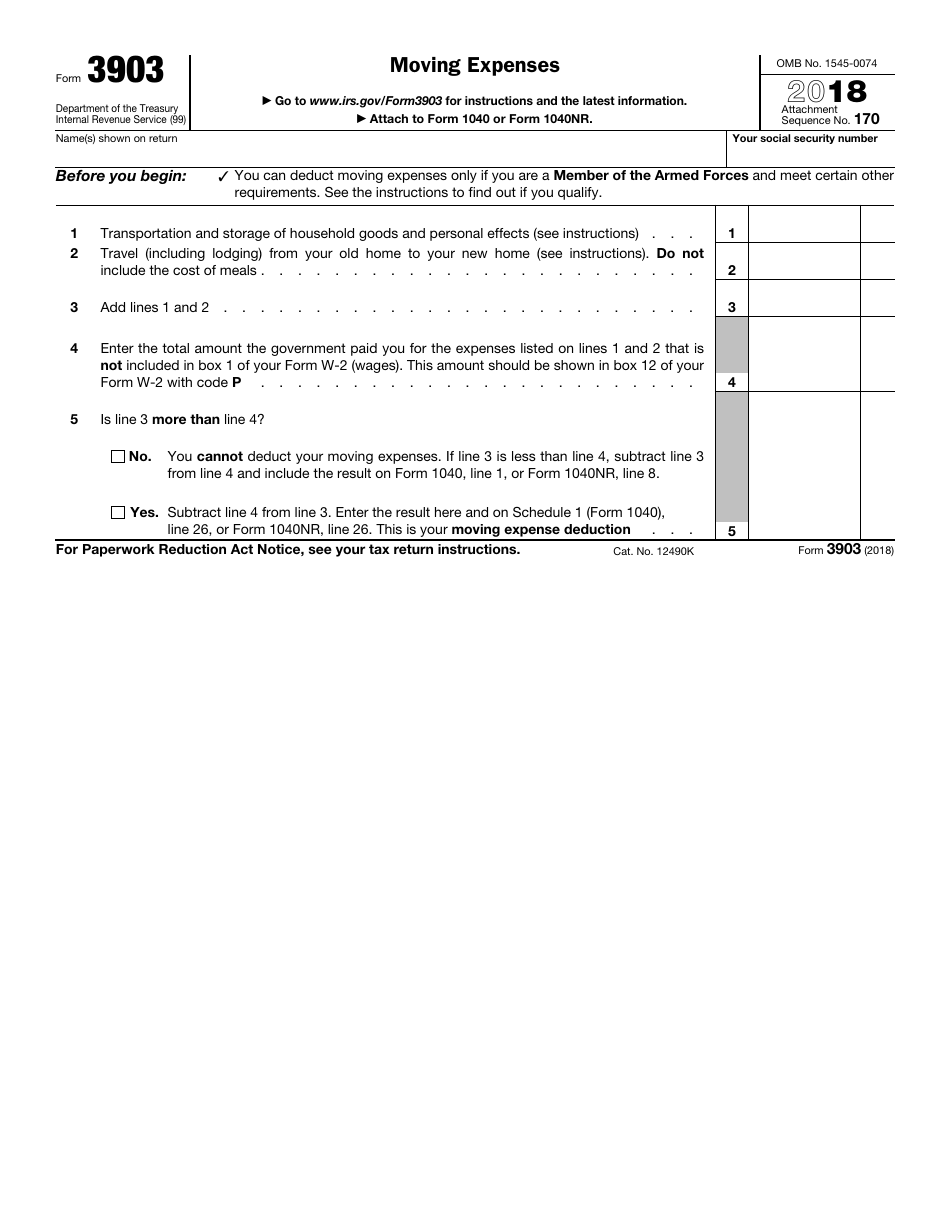

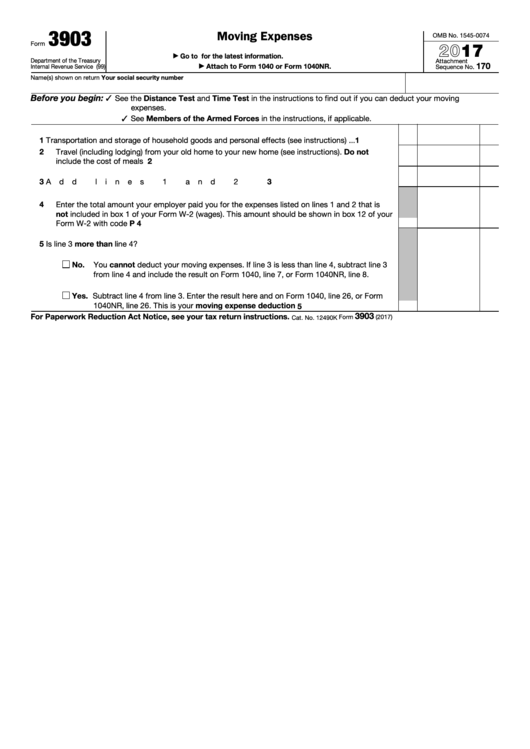

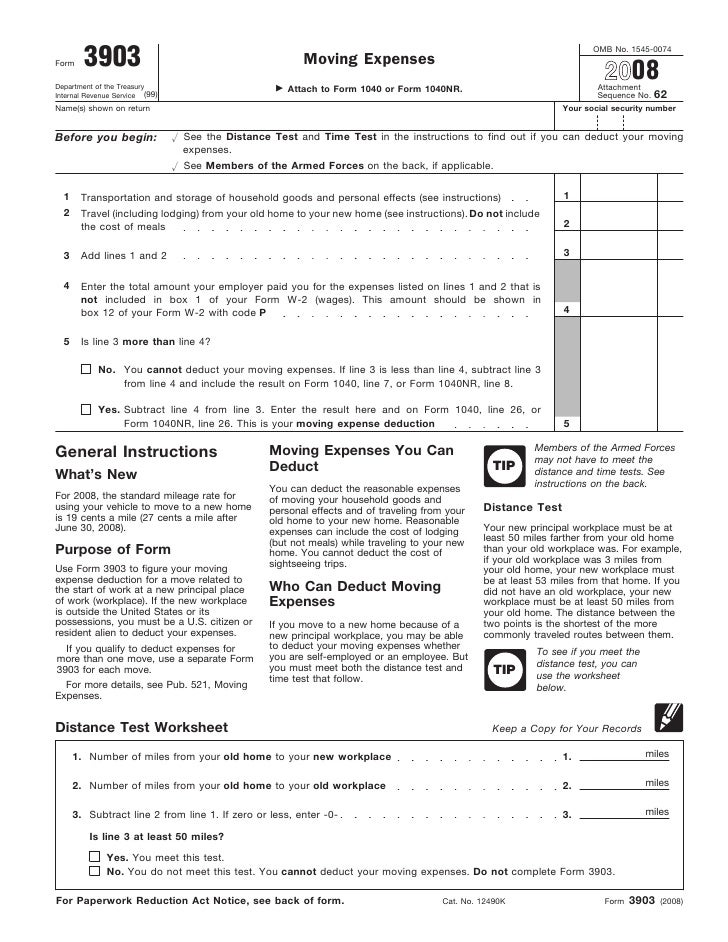

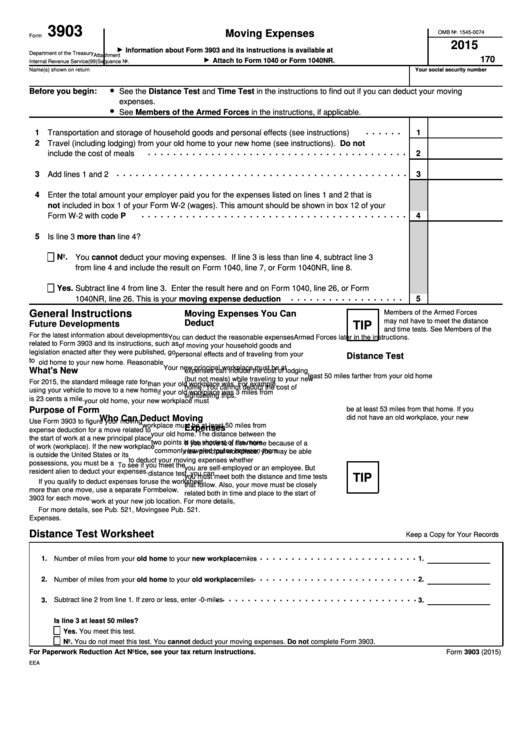

Moving Expenses Form 3903

Moving Expenses Form 3903 - If the new workplace for more details, see pub. Web moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Web moving expenses go to www.irs.gov/form3903 for instructions and the latest information. You can't deduct expenses for moving furniture or other goods you bought on the way from your old home to your new home. You can deduct moving expenses only if you are a. Do you know how to fill out form 3903 to claim your moving expenses and recoup some of your costs? Who may deduct moving expenses if you move to a new home because of a new principal workplace, you may be able to deduct your moving. You must satisfy two primary criteria to qualify for counting these expenses as tax deductions: Meeting the time and distance tests. Citizen or resident alien to deduct your expenses.

You can't deduct expenses that are reimbursed or paid for directly by the government. You must satisfy two primary criteria to qualify for counting these expenses as tax deductions: Do you know how to fill out form 3903 to claim your moving expenses and recoup some of your costs? Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). For more details, see pub. Member of the armed forces If the new workplace is outside the united states or its possessions, you must be a u.s. Who may deduct moving expenses if you move to a new home because of a new principal workplace, you may be able to deduct your moving. Currently, the moving expense deduction is an above the line tax deduction, as an adjustment to gross income listed on schedule 1 of a federal return. Web what is irs form 3903?

If the new workplace for more details, see pub. Currently, the moving expense deduction is an above the line tax deduction, as an adjustment to gross income listed on schedule 1 of a federal return. For more details, see pub. Do you know how to fill out form 3903 to claim your moving expenses and recoup some of your costs? Web moving expenses go to www.irs.gov/form3903 for instructions and the latest information. You must satisfy two primary criteria to qualify for counting these expenses as tax deductions: Web purpose of form use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace) that is either: What is irs form 3903? Web you can deduct your unreimbursed moving expenses for you, your spouse, and your dependents. Who may deduct moving expenses if you move to a new home because of a new principal workplace, you may be able to deduct your moving.

Form 3903 Moving Expenses (2015) Free Download

Meeting the time and distance tests. Web you can deduct your unreimbursed moving expenses for you, your spouse, and your dependents. Currently, the moving expense deduction is an above the line tax deduction, as an adjustment to gross income listed on schedule 1 of a federal return. Do you know how to fill out form 3903 to claim your moving.

Form 3903 Moving Expenses (2015) Free Download

Who may deduct moving expenses if you move to a new home because of a new principal workplace, you may be able to deduct your moving. Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). Web what is irs form 3903? Meeting.

Form 3903 Moving Expenses (2015) printable pdf download

You can't deduct expenses for moving furniture or other goods you bought on the way from your old home to your new home. Web moving expenses go to www.irs.gov/form3903 for instructions and the latest information. For more details, see pub. Who may deduct moving expenses if you move to a new home because of a new principal workplace, you may.

Form 3903 Moving Expenses (2015) Free Download

Member of the armed forces Meeting the time and distance tests. Web you can deduct your unreimbursed moving expenses for you, your spouse, and your dependents. You can deduct moving expenses only if you are a. Web purpose of form use form 3903 to figure your moving expense deduction for a move related to the start of work at a.

Form 3903 Moving Expenses Definition

You must satisfy two primary criteria to qualify for counting these expenses as tax deductions: If the new workplace for more details, see pub. Web purpose of form use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace) that is either: Do you know.

IRS Form 3903 Download Fillable PDF or Fill Online Moving Expenses

If the new workplace is outside the united states or its possessions, you must be a u.s. This quick guide will show you the ropes. You can deduct moving expenses only if you are a. Web moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Member of the armed forces

Fillable Form 3903 Moving Expenses 2017 printable pdf download

Web you can deduct your unreimbursed moving expenses for you, your spouse, and your dependents. Meeting the time and distance tests. You can deduct moving expenses only if you are a. Who may deduct moving expenses if you move to a new home because of a new principal workplace, you may be able to deduct your moving. Irs form 3903,.

Form 3903 Moving Expenses Sign on the Page Stock Image Image of sign

Web purpose of form use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace) that is either: Who may deduct moving expenses if you move to a new home because of a new principal workplace, you may be able to deduct your moving. You.

IRS Form 3903 How To Deduct Moving Expenses Silver Tax Group

Currently, the moving expense deduction is an above the line tax deduction, as an adjustment to gross income listed on schedule 1 of a federal return. If the new workplace is outside the united states or its possessions, you must be a u.s. Moving expenses is a tax form distributed by the internal revenue service (irs) and used by taxpayers.

Form 3903Moving Expenses

Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). Web being able to claim those moving expenses on your taxes can help significantly decrease the stress associated with the moving process. You must satisfy two primary criteria to qualify for counting these.

You Can Deduct Moving Expenses Only If You Are A.

You must satisfy two primary criteria to qualify for counting these expenses as tax deductions: Web moving expenses go to www.irs.gov/form3903 for instructions and the latest information. Web you can deduct your unreimbursed moving expenses for you, your spouse, and your dependents. What is irs form 3903?

Meeting The Time And Distance Tests.

Web purpose of form use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace) that is either: Member of the armed forces Citizen or resident alien to deduct your expenses. Web moving expenses go to www.irs.gov/form3903 for instructions and the latest information.

Irs Form 3903, Moving Expenses, Is The Federal Form That Eligible Taxpayers May Use To Calculate The Moving Expense Deduction.

If the new workplace is outside the united states or its possessions, you must be a u.s. Do you know how to fill out form 3903 to claim your moving expenses and recoup some of your costs? Currently, the moving expense deduction is an above the line tax deduction, as an adjustment to gross income listed on schedule 1 of a federal return. Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace).

Web Being Able To Claim Those Moving Expenses On Your Taxes Can Help Significantly Decrease The Stress Associated With The Moving Process.

This quick guide will show you the ropes. Moving expenses is a tax form distributed by the internal revenue service (irs) and used by taxpayers to deduct moving expenses related to taking a new job. Web use form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). Who may deduct moving expenses if you move to a new home because of a new principal workplace, you may be able to deduct.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at1.44.35PM-b546319cf5d044c49b8599a543cf26ac.png)