Md Form 511 Instructions

Md Form 511 Instructions - However, if you filed on the old 510 and elected to pay tax on behalf of residents, you. Web others (see instructions) e. Web as we previously reported, senate bill 787 included (among many other things) official legislation required by the maryland comptroller’s office to provide. Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. What is maryland form 511? State and local taxes based on income. If you previously filed form 510 and didn't elect to remit taxes on. Web select the applicable module below for instructions on generating the new form 510 or form 511. Web after completing the processing of the 2020 form 511, the dtate will begin processing the filed 2021 forms 511. Web go to government md form 511, line 2, utilize form (pink) override with the correct amount.

Web others (see instructions) e. Web after completing the processing of the 2020 form 511, the dtate will begin processing the filed 2021 forms 511. If you previously filed form 510 and didn't elect to remit taxes on. Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. 6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. However, if you filed on the old 510 and elected to pay tax on behalf of residents, you. Web 2021 instruction booklets note: Web go to government md form 511, line 2, utilize form (pink) override with the correct amount. For forms, visit the 2021 individual tax forms or business tax forms pages. State and local taxes based on income.

Web go to government md form 511, line 2, utilize form (pink) override with the correct amount. 2021 individual income tax instruction booklets 2021. If you previously filed form 510 and didn't elect to remit taxes on. For forms, visit the 2021 individual tax forms or business tax forms pages. Web the newly released maryland administrative release no. What is maryland form 511? Web after completing the processing of the 2020 form 511, the dtate will begin processing the filed 2021 forms 511. Web if you've already filed, you probably don't need to file an amended return. 6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. Web select the applicable module below for instructions on generating the new form 510 or form 511.

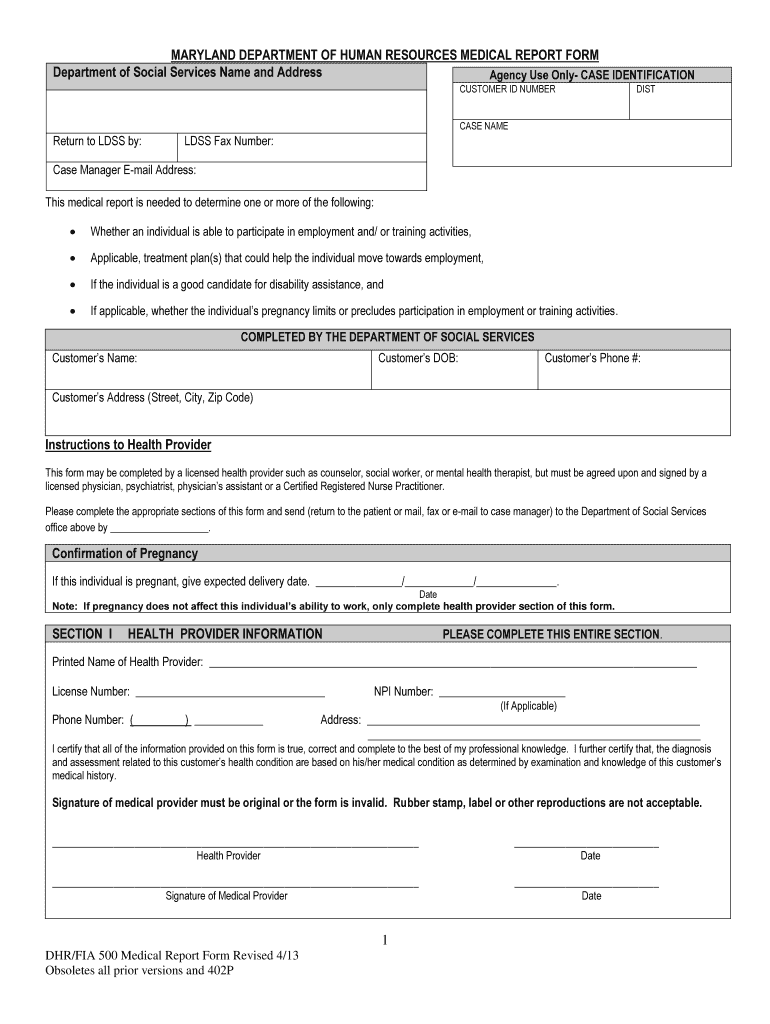

Md Medical Form Fill Out and Sign Printable PDF Template signNow

Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. Web select the applicable module below for instructions on generating the new form 510 or form 511. Web if you've already filed, you probably don't need to file an amended return. Web go.

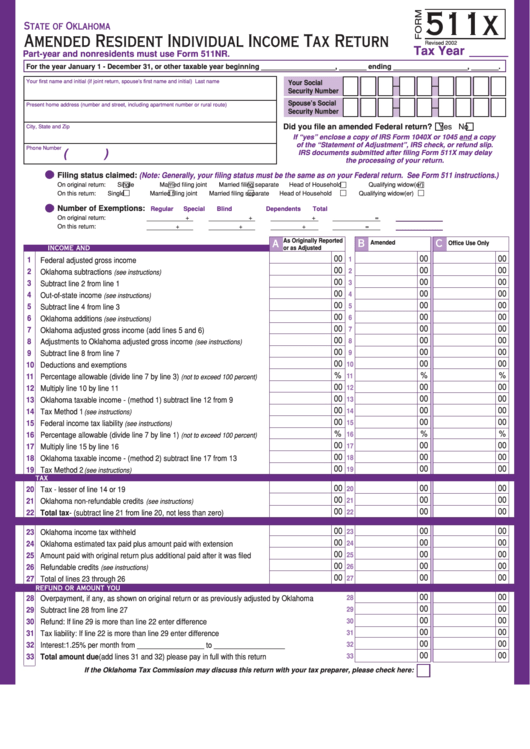

Form 511x Amended Resident Individual Tax Return printable pdf

For forms, visit the 2021 individual tax forms or business tax forms pages. Web select the applicable module below for instructions on generating the new form 510 or form 511. Web go to government md form 511, line 2, utilize form (pink) override with the correct amount. Web 2021 instruction booklets note: 6 (july 2021) and the instructions to form.

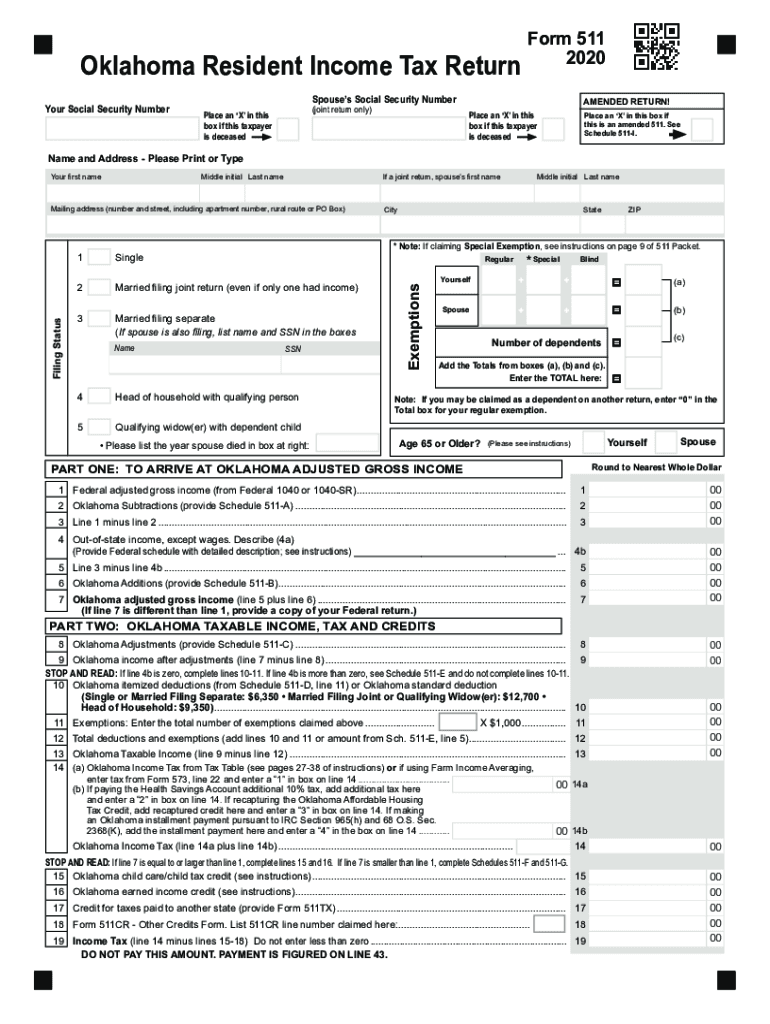

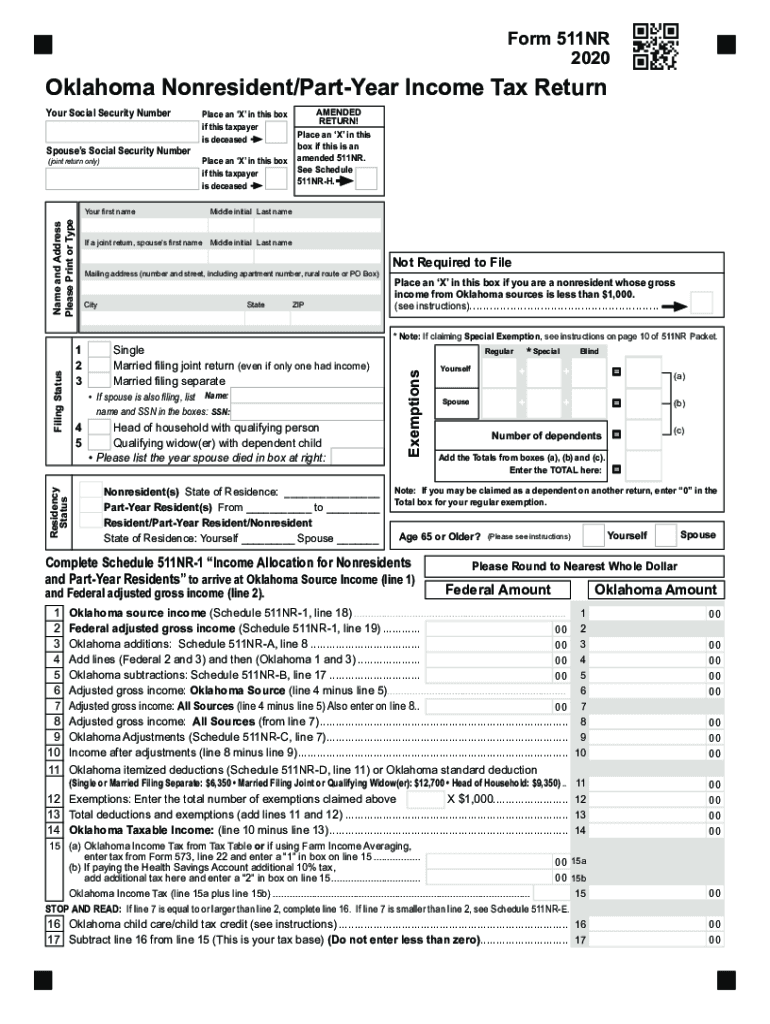

Oklahoma State Tax Form Fill Out and Sign Printable PDF Template

Web after completing the processing of the 2020 form 511, the dtate will begin processing the filed 2021 forms 511. For forms, visit the 2021 individual tax forms or business tax forms pages. State and local taxes based on income. Web 2021 instruction booklets note: Web go to government md form 511, line 2, utilize form (pink) override with the.

2017 MD Form 548 Fill Online, Printable, Fillable, Blank pdfFiller

Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. 6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. Web as we previously reported, senate bill 787 included (among many other things) official legislation required.

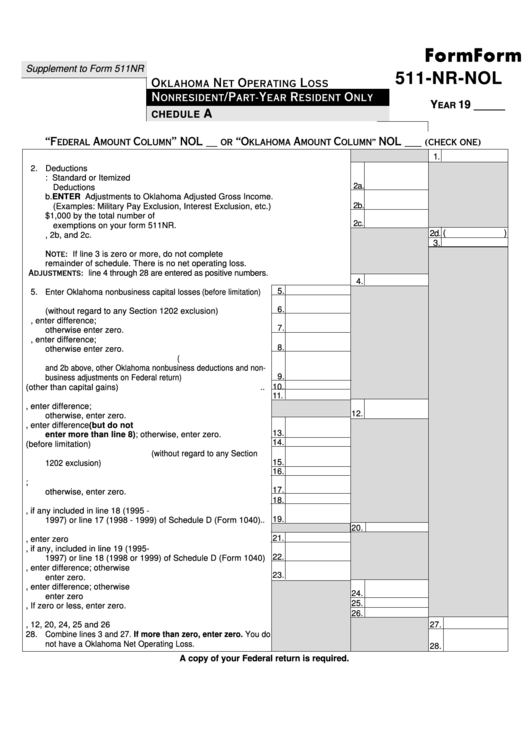

Form 511NrNol N.o.l. Schedule A Oklahoma Net Operating Loss

For forms, visit the 2021 individual tax forms or business tax forms pages. If you previously filed form 510 and didn't elect to remit taxes on. State and local taxes based on income. Web after completing the processing of the 2020 form 511, the dtate will begin processing the filed 2021 forms 511. 2021 individual income tax instruction booklets 2021.

MD Form MET 2 ADJ 2011 Fill out Tax Template Online US Legal Forms

Web select the applicable module below for instructions on generating the new form 510 or form 511. What is maryland form 511? Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. However, if you filed on the old 510 and elected to.

2020 Oklahoma Tax Fill Out and Sign Printable PDF Template signNow

Web after completing the processing of the 2020 form 511, the dtate will begin processing the filed 2021 forms 511. What is maryland form 511? Web others (see instructions) e. State and local taxes based on income. Web as we previously reported, senate bill 787 included (among many other things) official legislation required by the maryland comptroller’s office to provide.

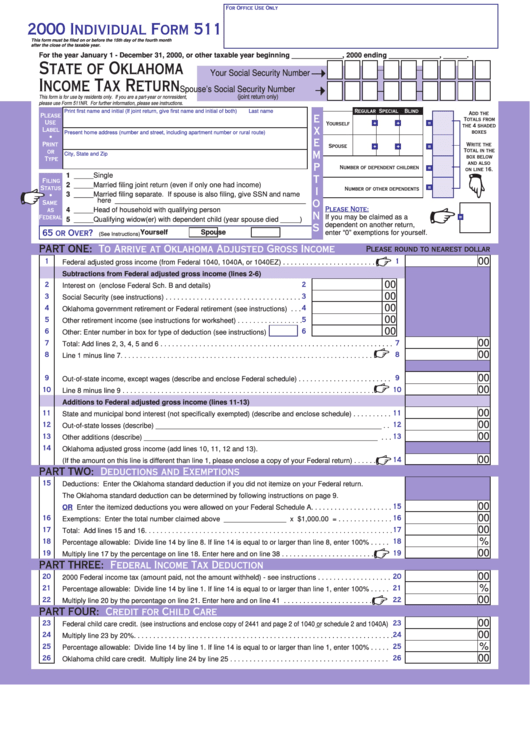

Individual Form 511 State Of Oklahoma Tax Return 2000

Web go to government md form 511, line 2, utilize form (pink) override with the correct amount. For forms, visit the 2021 individual tax forms or business tax forms pages. Web 2021 instruction booklets note: Web the newly released maryland administrative release no. 2021 individual income tax instruction booklets 2021.

Form 202 Maryland Fill Online, Printable, Fillable, Blank pdfFiller

Web as we previously reported, senate bill 787 included (among many other things) official legislation required by the maryland comptroller’s office to provide. Web the newly released maryland administrative release no. 2021 individual income tax instruction booklets 2021. 6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. Web the newly released form.

Md Form Fill Out and Sign Printable PDF Template signNow

Web go to government md form 511, line 2, utilize form (pink) override with the correct amount. 2021 individual income tax instruction booklets 2021. Web as we previously reported, senate bill 787 included (among many other things) official legislation required by the maryland comptroller’s office to provide. Web the newly released form 511 properly calculates the amount of maryland pte.

Web As We Previously Reported, Senate Bill 787 Included (Among Many Other Things) Official Legislation Required By The Maryland Comptroller’s Office To Provide.

Web if you've already filed, you probably don't need to file an amended return. State and local taxes based on income. If you previously filed form 510 and didn't elect to remit taxes on. What is maryland form 511?

Web After Completing The Processing Of The 2020 Form 511, The Dtate Will Begin Processing The Filed 2021 Forms 511.

6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. 2021 individual income tax instruction booklets 2021. For forms, visit the 2021 individual tax forms or business tax forms pages. Web others (see instructions) e.

Web Select The Applicable Module Below For Instructions On Generating The New Form 510 Or Form 511.

Web 2021 instruction booklets note: However, if you filed on the old 510 and elected to pay tax on behalf of residents, you. Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. Web the newly released maryland administrative release no.