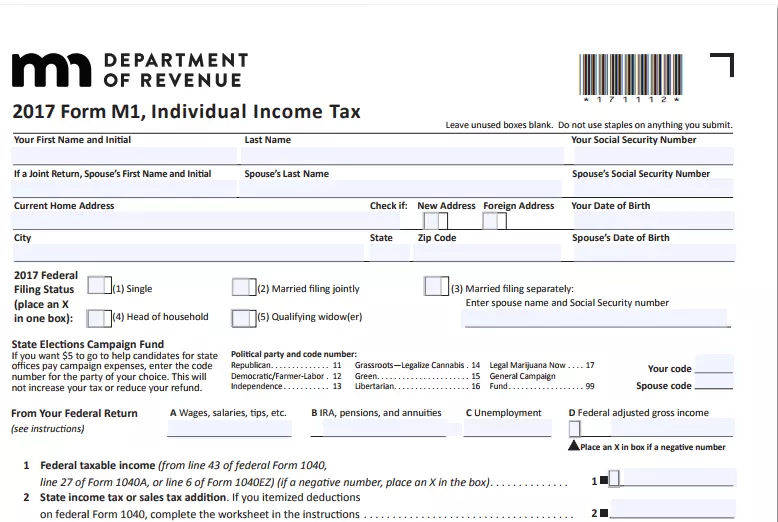

Minnesota Form M1 Instructions 2022

Minnesota Form M1 Instructions 2022 - Subtract line 8 from line 3. Web 9 minnesota taxable income. If zero or less, leave blank. You must file yearly by april 17. We'll make sure you qualify, calculate your. Web we last updated minnesota form m1x in february 2023 from the minnesota department of revenue. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. It will help candidates for state offices. This form is for income earned in tax year 2022, with tax returns due in april. Form m1 is the most common individual income tax return filed for minnesota residents.

Subtract line 8 from line 3. Web filing a paper income tax return. Web we last updated minnesota form m1x in february 2023 from the minnesota department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Web forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule m1sa minnesota. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web if you were a nonresident ,. The following draft forms and instructions are for. You may qualify for certain minnesota itemized deductions. We'll make sure you qualify, calculate your.

You can download or print current or. You may qualify for certain minnesota itemized deductions. Web you must register to file withholding tax if any of these apply: Web here's how it works 02. 2022 minnesota income tax withheld (onscreen version) get. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your. Share your form with others send m1x. Web we last updated minnesota form m1x in february 2023 from the minnesota department of revenue. It will help candidates for state offices.

Minnesota tax forms Fill out & sign online DocHub

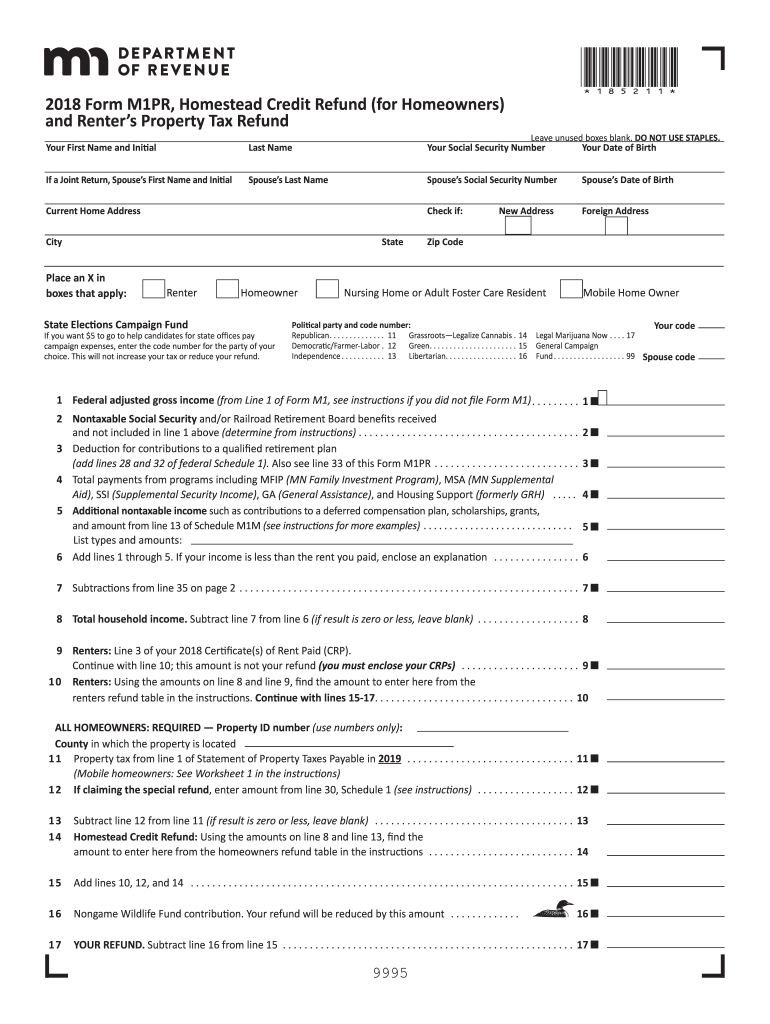

It will help candidates for state offices. Web we last updated minnesota form m1lti in february 2023 from the minnesota department of revenue. The following draft forms and instructions are for. Web 9 minnesota taxable income. You may qualify for certain minnesota itemized deductions.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web filing a paper income tax return. Web if you were a nonresident ,. You may qualify for certain minnesota itemized deductions. Share your form with others send m1x. Web we last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022.

Minnesota Form M1

This form is for income earned in tax year 2022, with tax returns due in april. Share your form with others send m1x. Subtract line 8 from line 3. You may qualify for certain minnesota itemized deductions. If zero or less, leave blank.

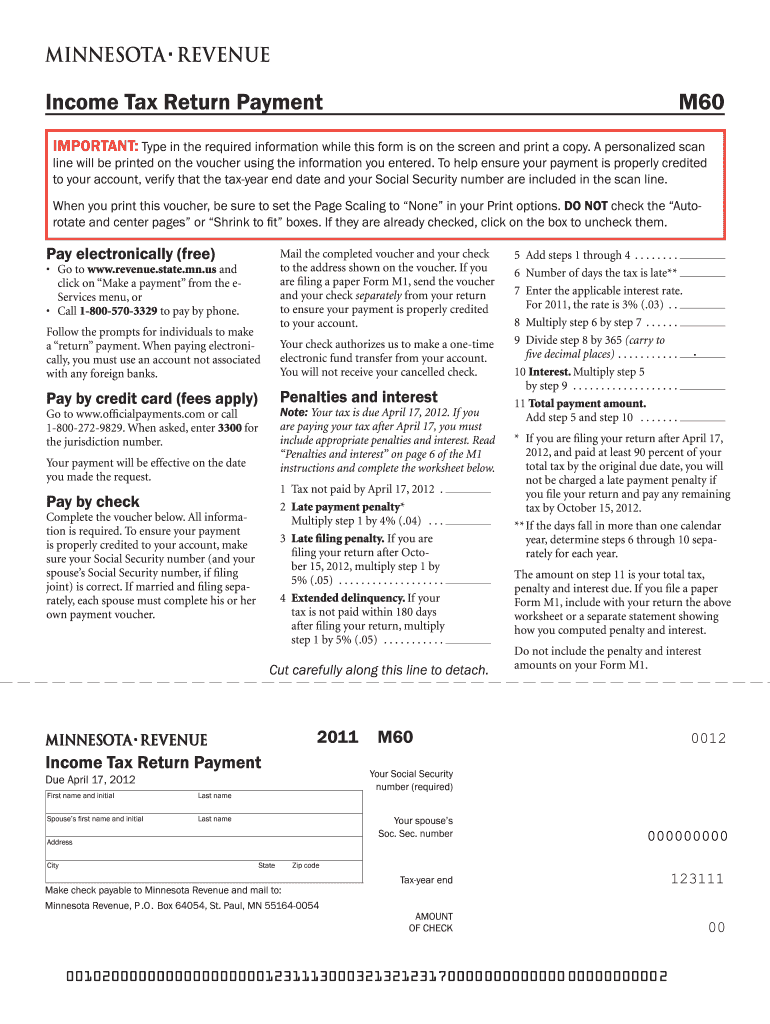

Mn tax payment voucher m60 Fill out & sign online DocHub

Web we last updated minnesota form m1x in february 2023 from the minnesota department of revenue. Web june 15, 2023 — forms m1pr, m1prx, and instructions have been posted for taxpayer use. Web 9 minnesota taxable income. Share your form with others send m1x. The final deadline to claim the 2022 refund is august 15, 2024.

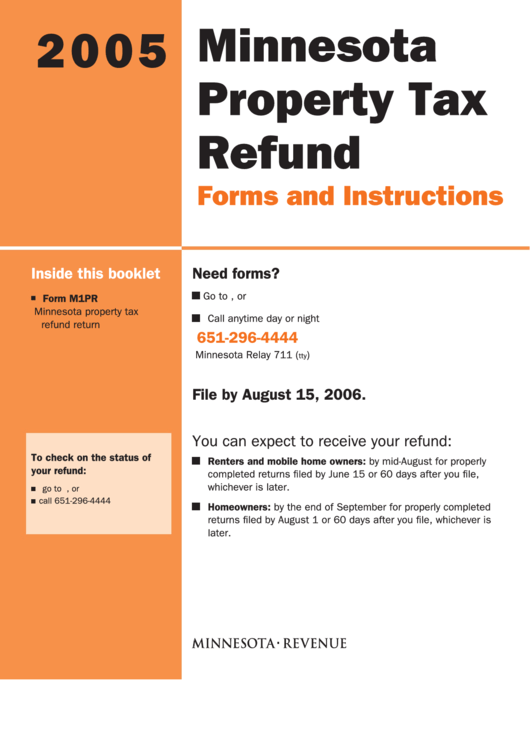

How To File Minnesota Property Tax Refund

Subtract line 8 from line 3. Web you must register to file withholding tax if any of these apply: 2022 minnesota income tax withheld (onscreen version) get. Web if you were a nonresident ,. Find them using find a form.

2020 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. 2022 income additions and subtractions (onscreen version) get form m1m: You can download or print current or. • you have employees and anticipate withholding tax from their wages in the next 30 days • you agree to.

MN DoR M4 20202022 Fill out Tax Template Online US Legal Forms

Web here's how it works 02. Web we last updated the individual income tax return in december 2022, so this is the latest version of form m1, fully updated for tax year 2022. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your. Web 9 minnesota taxable.

Minnesota Tax Table M1 Instructions 2020

Web here's how it works 02. Share your form with others send m1x. It will help candidates for state offices. Before starting your minnesota income tax return ( form m1, individual income tax ), you must complete federal form 1040 to determine your. The following draft forms and instructions are for.

Fill Free fillable Minnesota Department of Revenue PDF forms

2022 income additions and subtractions (onscreen version) get form m1m: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. From the table in the form m1 instructions. Web we last updated minnesota form m1lti in february 2023 from the minnesota department of revenue. Web 2020 form.

Form M1pr Minnesota Property Tax Refund Return Instructions 2005

Web you must register to file withholding tax if any of these apply: Web filing a paper income tax return. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. 2022 minnesota income tax withheld (onscreen version) get. You can download or print current or.

From The Table In The Form M1 Instructions.

Form m1 is the most common individual income tax return filed for minnesota residents. Web if you were a nonresident ,. You must file yearly by april 17. We'll make sure you qualify, calculate your.

• You Have Employees And Anticipate Withholding Tax From Their Wages In The Next 30 Days • You Agree To Withhold.

If zero or less, leave blank. The final deadline to claim the 2022 refund is august 15, 2024. You may qualify for certain minnesota itemized deductions. The following draft forms and instructions are for.

Share Your Form With Others Send M1X.

It will help candidates for state offices. 2022 minnesota income tax withheld (onscreen version) get. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. This form is for income earned in tax year 2022, with tax returns due in april.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web we last updated minnesota form m1x in february 2023 from the minnesota department of revenue. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. 2022 income additions and subtractions (onscreen version) get form m1m: Web you must register to file withholding tax if any of these apply: