Kentucky Form 720 Instructions 2021

Kentucky Form 720 Instructions 2021 - How to obtain forms and instructions Get your online template and fill it in using progressive features. Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form 720s instructions, fully updated for tax year 2022. Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). Include federal form 1120 with all supporting schedules and statements. Form 720 is complementary to the federal form 1120 series. Web download the taxpayer bill of rights. Follow the simple instructions below: Form pte is complementary to the federal forms 1120s and 1065. Line 1(b)— enter the amount of current year estimated taxable net income and kgr or kgp.

How to obtain forms and instructions You can print other kentucky tax forms here. Web how to fill out and sign ky form 720 instructions 2021 online? How to obtain additional forms Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form 720s instructions, fully updated for tax year 2022. Web download the taxpayer bill of rights. Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). Follow the simple instructions below: Get your online template and fill it in using progressive features.

Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). Include federal form 1120 with all supporting schedules and statements. Enjoy smart fillable fields and interactivity. Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form 720s instructions, fully updated for tax year 2022. Go out of business, or 2. If you are only filing to report zero tax and you won't owe excise tax in future quarters, check the final return box above part i of form 720. Line 1(b)— enter the amount of current year estimated taxable net income and kgr or kgp. Follow the simple instructions below: Get your online template and fill it in using progressive features. Web law to file a kentucky corporation income tax and llet return.

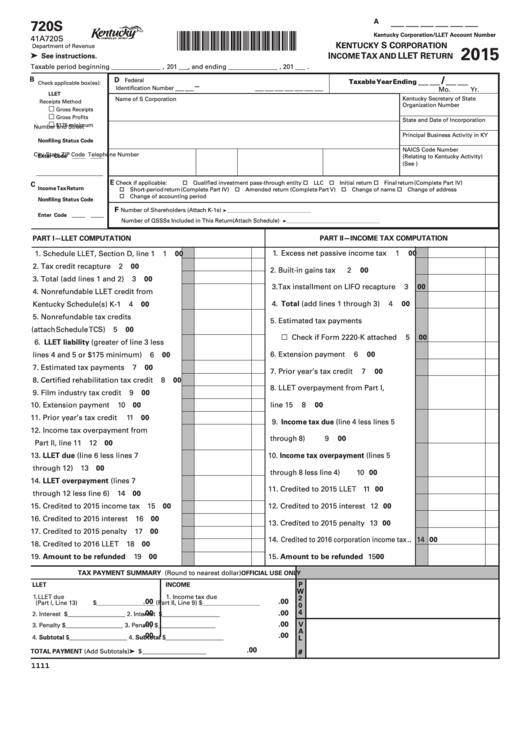

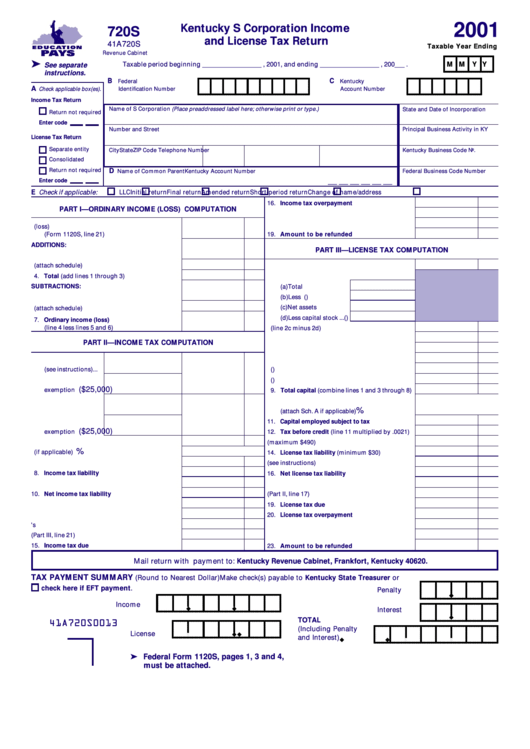

Fillable Form 720s Kentucky S Corporation Tax And Llet Return

Go out of business, or 2. Include federal form 1120 with all supporting schedules and statements. Web file a final return if you have been filing form 720 and you: Follow the simple instructions below: Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form.

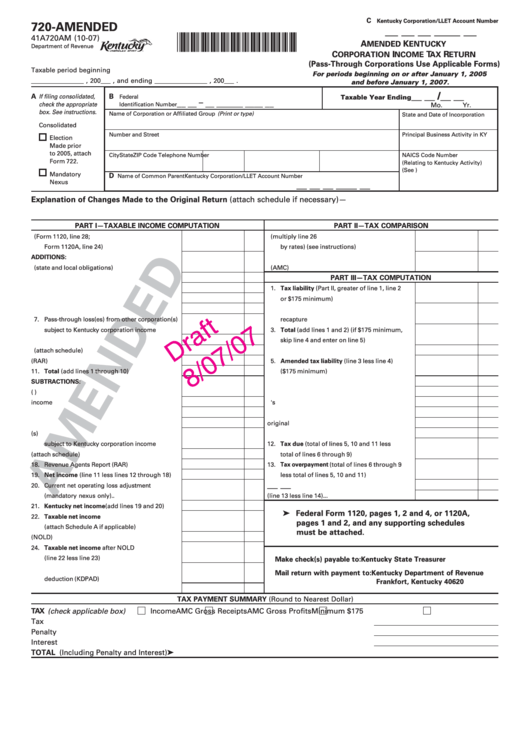

Form 720Amended Amended Kentucky Corporation Tax Return

Web law to file a kentucky corporation income tax and llet return. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. Go out of business, or 2. Form 720 is complementary to the federal form 1120 series. Line 1(b)— enter the amount of current year.

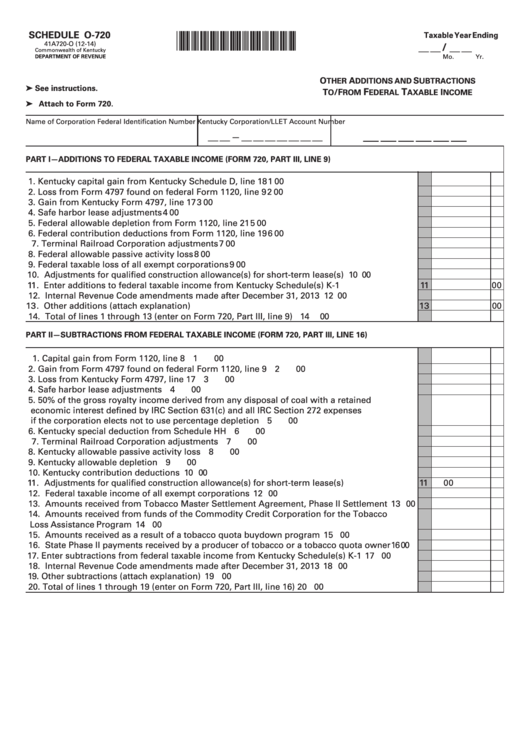

Fillable Schedule O720 (Form 41a720O) Other Additions And

Go out of business, or 2. Include federal form 1120 with all supporting schedules and statements. Enjoy smart fillable fields and interactivity. Web law to file a kentucky corporation income tax and llet return. Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form 720s.

Form 720 Kentucky Corporation Tax And Llet Return 2013

Get your online template and fill it in using progressive features. Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form 720s instructions, fully updated for tax year 2022. You can print other kentucky tax forms here. Web law to file a kentucky corporation income.

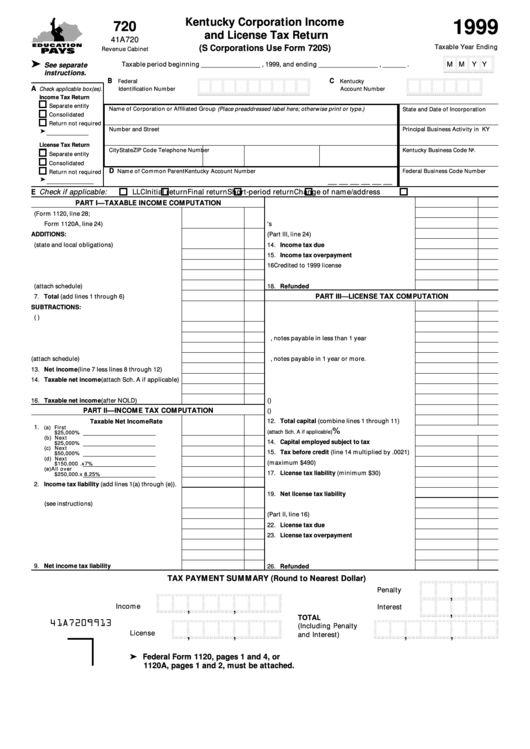

Form 720 Kentucky Corporation And License Tax Return 1999

Go out of business, or 2. You can print other kentucky tax forms here. Won't owe excise taxes that are reportable on form 720 in future quarters. Web file a final return if you have been filing form 720 and you: How to obtain forms and instructions

Kentucky Form 720S 2019

Get your online template and fill it in using progressive features. Go out of business, or 2. How to obtain forms and instructions Won't owe excise taxes that are reportable on form 720 in future quarters. Follow the simple instructions below:

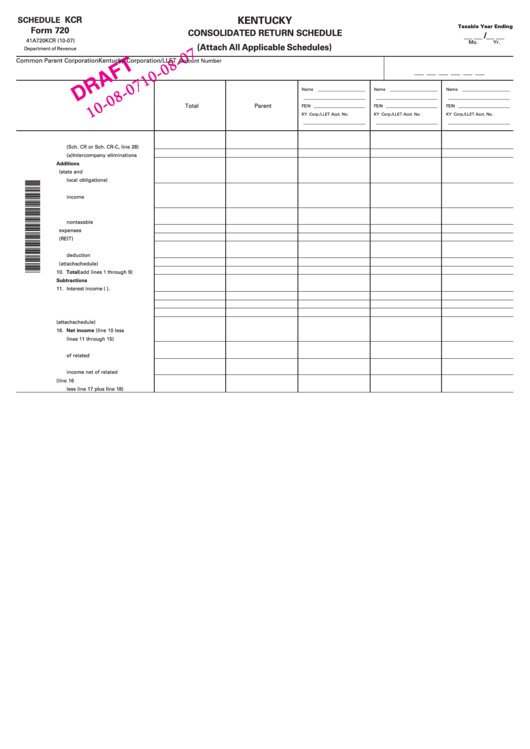

Form 720 Draft Schedule Kcr Kentucky Consolidated Return Schedule

The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web how to fill out and sign ky form 720 instructions 2021 online? Line 1(b)— enter the amount of current year estimated taxable net income and kgr or kgp. How to obtain additional forms Form pte is complementary to the federal forms 1120s and.

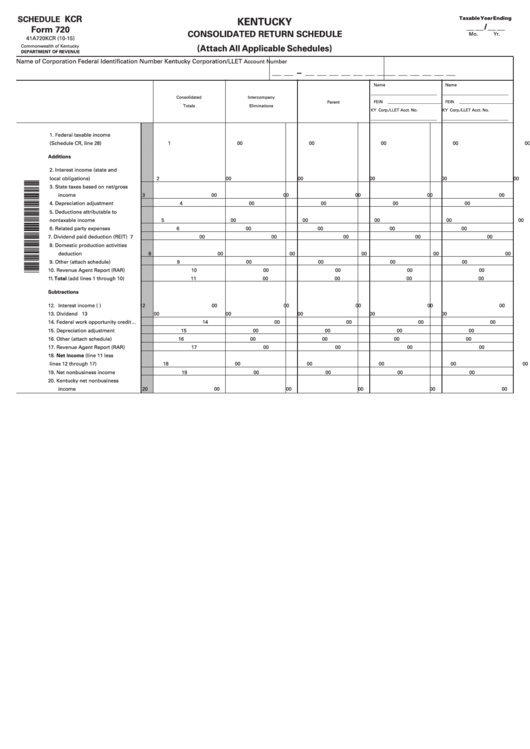

Fillable Schedule Kcr (Form 720) Kentucky Consolidated Return

Web law to file a kentucky corporation income tax and llet return. How to obtain additional forms Line 1(b)— enter the amount of current year estimated taxable net income and kgr or kgp. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for.

Form 720 Vi Fill Online, Printable, Fillable, Blank PDFfiller

You can print other kentucky tax forms here. How to obtain additional forms If you are only filing to report zero tax and you won't owe excise tax in future quarters, check the final return box above part i of form 720. Go out of business, or 2. Line 1(b)— enter the amount of current year estimated taxable net income.

What Is IRS Form 720? Calculate, Pay Excise Tax NerdWallet

Won't owe excise taxes that are reportable on form 720 in future quarters. Web law to file a kentucky corporation income tax and llet return. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. Follow the simple instructions below: Form 720 is complementary to the.

Web Download The Taxpayer Bill Of Rights.

Form 720 is complementary to the federal form 1120 series. Web file a final return if you have been filing form 720 and you: Line 1(b)— enter the amount of current year estimated taxable net income and kgr or kgp. If you are only filing to report zero tax and you won't owe excise tax in future quarters, check the final return box above part i of form 720.

Form Pte Is Complementary To The Federal Forms 1120S And 1065.

Won't owe excise taxes that are reportable on form 720 in future quarters. Web law to file a kentucky corporation income tax and llet return. How to obtain forms and instructions Go out of business, or 2.

Web How To Fill Out And Sign Ky Form 720 Instructions 2021 Online?

Get your online template and fill it in using progressive features. Web line 1(a)—specify if kentucky gross receipts (kgr) or kentucky gross profits (kgp) are entered for taxable llet in column a, line 1(b). Include federal form 1120 with all supporting schedules and statements. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet.

Follow The Simple Instructions Below:

You can print other kentucky tax forms here. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. Any corporation electing s corporation treatment in accordance with §§1361(a) and 1362(a) of the internal revenue code must use form pte and related schedules. Web we last updated the kentucky s corporation income tax and llet return instructions in february 2023, so this is the latest version of form 720s instructions, fully updated for tax year 2022.