Ny Farm Tax Exempt Form

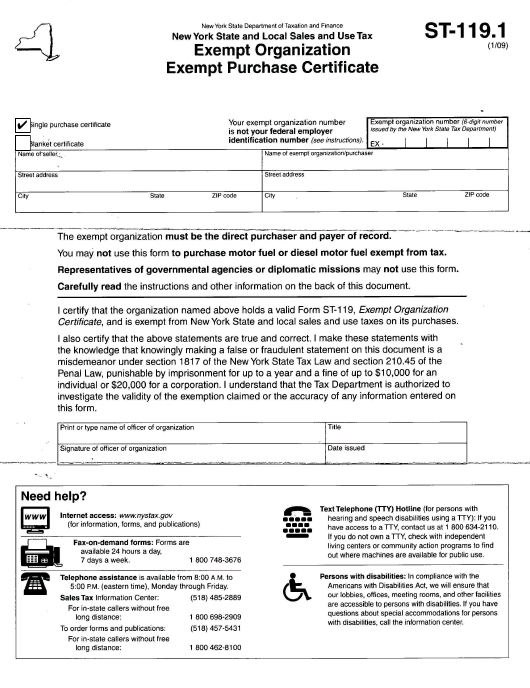

Ny Farm Tax Exempt Form - Web (solution found) how to become farm tax exempt in ny? Of taxation and finance website listed below. Web you cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see note below). Certify that i am exempt from payment of sales and use taxes on. Web farm building exemption. Web if you are an employee of an entity of new york state or the united states government and you are on oficial new york state or federal government business and staying in a hotel. Farmers are exempt from paying sales tax on purchases of supplies used in farming. This includes most tangible personal. Some farm buildings are wholly or partially exempt from. These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally.

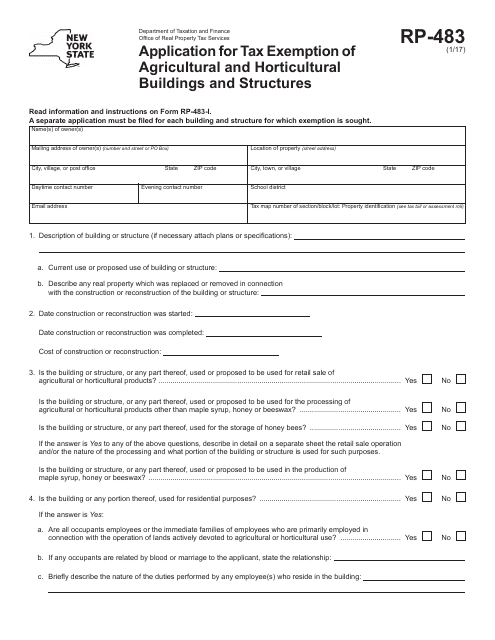

(solution found) to receive the exemption, the landowner must apply for agricultural assessment and. Certify that i am exempt from payment of sales and use taxes on. Of taxation and finance website listed below. Web 19 rows application for tax exemption of agricultural and horticultural buildings and structures. Web (solution found) how to become farm tax exempt in ny? Web 25 rows farmer’s and commercial horse boarding operator's exemption certificate:. This form is used to report income tax withheld and employer and employee social security. Web to make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out. These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally. Web this form illustrates a sample farm work agreement that employers should use to notify each employee in writing of conditions of employment at time of commitment to hire.

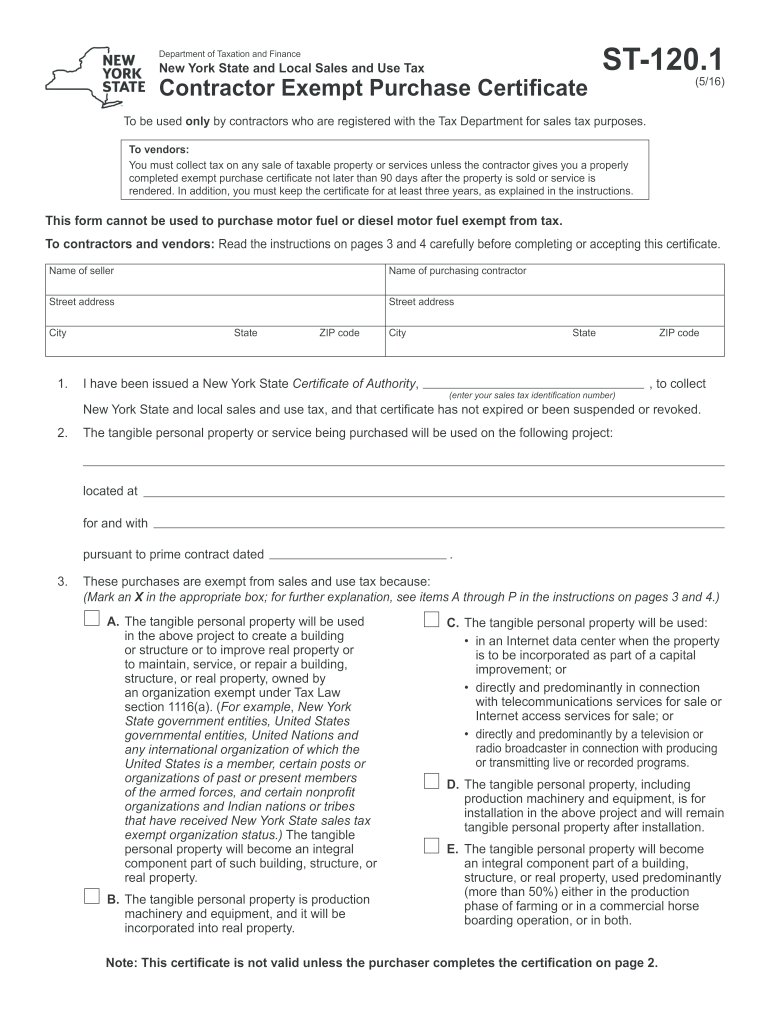

Web farm building exemption. Of taxation and finance website listed below. Web the following irs forms and publications relate specifically to farmers: Web to make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out. Web 8 rows form title. This includes most tangible personal. Web if you are an employee of an entity of new york state or the united states government and you are on oficial new york state or federal government business and staying in a hotel. Web (solution found) how to become farm tax exempt in ny? Web this form illustrates a sample farm work agreement that employers should use to notify each employee in writing of conditions of employment at time of commitment to hire. Web what are the tax benefits?

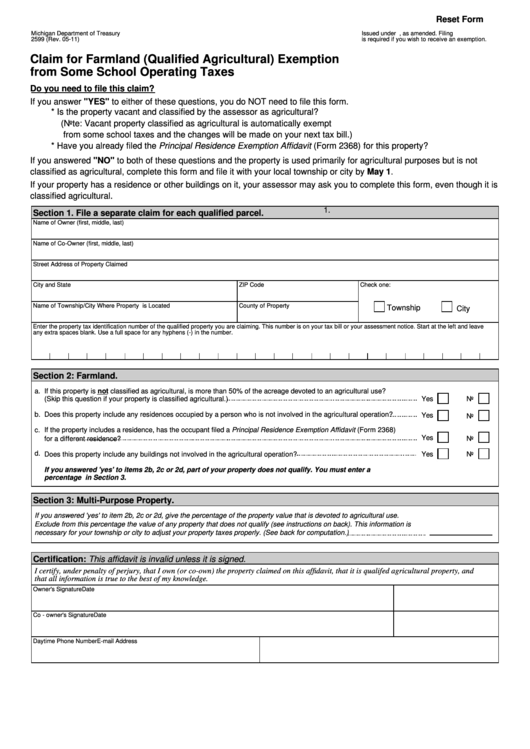

Fillable Form 2599 Claim For Farmland (Qualified Agricultural

(solution found) to receive the exemption, the landowner must apply for agricultural assessment and. Of taxation and finance website listed below. Farmers are exempt from paying sales tax on purchases of supplies used in farming. Web forms are available on the state dept. Web 25 rows farmer’s and commercial horse boarding operator's exemption certificate:.

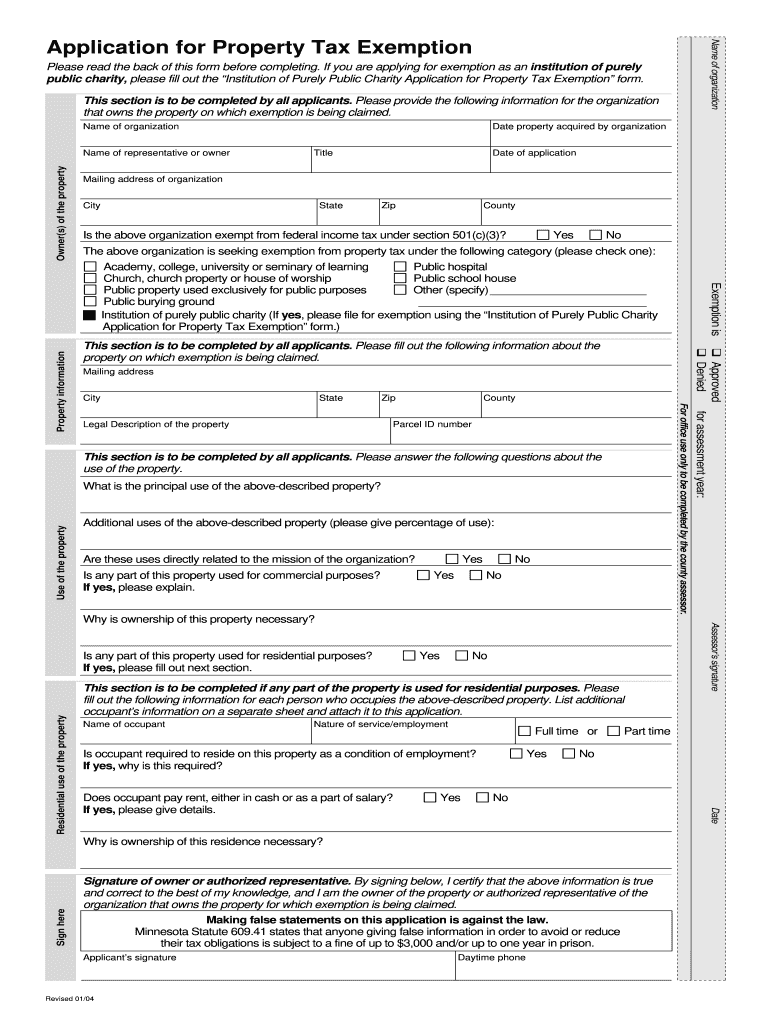

Property Tax Form Pdf Fill Out and Sign Printable PDF Template signNow

Some farm buildings are wholly or partially exempt from. Web what are the tax benefits? Web you cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see note below). Web this form illustrates a sample farm work agreement that employers should use to notify each employee in writing of conditions of employment at.

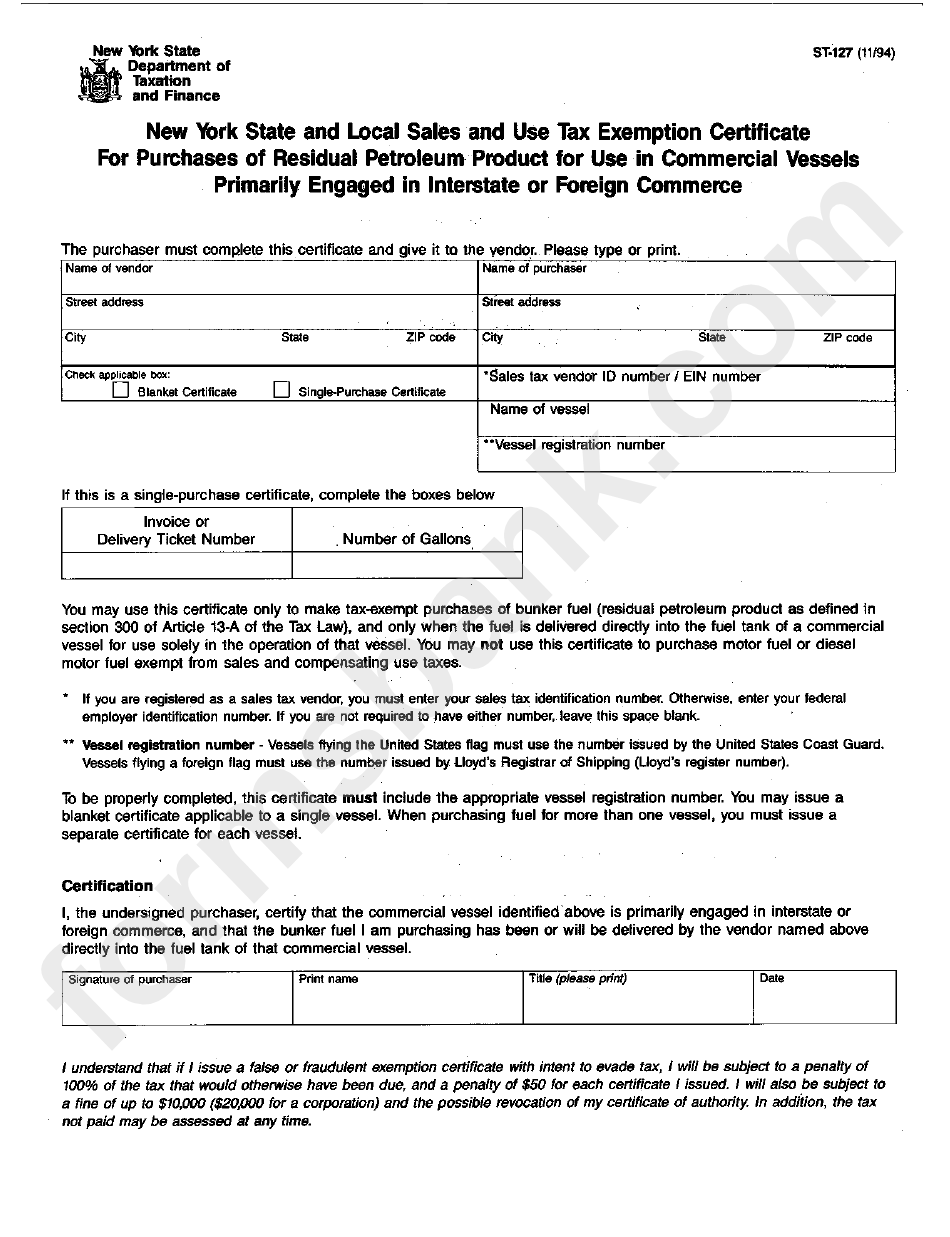

Form St127 New York State And Local Sales And Use Tax Exemption

Please note that the vendor is not. Web you cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see note below). These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally. (solution found) to receive the exemption, the landowner must apply for agricultural assessment.

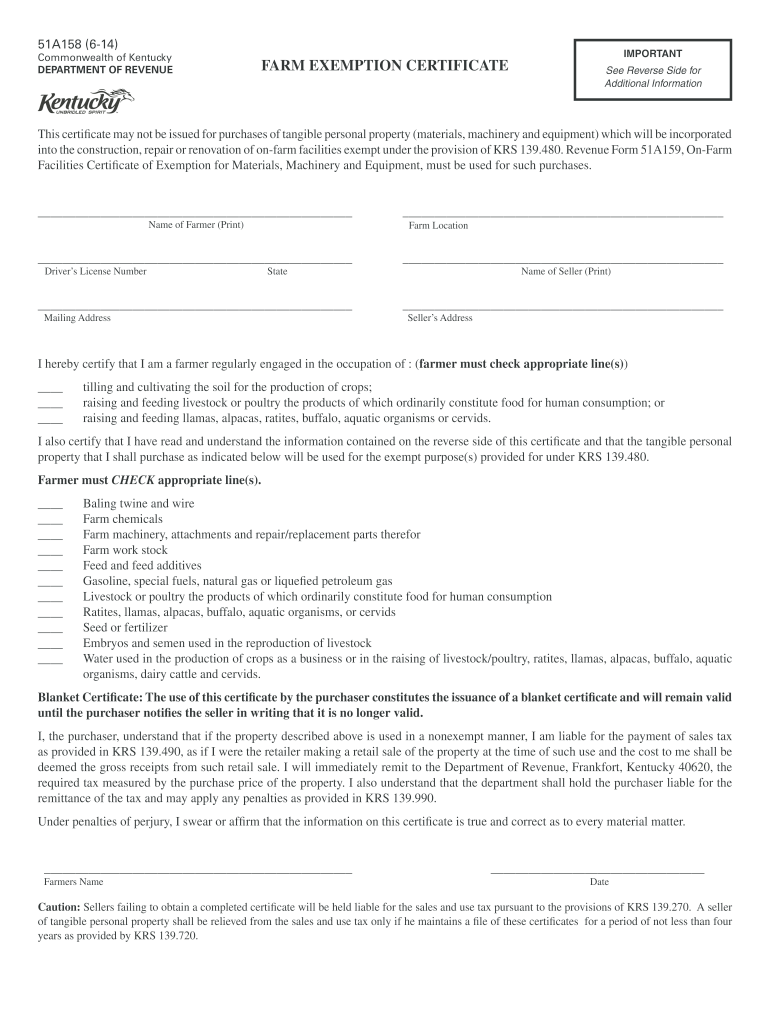

Kentucky Farm Tax Exempt Requirements 2020 Fill and Sign Printable

Web the following irs forms and publications relate specifically to farmers: Web what are the tax benefits? These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally. Web forms are available on the state dept. This form is used to report income tax withheld and employer and employee social security.

Tax Exempt Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

This form is used to report income tax withheld and employer and employee social security. Web the following irs forms and publications relate specifically to farmers: Please note that the vendor is not. These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally. Web 8 rows form title.

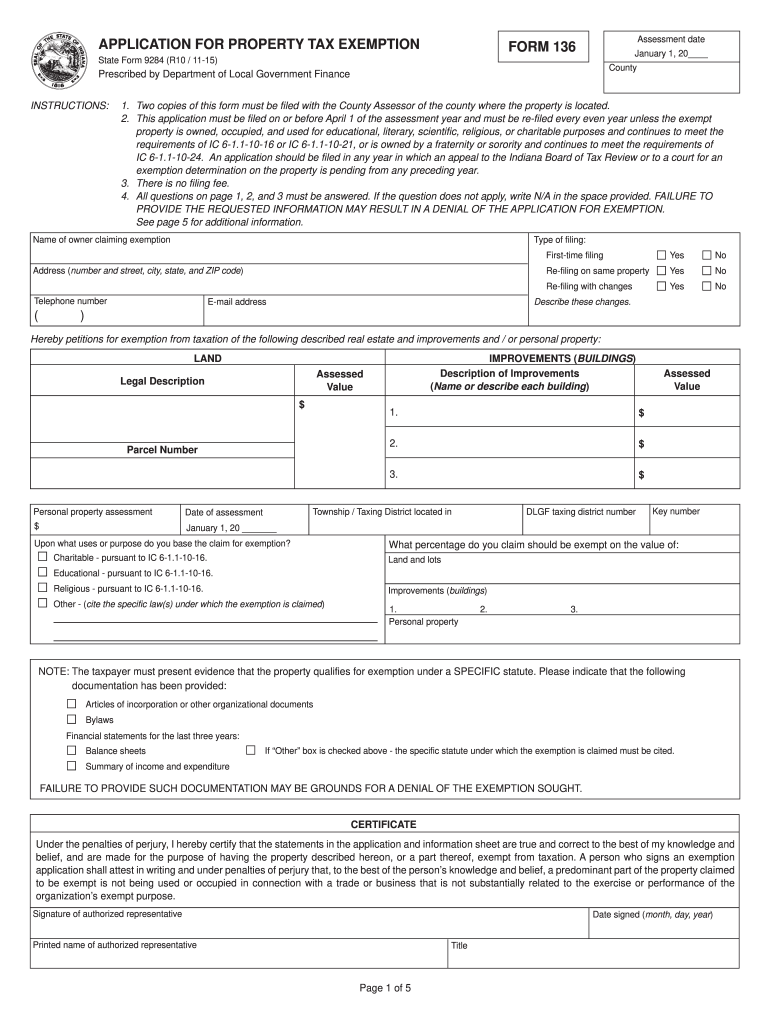

20152022 IN State Form 9284 Fill Online, Printable, Fillable, Blank

Certify that i am exempt from payment of sales and use taxes on. (solution found) to receive the exemption, the landowner must apply for agricultural assessment and. Web 8 rows form title. Web forms are available on the state dept. Web the following irs forms and publications relate specifically to farmers:

Form RP483 Download Fillable PDF or Fill Online Application for Tax

Web the following irs forms and publications relate specifically to farmers: Some farm buildings are wholly or partially exempt from. Web (solution found) how to become farm tax exempt in ny? Web 25 rows farmer’s and commercial horse boarding operator's exemption certificate:. These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports.

New York State Tax Exempt Form Farm

This form is used to report income tax withheld and employer and employee social security. Web follow the simple instructions below: Some farm buildings are wholly or partially exempt from. Please note that the vendor is not. Web forms are available on the state dept.

20162020 Form NY DTF ST120.1 Fill Online, Printable, Fillable, Blank

Web 8 rows form title. Certify that i am exempt from payment of sales and use taxes on. (solution found) to receive the exemption, the landowner must apply for agricultural assessment and. Web the following irs forms and publications relate specifically to farmers: Web you cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from.

Farm Bag Supply Supplier of Agricultural Film

Web to make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out. Web follow the simple instructions below: Farmers are exempt from paying sales tax on purchases of supplies used in farming. These days, most americans tend to prefer to do their own taxes and,.

Web Forms Are Available On The State Dept.

Web follow the simple instructions below: Web 8 rows form title. This includes most tangible personal. These days, most americans tend to prefer to do their own taxes and, moreover, to fill in reports digitally.

Web 25 Rows Farmer’s And Commercial Horse Boarding Operator's Exemption Certificate:.

Farmers are exempt from paying sales tax on purchases of supplies used in farming. Some farm buildings are wholly or partially exempt from. Web to make qualifying purchases, other than motor fuel and diesel motor fuel, without paying sales tax, a farmer or commercial horse boarding operator must fill out. Web farm building exemption.

This Form Is Used To Report Income Tax Withheld And Employer And Employee Social Security.

Web 19 rows application for tax exemption of agricultural and horticultural buildings and structures. (solution found) to receive the exemption, the landowner must apply for agricultural assessment and. Web the following irs forms and publications relate specifically to farmers: Web you cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see note below).

Of Taxation And Finance Website Listed Below.

Web if you are an employee of an entity of new york state or the united states government and you are on oficial new york state or federal government business and staying in a hotel. Certify that i am exempt from payment of sales and use taxes on. Web (solution found) how to become farm tax exempt in ny? Web what are the tax benefits?