Louisiana State Tax Form 2022

Louisiana State Tax Form 2022 - Request an individual income tax return. This form is for income earned in tax year 2022, with tax returns due in april. Web act 410 of the 2022 regular legislative session changed how an extension is granted starting with tax year 2022. Web using louisiana file online and direct deposit, you can receive your refund within 30 days. Get ready for tax season deadlines by completing any required tax forms today. Check on the status of your individual income refund. New users for online filing in order to use the online tax filing application, you must have already filed a. Find forms for your industry in minutes. Web 33 rows louisiana has a state income tax that ranges between 2% and 6% , which is. Web louisiana department of revenue purpose:

A 2022 calendar year return is due on or before may. Web what’s new for louisiana 2022 individual income tax. Web please check frequently for updates. Find forms for your industry in minutes. The online appeal filing system is closed for tax year 2022 (orleans parish 2023). If you know you cannot file your return by the due date, you. Streamlined document workflows for any industry. Download this form print this form more about the. Web the state of louisiana has issued the following guidance regarding income tax filing deadlines for individuals: Web using louisiana file online and direct deposit, you can receive your refund within 30 days.

Web using louisiana file online and direct deposit, you can receive your refund within 30 days. This form is for income earned in tax year 2022, with tax returns due in april. Web please check frequently for updates. Get ready for tax season deadlines by completing any required tax forms today. 37 amount of line 36 to be credited to 2022 income tax credit 38. A 2022 calendar year return is due on or before may. Web louisiana department of revenue purpose: The online appeal filing system is closed for tax year 2022 (orleans parish 2023). Web the state of louisiana has issued the following guidance regarding income tax filing deadlines for individuals: If you know you cannot file your return by the due date, you.

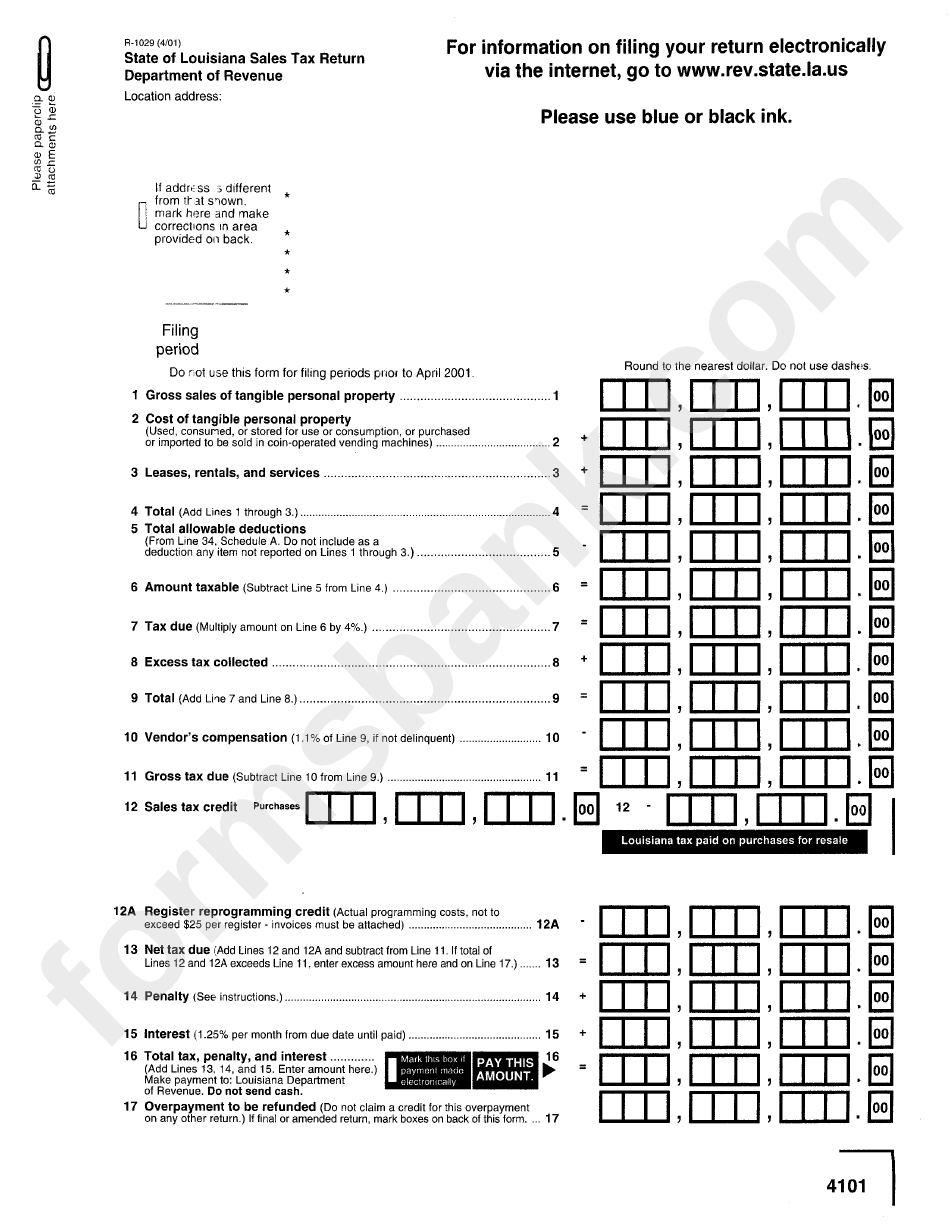

Form R1029 State Of Louisiana Sales Tax Return Department Of Revenue

Download this form print this form more about the. New users for online filing in order to use the online tax filing application, you must have already filed a. Be sure to verify that the form you are. Complete, edit or print tax forms instantly. Web what’s new for louisiana 2022 individual income tax.

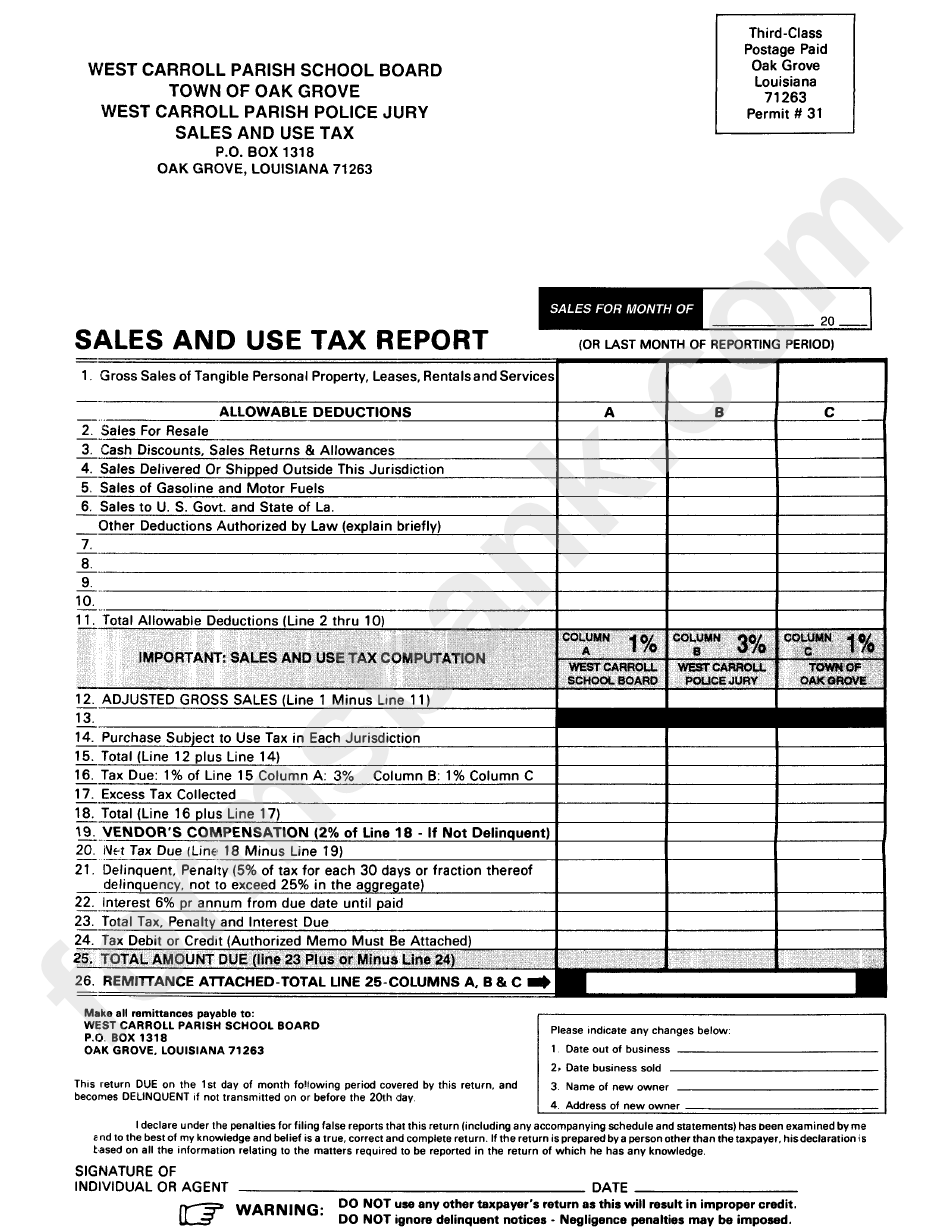

Sales And Use Tax Report Form State Of Louisiana printable pdf download

If you know you cannot file your return by the due date, you. Complete, edit or print tax forms instantly. Web where's my refund. Web 33 rows louisiana has a state income tax that ranges between 2% and 6% , which is. Web please check frequently for updates.

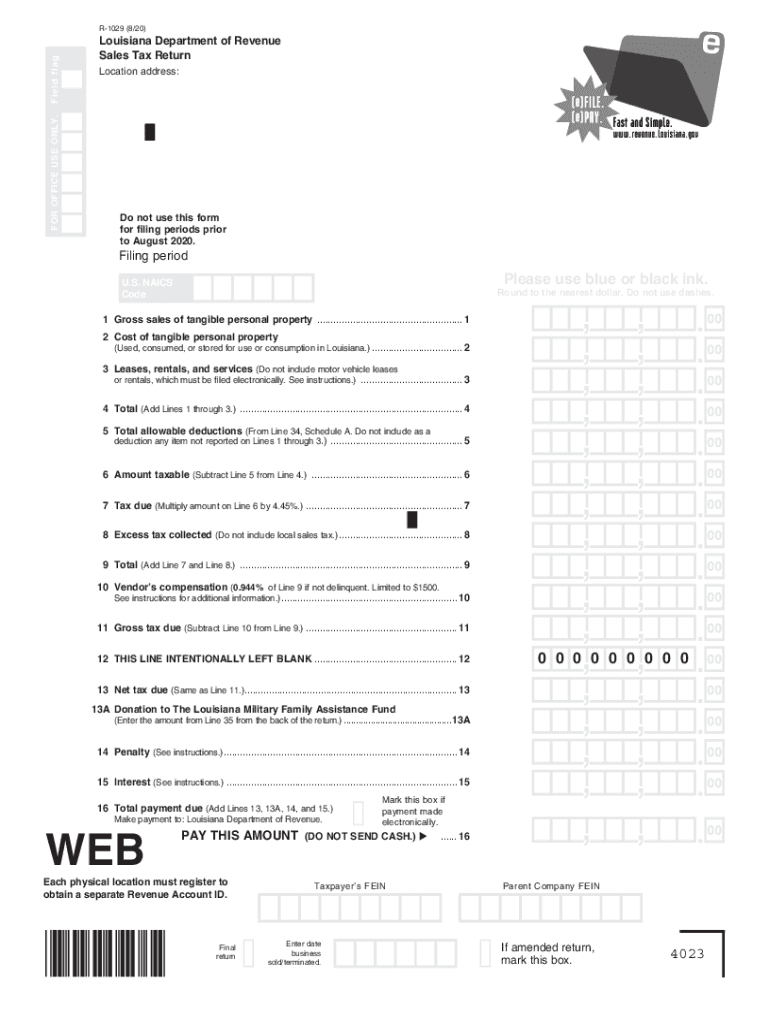

2020 Form LA R1029 Fill Online, Printable, Fillable, Blank pdfFiller

If you know you cannot file your return by the due date, you. Web act 410 of the 2022 regular legislative session changed how an extension is granted starting with tax year 2022. Web using louisiana file online and direct deposit, you can receive your refund within 30 days. Web report error it appears you don't have a pdf plugin.

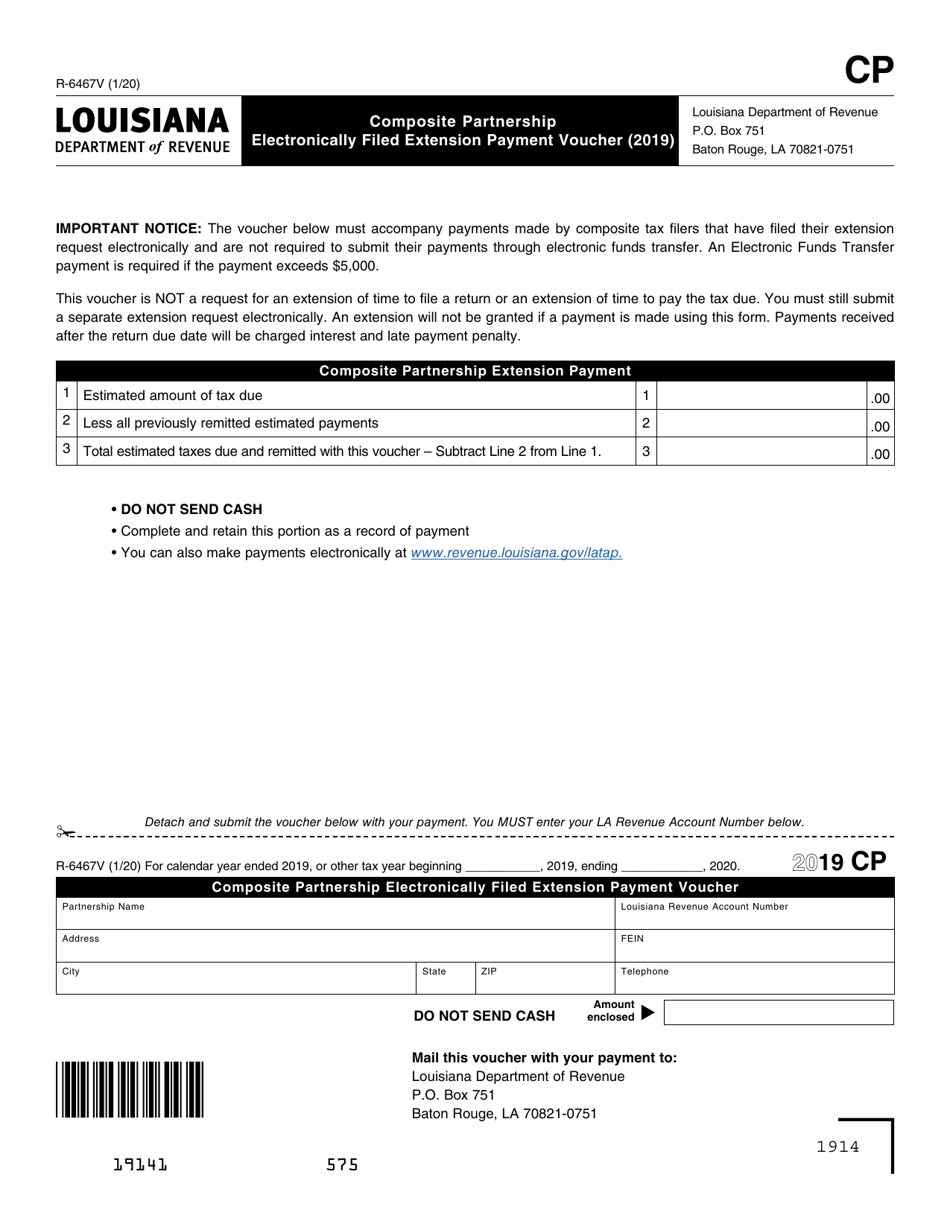

Form R6467V Download Fillable PDF or Fill Online Composite Partnership

Streamlined document workflows for any industry. Web please check frequently for updates. Complete, edit or print tax forms instantly. The online appeal filing system is closed for tax year 2022 (orleans parish 2023). Web the state of louisiana has issued the following guidance regarding income tax filing deadlines for individuals:

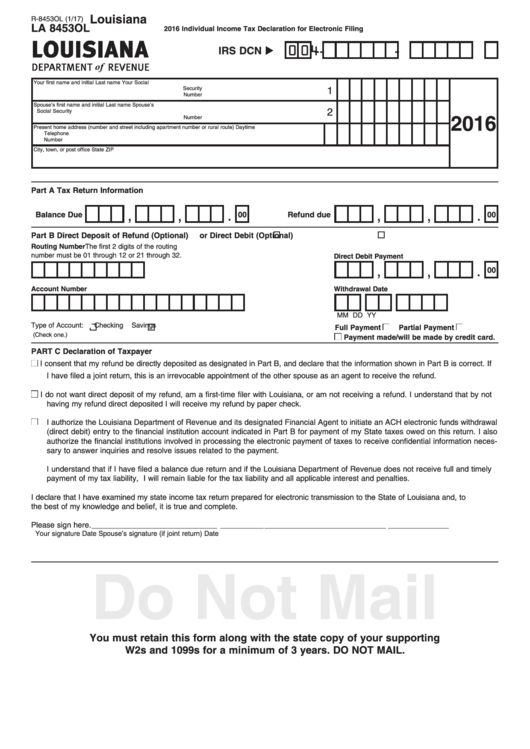

8453 Ol Form Louisiana Department Of Revenue Individual Tax

Web please check frequently for updates. Streamlined document workflows for any industry. A 2022 calendar year return is due on or before may. 37 amount of line 36 to be credited to 2022 income tax credit 38. Web where's my refund.

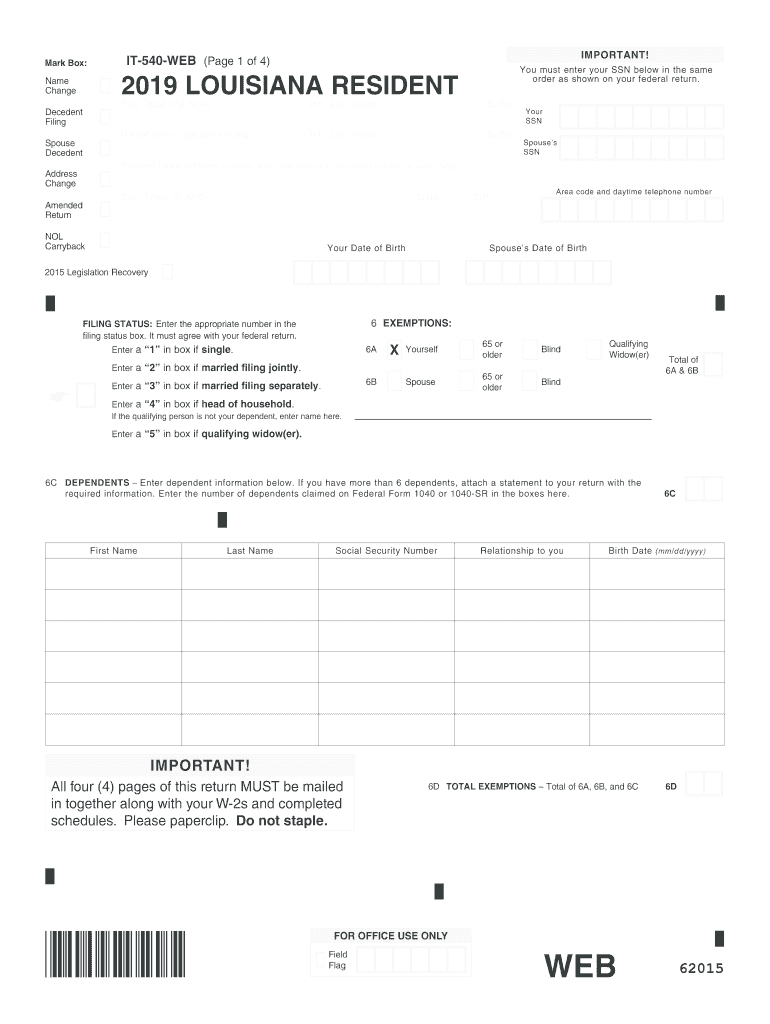

2019 Form LA IT540 Fill Online, Printable, Fillable, Blank pdfFiller

Download this form print this form more about the. 37 amount of line 36 to be credited to 2022 income tax credit 38. Web using louisiana file online and direct deposit, you can receive your refund within 30 days. Request an individual income tax return. Complete, edit or print tax forms instantly.

LA LDR R1201 2020 Fill out Tax Template Online US Legal Forms

Web where's my refund. Find forms for your industry in minutes. 37 amount of line 36 to be credited to 2022 income tax credit 38. Web act 410 of the 2022 regular legislative session changed how an extension is granted starting with tax year 2022. Web please check frequently for updates.

Tax Exempt Form 20202021 Fill and Sign Printable Template Online

Be sure to verify that the form you are. Web the state of louisiana has issued the following guidance regarding income tax filing deadlines for individuals: 37 amount of line 36 to be credited to 2022 income tax credit 38. Check on the status of your individual income refund. Find forms for your industry in minutes.

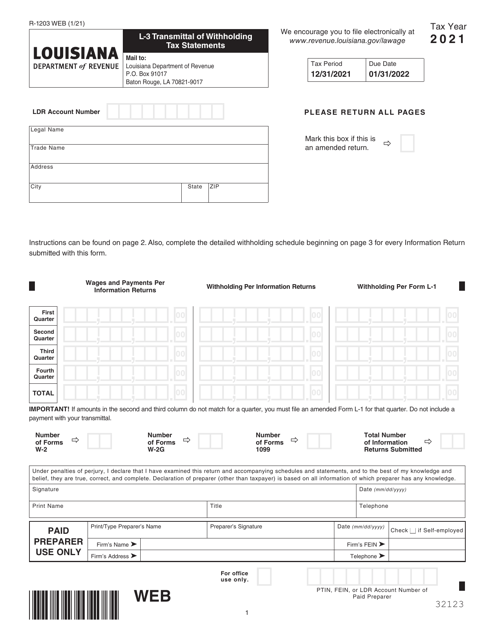

Form L3 (R1203) Download Fillable PDF or Fill Online Transmittal of

Be sure to verify that the form you are. Web please check frequently for updates. Streamlined document workflows for any industry. Web act 410 of the 2022 regular legislative session changed how an extension is granted starting with tax year 2022. Download this form print this form more about the.

Web Louisiana Department Of Revenue Purpose:

37 amount of line 36 to be credited to 2022 income tax credit 38. If you know you cannot file your return by the due date, you. Web the state of louisiana has issued the following guidance regarding income tax filing deadlines for individuals: New users for online filing in order to use the online tax filing application, you must have already filed a.

The Online Appeal Filing System Is Closed For Tax Year 2022 (Orleans Parish 2023).

Web what’s new for louisiana 2022 individual income tax. Get ready for tax season deadlines by completing any required tax forms today. Download this form print this form more about the. Web using louisiana file online and direct deposit, you can receive your refund within 30 days.

Streamlined Document Workflows For Any Industry.

Request an individual income tax return. Web act 410 of the 2022 regular legislative session changed how an extension is granted starting with tax year 2022. Web please check frequently for updates. Web report error it appears you don't have a pdf plugin for this browser.

Check On The Status Of Your Individual Income Refund.

A 2022 calendar year return is due on or before may. This form is for income earned in tax year 2022, with tax returns due in april. Web 33 rows louisiana has a state income tax that ranges between 2% and 6% , which is. Be sure to verify that the form you are.