Ohio Form 4738

Ohio Form 4738 - If the amount on a line is. Ohio does list lacert as an approved vendor to. Section 4738.021 | collection of. The tos no longer requires pte and fiduciary filers to. Web the ohio department of taxation jan. The due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Web ohio department of natural resources This is effective for years. Web this january, when filing for 2022, ohio entities may now elect to file using form it 4738, which was established in june 2022 via ohio senate bill 246 (s.b. Web payment due dates are october 15, 2022, and january 15, 2023.

For taxable year 2022, the due date for filing is april 18,. Web the ohio department of taxation jan. Web payment due dates are october 15, 2022, and january 15, 2023. Web election is made known to the department by filing the it 4738. The due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Section 4738.021 | collection of. If the amount on a line is. When you file the it 4738, there will be a line in schedule i of the return (page 2, line 12) to notify the department. Web ohio department of natural resources Leave the state use field.

Ohio does list lacert as an approved vendor to. Section 4738.021 | collection of. The tos no longer requires pte and fiduciary filers to. Web the ohio society of cpas is offering a cpe webinar on thursday, march 9 at noon to cover the new it 4738 form. The due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Web the ohio department of taxation jan. This is effective for years. Here’s how you know language translation. Matt dodovich, an attorney supervisor in the. 02/28/2023 all transferred payments carry to it 4738, line 12 with a supporting statement.

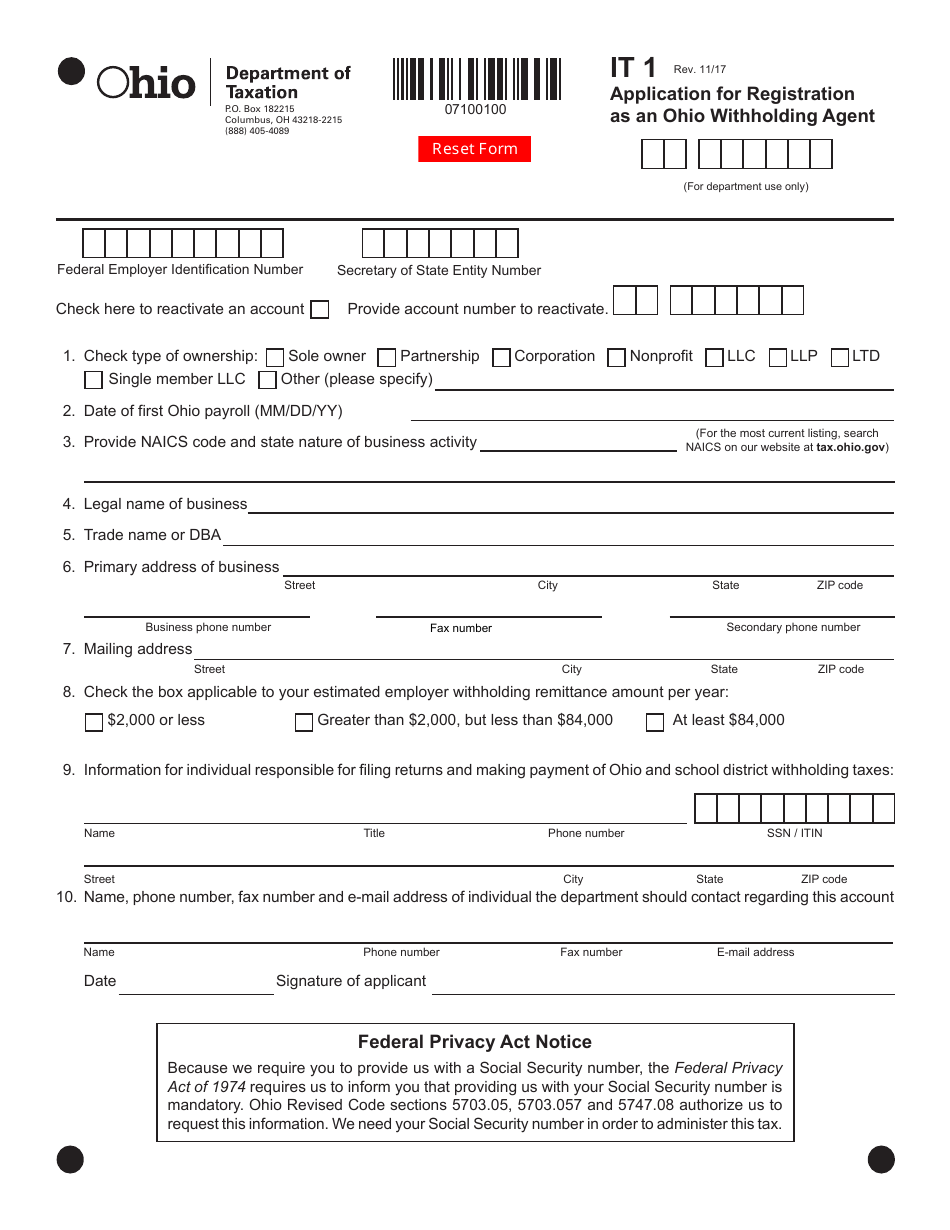

Ohio Withholding Business Registration Subisness

Ohio does list lacert as an approved vendor to. Web this january, when filing for 2022, ohio entities may now elect to file using form it 4738, which was established in june 2022 via ohio senate bill 246 (s.b. When you file the it 4738, there will be a line in schedule i of the return (page 2, line 12).

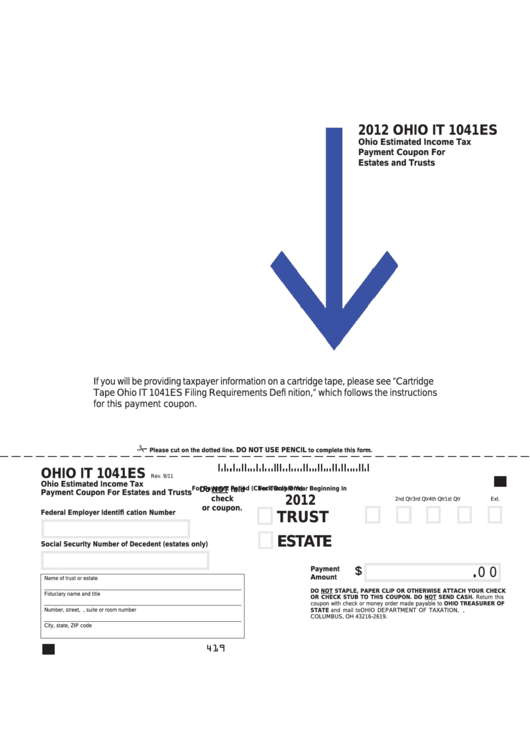

Fillable Ohio Form It 1041es Ohio Estimated Tax Payment Coupon

Ohio does list lacert as an approved vendor to. Web here’s how you know. Web ohio form 4738 is a new ohio entity tax return and it would be great to be able to e file this return thru the software. Web section section 4738.01 | motor vehicle salvage definitions. For taxable year 2022, the due date for filing is.

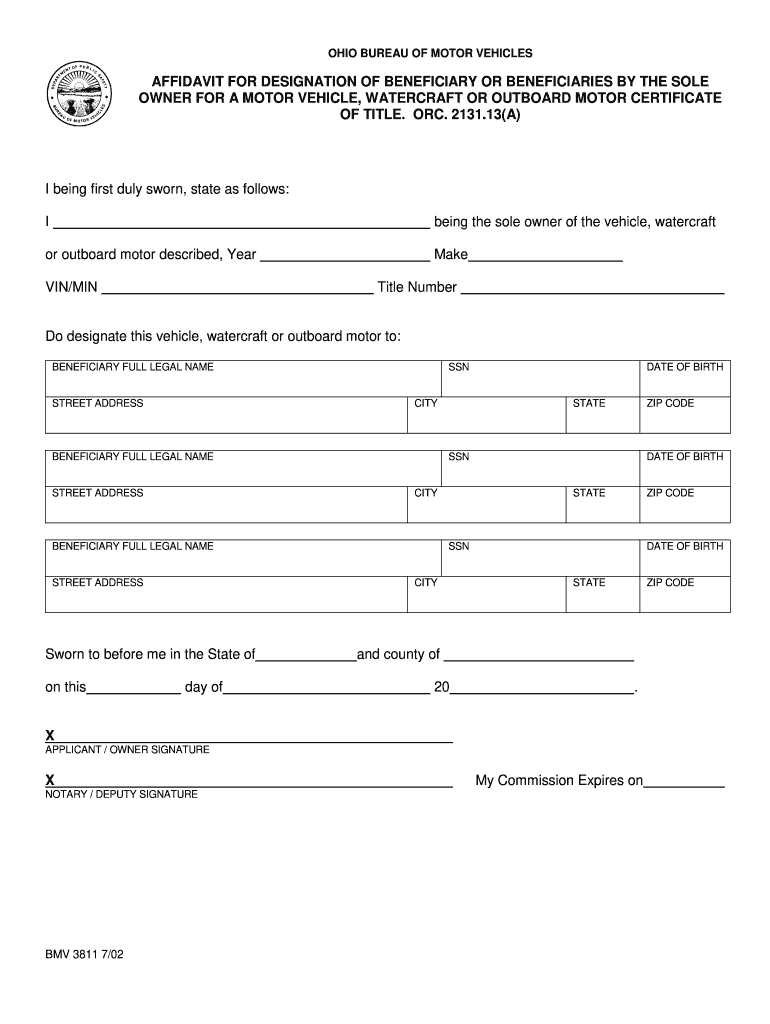

Ohio Title Search Fill and Sign Printable Template Online US Legal

Web the ohio society of cpas is offering a cpe webinar on thursday, march 9 at noon to cover the new it 4738 form. Web section section 4738.01 | motor vehicle salvage definitions. Ohio does list lacert as an approved vendor to. 02/28/2023 all transferred payments carry to it 4738, line 12 with a supporting statement. Matt dodovich, an attorney.

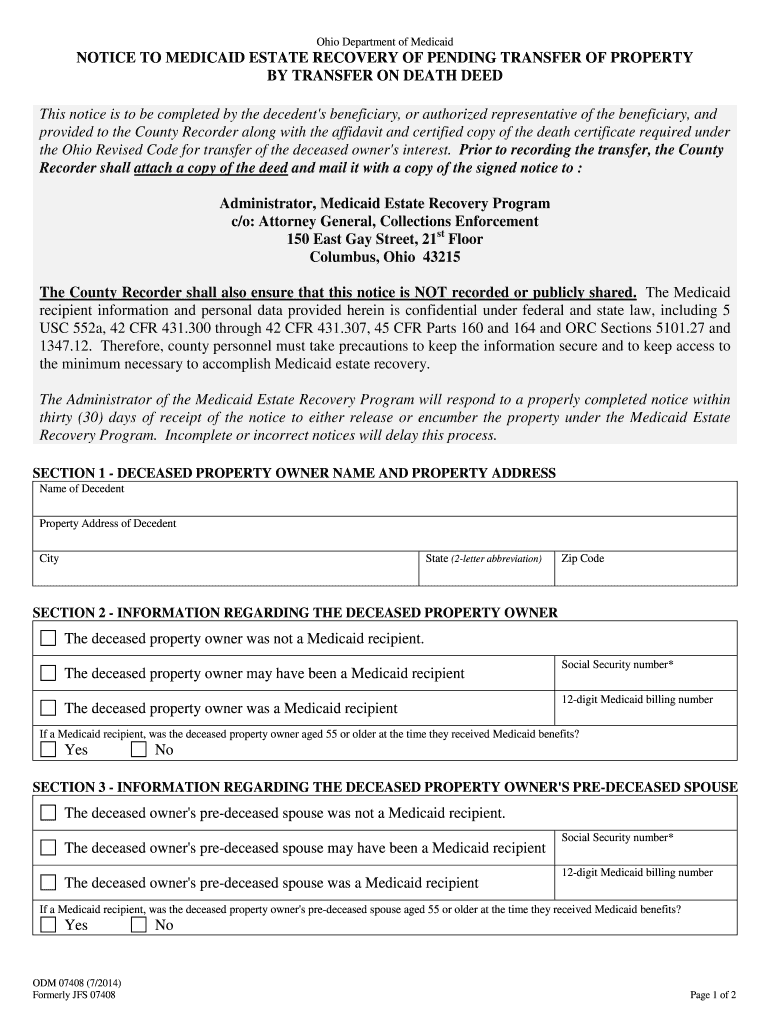

Ohio Form Medicaid Fill Out and Sign Printable PDF Template signNow

Web election is made known to the department by filing the it 4738. Tax rate is 5% for the taxable year beginning january 1, 2022, and for taxable years beginning january 1,. Web ohio form 4738 is a new ohio entity tax return and it would be great to be able to e file this return thru the software. Section.

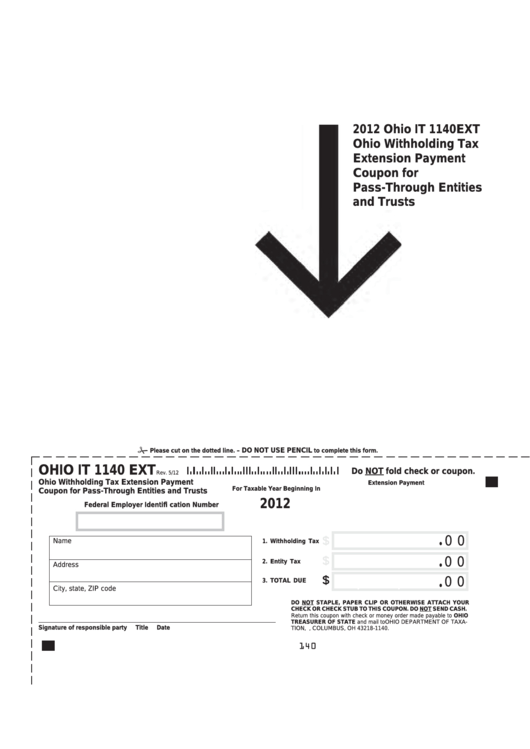

Fillable Ohio Form It 1140 Ext Ohio Withholding Tax Extension Payment

Web ohio department of natural resources The due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Web ohio pte 2022 return information last modified: Web section section 4738.01 | motor vehicle salvage definitions. When you file the it 4738, there will be a line in schedule i of the.

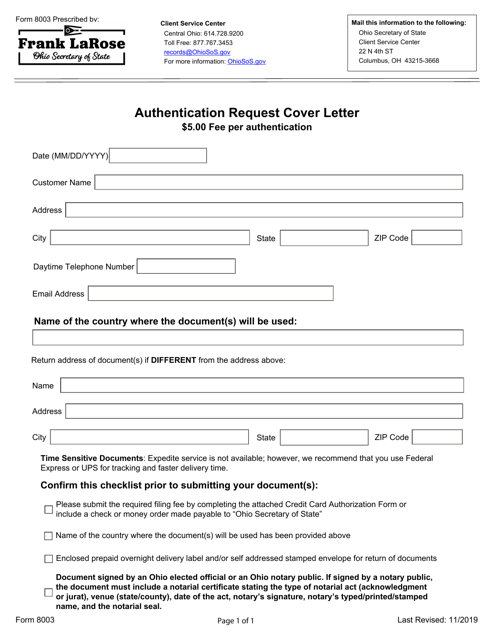

Form 8003 Download Fillable PDF or Fill Online Authentication Request

The tos no longer requires pte and fiduciary filers to. If the amount on a line is. Ohio does list lacert as an approved vendor to. Leave the state use field. Tax rate is 5% for the taxable year beginning january 1, 2022, and for taxable years beginning january 1,.

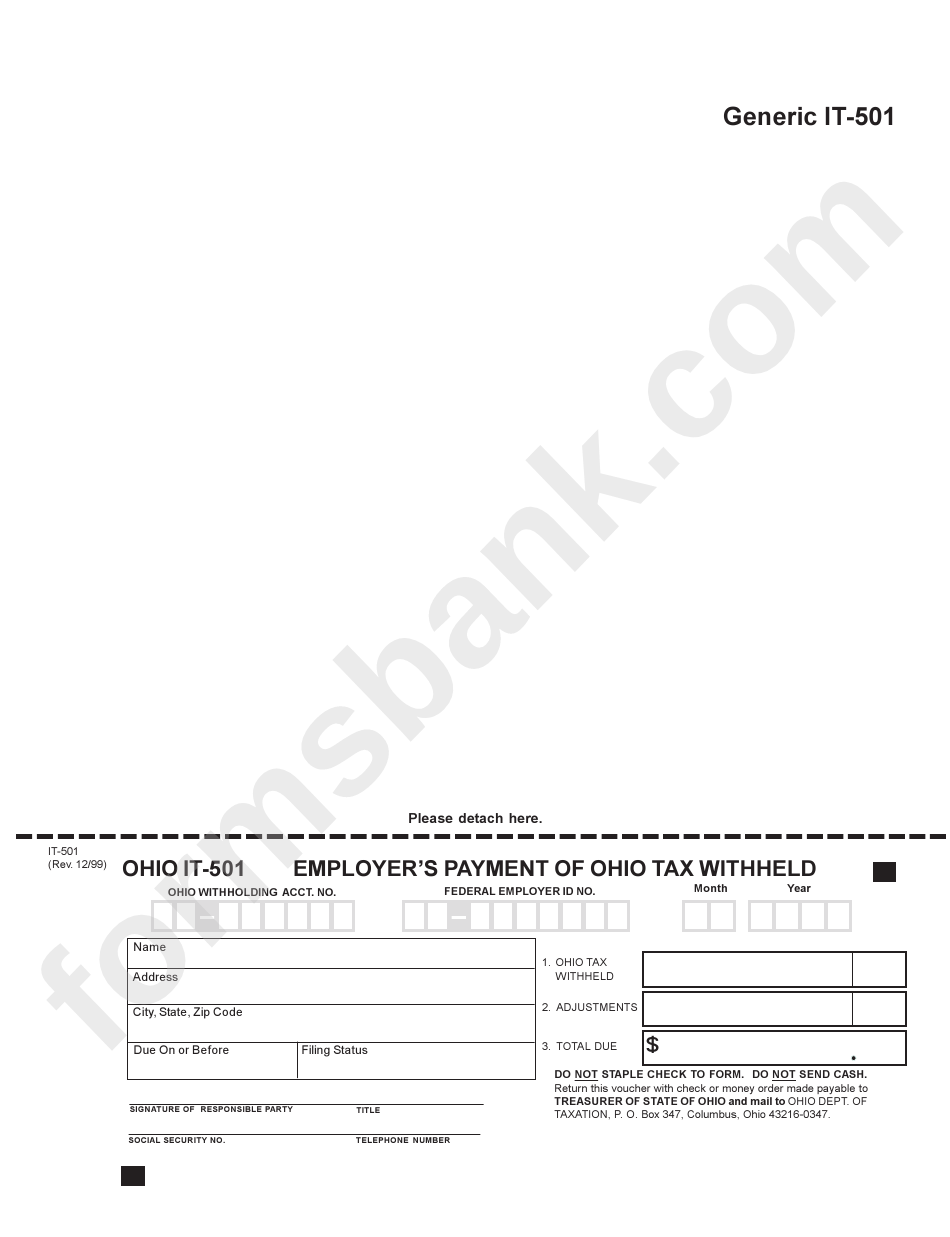

Ohio Form It501 Employers Payment Of Ohio Tax Withheld printable pdf

This is effective for years. Web this january, when filing for 2022, ohio entities may now elect to file using form it 4738, which was established in june 2022 via ohio senate bill 246 (s.b. If the amount on a line is. Web ohio department of natural resources Web ohio pte 2022 return information last modified:

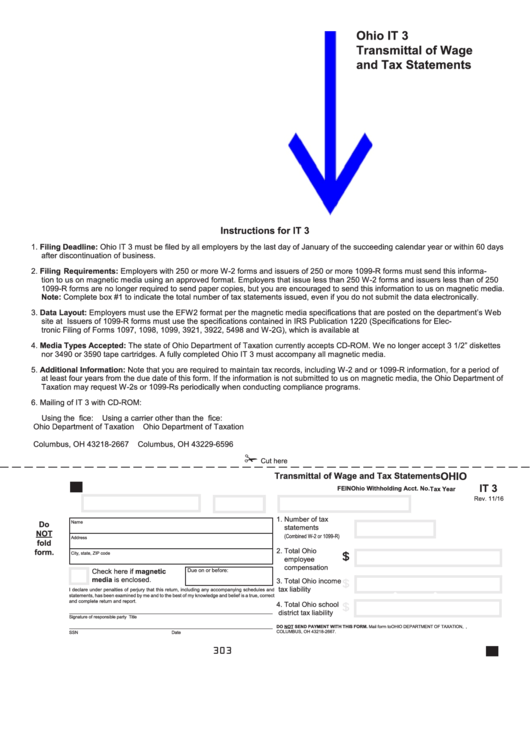

Ohio Form It 3 Transmittal Of Wage And Tax Statements printable pdf

02/28/2023 all transferred payments carry to it 4738, line 12 with a supporting statement. For taxable year 2022, the due date for filing is april 18,. The due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Web ohio has created a new tax form, ohio form it 4738, on.

I9 Form 2021 Printable Customize and Print

For taxable year 2022, the due date for filing is april 18,. Here’s how you know language translation. Web ohio has created a new tax form, ohio form it 4738, on which ptes can make the election if they do so on or before the filing deadline. When you file the it 4738, there will be a line in schedule.

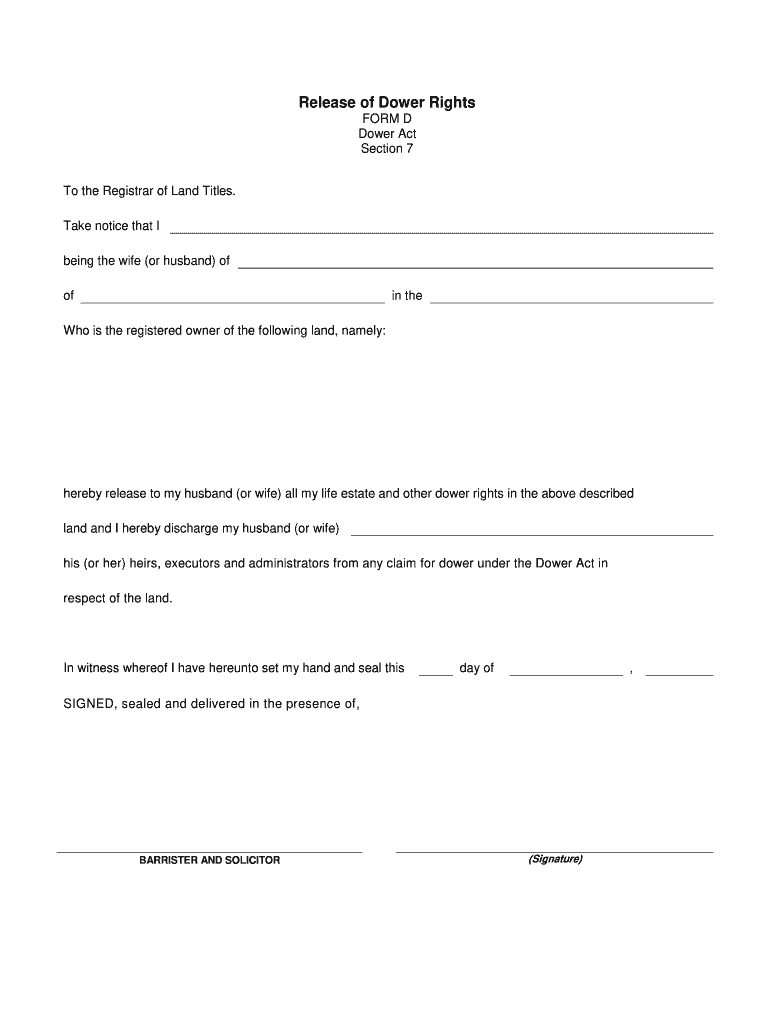

Ohio Dower Release 20202021 Fill and Sign Printable Template Online

Web the ohio society of cpas is offering a cpe webinar on thursday, march 9 at noon to cover the new it 4738 form. Web the ohio department of taxation jan. Web the ohio historic rehabilitation tax credit is a credit equal to 25% of qualified expenditures to rehabilitate a historic building according to certain preservation criteria. Leave the state.

The Tos No Longer Requires Pte And Fiduciary Filers To.

If the amount on a line is. Here’s how you know language translation. Section 4738.02 | motor vehicle salvage dealer's license required. Web here’s how you know.

Web Ohio Pte 2022 Return Information Last Modified:

02/28/2023 all transferred payments carry to it 4738, line 12 with a supporting statement. Web the ohio historic rehabilitation tax credit is a credit equal to 25% of qualified expenditures to rehabilitate a historic building according to certain preservation criteria. The due date for filing the it 4738 is april 15th after the year in which the entity’s fiscal year ends. Web ohio has created a new tax form, ohio form it 4738, on which ptes can make the election if they do so on or before the filing deadline.

Web Ohio Department Of Natural Resources

Matt dodovich, an attorney supervisor in the. Web election is made known to the department by filing the it 4738. Web ohio form 4738 is a new ohio entity tax return and it would be great to be able to e file this return thru the software. When you file the it 4738, there will be a line in schedule i of the return (page 2, line 12) to notify the department.

Section 4738.021 | Collection Of.

Ohio does list lacert as an approved vendor to. For taxable year 2022, the due date for filing is april 18,. Tax rate is 5% for the taxable year beginning january 1, 2022, and for taxable years beginning january 1,. Web this january, when filing for 2022, ohio entities may now elect to file using form it 4738, which was established in june 2022 via ohio senate bill 246 (s.b.