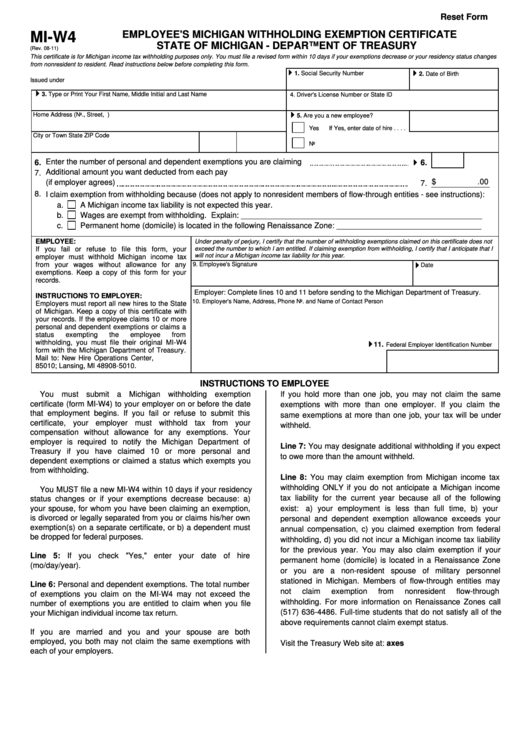

Mi W 4 Form

Mi W 4 Form - This form is for income earned in tax year 2022, with tax returns due in april. You must file a revised form within 10 days if your exem ptions decrease or your. Employee's withholding exemption certificate and instructions: If too little is withheld, you will generally owe tax when you file your tax return. Withholding certificate for michigan pension or annuity payments: Web 2022 individual income tax forms and instructions need a different form? You must file a revised form within 10. Web if you received a letter of inquiry regarding annual return for the return period of 2020, visit michigan treasury online (mto) to file or access the 2020 sales, use and. Resources state michigan w4 web page (18.98 kb) news fye 2023 bi. If you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form.

If too little is withheld, you will generally owe tax when you file your tax return. Web 2022 individual income tax forms and instructions need a different form? If too little is withheld, you will generally owe tax when you file your tax return. Web city tax withholding (w4) forms. Web if you received a letter of inquiry regarding annual return for the return period of 2020, visit michigan treasury online (mto) to file or access the 2020 sales, use and. Withholding certificate for michigan pension or annuity payments: If you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. If you fail or refuse to submit. You must file a revised form within 10 days if your exem ptions decrease or your. Employee's withholding exemption certificate and instructions:

Employee's withholding exemption certificate and instructions: Employee's withholding exemption certificate and instructions: If you fail or refuse to submit. Resources state michigan w4 web page (18.98 kb) news fye 2023 bi. Web 2022 individual income tax forms and instructions need a different form? If too little is withheld, you will generally owe tax when you file your tax return. You must file a revised form within 10 days if your exem ptions decrease or your. If you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. If too little is withheld, you will generally owe tax when you file your tax return. Web if you received a letter of inquiry regarding annual return for the return period of 2020, visit michigan treasury online (mto) to file or access the 2020 sales, use and.

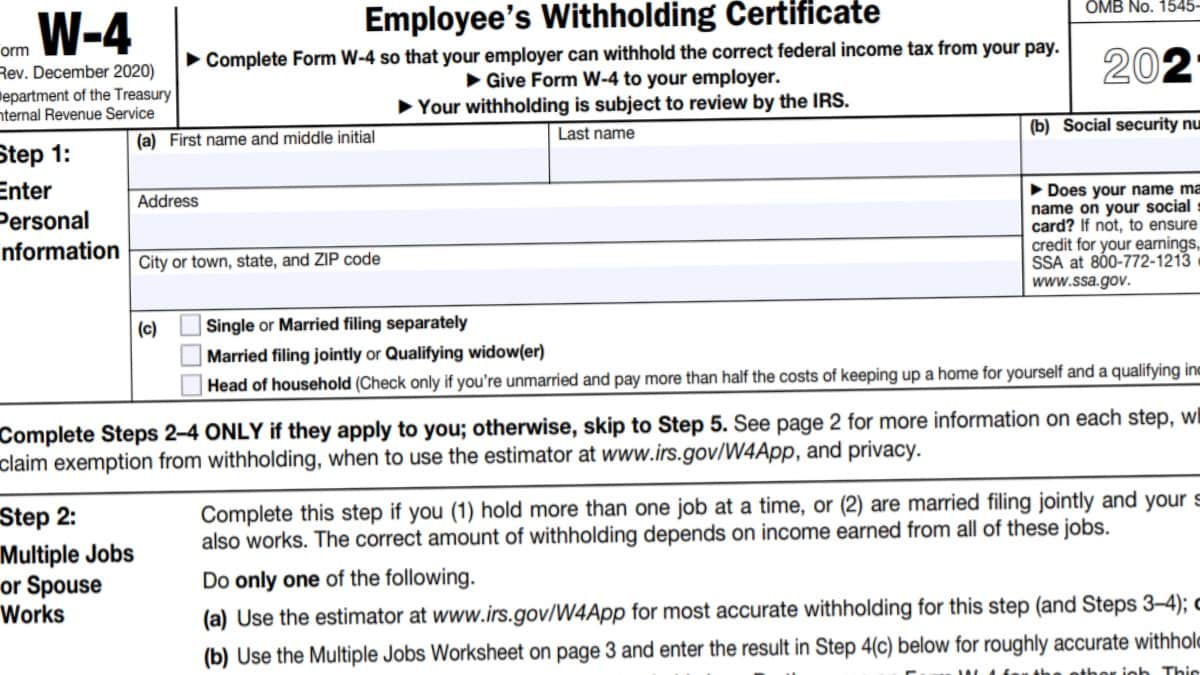

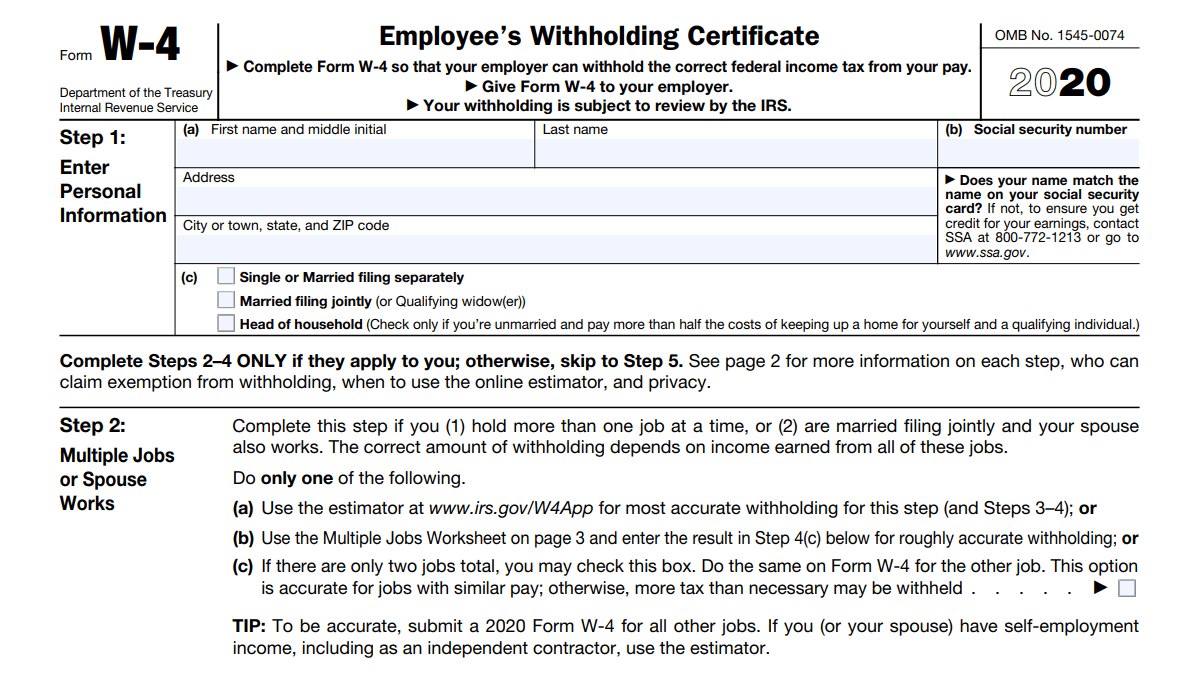

W4 Form 2022 Instructions W4 Forms TaxUni

Withholding certificate for michigan pension or annuity payments: Look for forms using our forms search or view a list of income tax forms by year. Withholding certificate for michigan pension or annuity payments: Web if you received a letter of inquiry regarding annual return for the return period of 2020, visit michigan treasury online (mto) to file or access the.

Ms Printable W4 Forms 2021 2022 W4 Form

Employee's withholding exemption certificate and instructions: If too little is withheld, you will generally owe tax when you file your tax return. You must file a revised form within 10. Employee's withholding exemption certificate and instructions: Resources state michigan w4 web page (18.98 kb) news fye 2023 bi.

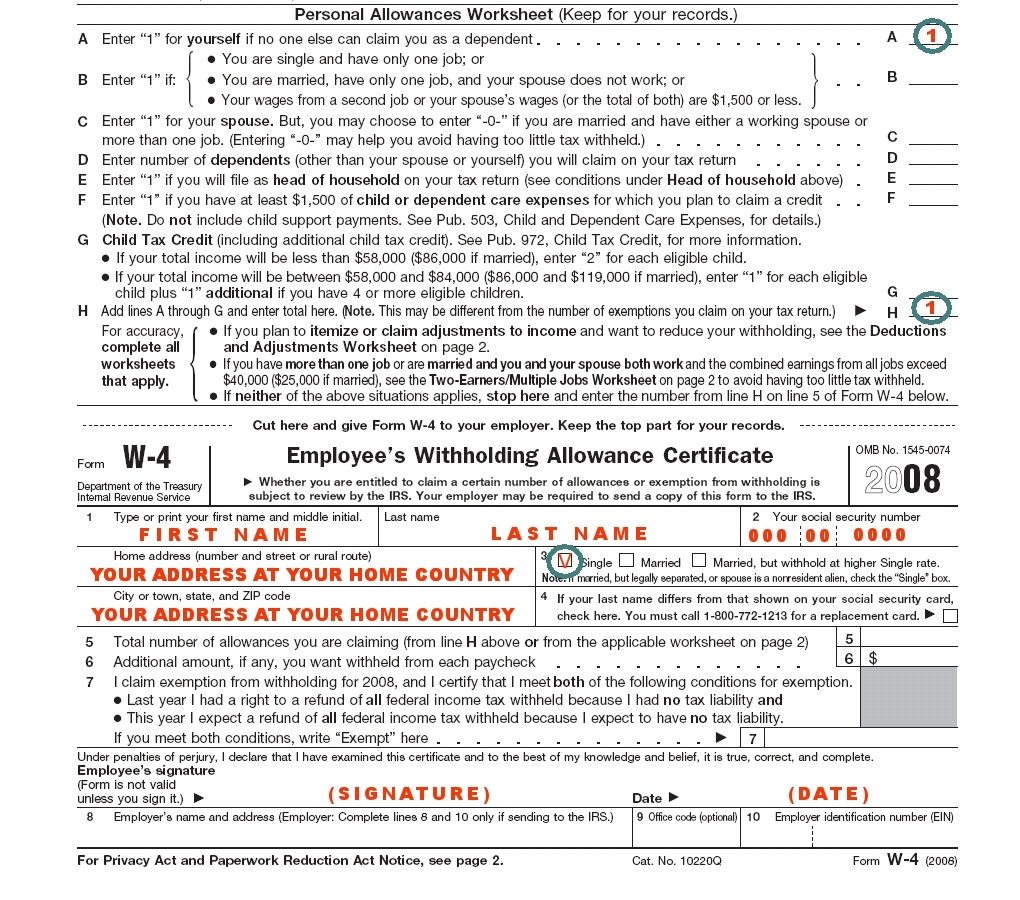

Sample W 4 Form W4 Form 2021 Printable

If too little is withheld, you will generally owe tax when you file your tax return. Withholding certificate for michigan pension or annuity payments: Web city tax withholding (w4) forms. If too little is withheld, you will generally owe tax when you file your tax return. You must file a revised form within 10.

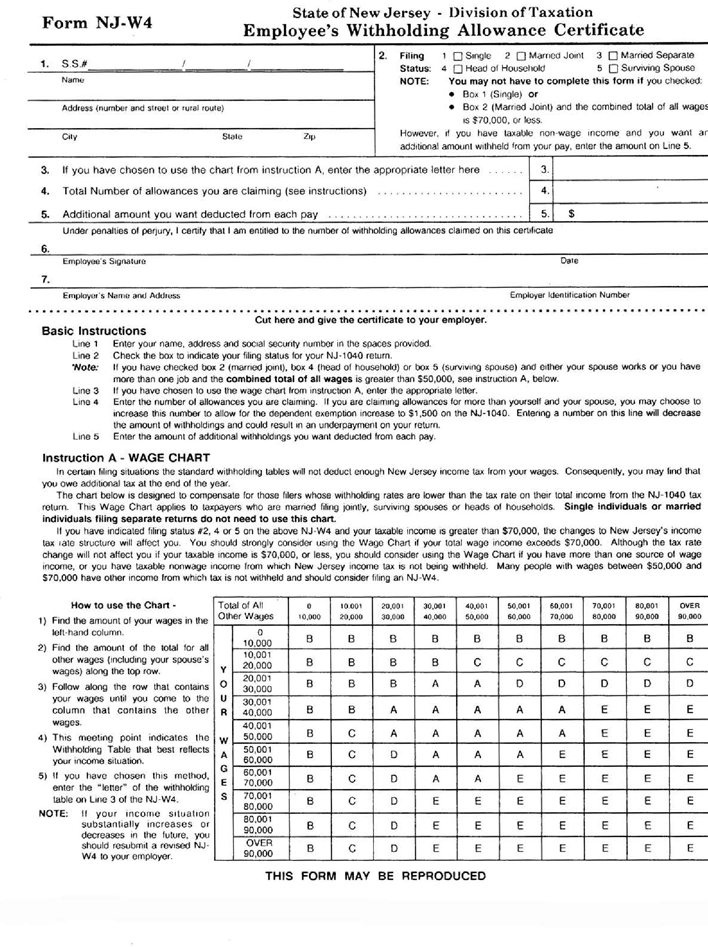

State Tax Withholding Forms Template Free Download Speedy Template

Web 2022 individual income tax forms and instructions need a different form? If you fail or refuse to submit. If too little is withheld, you will generally owe tax when you file your tax return. Withholding certificate for michigan pension or annuity payments: Withholding certificate for michigan pension or annuity payments:

Important Tax Information and Tax Forms · Camp USA · InterExchange

Web city tax withholding (w4) forms. If you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. If too little is withheld, you will generally owe tax when you file your tax return. This form is for income earned in tax year 2022, with tax returns due.

Fillable Form MiW4 Emploee'S Michigan Withholding Exemption

If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. Resources state michigan w4 web page (18.98 kb) news fye 2023 bi. This form is for income earned in tax year 2022, with tax returns due in april..

Download Michigan Form MIW4 for Free FormTemplate

You must file a revised form within 10 days if your exem ptions decrease or your. You must file a revised form within 10. This form is for income earned in tax year 2022, with tax returns due in april. Web if you received a letter of inquiry regarding annual return for the return period of 2020, visit michigan treasury.

Michigan Form Mi W4 PDFSimpli

Web city tax withholding (w4) forms. You must file a revised form within 10. If too little is withheld, you will generally owe tax when you file your tax return. Employee's withholding exemption certificate and instructions: Withholding certificate for michigan pension or annuity payments:

How to fill out your 2018 W4 form YouTube

Resources state michigan w4 web page (18.98 kb) news fye 2023 bi. You must file a revised form within 10. You must file a revised form within 10 days if your exem ptions decrease or your. Withholding certificate for michigan pension or annuity payments: Web city tax withholding (w4) forms.

W 4 Form 2020 Spanish 2022 W4 Form

Look for forms using our forms search or view a list of income tax forms by year. Web city tax withholding (w4) forms. This form is for income earned in tax year 2022, with tax returns due in april. Employee's withholding exemption certificate and instructions: Withholding certificate for michigan pension or annuity payments:

Resources State Michigan W4 Web Page (18.98 Kb) News Fye 2023 Bi.

If you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Web city tax withholding (w4) forms. You must file a revised form within 10. If too little is withheld, you will generally owe tax when you file your tax return.

Web If You Received A Letter Of Inquiry Regarding Annual Return For The Return Period Of 2020, Visit Michigan Treasury Online (Mto) To File Or Access The 2020 Sales, Use And.

Employee's withholding exemption certificate and instructions: If you fail or refuse to submit. Look for forms using our forms search or view a list of income tax forms by year. Withholding certificate for michigan pension or annuity payments:

Withholding Certificate For Michigan Pension Or Annuity Payments:

Employee's withholding exemption certificate and instructions: You must file a revised form within 10 days if your exem ptions decrease or your. If too little is withheld, you will generally owe tax when you file your tax return. This form is for income earned in tax year 2022, with tax returns due in april.