Ks Withholding Form

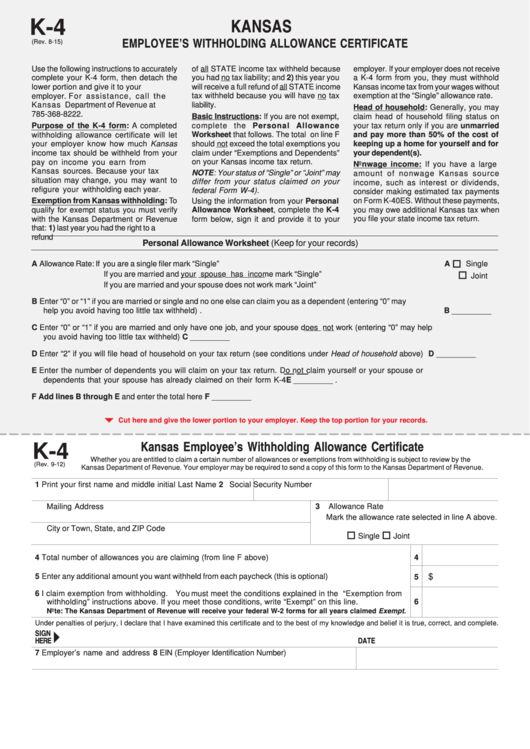

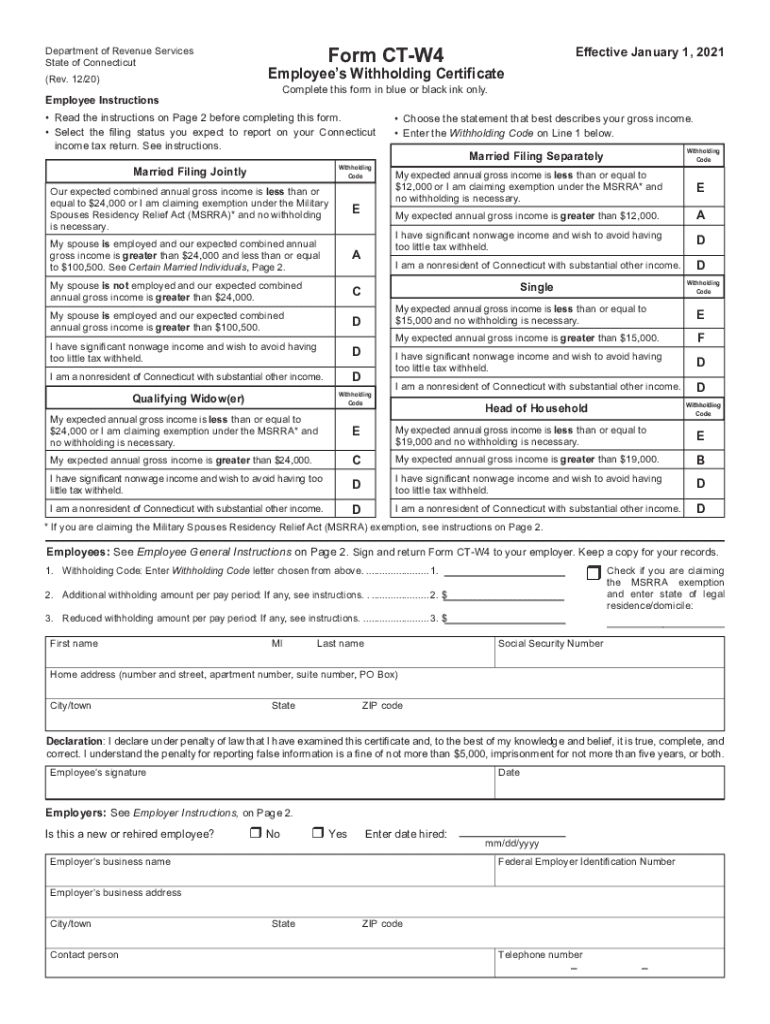

Ks Withholding Form - Web electronic services for withholding. Your withholding is subject to review by the. Please use the link below. Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. Web any employer or payor who must withhold federal income tax from payments other than wages made to kansas residents must also withhold kansas tax. However, due to differences between state and. File your state taxes online; First, it summarizes your withholding deposits. Create legally binding electronic signatures on any device. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

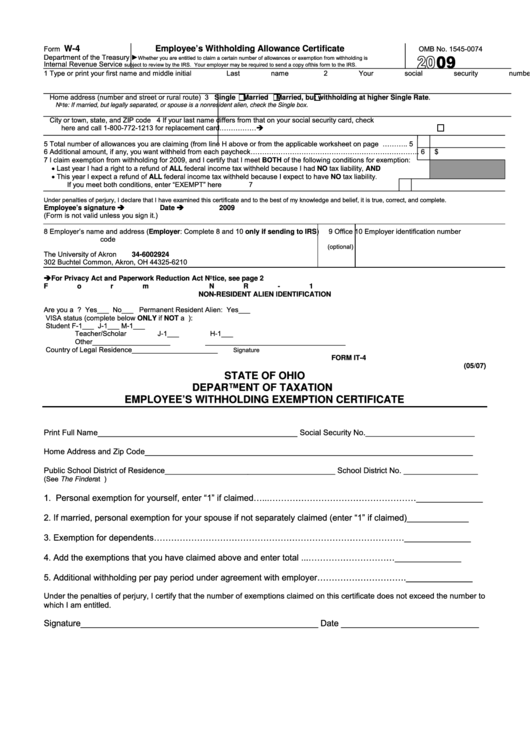

However, due to differences between state and. Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. Web any employer or payor who must withhold federal income tax from payments other than wages made to kansas residents must also withhold kansas tax. If too little tax is withheld, you will generally owe tax when you. Create legally binding electronic signatures on any device. For kansas webfile or customer service center. Ad signnow allows users to edit, sign, fill and share all type of documents online. Web electronic services for withholding. Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. Employee's withholding certificate form 941;

Web electronic services for withholding. Log in or register unemployment forms and guides expand all unemployment. Employee's withholding certificate form 941; Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Employers engaged in a trade or business who. File your state taxes online; Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Please use the link below. For kansas webfile or customer service center.

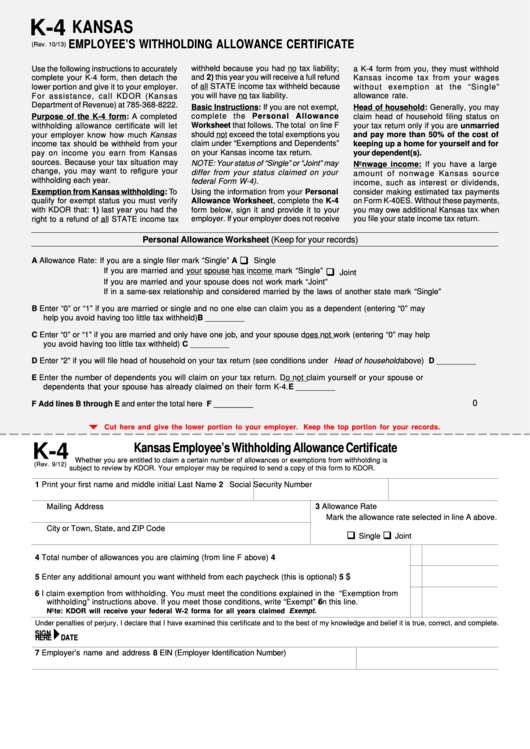

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

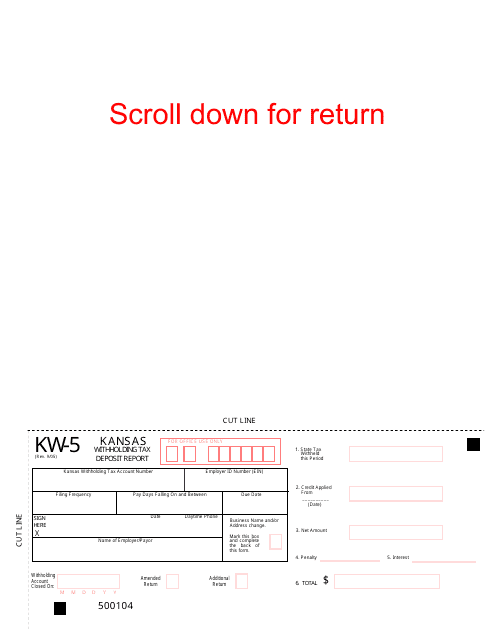

First, it summarizes your withholding deposits. Your withholding is subject to review by the. Ad signnow allows users to edit, sign, fill and share all type of documents online. Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from.

Irs New Tax Employee Forms 2023

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Create legally binding electronic signatures on any device. File your state taxes online; Your withholding is subject to review by the. If too little tax is withheld, you will generally owe tax when you.

Form KW5 Download Fillable PDF or Fill Online Kansas Withholding Tax

Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. Web electronic services for withholding. File your state taxes online; Employers engaged in a trade or business who. Log in or register unemployment forms and guides expand all unemployment.

Ohio Withholding Form W 4 2022 W4 Form

Ad download or email kansas nonresident & more fillable forms, register and subscribe now! Create legally binding electronic signatures on any device. Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. File your state taxes online; A completed withholding allowance certificate will let your employer know how much kansas income tax should.

2022 Tax Table Weekly Latest News Update

Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. File your state taxes online; Please use the link below. Your withholding is subject to review by the. Web kansas — employees withholding allowance certificate download this form print this form it appears you don't have a pdf plugin for this browser.

Connecticut Employee Withholding Form 2021 2022 W4 Form

A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Employers engaged in a trade or business who. Create legally binding electronic signatures on any device. If too little tax is withheld, you will generally owe tax when you. File your state taxes online;

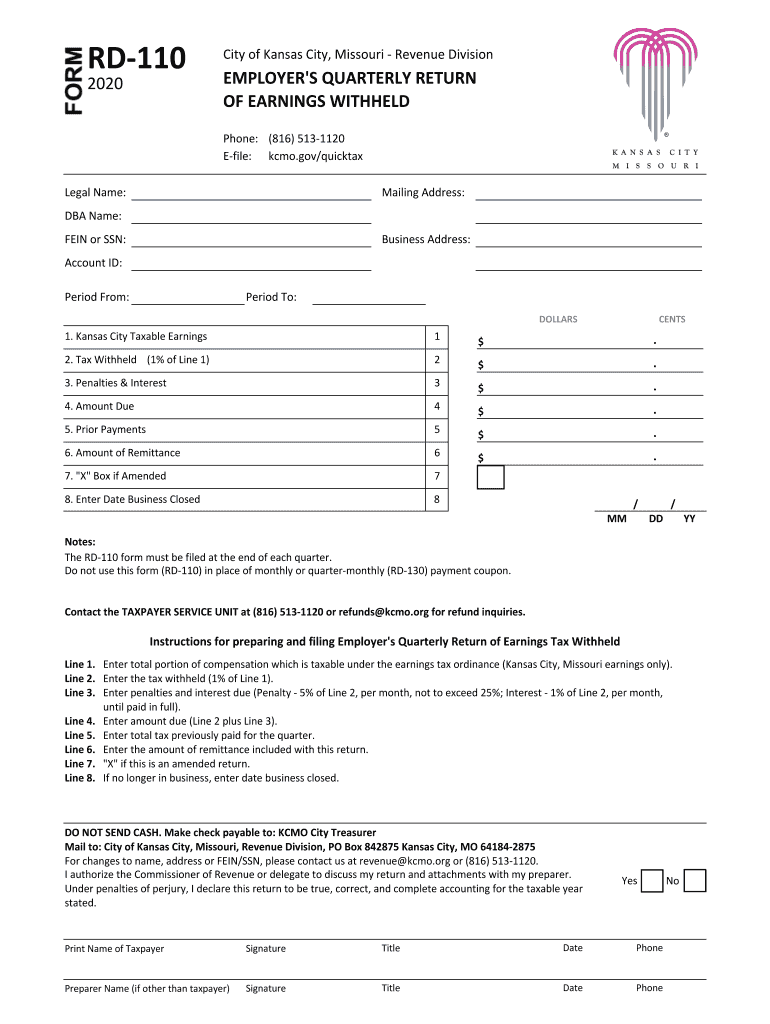

20202022 Form MO RD110 Fill Online, Printable, Fillable, Blank

However, due to differences between state and. File your state taxes online; Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. Log in or register unemployment forms and guides expand all unemployment. Employee's withholding certificate form 941;

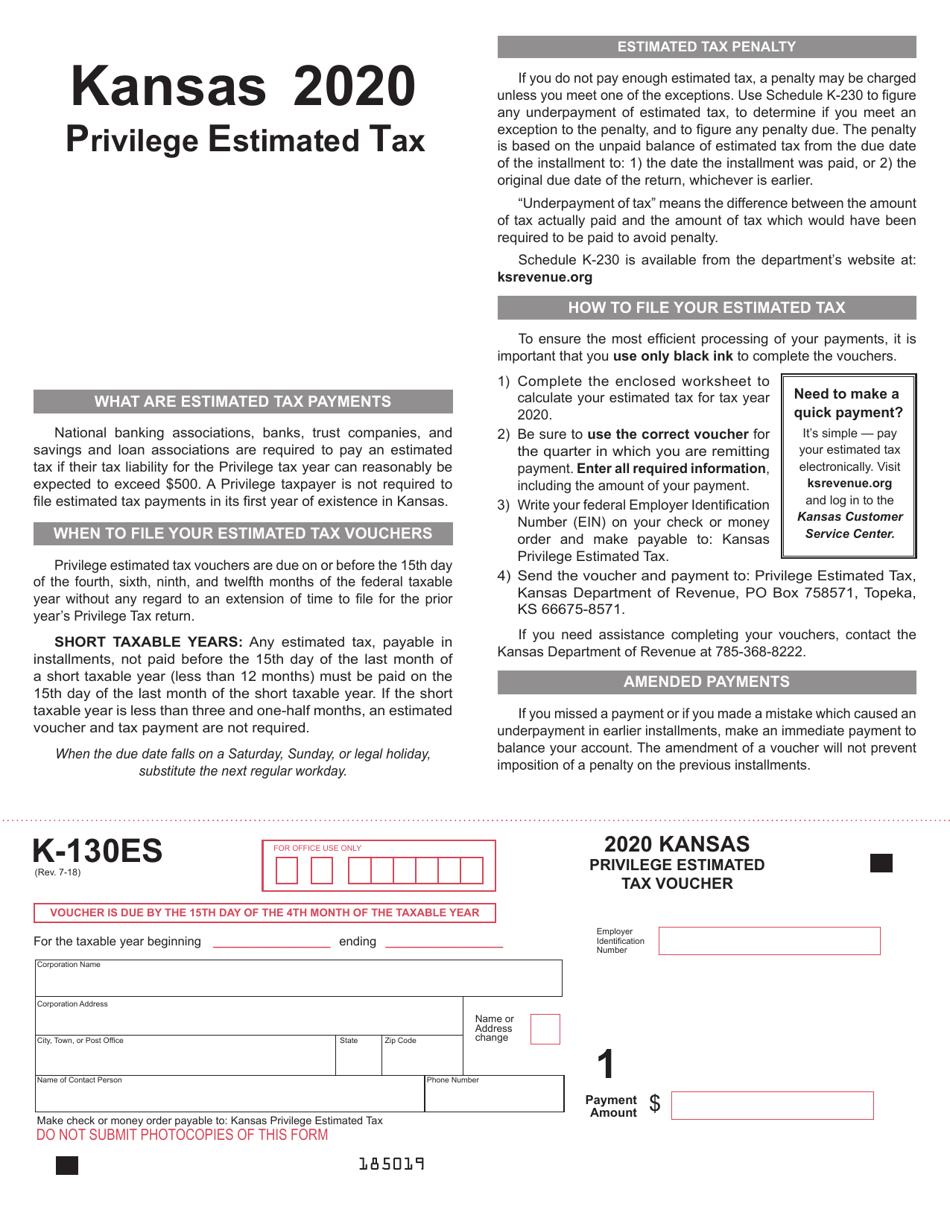

Form K130ES Download Fillable PDF or Fill Online Privilege Estimated

File your state taxes online; Log in or register unemployment forms and guides expand all unemployment. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Employee's withholding certificate form 941; Employers engaged in a trade or business who.

Kansas Withholding Form K 4 2022 W4 Form

Ad download or email kansas nonresident & more fillable forms, register and subscribe now! Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. File your state taxes online; If too little tax is withheld, you will generally owe tax when you. Ad signnow allows users to edit, sign, fill and share all.

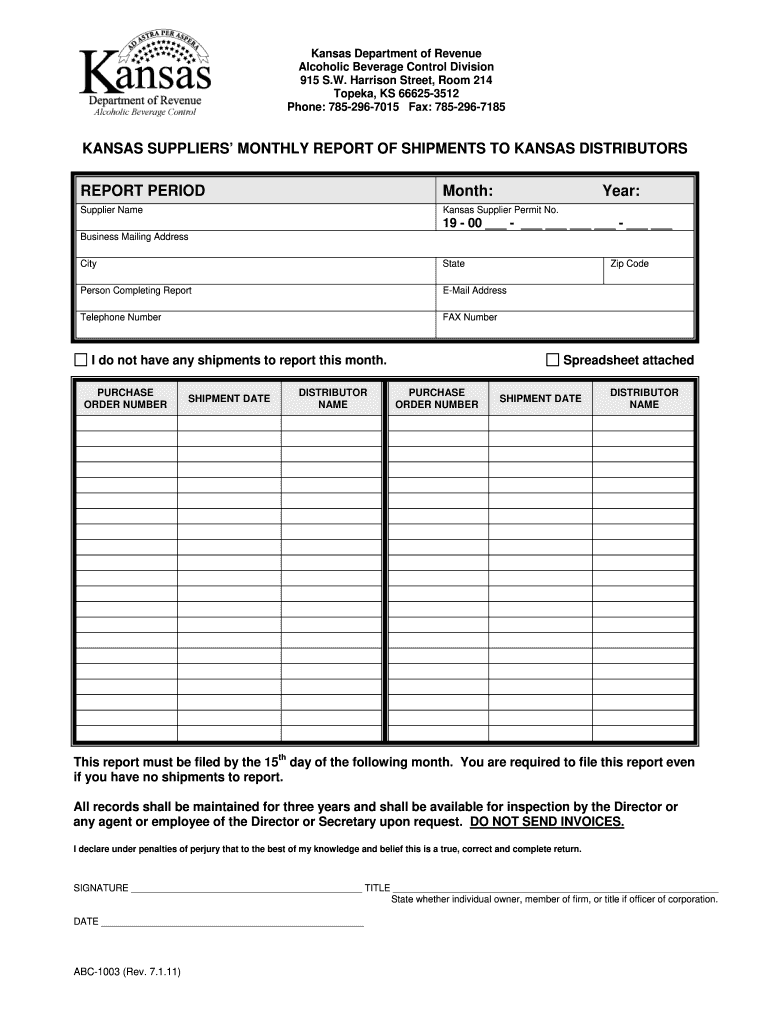

Kansas Monthly Report Fill Online, Printable, Fillable, Blank pdfFiller

File your state taxes online; For kansas webfile or customer service center. First, it summarizes your withholding deposits. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web kansas — employees withholding allowance certificate download this form print this form it appears you don't have a pdf.

Web Any Employer Or Payor Who Must Withhold Federal Income Tax From Payments Other Than Wages Made To Kansas Residents Must Also Withhold Kansas Tax.

If too little tax is withheld, you will generally owe tax when you. Please use the link below. First, it summarizes your withholding deposits. However, due to differences between state and.

Web Electronic Services For Withholding.

Your withholding is subject to review by the. Employee's withholding certificate form 941; A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. File your state taxes online;

Web Kansas — Employees Withholding Allowance Certificate Download This Form Print This Form It Appears You Don't Have A Pdf Plugin For This Browser.

Web regents should be aware that the withholding on supplemental wages rate remains at 22% for 2023. Log in or register unemployment forms and guides expand all unemployment. Create legally binding electronic signatures on any device. Ad download or email kansas nonresident & more fillable forms, register and subscribe now!

For Kansas Webfile Or Customer Service Center.

Web go to getkansasbenefits.gov to apply for unemployment benefits or file a weekly claim. Ad signnow allows users to edit, sign, fill and share all type of documents online. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. File your state taxes online;