Llc Form 8832

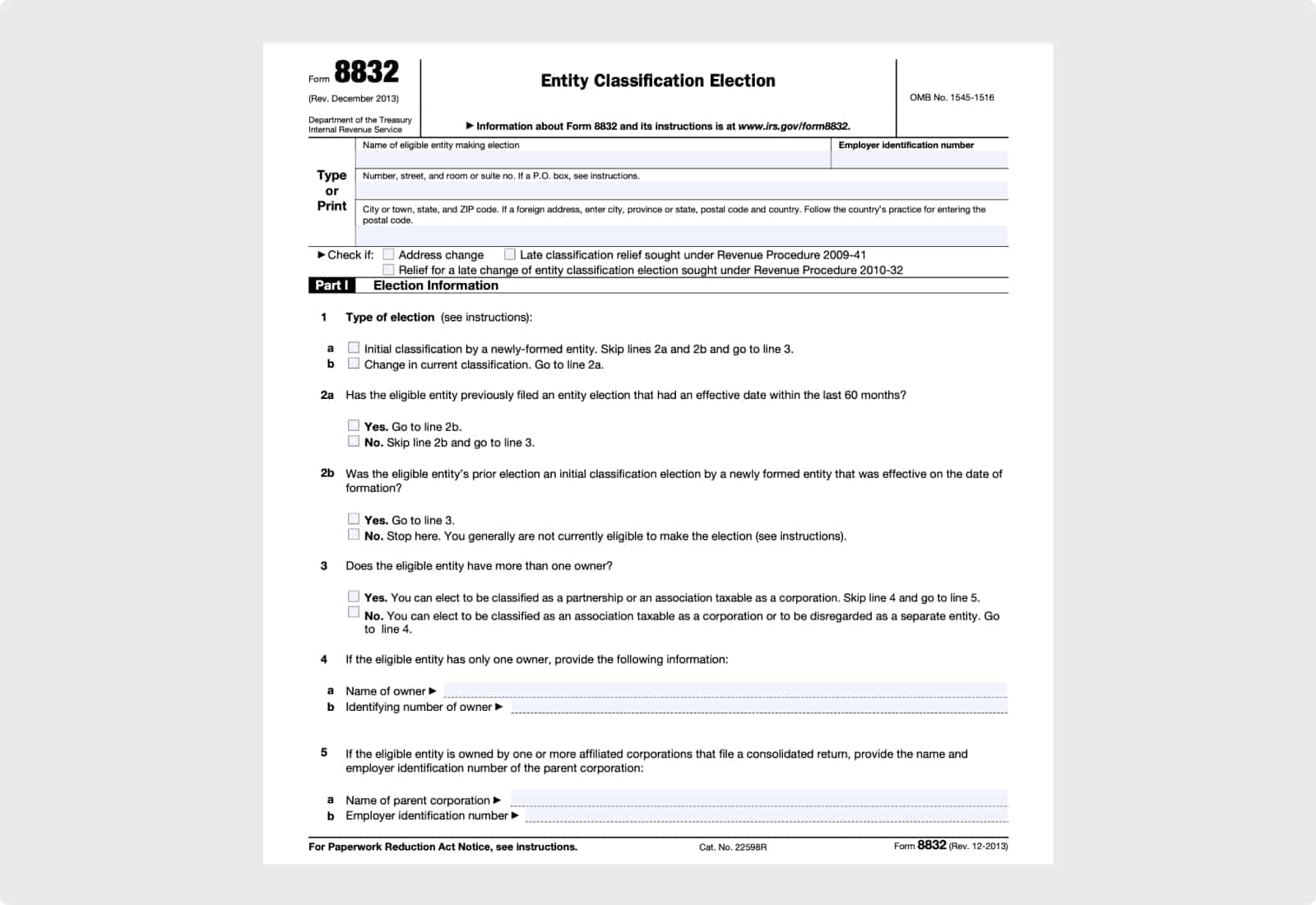

Llc Form 8832 - Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Web a foreign country or u.s. Tip a new eligible entity should not file form 8832 if it will be using its default. Web if the llc elects to be classified as a corporation by filing form 8832, a copy of the llc's form 8832 must be attached to the federal income tax return of each direct. Irs form 8823 is a tax. Changing your tax status could potentially save you tax money every year. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Web using form 8832, businesses can ask to be taxed as a corporation, partnership, or sole proprietorship. It is filed to elect a tax status other than the default status for your entity. Web certain foreign entities (see form 8832 instructions).

Web a foreign country or u.s. Meanwhile, form 2553 is for llcs or corporations. We offer a full suite of startup services to support you in your continued success. Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax. Web if you want to do so, you’ll have to file irs form 8832 to change your llc’s tax status with the federal government. Ad free registered agent service for first year. Web at a glance. Irs form 8823 is a tax. Get ready for tax season deadlines by completing any required tax forms today. An llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default rules.

Irs form 8823 is a tax. You can find form 8832 on the irs website. Web if you want to do so, you’ll have to file irs form 8832 to change your llc’s tax status with the federal government. Changing your tax status could potentially save you tax money every year. Web using form 8832, businesses can ask to be taxed as a corporation, partnership, or sole proprietorship. An llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default rules. Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax. Meanwhile, form 2553 is for llcs or corporations. Contrarily, to adopt s corp tax status, corporations,. We'll do the legwork so you can set aside more time & money for your business.

Using Form 8832 to Change Your LLC’s Tax Classification

An llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default rules. We'll do the legwork so you can set aside more time & money for your business. Web a foreign country or u.s. Generally, llcs are not automatically included in this list, and are.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto in 2021 C

Generally, llcs are not automatically included in this list, and are therefore not required. Web certain foreign entities (see form 8832 instructions). Web a foreign country or u.s. Web form 8832 can be filed with the irs for partnerships and limited liability companies (llcs) if they want to be taxed as different kinds of companies, like a. Web form 8832.

Using Form 8832 to Change Your LLC’s Tax Classification

Ad complete irs tax forms online or print government tax documents. Irs form 8823 is a tax. About form 8832, entity classification election irs: Web irs form 8832, the entity classification election form, is an irs election form that limited liability corporation (llc) business owners use to elect how they’d. Generally, llcs are not automatically included in this list, and.

USING FORM 8832 TO CHANGE THE US TAX CLASSIFICATION OF YOUR COMPANY

Web at a glance. Get ready for tax season deadlines by completing any required tax forms today. An llc that is not automatically classified as a corporation and does not file form 8832 will be classified, for federal tax purposes under the default rules. Web for income tax purposes, an llc with only one member is treated as an entity.

Form 8832 and Changing Your LLC Tax Status Bench Accounting

Meanwhile, form 2553 is for llcs or corporations. Complete, edit or print tax forms instantly. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. You can find form 8832 on the irs website. Web if you want.

Form 8832 Instructions and Frequently Asked Questions

Web a foreign country or u.s. We offer a full suite of startup services to support you in your continued success. Get ready for tax season deadlines by completing any required tax forms today. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form.

Delaware Llc Uk Tax Treatment Eayan

Get ready for tax season deadlines by completing any required tax forms today. Web using form 8832, businesses can ask to be taxed as a corporation, partnership, or sole proprietorship. Ad complete irs tax forms online or print government tax documents. Web form 8832 is the entity classification election form from the irs. Complete your basic business information.

2 [PDF] FORM 8832 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2

Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax. About form 8832, entity classification election irs: Web at a glance. Web for income tax purposes, an llc with only one member is treated as an entity disregarded.

LLC vs. Corporation (Which One Should I Choose?) SimplifyLLC

Meanwhile, form 2553 is for llcs or corporations. Complete your basic business information. Web at a glance. You also need to use this form if your llc is being taxed as a. About form 8832, entity classification election irs:

Using Form 8832 to Change Your LLC’s Tax Classification

Web at a glance. Ad complete irs tax forms online or print government tax documents. Web this form to establish the entity’s filing and reporting requirements for federal tax purposes. We offer a full suite of startup services to support you in your continued success. Ad protect your personal assets with a $0 llc—just pay state filing fees.

Web A Foreign Country Or U.s.

You also need to use this form if your llc is being taxed as a. About form 8832, entity classification election irs: Web if you want to do so, you’ll have to file irs form 8832 to change your llc’s tax status with the federal government. Web form 8832 is the irs form a new limited liability company (llc) uses to elect how it wants to be taxed or an established llc uses to change its current tax.

Meanwhile, Form 2553 Is For Llcs Or Corporations.

Complete your basic business information. Generally, llcs are not automatically included in this list, and are therefore not required. Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Tip a new eligible entity should not file form 8832 if it will be using its default.

Changing Your Tax Status Could Potentially Save You Tax Money Every Year.

We offer a full suite of startup services to support you in your continued success. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and affirmatively elects to be. You can find form 8832 on the irs website. Irs form 8823 is a tax.

For Example, An Llc Can Elect To Be.

Web an eligible entity uses form 8832 to elect how it will be classified for federal tax purposes, as a corporation, a partnership, or an entity disregarded as separate from its owner. Web at a glance. Complete, edit or print tax forms instantly. Contrarily, to adopt s corp tax status, corporations,.

![2 [PDF] FORM 8832 APPROVAL FREE PRINTABLE DOCX 2020 ApprovalForm2](https://www.llcuniversity.com/wp-content/uploads/IRS-CP277-Form-8832-Approval.jpg)