Mn Tax Form M1

Mn Tax Form M1 - Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine. Subtraction limits the maximum subtraction allowed for purchases of personal computer hardware. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Use this tool to search for a specific tax form using the tax form number or name. Web filing a paper income tax return. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. You must file yearly by april 15. Web for examples of qualifying education expenses, see the form m1 instructions. Ad download or email mn form m1 & more fillable forms, register and subscribe now! You can also look for forms by category below the search box.

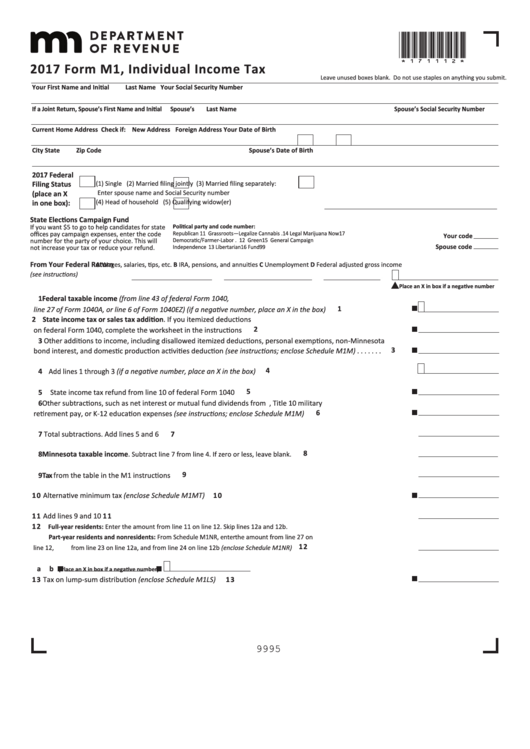

Do not use staples on anything you submit. Web for examples of qualifying education expenses, see the form m1 instructions. Do not use staples on anything you submit. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Your first name and initial last name ifajointreturn,spouse’sfirstnameandinitial your social. You can also look for forms by category below the search box. For instructions on completing the reciprocity study section on. We last updated the individual income tax return in. Web 2018 form m1, individual income tax leave unused boxes blank. You will need the 2020 individual income tax instructions to complete this form.

Do not use staples on anything you submit. Web mn tax forms 2019; Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Renters — include your 2020 crp(s). Web form m1 for minnesota and wisconsin residents who worked in the other state to provide additional information. For instructions on completing the reciprocity study section on. You can get minnesota tax forms either by mail or in person. If zero or less leave blank. Complete, edit or print tax forms instantly. You can also look for forms by category below the search box.

2018 Form MN DoR M1 Fill Online, Printable, Fillable, Blank PDFfiller

Disabled veterans homestead exclusion (see instructions) 31. Use this tool to search for a specific tax form using the tax form number or name. Web mn tax forms 2019; Web form m1 for minnesota and wisconsin residents who worked in the other state to provide additional information. Web file this form if you need to correct (or amend) an original.

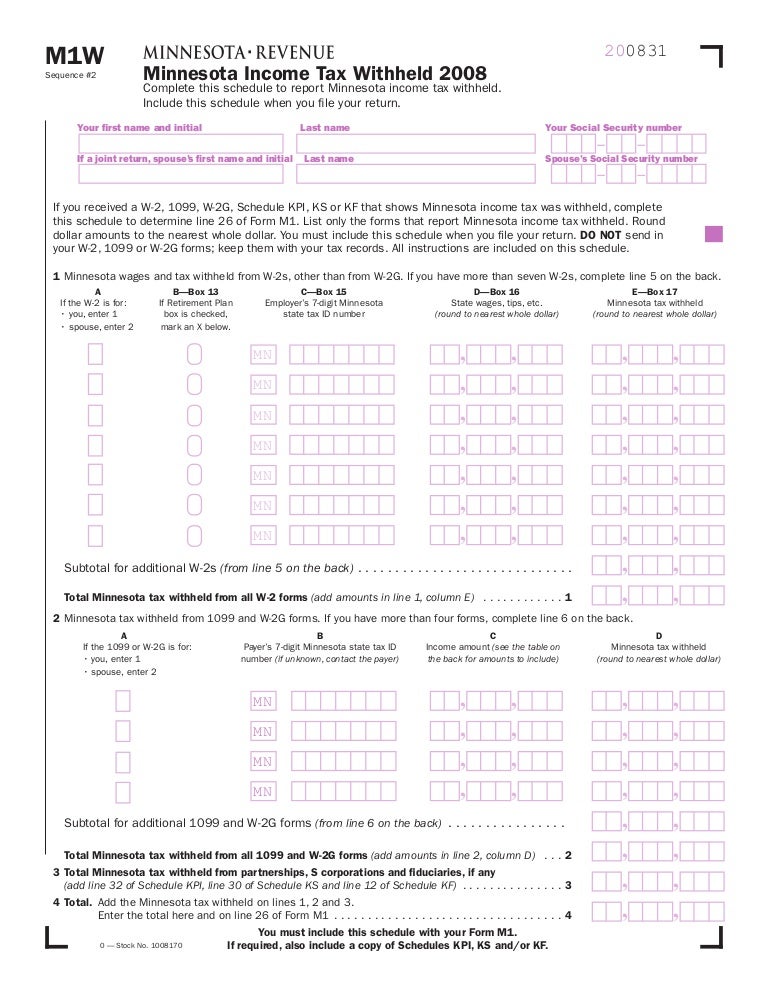

2012 Form MN M1W Fill Online, Printable, Fillable, Blank PDFfiller

Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Web file this form if you need to correct (or amend) an original minnesota individual income tax return. Use this tool to search for a specific tax form using the tax form number or name. Web form m1 for minnesota.

M1W taxes.state.mn.us

Web mn tax forms 2019; For instructions on completing the reciprocity study section on. Go paperless, fill & sign documents electronically. Minnesota individual income tax, mail station 0010, 600 n. Web what is minnesota form m1?

Tax Table M1 Instructions

Ad download or email mn form m1 & more fillable forms, register and subscribe now! Subtraction limits the maximum subtraction allowed for purchases of personal computer hardware. Web 2018 form m1, individual income tax leave unused boxes blank. Web 2021 form m1, individual income tax do not use staples on anything you submit. Your first name and initial last name.

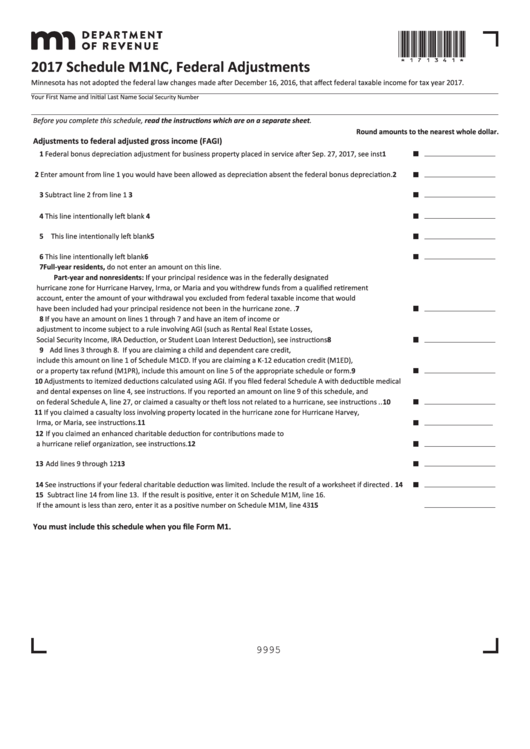

Fillable Schedule M1nc Federal Adjustments 2017 printable pdf download

You can also look for forms by category below the search box. We last updated the individual income tax return in. Renters — include your 2020 crp(s). Disabled veterans homestead exclusion (see instructions) 31. Go paperless, fill & sign documents electronically.

Fill Free fillable Minnesota Department of Revenue PDF forms

Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Go paperless, fill & sign documents electronically. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. Web form m1 is the most common individual income tax return filed for minnesota residents. File.

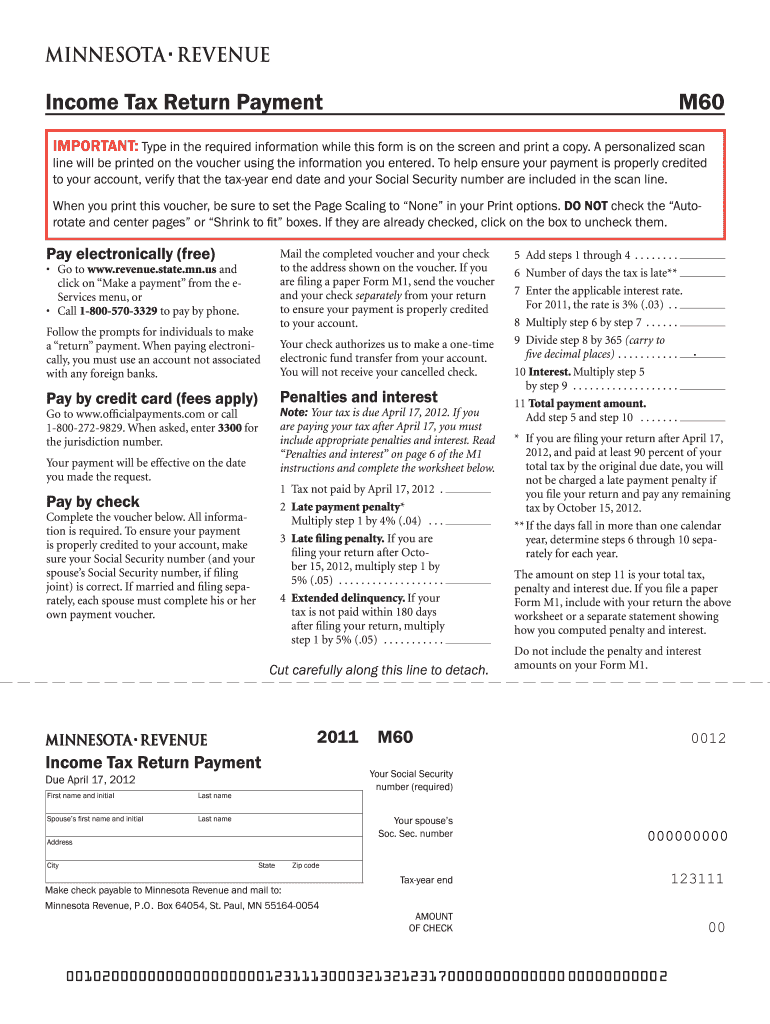

Mn tax payment voucher m60 Fill out & sign online DocHub

Web only use the 2022 form m1x to amend your 2022 form m1. Do not use staples on anything you submit. Web form m1 is the most common individual income tax return filed for minnesota residents. File this form if you need to correct (or amend) an original minnesota individual income tax. Minnesota individual income tax applies to residents and.

Form M1 Individual Tax 2017 printable pdf download

Web mn tax forms 2019; Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. You can get minnesota tax forms either by mail or in person. Web minnesota working family credit > schedule m1ref refundable credits > schedule m1c nonrefundable credits > schedule m1m income additions and. Complete, edit or print tax forms.

2012 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. Web for examples of qualifying education expenses, see the form m1 instructions. Before starting your minnesota income tax return ( form m1, individual income tax ), you.

2019 Form MN M1W Fill Online, Printable, Fillable, Blank pdfFiller

Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine. Web 2021 form m1, individual income tax do not use staples on anything you submit. Go paperless, fill & sign documents electronically. Renters — include your 2020 crp(s). Before starting your minnesota income tax return ( form m1.

For Instructions On Completing The Reciprocity Study Section On.

It will help candidates for state offices. Web what is minnesota form m1? Web 2018 form m1, individual income tax leave unused boxes blank. Use this tool to search for a specific tax form using the tax form number or name.

Web File This Form If You Need To Correct (Or Amend) An Original Minnesota Individual Income Tax Return.

Web up to $40 cash back 181111 2018 form m1 individual income tax leave unused boxes blank. You can also look for forms by category below the search box. If zero or less leave blank. File this form if you need to correct (or amend) an original minnesota individual income tax.

Ad Download Or Email Mn Form M1 & More Fillable Forms, Register And Subscribe Now!

You must file yearly by april 15. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Disabled veterans homestead exclusion (see instructions) 31. Web 5 rows we last updated the minnesota individual income tax instructions (form m1) in february 2023,.

You Will Need The 2020 Individual Income Tax Instructions To Complete This Form.

You can get minnesota tax forms either by mail or in person. Minnesota property tax refund st. Complete, edit or print tax forms instantly. Web minnesota working family credit > schedule m1ref refundable credits > schedule m1c nonrefundable credits > schedule m1m income additions and.