Oregon Form 40 Instructions 2021

Oregon Form 40 Instructions 2021 - Complete the table in section 2 with the code and amount reported for each. Web current forms and publications. Web 2021 personal income tax returns general portland/multnomah county business tax forms business income tax extension forms 2022 business income tax returns 2021. View all of the current year's forms and publications by popularity or program area. Form 40 can be efiled, or a paper copy can be filed via mail. Web 2021 forms and publications. Oregon individual income tax return for full as 5 stars rate www oregon govform or. Web form 40 is the general income tax return for oregon residents. Oregon.gov/dor july 15, 2020is the due date for filing your return and paying your tax due. This form is for income earned in tax year 2022, with tax.

Web federal tax law oregon is tied to the federal definition of taxable income, with two exceptions: View all of the current year's forms and publications by popularity or program area. Web send out signed oregon state tax forms 2021 or print it rate the oregon state tax forms 2022 4.8 satisfied 66 votes what makes the oregon form 40 legally binding? Web 2021 forms and publications. Web form 40 is the general income tax return for oregon residents. Part time resident tax form. Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. File electronically—it’s fast, easy, and secure. Internal revenue code (irc) section 139a for federal subsidies for. Oregon individual income tax return for full as 5 stars rate www oregon govform or.

Web 2021 forms and publications. Download and save the form to your computer, then open it in adobe reader to complete and print. Internal revenue code (irc) section 139a for federal subsidies for. Part time resident tax form. Complete the table in section 2 with the code and amount reported for each. Web send out signed oregon state tax forms 2021 or print it rate the oregon state tax forms 2022 4.8 satisfied 66 votes what makes the oregon form 40 legally binding? File electronically—it’s fast, easy, and secure. Web use a form 3840 2021 template to make your document workflow more streamlined. Select a heading to view its forms, then u se the search. Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box.

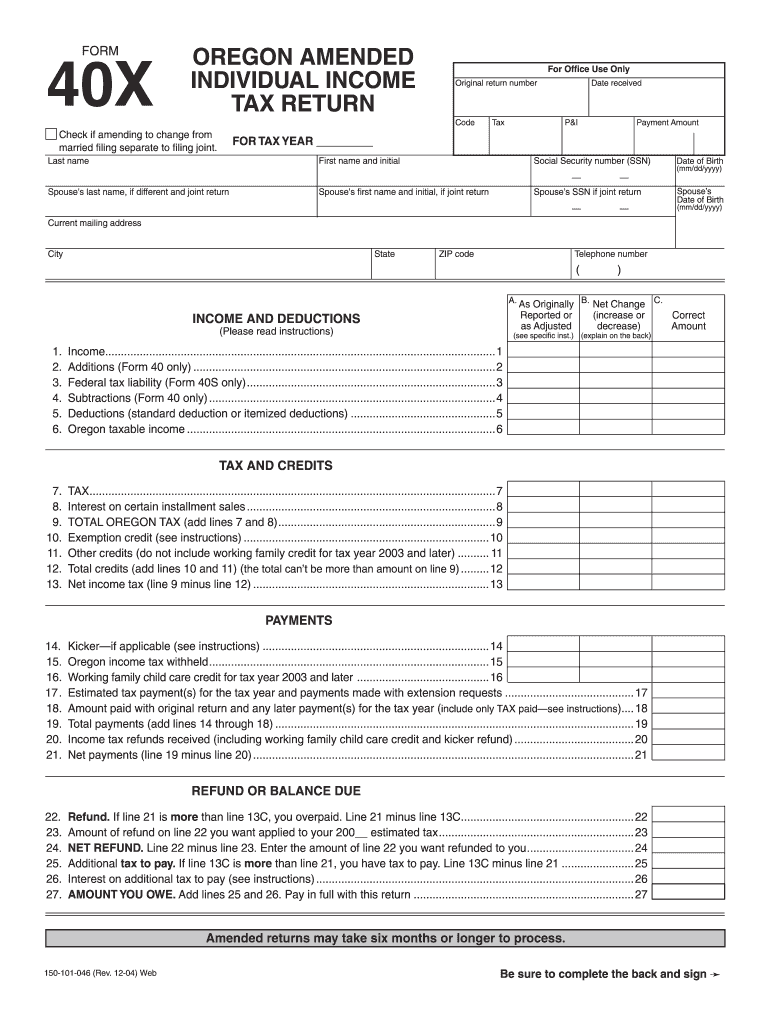

Oregon Form 40X Fill Out and Sign Printable PDF Template signNow

View all of the current year's forms and publications by popularity or program area. Web 2021 personal income tax returns general portland/multnomah county business tax forms business income tax extension forms 2022 business income tax returns 2021. Download and save the form to your computer, then open it in adobe reader to complete and print. We last updated the resident.

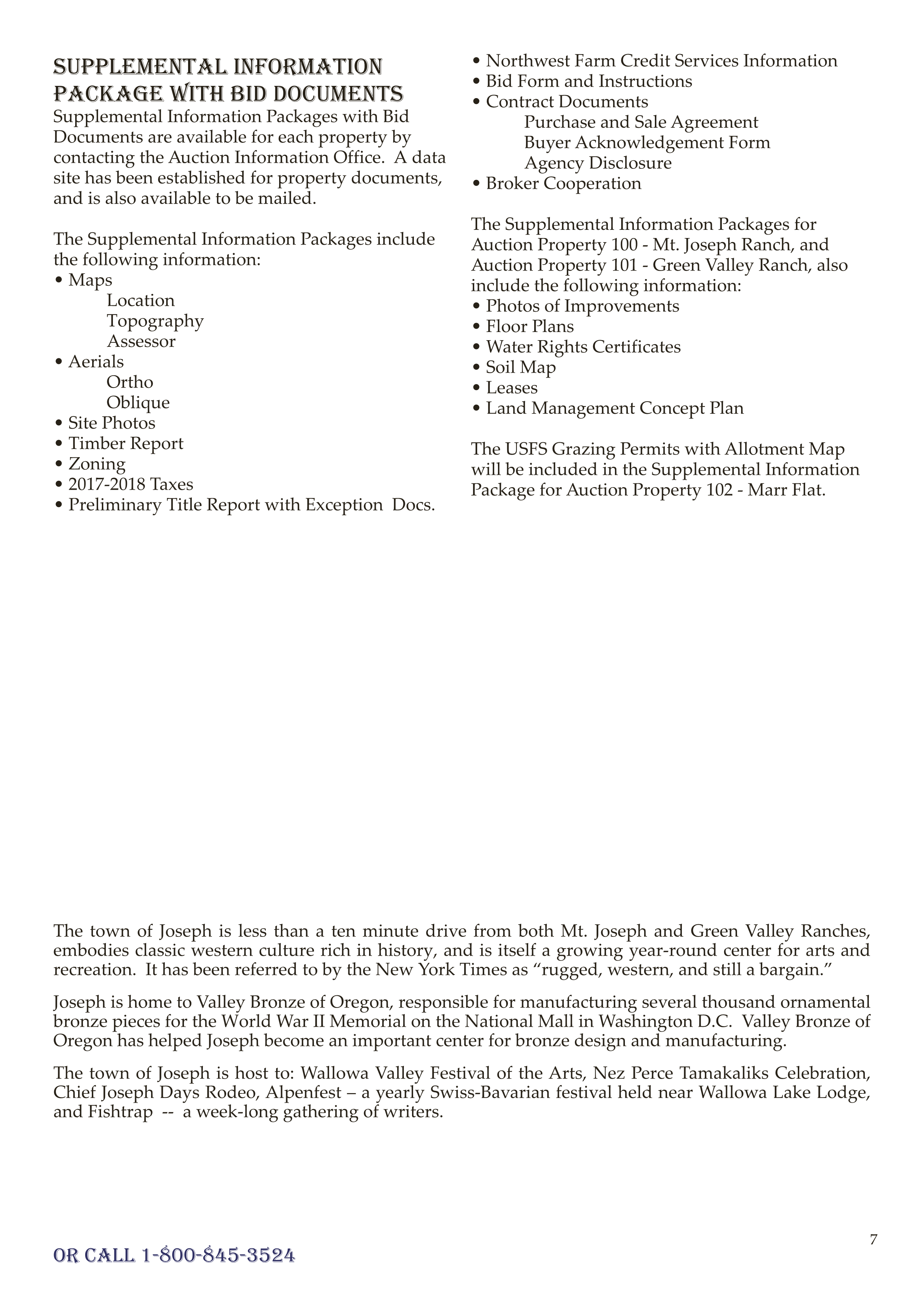

40 Instructions Form Fill Online, Printable, Fillable, Blank pdfFiller

Download and save the form to your computer, then open it in adobe reader to complete and print. We last updated the resident individual income tax. Oregon.gov/dor july 15, 2020is the due date for filing your return and paying your tax due. Web it appears you don't have a pdf plugin for this browser. Part time resident tax form.

Oregon Form 40 Instructions 2018 slidesharedocs

Estimated tax payments must be sent. File electronically—it’s fast, easy, and secure. Web use a form 3840 2021 template to make your document workflow more streamlined. Web send out signed oregon state tax forms 2021 or print it rate the oregon state tax forms 2022 4.8 satisfied 66 votes what makes the oregon form 40 legally binding? • itemize your.

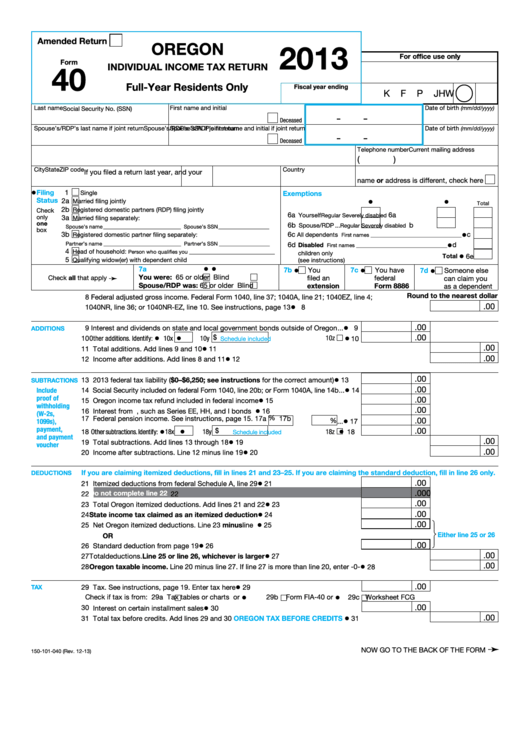

Fillable Form 40 Oregon Individual Tax Return 2013 printable

Web send out signed oregon state tax forms 2021 or print it rate the oregon state tax forms 2022 4.8 satisfied 66 votes what makes the oregon form 40 legally binding? Web current forms and publications. Internal revenue code (irc) section 139a for federal subsidies for. View all of the current year's forms and publications by popularity or program area..

Oregon form 40 v Fill out & sign online DocHub

Web send out signed oregon state tax forms 2021 or print it rate the oregon state tax forms 2022 4.8 satisfied 66 votes what makes the oregon form 40 legally binding? Web it appears you don't have a pdf plugin for this browser. Download and save the form to your computer, then open it in adobe reader to complete and.

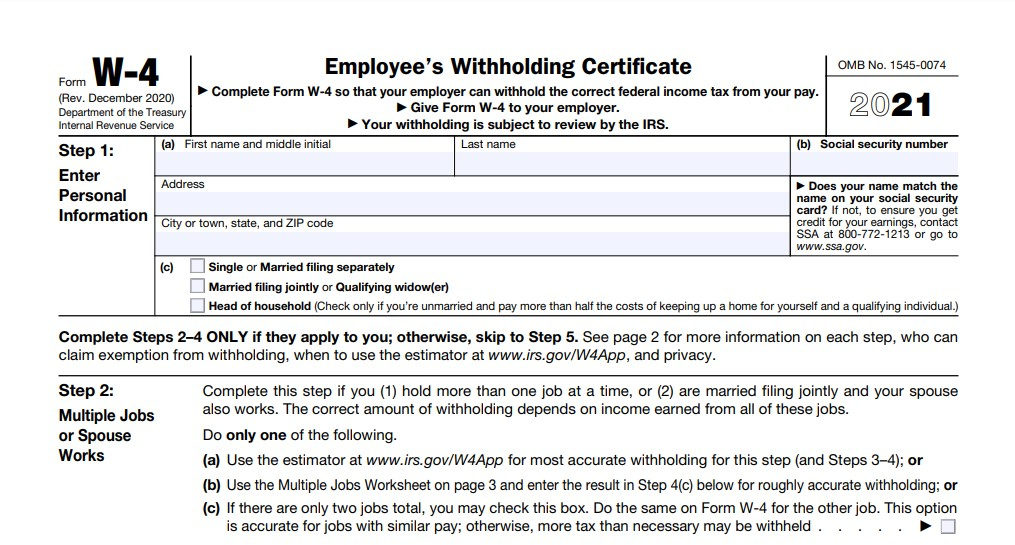

Oregon 2021 W 4 Form Printable 2022 W4 Form

Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. We last updated the resident individual income tax. Web current forms and publications. Oregon.gov/dor july 15, 2020is the due date for filing your return and paying your tax due. Web 2021 personal income tax returns general portland/multnomah county business tax.

Oregon Form 40 2021 Printable Printable Form 2022

We last updated the resident individual income tax. Internal revenue code (irc) section 139a for federal subsidies for. Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. Web send out signed oregon state tax forms 2021 or print it rate the oregon state tax forms 2022 4.8 satisfied 66.

2015 Form OR DoR 41 Fill Online, Printable, Fillable, Blank pdfFiller

Web use a form 3840 2021 template to make your document workflow more streamlined. Part time resident tax form. Web 2021 forms and publications. Web current forms and publications. Web it appears you don't have a pdf plugin for this browser.

2021 PA Form PA40 ES (I) Fill Online, Printable, Fillable, Blank

Form 40 can be efiled, or a paper copy can be filed via mail. Web federal tax law oregon is tied to the federal definition of taxable income, with two exceptions: Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. Web current forms and publications. Internal revenue code (irc).

Filliable 2013 Oregon Form 40 Fill and Sign Printable Template Online

Fill in the total of all additions. Web use a form 3840 2021 template to make your document workflow more streamlined. Download and save the form to your computer, then open it in adobe reader to complete and print. Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. •.

File Electronically—It’s Fast, Easy, And Secure.

Web 2021 forms and publications. Enter the payment amount from line 3 of the tax payment worksheet, and check the “original return” payment type box. Part time resident tax form. Fill in the total of all additions.

Web Form 40 Is The General Income Tax Return For Oregon Residents.

Internal revenue code (irc) section 139a for federal subsidies for. Download and save the form to your computer, then open it in adobe reader to complete and print. Select a heading to view its forms, then u se the search. Form 40 can be efiled, or a paper copy can be filed via mail.

Web Current Forms And Publications.

View all of the current year's forms and publications by popularity or program area. Estimated tax payments must be sent. • itemize your oregon deductions or. Web use a form 3840 2021 template to make your document workflow more streamlined.

Oregon Individual Income Tax Return For Full As 5 Stars Rate Www Oregon Govform Or.

This form is for income earned in tax year 2022, with tax. Web individual estimated income tax return you must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. We last updated the resident individual income tax. Complete the table in section 2 with the code and amount reported for each.