Nationwide 401K Withdrawal Form

Nationwide 401K Withdrawal Form - There are already more than 3 million users taking advantage of our unique catalogue of legal forms. Web rollover and transfer funds. Web because 401 (k)s are retirement savings plans designed to help you save for retirement, any money you take out early will be subject to an additional 10% early withdrawal tax unless an exception applies. This form is to be used for participants of plans where nationwide serves as third party administrator. Web sum or systematic withdrawal lasting less than 10 years 20% of the taxable portion of the distribution paid to you will be withheld for federal income taxes. First, any amounts withdrawn will be subject to ordinary income tax. [2] “how to plan for rising health care costs,” fidelity viewpoints (aug. [1] some plans may have restrictions. Web participant withdrawal/direct rollover request private sector operations page 1 of 3phone: Web download and print nationwide forms for commercial agribusiness policies, personal property and auto policies, life insurance policies, mutual funds and more

Web rollover and transfer funds. Web participant withdrawal/direct rollover request private sector operations page 1 of 3phone: Web rapidly create a nationwide 401k hardship withdrawal without having to involve experts. Web because 401 (k)s are retirement savings plans designed to help you save for retirement, any money you take out early will be subject to an additional 10% early withdrawal tax unless an exception applies. [2] “how to plan for rising health care costs,” fidelity viewpoints (aug. Web download and print nationwide forms for commercial agribusiness policies, personal property and auto policies, life insurance policies, mutual funds and more Web sum or systematic withdrawal lasting less than 10 years 20% of the taxable portion of the distribution paid to you will be withheld for federal income taxes. There are already more than 3 million users taking advantage of our unique catalogue of legal forms. _ case number case name _ participant name social securitynumber(### ‐## ####) dateofbirth(mm/dd/yyyy) date ofhire(mm/dd/yyyy) home address city state zipcode Join us today and get access to.

Web rapidly create a nationwide 401k hardship withdrawal without having to involve experts. State taxes will be withheld where applicable. 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments. _ case number case name _ participant name social securitynumber(### ‐## ####) dateofbirth(mm/dd/yyyy) date ofhire(mm/dd/yyyy) home address city state zipcode Web because 401 (k)s are retirement savings plans designed to help you save for retirement, any money you take out early will be subject to an additional 10% early withdrawal tax unless an exception applies. There are already more than 3 million users taking advantage of our unique catalogue of legal forms. Web download and print nationwide forms for commercial agribusiness policies, personal property and auto policies, life insurance policies, mutual funds and more Web participant withdrawal/direct rollover request private sector operations page 1 of 3phone: Join us today and get access to. [2] “how to plan for rising health care costs,” fidelity viewpoints (aug.

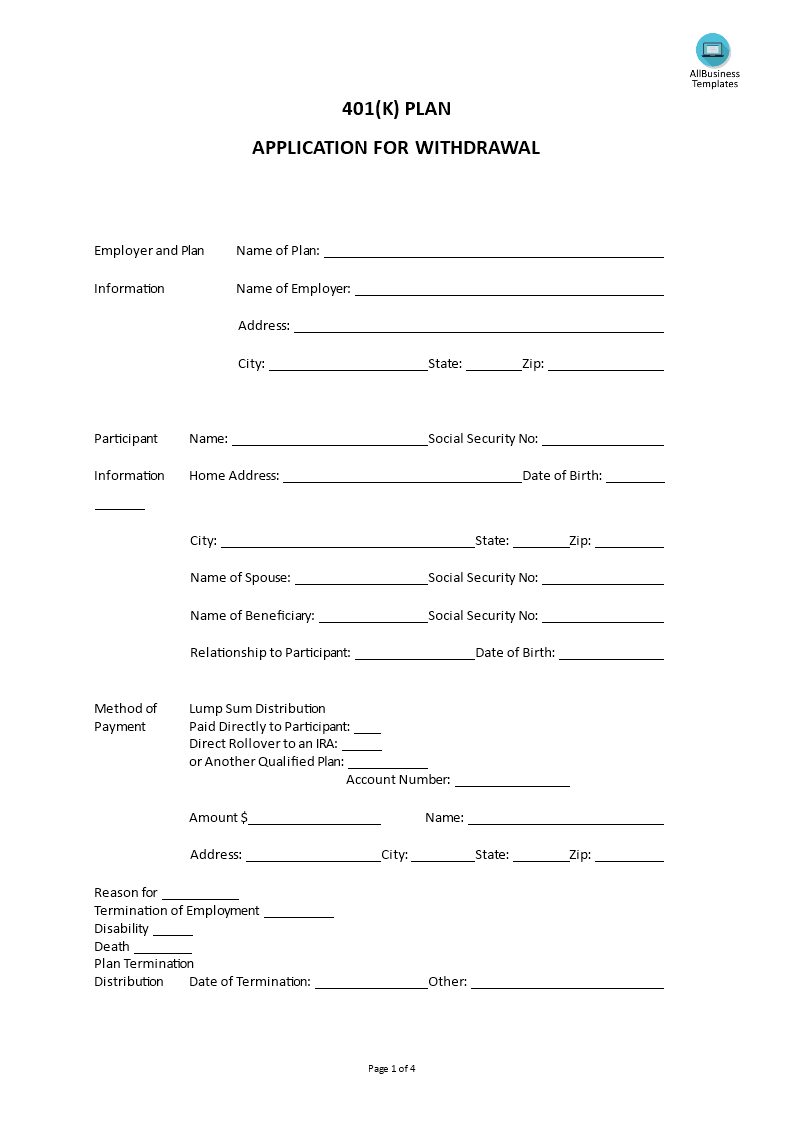

401K Application For Withdrawal Templates at

Web download and print nationwide forms for commercial agribusiness policies, personal property and auto policies, life insurance policies, mutual funds and more [1] some plans may have restrictions. There are already more than 3 million users taking advantage of our unique catalogue of legal forms. 402 (f) special tax notice (pdf) review this form for information regarding special tax information.

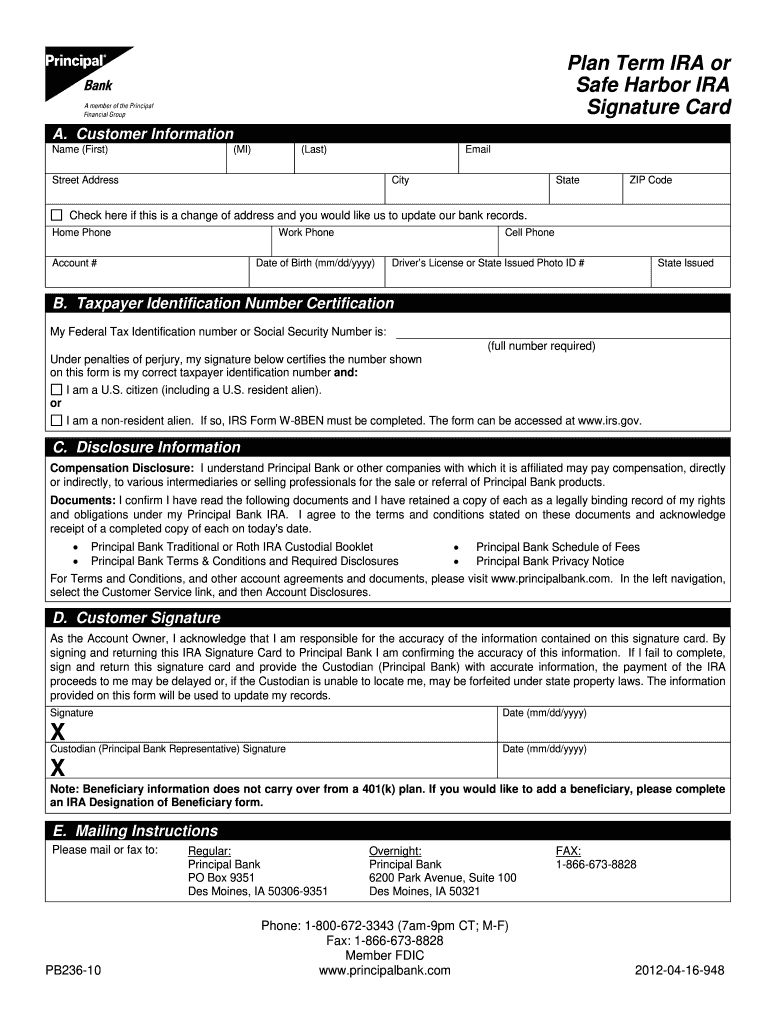

Principal 401K Withdrawal Fill Out and Sign Printable PDF Template

Web rollover and transfer funds. Web rapidly create a nationwide 401k hardship withdrawal without having to involve experts. Web download and print nationwide forms for commercial agribusiness policies, personal property and auto policies, life insurance policies, mutual funds and more 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments. There are.

401k Distribution Form 1099 Universal Network

Web rollover and transfer funds. There are already more than 3 million users taking advantage of our unique catalogue of legal forms. [2] “how to plan for rising health care costs,” fidelity viewpoints (aug. Web download and print nationwide forms for commercial agribusiness policies, personal property and auto policies, life insurance policies, mutual funds and more Web sum or systematic.

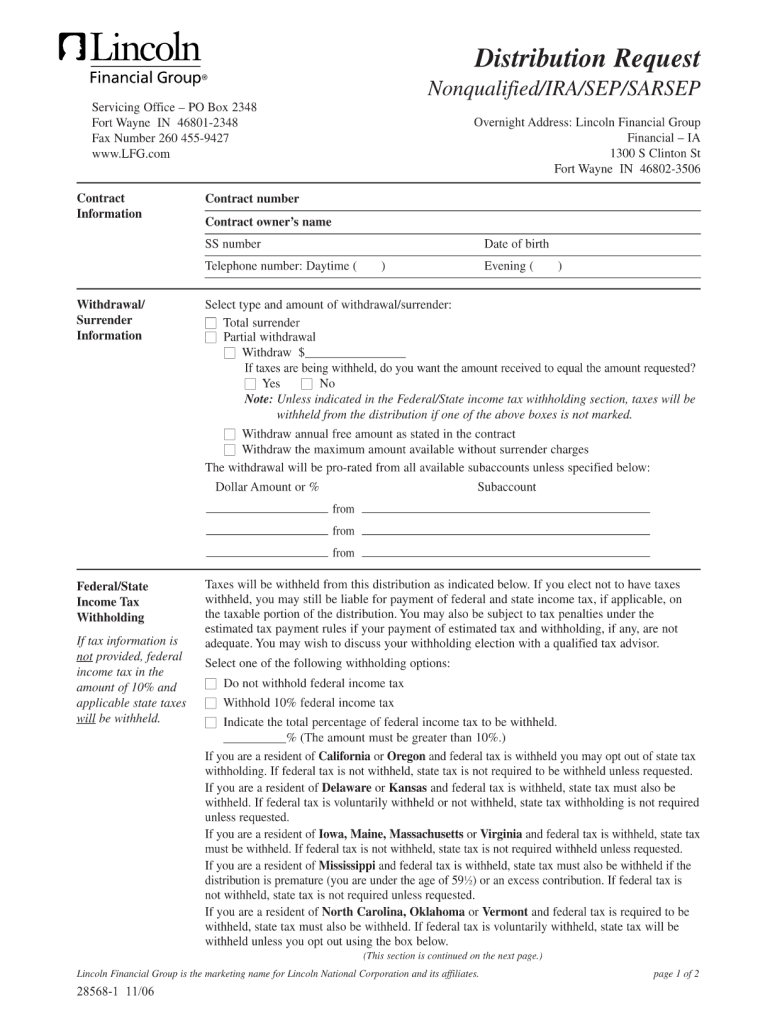

2006 Form Lincoln 285681 Fill Online, Printable, Fillable, Blank

State taxes will be withheld where applicable. Web rollover and transfer funds. There are already more than 3 million users taking advantage of our unique catalogue of legal forms. _ case number case name _ participant name social securitynumber(### ‐## ####) dateofbirth(mm/dd/yyyy) date ofhire(mm/dd/yyyy) home address city state zipcode [1] some plans may have restrictions.

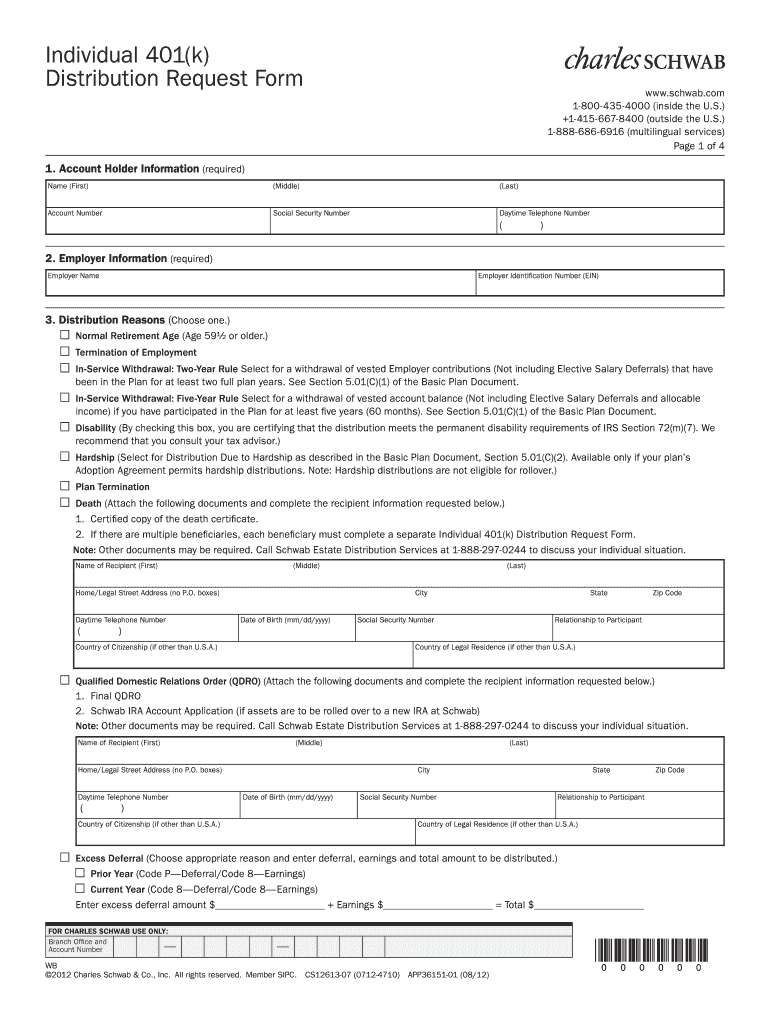

Charles Schwab Hardship Withdrawal Forms Fill Out and Sign Printable

There are already more than 3 million users taking advantage of our unique catalogue of legal forms. _ case number case name _ participant name social securitynumber(### ‐## ####) dateofbirth(mm/dd/yyyy) date ofhire(mm/dd/yyyy) home address city state zipcode 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments. First, any amounts withdrawn will.

401k Opt Out Form Template Fill Online, Printable, Fillable, Blank

[1] some plans may have restrictions. State taxes will be withheld where applicable. First, any amounts withdrawn will be subject to ordinary income tax. This form is to be used for participants of plans where nationwide serves as third party administrator. [2] “how to plan for rising health care costs,” fidelity viewpoints (aug.

Pentegra 401k Withdrawal Form Universal Network

[1] some plans may have restrictions. Web sum or systematic withdrawal lasting less than 10 years 20% of the taxable portion of the distribution paid to you will be withheld for federal income taxes. Join us today and get access to. Web download and print nationwide forms for commercial agribusiness policies, personal property and auto policies, life insurance policies, mutual.

401k Withdrawal Form Fill Out and Sign Printable PDF Template signNow

State taxes will be withheld where applicable. [2] “how to plan for rising health care costs,” fidelity viewpoints (aug. This form is to be used for participants of plans where nationwide serves as third party administrator. Web rapidly create a nationwide 401k hardship withdrawal without having to involve experts. Web sum or systematic withdrawal lasting less than 10 years 20%.

401k Withdrawal Former Employer Universal Network

Web rollover and transfer funds. First, any amounts withdrawn will be subject to ordinary income tax. Web participant withdrawal/direct rollover request private sector operations page 1 of 3phone: State taxes will be withheld where applicable. This form is to be used for participants of plans where nationwide serves as third party administrator.

Nationwide 401k Withdrawal Form Universal Network

There are already more than 3 million users taking advantage of our unique catalogue of legal forms. Web sum or systematic withdrawal lasting less than 10 years 20% of the taxable portion of the distribution paid to you will be withheld for federal income taxes. Web rollover and transfer funds. This form is to be used for participants of plans.

[1] Some Plans May Have Restrictions.

Web download and print nationwide forms for commercial agribusiness policies, personal property and auto policies, life insurance policies, mutual funds and more Web rollover and transfer funds. Web participant withdrawal/direct rollover request private sector operations page 1 of 3phone: This form is to be used for participants of plans where nationwide serves as third party administrator.

Web Because 401 (K)S Are Retirement Savings Plans Designed To Help You Save For Retirement, Any Money You Take Out Early Will Be Subject To An Additional 10% Early Withdrawal Tax Unless An Exception Applies.

First, any amounts withdrawn will be subject to ordinary income tax. Web sum or systematic withdrawal lasting less than 10 years 20% of the taxable portion of the distribution paid to you will be withheld for federal income taxes. [2] “how to plan for rising health care costs,” fidelity viewpoints (aug. Join us today and get access to.

_ Case Number Case Name _ Participant Name Social Securitynumber(### ‐## ####) Dateofbirth(Mm/Dd/Yyyy) Date Ofhire(Mm/Dd/Yyyy) Home Address City State Zipcode

Web rapidly create a nationwide 401k hardship withdrawal without having to involve experts. There are already more than 3 million users taking advantage of our unique catalogue of legal forms. State taxes will be withheld where applicable. 402 (f) special tax notice (pdf) review this form for information regarding special tax information for plan payments.