’t submit photocopies or use. Blind standard deductions single married filing jointly married filing separately qualifying surviving spouse head of household $2,420 $4,840 $2,420 or. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Legal, tax, business and other electronic documents require a top level of protection and compliance with the legislation. Web list your dependents in order from youngest to oldest. Don’t use the form or. Use blue or black ink.

To electronically sign a federal. 01) • use uppercase letters. Legal, tax, business and other electronic documents require a top level of protection and compliance with the legislation. Include your payment with this return. Web • these instructions are not a complete statement of laws and oregon department of revenue rules. You may need more information. • use blue or black ink. Web the following tips can help you complete instructions for oregon form 40 easily and quickly: If more than four, check this box with your return. We last updated the nonresident individual income tax return in january 2023, so.

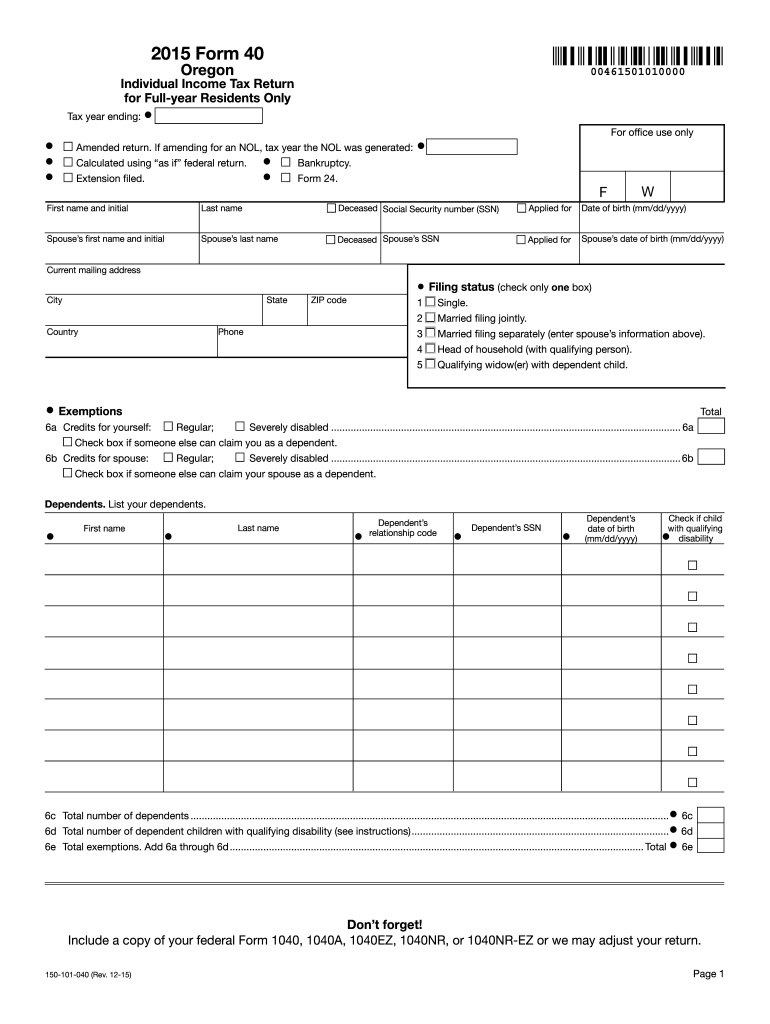

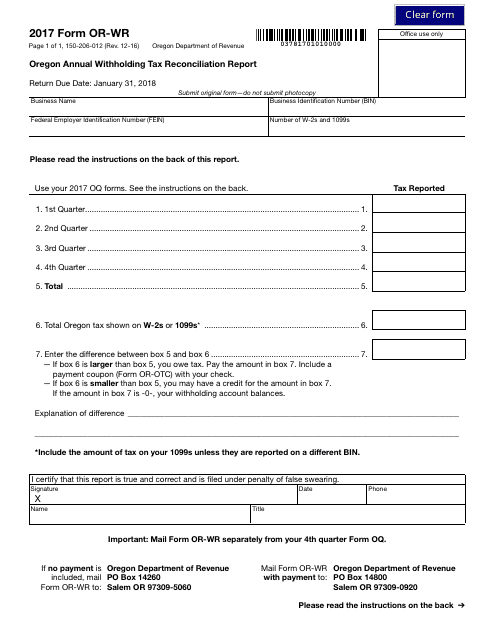

Oregon gov dor forms Fill out & sign online DocHub

Oregon 529 college savings network and able account credits. Does oregon require an e file authorization form? Web follow the simple instructions below: For more information, see “amended. Legal, tax, business and other electronic documents require a top level of protection and compliance with the legislation.

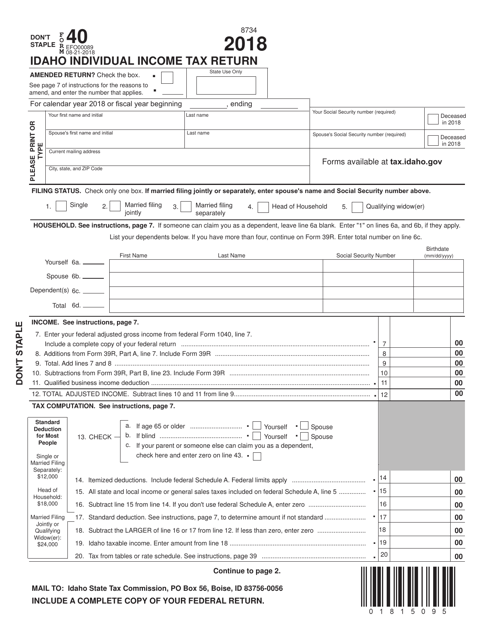

Oregon Form 40 Instructions 2018 slidesharedocs

We last updated the nonresident individual income tax return in january 2023, so. Legal, tax, business and other electronic documents require a top level of protection and compliance with the legislation. For more information, see “amended. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Web • these instructions are not a.

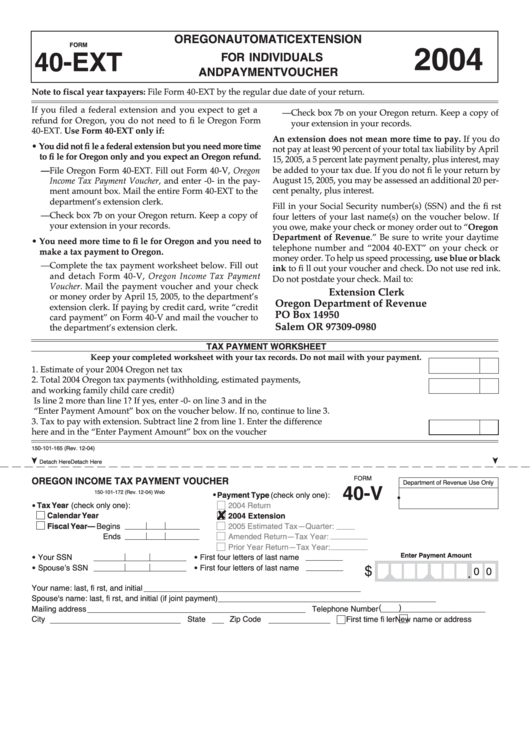

Fillable Form 40Ext Oregon Automatic Extension For Individuals And

You may need more information. We last updated the nonresident individual income tax return in january 2023, so. If more than four, check this box with your return. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Include your payment with this return.

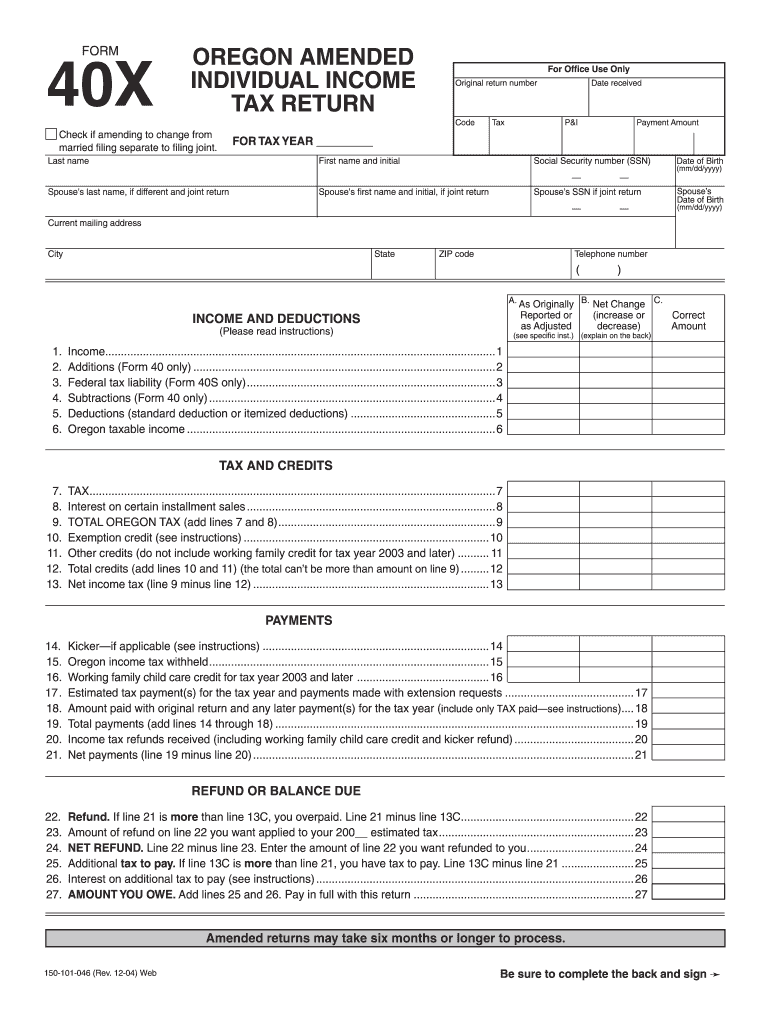

Oregon Form 40X Fill Out and Sign Printable PDF Template signNow

01) • use uppercase letters. Oregon 529 college savings network and able account credits. • print actual size (100%). Does oregon require an e file authorization form? For more information, see “amended.

Top 8 Oregon Form 40 Templates free to download in PDF format

Web there’s a time limit for filing an amended return. If more than four, check this box with your return. Use blue or black ink. You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment. Oregon 529 college savings network and able account credits.

Oregon Form 40 Instructions 2017 slidesharedocs

• print actual size (100%). Include your payment with this return. Web 65 or older 17d. Web there’s a time limit for filing an amended return. Legal, tax, business and other electronic documents require a top level of protection and compliance with the legislation.

Oregon Form 40 Instructions 2018 slidesharedocs

Use blue or black ink. We last updated the nonresident individual income tax return in january 2023, so. • use blue or black ink. • print actual size (100%). You’ll owe interest on any unpaid tax starting april 19, 2023, until the date of your payment.

Oregon 2017 Fill In Form Tax Fill Out and Sign Printable PDF

Web follow the simple instructions below: • print actual size (100%). Web 65 or older 17d. Web there’s a time limit for filing an amended return. Web the following tips can help you complete instructions for oregon form 40 easily and quickly:

Oregon Form 40 Instructions 2018 slidesharedocs

Web use this instruction booklet to help you fill out and file your voucher/s. Web the following tips can help you complete instructions for oregon form 40 easily and quickly: Does oregon require an e file authorization form? Don’t submit photocopies or use. If more than four, check this box with your return.

Oregon form 40 v Fill out & sign online DocHub

We last updated the nonresident individual income tax return in january 2023, so. For more information, see “amended. Web the following tips can help you complete instructions for oregon form 40 easily and quickly: Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax. Use blue or black ink.

Web Use This Instruction Booklet To Help You Fill Out And File Your Voucher/S.

01) • use uppercase letters. If you choose to file a joint return for oregon, use form 40n. You may need more information. Web follow the simple instructions below:

Web List Your Dependents In Order From Youngest To Oldest.

Don’t use the form or. To electronically sign a federal. We last updated the nonresident individual income tax return in january 2023, so. Oregon.gov/dor • april 18, 2022 is the due date for filing your return and paying your tax.

You’ll Owe Interest On Any Unpaid Tax Starting April 19, 2023, Until The Date Of Your Payment.

• print actual size (100%). Web 65 or older 17d. If more than four, check this box with your return. For more information, see “amended.

Don’t Submit Photocopies Or Use.

Web form 40n requires you to list multiple forms of income, such as wages, interest, or alimony. Include your payment with this return. Blind standard deductions single married filing jointly married filing separately qualifying surviving spouse head of household $2,420 $4,840 $2,420 or. Web • these instructions are not a complete statement of laws and oregon department of revenue rules.