Ky Form 740-Es 2022

Ky Form 740-Es 2022 - The regular deadline to file a kentucky state income tax return is april. Web more about the kentucky form 740 individual income tax tax return ty 2022 form 740 is the kentucky income tax return for use by all taxpayers. Web form 740 is the kentucky income tax return for use by all taxpayers. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. Web • pay all of your estimated tax by january 18, 2022. In this case, 2021 estimated tax. If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. Check if estate or trust.

Web estimated income tax return. Web withhold kentucky income tax on the distributive share, whether distributed or undistributed, of each nonresident individual partner, member, or shareholder. The regular deadline to file a kentucky state income tax return is april. Web form 740 kentucky — kentucky individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web download the taxpayer bill of rights. Check if estate or trust. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. At this time, dor accepts payments by credit card or electronic. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application.

This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. In this case, 2021 estimated tax. Web • pay all of your estimated tax by january 18, 2022. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web form 740 is the kentucky income tax return for use by all taxpayers. Web form 740 kentucky — kentucky individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. The regular deadline to file a kentucky state income tax return is april. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet.

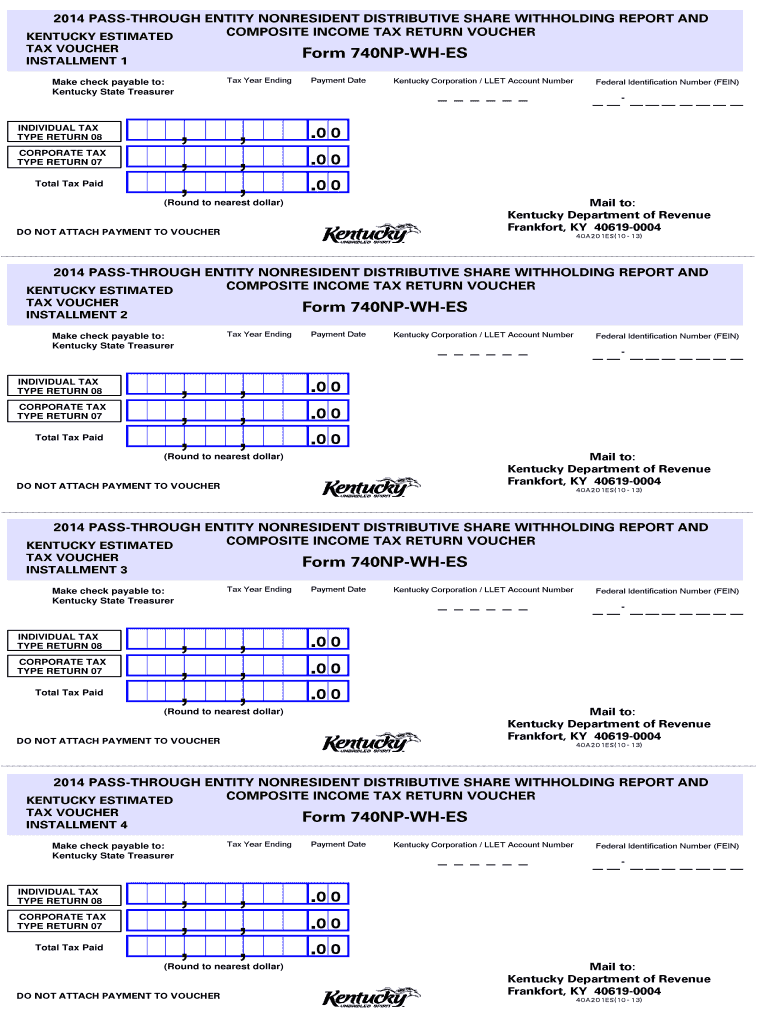

740Np Wh Fill Out and Sign Printable PDF Template signNow

In this case, 2021 estimated tax. Web • pay all of your estimated tax by january 18, 2022. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. The regular deadline to file a kentucky state income tax return is april. Check if estate or trust.

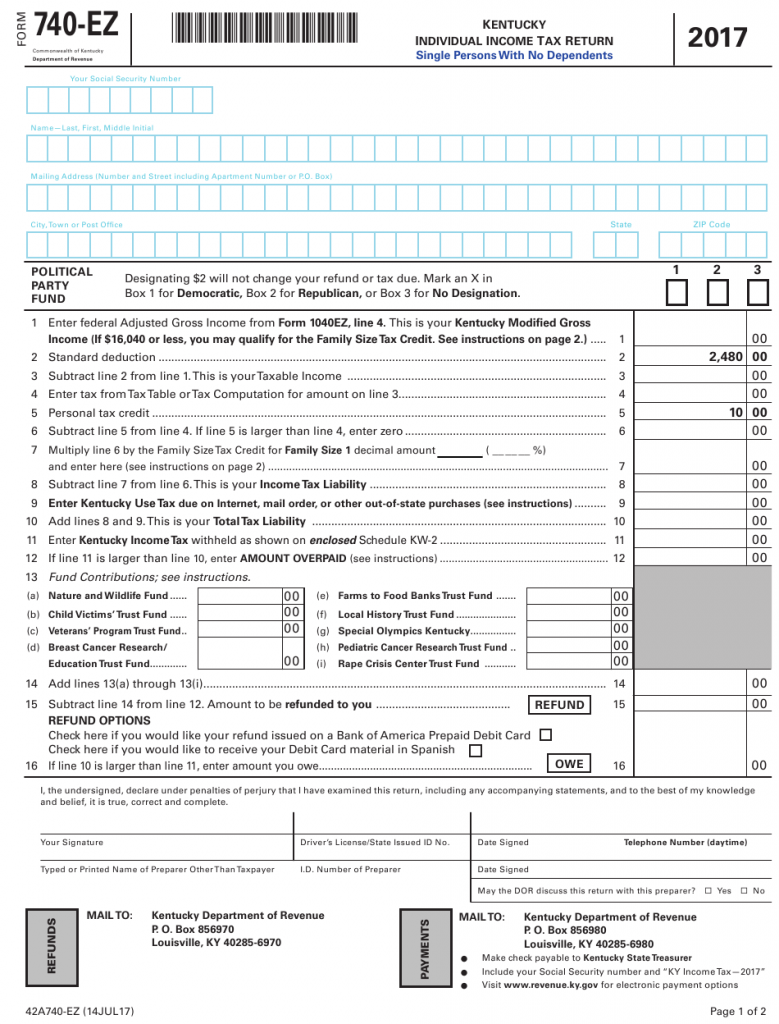

Printable Kentucky State Tax Forms Printable Form 2022

If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. At this time, dor accepts payments by credit card or electronic. In this case, 2021 estimated tax. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. Web more about.

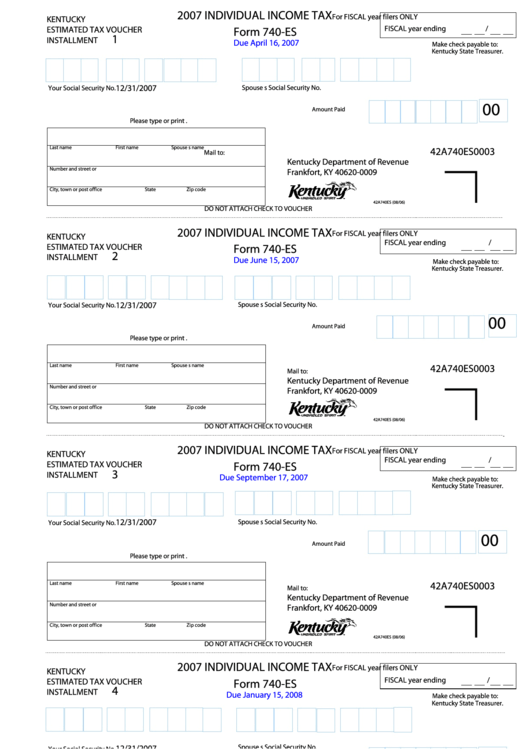

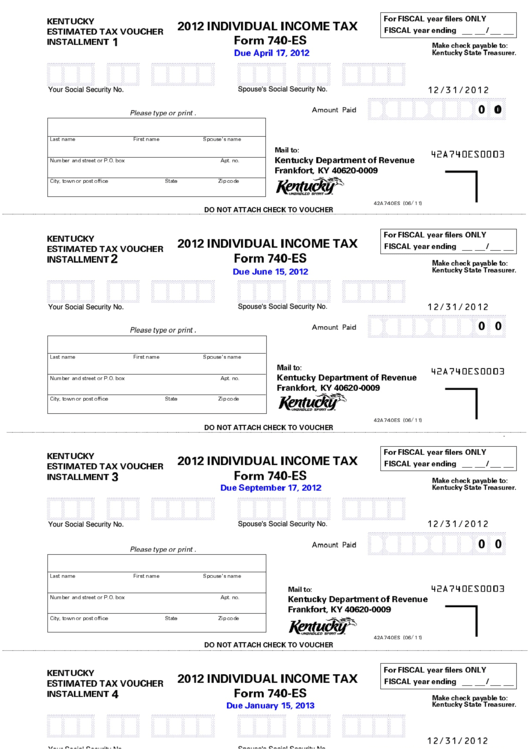

Fillable Form 740Es Individual Tax 2007 printable pdf download

This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web • pay all of your estimated tax by january 18, 2022. At this time, dor accepts payments by credit card or electronic. Web pay online pay your taxes online.

Kentucky Yearly Vehicle Tax VEHICLE UOI

Web form 740 kentucky — kentucky individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. The regular deadline to file a kentucky state income tax return is april. At this time, dor.

Fillable Form 740Es Individual Tax Estimated Tax Voucher

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. Web withhold kentucky income tax on the distributive share, whether distributed or.

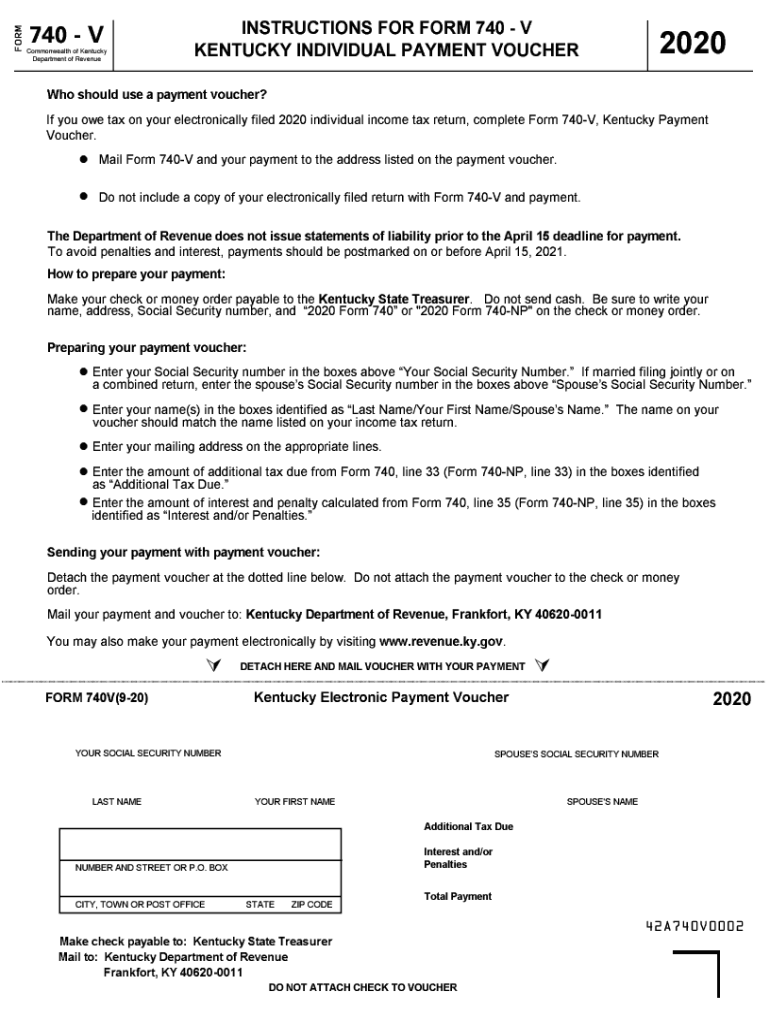

2020 Form KY 740V Fill Online, Printable, Fillable, Blank pdfFiller

Web form 740 kentucky — kentucky individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. At this time, dor accepts payments by credit card or electronic. Web form 740 is the kentucky income tax return for use by all taxpayers. In this case, 2021 estimated tax. The regular.

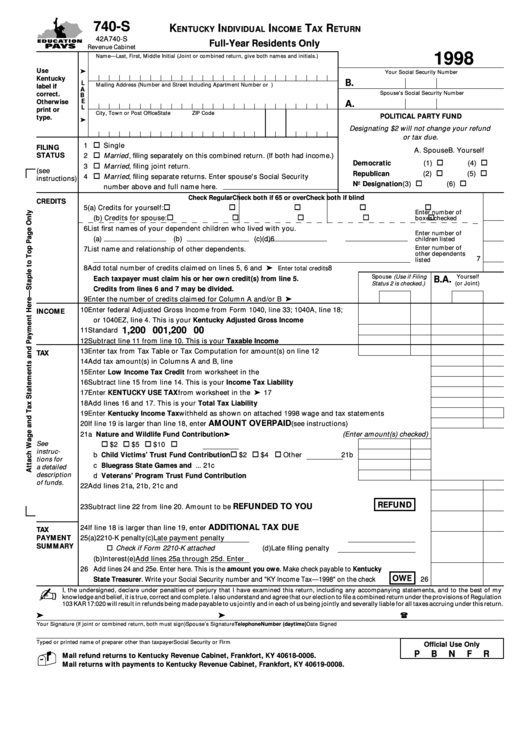

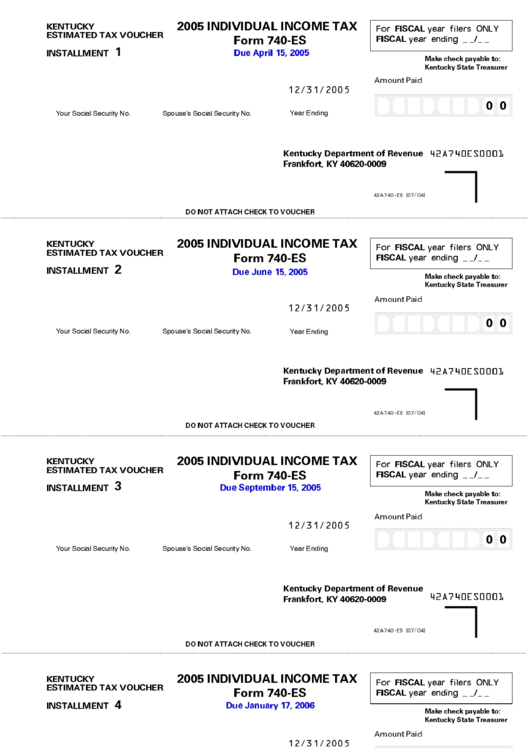

Form 740Es 2005 Individual Tax Kentucky Department Of

Web • pay all of your estimated tax by january 18, 2022. Check if estate or trust. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web more about the kentucky form 740 individual income tax tax.

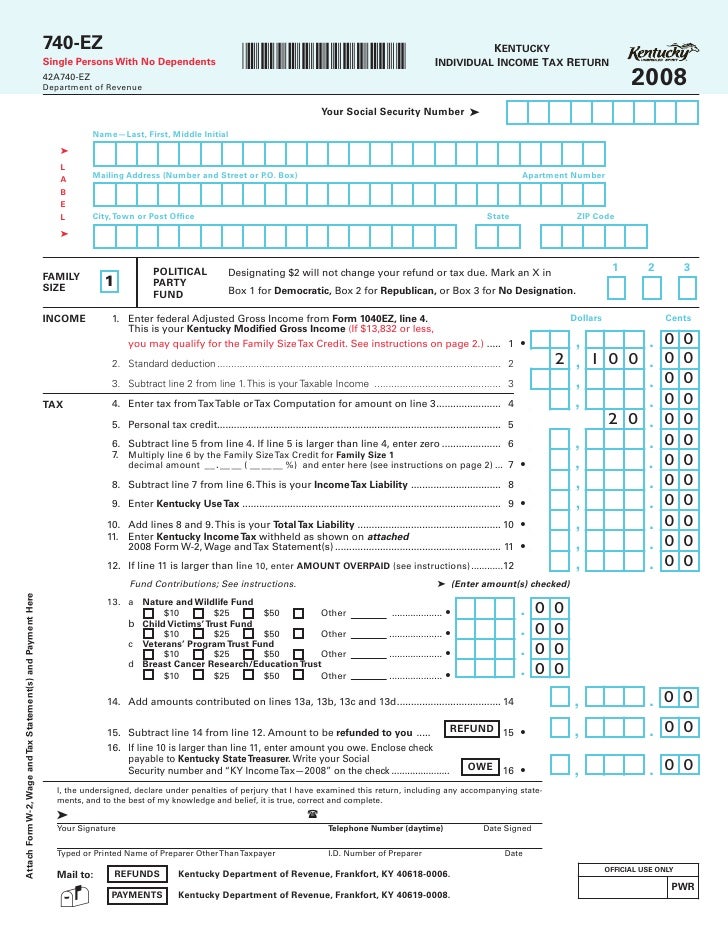

740EZ 2008 Kentucky Individual Tax Return Form 42A740EZ

Web • pay all of your estimated tax by january 18, 2022. Web withhold kentucky income tax on the distributive share, whether distributed or undistributed, of each nonresident individual partner, member, or shareholder. Web download the taxpayer bill of rights. Web more about the kentucky form 740 individual income tax tax return ty 2022 form 740 is the kentucky income.

Ky Quarterly Tax Fill Out and Sign Printable PDF Template signNow

Web download the taxpayer bill of rights. If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. Web estimated income tax return. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Web more about the kentucky form 740 individual income tax.

2013 Form KY DoR 740NPWHES Fill Online, Printable, Fillable, Blank

If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. Web estimated income tax return. Check if estate or trust. Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. At this time, dor accepts payments by credit card or.

Web • Pay All Of Your Estimated Tax By January 18, 2022.

Web pay online pay your taxes online using the kentucky department of revenue's electronic payment application. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Web more about the kentucky form 740 individual income tax tax return ty 2022 form 740 is the kentucky income tax return for use by all taxpayers. Web form 740 is the kentucky income tax return for use by all taxpayers.

Web Download The Taxpayer Bill Of Rights.

Check if estate or trust. At this time, dor accepts payments by credit card or electronic. Web form 740 kentucky — kentucky individual income tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax.

The Kentucky Department Of Revenue Conducts Work Under The Authority Of The Finance And Administration Cabinet.

If you do not have income tax withheld from your paychecks by an employer, you may have to submit quarterly estimated payments to kentucky. Web withhold kentucky income tax on the distributive share, whether distributed or undistributed, of each nonresident individual partner, member, or shareholder. The regular deadline to file a kentucky state income tax return is april. Web estimated income tax return.