My Car Was Never Repossessed After Chapter 13

My Car Was Never Repossessed After Chapter 13 - However, the outcome is different depending on whether you file for chapter 7 or chapter 13. Web as long as you don't miss any, the lender can't repossess your vehicle. When your lender can repossess your car, and; It is very common, for example, for vehicle loans to be paid through a chapter 13 bankruptcy. In some cases, you can even get a car back if the lender repossessed it shortly before you filed for chapter 13. Web how to get your car back after it has been repossessed? Web a car lender can't repossess your car if you've already filed for chapter 13 bankruptcy. Web prior to this decision, if a vehicle was repossessed before chapter 13 bankruptcy was filed, the debtor would normally be required to provide “adequate protection” to the creditor before the. This will keep your automobile safe. If your car has already been repossessed, contact flexer law immediately to discuss your.

Web getting your car back after it has been repossessed is possible with a st. Web as long as you don't miss any, the lender can't repossess your vehicle. Web one of the great benefits of a chapter 13 plan is that you can shut down a foreclosure action on your home or the repossession of your car. However, the outcome is different depending on whether you file for chapter 7 or chapter 13. In some cases, you can even get a car back if the lender repossessed it shortly before you filed for chapter 13. This stay instantly stops all repossessions. Web how to get your car back after it has been repossessed? This will keep your automobile safe. Web filing for chapter 13 bankruptcy can be a good solution to avoid vehicle repossession. Falling behind on your car payments might have you wondering if you could use bankruptcy as a debt relief tool to get your.

I told them where the car was but they never. Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession naturally causes a lot of stress and worry. If your vehicle was taken after the bankruptcy case was filed, your automobile creditor will be required to return the vehicle. Web keeping your car in a chapter 13 bankruptcy case let’s summarize… many americans who think about filing for bankruptcy worry that doing so could cause them to lose their car or truck. In some cases, you can even get a car back if the lender repossessed it shortly before you filed for chapter 13. I bought a car in 2000 and in 2008 i stop paying for it they said they called and said they were going to repossess it. It is also possible to maintain possession and ownership of the vehicle by filing a st. But what happens if the vehicle you are paying for through your chapter 13. Meanwhile, you can integrate the back payments owed on your car loan into your chapter 13 repayment. When your lender can repossess your car, and;

46+ My Car Was Never Repossessed After Chapter 7 HubertSaalih

Since you need your car to get to work and take care of all the. Meanwhile, you can integrate the back payments owed on your car loan into your chapter 13 repayment. This stay instantly stops all repossessions. Web how chapter 13 bankruptcy can help get a repossessed car back if you were already considering filing for chapter 13 bankruptcy,.

Using Chapter 13 Bankruptcy to Get Your Repossessed Car Back! Shevitz

Meanwhile, you can integrate the back payments owed on your car loan into your chapter 13 repayment. How to avoid car repossession in chapter. Q&a asked in detroit, mi | aug 28, 2016 save what happens if they never repo the car? In chapter 13 bankruptcy, you can repay any car loan arrears through your chapter 13. However, the outcome.

46+ My Car Was Never Repossessed After Chapter 7 BethneEinstein

Louis chapter 13 before the repossession happens. Once inside of a missouri chapter 13… Web motion to incur new debt. Since you need your car to get to work and take care of all the. Web after your chapter 13 is filed, the “automatic stay” will protect you from a further collection activity.

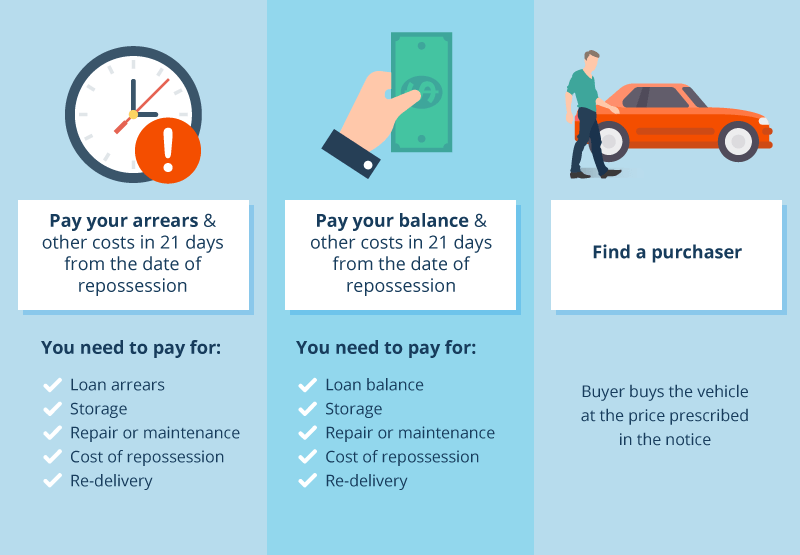

What To Do When Your Car Is Repossessed In Malaysia?

Web how chapter 13 bankruptcy can help get a repossessed car back if you were already considering filing for chapter 13 bankruptcy, then if you do so quickly you might be able to keep your car. If your vehicle was taken after the bankruptcy case was filed, your automobile creditor will be required to return the vehicle. Q&a asked in.

My car just got repossessed. Can I get it back if I file bankruptcy

Louis chapter 13 before the repossession happens. Web prior to this decision, if a vehicle was repossessed before chapter 13 bankruptcy was filed, the debtor would normally be required to provide “adequate protection” to the creditor before the. In chapter 13 bankruptcy, you can repay any car loan arrears through your chapter 13. This will keep your automobile safe. This.

My Vehicle is Being Repossessed, What Should I do?

This stay instantly stops all repossessions. Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession naturally causes a lot of stress and worry. How to avoid car repossession in chapter. Meanwhile, you can integrate the back payments owed on your car loan into your chapter 13 repayment. Web how to.

46+ My Car Was Never Repossessed After Chapter 7 BethneEinstein

Web legal advice lemon law advice what happens if they never repo the car? This stay instantly stops all repossessions. Web filing for chapter 13 bankruptcy can be a good solution to avoid vehicle repossession. Once an automatic stay goes into effect, the car lender is stopped from repossessing your car until the judge confirms your debt. Web after your.

What Can I Do If My Car Was Repossessed by Mistake? Consumers Law

Louis chapter 13 before the repossession happens. Once inside of a missouri chapter 13… When your lender can repossess your car, and; I told them where the car was but they never. Web one of the great benefits of a chapter 13 plan is that you can shut down a foreclosure action on your home or the repossession of your.

Car Payments and Repossession Sawin & Shea

But what happens if the vehicle you are paying for through your chapter 13. Web motion to incur new debt. Web getting your car back after it has been repossessed is possible with a st. A motion for turnover orders the lender to return your car. Web keeping your car in a chapter 13 bankruptcy case let’s summarize… many americans.

What to do if your car gets repossessed

Web how to get your car back after it has been repossessed? If your car has already been repossessed, contact flexer law immediately to discuss your. Once an automatic stay goes into effect, the car lender is stopped from repossessing your car until the judge confirms your debt. A motion for turnover orders the lender to return your car. Meanwhile,.

Once An Automatic Stay Goes Into Effect, The Car Lender Is Stopped From Repossessing Your Car Until The Judge Confirms Your Debt.

The chapter 7 repossession process; Web prior to this decision, if a vehicle was repossessed before chapter 13 bankruptcy was filed, the debtor would normally be required to provide “adequate protection” to the creditor before the. Web vehicle repossession & chapter 13 bankruptcy if your car is still in your possession let’s summarize… car repossession naturally causes a lot of stress and worry. Web motion to incur new debt.

Web If Your Car Is Necessary To Your Household (For Example, You Need The Car To Get To Work So That You Can Make Your Chapter 13 Payments) And Your Chapter 13 Plan Pays The Lender Both The Back Payments And The Payments Due Going Forward, You Can File A Motion For Turnover.

When your lender can repossess your car, and; A chapter 13 bankruptcy is a payment plan whereby the debtor is repaying certain debts. This will keep your automobile safe. Since you need your car to get to work and take care of all the.

However, The Outcome Is Different Depending On Whether You File For Chapter 7 Or Chapter 13.

Web one of the great benefits of a chapter 13 plan is that you can shut down a foreclosure action on your home or the repossession of your car. Meanwhile, you can integrate the back payments owed on your car loan into your chapter 13 repayment. Web as long as you don't miss any, the lender can't repossess your vehicle. It is also possible to maintain possession and ownership of the vehicle by filing a st.

Web How To Get Your Car Back After It Has Been Repossessed?

Falling behind on your car payments might have you wondering if you could use bankruptcy as a debt relief tool to get your. Web as long as you remain in chapter 7 bankruptcy, your car lender can't repossess your car without first getting permission from the bankruptcy court. A motion for turnover orders the lender to return your car. Web how chapter 13 bankruptcy can help get a repossessed car back if you were already considering filing for chapter 13 bankruptcy, then if you do so quickly you might be able to keep your car.