Mn Form M1M

Mn Form M1M - Web 25 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax withheld, enter the amount from line 1 of form m1. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. Web 2020 form m1, individual income tax your first name and initial *201111* your last name your social security number (ssn) if a joint return, spouse’s first name and initial. Wednesday night i filed 2 returns that bounced on minnesota with the following message: Web plete schedule m1mt to determine if you are required to pay minnesota amt. Complete form m1 using the minnesota. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. Web • enter line 10 of your federal form 4562 on line 10 of your minnesota m1m 4562. • recalculate lines 4, 5, 8, 9, 11, and 12 of your minnesota m1m 4562. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements.

• recalculate lines 4, 5, 8, 9, 11, and 12 of your minnesota m1m 4562. Your first name and initial last nameyour social. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. Complete form m1 using the minnesota. Web plete schedule m1mt to determine if you are required to pay minnesota amt. You may be required to pay minnesota alternative minimum tax even if you did not have to pay. Determine line 4 of schedule m1m by c omple ng the following s teps: Web minnesota allows the following subtractions from income on forms m1m and m1mb: Web 25 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax withheld, enter the amount from line 1 of form m1. Web we last updated minnesota form m1m in december 2022 from the minnesota department of revenue.

Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Web we last updated the income additions and subtractions (onscreen version) in december 2022, so this is the latest version of form m1m, fully updated for tax year 2022. See the minnesota instructions for full requirements. Web • enter line 10 of your federal form 4562 on line 10 of your minnesota m1m 4562. Complete form m1 using the minnesota. If the result is less than $12,525 and you had amounts withheld or. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. You may be required to pay minnesota alternative minimum tax even if you did not have to pay. Web 2020 form m1, individual income tax your first name and initial *201111* your last name your social security number (ssn) if a joint return, spouse’s first name and initial.

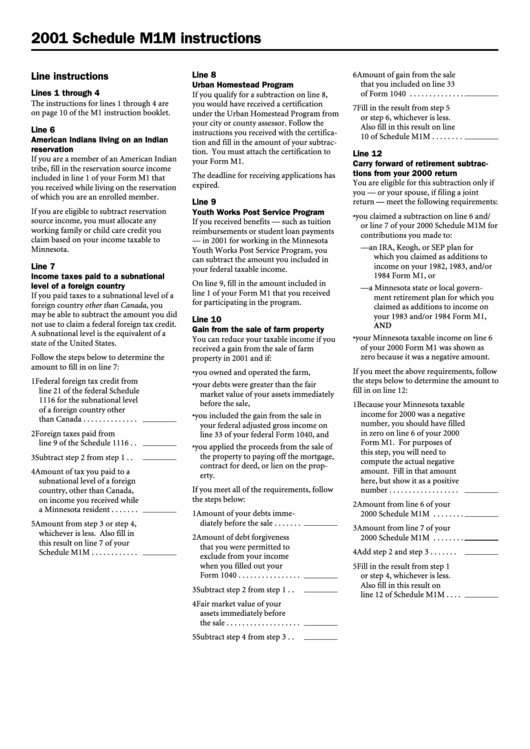

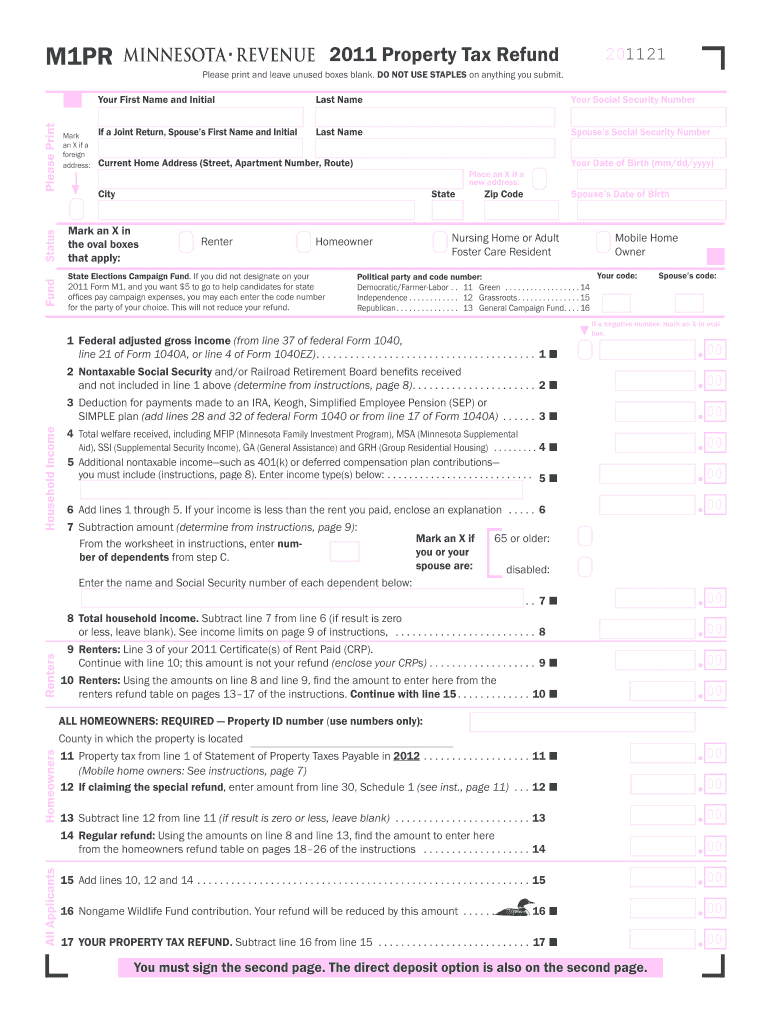

Schedule M1m Instructions 2001 printable pdf download

Web plete schedule m1mt to determine if you are required to pay minnesota amt. Web minnesota allows the following subtractions from income on forms m1m and m1mb: If the result is less than $12,525 and you had amounts withheld or. This form is for income earned in tax year 2022, with tax returns due in april. Wednesday night i filed.

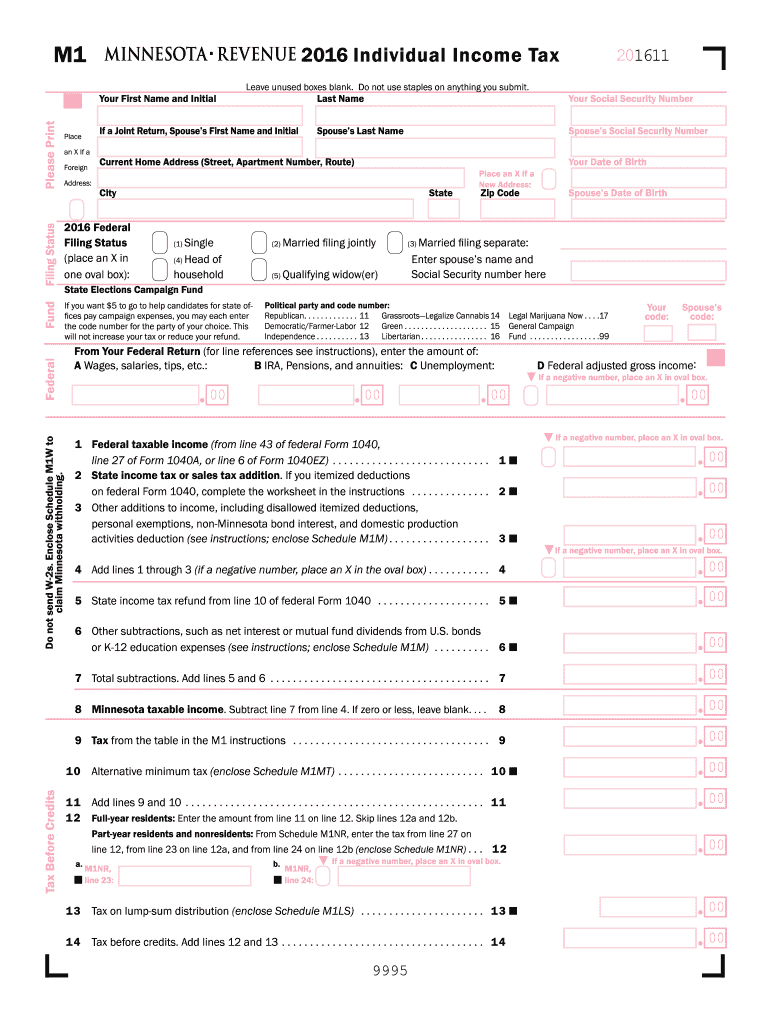

MN DoR M1 2018 Fill out Tax Template Online US Legal Forms

Web • enter line 10 of your federal form 4562 on line 10 of your minnesota m1m 4562. Web we last updated the income additions and subtractions (onscreen version) in december 2022, so this is the latest version of form m1m, fully updated for tax year 2022. You may be required to pay minnesota alternative minimum tax even if you.

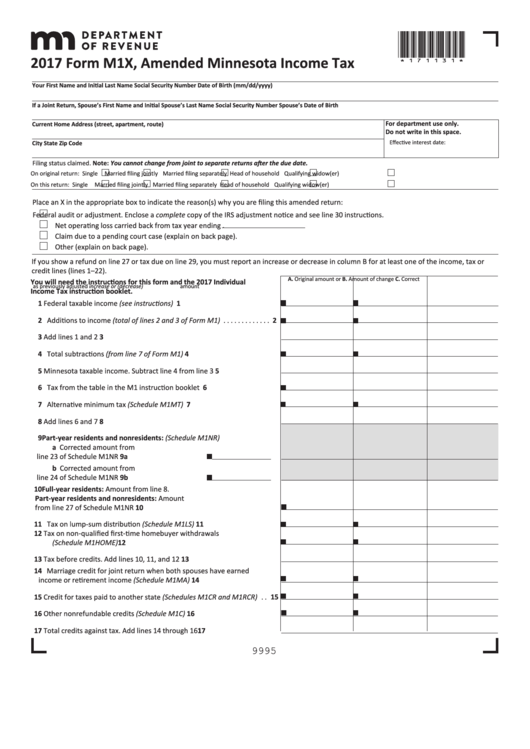

Fillable Form M1x Amended Minnesota Tax 2017 printable pdf

See the minnesota instructions for full requirements. Determine line 4 of schedule m1m by c omple ng the following s teps: Wednesday night i filed 2 returns that bounced on minnesota with the following message: If the result is less than $12,525 and you had amounts withheld or. Web get the minnesota form m1m (income additions and subtractions.

Mn Form Instructions Fill Out and Sign Printable PDF Template signNow

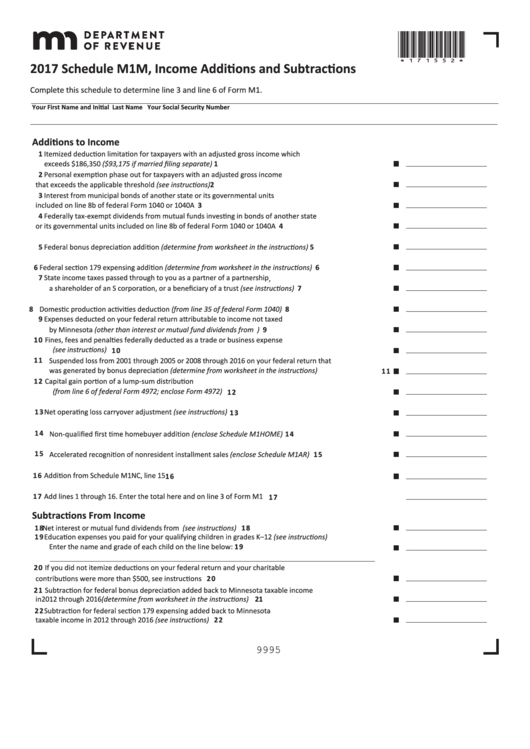

Web 25 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax withheld, enter the amount from line 1 of form m1. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. Web 2018 schedule m1m, income additions and subtractions completethis scheduleto.

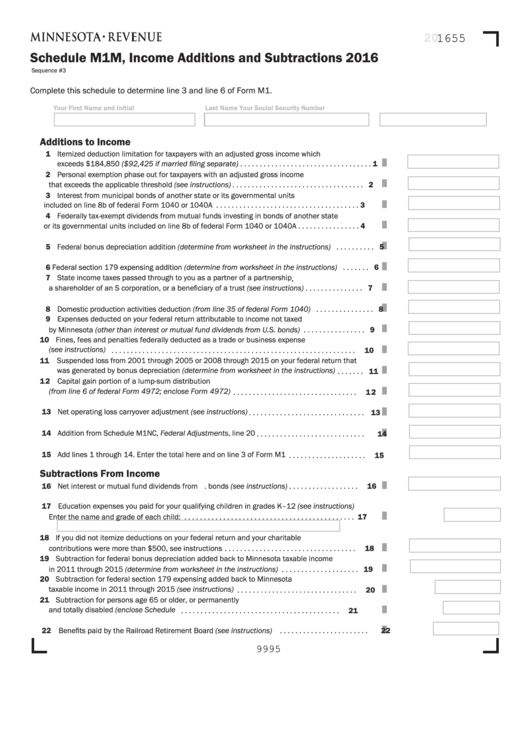

Schedule M1m Additions And Substractions 2016 printable pdf

Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. This form is for income earned in tax year 2022, with tax returns due in april. Web use form m1 , individual income tax , to estimate your minnesota tax. Line 1 of that form. Web we last updated minnesota form m1m in december.

Minnesota Form Fill Out and Sign Printable PDF Template signNow

Web 2018 schedule m1m, income additions and subtractions completethis scheduleto determineline 2 and line 7 of formm1. You may be required to pay minnesota alternative minimum tax even if you did not have to pay. Download your adjusted document, export it to the cloud, print it from the. Web 25 if you are a resident of michigan or north dakota.

Fill Free fillable 2020 Schedule M1M, Addions and Subtracons

Web use form m1 , individual income tax , to estimate your minnesota tax. Complete form m1 using the minnesota. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Your first name and initial last nameyour social. You may be required to pay minnesota alternative minimum tax even if you.

Schedule M1m Additions And Subtractions 2017 printable pdf

Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Your first name and initial last nameyour social. Income you calculated in step 1 on form m1 , line 1. Web get the minnesota form m1m (income additions.

M1M taxes.state.mn.us

Web • enter line 10 of your federal form 4562 on line 10 of your minnesota m1m 4562. Web minnesota itemized deductions > schedule m1ma marriage credit > schedule m1wfc minnesota working family credit > schedule m1ref refundable credits > schedule. Web 2018 schedule m1m, income additions and subtractions completethis scheduleto determineline 2 and line 7 of formm1. Web get.

2016 M1 Instructions Fill Out and Sign Printable PDF Template signNow

Line 1 of that form. Download your adjusted document, export it to the cloud, print it from the. Web the result on line 12 of minnesota form 4562 cannot be more than. This form is for income earned in tax year 2022, with tax returns due in april. Web 2018 schedule m1m, income additions and subtractions completethis scheduleto determineline 2.

Web We Last Updated The Minnesota Individual Income Tax Instructions (Form M1) In February 2023, So This Is The Latest Version Of Form M1 Instructions, Fully Updated For Tax Year.

Web 25 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax withheld, enter the amount from line 1 of form m1. Your first name and initial last nameyour social. See the minnesota instructions for full requirements. Web we last updated the income additions and subtractions (onscreen version) in december 2022, so this is the latest version of form m1m, fully updated for tax year 2022.

Web 18 If You Are A Resident Of Michigan Or North Dakota Filing Form M1 Only To Receive A Refund Of All Minnesota Tax Withheld, Enter The Amount From Line 1 Of Form M1.

Line 1 of that form. Web we last updated minnesota form m1m in december 2022 from the minnesota department of revenue. Bond obligations if you deducted expenses on your federal return connected with. Download your adjusted document, export it to the cloud, print it from the.

Web Line 3 — Expenses Relating To Income Not Taxed By Minnesota, Other Than From U.s.

Web the result on line 12 of minnesota form 4562 cannot be more than. Web • enter line 10 of your federal form 4562 on line 10 of your minnesota m1m 4562. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Web use form m1 , individual income tax , to estimate your minnesota tax.

Wednesday Night I Filed 2 Returns That Bounced On Minnesota With The Following Message:

If the result is less than $12,525 and you had amounts withheld or. This form is for income earned in tax year 2022, with tax returns due in april. You may be required to pay minnesota alternative minimum tax even if you did not have to pay. • recalculate lines 4, 5, 8, 9, 11, and 12 of your minnesota m1m 4562.