Mississippi Withholding Form 2023

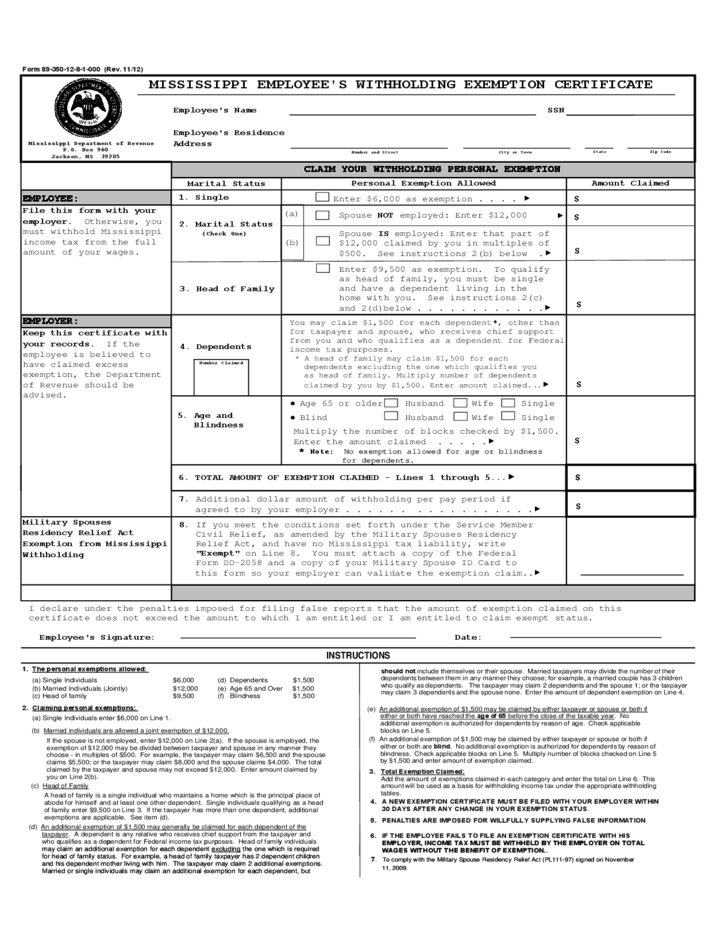

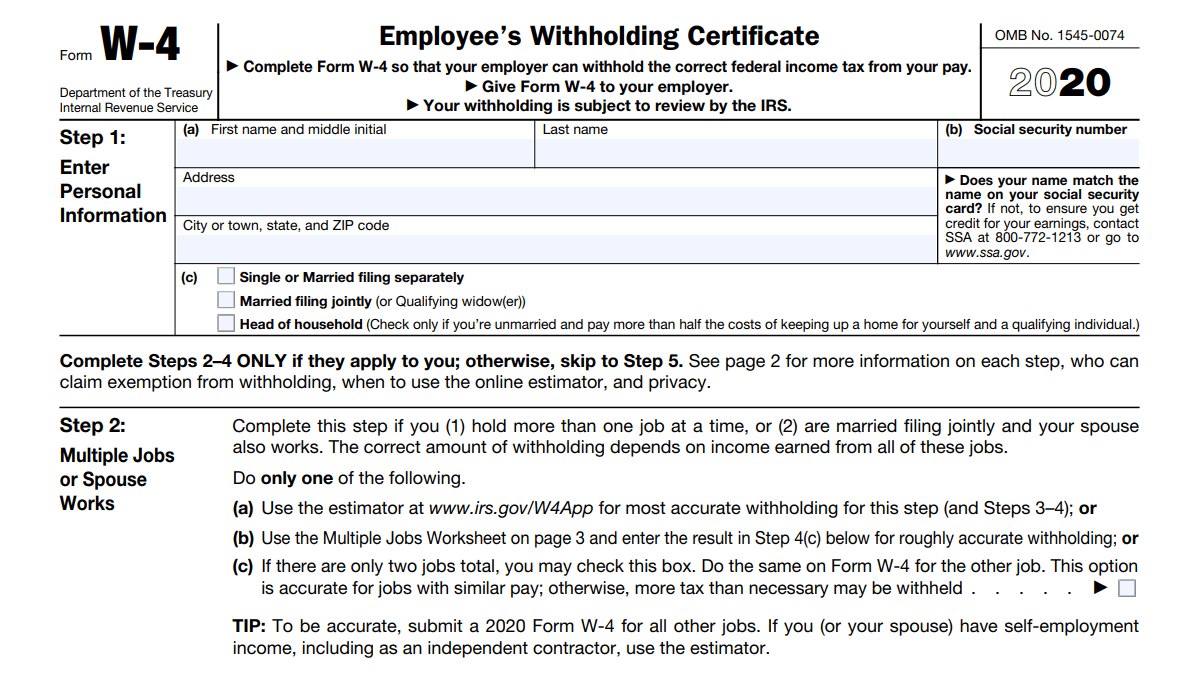

Mississippi Withholding Form 2023 - Web mississippi’s 2023 withholding formula was released by the state revenue department and is the first to use a flat tax rate. Legislation passed in 2022 ( h.b. Single file this form with your employer. Web mississippi employee's withholding exemption certificate. If you are not able to complete and submit your registration, your information will not be saved. Otherwise, you must withhold mississippi income tax from the full amount of your wages. Gather this information before beginning the registration process. Create your tap account go to tap to register. Head of family (a) (b) spouse. $ file this form with your employer.

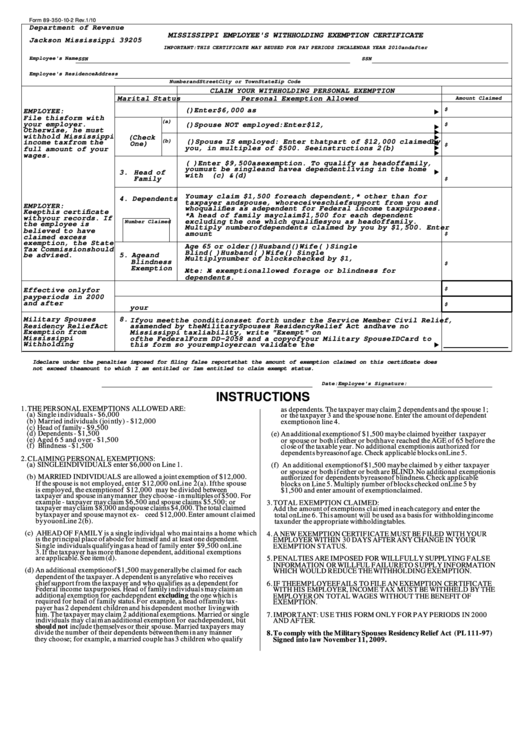

If you are not able to complete and submit your registration, your information will not be saved. 8/19 mississippi employee's withholding exemption certificate employee's name ssn employee's residence address marital status employee: Web claim your withholding personal exemption personal exemption allowed. 531) introduced a flat 5% tax rate on annual income over $10,000 starting in 2023. Otherwise, you must withhold mississippi income tax from the full amount of your wages. Legislation passed in 2022 ( h.b. Gather this information before beginning the registration process. Marital status (check one) 3. Web withholding tax online filing system withholding taxpayers use tap (taxpayer access point) for online filing. $ file this form with your employer.

Web individual income tax forms | dor individual income tax forms electronic filing of your tax return and choosing direct deposit may speed up your refund by 8 weeks! Head of family (a) (b) spouse. Legislation passed in 2022 ( h.b. Marital status (check one) 3. Otherwise, you must withhold mississippi income tax from the full amount of your wages. 531) introduced a flat 5% tax rate on annual income over $10,000 starting in 2023. Web claim your withholding personal exemption personal exemption allowed. Web withholding tax online filing system withholding taxpayers use tap (taxpayer access point) for online filing. Gather this information before beginning the registration process. If you are not able to complete and submit your registration, your information will not be saved.

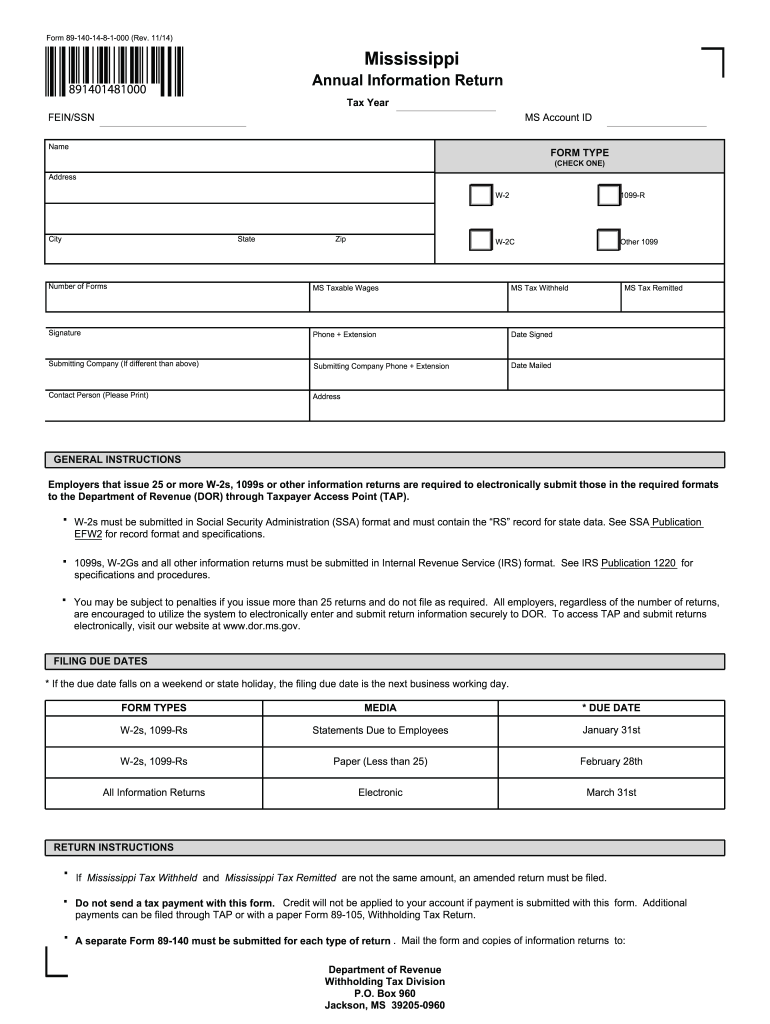

Fill Free fillable forms for the state of Mississippi

Single file this form with your employer. Otherwise, you must withhold mississippi income tax from the full amount of your wages. 531) introduced a flat 5% tax rate on annual income over $10,000 starting in 2023. Web individual income tax forms | dor individual income tax forms electronic filing of your tax return and choosing direct deposit may speed up.

Mississippi State Withholding Form Personal Exemption

Web a downloadable pdf list of all available individual income tax forms. Marital status (check one) 3. Web mississippi employee's withholding exemption certificate. Otherwise, you must withhold mississippi income tax from the full amount of your wages. If you are not able to complete and submit your registration, your information will not be saved.

Mississippi Sales Tax Exemption Form

Marital status (check one) 3. Create your tap account go to tap to register. Otherwise, you must withhold mississippi income tax from the full amount of your wages. Web claim your withholding personal exemption personal exemption allowed. Otherwise, you must withhold mississippi income tax from the full amount of your wages.

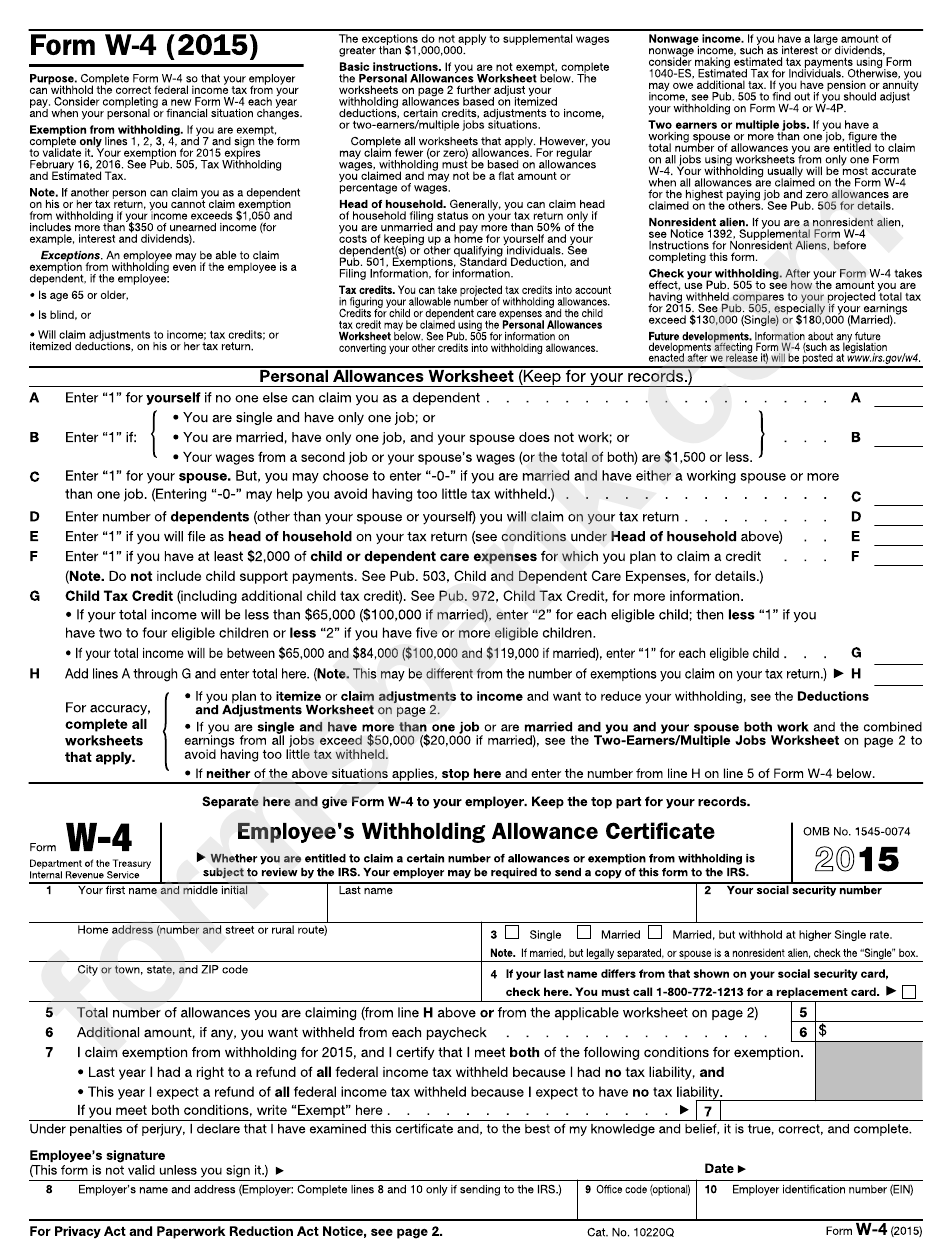

Federal Withholding Tables 2023 Federal Tax

Gather this information before beginning the registration process. Otherwise, you must withhold mississippi income tax from the full amount of your wages. Head of family (a) (b) spouse. Web mississippi employee's withholding exemption certificate. Web individual income tax forms | dor individual income tax forms electronic filing of your tax return and choosing direct deposit may speed up your refund.

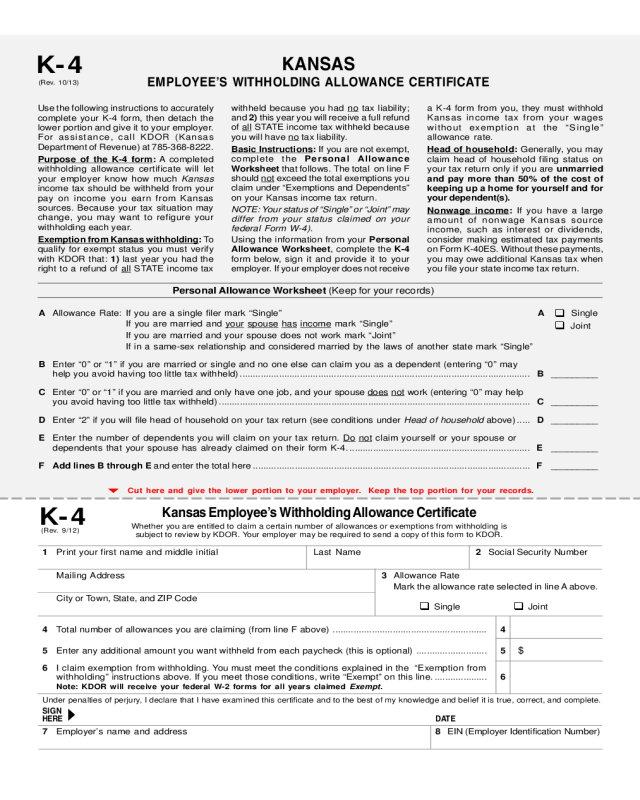

Employees Withholding Allowance Certificate Kansas Edit, Fill, Sign

Legislation passed in 2022 ( h.b. Otherwise, you must withhold mississippi income tax from the full amount of your wages. Head of family (a) (b) spouse. Web claim your withholding personal exemption personal exemption allowed. $ file this form with your employer.

Mississippi State W 4 Form W4 Form 2021

If you are not able to complete and submit your registration, your information will not be saved. Web mississippi’s 2023 withholding formula was released by the state revenue department and is the first to use a flat tax rate. Web mississippi employee's withholding exemption certificate. Web a downloadable pdf list of all available individual income tax forms. Gather this information.

Mississippi State Withholding Form 2021 2022 W4 Form

Legislation passed in 2022 ( h.b. Gather this information before beginning the registration process. Web mississippi’s 2023 withholding formula was released by the state revenue department and is the first to use a flat tax rate. Single file this form with your employer. 8/19 mississippi employee's withholding exemption certificate employee's name ssn employee's residence address marital status employee:

2017 ms state tax forms Fill out & sign online DocHub

Single file this form with your employer. Web individual income tax forms | dor individual income tax forms electronic filing of your tax return and choosing direct deposit may speed up your refund by 8 weeks! Web a downloadable pdf list of all available individual income tax forms. $ file this form with your employer. 8/19 mississippi employee's withholding exemption.

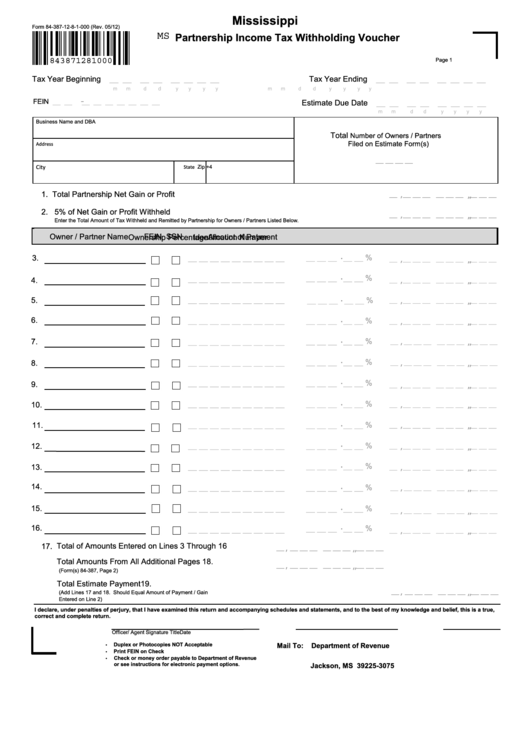

Form 843871281000 Mississippi Partnership Tax Withholding

Head of family (a) (b) spouse. Web withholding tax online filing system withholding taxpayers use tap (taxpayer access point) for online filing. Otherwise, you must withhold mississippi income tax from the full amount of your wages. Marital status (check one) 3. Legislation passed in 2022 ( h.b.

Ms Printable W4 Forms 2021 2022 W4 Form

8/19 mississippi employee's withholding exemption certificate employee's name ssn employee's residence address marital status employee: Head of family (a) (b) spouse. Marital status (check one) 3. Web a downloadable pdf list of all available individual income tax forms. Create your tap account go to tap to register.

Web Mississippi Employee's Withholding Exemption Certificate.

Head of family (a) (b) spouse. Otherwise, you must withhold mississippi income tax from the full amount of your wages. 531) introduced a flat 5% tax rate on annual income over $10,000 starting in 2023. Marital status (check one) 3.

Otherwise, You Must Withhold Mississippi Income Tax From The Full Amount Of Your Wages.

Web a downloadable pdf list of all available individual income tax forms. Single file this form with your employer. Web individual income tax forms | dor individual income tax forms electronic filing of your tax return and choosing direct deposit may speed up your refund by 8 weeks! Web claim your withholding personal exemption personal exemption allowed.

Web Mississippi’s 2023 Withholding Formula Was Released By The State Revenue Department And Is The First To Use A Flat Tax Rate.

Create your tap account go to tap to register. $ file this form with your employer. 8/19 mississippi employee's withholding exemption certificate employee's name ssn employee's residence address marital status employee: Legislation passed in 2022 ( h.b.

Web Withholding Tax Online Filing System Withholding Taxpayers Use Tap (Taxpayer Access Point) For Online Filing.

If you are not able to complete and submit your registration, your information will not be saved. Gather this information before beginning the registration process.