Maryland Form 510 Instructions 2022

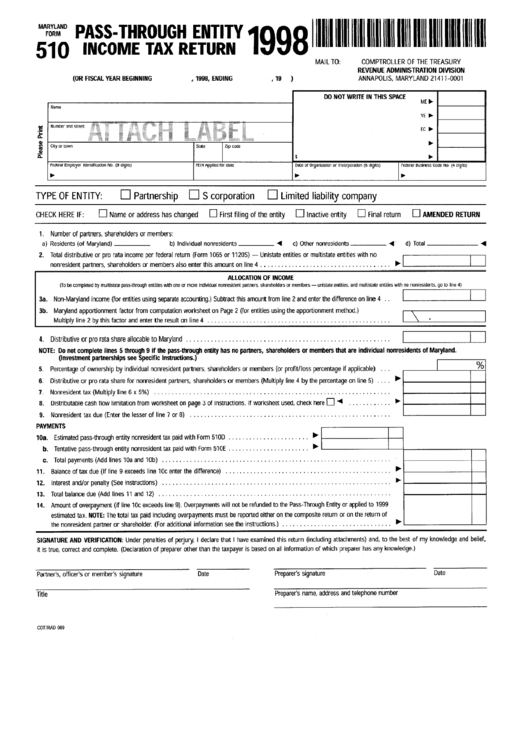

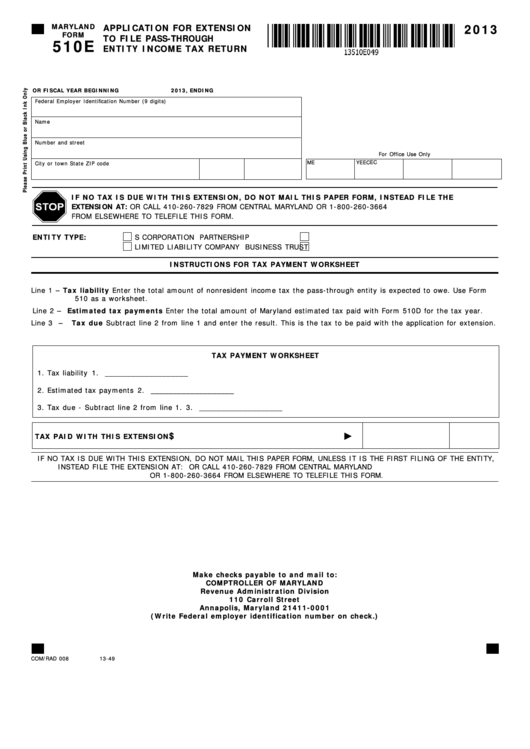

Maryland Form 510 Instructions 2022 - Visit any of our taxpayer service offices to obtain forms. 2022 individual income tax instruction booklets 2022 business income tax instruction booklets You can download tax forms using the links listed below. Form 504, see instructions for form 504. File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Maryland schedules a and b instructions form 511 2022 6. Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. The request for extension of time to file will be granted provided. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Resident individual members filingform 502:

Line 45 for credits from form 510 and for electing ptes, list credit on form 502cr, part cc, line 9. Form 504, see instructions for form 504. See instructions for form 505: Nonresident members other than individuals may not. Web 2022 individual income tax forms 2022 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. This form may be used if the pte is paying tax only on behalf of nonresident members and not electing to remit on all members' share of income. Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Web (investment partnerships see specific instructions.) 5. Web 2022 instruction booklets note: The instruction booklets listed here do not include forms.

You can download tax forms using the links listed below. List credit on form 502cr, part cc, lines 6 and/or 9. File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. For forms, visit the 2022 individual tax forms or business tax forms pages. This form may be used if the pte is paying tax only on behalf of nonresident members and not electing to remit on all members' share of income. List credit on form 500cr. Nonresident members other than individuals may not. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Forms are available for downloading in the resident individuals income tax forms section below. The request for extension of time to file will be granted provided.

Fillable Maryland Form 510 PassThrough Entity Tax Return

Web 2022 individual income tax forms 2022 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. The instruction booklets listed here do not include forms. For forms, visit the 2022 individual tax forms or business tax forms pages. Line 45 for credits from form 510 and for electing ptes, list credit on form.

2013 Form MD MW506FR Fill Online, Printable, Fillable, Blank pdfFiller

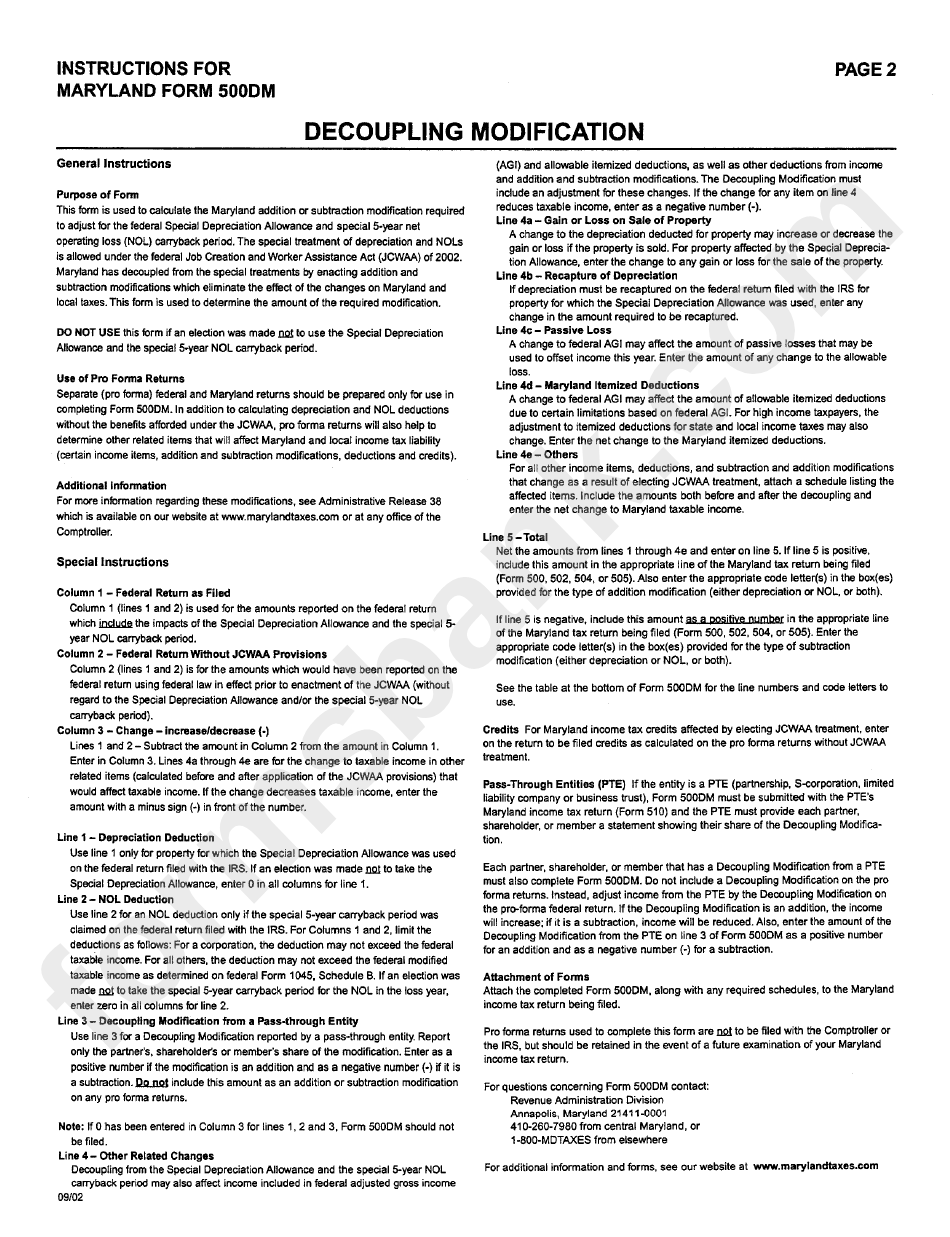

See instructions for form 505: Web instructions for form 500. 2022 individual income tax instruction booklets 2022 business income tax instruction booklets Maryland schedules a and b instructions form 511 2022 6. Line 45 for credits from form 510 and for electing ptes, list credit on form 502cr, part cc, line 9.

Maryland Form 202 Fill and Sign Printable Template Online US Legal

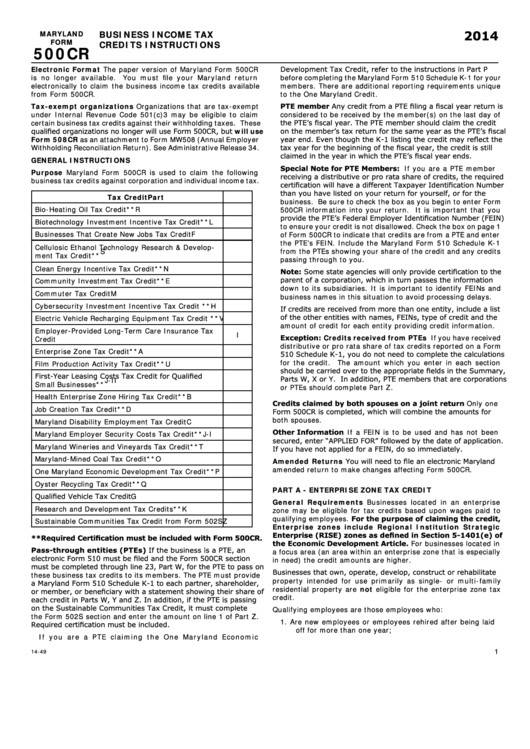

File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Web instructions for form 500. Visit any of our taxpayer service offices to obtain forms. Form 504, see instructions for form 504. Maryland schedules a and b instructions form 511 2022 6.

Fillable Maryland Form 510e Application For Extension To File Pass

List credit on form 500cr. List credit on form 502cr, part cc, lines 6 and/or 9. 2022 individual income tax instruction booklets 2022 business income tax instruction booklets Web 2022 individual income tax forms 2022 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. This form may be used if the pte is.

Instructions For Maryland Form 500dm printable pdf download

Web instructions for form 500. Line 45 for credits from form 510 and for electing ptes, list credit on form 502cr, part cc, line 9. Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Form 504, see instructions for form 504. 2022 individual income tax instruction booklets 2022 business income tax instruction booklets

MD Comptroller MW508 20202021 Fill out Tax Template Online US

Resident individual members filingform 502: Web 2022 individual income tax forms 2022 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Maryland schedules a and b instructions form 511 2022 6. See instructions for form 505: Web 510c filed this tax year's beginning and ending dates are different from last year's due to.

maryland form 510 instructions 2021

Forms are available for downloading in the resident individuals income tax forms section below. Form 504, see instructions for form 504. Web 2022 individual income tax forms 2022 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Visit any of our taxpayer service offices to obtain forms. Percentage of ownership by individual nonresident.

Form 202 Maryland Fill Online, Printable, Fillable, Blank pdfFiller

Web 2022 individual income tax forms 2022 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Form 504, see instructions for form 504. Line 45 for credits from form 510 and for electing ptes, list credit on form 502cr, part cc, line 9. Forms are available for downloading in the resident individuals income.

elliemeyersdesigns Maryland Form 510

The request for extension of time to file will be granted provided. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. Web (investment partnerships see specific instructions.) 5. Form 504, see instructions for form 504.

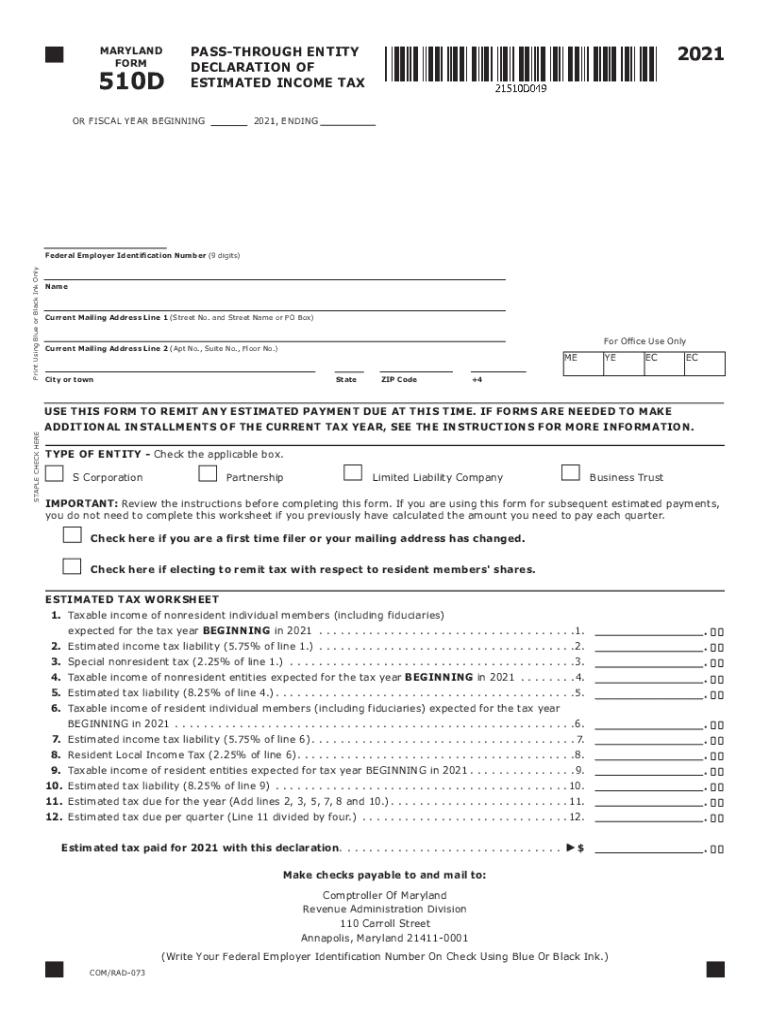

2021 MD Form 510D Fill Online, Printable, Fillable, Blank pdfFiller

You can download tax forms using the links listed below. Maryland schedules a and b instructions form 511 2022 6. Web instructions for form 500. Nonresident members other than individuals may not. Web (investment partnerships see specific instructions.) 5.

Web 2022 Instruction Booklets Note:

Formula of receipts and property, with receipts from intangible items. File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Resident individual members filingform 502: Visit any of our taxpayer service offices to obtain forms.

List Credit On Form 502Cr, Part Cc, Lines 6 And/Or 9.

Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Web (investment partnerships see specific instructions.) 5. Web instructions for form 500. Line 45 for credits from form 510 and for electing ptes, list credit on form 502cr, part cc, line 9.

You Can Download Tax Forms Using The Links Listed Below.

The instruction booklets listed here do not include forms. For forms, visit the 2022 individual tax forms or business tax forms pages. Maryland schedules a and b instructions form 511 2022 6. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.

Nonresident Members Other Than Individuals May Not.

Forms are available for downloading in the resident individuals income tax forms section below. The request for extension of time to file will be granted provided. See instructions for form 505: Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss.