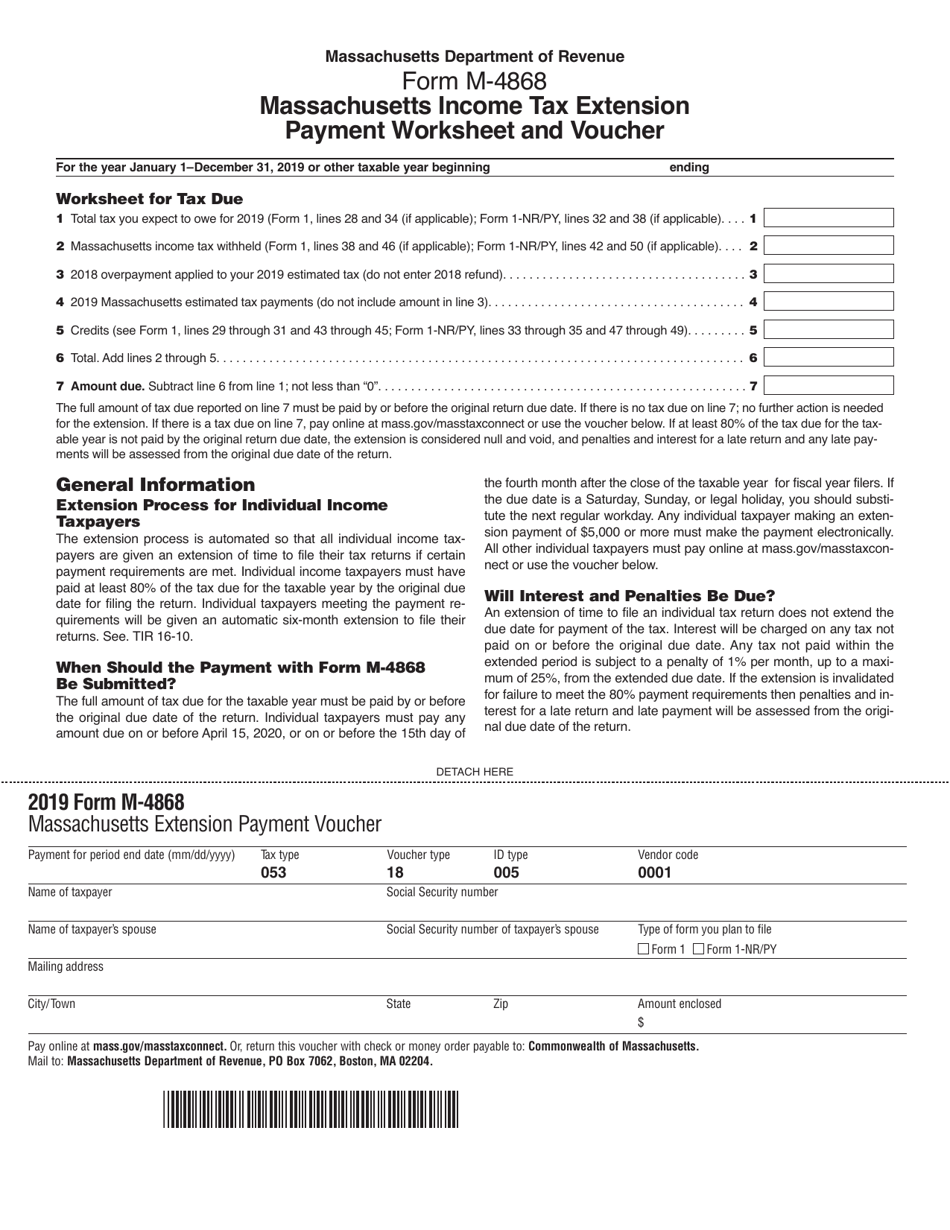

M 4868 Form

M 4868 Form - Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Edit your form m 4868 online. An extension for federal income tax returns due on april 15. Mail the completed voucher with your payment to: Ad access irs tax forms. If the due date is a saturday, sunday, or legal holiday,. Ad get ready for tax season deadlines by completing any required tax forms today. Draw your signature, type it,. Get ready for tax season deadlines by completing any required tax forms today. Individual income tax return,” is a form that taxpayers can file with the irs if.

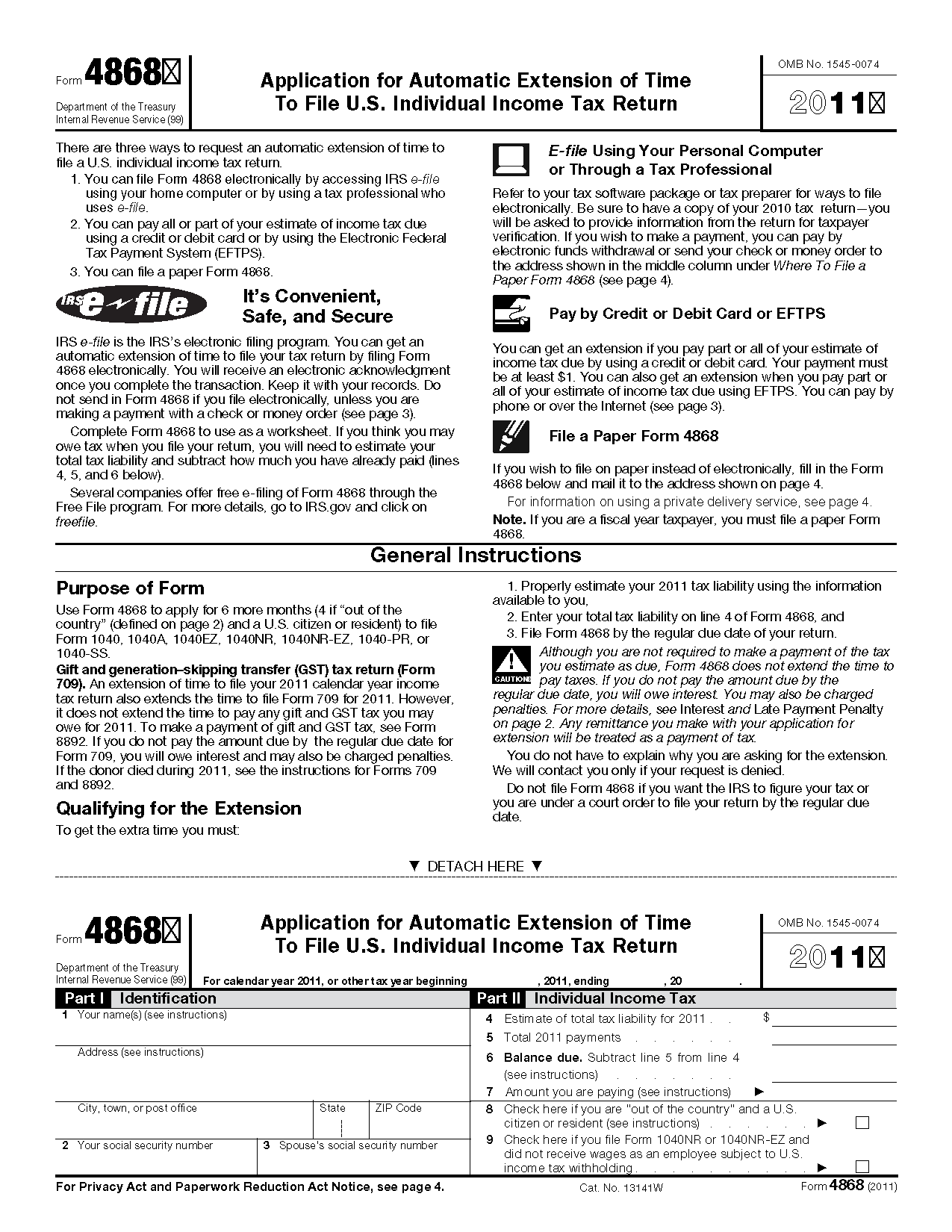

Ad get ready for tax season deadlines by completing any required tax forms today. Current revision form 4868 pdf recent. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web irs form 4868, application for automatic extension of time to file. Anyone that misses the deadline to file should make payment of any tax due via a return payment. Sign it in a few clicks. Citizen or resident files this form to request an automatic extension of time to file a u.s. Underpayment of massachusetts estimated income. Web form 4868 (2019) page. Web 2021 form efo:

Ad get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Mail the completed voucher with your payment to: Ad access irs tax forms. Web 2021 form efo: Web form 4868 (2019) page. Type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional).

How to Complete Form 4868? ExpressExtension YouTube

You have two options to submit your irs form 4868. Edit your form m 4868 online. Citizen or resident files this form to request an automatic extension of time to file a u.s. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 4868, also known as an “application for automatic extension of time.

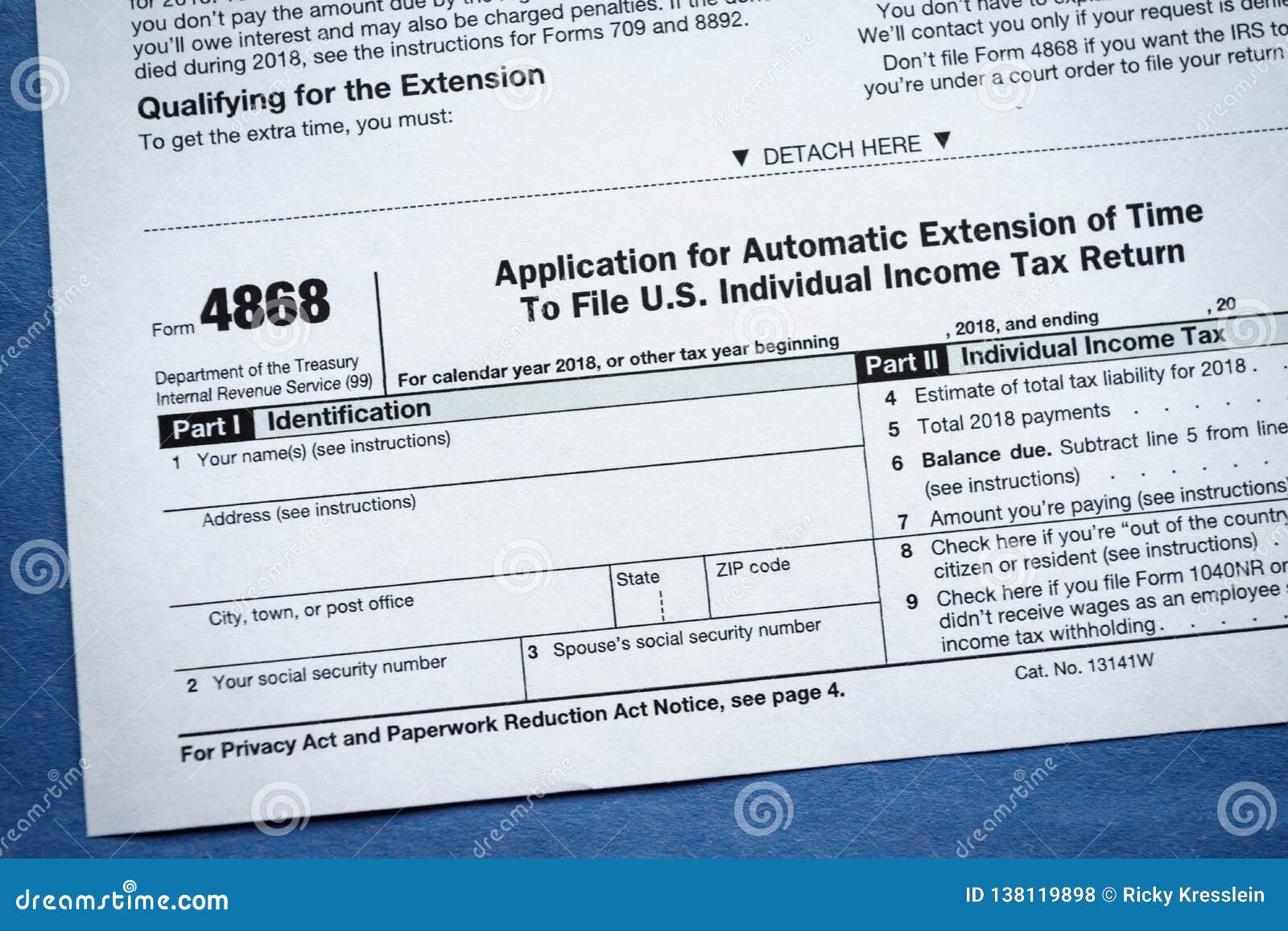

Form 4868 Application for Automatic Extension of Time To File U.S

Complete, edit or print tax forms instantly. Mail the completed voucher with your payment to: Estimate the amount of taxes you will owe for the year. This form is for income earned in tax year 2022, with tax. Anyone that misses the deadline to file should make payment of any tax due via a return payment.

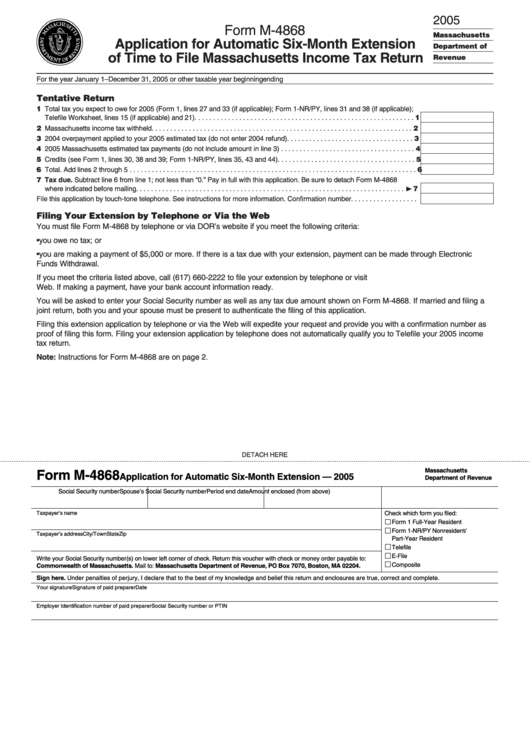

Form M4868 Application For Automatic SixMonth Extension Of Time To

2 when to file form 4868 file form 4868 by april 15, 2020. Edit your form m 4868 online. Web form 4868 (2019) page. An extension for federal income tax returns due on april 15. Get ready for tax season deadlines by completing any required tax forms today.

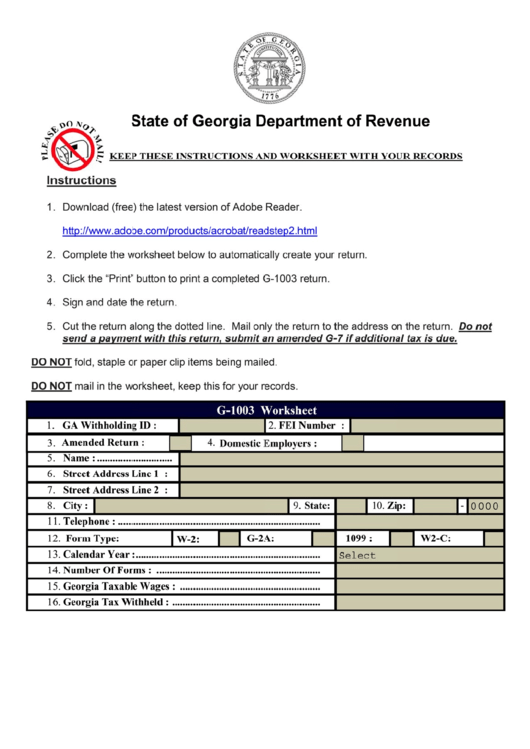

Form G1003 Statement Return Department Of Revenue

Sign it in a few clicks. Anyone that misses the deadline to file should make payment of any tax due via a return payment. Complete, edit or print tax forms instantly. This form may also be used to extend the. Type text, add images, blackout confidential details, add comments, highlights and more.

IRS Personal Extension Tax Form 4868 Online Reporting Taxgarden

Individual income tax return,” is a form that taxpayers can file with the irs if. Web form 4868, also known as an “application for automatic extension of time to file u.s. Mail the completed voucher with your payment to: You have two options to submit your irs form 4868. Web you can file a paper form 4868 and enclose payment.

Form 4868 Application For Automatic Extension Of Time To 2021 Tax

Sign it in a few clicks. Individual income tax return,” is a form that taxpayers can file with the irs if. 2 when to file form 4868 file form 4868 by april 15, 2020. Massachusetts requires a separate tax extension form to be filed with the state department apart from the federal tax extension form 4868. Draw your signature, type.

Form 4868

Get ready for tax season deadlines by completing any required tax forms today. Web 2021 form efo: Underpayment of massachusetts estimated income. This form may also be used to extend the. Web form 4868, also known as an “application for automatic extension of time to file u.s.

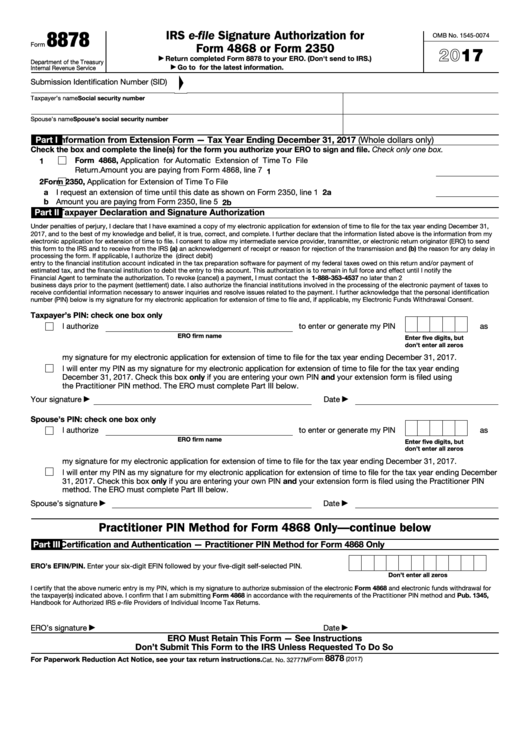

Fillable Form 8878 Irs EFile Signature Authorization For Form 4868

Get ready for tax season deadlines by completing any required tax forms today. Web 2021 form efo: Ad get ready for tax season deadlines by completing any required tax forms today. Type text, add images, blackout confidential details, add comments, highlights and more. Edit your form m 4868 online.

Form M4868 Download Printable PDF or Fill Online Massachusetts

This form is for income earned in tax year 2022, with tax. 2 when to file form 4868 file form 4868 by april 15, 2020. An extension for federal income tax returns due on april 15. Web irs form 4868, application for automatic extension of time to file. Complete, edit or print tax forms instantly.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Estimate the amount of taxes you will owe for the year. Mail in the paper irs form 4868. Fiscal year taxpayers file form 4868 by the original due date of the fiscal year return. Current revision form 4868 pdf recent.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Ad access irs tax forms. Anyone that misses the deadline to file should make payment of any tax due via a return payment. This form is for income earned in tax year 2022, with tax. 2 when to file form 4868 file form 4868 by april 15, 2020.

Citizen Or Resident Files This Form To Request An Automatic Extension Of Time To File A U.s.

Type text, add images, blackout confidential details, add comments, highlights and more. Mail the completed voucher with your payment to: This form may also be used to extend the. Web form 4868 (2019) page.

Sign It In A Few Clicks.

Web 2021 form efo: An extension for federal income tax returns due on april 15. Complete, edit or print tax forms instantly. Web irs form 4868, application for automatic extension of time to file.

:max_bytes(150000):strip_icc()/4868-ApplicationofExtensionofTime-1-088a69a2d6454cb5837a3a801d330a8d.png)