Michigan State Tax Exemption Form

Michigan State Tax Exemption Form - Look for forms using our forms search or view a list of income tax forms by year. If any of these links are broken, or you can't find the form you need, please let. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Complete, edit or print tax forms instantly. Web forms and exemption certificates can be found at tax services forms download web page. Request to rescind principal residence exemption. Web business taxes sales and use tax 2022 sales & use tax forms important note tax forms are tax year specific. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. Web michigan homestead property tax credit. Dependents include qualifying children and qualifying relatives.

Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Web the purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed below. Web download a copy of the michigan general sales tax exemption form and return it to: Web additional resources need a different form? Complete, edit or print tax forms instantly. Web business taxes sales and use tax 2022 sales & use tax forms important note tax forms are tax year specific. Any altering of a form to change a tax year or any reported tax period outside. Web student organizations cannot claim an exemption from sales and use tax using msu’s exempt status. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: However, if the student organization has obtained its own exempt status,.

Web for other michigan sales tax exemption certificates, go here. Web forms and exemption certificates can be found at tax services forms download web page. Look for forms using our forms search or view a list of income tax forms by year. Web michigan state university, as an instrumentality of the state of michigan and exempt from federal income tax under section 501(c)(3) of the internal revenue code, is exempt. Complete, edit or print tax forms instantly. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. However, if the student organization has obtained its own exempt status,. Web neighborhood enterprise zone (nez) act new personal property exemption a personal property tax exemption for specific businesses located within eligible distressed. Web additional resources need a different form?

Outofstate homeowners use loophole to avoid Michigan property taxes

If any of these links are broken, or you can't find the form you need, please let. Web neighborhood enterprise zone (nez) act new personal property exemption a personal property tax exemption for specific businesses located within eligible distressed. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf,.

How to get a Certificate of Exemption in Michigan

Web michigan homestead property tax credit. Web the purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed below. Web student organizations cannot claim an exemption from sales and use tax using msu’s exempt status. Please make sure to complete the form entirely. Complete, edit or print tax forms instantly.

Form 3372 Download Fillable PDF or Fill Online Michigan Sales and Use

Web michigan state university, as an instrumentality of the state of michigan and exempt from federal income tax under section 501(c)(3) of the internal revenue code, is exempt. This certifies that this claim is. Web this letter serves as notice to a seller that michigan state university qualifies to buy goods and services without paying the michigan sales or use.

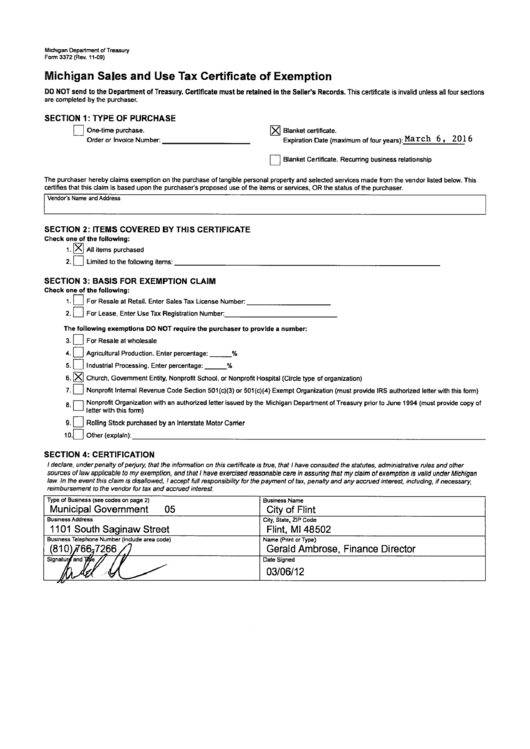

Michigan Sales And Use Tax Certificate Of Exemption City Of Flint

Web principal residence exemption affidavit. Web neighborhood enterprise zone (nez) act new personal property exemption a personal property tax exemption for specific businesses located within eligible distressed. Notice of denial of principal residence exemption (local. Web michigan homestead property tax credit. Web we have three michigan sales tax exemption forms available for you to print or save as a pdf.

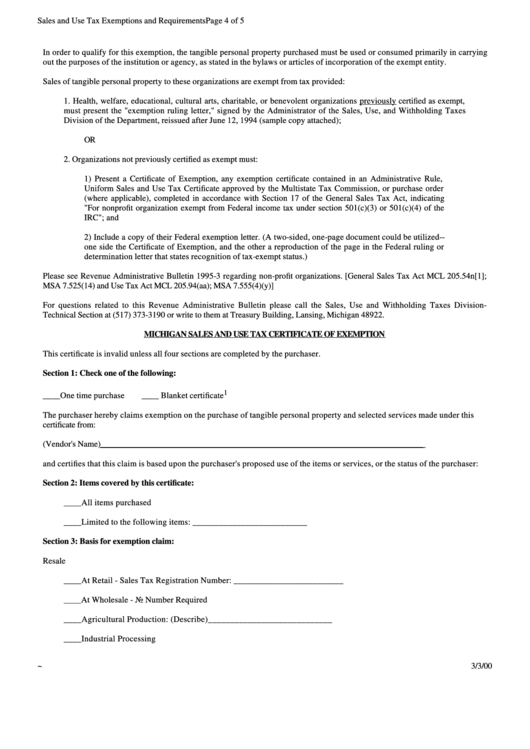

Michigan Sales And Use Tax Certificate Of Exemption Form March 2000

Notice of denial of principal residence exemption (local. Web michigan homestead property tax credit. Please make sure to complete the form entirely. Web we have three michigan sales tax exemption forms available for you to print or save as a pdf file. Look for forms using our forms search or view a list of income tax forms by year.

MICHIGAN SALES AND USE TAX CERTIFICATE OF EXEMPTION

Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. Complete, edit or print tax forms instantly. Web principal residence exemption affidavit. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Web michigan state university, as.

State Tax Exemption Map ⋆ National Utility Solutions

Any altering of a form to change a tax year or any reported tax period outside. Dependents include qualifying children and qualifying relatives. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Web the purchaser hereby claims exemption on the purchase of tangible personal property and selected services made from the vendor listed.

Employee Withholding Exemption Certificate Michigan Free Download

Any altering of a form to change a tax year or any reported. If you fail or refuse to submit. Web this letter serves as notice to a seller that michigan state university qualifies to buy goods and services without paying the michigan sales or use tax based on exempt status. Download or email mi form 5076 & more fillable.

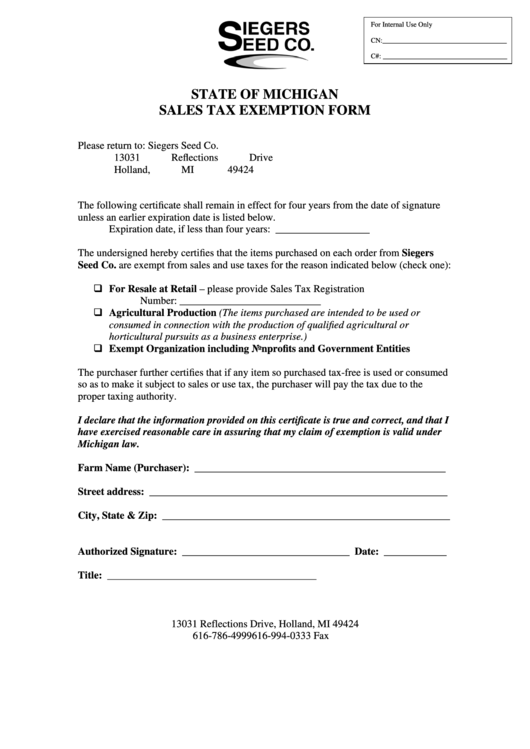

State Of Michigan Sales Tax Exemption Form Siegers Seed Co. printable

Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. Web download a copy of the michigan general sales tax exemption form and return it to: Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. If.

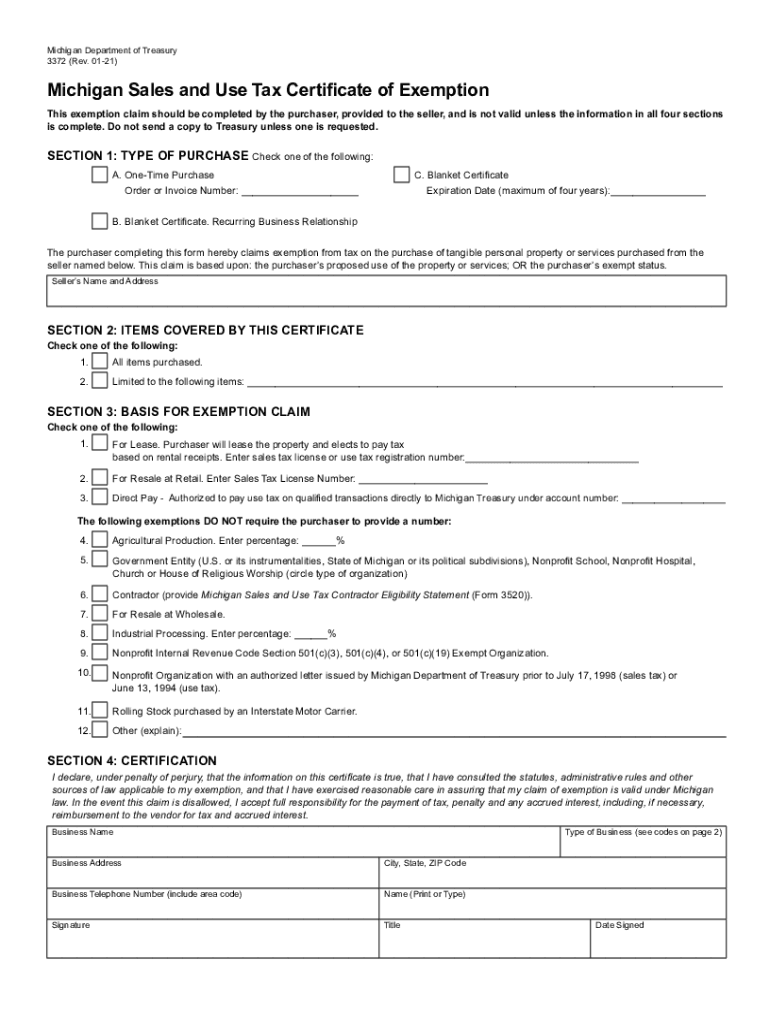

Form 3372 Fill Out and Sign Printable PDF Template signNow

Web michigan department of treasury 3372 (rev. If any of these links are broken, or you can't find the form you need, please let. Any altering of a form to change a tax year or any reported. Download a pdf form 3372 sales. Purchases or payment of services must be made directly from michigan.

Please Make Sure To Complete The Form Entirely.

Download a pdf form 3372 sales. Web forms and exemption certificates can be found at tax services forms download web page. Web principal residence exemption affidavit. Any altering of a form to change a tax year or any reported.

Look For Forms Using Our Forms Search Or View A List Of Income Tax Forms By Year.

Web レコルト recolte ソロ ブレンダー solen ソラン用トライタン製ボトル ブレンダー ミキサー ジューサー スムージー トライタン 割れない 軽量 400ml 別売り【ポイント10倍】. Web additional resources need a different form? Web neighborhood enterprise zone (nez) act new personal property exemption a personal property tax exemption for specific businesses located within eligible distressed. This certifies that this claim is.

Web In Order To Claim An Exemption From Sales Or Use Tax, A Purchaser Must Provide A Valid Claim Of Exemption To The Vendor By Completing One Of The Following:

Any altering of a form to change a tax year or any reported tax period outside. If you fail or refuse to submit. Web for other michigan sales tax exemption certificates, go here. Web michigan homestead property tax credit.

Web Download A Copy Of The Michigan General Sales Tax Exemption Form And Return It To:

Web student organizations cannot claim an exemption from sales and use tax using msu’s exempt status. Purchases or payment of services must be made directly from michigan. Web michigan state university, as an instrumentality of the state of michigan and exempt from federal income tax under section 501(c)(3) of the internal revenue code, is exempt. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently.